AIG Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIG Bundle

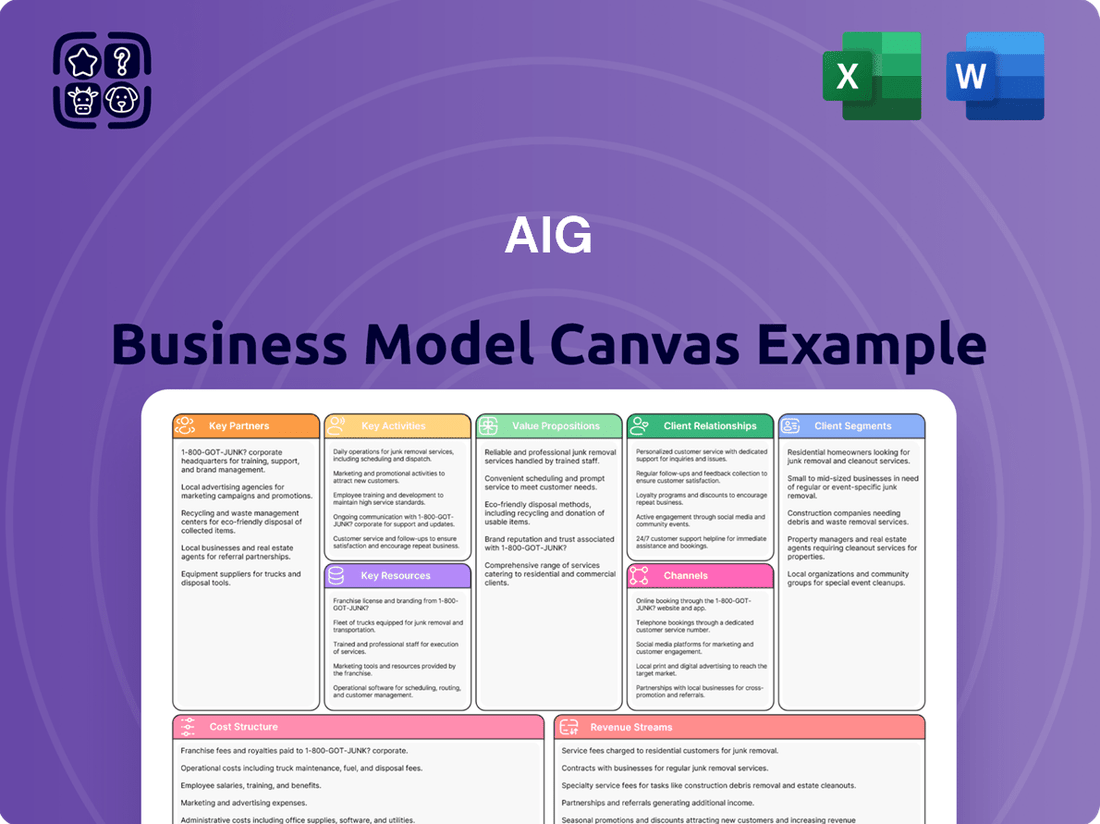

Curious about AIG's intricate business operations? Our Business Model Canvas provides a comprehensive look at how they attract and retain customers, manage key resources, and generate revenue. It's a powerful tool for understanding their strategic advantage.

Explore the core components that drive AIG's success, from their unique value propositions to their essential partnerships and cost structures. This detailed canvas offers a strategic roadmap for anyone seeking to dissect a global insurance giant.

Unlock the full strategic blueprint behind AIG's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Want to see exactly how AIG operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out AIG’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Partnerships

Independent brokers and agents serve as AIG's foundational distribution network, extending its reach to a diverse client base ranging from individual policyholders to multinational corporations. AIG leverages their extensive market knowledge and established client relationships to effectively distribute its complex array of insurance products. This channel remains critical for AIG, with broker-sourced premiums representing a significant portion of its general insurance business, reflecting its continued reliance on these partnerships for market penetration. This collaborative model enables AIG to maintain a broad sales footprint efficiently, minimizing the overhead associated with a fully direct sales force, a strategy that continues to be cost-effective into 2024.

AIG collaborates closely with leading reinsurance companies such as Swiss Re and Munich Re. This strategic partnership enables AIG to cede a significant portion of its underwriting risk, particularly for high-value policies and potential catastrophic events. For example, in 2024, AIG continued to leverage these relationships to manage its exposure effectively. This approach is vital for maintaining capital solvency and safeguarding AIG’s balance sheet against extreme loss volatility. These fundamental alliances empower AIG to confidently underwrite large, complex global risks across diverse sectors.

