AIG Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIG Bundle

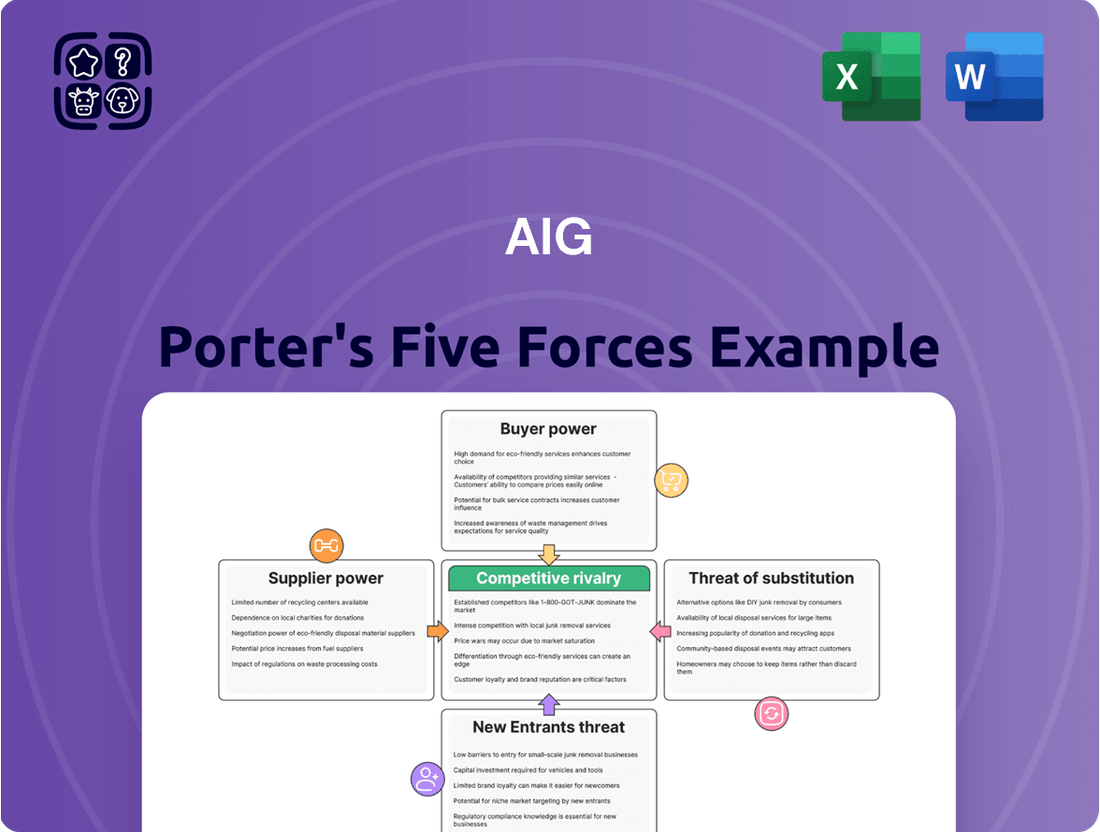

Understanding AIG's competitive landscape is crucial, and Porter's Five Forces provides the framework. We've touched upon how buyer power, supplier leverage, and the threat of substitutes impact AIG's market. The intensity of rivalry and the threat of new entrants also play significant roles in shaping its strategic options.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore AIG’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

AIG, like many global insurers, faces a moderate to high bargaining power from specialized reinsurance providers. These reinsurers are crucial for AIG to manage significant risks, particularly those associated with catastrophic events. The concentration within this reinsurance market allows these providers to significantly influence terms and pricing for the capacity they offer, especially when considering past loss trends.

In 2024, the reinsurance market has seen a hardening trend, with reinsurers increasingly dictating terms and pricing due to a combination of factors including higher inflation impacting claims costs and a more cautious approach to underwriting. This environment empowers reinsurers to demand higher premiums and more restrictive coverage terms from primary insurers like AIG.

