AIG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIG Bundle

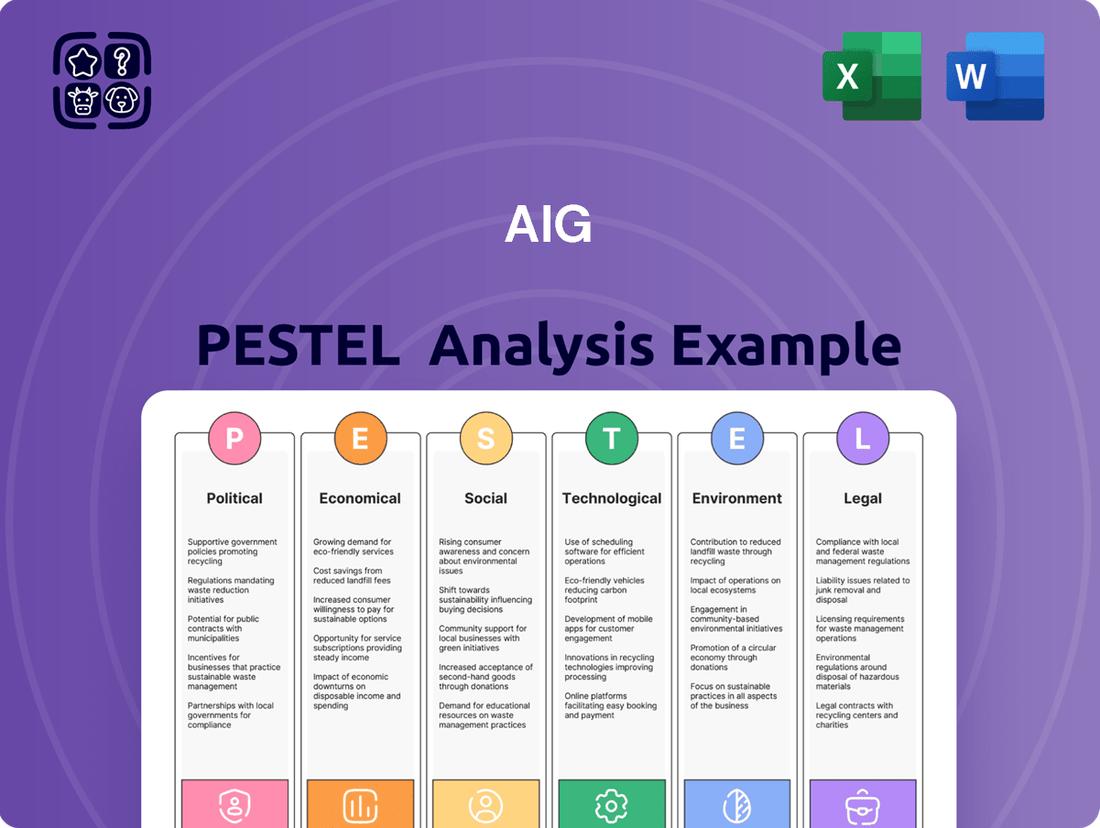

Unlock AIG's strategic landscape with our detailed PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are shaping the insurance giant's future. This comprehensive report offers actionable insights into technological advancements, environmental regulations, and legal frameworks impacting AIG. Gain a competitive edge by leveraging this expert-crafted intelligence to inform your own market strategy and investment decisions. Download the full PESTLE analysis now for immediate access to crucial data.

Political factors

Geopolitical instability and escalating trade tensions significantly impact AIG as a global insurer. Increased conflict or protectionist policies can directly translate to higher claims for political risk insurance, a segment where AIG is a major player. For instance, the ongoing geopolitical shifts in Eastern Europe and the Middle East have already heightened demand for such coverage throughout 2024.

These global disruptions also ripple through supply chains, creating business interruption and contingent business interruption claims for AIG's commercial clients. Furthermore, the volatile international environment affects AIG's vast investment portfolio, as fluctuating currency values and market uncertainty can impact asset performance. Analysts note that rising interest rates in major economies, partly a response to geopolitical inflation, present both opportunities and risks for investment returns.

Governments and regulatory bodies globally maintain a significant impact on the insurance industry, directly influencing companies like AIG. Shifts in insurance regulations, solvency mandates, and consumer protection legislation can substantially affect AIG's operating expenses, the products it can offer, and its ability to enter new markets.