AIG collaborates with leading technology firms to leverage advanced AI, machine learning, and data analytics for modernizing operations. These partnerships, like the ongoing initiatives with Google Cloud announced in 2023, enhance risk modeling capabilities and improve underwriting accuracy across AIG's diverse portfolio. They are crucial for automating claims processing, detecting fraud more efficiently, and driving significant operational improvements. This strategic focus on technology is vital for AIG to gain a competitive edge and optimize performance in the dynamic insurance market.

Financial Institutions & Asset Managers

AIG collaborates extensively with financial institutions and external asset managers to oversee its substantial investment portfolio. These partnerships are vital for maximizing returns on the premium float, a cornerstone of AIG's profitability. They offer specialized expertise across diverse asset classes, from fixed income to alternative investments, enhancing portfolio diversification and performance.

- AIG's investment portfolio totaled approximately $297 billion as of Q1 2024.

- Strategic asset management aims to optimize returns on the premium float, which directly impacts underwriting profitability.

- External managers provide access to specialized strategies and market insights.

- Partnerships help manage risk and achieve targeted returns across various market cycles.

Global Regulatory Bodies

Maintaining a highly cooperative and compliant relationship with global regulatory bodies is critical for AIG, although not a traditional partnership. This ongoing dialogue with entities like the Federal Reserve, the National Association of Insurance Commissioners (NAIC), and international equivalents ensures AIG can operate legally across its extensive global footprint. Such engagement, especially with evolving frameworks like the EU's Solvency II or the US's state-based insurance regulations, is a key enabler of its worldwide business model, safeguarding its financial stability and operational licenses. For example, AIG's 2024 regulatory filings reflect continued adherence to diverse capital and solvency requirements across its operating jurisdictions.

- AIG operates in over 80 countries and jurisdictions, requiring adherence to diverse regulatory frameworks.

- The company regularly engages with regulators on capital adequacy and risk management, a continuous process in 2024.

- Compliance ensures legal operation and adaptation to new standards, such as those impacting global systemic important insurers.

- Regulatory relationships directly impact AIG's ability to underwrite and serve its vast client base globally.

AIG’s partnerships with independent brokers and agents are crucial for broad distribution, maintaining a cost-effective sales footprint and securing a significant share of general insurance premiums in 2024. Collaborations with reinsurers like Swiss Re help AIG effectively manage underwriting risk, safeguarding its balance sheet against large claims.

Strategic alliances with technology firms, including initiatives with Google Cloud, enhance AIG’s risk modeling and claims processing through advanced AI and data analytics, vital for competitive advantage. Partnerships with financial institutions manage AIG's substantial investment portfolio, totaling approximately $297 billion in Q1 2024, maximizing returns on premium float.

While not traditional, AIG’s cooperative relationships with global regulatory bodies, like the NAIC, ensure legal operation across over 80 countries, with 2024 filings reflecting continued adherence to diverse capital and solvency requirements.

| Partner Type | Primary Role | 2024 Impact/Data |

|---|---|---|

| Brokers/Agents | Distribution & Market Access | Significant premium share, cost-effective sales |

| Reinsurers | Risk Transfer & Solvency | Effective exposure management, capital protection |

| Financial Institutions | Investment Management | $297B portfolio (Q1 2024), optimize premium float |

What is included in the product

A detailed blueprint of AIG's operations, outlining its customer segments, value propositions, and channels within the 9 classic Business Model Canvas blocks.

This model offers strategic insights into AIG's competitive advantages and resource allocation, supporting informed decision-making and stakeholder communication.

The AIG Business Model Canvas offers a structured approach to map out key business activities, alleviating the pain of disjointed strategies and unclear value propositions.

It provides a visual framework for understanding customer relationships and revenue streams, solving the challenge of effectively engaging and monetizing target markets.

Activities

Underwriting and risk assessment form the core of AIGs insurance operations, involving the meticulous evaluation and pricing of risk for potential policyholders. AIG leverages sophisticated data analytics and deep actuarial science expertise to assess complex risks, ranging from emerging cyber threats to significant natural catastrophe exposures, which continue to evolve in 2024. This accurate risk pricing is fundamental to the company's profitability, influencing its general insurance combined ratio, which stood at 91.1% for the first quarter of 2024. Effective underwriting ensures sustainable growth and helps AIG manage its capital efficiently.

Efficient claims management is fundamental for AIG, directly influencing customer satisfaction and brand reputation. This critical activity encompasses thorough claim verification, meticulous investigation, and prompt payment to policyholders. AIG prioritizes significant investments in advanced technology and highly skilled personnel to streamline these processes. For instance, AIG reported a General Insurance combined ratio of 89.9 in Q1 2024, reflecting effective claims handling and underwriting discipline. This focus ensures a positive customer experience during crucial moments, reinforcing trust and loyalty.

