AIMCO Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIMCO Bundle

AIMCO's competitive landscape is shaped by moderate buyer power and significant threat of substitutes, influencing pricing and product development. The bargaining power of suppliers presents a key challenge, while the threat of new entrants is currently manageable but requires ongoing vigilance. Understanding these forces is crucial for navigating AIMCO's market.

This snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore AIMCO’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers of construction materials and labor are wielding considerable power, largely driven by escalating costs. In 2024, the average cost to build a new single-family home hit an all-time high of $428,215. This surge means that construction expenses now represent a substantial 64.4% of the typical home's price.

This widespread inflation in building material prices, coupled with significant wage increases stemming from persistent labor shortages, directly impacts AIMCO's ability to manage costs for its development and redevelopment initiatives.

The construction industry, particularly for large-scale projects undertaken by REITs like AIMCO, faces a significant challenge with the limited availability of skilled labor. This scarcity inherently shifts bargaining power towards these specialized workers and contractors.

These ongoing shortages have directly contributed to substantial wage growth within the sector. For instance, in 2024, average hourly wages for construction laborers saw a notable increase, putting upward pressure on project budgets and potentially impacting AIMCO's development timelines.

This constraint on skilled personnel doesn't just affect costs; it can also lead to delays in project completion. Such disruptions can increase overall development expenses for REITs, as extended timelines often mean higher financing costs and prolonged periods before revenue generation.

The availability of desirable land in key U.S. markets, where AIMCO focuses its investments, grants landowners significant leverage. When demand for prime development sites is high, it directly increases land acquisition costs, a factor that represented 13.7% of the average home sales price in 2024.

This trend can restrict AIMCO's capacity to grow its portfolio or require greater capital outlays for new projects. Suppliers of land in these sought-after locations can therefore exert considerable bargaining power, influencing AIMCO's expansion strategies and profitability.

Specialized Services and Technology Providers

Providers of specialized services and technology are increasingly influencing the real estate sector. For instance, property management software and advanced building systems are becoming essential for operational efficiency. AIMCO's reliance on these specific vendors for critical systems could lead to higher costs or less favorable terms if these providers have significant market power.

The increasing integration of technology in property management means that companies like AIMCO must carefully consider their vendor relationships. A dependence on particular software or hardware suppliers for core functions, such as tenant portals or energy management systems, can give those suppliers leverage. This leverage can translate into increased prices or less flexible contract terms, impacting AIMCO's profitability and operational agility.

AIMCO faces the challenge of balancing the adoption of innovative technologies with cost-effectiveness. In 2023, the PropTech market saw significant investment, with companies focusing on AI-driven solutions and IoT integration for smart buildings. This trend suggests that specialized technology providers are gaining traction, potentially increasing their bargaining power. For example, a leading property management software provider might command higher subscription fees due to the essential nature of its platform and the cost of switching.

- Specialized Software: Property management software is a critical operational tool, and switching costs can be substantial.

- Advanced Building Systems: Providers of integrated building management systems (BMS) and smart technology offer unique value, potentially increasing their leverage.

- Sustainable Solutions: With growing demand for green buildings, providers of sustainable construction materials and energy-efficient technologies may gain bargaining power.

- Vendor Lock-in: Dependence on proprietary technology from a single vendor can limit AIMCO's options and increase supplier influence.

Financing and Capital Markets

Lenders and capital providers act as crucial suppliers of funds for AIMCO's real estate ventures. In 2024, the Federal Reserve maintained a hawkish stance, with interest rates hovering around 5.25%-5.50%, impacting borrowing costs for REITs. This pressure on capital costs can directly influence AIMCO's ability to finance new acquisitions and development projects.

The bargaining power of these capital suppliers is amplified by market conditions. For instance, in early 2024, a tightening credit environment led to higher yields on commercial mortgage-backed securities (CMBS), reflecting increased demand for capital and a greater cost for borrowers like AIMCO. While REITs typically manage debt maturities effectively, sustained high interest rates, as anticipated through much of 2025, can still squeeze profit margins.

- Increased Cost of Capital: Higher interest rates directly translate to more expensive debt financing for AIMCO's projects.