AIG's 2024 annual report explicitly acknowledges the ongoing challenge of navigating complex geopolitical landscapes and economic instability, underscoring how these macro-political factors necessitate adaptive strategies. For instance, increased capital requirements for insurers, as seen in some European Union directives, can force adjustments in AIG's capital allocation and business models.

The global political landscape in 2024 and extending into 2025 is marked by an unusually high volume of elections across numerous countries. This surge in electoral activity inherently breeds policy uncertainty, creating a ripple effect that can significantly disrupt financial markets and reshape international diplomatic ties. For a company like AIG, this translates into a dynamic environment where potential shifts in economic policies, the introduction of new tax reforms, or changes in industry-specific regulations could directly impact its profitability and the efficacy of its long-term strategic planning.

Navigating this period of heightened political flux requires a keen focus on regulatory decision-making processes and the cultivation of strong relationships at the state and national levels. As of early 2024, over 60 countries were scheduled to hold elections, impacting roughly half of the world's population, underscoring the widespread nature of this phenomenon. This means AIG must remain agile, closely monitoring legislative developments and adapting its business strategies to accommodate evolving governmental priorities and potential changes in the regulatory frameworks governing the insurance and financial services sectors.

Protectionist Policies and Tariffs

The global trend towards protectionist policies and increased tariffs, notably from major economic powers, presents a complex challenge for AIG. These measures can directly affect claims costs; for instance, tariffs on imported auto parts could raise the severity of collision claims for AIG's auto insurance division. Furthermore, such policies can dampen international trade, potentially reducing demand for AIG's trade credit insurance products.

The imposition of tariffs, such as those seen in trade disputes impacting global supply chains, directly influences the cost of goods and services. For example, in 2023, the average tariff rate on imported goods into the United States remained a significant factor in business operations. This increase in the cost of repairs or replacement parts for insured assets can lead to higher payouts for insurers like AIG, impacting profitability.

- Increased Claims Costs: Tariffs on auto parts and manufactured goods can inflate repair expenses for damaged vehicles and property, directly increasing AIG's claims payouts.

- Reduced Demand for Trade Credit Insurance: Heightened trade barriers and the uncertainty associated with protectionist measures can decrease international trade volumes, thereby lowering the need for trade credit insurance.

- Supply Chain Disruptions: Protectionist policies can disrupt global supply chains, leading to delays and increased costs for businesses, which may indirectly affect AIG through business interruption claims or financial stability of insured entities.

- Market Volatility: The unpredictable nature of trade policy shifts creates market volatility, making it harder for AIG to accurately price risk and manage its investment portfolio.

Government Support and Bailout Perceptions

The legacy of AIG's 2008 government bailout, while not an immediate concern, continues to shape perceptions. This historical event means that the potential for future government intervention remains a background factor, influencing public trust and regulatory oversight. This event spurred significant re-evaluation of business and technology strategies across the insurance industry.

This historical context impacts AIG's strategic decision-making, particularly concerning risk management and financial stability. The perception of government support can affect investor confidence and the company's ability to operate with autonomy.

- Government Support Perception: The 2008 bailout continues to influence how stakeholders view AIG's relationship with the government.

- Regulatory Scrutiny: Past events often lead to heightened and ongoing regulatory attention.

- Risk Management Evolution: The industry, including AIG, has had to adapt its risk management frameworks significantly post-2008.

The global political climate in 2024 and 2025 is characterized by widespread elections and a resurgence of protectionist trade policies. These shifts create policy uncertainty, impacting AIG's global operations and investment strategies. For example, over 60 countries held elections in 2024, affecting roughly half the world's population.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting AIG, providing a comprehensive understanding of the external landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions by highlighting key external factors impacting AIG.

Economic factors

AIG's financial health is closely linked to the overall health of the global economy. While the insurance sector demonstrated its ability to weather economic shifts through 2024, initial indicators for early 2025 point towards a slowdown in global economic expansion. This deceleration could mean slower growth in insurance premiums as businesses and individuals might scale back on discretionary spending.

Inflation presents another significant challenge, directly affecting the cost of claims, especially for property and casualty insurance. As the cost of repairs, materials, and labor rises due to inflation, insurers like AIG must adapt their pricing strategies to maintain profitability. For instance, rising construction costs in 2024 and projected for 2025 directly impact rebuilding costs covered by property insurance.

The elevated interest rate environment in 2024 has been a boon for AIG’s life and annuity businesses. Higher yields on investments directly translate to improved profitability for these segments. For example, the average yield on AIG’s investment portfolio saw a notable increase, bolstering the company's financial performance.