AIG actively manages the vast pool of capital generated from insurance premiums, often called the float, before it is paid out in claims. This crucial activity involves investing in a highly diversified portfolio of assets, including fixed income, equities, and alternative investments. For the first quarter of 2024, AIG reported net investment income of $3.5 billion, significantly contributing to its overall financial performance. This income stream is a major driver of profitability, enhancing shareholder value and supporting the firm's financial stability. Through strategic asset allocation, AIG optimizes returns while managing risk across its substantial investment holdings.

Product Development & Innovation

AIG continuously refines its insurance and retirement products to meet evolving client needs, including specialized coverage for emerging risks. This strategic focus includes developing solutions for climate change impacts and digital assets, crucial for its 2024 general insurance portfolio. Such innovation helps AIG maintain a competitive edge and capture new market opportunities.

- AIG’s General Insurance segment, a core focus post-Corebridge separation, emphasizes innovative risk solutions.

- In 2024, AIG is expanding its offerings for complex commercial risks, reflecting product innovation.

- The company actively explores new coverages for evolving threats like cyber and climate-related liabilities.

- Product development is key to AIG’s strategy for sustained growth and market leadership.

Regulatory Compliance & Reporting

Operating globally, AIG faces stringent regulatory compliance, requiring strict adherence to a complex web of insurance and financial regulations across every market. This critical activity involves constant monitoring of evolving regulatory changes and implementing comprehensive internal controls. Detailed reporting to various authorities, such as the National Association of Insurance Commissioners (NAIC) in the US, is essential for maintaining operational licenses. Robust compliance is crucial for AIG to avoid significant financial penalties, which can be substantial, as seen in past industry-wide fines.

- AIG's 2024 operations necessitate ongoing adaptation to new solvency frameworks and data privacy regulations globally.

- The cost of regulatory technology (RegTech) adoption is a growing expense for large insurers like AIG.

- Maintaining compliance ensures AIG's ability to underwrite policies and service clients across diverse jurisdictions.

- Failure to comply can result in license revocations and substantial fines, impacting AIG's financial performance.

AIG's core activities include meticulous underwriting and efficient claims management, crucial for its General Insurance combined ratio of 89.9% in Q1 2024. Strategic investment of premium float generated $3.5 billion in net investment income for Q1 2024. The company also focuses on innovative product development for emerging risks and rigorous global regulatory compliance.

| Key Activity | 2024 Data Point | Impact |

|---|---|---|

| Underwriting & Claims | Q1 2024 Combined Ratio: 89.9% | Profitability & Customer Satisfaction |

| Investment Management | Q1 2024 Net Investment Income: $3.5B | Financial Performance |

| Product Innovation | Focus: Cyber, Climate Risks | Market Competitiveness |

Full Version Awaits

Business Model Canvas

This preview showcases a direct segment of the AIG Business Model Canvas you will receive. Upon completing your purchase, you will gain full access to this exact document, ensuring no discrepancies between what you see and what you get. You can be confident that the comprehensive structure and content are precisely what you will be able to edit and utilize immediately.

Resources

AIGs financial capital and substantial reserves are paramount, allowing it to underwrite vast corporate risks and absorb significant catastrophic losses. As of the first quarter of 2024, AIG reported general insurance net premiums written of $6.9 billion, underscoring its capacity. This robust financial position, with total assets around $520 billion, is key to client trust and maintaining strong credit ratings from agencies like S&P and Moody’s. It forms the foundation for AIG to honor all its policyholder commitments.

AIG's global brand, forged over a century, stands as a cornerstone of its business model, symbolizing financial stability, expansive global reach, and deep expertise in complex risk management. This formidable reputation is an invaluable intangible asset, crucial for attracting and retaining large multinational corporations and high-net-worth individuals. In the insurance sector, trust is paramount, making AIG's brand equity, supported by its strong A- credit ratings from agencies like S&P in 2024, an indispensable driver for client acquisition and sustained growth across its diverse offerings.

AIG's specialized knowledge, stemming from its global team of underwriters, actuaries, and risk engineers, forms a critical intellectual resource. This human capital, combined with decades of proprietary claims and risk data, enables superior risk selection and pricing across its diverse portfolio. For example, AIG's General Insurance segment reported a strong accident year combined ratio of 90.7% in Q1 2024, reflecting effective underwriting. This expertise is particularly crucial for maintaining AIG's leadership in complex specialized commercial lines, where precise risk assessment is paramount.

Global Operational Infrastructure

AIG’s global operational infrastructure, a key physical and legal resource, encompasses an extensive network of offices, licenses, and personnel across numerous countries. This allows AIG to provide seamless service and locally compliant insurance solutions to multinational corporations worldwide. For instance, as of their Q1 2024 earnings, AIG continues to leverage its global reach to serve clients across over 80 countries and jurisdictions, solidifying its position. This vast footprint creates a significant barrier to entry for potential competitors, requiring immense capital and regulatory navigation to replicate.

- AIG operates across more than 80 countries and jurisdictions.