- Impact on Project Feasibility: Elevated borrowing costs can make certain development or acquisition opportunities less attractive financially.

- Debt Management Strategies: AIMCO's ability to manage its debt maturities and access diverse funding sources mitigates some supplier power.

- Market Volatility: Fluctuations in interest rates and credit availability in 2024 and 2025 empower lenders to demand more favorable terms.

Suppliers of essential construction materials and skilled labor hold significant sway due to rising costs and shortages. In 2024, the average cost for new single-family home construction reached $428,215, with these expenses comprising 64.4% of the home's total price.

This inflationary environment, coupled with wage hikes driven by persistent labor deficits, directly impacts AIMCO's cost management for development projects. The scarcity of skilled workers in the construction industry, a critical sector for REITs like AIMCO, inherently shifts bargaining power towards these specialized professionals.

The limited availability of skilled construction personnel not only inflates costs but can also lead to project delays, increasing overall development expenses for REITs through higher financing costs and deferred revenue generation.

Landowners in desirable U.S. markets, where AIMCO concentrates its investments, also possess considerable leverage. High demand for prime development sites in 2024 pushed land acquisition costs to an average of 13.7% of a home's sales price, potentially restricting AIMCO's portfolio growth or necessitating larger capital outlays.

What is included in the product

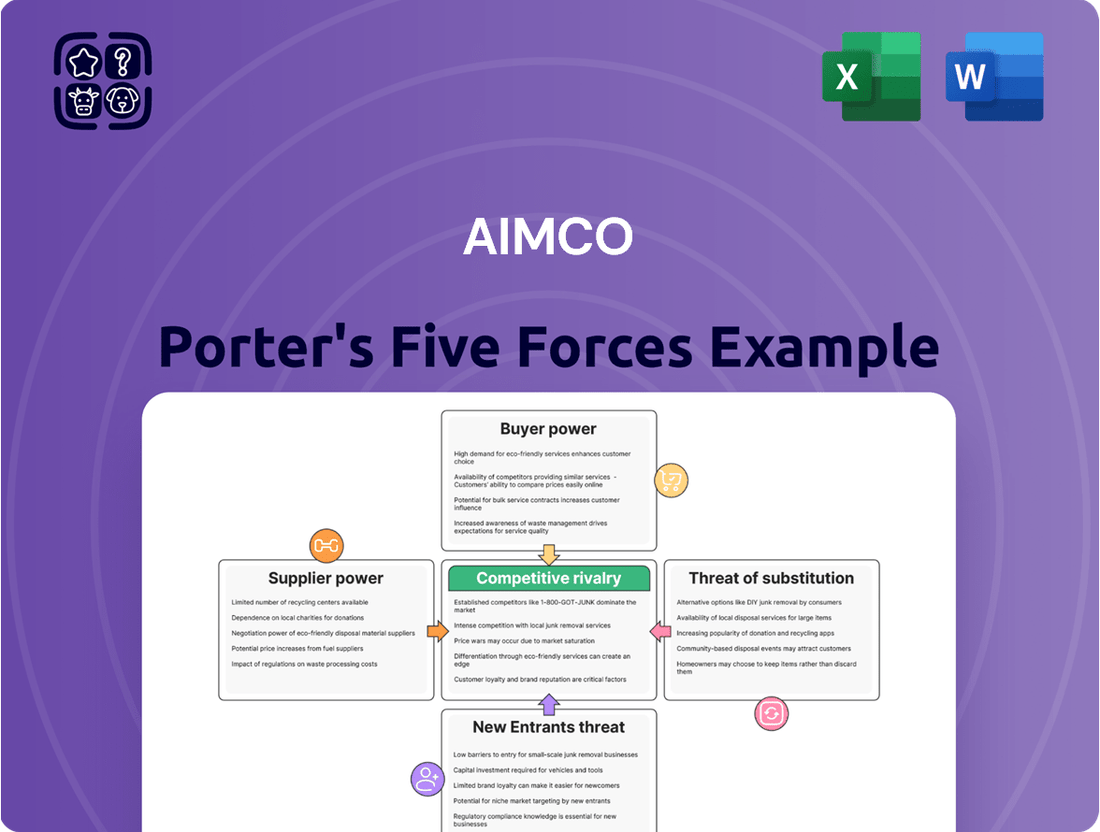

This AIMCO Porter's Five Forces analysis dissects the competitive intensity within its operating environment, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Instantly identify and mitigate competitive threats with a dynamic, interactive Porter's Five Forces model.