Reinsurers have actively benefited from reducing their coverage limits and increasing deductibles, making them more selective about the risks they assume. This strategic shift means they are highly motivated to secure renewals and attract new, profitable business, further strengthening their hand in negotiations with insurers seeking to offload risk.

The bargaining power of advanced technology and data analytics vendors for AIG is substantial and growing. AIG's commitment to leveraging AI and machine learning for enhanced decision-making and operational efficiency makes these specialized suppliers critical partners. For instance, in 2024, the global AI market was projected to reach hundreds of billions of dollars, indicating the high demand and value placed on these advanced capabilities.

This increasing reliance means that vendors offering cutting-edge AI, machine learning, and data analytics solutions hold significant sway. As the insurance industry, including AIG, rapidly adopts these technologies to gain a competitive edge, the indispensability of these suppliers is amplified. Their ability to provide unique algorithms, specialized platforms, or proprietary data sets can significantly increase their leverage in negotiations with AIG.

The bargaining power of suppliers, particularly those providing underwriting and claims expertise, is significant for insurers like AIG. Highly skilled actuaries, underwriters, and claims specialists possess specialized knowledge crucial for accurate risk assessment and pricing. The scarcity of such talent means these individuals or consulting firms can command higher fees, impacting AIG's operational costs.

For instance, the demand for experienced actuaries, vital for pricing complex insurance products, often outstrips supply. In 2024, the Society of Actuaries reported a continued high demand for actuarial talent across the insurance sector, underscoring the leverage these professionals hold.

AIG's strategic investments in data analytics and digital transformation are partly aimed at augmenting internal capabilities in these core functions. This can, to some extent, mitigate reliance on external expertise and reduce the bargaining power of specialized supplier groups by building in-house proficiency and efficiency.

Regulatory and Compliance Service Firms

The bargaining power of regulatory and compliance service firms for AIG is significant due to the highly regulated nature of the global insurance industry. These specialized firms, offering expertise in legal, compliance, and auditing services, are crucial for AIG to navigate complex and constantly changing regulatory landscapes across various countries. The high cost associated with non-compliance in this sector amplifies the leverage these suppliers hold.

The specialized knowledge and critical nature of these services mean that few firms can provide them effectively. For instance, in 2024, the global regulatory compliance market was projected to reach over $100 billion, indicating substantial demand and the specialized nature of the providers.

- High barriers to entry: The need for deep legal and regulatory expertise creates significant barriers for new entrants, limiting the pool of qualified service providers.

- Criticality of service: AIG's operations are heavily reliant on these firms to avoid severe penalties and reputational damage, making their services indispensable.

- Cost of non-compliance: Failure to adhere to regulations can result in substantial fines; for example, in 2023, financial institutions faced billions in regulatory penalties globally, underscoring the importance of expert guidance.

- Limited substitutability: While internal compliance teams exist, specialized external firms offer a depth of knowledge and agility that is difficult to replicate in-house, especially across diverse international regulations.

Infrastructure and Cloud Service Providers

As AIG invests heavily in its digital transformation and builds out cloud-native environments, the bargaining power of major cloud service providers is significant. These providers, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, are crucial for AIG's data engineering, AI initiatives, and overall digital platforms.

The considerable switching costs involved in migrating extensive IT infrastructure make it difficult for AIG to change providers. This reliance is amplified by the critical nature of these services for AIG's operational efficiency and data security. For instance, in 2023, the global cloud computing market was valued at approximately $600 billion, highlighting the scale and concentration of these providers.

- High Switching Costs: Migrating terabytes of data and complex application stacks to a new cloud provider can take months, if not years, and incur substantial upfront costs for AIG.

- Critical Infrastructure: Cloud providers offer essential services that underpin AIG's core operations, from claims processing to customer portals, making them indispensable partners.

- Limited Provider Options: While the market has major players, the number of providers capable of handling AIG's scale and specific security requirements is limited, concentrating power.