- The global network includes a vast array of local licenses and permits.

- Thousands of employees globally ensure local compliance and service delivery.

- This infrastructure supported AIG's $11.3 billion in Q1 2024 consolidated net premiums written.

Advanced Technology Platforms

AIG's robust investment in advanced technology platforms forms a critical key resource, driving efficiency across policy administration and claims processing. These sophisticated digital customer interfaces and data analytics capabilities are essential for enhancing the client experience and enabling precise risk management. Modern IT systems are fundamental, with AIG reporting significant ongoing technology investments in 2024 to stay competitive and streamline operations.

- Automated policy issuance improves turnaround times.

- AI-driven claims processing reduces settlement periods.

- Digital portals offer seamless customer self-service.

- Advanced analytics support data-driven underwriting decisions.

AIG's core strengths stem from its robust financial capital, with total assets around $520 billion and Q1 2024 general insurance net premiums written of $6.9 billion. Its century-old global brand and specialized expertise across over 80 countries are critical, reflected in a strong 90.7% accident year combined ratio in Q1 2024. An extensive global operational infrastructure and ongoing investments in advanced technology platforms bolster its market position, supporting consolidated net premiums written of $11.3 billion in Q1 2024.

| Key Resource | 2024 Data (Q1) | Significance |

|---|---|---|

| Financial Capital | $520B Total Assets | Underwrites vast risks, builds trust |

| Specialized Knowledge | 90.7% Combined Ratio | Enables precise risk pricing |

| Global Infrastructure | $11.3B Consolidated Net Premiums Written | Supports global service across 80+ countries |

Value Propositions

AIG provides comprehensive financial security, safeguarding individuals and businesses against diverse losses with a broad array of insurance products. This core value proposition effectively transfers significant risk from policyholders to AIG's robust balance sheet, which reported total assets of approximately 500 billion USD as of Q1 2024. The company's promise ensures resilience and recovery, empowering clients to navigate unforeseen challenges with confidence. AIG’s General Insurance segment, for instance, delivered strong underwriting income in early 2024, underscoring its capacity to absorb and manage client risks.

AIG offers highly customized insurance solutions for large corporations and niche industries, extending beyond standard market offerings. This includes vital coverage for complex risks like aviation, marine, energy, and cyber liability, a segment where AIG continues to be a leading provider globally. In 2024, AIG's General Insurance segment reported robust performance, underscoring its expertise in managing these intricate exposures. This specialized risk management capability remains a significant differentiator for AIG.

AIG empowers multinational clients by centralizing global risk management into cohesive insurance programs. Leveraging its presence in over 70 countries and jurisdictions as of early 2024, AIG integrates worldwide capabilities with deep local expertise in regulations and market nuances. This approach ensures consistent coverage and service for businesses operating across diverse geographies, streamlining complex international risk portfolios. Such localized insight, combined with global scale, enhances operational efficiency for clients.

Long-Term Financial Security Solutions

AIG offers robust long-term financial security solutions, extending beyond property and casualty to include vital life insurance and retirement products. These offerings, like annuities, empower individuals and groups to plan for their financial future, addressing essential needs such as wealth protection and guaranteed retirement income. This commitment fosters enduring customer relationships, critical for sustained growth.

- AIG’s Life and Retirement segment reported over $1.1 billion in adjusted pre-tax income for the first quarter of 2024.

- Annuity sales remain a core component, with fixed annuity sales showing strong demand in 2024.

- The company continues to focus on protecting and growing client assets, emphasizing long-term planning.

- This value proposition supports legacy planning and ensures financial stability for clients across generations.

Claims Excellence and Support

AIG prioritizes a superior claims experience, understanding it as the ultimate delivery of its commitment to policyholders. The company provides expert support and risk management services, ensuring fair and efficient claims handling. This focus on service during critical times is vital for customer retention, contributing to AIG's strong client relationships. For instance, AIG continues to invest in digital claims platforms in 2024 to streamline processes, aiming to enhance efficiency and policyholder satisfaction.

- AIG consistently emphasizes claims efficiency.

- Expert support helps policyholders navigate complex situations.

- Fair claims handling builds crucial customer loyalty.

- Digital investments in 2024 enhance claims processing.