However, this same environment presents challenges. Interest rate volatility can negatively impact the market value of AIG's existing bond holdings, potentially leading to unrealized losses. Fluctuations can also affect investment income streams, possibly necessitating adjustments to premiums or product pricing to maintain profitability targets.

AIG's financial health is closely tied to its net investment income, a crucial component of its profitability. In the first quarter of 2024, AIG reported total net investment income of $3.2 billion, showcasing its reliance on these returns.

However, market volatility, fueled by ongoing geopolitical tensions and shifting trade policies throughout 2024, directly impacts asset valuations and, consequently, AIG's investment returns. This uncertainty can create headwinds for the company's income generation.

To counter these market fluctuations and bolster its income, AIG is strategically reinvesting its assets, particularly in areas offering higher yields. This includes a growing focus on private credit, which offers potentially more attractive returns compared to traditional fixed-income instruments.

Consumer Spending and Disposable Income

Consumer spending patterns are a crucial economic factor impacting AIG. When consumers tighten their belts and demand weakens, especially in developed economies, it can slow down premium growth for both life and non-life insurance. This is because insurance, particularly life insurance and retirement products, is often seen as discretionary spending when household budgets are strained.

Disposable income levels directly dictate how much individuals can afford to spend on insurance. Higher disposable income generally translates to a greater ability and willingness to invest in comprehensive insurance coverage and long-term retirement solutions. Conversely, falling disposable income can lead to reduced uptake or even cancellations of policies.

- Consumer Spending Trends: In the first quarter of 2024, US consumer spending increased by 3.2% at an annual rate, showing resilience but with some signs of moderation compared to previous quarters.

- Disposable Income Impact: Real disposable personal income in the US saw a modest increase in early 2024, but inflation continues to erode purchasing power for many households, affecting their capacity for insurance purchases.

- Insurance Affordability: Surveys in late 2023 and early 2024 indicated that a significant percentage of households found it challenging to afford essential goods and services, let alone premium insurance products.

- Market Specifics: In Europe, consumer confidence remained subdued through much of 2024, impacting discretionary spending, including demand for new life insurance policies and higher coverage levels.

Catastrophe Losses and Reinsurance Costs

The insurance sector, including major players like AIG, is facing significant headwinds from an increasing frequency and severity of climate-related natural disasters. These events directly translate into higher catastrophe losses, putting pressure on insurers' financial stability. For instance, the U.S. experienced an unprecedented 28 separate billion-dollar weather and climate disasters in 2023 alone, according to NOAA, a stark increase from previous years.

These escalating losses necessitate a critical reevaluation of underwriting practices and pricing strategies. Insurers are forced to factor in higher anticipated payouts, which in turn drives up the cost of reinsurance, the insurance that insurers buy to protect themselves from large losses. This dynamic directly impacts AIG's profitability and its ability to offer competitive premiums.

The heightened risk environment and rising reinsurance expenses are compelling insurers to adjust their business models and risk appetites. This could involve withdrawing from certain high-risk geographies or lines of business, or demanding higher premiums to cover the increased exposure.

- Increased Frequency of Catastrophes: 2023 saw a record 28 billion-dollar disasters in the US, a significant jump indicating a growing trend.

- Elevated Catastrophe Losses: This trend directly translates to higher claims payouts for insurers like AIG.

- Rising Reinsurance Costs: As insurers face greater risk, the cost of transferring that risk to reinsurers escalates, impacting AIG's operating expenses.

- Pricing Model Adjustments: Insurers must adapt their pricing to reflect these increased costs and potential future losses, potentially affecting premium competitiveness.

While a strong investment income stream bolstered AIG in early 2024, a projected slowdown in global economic expansion for 2025 could temper premium growth. Inflation's persistence, particularly in construction costs, continues to pressure property and casualty claims, requiring careful repricing. Conversely, higher interest rates provided a significant tailwind for AIG's life and annuity segments through much of 2024, boosting investment yields.

| Economic Factor | 2024 Impact | 2025 Outlook |

| Global Economic Growth | Resilient, some moderation | Projected slowdown |

| Inflation | Elevated, impacting claims costs | Persisting, particularly in materials |

| Interest Rates | Beneficial for Life/Annuity, higher yields | Potential volatility impacting bond values |

| Net Investment Income (Q1 2024) | $3.2 billion | Dependent on market volatility |

| Consumer Spending (US Q1 2024) | +3.2% annual rate | Expected moderation |

Full Version Awaits

AIG PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive AIG PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a deep understanding of the external forces shaping AIG's strategic landscape.

