AIMCO Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIMCO Bundle

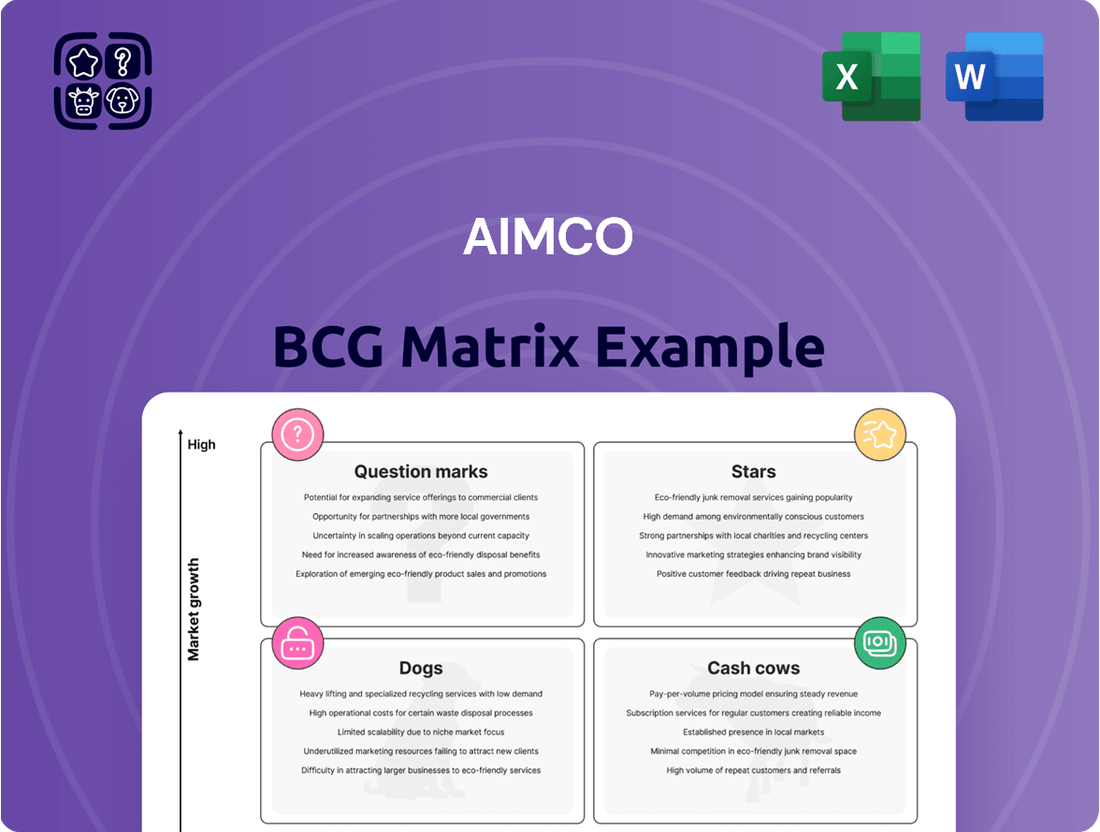

Unlock the strategic potential of AIMCO's product portfolio with our comprehensive BCG Matrix analysis. Understand which products are fueling growth (Stars), generating consistent revenue (Cash Cows), requiring careful consideration (Question Marks), or potentially hindering progress (Dogs). This preview offers a glimpse into the power of strategic product positioning.

Don't settle for a partial view. Purchase the full AIMCO BCG Matrix report to gain in-depth quadrant analysis, actionable insights for resource allocation, and a clear roadmap to optimize your business strategy for maximum impact and sustained success.

Stars

AIMCO's commitment to high-growth development is exemplified by projects like the ultra-luxury waterfront residential tower on 34th Street in Miami. This development is slated to open its doors in Q3 2027, with stabilized occupancy anticipated by Q4 2028.

Miami's real estate market presents a compelling case for such ventures, having experienced substantial rent increases. Projections for 2025 indicate continued strong rent growth, underscoring the high potential for new luxury residential projects in this dynamic market.

Properties in markets like Northern New Jersey and San Francisco are positioned for strong performance within AIMCO's portfolio. These areas are experiencing significant rent growth, with Northern New Jersey seeing effective rental rate increases of over 10% year-over-year in early 2024, and San Francisco showing similar trends driven by robust demand.