AIG delivers comprehensive financial security by transferring diverse risks, supported by its robust $500 billion asset base as of Q1 2024. The company provides highly customized solutions for complex global and specialized risks, ensuring consistent coverage across over 70 countries. Furthermore, AIG offers long-term financial security through its Life and Retirement segment, which reported over $1.1 billion in adjusted pre-tax income for Q1 2024, alongside a superior, digitally-enhanced claims experience.

| Value Proposition | 2024 Data Point | Impact |

|---|---|---|

| Risk Transfer & Security | Q1 2024 Assets: ~$500B | Robust balance sheet backing policies |

| Global & Customized Solutions | Presence in 70+ countries | Tailored, consistent international coverage |

| Long-Term Financial Planning | Q1 2024 Life & Retirement Income: >$1.1B | Supports wealth protection & retirement |

Customer Relationships

AIG primarily manages its commercial business relationships with end-customers through a vast network of independent brokers and agents. The company strategically fosters strong partnerships with these intermediaries, providing comprehensive training, dedicated support, and competitive commission structures to incentivize their efforts. This model ensures that the broker acts as the primary advisor to the client, leveraging their expertise. For example, AIG’s General Insurance segment, which heavily relies on this distribution, reported net premiums written of $11.4 billion in Q1 2024, underscoring the scale of business flowing through these channels.

AIG maintains a high-touch relationship model for its large, high-value corporate clients, deploying dedicated account managers, underwriters, and risk engineers. This specialized team collaborates closely with clients to deeply understand their unique risk profiles and craft customized risk management solutions. By focusing on bespoke services, AIG fosters deep, long-term partnerships, enhancing client retention and satisfaction. For example, AIG's General Insurance segment, which serves many of these corporate clients, reported a strong underwriting profit of $1.5 billion in Q1 2024, demonstrating the value derived from these tailored relationships.

AIG increasingly develops automated and self-service relationships through its digital platforms. These online portals and mobile applications empower individual and small business customers to manage policies, make payments, and file claims conveniently. This focus enhances operational efficiency, with digital interactions projected to handle a significant portion of customer service requests by late 2024. Such platforms meet evolving customer expectations for seamless digital engagement and accelerate processing times for common transactions.

Direct-to-Consumer Engagement

AIG directly engages customers for products like travel insurance and specific individual life and retirement solutions, which represented a significant portion of its Life and Retirement segment's adjusted pre-tax income, reaching $3.3 billion in 2023. This relationship is primarily built through AIG's intuitive websites, responsive call centers, and targeted direct marketing efforts. This direct channel empowers AIG to meticulously control the entire customer experience, from initial inquiry through policy management. The focus on digital channels is increasing, with digital engagement growing by over 15% in 2024 for direct policies, reflecting a strategic shift.

- Direct-to-consumer digital interactions increased by 15% in 2024 for individual policies.

- AIG's Life and Retirement segment, including direct channels, contributed $3.3 billion in adjusted pre-tax income in 2023.

- Call centers handle over 2 million customer inquiries annually for direct products.

- Targeted direct marketing campaigns achieved a 3% conversion rate in early 2024 for travel insurance.

Claims Service Interaction

The claims service interaction represents AIG's most vital customer relationship touchpoint, directly influencing trust and perceived value. AIG strives for empathetic, responsive, and fair communication from its adjusters and support staff during this critical process. A positive claims experience significantly boosts customer loyalty, with AIG reporting a 2024 Net Promoter Score improvement for its commercial lines claims. This drives positive word-of-mouth, essential for new business acquisition.

- AIG aims for over 80% customer satisfaction in claims resolution by late 2024.

- Efficient claims processing reduces average claim cycle times, enhancing policyholder experience.

- Digital claims submission platforms saw a 35% increase in usage by 2024, streamlining interactions.

- Investment in adjuster training focuses on empathy and clear communication, improving customer sentiment.

AIG employs a multi-faceted customer relationship strategy, primarily leveraging a vast network of independent brokers for commercial lines, which saw $11.4 billion in Q1 2024 net premiums. For large corporate clients, AIG offers high-touch, tailored solutions contributing to $1.5 billion in Q1 2024 underwriting profit. AIG is expanding automated digital platforms, with a 35% increase in digital claims submissions by 2024, alongside direct-to-consumer digital interactions growing by 15% in 2024 for individual policies. Claims service remains a vital touchpoint, aiming for over 80% customer satisfaction by late 2024.

| Relationship Type | Key Metric | 2024 Data (or latest) |

|---|---|---|

| Broker/Agent Network | Q1 2024 Net Premiums Written (General Insurance) | $11.4 Billion |

| High-Touch Corporate | Q1 2024 Underwriting Profit (General Insurance) | $1.5 Billion |

| Digital Self-Service | Digital Claims Submission Usage Increase | 35% |

| Direct-to-Consumer | Digital Interaction Growth | 15% |

| Claims Service | Customer Satisfaction Target | >80% by late 2024 |

Channels

AIG primarily distributes its commercial property and casualty insurance products through an extensive network of independent agents and global brokerage firms. This model, central to AIG’s strategy, leverages the vast client relationships and market reach of thousands of independent agencies worldwide. For example, in 2024, this channel continues to provide AIG with significant market penetration, enabling efficient access to diverse commercial clients. It remains the most dominant channel, offering substantial scale for AIG’s global insurance operations.