Sociological factors

Global demographic shifts significantly impact insurance demand. Advanced economies are experiencing an aging population, increasing the need for health and life insurance. For instance, in 2024, the percentage of the global population aged 65 and over reached approximately 10.5%, a figure projected to climb considerably in the coming years.

Conversely, emerging markets are characterized by rapid population growth. This dynamic creates demand for a broader range of insurance products, from basic life coverage to more specialized offerings. By 2025, emerging markets are expected to account for a substantial portion of global population growth, presenting a key opportunity for insurers.

The aging demographic specifically fuels demand for health and long-term care insurance as individuals seek to manage healthcare costs and ensure financial security in later life. In 2024, global healthcare spending continued its upward trend, underscoring this need.

Simultaneously, younger demographics are increasingly driving growth in life insurance applications, particularly in regions with expanding middle classes and greater awareness of financial planning. This segment often seeks protection and wealth accumulation solutions.

Customers now demand insurance that’s tailored, clear, and easily accessible, often through online avenues. This shift means AIG must evolve its products and how it reaches consumers, as digital channels, particularly mobile apps, are becoming the primary sales method for many insurance types.

By mid-2024, data indicated that over 70% of insurance shoppers researched policies online before making a purchase. This growing reliance on digital engagement highlights the critical need for AIG to enhance its online presence and user experience to capture this increasingly digitally-native customer base.

Societies are increasingly attuned to complex risks like cyberattacks and the impacts of climate change, which directly affects how people approach insurance and financial planning. This heightened awareness is driving a demand for more sophisticated and adaptable insurance products. For instance, the global cyber insurance market was projected to reach $29.3 billion by 2025, highlighting this growing concern.

AIG's proactive stance in developing solutions for climate-related risks and fostering resilience is essential. By offering innovative coverage for renewable energy projects and natural disaster mitigation, AIG addresses these societal anxieties and builds confidence in its ability to manage evolving threats.

Workforce Evolution and Talent Management

The insurance sector, including AIG, is grappling with a significant workforce evolution. This shift demands a modernization of operations and technology, pushing companies to attract and retain talent with skills in AI, data analytics, and digital transformation. For instance, in 2024, the demand for cybersecurity professionals in financial services, a related field, saw a 27% increase year-over-year, highlighting the need for specialized tech talent.

AIG's operational effectiveness is directly tied to its ability to adapt its talent management strategies. This involves not only upskilling existing employees but also recruiting individuals who can drive innovation and manage increasingly complex digital environments. By 2025, it's projected that nearly 40% of the global workforce will require reskilling or upskilling to keep pace with technological advancements.

- Attracting Tech Talent: AIG needs to compete for skilled professionals in AI, data science, and cloud computing, areas crucial for modernizing insurance operations.

- Upskilling Existing Workforce: Investing in training programs for current employees to adapt to new technologies and analytical tools is paramount.

- Diversity and Inclusion: Building a diverse workforce brings varied perspectives, essential for innovation and understanding a broader customer base.

- Remote and Hybrid Work Models: Adapting to flexible work arrangements is key to retaining talent and accessing a wider geographical pool of candidates.

ESG and Corporate Social Responsibility

Societal expectations are increasingly shaping how companies like AIG operate, particularly concerning Environmental, Social, and Governance (ESG) factors. This growing emphasis directly influences AIG's public image, how it makes investment choices, and the types of products it develops. For instance, investors and consumers alike are scrutinizing companies' environmental footprints and social impact more than ever before.

AIG is actively responding to these ESG trends. The company has set ambitious goals to cut its greenhouse gas emissions and has published a detailed climate roadmap. This proactive approach demonstrates an alignment with the broader societal push for greater corporate responsibility and sustainability, aiming to build trust and ensure long-term viability in a changing world.

- ESG Integration: AIG’s commitment to ESG principles guides its investment strategies and product innovation, reflecting a growing market demand for sustainable finance.

- Climate Action: The company has established specific targets for reducing its greenhouse gas emissions, showcasing a tangible effort to address climate change concerns.

- Transparency: AIG's publication of a climate roadmap signifies a dedication to transparency and accountability regarding its environmental performance and future plans.

- Stakeholder Expectations: Meeting evolving societal expectations on ESG is crucial for AIG's reputation, attracting talent, and maintaining customer loyalty in the 2024-2025 period.