- Innovation and Service Bundles: Cloud providers continuously innovate and offer bundled services, making it more attractive for AIG to deepen its relationship rather than seek alternatives.

Suppliers of specialized underwriting and actuarial expertise hold considerable sway due to the scarcity of talent in these critical areas. For instance, the demand for experienced actuaries, vital for pricing complex insurance products, often outstrips supply, as indicated by the Society of Actuaries' reports on high demand in 2024. This leverage translates into higher fees for these essential services.

What is included in the product

Explores the competitive intensity and profitability potential within the insurance industry by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry for AIG.

Instantly identify and prioritize competitive threats with a dynamic dashboard visualizing all five forces.

Customers Bargaining Power

AIG's broad and varied customer base significantly dilutes individual customer bargaining power. Serving everyone from individual policyholders to massive global enterprises means no single group or entity can exert substantial pressure on pricing or terms. This wide reach, encompassing diverse needs and sensitivities across segments like life insurance, property and casualty, and retirement services, prevents a unified front from customers.

In mature insurance markets, especially for common products, customers often prioritize price. This leads insurers to engage in competitive pricing. For instance, in early 2024, the property and casualty insurance sector saw average premium increases moderating compared to prior years, signaling increased price competition as capacity returned to the market.

The insurance market conditions experienced a softening in several lines during 2024, and new capital entered the sector in late 2024 and projected into 2025. This influx of capacity directly enhances the bargaining power of customers, as more insurers compete for their business, often on price alone.

Buyers are increasingly navigating a more competitive underwriting landscape. This environment means insurers must offer more attractive terms and pricing to secure new business, giving customers greater leverage to negotiate better rates and policy conditions.

For many standard insurance products, the cost for customers to switch providers is quite low. This means a policyholder can easily shop around and move to a different insurer if they find a better deal or service. In 2024, this trend puts significant pressure on companies like AIG, as customers expect more competitive pricing and superior service to retain their business.

Information Availability and Digital Platforms

The proliferation of digital platforms and aggregators has dramatically boosted information availability for customers, leading to greater price transparency. For instance, by mid-2024, comparison websites in the insurance sector were facilitating millions of quotes annually, giving consumers unprecedented insight into market pricing and product features. This ease of access empowers customers to readily compare policies, gather quotes from multiple providers, and scrutinize customer reviews, significantly amplifying their leverage against established insurers.

InsurTech innovations are at the forefront of this shift, enabling the creation of intuitive digital interfaces and highly personalized customer experiences. These advancements allow consumers to seamlessly navigate policy options and tailor coverage to their specific needs. By mid-2024, reports indicated that over 70% of insurance consumers preferred to engage with insurers through digital channels, highlighting the growing customer expectation for accessible and user-friendly online services.

- Increased Price Transparency: Digital platforms allow for easy comparison of insurance quotes, revealing price variations across providers.

- Enhanced Information Access: Customers can readily research policy details, coverage options, and provider reputations online.

- Empowered Decision-Making: With more information, customers are better equipped to negotiate terms and select the most suitable insurance products.

- InsurTech Influence: User-friendly interfaces and personalized services offered by InsurTech companies further strengthen the customer's position.

Large Corporate and Institutional Clients

Large corporate and institutional clients wield considerable bargaining power over AIG. Their substantial premium volumes and intricate risk requirements mean they often negotiate for customized policies, competitive pricing, and enhanced risk management services. This can directly impact AIG's profitability and operational flexibility.

These sophisticated buyers frequently have the resources to conduct thorough market analysis and can switch providers if their demands are not met. For instance, in 2024, the insurance market saw continued price sensitivity among large commercial clients, particularly in property and casualty lines, as they sought to optimize their insurance spend amidst evolving economic conditions.

- Significant Premium Volumes: Large clients represent a substantial portion of AIG's revenue, giving them leverage in negotiations.

- Complex Risk Profiles: Tailoring coverage for these clients requires specialized expertise and resources, increasing AIG's service costs.

- Demand for Bespoke Solutions: Institutional clients often require highly customized insurance products and risk mitigation strategies.