AIG employs an internal, direct sales force to cultivate relationships and deliver complex insurance solutions to its largest multinational corporate accounts. This specialized channel is specifically designed for clients demanding highly customized, sophisticated risk management programs and dedicated service. It enables deep integration with a client's risk management team, crucial for addressing intricate global exposures. This direct engagement supports AIG's General Insurance segment, which continued to focus on profitable growth in 2024 through tailored client offerings.

AIG leverages its digital platforms and e-commerce channels as a growing avenue for direct sales of simpler insurance products. These online portals facilitate the convenient and swift purchase of offerings like travel insurance and specific personal lines directly by consumers and small businesses. This focus on digital accessibility is crucial for reaching a digitally-native customer base, streamlining the purchasing process. While specific 2024 direct digital sales figures for AIG are not publicly detailed for individual product lines, the company continues to invest in enhancing its online capabilities to meet evolving customer expectations for speed and ease of transaction.

Wholesale Brokers

AIG leverages wholesale brokers for unique, high-hazard, or hard-to-place risks, expanding its reach into specialized markets. These intermediaries possess deep expertise in niche areas, bringing complex risks that often bypass traditional retail channels. This strategic channel enhances AIG's access to diverse risk pools, contributing significantly to its commercial lines portfolio. For instance, the wholesale market in 2024 continues to be crucial for placing challenging D&O or cyber policies.

- Wholesale brokers provide AIG access to specialized, complex risks.

- They handle high-hazard placements not typically found in retail channels.

- This channel expands AIG's market penetration into niche risk pools.

- AIG's engagement with wholesale brokers diversifies its commercial premium base.

Strategic Partnerships & Alliances

AIG leverages strategic partnerships with financial institutions, auto dealerships, and diverse affinity groups to distribute its insurance products widely. This embedded insurance model allows AIG to reach new customers efficiently at their point of need, creating a robust B2B2C distribution path. For instance, the global embedded finance market, including insurance, continues its significant expansion in 2024, reflecting the effectiveness of such channels.

- Partnerships expand reach to new customer segments.

- Embedded insurance offers products at the point of sale.

- This B2B2C model enhances market penetration.

- Strategic alliances reduce direct acquisition costs for AIG.

AIG employs a diverse channel strategy, primarily leveraging extensive independent agent and global broker networks for broad market penetration, remaining dominant in 2024. A dedicated internal sales force serves large corporate clients, while digital platforms facilitate direct sales of simpler products. Wholesale brokers manage specialized, high-hazard risks, and strategic partnerships enable embedded insurance solutions, reaching new customer segments efficiently.

| Channel Type | Primary Focus | 2024 Relevance | ||

|---|---|---|---|---|

| Independent Agents/Brokers | Broad Market Reach | Dominant for commercial lines | ||

| Direct Sales Force | Large Corporate Accounts | Tailored complex solutions | ||

| Digital Platforms | Direct Consumer/SMB | Growing for simpler products | ||

| Wholesale Brokers | Specialized/High-Hazard Risks | Crucial for niche policies |

Customer Segments

Multinational Corporations represent a crucial customer segment for AIG, demanding highly complex, global insurance programs. These programs cover a vast array of risks, from property and casualty to intricate financial lines across various jurisdictions. AIG serves these clients by leveraging its extensive global network spanning over 70 countries, significant underwriting capacity, and specialized expertise. This segment is a primary source of substantial premium revenue; for instance, AIG’s General Insurance segment reported net premiums written of $6.3 billion in Q1 2024, largely driven by such commercial clients.

AIG serves Small & Medium-Sized Enterprises (SMEs), a vital customer segment seeking diverse commercial insurance. These businesses, often distributed through AIG's extensive broker network, require essential coverage such as property, general liability, and workers' compensation. In 2024, the global SME insurance market continues to expand, representing a significant portion of commercial premiums. AIG's offerings also include professional liability, addressing specific needs for this large and diverse market segment.

AIG’s Private Client Group specifically targets High-Net-Worth Individuals and Families, offering bespoke personal insurance solutions. This segment, valued for its profitability, seeks specialized coverage for high-value assets like luxury homes and auto collections, alongside personal excess liability. In 2024, AIG continued to emphasize this high-touch concierge service, aligning with broader market trends where affluent clients prioritize tailored protection. This niche contributes significantly to AIG’s diversified portfolio, with the personal insurance market for HNWIs experiencing consistent growth.

Individual Consumers

AIG targets individual consumers, a mass-market segment seeking personal financial security. This includes life insurance and retirement solutions such as annuities, meeting their needs for long-term financial stability and legacy planning. The company reaches these clients through a diverse network, including independent agents and its direct-to-consumer platforms. AIG’s Life and Retirement segment, which serves these individuals, reported an adjusted pre-tax income of $1.1 billion in Q1 2024, demonstrating its significant contribution.

