AIG Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIG Bundle

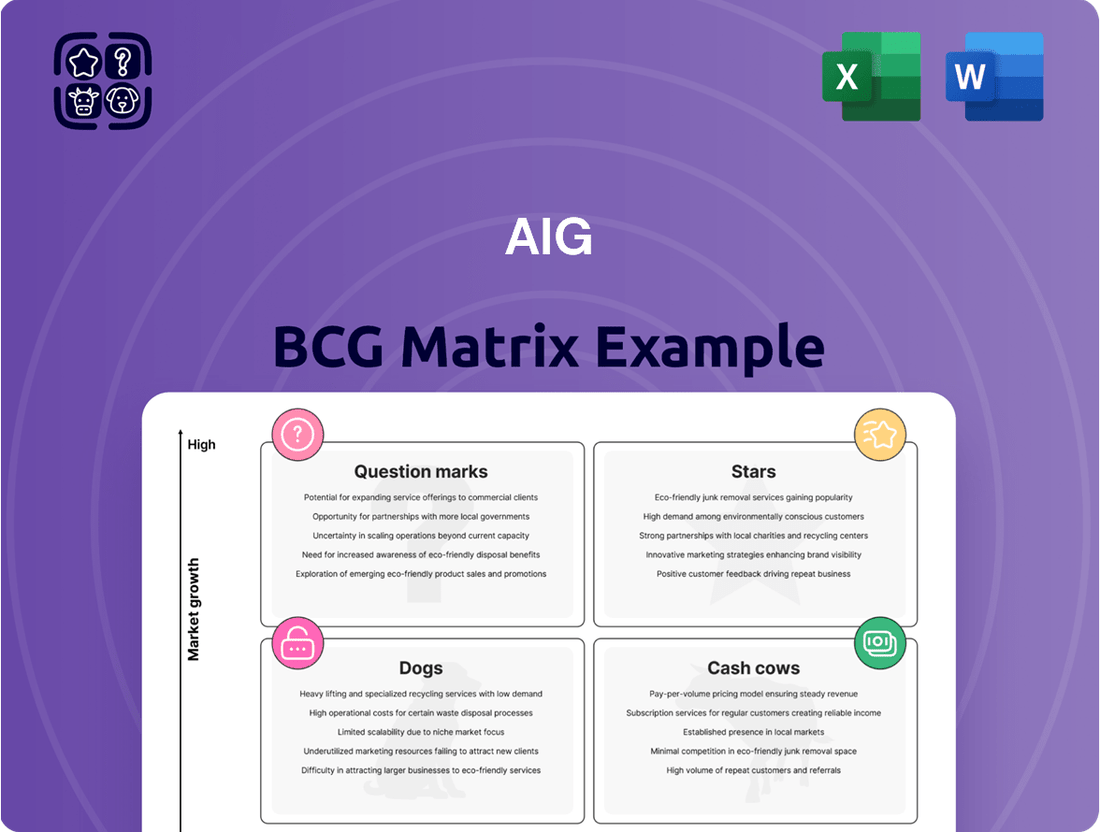

The AIG BCG Matrix helps clarify their product portfolio's strategic potential. Question Marks, Stars, Cash Cows, or Dogs? This framework provides a snapshot of where AIG products stand. This brief overview only scratches the surface. Get the full BCG Matrix report for a complete view of AIG's strategic landscape and expert-driven insights.

Stars

AIG's North America Commercial segment is a "Star" in its BCG Matrix. In 2024, net premiums written saw substantial growth, fueled by Lexington Insurance. This highlights a robust market presence and business expansion. The segment's accident year combined ratio improved, signaling better profitability.

AIG's International Commercial Insurance segment shows robust growth in net premiums. This growth is fueled by its global reach and expansion in commercial lines across various regions. In 2024, this segment saw a 7% increase in net premiums written. This expansion boosts AIG's market share.

AIG's Global Commercial business is a "Star" due to substantial growth. In 2024, net premiums grew significantly. High retention rates show client satisfaction. Record new business highlights a strong competitive position.

Excess & Surplus Lines

AIG's excess and surplus (E&S) lines business is substantial. In 2024, the E&S market is expected to continue its growth trajectory. AIG benefits from this expansion due to its established presence. Double-digit growth in the E&S market highlights its importance.

- AIG is a major player in the U.S. E&S market.

- The E&S market has shown significant growth.

- This growth indicates increased demand for specialized insurance.

- AIG is well-positioned to capitalize on market expansion.

Underwriting Expertise and Reinsurance Strategy

AIG's underwriting skills and reinsurance strategies are crucial for its financial health. This combination helps AIG navigate the complex insurance market effectively. The company's expertise in risk management is a key factor. In 2024, AIG reported a strong accident year combined ratio.