- Market Sophistication: These clients are well-informed and can easily compare offerings from multiple insurers.

Despite this pressure, AIG's Global Commercial segment has demonstrated robust client retention, underscoring the company's ability to maintain strong relationships with these key accounts by delivering value-added services and tailored solutions. This suggests that while bargaining power exists, AIG effectively manages these relationships.

Customers' bargaining power is amplified by increased price transparency, readily available information through digital platforms, and the ease of switching providers. In 2024, the insurance market saw a general softening in pricing across several lines, with new capital entering the sector, further empowering buyers to negotiate better terms.

| Factor | Impact on Customer Bargaining Power | 2024 Data/Observation |

|---|---|---|

| Price Sensitivity | High for standard products | Moderating premium increases in P&C due to market capacity |

| Switching Costs | Low | Customers expect competitive pricing and superior service to retain business |

| Information Access | High via digital platforms/aggregators | Comparison websites facilitating millions of quotes by mid-2024 |

| Digital Engagement Preference | Growing | Over 70% of consumers preferred digital channels by mid-2024 |

| Large Client Leverage | Significant due to premium volumes and complex needs | Continued price sensitivity among large commercial clients in 2024 |

Same Document Delivered

AIG Porter's Five Forces Analysis

This preview showcases the complete AIG Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the insurance industry. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase, ensuring no surprises. You'll gain instant access to this in-depth strategic tool, ready for your immediate use and application to understand AIG's competitive landscape. This comprehensive report delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors, all presented in the exact format you are previewing.

Rivalry Among Competitors

The global insurance market is indeed a crowded space, and AIG is right in the thick of it. With so many established companies vying for customers, it's a mature industry where breaking away from the pack is tough. This high degree of fragmentation means that insurers can't just charge whatever they want; they have to be smart about pricing and constantly come up with new ideas to stand out.

Think about it: in 2024, the property and casualty insurance sector alone is projected to reach over $2.8 trillion globally. AIG, as a major player, faces intense rivalry from both large, diversified insurers and smaller, specialized ones. This competitive pressure is a constant force, pushing AIG to innovate in its product offerings and customer service to maintain its market position.

AIG contends with significant competition from established global insurance powerhouses like Allianz, AXA, MetLife, Prudential Financial, Chubb, and Berkshire Hathaway. These firms bring substantial global reach, broad product offerings, and robust financial strength to the market, directly challenging AIG's position.

The sheer scale and resources of these global giants mean they can leverage economies of scale in operations and marketing, often leading to more competitive pricing and a wider distribution network. For instance, as of the first quarter of 2024, Chubb reported total shareholders' equity of over $100 billion, illustrating its considerable financial backing.

This intense rivalry among major players puts pressure on AIG to continuously innovate and maintain cost efficiencies to preserve its market share and profitability. Competitors’ strong brand recognition and customer loyalty further amplify the competitive challenge AIG faces in acquiring and retaining clients.

For example, in 2023, MetLife achieved a net income of approximately $6.1 billion, showcasing its operational success and the financial capacity it brings to market competition, which AIG must actively counter.

Competitive rivalry within the insurance sector is significantly shaped by product diversification and a firm's capacity for innovation, particularly as new risks emerge. For instance, the increasing frequency of climate-related events and the escalating threat of cyberattacks are compelling insurers to constantly develop novel solutions.

Insurers are actively creating new products and services to attract and retain clients, with a notable surge in offerings like sustainable insurance designed for environmentally conscious businesses and specialized coverage for artificial intelligence-related risks. This dynamic innovation is crucial for staying competitive.

AIG, as a major player, exemplifies this by maintaining a diversified business model that spans a broad spectrum of insurance lines and financial services. This diversification allows AIG to offer a wide array of products, from traditional property and casualty to specialty lines, catering to a varied customer base and mitigating risks across different segments.