Societal shifts, including evolving customer expectations for digital interaction and personalized services, are reshaping the insurance landscape. By mid-2024, over 70% of insurance shoppers researched policies online, signaling AIG's need to bolster its digital presence and user experience.

Growing awareness of complex risks like cyber threats and climate change is driving demand for more sophisticated insurance products. The global cyber insurance market, for example, was projected to reach $29.3 billion by 2025, indicating a clear market opportunity for AIG to offer specialized coverage.

The workforce is undergoing a transformation, with a critical need for talent skilled in AI, data analytics, and digital technologies. Projections suggest that by 2025, nearly 40% of the global workforce will require reskilling or upskilling to adapt to technological advancements, underscoring AIG's focus on talent development.

Societal emphasis on Environmental, Social, and Governance (ESG) factors is increasingly influencing AIG's operations and investment decisions. AIG's commitment to reducing greenhouse gas emissions and its transparent climate roadmap directly address these growing stakeholder expectations for corporate responsibility.

| Societal Factor | Impact on AIG | 2024/2025 Data/Projection |

|---|---|---|

| Digitalization of Services | Increased demand for online research and purchasing; need for enhanced digital platforms. | Over 70% of insurance shoppers researched online by mid-2024. |

| Risk Awareness | Growing demand for coverage against cyberattacks and climate-related events. | Global cyber insurance market projected to reach $29.3 billion by 2025. |

| Workforce Evolution | Need for specialized tech talent (AI, data analytics) and upskilling existing staff. | Nearly 40% of global workforce to require reskilling/upskilling by 2025. |

| ESG Focus | Influence on investment strategies, product development, and corporate reputation. | Increased scrutiny on corporate environmental footprints and social impact. |

Technological factors

AIG is heavily investing in Artificial Intelligence (AI) and Machine Learning (ML) to streamline its core operations. This includes revolutionizing underwriting, claims processing, and risk assessment, with the goal of significantly boosting efficiency and profitability.

Generative AI, in particular, is seen as a game-changer for the insurance industry. AIG's strategy centers on deploying AI technologies across the board to foster innovation and ensure sustained, long-term growth. For instance, in 2024, AIG highlighted its ongoing investments in AI capabilities as a key driver for competitive advantage.

Technological advancements in data analytics and big data are fundamentally reshaping the insurance landscape for AIG. The capacity to collect, process, and analyze enormous datasets allows AIG to uncover intricate patterns in customer behavior, refine risk assessments, and anticipate emerging market shifts. For instance, as of early 2024, the global big data analytics market was projected to reach over $270 billion, highlighting the immense potential for companies like AIG to leverage these tools.

These sophisticated analytical capabilities directly translate into tangible benefits for AIG. More precise underwriting, driven by data-driven insights, leads to better pricing and reduced losses. Furthermore, the ability to personalize product offerings based on individual customer data enhances engagement and loyalty. In 2023, insurers leveraging advanced analytics reported a 15% improvement in fraud detection rates compared to those relying on traditional methods.

AIG's reliance on digital platforms for operations and customer interactions, including policy management and claims processing, makes robust cybersecurity essential. In 2024, the financial services sector, including insurance, continued to be a prime target for cyberattacks. AIG must invest heavily in advanced threat detection and prevention systems to safeguard its vast amounts of sensitive customer data, such as financial information and personal details.

Data privacy is a critical technological factor for AIG, especially with evolving global regulations like GDPR and CCPA. Failure to comply can result in significant fines and reputational damage. In 2024, data privacy breaches remained a substantial concern across industries, underscoring the need for AIG to maintain strict protocols for data collection, storage, and usage, ensuring customer trust and regulatory adherence.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are poised to significantly reshape the insurance landscape, offering enhanced security and efficiency. These innovations can streamline everything from claims processing to policy management, creating more transparent and robust business networks. For instance, in 2023, the global blockchain in insurance market was valued at approximately $1.2 billion and is projected to reach over $8 billion by 2030, indicating substantial growth and adoption.

The potential benefits are considerable. Blockchain's inherent immutability and distributed nature can reduce fraud, speed up settlements, and lower operational costs. This technology could also facilitate the creation of smart contracts, automating payouts when specific conditions are met, thereby improving customer experience and operational agility.

- Enhanced Transparency: DLT provides a shared, immutable record of transactions, reducing disputes and increasing trust among insurers, reinsurers, and policyholders.

- Streamlined Claims Processing: Smart contracts on a blockchain can automatically trigger claim payouts upon verification of predefined events, significantly reducing processing times.