Customers Bargaining Power

AIMCO's renters, its primary customers, experience diminished bargaining power when occupancy rates are high and demand for rentals is robust. This is clearly demonstrated by AIMCO's performance, which saw average daily occupancy exceed 97% through April 2025. This high occupancy, coupled with accelerating effective rental rate growth, signals a tight rental market where tenants have limited alternatives, thereby strengthening AIMCO's position.

AIMCO's customer bargaining power is heavily influenced by local market conditions across the U.S. In areas with abundant new apartment supply or sluggish rental demand, tenants gain more leverage to negotiate lease terms or ask for concessions. For instance, markets like Phoenix saw a significant increase in apartment deliveries in 2023, potentially increasing tenant power there.

Conversely, in markets characterized by strong rental demand and limited new construction, such as parts of California, AIMCO customers have less bargaining power. This dynamic allows the company to maintain higher occupancy and rental rates in supply-constrained areas, demonstrating how market-specific supply-demand balances directly impact tenant influence.

While not always a significant barrier, the practicalities of relocating, such as security deposits, moving expenses, and the inherent disruption, can make tenants hesitant to switch properties. This inertia limits their immediate bargaining power.

AIMCO's Q1 2025 renewal rate of 62.7% highlights a substantial portion of tenants choosing to stay, suggesting that these switching costs, combined with tenant satisfaction, contribute to less aggressive tenant negotiation.

Availability of Rental Information

The increasing availability of rental information, especially through online platforms, significantly boosts customer bargaining power. Renters can now easily compare prices and amenities across numerous properties, making it simpler to identify opportunities where AIMCO might not be competitively priced.

This transparency means customers are better informed about market rates. For instance, in 2024, platforms like Zillow and Apartments.com provided millions of rental listings, giving renters a broad view of what’s available. If AIMCO's offerings are perceived as less valuable or overpriced compared to readily available alternatives, customers can leverage this information to negotiate better terms or simply choose a different provider.

AIMCO must therefore focus on maintaining competitive pricing and ensuring its properties offer compelling value through amenities and service. Failure to do so in a transparent market can lead to reduced occupancy and pressure on rental income.

- Increased Transparency: Online platforms offer vast amounts of rental data, empowering consumers.

- Informed Comparisons: Renters can easily benchmark AIMCO's pricing and features against competitors.

- Negotiating Leverage: Greater information access strengthens customers' ability to seek better deals.

- Competitive Imperative: AIMCO must align pricing and amenities with market expectations to retain customers.

Affordability Challenges and Economic Pressures

Rising rent prices and persistent affordability challenges can significantly amplify the collective bargaining power of renters. As economic pressures mount, tenants become more acutely aware of their housing costs, making them more receptive to seeking out more affordable alternatives.

This heightened sensitivity can translate into a greater willingness to share housing, delay relocation, or even negotiate lease terms more aggressively. For companies like AIMCO, this dynamic can act as a natural brake on aggressive rent increases, as a large segment of their customer base faces financial strain.

- Rent Affordability: In 2024, many major US cities continued to grapple with rents that outpaced wage growth, creating significant affordability hurdles for a substantial portion of the renter population.

- Economic Headwinds: Persistent inflation and interest rate concerns throughout 2024 have put additional pressure on household budgets, forcing renters to prioritize essential spending over discretionary housing costs.

- Shifting Tenant Behavior: Data from late 2023 and early 2024 indicated an increase in inquiries about rent-stabilized units and a growing interest in roommate arrangements as renters sought to mitigate rising living expenses.

