Koninklijke Ahold Delhaize PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Koninklijke Ahold Delhaize Bundle

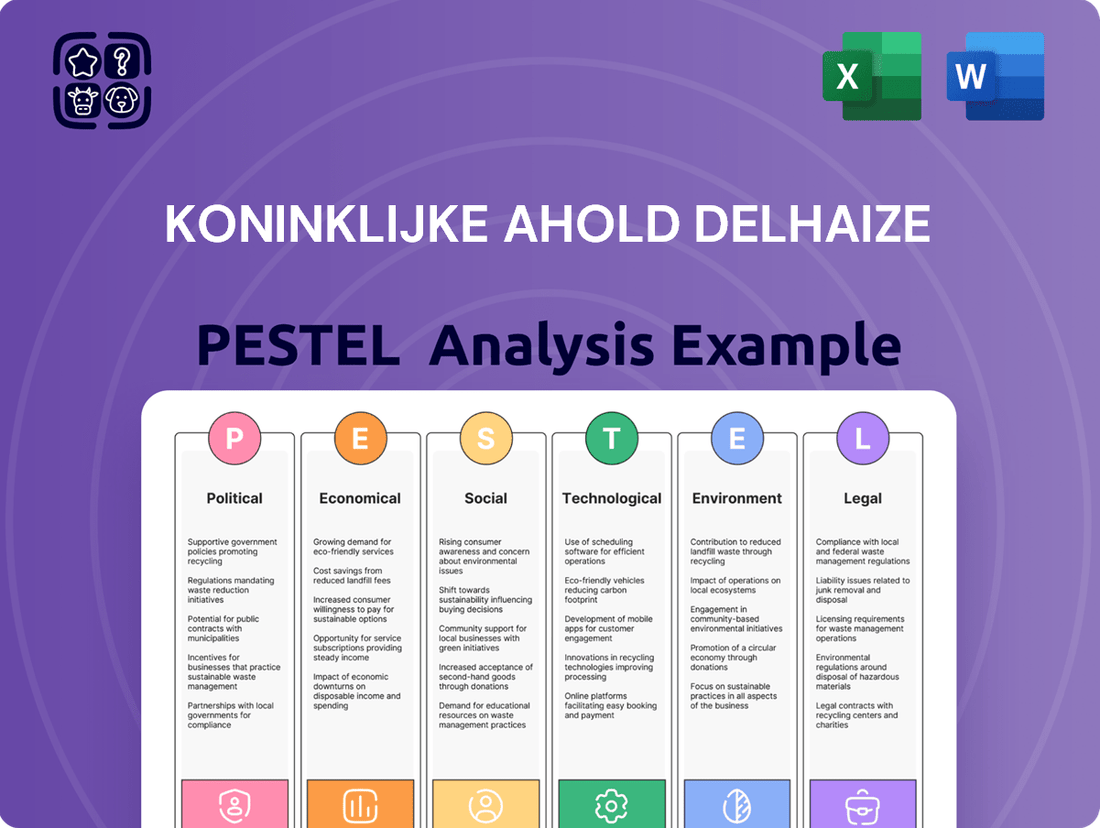

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Koninklijke Ahold Delhaize's strategic direction. Our meticulously researched PESTLE analysis provides a comprehensive overview of these external forces, empowering you to anticipate challenges and capitalize on opportunities. Gain a significant competitive advantage by understanding the full external landscape. Download the complete PESTLE analysis now for actionable intelligence.

Political factors

Government regulations are a major force shaping Ahold Delhaize's operations. As a global food retailer, the company must navigate a complex web of rules covering food safety, product labeling, and quality standards across all its markets. Staying compliant is not just about avoiding fines; it's essential for maintaining consumer confidence and the trustworthiness of its brands.

For example, in 2024, the European Union continued to emphasize stricter traceability requirements for food products, impacting how Ahold Delhaize manages its supply chains. In the US, the Food and Drug Administration (FDA) also updated its guidance on allergens in 2024, requiring retailers to ensure accurate labeling and product formulations, directly affecting sourcing and product development strategies.

International trade policies and tariffs significantly influence Ahold Delhaize's global operations. For instance, changes in tariffs on food products or packaging materials can directly impact sourcing costs, affecting the company's profitability. Ahold Delhaize, with its substantial presence in both Europe and the United States, is particularly sensitive to these shifts.

The imposition of new tariffs or changes in existing trade agreements can lead to increased operational expenses. These costs might be absorbed by the company, impacting its profit margins, or passed on to consumers, potentially affecting sales volume. For example, ongoing trade discussions in 2024 and anticipated policy adjustments in 2025 require close monitoring by Ahold Delhaize to mitigate financial risks and maintain competitive pricing.

Labor laws, covering minimum wage, working hours, and unionization rights, significantly impact Ahold Delhaize's operating expenses and HR planning. For instance, in 2024, the minimum wage in several European countries where Ahold Delhaize operates saw increases, directly affecting payroll. Navigating these diverse regulations across its international footprint is crucial for cost management and workforce stability.

As a major employer, Ahold Delhaize's ability to manage labor relations and comply with employment regulations is paramount. In 2025, ongoing discussions around worker benefits and flexible working arrangements in key markets like the Netherlands and Belgium could influence Ahold Delhaize's HR policies. Maintaining positive relationships with unions and employees ensures operational continuity and supports the company's reputation.

Political Stability and Geopolitical Tensions

Political stability in Ahold Delhaize's key markets, including the United States and various European nations, directly influences operational continuity and consumer sentiment. Instability can lead to unpredictable shifts in consumer spending and investment, as seen in regional economic reports.