- Improved Security and Fraud Prevention: The cryptographic nature of blockchain makes it highly resistant to tampering, thereby mitigating risks of fraudulent activities in policy issuance and claims.

- New Product Development: Blockchain can enable innovative insurance products, such as parametric insurance, which automatically pays out based on specific, verifiable data triggers.

Cloud Computing and Digital Infrastructure

Cloud computing offers AIG a highly scalable and flexible foundation for its ongoing digital transformation efforts. This technology is critical for efficiently managing vast amounts of data, processing complex analytics, and deploying new applications that enhance operational efficiency and customer engagement.

AIG's investment in a robust digital infrastructure is paramount for modernizing its core operations and ensuring the delivery of seamless, intuitive customer experiences across all touchpoints. This includes enhancing cybersecurity measures and leveraging advanced analytics for risk assessment and product development.

- Scalability: Cloud platforms allow AIG to quickly scale resources up or down based on demand, optimizing costs and performance for its diverse insurance and financial services.

- Data Analytics: Advanced cloud-based analytics tools enable AIG to process large datasets for better risk modeling, fraud detection, and personalized customer offerings, with the global cloud market projected to reach over $1 trillion by 2025.

- Application Modernization: Cloud-native architectures facilitate the rapid development and deployment of new digital products and services, improving AIG's agility in a competitive market.

- Cybersecurity: Major cloud providers invest billions in security, offering AIG enhanced protection against evolving cyber threats, a critical factor given the sensitive nature of financial data.

AIG's strategic adoption of AI and machine learning is revolutionizing underwriting, claims, and risk assessment, aiming for significant efficiency gains. Generative AI, in particular, is a key focus for innovation and long-term growth, with AIG continuing its investments in these capabilities throughout 2024 to maintain a competitive edge.

Big data analytics are reshaping the industry for AIG, enabling deeper insights into customer behavior, refined risk modeling, and anticipation of market trends. This is crucial as the global big data analytics market was projected to exceed $270 billion in 2024, offering substantial opportunities for data-driven advantages.

AIG's digital operations demand robust cybersecurity, as the financial sector remained a prime target for cyberattacks in 2024. Protecting sensitive customer data requires continuous, significant investment in advanced threat detection and prevention systems.

Data privacy is paramount, with AIG needing to adhere to evolving regulations like GDPR and CCPA to avoid substantial fines and reputational damage, a concern amplified in 2024 by ongoing industry-wide data privacy breaches.

Legal factors

AIG navigates a complex web of global insurance regulations, including Solvency II in Europe and the Solvency Modernization Initiative in the United States. These frameworks dictate stringent capital requirements, robust governance structures, and sophisticated risk management practices, directly influencing AIG's operational capacity and strategic planning.

Compliance with these evolving regulations necessitates significant investment in systems and expertise, impacting AIG's financial reporting and overall business model. For instance, Solvency II, implemented in 2016, aimed to harmonize insurance regulation across the EU, focusing on risk-based capital and governance, and continues to shape how insurers like AIG manage their balance sheets and disclose their financial health.

AIG, like all major insurers, operates under a stringent legal framework concerning data protection and privacy. Regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States place significant demands on how AIG handles customer information. These laws dictate strict protocols for data collection, storage, processing, and sharing, requiring robust security measures and transparent consent processes.

Non-compliance with these evolving legal mandates can result in substantial financial penalties and reputational damage. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. The CCPA, while offering different penalty structures, also presents significant financial risks for data breaches or improper data handling. AIG’s commitment to navigating these regulations is therefore paramount for maintaining customer trust and operational integrity.

AIG operates under a complex web of consumer protection and market conduct regulations globally, impacting everything from product development to how claims are processed. These rules are designed to ensure policyholders are treated fairly and transparently. For instance, in the United States, the National Association of Insurance Commissioners (NAIC) sets model laws that states often adopt, covering areas like unfair trade practices and advertising.

In 2024, regulators continue to scrutinize data privacy and cybersecurity practices, with significant fines levied for non-compliance. Companies like AIG must demonstrate robust data protection measures to safeguard sensitive customer information. The European Union's General Data Protection Regulation (GDPR) continues to set a high standard, influencing AIG's data handling policies even outside the EU.

Market conduct examinations in 2024 and projections for 2025 highlight a focus on complaint handling, underwriting fairness, and sales practices. AIG's adherence to these regulations is crucial for maintaining its license to operate and its reputation. For example, a failure in claims handling transparency could lead to regulatory sanctions and financial penalties, directly impacting profitability and customer trust.