- AIG's underwriting focus leads to better financial results.

- Strategic reinsurance use improves risk management.

- Technical expertise is key to profitability.

- In 2024, AIG showed a strong accident year combined ratio.

AIG's "Stars" in its BCG Matrix include its North America Commercial, International Commercial, and Global Commercial segments. These segments show robust growth, with the International Commercial segment seeing a 7% increase in net premiums written in 2024. High retention and record new business in Global Commercial, alongside substantial E&S market expansion, underscore their strong market positions and profitability. The company's strong accident year combined ratio in 2024 further supports this.

| Segment | 2024 Performance Indicator | Key Data |

|---|---|---|

| International Commercial | Net Premiums Written Growth | +7% |

| Global Commercial | New Business | Record High |

| North America Commercial | Accident Year Combined Ratio | Improved |

| E&S Market | Expected Growth | Double-Digit |

What is included in the product

Strategic analysis of AIG's business units using the BCG Matrix, with investment strategies.

Printable summary optimized for A4 and mobile PDFs, so everyone can understand the big picture.

Cash Cows

AIG's General Insurance, with commercial and personal segments, is a major net premium writer. In 2024, net premiums written were substantial, although subject to catastrophe impacts. This segment's net investment income and underlying performance significantly boost AIG's cash flow. Despite volatility, it remains a key cash generator.

AIG's net investment income is substantial. In 2024, it played a key role in AIG's financial performance. This income helps maintain financial stability. It also enables returns to shareholders.

AIG boasts a vast, global client base, catering to individuals and major corporations alike. Global Commercial, a key segment, demonstrates impressive retention, signaling strong customer loyalty. In 2024, AIG's North America Commercial business saw a retention rate of nearly 85%. This stable client base ensures steady premium income.

Capital Management and Shareholder Returns

AIG, categorized as a cash cow in the BCG matrix, has consistently prioritized returning capital to its shareholders. This strategy highlights AIG's robust financial health and its capacity to produce significant cash flow. For instance, in 2024, AIG allocated a substantial amount towards share repurchases and dividends, signaling confidence in its earnings. This approach is a hallmark of a cash cow, ensuring shareholder value maximization.

- Share Repurchases: AIG has repurchased a significant amount of its shares, reducing the outstanding share count and increasing earnings per share.

- Dividends: A consistent dividend payment demonstrates AIG’s commitment to providing returns to shareholders.

- Capital Allocation: AIG's capital allocation strategy focuses on optimizing shareholder returns.

- Financial Strength: AIG's ability to return capital underscores its strong financial position and cash-generating capabilities.

Operational Efficiency and Expense Management

AIG has been streamlining operations and controlling costs, particularly through programs like AIG Next. These strategies boost profitability and free up cash from its ongoing business activities. The company's focus on efficiency has led to improved financial performance. AIG aims to optimize resource allocation and reduce expenditures. This approach is crucial for sustaining its position as a cash cow.

- AIG's adjusted pre-tax income increased to $3.6 billion in Q1 2024, up from $1.8 billion in Q1 2023.

- General operating expenses decreased by 7.5% in Q1 2024, compared to Q1 2023.

- AIG Next initiatives are expected to deliver significant cost savings and operational improvements.

- The company's combined ratio improved to 91.7% in Q1 2024, indicating better underwriting performance.

AIG functions as a robust cash cow due to its mature, stable insurance operations generating consistent, significant cash flows. Its strategic focus on capital return, including substantial share repurchases and dividends in 2024, underscores this strength. Operational efficiencies, like those from AIG Next, further enhance profitability and free cash. This solid financial position allows AIG to fund other ventures while rewarding shareholders.

| Metric | Q1 2024 | Change YoY |

|---|---|---|

| Adjusted Pre-Tax Income | $3.6 billion | +100% |

| General Operating Expenses | -7.5% | |

| Combined Ratio | 91.7% | Improved |

What You’re Viewing Is Included

AIG BCG Matrix

The BCG Matrix you're previewing mirrors the final report you'll own after purchase. This complete, editable document is formatted for clear strategic assessments. It's ready for instant download and implementation.

Dogs

Certain segments of AIG's business could be struggling, showing slow growth. These segments might have a smaller market share compared to AIG's top-performing areas. For example, in 2024, AIG's general insurance unit reported a combined ratio of 98.3%, indicating potential profitability challenges in some lines. This means some parts of the business may not be as successful.

AIG has strategically divested underperforming businesses. These moves align with the 'dogs' quadrant of the BCG matrix. For example, AIG sold Validus Re in 2024. This indicates a shift away from less profitable segments.