AIMCO's strategy centers on value-add and opportunistic redevelopment in suburban submarkets. These areas often feature constrained new construction and consistent renter interest, making them ideal for enhancing existing properties. This approach allows AIMCO to effectively capture greater market share and achieve higher rental yields.

Luxury Single-Family Rental Communities (e.g., Corte Madera, CA)

Luxury single-family rental communities are positioned as Stars in the BCG Matrix, reflecting their robust performance and market demand. The successful lease-up of properties like Oak Shore in Corte Madera, California, which achieved 96% occupancy by April 2025, underscores their status as high-growth assets.

This strong market acceptance is further bolstered by the increasing preference for single-family rental options in key geographic areas. These communities are generating significant revenue and are expected to continue their upward trajectory.

- High Growth: Demonstrated by rapid lease-up rates in desirable locations.

- Strong Market Demand: Driven by a growing preference for single-family rental living.

- High Occupancy: Exemplified by properties like Oak Shore reaching 96% leased by April 2025.

- Revenue Generation: Contributing significantly to overall portfolio performance.

Strategic Investments in Emerging High-Demand Locations

AIMCO's strategic investment in its 901 North development site in Fort Lauderdale, Florida, highlights a focus on emerging high-demand locations within its portfolio.

This proactive approach, encompassing programming, design, documentation, and entitlement efforts, positions AIMCO to capitalize on anticipated market growth.

Fort Lauderdale, situated in the booming Southeast region, is projected to experience significant rent increases, with forecasts suggesting the greatest growth in the nation for 2025.

This strategic positioning allows AIMCO to capture future market share in a rapidly appreciating rental market.

- Southeast Region Rent Growth: Expected to lead the nation in rent increases in 2025.

- AIMCO's Fort Lauderdale Investment: Focus on development at 901 North signifies market confidence.

- Strategic Location: Fort Lauderdale represents a key growth market for multifamily real estate.

- Proactive Market Capture: Investments in development indicate a strategy to secure future rental income.

Stars in AIMCO's portfolio, such as luxury single-family rental communities, represent high-growth, high-market-share assets. These ventures are characterized by rapid lease-up rates and strong renter demand, as seen with Oak Shore in Corte Madera reaching 96% occupancy by April 2025.

These properties are performing exceptionally well due to a growing preference for single-family rental living in key markets. Their robust revenue generation is a testament to their strong market acceptance and continued upward trajectory.

| Asset Type | Market Growth Potential | Occupancy Rate (as of April 2025) | Revenue Contribution |

|---|---|---|---|

| Luxury Single-Family Rentals | High | 96% (Oak Shore) | Significant |

| Ultra-Luxury Waterfront Residential (Miami) | High (projected) | Stabilized by Q4 2028 | High potential |

| Fort Lauderdale Development (901 North) | Very High (Southeast region leading rent growth) | Pre-stabilization | Future high contributor |

What is included in the product

The AIMCO BCG Matrix categorizes business units by market share and growth rate, offering strategic guidance.

It helps identify which units to invest in, hold, or divest for optimal resource allocation.

AIMCO BCG Matrix offers a clear, one-page overview of your portfolio, instantly clarifying which units need attention.

Cash Cows

AIMCO's stabilized operating properties in established suburban markets like Boston and Chicago are performing strongly, acting as true cash cows. These assets consistently deliver robust Net Operating Income (NOI), a key indicator of profitability. For instance, in 2024, these properties maintained average daily occupancy rates exceeding 97%, underscoring their stability and consistent demand.

The mature nature of these suburban markets, coupled with their stable demand, means these properties require minimal aggressive promotional investment. This allows them to generate a steady and predictable cash flow, making them reliable income generators for AIMCO's portfolio.

AIMCO's core portfolio, comprising over 5,200 well-located apartment homes, functions as a classic cash cow. These established assets are positioned for strong revenue growth, reflecting their consistent ability to generate substantial cash flow.

These communities likely benefit from a competitive advantage due to their mature market positioning and sustained renter demand, leading to high profit margins. For instance, in 2024, AIMCO reported that its same-store revenue growth was driven by strong occupancy and rental rate increases in its established communities.

Properties with high resident renewal rates are classic examples of Cash Cows within the AIMCO BCG Matrix. In Q4 2024, AIMCO saw an impressive 71.7% of residents choose to renew their leases. This trend continued into Q1 2025, with a 62.7% renewal rate.