Anti-Money Laundering (AML) and Sanctions Laws

As a major global insurer and financial services provider, AIG faces significant legal scrutiny regarding Anti-Money Laundering (AML) and sanctions compliance. These regulations are designed to prevent financial institutions from being used for illicit purposes, such as funding terrorism or criminal activities. AIG must maintain sophisticated systems and processes to identify and report suspicious transactions, as well as to screen customers and counterparties against various sanctions lists. Failure to comply can result in substantial fines and reputational damage.

In 2024, global efforts to combat financial crime continue to intensify, with regulatory bodies worldwide enhancing enforcement. For instance, the Financial Crimes Enforcement Network (FinCEN) in the United States regularly updates its guidance and imposes penalties on institutions that fall short of AML requirements. Similarly, international bodies like the Financial Action Task Force (FATF) set standards that AIG must adhere to across its operations. These legal frameworks necessitate continuous investment in technology and training to ensure robust compliance.

- Regulatory Landscape: AIG operates under a complex web of AML and sanctions laws in every jurisdiction where it does business, including the Bank Secrecy Act in the US and similar frameworks in Europe and Asia.

- Compliance Investment: Companies like AIG are estimated to spend billions annually on compliance, with a significant portion dedicated to AML and sanctions screening technology and personnel.

- Sanctions Regimes: AIG must monitor and adhere to sanctions imposed by the U.S. Office of Foreign Assets Control (OFAC), the United Nations, and other international bodies, which can change frequently.

- Enforcement Actions: In recent years, financial institutions have faced significant penalties for AML and sanctions violations, underscoring the critical importance of stringent adherence.

Litigation and Legal Disputes

AIG is continually exposed to litigation and legal disputes. These can arise from various sources, including insurance claims, alleged contract breaches, and actions taken by shareholders. The company must actively manage these legal challenges to safeguard its financial stability and public image. For instance, in 2023, AIG reported that its total litigation accruals, which represent estimated losses from ongoing legal matters, were a significant figure, reflecting the substantial nature of these risks.

Effective management of these legal issues is crucial for maintaining AIG's operational integrity and investor confidence. The company dedicates substantial resources to legal defense and compliance efforts. In its 2024 filings, AIG highlighted ongoing legal proceedings that could potentially impact its financial results, underscoring the dynamic nature of this risk.

The types of legal disputes AIG encounters are diverse. They often involve complex insurance coverage issues, allegations of regulatory non-compliance, and disputes stemming from its financial products.

- Claims Litigation: Disputes over the interpretation and payout of insurance policies.

- Regulatory Actions: Legal challenges arising from non-compliance with insurance and financial regulations.

- Shareholder Disputes: Lawsuits filed by shareholders, often related to corporate governance or financial performance.

- Contractual Disputes: Disagreements concerning the terms and execution of various business contracts.

AIG's operations are significantly shaped by evolving global insurance regulations, such as Solvency II in Europe and the Solvency Modernization Initiative in the US, which mandate robust capital and risk management. These frameworks, like Solvency II implemented in 2016, require substantial investment in systems and expertise, impacting financial reporting and business models.

Data protection laws like GDPR and CCPA impose strict protocols on AIG's handling of customer information, demanding robust security and transparent consent. Non-compliance can lead to substantial penalties, with GDPR fines potentially reaching 4% of global annual revenue.

AIG must also navigate complex consumer protection and market conduct rules, ensuring fair treatment of policyholders, with regulators focusing on complaint handling and underwriting fairness in 2024-2025, impacting licensing and reputation.

Environmental factors

Climate change is a significant environmental concern, driving more frequent and intense extreme weather events like wildfires, hurricanes, and floods. These directly affect AIG's property and casualty insurance lines, forcing adjustments in how they assess risk and set premiums.

For instance, the increased frequency of severe convective storms in the US alone led to insured losses exceeding $50 billion in 2023, a figure that continues to rise, impacting AIG's claims costs and profitability.

AIG must continually refine its actuarial models to account for these escalating weather-related risks, ensuring that its pricing accurately reflects the potential for higher payouts due to climate-driven events.

This necessitates a forward-looking approach to underwriting, incorporating climate science data to anticipate future losses and maintain financial stability in a changing environment.