Digital Transformation and Technology Adoption

The insurance industry's competitive intensity is significantly amplified by rapid digital transformation and the widespread adoption of advanced technologies. Insurers are channeling substantial resources into areas like artificial intelligence (AI) and data analytics to streamline operations, elevate customer engagement, and secure a distinct market advantage.

AIG, for instance, is making considerable investments in cutting-edge technologies. These investments are strategically aimed at boosting operational efficiencies and simplifying complex processes, thereby enhancing its competitive posture in the evolving market. For example, in 2024, AIG continued its focus on digital innovation, with a significant portion of its IT budget allocated to cloud migration and AI-driven customer service tools.

- Digitalization Investments: Insurers are increasing their spending on digital tools, with global spending on AI in insurance projected to reach tens of billions of dollars annually by 2025, a figure that is expected to grow further into 2024 and beyond.

- AI and Data Analytics Adoption: The adoption of AI for claims processing and underwriting has shown efficiency gains of up to 30% in some insurers, driving a competitive race to implement these technologies.

- Customer Experience Enhancement: Technology is crucial for improving customer interactions, with many insurers now offering digital platforms for policy management, claims filing, and personalized advice.

- Operational Efficiency Gains: Automation powered by AI and machine learning is reducing operational costs, with some companies reporting a 15-20% reduction in processing times for routine tasks.

Underwriting Discipline and Capital Management

Competitive rivalry within the insurance sector, particularly for companies like AIG, is intensified by the necessity for disciplined underwriting and prudent capital management. Insurers must maintain profitability even when markets are unpredictable and claims costs are climbing. This often means making tough choices about which risks to underwrite and how to allocate financial resources efficiently. AIG’s strategy has centered on strengthening its underwriting, deploying capital more strategically, and streamlining its operational costs.

This focus on operational efficiency and risk selection bore fruit in 2024. AIG reported a significant 28% year-over-year increase in its adjusted after-tax income for the full year. This robust performance is a direct indicator of the success of their underlying underwriting results, demonstrating that a commitment to disciplined practices can lead to substantial financial gains in a competitive landscape.

- Underwriting Discipline: AIG emphasizes careful risk selection and pricing to ensure profitable growth.

- Capital Management: Strategic deployment of capital aims to maximize returns while maintaining financial strength.

- Expense Reduction: AIG has actively worked to lower its operational expenses to improve profitability.

- 2024 Performance: AIG achieved a 28% year-over-year increase in adjusted after-tax income, highlighting strong underwriting.

Competitive rivalry is a defining characteristic of the insurance industry, with AIG facing intense pressure from a multitude of global and specialized competitors. This crowded market necessitates constant innovation in products and services, as well as strategic pricing to capture and retain market share. For instance, the property and casualty insurance sector alone is projected to exceed $2.8 trillion globally in 2024, underscoring the scale of competition.

Major players like Chubb, with over $100 billion in total shareholders' equity as of Q1 2024, and MetLife, which reported a net income of approximately $6.1 billion in 2023, possess significant financial strength and broad market reach. This compels AIG to focus on operational efficiencies and disciplined underwriting to maintain its competitive edge.

The ongoing digital transformation and adoption of advanced technologies, such as AI, are further intensifying this rivalry. Insurers are investing heavily in these areas to enhance customer experience and streamline operations. AIG’s strategic allocation of its IT budget towards cloud migration and AI-driven customer service tools in 2024 exemplifies this industry-wide trend.

Ultimately, AIG’s ability to navigate this competitive landscape hinges on its disciplined underwriting, effective capital management, and continuous efforts to reduce operational costs, as evidenced by its reported 28% year-over-year increase in adjusted after-tax income in 2024, driven by strong underwriting results.

| Competitor | 2023 Net Income (Approx.) | 2024 Market Projection (P&C) | Key Competitive Factor |

|---|---|---|---|

| Chubb | N/A (Focus on Shareholders' Equity) | N/A | Financial Strength, Global Reach |

| MetLife | $6.1 Billion | N/A | Diversified Offerings, Brand Recognition |

| Allianz, AXA | N/A | N/A | Global Presence, Product Breadth |

| AIG | N/A (Focus on Profit Growth) | N/A | Underwriting Discipline, Digital Innovation |

SSubstitutes Threaten

Large corporations, a core client base for AIG, increasingly explore self-insurance and the creation of captive insurers. This trend allows them to manage risks internally, diminishing their dependence on external insurance providers, particularly for predictable or substantial liabilities.