This consistent tenant retention signifies strong resident satisfaction and creates a dependable, recurring revenue stream for AIMCO. Such high renewal percentages directly translate into reduced operational expenses related to tenant turnover, such as marketing and unit preparation, further solidifying their Cash Cow status by ensuring predictable cash flow.

Properties with Moderate but Steady Rent Growth

Properties with moderate but steady rent growth are the backbone of a stable portfolio, much like Cash Cows in the BCG matrix. These assets don't necessarily reside in booming markets, but they consistently deliver reliable income. For instance, AIMCO observed all transacted leases showing 3.6% growth in Q4 2024, and their stabilized portfolio saw effective rents climb by 5.2% in Q1 2025. This steady appreciation means they contribute reliably to overall revenue without demanding substantial new capital infusions, a hallmark of a mature, cash-generating asset.

These properties represent a dependable income stream. Their consistent performance, even in less dynamic markets, solidifies their Cash Cow status. The ability to generate positive rent growth, such as the 3.6% observed across all AIMCO transacted leases in Q4 2024, without the need for heavy reinvestment, is key to their value. This stability allows for predictable revenue generation, supporting broader financial objectives.

- Steady Rent Growth: Properties demonstrating consistent, positive rent increases, like the 3.6% on all transacted leases in Q4 2024.

- Reliable Revenue Contribution: These assets reliably contribute to overall revenue streams without significant new investment.

- Effective Rent Performance: AIMCO's stabilized portfolio achieved 5.2% effective rents in Q1 2025, highlighting consistent performance.

- Cash Cow Profile Alignment: The combination of steady growth and low capital needs fits the classic Cash Cow definition.

Diversified Portfolio Providing Consistent Rental Income

AIMCO's strategy of holding a diversified portfolio of operating apartment communities in eight major U.S. markets positions these assets as Cash Cows. This broad geographic spread, with average rents aligning with local market norms, creates a stable and reliable foundation for consistent rental income.

The company's commitment to maintaining these properties ensures their continued appeal and ability to generate steady cash flow, a hallmark of Cash Cow assets within the BCG framework. This diversification effectively buffers against localized economic downturns, fostering a resilient income stream.

- Diversified Markets: Operating in eight major U.S. markets.

- Stable Rents: Average rents are in line with local market averages.

- Consistent Cash Flow: Diversification mitigates market-specific risks for reliable income.

- Operating Communities: Focus on established, income-generating apartment properties.

Cash Cows in AIMCO's portfolio are those stabilized operating properties in established markets that consistently generate robust Net Operating Income. These assets, like those in suburban Boston and Chicago, benefit from high occupancy rates, often exceeding 97% in 2024, and require minimal aggressive investment due to stable demand. Their mature market positioning and sustained renter demand contribute to high profit margins, with same-store revenue growth in 2024 driven by occupancy and rental rate increases.

| Metric | 2024 Performance | Significance |

| Average Daily Occupancy (Suburban Markets) | > 97% | Indicates strong, consistent demand and stability. |

| Resident Renewal Rate (Q4 2024) | 71.7% | Demonstrates high resident satisfaction and recurring revenue. |

| Transacted Lease Rent Growth (Q4 2024) | 3.6% | Shows steady, reliable income appreciation. |

| Effective Rent Growth (Stabilized Portfolio Q1 2025) | 5.2% | Highlights consistent performance and revenue generation. |

Delivered as Shown

AIMCO BCG Matrix

The BCG Matrix document you are previewing is the identical, fully completed report you will receive upon purchase. This means you're seeing the final, polished analysis, ready for immediate implementation without any hidden surprises or additional work. The strategic insights and clear visualization of your product portfolio's market position are exactly as presented here, ensuring you get precisely what you need for informed decision-making.

Dogs

Properties in Sun Belt markets experiencing significant new construction and subsequent rent decreases could be categorized as underperforming assets. This oversupply situation, particularly evident in 2024, can lead to reduced market share and dampened growth prospects for existing properties.

Markets such as Austin, Tampa, Raleigh, and Nashville have reported rent declines in 2024 due to this oversupply. For instance, some reports indicated average rent decreases of 2-3% in certain submarkets within these cities during the first half of 2024. This trend directly impacts the performance of AIMCO's assets in these specific areas if they are not keeping pace with market dynamics.