Investor, regulatory, and public demand for sustainable investing is significantly shaping AIG's investment strategies. This growing pressure is pushing companies like AIG to integrate Environmental, Social, and Governance (ESG) factors more deeply into their core business practices and decision-making processes. For instance, many financial institutions are setting ambitious goals, with a notable trend towards net-zero greenhouse gas emission commitments across their investment portfolios. By 2024, over 80% of the world's largest companies were expected to report on ESG metrics, a trend that will only accelerate, impacting AIG's operational and investment landscape.

Resource scarcity, a growing concern in 2024 and projected to intensify through 2025, directly impacts global supply chains. This can translate into significantly higher costs for parts and materials needed for repairs, directly affecting the claims payouts for insurers like AIG, particularly in property and auto lines. For instance, disruptions in semiconductor supply chains in 2023-2024 have already driven up the cost of vehicle repair and replacement, a trend expected to continue.

These escalating repair and replacement expenses due to resource scarcity put pressure on AIG's underwriting profitability. When the cost of claims rises faster than premiums collected, margins shrink. This is especially critical in sectors like property insurance, where natural disasters can create sudden, widespread demand for materials already in short supply, exacerbating cost increases.

Pollution and Environmental Liability

AIG, as a major insurer, faces significant exposure to environmental liability risks stemming from pollution and contamination events. This translates into potential claims from companies dealing with environmental damage, cleanup costs, or regulatory fines, necessitating robust environmental insurance offerings and specialized underwriting expertise.

The increasing focus on climate change and sustainability amplifies these risks. For instance, the global environmental insurance market was valued at approximately USD 11.5 billion in 2023 and is projected to grow, indicating a rising demand for such coverage as businesses grapple with environmental compliance and potential liabilities.

AIG's response involves developing and offering tailored environmental insurance products, such as Pollution Legal Liability and Contractors Pollution Liability. These policies are crucial for industries that pose a higher risk of environmental impact, including manufacturing, construction, and energy sectors.

- Growing Market Demand: The global environmental insurance market's projected growth underscores the increasing need for specialized coverage to mitigate pollution-related liabilities.

- Industry-Specific Needs: AIG must cater to diverse industries, each with unique environmental exposures, requiring flexible and comprehensive policy structures.

- Regulatory Landscape: Evolving environmental regulations worldwide create new liabilities for businesses, driving demand for insurance solutions that cover compliance failures and penalties.

- Climate Change Impact: The physical impacts of climate change can exacerbate existing pollution risks or create new ones, such as increased flooding leading to hazardous material release, impacting insurers like AIG.

Sustainability Reporting and Transparency

There's a growing expectation for companies like AIG to be upfront about their sustainability efforts and how they're addressing environmental concerns. This includes detailing their carbon footprint and plans for transitioning to a greener future.

AIG has made a commitment to share its climate roadmap, offering investors a clear view of the company's strategies and future actions in this area. This move reflects a broader industry trend towards greater environmental accountability.

For instance, in 2023, AIG reported that its total Scope 1 and Scope 2 greenhouse gas emissions were approximately 104,000 metric tons of CO2 equivalent. This figure is a key data point investors will look at when evaluating the company's climate transition plans.

- Increased Investor Scrutiny: Investors are actively seeking detailed sustainability reports and climate transition plans from insurers.

- AIG's Climate Roadmap: AIG plans to publish a comprehensive climate roadmap to enhance transparency for stakeholders.

- Emission Reporting: The company's 2023 emissions data provides a baseline for assessing progress in its environmental strategy.

The intensifying impact of climate change, marked by more frequent extreme weather, directly affects AIG's property and casualty insurance lines, necessitating adjustments in risk assessment and premium setting as evidenced by the over $50 billion in insured losses from severe convective storms in the US in 2023.

Resource scarcity, a growing concern through 2024 and 2025, inflates repair costs for AIG, particularly in auto and property insurance, as seen with semiconductor supply chain issues impacting vehicle replacement costs. This upward pressure on claims expenses directly squeezes underwriting profitability.

AIG faces expanding environmental liability risks, with the global environmental insurance market valued at approximately USD 11.5 billion in 2023 and growing, driven by increased regulatory focus and climate change impacts on pollution events.

Investor and regulatory demand for transparency in sustainability is pushing AIG to disclose its environmental strategies, including its 2023 Scope 1 and 2 greenhouse gas emissions of roughly 104,000 metric tons of CO2 equivalent as a baseline for its climate transition plans.

PESTLE Analysis Data Sources

Our PESTLE Analysis is powered by a comprehensive blend of public and proprietary data, encompassing official government publications, leading economic indicators, and specialized industry research. This ensures our insights reflect current market realities and emerging trends across all PESTLE factors.