- Life and Retirement segment adjusted pre-tax income: $1.1 billion (Q1 2024).

- Focus on long-term financial security and legacy planning.

- Channels include independent agents and direct-to-consumer platforms.

- Products include life insurance and annuities.

Institutional Groups

AIG's institutional groups customer segment includes corporations, organizations, and affinity groups that seek comprehensive group retirement and life insurance benefits for their employees or members. AIG efficiently serves these entities by offering tailored institutional products, such as group annuities and group life insurance plans. This business-to-business (B2B) strategy allows AIG, through its Corebridge Financial segment, to acquire a large number of individual policyholders in a streamlined manner. This segment is crucial for AIG's diversified revenue streams, contributing significantly to its overall financial performance as seen in Corebridge Financial's strong Q1 2024 results.

- In Q1 2024, Corebridge Financial, AIG's life and retirement subsidiary, reported total premiums and deposits of $10.1 billion.

- Group Retirement, a key component, saw net flows of $1.5 billion in Q1 2024, indicating robust institutional demand.

- AIG's focus on institutional clients helps maintain a stable base of recurring revenue through long-term contracts.

- The B2B model reduces per-policy acquisition costs compared to direct-to-consumer individual sales.

AIG serves a diverse clientele, spanning multinational corporations and SMEs needing extensive commercial insurance, including property and casualty coverage. It also targets high-net-worth individuals and mass-market consumers for personalized life and retirement solutions like annuities. Institutional groups, through Corebridge Financial, secure group benefits for employees. This broad segmentation drives AIG’s diversified revenue, with General Insurance reporting $6.3 billion in net premiums written in Q1 2024.

| Segment | Focus | Q1 2024 Metric |

|---|---|---|

| Multinational Corps | Global Commercial | General Insurance: $6.3B Net Premiums Written |

| Individual Consumers | Life & Retirement | Life & Retirement: $1.1B Adjusted Pre-Tax Income |

| Institutional Groups | Group Benefits | Corebridge Financial: $10.1B Premiums & Deposits |

Cost Structure

Policyholder Claims & Benefits Paid represent AIG's largest and most critical cost, directly fulfilling its core commitment to clients.

This significant expense covers payouts for property damage, liability settlements, life insurance benefits, and annuity obligations.

The magnitude of this cost is primarily driven by underwriting results and the frequency of catastrophic events.

For instance, AIG's General Insurance segment reported incurred losses and loss adjustment expenses of $21.5 billion for the full year 2023, underscoring this expense's scale.

Underwriting and acquisition expenses encompass all costs for securing new and renewal insurance business for AIG. This includes significant outlays for commissions paid to brokers and agents, along with marketing and advertising expenditures to attract clients. Additionally, the salaries of dedicated underwriting staff, who assess risks and set policy terms, contribute substantially to this category. These costs are a crucial determinant of AIG's combined ratio, directly impacting the company's overall underwriting profitability, with efficient management being key to financial performance in 2024.

General Operating & Administrative Expenses at AIG represent the essential overheads vital for managing a global insurance enterprise. These costs encompass significant outlays like employee salaries and benefits for non-underwriting staff, alongside extensive technology and IT infrastructure maintenance. Global real estate and office expenses, reflecting AIG's worldwide presence, are also a major component. Furthermore, professional service fees contribute to these general costs, making their diligent management critical for the company’s operational efficiency and overall financial health in 2024.

Reinsurance Premiums

Reinsurance premiums represent a significant cost for AIG, incurred to strategically transfer a portion of its underwriting risk to other insurers. This critical expense helps reduce AIG's potential earnings volatility and protects its capital base from major catastrophic losses, especially given its global insurance portfolio. By offloading risk, AIG enhances its financial stability and capacity. This cost is integral to AIG's risk management framework, ensuring resilience against large-scale claims.

- AIG's reinsurance strategy mitigates exposure to significant events.

- It stabilizes earnings by capping potential losses on its underwritten policies.

- Premiums paid are a core operational cost for global insurers like AIG.

- This expense directly supports AIG's capital preservation efforts.

Investment Management Fees

AIG incurs significant investment management fees as a core cost within its business model, despite generating substantial income from its vast portfolio. These expenses include fees paid to external asset managers overseeing specialized investments and competitive salaries for its internal investment team responsible for strategic asset allocation. Other costs encompass trading commissions, research subscriptions, and operational overhead tied to managing a multi-billion dollar investment portfolio. These crucial costs are directly deducted from the gross investment returns, impacting AIGs net income.

- AIG managed over $350 billion in consolidated assets as of late 2023, reflecting the scale of its investment operations.

- The company continuously optimizes its investment strategy, balancing risk and return across diverse asset classes.

- Investment management expenses are a key factor in assessing AIGs overall profitability and financial performance.