These internal risk management solutions offer companies enhanced control over their insurance programs and the potential for significant cost efficiencies. For instance, in 2023, the global captive insurance market was estimated to be valued at over $70 billion, indicating a substantial shift towards alternative risk transfer mechanisms.

The growing availability of Alternative Risk Transfer (ART) mechanisms, like catastrophe bonds and other innovative financial products, presents a significant threat of substitutes for traditional insurance and reinsurance. These ART solutions allow corporations to access capital markets directly for risk financing, offering customized coverage that can mirror or even surpass what traditional insurers provide. For instance, the catastrophe bond market saw robust issuance in 2023, with total issuances reaching approximately $15 billion globally, demonstrating a strong appetite for these capital markets-based risk transfer tools.

Government-backed insurance programs can serve as potent substitutes for private insurers like AIG, especially in areas where the private market struggles to provide coverage. For instance, the National Flood Insurance Program (NFIP) in the United States directly competes with private flood insurance providers, particularly in high-risk areas. As of 2024, the NFIP covers over five million policyholders, demonstrating a significant market presence that can divert demand from private sector alternatives.

These government initiatives often step in to address market failures or to ensure essential coverage, such as in agricultural sectors where programs like crop insurance can reduce reliance on private insurers for specific perils. Such programs are designed to provide a safety net, impacting the potential customer base for private insurers by offering more affordable or accessible options for certain risks.

Risk Mitigation and Loss Prevention Technologies

The increasing sophistication of risk mitigation and loss prevention technologies poses a significant threat of substitution for traditional insurance. Innovations like Internet of Things (IoT) sensors and predictive analytics are empowering clients to proactively manage and reduce the likelihood of insurable events. For instance, telematics in commercial fleets can lower accident rates, directly impacting the need for collision coverage. This trend shifts the value proposition from simply indemnifying losses to actively preventing them.

These technological advancements can diminish the perceived necessity of substantial insurance policies. As businesses become more adept at self-insuring through robust prevention strategies, the demand for traditional insurance products may contract. This evolution could lead to a reduction in premium volumes across the industry, as clients opt for technology-driven solutions over comprehensive coverage for certain risks. For example, advanced cybersecurity tools can reduce the need for cyber insurance by preventing breaches.

- IoT Sensors: Enable real-time monitoring of assets and environments to detect and prevent potential losses, such as in supply chain tracking or industrial equipment monitoring.

- Telematics: Used in vehicles and machinery to track usage, driver behavior, and operational conditions, leading to reduced accidents and better maintenance, thereby lowering claims.

- Predictive Analytics: Leverages data to forecast potential risks and advise on preventative measures, allowing businesses to mitigate issues before they result in losses.

- Shift in Focus: The industry is seeing a move from pure indemnification to a more proactive risk management approach, where technology plays a central role in loss prevention.

Embedded and Parametric Insurance Solutions

The rise of embedded and parametric insurance solutions poses a significant threat of substitutes for traditional insurers like AIG. Embedded insurance, integrated directly into product or service purchases, offers unparalleled convenience. For instance, travel insurance offered at the point of booking a flight or extended warranties added during electronics purchases streamlines the customer experience.

Parametric insurance, which pays out based on pre-defined triggers like a specific earthquake magnitude or rainfall level, bypasses traditional loss adjustment processes. This leads to faster payouts, a key differentiator. By mid-2024, the global parametric insurance market was projected to reach over $10 billion, demonstrating its growing appeal and potential to disrupt conventional coverage models.