The bargaining power of AIMCO's customers is moderate, influenced by market conditions and information availability. High occupancy rates, like AIMCO's exceeding 97% through April 2025, reduce tenant leverage. However, increased online transparency in 2024, with platforms listing millions of rentals, empowers renters to compare prices and amenities, potentially increasing their negotiating power if AIMCO's offerings are not competitive.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2024-2025) |

|---|---|---|

| Occupancy Rates | Decreases Power | AIMCO's average daily occupancy > 97% (Q1 2025) |

| Market Supply/Demand | Varies by Location | Increased apartment deliveries in Phoenix (2023) vs. supply-constrained California markets |

| Information Transparency | Increases Power | Millions of rental listings on platforms like Zillow (2024) |

| Switching Costs | Decreases Power | 62.7% renewal rate (Q1 2025) suggests inertia |

| Rent Affordability | Increases Power | Rents outpacing wages in many US cities (2024) |

Preview the Actual Deliverable

AIMCO Porter's Five Forces Analysis

This preview showcases the complete AIMCO Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring transparency and immediate access to valuable strategic insights. This professionally crafted analysis is ready for your immediate use, providing a comprehensive understanding of AIMCO's competitive landscape without any hidden elements or placeholders.

Rivalry Among Competitors

The U.S. multifamily housing sector, where AIMCO operates, is characterized by significant fragmentation. This means there are many companies and individuals competing for the same tenants and investment properties. For instance, in 2024, the National Association of Real Estate Investment Trusts (NAREIT) reported a substantial number of publicly traded REITs specializing in residential properties, alongside countless private equity funds and individual landlords.

This crowded field intensifies competitive rivalry. Each player, from large institutional investors to smaller operators, is constantly seeking to attract and retain residents. AIMCO, therefore, faces the challenge of distinguishing its apartment communities and the services it offers to stand out in this highly competitive environment.

The real estate sector, including companies like AIMCO, is burdened by substantial fixed costs. These include property acquisition, ongoing maintenance, and management expenses, which are significant investments. For instance, the average cost to build a new apartment unit in major US cities can range from $200,000 to $500,000 or more, representing a considerable upfront capital commitment.

Exit barriers in real estate are also quite high. Selling off properties, especially in a down market, can incur substantial transaction costs, including brokerage fees and potential capital gains taxes. This makes it difficult for companies to quickly divest assets, forcing them to remain operational and competitive even when market conditions are unfavorable.

These high fixed costs and exit barriers pressure companies to maintain high occupancy rates to cover their expenses. In 2023, the national apartment occupancy rate in the US hovered around 93%, a figure that, while strong, still means a portion of units are vacant, impacting revenue. This necessity often leads to competitive pricing strategies, as companies strive to fill units and generate cash flow, intensifying rivalry.

While demand for multifamily housing remains robust, the market is experiencing a noticeable shift. In 2024, we're seeing moderating rent growth, a direct consequence of a significant increase in new supply coming online. This surge in new units intensifies competition among landlords, potentially leading to a greater need for concessions to attract and retain tenants.

Looking ahead, the pipeline suggests a slowdown in apartment completions for 2025. However, the immediate impact of 2024's substantial new supply continues to exert downward pressure on rental rates. For instance, in many major markets, rent growth that was in the double digits in prior years has cooled considerably, with some areas even experiencing slight declines in effective rents as operators adjust to higher vacancy rates.

Geographic Concentration and Local Competition

AIMCO's strategy of concentrating on specific U.S. markets intensifies local rivalry. While national competition might be widespread, the competition within AIMCO's chosen submarkets can be particularly fierce. This geographic focus means that direct competition for both tenants and potential property acquisitions is a significant factor.

The presence of other substantial apartment owners and developers in AIMCO's primary operating regions directly fuels this intense local competition. These players actively vie for the same tenant base and acquisition opportunities, impacting market share and pricing power.

- Intensified Rivalry in Key Markets: AIMCO's focus on select U.S. markets means competition is not evenly distributed, leading to higher rivalry in its core operating areas.

- Direct Competition for Tenants: Other large apartment owners in these specific markets directly compete for AIMCO's target demographic, influencing occupancy rates and rental growth.

- Competition for Acquisitions: The presence of similar large-scale investors in AIMCO's chosen regions creates a competitive environment for acquiring new properties, potentially driving up acquisition costs.