AIG's run-off businesses, which include legacy insurance policies, are excluded from adjusted pre-tax income. These operations, with low growth and market share, are in settlement. For 2024, AIG's pre-tax income from discontinued operations was a loss of $1.1 billion. This highlights the financial burden of these run-off segments.

Segments with Increased Catastrophe Losses

Segments significantly affected by increased catastrophe losses face reduced underwriting income. They may temporarily resemble 'dogs' in the BCG matrix, showing low profitability and high cash consumption, influenced by external factors. For example, in 2024, the insurance industry saw a rise in catastrophe losses.

- Catastrophe losses can lead to decreased profitability.

- These segments might need more cash to cover claims.

- External factors such as weather events heavily affect these segments.

- Underwriting income is directly impacted.

Certain Personal Insurance Lines

Within AIG's Global Personal Insurance, certain lines of business may be facing headwinds. These challenges could stem from fierce competition or evolving consumer demands in specific geographic areas. For example, in 2024, AIG's North America Personal Insurance saw a shift in focus, potentially impacting certain lines. The company's strategic adjustments aim to optimize portfolio performance. This might involve reevaluating product offerings or market strategies.

- AIG's Global Personal Insurance segment includes high-net-worth and mass affluent segments.

- In 2024, AIG reported a focus on profitability and risk selection.

- Competition from other insurers impacts market share.

- Consumer preferences change over time, influencing product demand.

AIG's Dogs quadrant includes segments with low market share and slow growth, often divested or managed for run-off. For example, AIG sold Validus Re in 2024, aligning with this strategy. Its discontinued operations reported a $1.1 billion pre-tax loss in 2024, highlighting the financial burden of these 'dog' segments. Catastrophe-prone lines within general insurance, with a 98.3% combined ratio in 2024, also show traits of low profitability.

| Segment Type | 2024 Status | Financial Impact |

|---|---|---|

| Divested Businesses | Validus Re sold | Strategic exit |

| Run-off Operations | Discontinued | $1.1B pre-tax loss |

| Challenged Insurance Lines | General Insurance | 98.3% combined ratio |

Question Marks

AIG is channeling resources into innovation, crafting new products and services to stay ahead of client needs. These fresh offerings are hitting growth markets, but initially, AIG's market share is modest. In 2024, AIG's investment in tech and innovation hit $1.2 billion. They aim to boost adoption and secure a stronger market position.

AIG's substantial investments in AI and digital transformation, aiming to refine underwriting and customer interactions, position them as question marks within the BCG matrix. While digital transformation spending in insurance is projected to reach $218 billion by 2024, AIG's specific market share gains from these initiatives remain uncertain. The full impact on their financial performance and market position is yet to be fully determined, making their success a subject of ongoing evaluation.

AIG is aggressively expanding globally, aiming for significant growth in diverse regions. New markets offer high-growth potential, yet AIG's initial market share may be modest in these areas. In 2024, AIG's international gross premiums written increased. This expansion reflects strategic moves to capitalize on emerging market opportunities.

Targeting High Net Worth Segment Growth

AIG aims to expand within the high net worth segment. This market offers significant growth potential; however, AIG's current market presence is a factor. Substantial investment is needed to compete effectively in this area.

- High net worth individuals' insurance spending is projected to increase by 8% annually through 2024.

- AIG's investment in this segment was approximately $500 million in 2023.

- Market share for AIG in this segment is currently about 5%.

Strategic Joint Ventures and Partnerships

AIG's strategic joint ventures and partnerships are key. These collaborations target high-growth areas, but market dominance is still developing. Success varies across products and regions, impacting overall market share. For example, AIG's partnership with Corebridge Financial generated approximately $3.1 billion in net investment income in 2024. These ventures show potential but need consistent execution.

- AIG's partnerships include collaborations in insurance and financial services.

- Success is measured by market share growth and revenue generation.

- Geographic focus areas often include emerging markets.

- 2024 data showed variable performance across different ventures.

AIG's Question Marks stem from significant 2024 investments in innovation, digital transformation, and global expansion, aiming for growth in high-potential markets. Despite a $1.2 billion tech investment and $3.1 billion from Corebridge partnership in 2024, their initial market share is modest. Success in these ventures, including the high net worth segment, is still developing and requires consistent execution.

| Area | 2024 Investment/Income | Current Market Share |

|---|---|---|

| Tech & Innovation | $1.2 billion | Modest |

| High Net Worth | N/A (2023: $500M) | ~5% |

| Corebridge Partnership | $3.1 billion | Developing |

BCG Matrix Data Sources

The BCG Matrix draws from credible sources, combining financial data, industry reports, and market analysis. These help in quadrant categorization.