These innovative approaches challenge the established insurance sales channels and claims handling procedures. Customers increasingly value the speed and simplicity offered by these alternatives. For example, parametric solutions can disburse funds within days of an event, a stark contrast to the weeks or months often required for traditional claims settlements.

- Embedded Insurance Convenience: Coverage is integrated at point-of-sale, simplifying customer acquisition and reducing friction.

- Parametric Insurance Speed: Payouts are triggered by objective data, enabling rapid disbursement of funds.

- Market Growth: The parametric insurance market is expanding rapidly, indicating strong customer adoption.

- Disruption of Traditional Models: These solutions challenge established sales and claims processes by offering faster, simpler alternatives.

The threat of substitutes for AIG is significant as clients increasingly adopt internal risk management solutions and alternative risk transfer mechanisms. These substitutes, including captives and capital markets products like catastrophe bonds, offer greater control and potential cost savings. For instance, the global captive insurance market was valued at over $70 billion in 2023, showcasing a strong move towards self-insuring.

Government programs and advanced risk mitigation technologies also present viable alternatives to traditional insurance. For example, the U.S. National Flood Insurance Program served over five million policyholders in 2024, diverting demand from private insurers. Furthermore, innovations like IoT sensors and predictive analytics empower clients to reduce risk proactively, lessening their reliance on indemnity-based coverage.

The emergence of embedded and parametric insurance further intensifies this threat by offering greater convenience and faster payouts. Parametric insurance, projected to exceed $10 billion globally by mid-2024, bypasses traditional claims adjustment, providing rapid disbursement based on pre-defined triggers. This shift challenges conventional insurance models by prioritizing speed and simplicity.

| Substitute Category | Key Features | Market Indicator (2023/2024 Data) | Impact on Traditional Insurers |

|---|---|---|---|

| Internal Risk Management | Captives, Self-insurance | Global captive insurance market > $70 billion (2023) | Reduced demand for external coverage, especially for predictable risks. |

| Alternative Risk Transfer (ART) | Catastrophe bonds, Capital markets financing | Catastrophe bond market issuances ~ $15 billion (2023) | Direct access to capital for risk financing, bypassing insurers. |

| Government Programs | NFIP, Crop insurance | NFIP covers > 5 million policyholders (2024) | Provides essential coverage, especially where private markets falter, diverting customers. |

| Risk Mitigation Technologies | IoT, Telematics, Predictive Analytics | (Data on adoption rates is varied, but impact is evident in reduced claims) | Proactive risk reduction lessens the need for indemnity-focused insurance. |

| Embedded & Parametric Insurance | Integrated at point-of-sale, Trigger-based payouts | Parametric insurance market projected > $10 billion (mid-2024) | Convenience and speed challenge traditional sales and claims processes. |

Entrants Threaten

The insurance sector, especially for large global insurers like AIG, demands substantial capital to underwrite a wide array of significant risks. These high capital requirements act as a formidable barrier, deterring new companies from entering the market and competing effectively. For instance, in 2024, global insurers are maintaining robust solvency ratios, often exceeding regulatory minimums, to ensure they can meet their obligations even during periods of high claims activity.

The insurance industry faces a formidable threat from new entrants due to a highly stringent regulatory environment. Globally, insurers must obtain extensive licensing and adhere to complex compliance and oversight mandates across numerous jurisdictions. Navigating this intricate regulatory landscape, which includes solvency requirements like Solvency II in Europe or Risk-Based Capital (RBC) in the U.S., presents a significant barrier to entry, demanding substantial capital and expertise.

Established insurers like AIG leverage significant brand recognition and customer trust, accumulated over many years. This deep-seated trust is a formidable barrier for newcomers aiming to gain traction, particularly in critical areas such as life insurance and retirement planning, where confidence is paramount.

Building a credible brand and fostering customer loyalty requires substantial time and financial commitment, presenting a steep challenge for new entrants seeking to quickly establish a market presence and compete with incumbents like AIG, which boasts a robust global reputation.