Differentiation in Property Offerings

Competitive rivalry is intensified by how distinct property offerings are, encompassing the types of homes, available amenities, and the caliber of service provided. AIMCO leverages its strategy of investing in quality housing and making smart, strategic property acquisitions to stand out. This means offering properties that are genuinely sought after, from high-end residential communities to revitalized urban developments.

The company's competitive edge is further sharpened by its capacity to appeal to specific groups of renters and residents. By focusing on delivering an elevated living experience, AIMCO aims to capture and retain tenants who value more than just a place to live. This differentiation is key in a market where many properties might seem similar on the surface.

- Property Type Specialization: AIMCO's portfolio includes a range of property types, from garden-style apartments to high-rise luxury living, catering to diverse demographic needs.

- Amenity Rich Environments: The company often enhances its properties with sought-after amenities like modern fitness centers, co-working spaces, and pet-friendly facilities, increasing their appeal.

- Service Quality Focus: AIMCO emphasizes responsive property management and resident services, aiming to create a superior living experience that fosters tenant loyalty.

- Strategic Redevelopment: Investments in redeveloping existing assets to modern standards and incorporating new features directly address market demand for updated and appealing housing options.

Competitive rivalry within the U.S. multifamily sector, AIMCO's operating ground, is significantly shaped by market fragmentation and intense local competition. As of 2024, the sheer volume of REITs and private equity funds competing for tenants and properties, alongside numerous individual landlords, underscores this dynamic. This crowded landscape forces companies like AIMCO to actively differentiate their offerings to attract and retain residents in their chosen markets.

The pressure to maintain high occupancy rates, especially with national averages around 93% in 2023, drives competitive pricing and concessions. Furthermore, the substantial influx of new apartment supply in 2024, leading to moderating rent growth, has amplified competition among landlords seeking to fill units. This environment necessitates strategic investments in property quality and resident services to stand out.

| Factor | Description | Impact on AIMCO |

|---|---|---|

| Market Fragmentation | Numerous competitors, from large institutions to individual landlords. | Intensifies competition for tenants and properties. |

| Local Market Focus | Concentration in specific U.S. submarkets. | Leads to heightened rivalry with direct competitors in those areas. |

| New Supply Impact (2024) | Significant increase in apartment completions. | Pressures rental rates and increases need for tenant acquisition strategies. |

| Differentiation Strategy | Focus on property quality, amenities, and service. | Key to standing out and retaining tenants in a competitive environment. |

SSubstitutes Threaten

The primary substitute for renting an apartment is the purchase of a single-family home. While high home prices and elevated mortgage rates in 2024 have made this option less accessible for many, a notable shift in these conditions could redirect demand. For instance, if mortgage rates were to decline significantly or if the supply of affordable starter homes increased, more renters might opt to buy.

The threat of substitutes for traditional apartment rentals is significant, particularly for those prioritizing affordability. Budget-conscious renters increasingly explore options like co-living spaces, mobile homes, manufactured homes, and tiny homes, which often come with a substantially lower price tag than conventional apartments. For instance, the median cost of a new manufactured home in 2024 was around $130,000, a stark contrast to urban apartment rental prices.

Economic pressures, like the rising cost of living, are pushing more people to live with family or friends. This trend, a form of substitution for traditional renting, directly impacts apartment communities by shrinking the pool of potential renters. For instance, in 2024, a significant portion of young adults, particularly those aged 18-29, are opting for multi-generational living arrangements to manage expenses, a shift that directly competes with the demand for independent apartment rentals.

Condominiums and Townhomes

Condominiums and townhomes present a significant threat of substitutes for AIMCO, particularly for individuals desiring more space or a different living arrangement than traditional apartments. These housing types can offer a middle ground, appealing to those who find apartments too restrictive but single-family homes too costly or maintenance-intensive.

The appeal of condominiums and townhomes is often tied to their perceived value and lifestyle benefits. For instance, in many urban and suburban markets, the median price for a townhome can be considerably lower than that of a detached single-family home, making them an attractive alternative for a broader range of buyers. This price differential can directly siphon potential renters or even buyers away from AIMCO's apartment communities.