Older properties needing significant capital expenditure with weak return potential are often categorized as Dogs in the AIMCO BCG Matrix. These assets, requiring substantial investment for upkeep or modernization, might be situated in areas experiencing low growth and demand. For instance, a 2024 analysis of the commercial real estate market indicated that properties in declining urban centers, despite needing extensive renovations, saw average rental growth of only 1.5% compared to a national average of 4.8%.

AIMCO might classify assets like the Brickell Assemblage in Miami as non-core, especially if their performance doesn't align with the company's focus on high-value, strategically important properties. This potential divestiture signals that these assets are not anticipated to be major drivers of future growth or market leadership for AIMCO.

Properties in Markets with Stagnant or Negative Rent Growth

Properties situated in markets exhibiting stagnant or negative rent growth, alongside a low market share for AIMCO, would be classified as Dogs in the AIMCO BCG Matrix. This signifies a challenging segment with limited growth prospects and competitive positioning.

For instance, if a particular market saw average rent growth of only 0.5% in 2024, a stark contrast to national averages that might hover around 3-4% for stronger markets, and AIMCO's presence in that market is minimal, these assets would fit the Dog profile.

- Low Market Growth: Markets with rent growth below 1% in 2024.

- Low Market Share: AIMCO's properties representing less than 5% of the local rental market.

- Strategic Consideration: These assets may require divestment or significant repositioning to improve performance.

- Example Scenario: A secondary city with an oversupply of apartments and declining tenant demand.

Small, Isolated Properties with Limited Scale or Synergies

These are individual properties that are small in scale or geographically isolated from AIMCO's larger clusters. This isolation means they offer limited operational synergies or market influence, potentially impacting their efficiency and overall portfolio contribution. In 2024, such properties might represent a smaller percentage of AIMCO's total asset value, perhaps less than 5%, due to their limited scale.

Such properties could have a low market share within their respective submarkets and be less efficient to manage on a per-unit basis. Their contribution to overall portfolio performance might be minimal, potentially dragging down average returns if not managed strategically. For instance, a single, small apartment building in a non-core market acquired in 2023 might fall into this category.

- Limited Scale: Individual properties with a small number of units, perhaps under 50 units, making economies of scale difficult to achieve.

- Geographic Isolation: Properties located far from other AIMCO holdings, increasing management overhead and reducing opportunities for shared resources.

- Low Market Share: Possessing a minimal presence in their local rental market, limiting pricing power and competitive advantage.

- Operational Inefficiencies: Higher per-unit operating costs due to lack of centralized management, maintenance, or procurement benefits.

Dogs in the AIMCO BCG Matrix represent assets with low market share in low-growth markets. These properties often require significant capital investment without a clear path to substantial returns, making them candidates for divestiture or repositioning. For example, properties in markets experiencing rent declines, such as certain areas in Austin or Tampa in 2024, where rent growth was below 1%, would fit this classification.

These assets are characterized by their weak competitive position and limited growth potential, often facing challenges like oversupply or declining demand. A property in a secondary city with an oversupply of apartments and stagnant rental income, where AIMCO's market share is less than 5%, exemplifies a Dog.

AIMCO might consider divesting these underperforming assets to reallocate capital towards more promising opportunities. The Brickell Assemblage in Miami, if deemed non-core and not contributing to growth, could be an example of an asset that might be classified as a Dog and considered for sale.

| Characteristic | Description | 2024 Market Example |

|---|---|---|

| Market Growth | Low (e.g., rent growth < 1%) | Stagnant rental markets in certain secondary cities. |

| Market Share | Low (e.g., AIMCO < 5%) | Minimal presence in submarkets with oversupply. |

| Capital Needs | High, with weak return potential | Older properties requiring extensive renovations. |

| Strategic Action | Divestment or significant repositioning | Focus on divesting non-core assets. |

Question Marks

AIMCO's three recently completed residential development projects, representing a total of 933 units, are now in the crucial lease-up phase. These properties are strategically located in expanding markets, but their market share is still being established.

During this phase, these developments are consuming operational cash and require significant marketing investment to attract and secure tenants. For example, as of Q1 2024, AIMCO reported that these lease-up properties contributed to a net increase in operating expenses, reflecting the costs associated with tenant acquisition and initial property stabilization.