Developed Distribution Networks

AIG benefits from deeply entrenched global distribution networks, encompassing a vast army of agents, brokers, and direct sales channels. Establishing similar reach requires substantial capital investment and considerable time, presenting a formidable hurdle for potential new entrants. For instance, in 2023, AIG's property casualty segment alone generated over $20 billion in net written premiums, underscoring the scale and effectiveness of its distribution capabilities.

These existing relationships and infrastructure allow AIG to access a broad spectrum of customer segments efficiently. The sheer difficulty and expense involved in building comparable distribution power acts as a significant deterrent.

- Extensive Global Reach: AIG’s established network spans numerous countries, providing access to diverse markets that new competitors would struggle to penetrate quickly.

- High Replicability Costs: The financial and time investment needed to build a comparable network of agents and brokers is a major barrier.

- Customer Acquisition Advantage: AIG’s distribution channels enable efficient and cost-effective acquisition of new customers, a significant edge over nascent players.

- Product Placement Power: The ability to place a wide range of insurance products with existing client bases through these networks is a critical competitive advantage.

InsurTech Innovation and Niche Players

The threat of new entrants in the insurance sector, while historically moderated by high capital requirements and regulatory hurdles, is increasingly being reshaped by InsurTech innovations. These nimble companies are carving out niches by utilizing advanced technology to streamline operations and introduce novel products, directly challenging established insurers.

InsurTech startups, particularly those operating as Managing General Agents (MGAs) or full-fledged insurtechs, are demonstrating a capacity to disrupt traditional underwriting. Their focus on specific market segments allows them to offer enhanced customer experiences and often more competitive pricing.

For instance, the global insurtech market was projected to reach over $10 billion in funding by the end of 2024, signaling a significant influx of capital and new players. This technological advancement enables them to bypass some of the legacy infrastructure costs of incumbents.

- InsurTech Funding Growth: Venture capital investment in insurtech has seen substantial growth, with billions invested annually, enabling new players to enter and innovate.

- Niche Market Focus: Many new entrants concentrate on underserved or specific customer segments, offering tailored products and services that traditional insurers may overlook.

- Technological Disruption: The adoption of AI, data analytics, and digital platforms allows insurtechs to improve underwriting accuracy, claims processing efficiency, and customer engagement.

- Regulatory Adaptation: While regulation remains a barrier, some insurtech models are designed to navigate or even leverage regulatory frameworks to their advantage, particularly in specialized areas.

While significant capital and regulatory hurdles historically limited new entrants in insurance, the landscape is evolving. InsurTech startups, fueled by substantial venture capital, are leveraging technology to target specific market niches, offering streamlined operations and innovative products.

These agile competitors are adept at utilizing data analytics and AI for underwriting and customer engagement, often bypassing the legacy costs of established players. For example, global insurtech funding was anticipated to exceed $10 billion by the end of 2024, indicating a strong influx of capital for new ventures.

| Factor | Impact on New Entrants | Example (2023-2024 Data) |

|---|---|---|

| Capital Requirements | High barrier; requires significant investment for solvency and underwriting capacity. | Global insurers maintained robust solvency ratios, often exceeding 150% of regulatory minimums. |

| Regulatory Compliance | Complex and costly; necessitates extensive licensing and adherence to diverse jurisdictional rules. | Navigating regulations like Solvency II or RBC requires specialized legal and financial expertise. |

| Brand & Trust | Difficult to replicate; incumbents benefit from decades of customer loyalty and perceived reliability. | Trust is crucial in life insurance; new entrants face a long road to build similar credibility. |

| Distribution Networks | Costly and time-consuming to build; established insurers have vast agent and broker relationships. | AIG's property casualty segment alone generated over $20 billion in net written premiums in 2023, showcasing network scale. |

| InsurTech Innovation | Opportunity for disruption; technology allows for niche market entry and operational efficiency. | Insurtech funding projected to surpass $10 billion in 2024, enabling rapid innovation and market penetration. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of comprehensive data, including detailed financial statements, industry-specific market research reports, and publicly available company filings.