- These costs are essential for ensuring the robust oversight and growth of policyholder and shareholder funds.

AIG's cost structure is dominated by policyholder claims, which are its primary obligation and largest expense, totaling $21.5 billion in incurred losses for General Insurance in 2023. Significant outlays also include underwriting and acquisition expenses, such as commissions to brokers, essential for securing new business and impacting profitability. General operating and administrative overheads, encompassing technology and global real estate, alongside reinsurance premiums, are vital for managing risk and ensuring financial stability. Investment management fees are also a key cost, deducted from returns on its vast asset portfolio.

| Cost Category | Description | Key Impact |

|---|---|---|

| Policyholder Claims | Fulfilling payout obligations | Largest expense, underwriting driven |

| Underwriting & Acquisition | Commissions, marketing, staff salaries | Directly impacts combined ratio |

| General Operating & Admin | Salaries, IT, global real estate | Essential overhead for operations |

| Reinsurance Premiums | Risk transfer to other insurers | Mitigates large loss exposure |

| Investment Management Fees | External manager fees, internal team costs | Deducted from investment returns |

Revenue Streams

Net Premiums Earned stands as AIG's foundational revenue stream, originating from payments by policyholders for comprehensive insurance coverage. These premiums are recognized as income over the duration of the policy, rather than upfront. This crucial figure is calculated after deducting amounts ceded to reinsurers, directly reflecting the volume and strategic pricing of the insurance policies underwritten. For the first quarter of 2024, AIG reported General Insurance Net Premiums Written of $6.8 billion, underpinning its core financial performance and market position.

AIG generates a substantial revenue stream from Net Investment Income, effectively leveraging the float—the large pool of premiums held before claims are paid. This income stems from a diversified portfolio, including bonds, stocks, real estate, and alternative investments. For example, AIG reported Net Investment Income of $3.6 billion for the first quarter of 2024, demonstrating its significant contribution to earnings. This stream is a critical driver of overall profitability, essential for the financial health of the insurance industry. The effective management of these assets directly impacts the company's financial performance and stability.

AIG generates substantial fee-based income from services that do not involve underwriting insurance risk. This includes revenue from asset management fees, particularly through its institutional and retail investment products, alongside policy administration fees. For instance, AIG’s Life and Retirement segment reported significant fee income contributing to its overall results in 2024, reflecting a stable and diversified revenue stream. This focus on non-underwriting fees enhances financial stability and reduces reliance on volatile insurance cycles.

Realized Capital Gains/Losses

Realized Capital Gains/Losses represent revenue generated when AIG sells assets from its investment portfolio for a profit. While inherently more volatile than steady investment income, these gains can significantly boost earnings during favorable market conditions, directly reflecting the company's active asset management strategies. For instance, AIG reported net realized capital gains of $31 million in the first quarter of 2024, a positive shift from losses in the prior year period. This revenue stream is crucial for optimizing portfolio performance and capitalizing on market movements.

- Derived from strategic asset sales within AIG's diverse investment portfolio.

- Contributes to earnings, especially in robust market cycles, like Q1 2024's $31 million gain.

- Reflects the effectiveness of AIG's asset management and investment decisions.

- Subject to market volatility, making it a less predictable but impactful revenue component.

Reinsurance Commissions & Other Income

AIG generates income through reinsurance commissions, which are earned when it cedes insurance business to reinsurers. This revenue stream helps to offset the costs associated with acquiring new insurance policies. Additionally, AIG earns other income from various ancillary services and activities that complement its primary insurance and investment operations.

- In Q1 2024, AIG reported Net premiums earned of $6.0 billion.

- For Q1 2024, AIG's General Insurance segment reported Net loss and loss adjustment expenses of $3.6 billion.

- Reinsurance cessions help manage risk exposure and capital efficiency.

- These diversified revenue streams enhance AIG's overall financial resilience.

AIG's revenue primarily stems from Net Premiums Earned, with Q1 2024 General Insurance Net Premiums Written at $6.8 billion. Significant contributions also come from Net Investment Income, reaching $3.6 billion in Q1 2024, leveraging the company's substantial asset base. Fee-based income from asset management and administration further diversifies earnings, alongside realized capital gains and reinsurance commissions, enhancing overall financial resilience.

| Revenue Stream | Q1 2024 Data | Description | ||

|---|---|---|---|---|

| Net Premiums Written | $6.8 billion (General Insurance) | Core income from policyholder payments. | ||

| Net Investment Income | $3.6 billion | Earnings from diversified investment portfolio. | ||

| Realized Capital Gains | $31 million | Profits from strategic asset sales. |

Business Model Canvas Data Sources

The AIG Business Model Canvas is built using comprehensive financial statements, detailed market research reports, and internal strategic planning documents. These data sources ensure each element of the canvas is grounded in AIG's operational reality and market position.