- Market Share: In 2024, the new condominium and townhome market continued to show resilience, with sales often outpacing single-family home sales in certain metropolitan areas due to affordability factors.

- Price Point: The average price of a new townhome in mid-2024 was approximately 15-25% less than a new single-family home in comparable neighborhoods, a key driver for substitute consideration.

- Lifestyle Appeal: Condominiums and townhomes often provide amenities and community features that can rival those offered in apartment complexes, further blurring the lines for consumers.

Seasonal or Work-Exchange Housing

For individuals with flexible lifestyles or those in seasonal industries, work-exchange programs and seasonal housing arrangements present a viable substitute to traditional apartment rentals. These arrangements often provide accommodation in exchange for labor, effectively nullifying rental costs for participants.

This trend is particularly relevant for demographics such as students, young professionals, and those engaged in seasonal work like tourism or agriculture. For instance, in 2024, many ski resorts and summer camps offered housing as part of their compensation packages, attracting a workforce that might otherwise seek conventional rentals.

- Seasonal Employment Housing: Many industries, particularly hospitality and agriculture, offer housing as a perk, reducing living expenses for workers.

- Work-Exchange Programs: Platforms facilitating exchanges of labor for accommodation are gaining traction, especially among younger demographics.

- Reduced Rental Burden: These substitutes directly address the high cost of traditional housing, making them attractive alternatives for budget-conscious individuals.

The threat of substitutes for apartment rentals is multifaceted, encompassing homeownership, alternative housing types, and shared living arrangements. These alternatives often appeal to renters seeking greater affordability, different living experiences, or ways to mitigate rising housing costs. The availability and attractiveness of these substitutes directly influence demand for traditional apartment units.

Homeownership, while a significant substitute, is influenced by market conditions. In 2024, high mortgage rates and home prices made purchasing a home less accessible for many, potentially bolstering demand for rentals. However, a shift in these economic factors, such as declining rates or increased starter home inventory, could redirect renters towards ownership.

Other housing options like manufactured homes, tiny homes, and co-living spaces offer lower entry costs. For example, the median price of a new manufactured home in 2024 was around $130,000, presenting a stark affordability contrast to apartment rents. Furthermore, living with family or friends, driven by economic pressures, also acts as a substitute, reducing the pool of potential renters.

| Substitute Type | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Homeownership | Desire for equity, stability, more space | High mortgage rates and home prices in 2024 made it less accessible for many. |

| Manufactured/Tiny Homes | Lower cost, often smaller footprint | Median cost of a new manufactured home ~ $130,000 in 2024. |

| Co-living Spaces | Shared amenities, potentially lower individual rent | Growing popularity among younger demographics seeking affordability and community. |

| Multi-generational Living | Cost savings, shared responsibilities | Significant portion of young adults (18-29) opted for this in 2024 to manage expenses. |

Entrants Threaten

The real estate investment and development sector, especially for large apartment communities, demands a massive amount of capital. This high cost of entry acts as a significant hurdle for any new company looking to break into the market. For instance, developing a new apartment complex can easily run into tens or even hundreds of millions of dollars, covering land purchase, construction materials, labor, and permits.

Newcomers must secure substantial financial backing to even begin operations. This includes funds for acquiring prime land, managing the complex construction process, and establishing robust ongoing property management systems. Established players, like AIMCO, benefit from years of accumulated capital and access to financing, which smaller or newer entities struggle to match, thereby limiting direct competition.

Regulatory hurdles and zoning laws present a formidable barrier to entry in the real estate sector. Complex permitting processes, varying local ordinances, and stringent state and federal regulations can significantly increase the time and cost for new developers. For instance, in 2024, the average time to obtain building permits in major U.S. cities often exceeded six months, with some projects facing delays of over a year due to regulatory reviews.

New entrants often face significant hurdles in accessing the capital needed to compete effectively. Established firms like AIMCO, with their robust balance sheets and long-standing relationships with lenders, typically secure financing on more favorable terms.

In 2024, the cost of capital remains a critical barrier. For instance, corporate bond yields for less established companies have been notably higher than those for investment-grade issuers, making debt financing substantially more expensive for newcomers. This disparity in borrowing costs directly impacts a new entrant's ability to fund operations, invest in infrastructure, or acquire necessary assets, thereby limiting their competitive threat.