New development projects in emerging submarkets represent AIMCO's "Question Marks." These ventures, often in areas with limited AIMCO presence and evolving market dynamics, demand substantial capital. For instance, in 2024, the real estate sector saw increased investment in niche urban infill projects, many of which carry higher risk due to unproven demand patterns.

These projects, while carrying high growth potential, face considerable uncertainty regarding market share capture. A 2024 report by a leading real estate analytics firm indicated that projects in previously underdeveloped urban zones had a success rate of only 60% in achieving projected occupancy within the first two years, compared to 85% in established markets.

Adaptive reuse or repositioning projects with unproven market acceptance fall into the Question Marks category of the AIMCO BCG Matrix. These ventures, transforming properties into new asset classes or targeting different demographics, carry inherent risks due to the uncertainty of market reception.

The success hinges on accurately gauging demand and establishing a solid presence in the new market segment, a challenge highlighted by the fact that in 2024, the conversion of underutilized office spaces to residential units, a form of adaptive reuse, saw a mixed success rate across major cities, with some projects achieving occupancy rates below 70% within the first year due to unforeseen tenant preferences and amenity demands.

Investments in New Real Estate Technologies or Services

Investments in emerging real estate technologies and services, such as advanced property management software or smart home integration platforms, would likely be categorized as Stars or Question Marks within the AIMCO BCG Matrix. These ventures often represent high-growth potential sectors within proptech, but their market penetration and profitability are still being defined.

These early-stage investments possess significant growth prospects, mirroring the characteristics of Stars. However, their uncertain market share and the substantial capital required for development and market entry place them firmly in the Question Mark quadrant. For instance, the global proptech market was valued at approximately $23.4 billion in 2023 and is projected to grow substantially, indicating fertile ground for innovation but also intense competition and unproven business models.

- High Growth Potential: These technologies aim to disrupt traditional real estate operations, offering efficiency gains and new revenue streams.

- Uncertain Market Share: Adoption rates and competitive landscapes are still evolving, making market share difficult to predict.

- Substantial Investment Required: Developing and scaling new technologies demands significant upfront capital for research, development, and marketing.

- Risk of Failure: Early-stage ventures face a higher risk of not achieving market traction or profitability compared to established services.

Strategic Land Holdings for Future Development in High-Growth Areas

AIMCO's strategic land holdings are positioned as future development opportunities, aligning with the company's extensive pipeline. This pipeline includes over 7.7 million square feet of potential development, with a strong focus on high-growth regions like Southeast Florida and the Washington D.C. Metro Area. These holdings represent significant future potential, though their current market share is zero, necessitating substantial capital and time to unlock their value.

- Strategic Land Holdings: AIMCO's land portfolio is geared towards future development in growth corridors.

- Development Potential: Over 7.7 million square feet of development capacity exists within AIMCO's pipeline.

- Geographic Focus: Key areas for future growth include Southeast Florida and the Washington D.C. Metro Area.

- Investment Profile: These are long-term, capital-intensive investments with zero current market share but substantial future upside.

Question Marks in AIMCO's portfolio represent new ventures with high growth potential but uncertain market share. These often include new development projects in emerging submarkets or adaptive reuse initiatives where market acceptance is still being gauged.

These projects require significant capital investment and carry a higher risk of failure, as demonstrated by the mixed success rates of similar projects in 2024. For instance, urban infill projects in 2024 had a success rate of only 60% in achieving projected occupancy within two years in new zones.

Investments in proptech also fall into this category, offering innovation but facing evolving competitive landscapes and unproven business models, despite the proptech market's significant growth to an estimated $23.4 billion in 2023.

AIMCO's strategic land holdings, with over 7.7 million square feet of potential development, are also positioned as Question Marks due to their zero current market share and the substantial capital needed to realize their future value.

| AIMCO BCG Matrix Category | Characteristics | Examples | 2024 Market Context | Key Considerations |

|---|---|---|---|---|

| Question Marks | High growth potential, low market share, high investment need, high risk | New residential developments in emerging markets, adaptive reuse projects, proptech investments, strategic land holdings | Increased investment in niche urban infill projects, mixed success for office-to-residential conversions, substantial proptech market growth | Market acceptance, competitive landscape, capital requirements, risk mitigation |

BCG Matrix Data Sources

Our BCG Matrix leverages proprietary market data, combining sales figures, customer acquisition costs, and competitive landscape analysis to provide actionable strategic direction.