Brand Recognition and Operational Scale

Established REITs like AIMCO possess significant brand recognition and operational scale, which act as substantial barriers to entry. Their long-standing presence allows for deep market penetration and a trusted reputation among tenants and investors alike.

Newcomers struggle to replicate the economies of scale that established players enjoy across property management, marketing, and procurement. This disadvantage makes it difficult for them to attract tenants and achieve comparable operational efficiencies and profitability margins.

- Brand Loyalty: AIMCO's established brand name fosters tenant loyalty, reducing churn and acquisition costs compared to new entrants.

- Operational Efficiencies: Existing REITs leverage scale for lower per-unit operating costs in management and maintenance. For instance, in 2024, large REITs often reported operating expense ratios significantly lower than smaller, newer portfolios.

- Procurement Advantages: Larger entities can negotiate better terms with suppliers and contractors, a benefit unavailable to smaller, less experienced competitors entering the market.

Market Saturation in Specific Segments

While the broader multifamily housing market demonstrates resilience, specific submarkets and property types can face temporary saturation. This occurs when a significant influx of new construction enters these particular segments, dampening their appeal for additional new entrants.

The heightened competition for renters in saturated areas naturally moderates rent growth. For instance, in late 2023 and early 2024, markets with substantial new supply, such as parts of the Sun Belt, experienced slower rent increases compared to less saturated regions.

This saturation can act as a deterrent for new developers. The prospect of facing intense competition for tenants and limited upside in rent appreciation makes these specific segments less attractive for further investment.

- Market Saturation: Specific multifamily submarkets can become oversaturated due to high new construction volumes.

- Reduced Attractiveness: Saturation lowers the appeal for new entrants looking to build in these areas.

- Intensified Competition: Competition for tenants increases significantly in saturated markets.

- Moderated Rent Growth: Rent growth tends to slow down in areas experiencing oversupply.

The threat of new entrants for AIMCO is generally low due to substantial capital requirements and regulatory complexities. Developing large apartment communities demands hundreds of millions of dollars, a significant barrier for newcomers. In 2024, securing financing remains challenging for less established entities, with higher corporate bond yields reflecting increased borrowing costs. For example, a new development project might face financing costs that are 1-2% higher than those for established REITs.

Established players like AIMCO benefit from economies of scale, brand recognition, and operational efficiencies, making it difficult for new firms to compete. These advantages translate into lower per-unit operating costs; in 2024, large REITs often reported operating expense ratios significantly below those of smaller portfolios. Procurement advantages also allow established firms to negotiate better terms with suppliers, a benefit unavailable to smaller, less experienced competitors.

Market saturation in certain submarkets can deter new entrants by intensifying competition for tenants and moderating rent growth. For instance, areas with significant new construction, like parts of the Sun Belt in late 2023 and early 2024, experienced slower rent increases. This saturation reduces the attractiveness of these segments for additional investment, further limiting the threat of new competition.

| Barrier Type | Description | Impact on New Entrants | 2024 Data Point |

|---|---|---|---|

| Capital Requirements | High cost of land acquisition and construction. | Significant hurdle, requiring substantial funding. | New development projects may face 1-2% higher borrowing costs than established REITs. |

| Regulatory Hurdles | Complex permitting and zoning laws. | Increases time and cost for new developers. | Average building permit acquisition time in major U.S. cities often exceeded six months in 2024. |

| Economies of Scale | Lower per-unit operating costs for established firms. | New entrants struggle to match operational efficiencies. | Large REITs reported lower operating expense ratios than smaller portfolios in 2024. |

| Market Saturation | Oversupply in specific submarkets. | Deters new investment due to intensified competition and moderated rent growth. | Sun Belt markets saw slower rent increases in late 2023/early 2024 due to high new supply. |

Porter's Five Forces Analysis Data Sources

Our AIMCO Porter's Five Forces analysis is built upon a robust foundation of data, drawing from AIMCO's own investor relations disclosures, industry-specific market research reports, and comprehensive competitor financial filings.