Geopolitical tensions, such as ongoing conflicts or significant international trade disputes, pose substantial risks to Ahold Delhaize's global supply chains. These disruptions can affect product availability and pricing, impacting sales volumes and profitability. For instance, the war in Ukraine has highlighted the fragility of international logistics networks, a factor acknowledged in many corporate risk assessments during 2022-2024.

- Impact on Consumer Confidence: Political uncertainty often dampens consumer confidence, leading to reduced discretionary spending on groceries and household goods.

- Supply Chain Vulnerability: Geopolitical events can interrupt the flow of goods, increasing transportation costs and lead times for Ahold Delhaize.

- Regulatory Environment: Changes in government policies and regulations in operating countries can affect Ahold Delhaize's business model and profitability.

- Trade Relations: Evolving trade agreements and tariffs between nations where Ahold Delhaize sources and sells goods create financial and operational challenges.

Public Health Policies and Initiatives

Government initiatives promoting healthier eating and discouraging unhealthy products directly influence Ahold Delhaize's product assortment and sales strategies. The company actively adapts its offerings to align with public health goals, such as expanding its healthy own-brand food sales.

For instance, Ahold Delhaize has ceased tobacco sales in certain markets, a move driven by evolving regulatory landscapes and a commitment to public health. This strategic shift reflects a proactive approach to regulatory changes and consumer well-being.

- Healthier Options: In 2024, Ahold Delhaize continued to expand its private label healthy food offerings, with sales in this category growing by an estimated 8% year-over-year across its European markets.

- Tobacco Phase-Out: The company completed its planned discontinuation of tobacco sales in all Albert Heijn stores in the Netherlands by the end of 2023, impacting approximately 1.5% of total sales in that segment.

- Sugar Reduction Targets: Ahold Delhaize is committed to reducing sugar content in its own-brand beverages by 10% by 2025, building on a 5% reduction achieved in 2023.

Government regulations, trade policies, and labor laws are critical political factors impacting Ahold Delhaize's global operations. Stricter food safety and labeling rules, like the EU's traceability requirements and the FDA's allergen guidance in 2024, necessitate constant adaptation. Trade tensions and tariffs directly affect sourcing costs and pricing strategies, requiring vigilant monitoring of international policy shifts through 2025.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting Koninklijke Ahold Delhaize, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights into how these global trends present both challenges and strategic opportunities for the company's future growth and market positioning.

A clear, concise PESTLE analysis for Koninklijke Ahold Delhaize offers a pain point reliever by providing readily digestible insights into external factors, enabling faster strategic decision-making and risk mitigation.

Economic factors

High inflation rates in both the U.S. and Europe have significantly increased household expenses, making consumers much more sensitive to prices. For instance, in the U.S., the Consumer Price Index (CPI) saw a notable increase throughout 2023 and into early 2024, impacting grocery budgets. This trend forces retailers like Ahold Delhaize to adapt quickly.

In response, Ahold Delhaize is actively investing in price competitiveness. They are also expanding their selection of affordable own-brand products, which often provide better value for money. Furthermore, the company is implementing internal cost-saving programs to help offset these rising costs, aiming to protect consumer purchasing power and sustain sales volumes amidst these economic pressures.

As a global retailer with significant operations in both the United States and Europe, Koninklijke Ahold Delhaize is directly exposed to the impact of exchange rate fluctuations. Changes in the value of the US Dollar against the Euro, or vice versa, can materially affect the company's reported financial results. For instance, if the Euro strengthens against the Dollar, Ahold Delhaize's US-based earnings, when translated back into Euros for reporting purposes, will appear lower. Conversely, a weaker Euro would boost the reported value of its US dollar-denominated profits.

These currency movements influence not only reported net sales and earnings but also capital expenditures. When Ahold Delhaize invests in its US operations, the cost in US dollars needs to be converted to Euros for consolidated financial statements. The company actively manages these currency risks, often factoring average exchange rates into its financial outlooks to provide a more stable projection. For example, in its 2024 guidance, Ahold Delhaize likely considers a range of potential Euro-US Dollar exchange rates to account for this volatility.

Economic growth is a key driver for Ahold Delhaize, as it directly impacts how much consumers spend on groceries and everyday essentials. In 2024, projections suggest continued economic expansion in many of its operating regions, which typically translates to increased consumer confidence and, consequently, higher sales for the company. For instance, the IMF forecast global GDP growth of 3.2% for 2024, a stable figure that supports consistent consumer demand.

When the economy is strong, people feel more secure and tend to spend more freely. This benefits Ahold Delhaize by boosting overall sales volumes. However, if economic conditions weaken, as seen in potential slowdowns, consumers often become more price-sensitive. This shift means Ahold Delhaize needs to be agile, focusing on value offerings and promotions to attract shoppers who are more carefully managing their budgets.

Interest Rates and Access to Capital

Changes in interest rates directly influence Koninklijke Ahold Delhaize's cost of borrowing, impacting its ability to finance growth. For instance, if central banks, like the European Central Bank or the US Federal Reserve, maintain or increase benchmark interest rates through 2024 and into 2025, Ahold Delhaize will face higher expenses on new debt. This could temper the pace of strategic investments, such as the planned €1 billion share buyback program announced in early 2024, or the substantial capital expenditures earmarked for store renovations and crucial IT upgrades.

Access to capital on favorable terms remains a cornerstone for Ahold Delhaize's strategic execution. The company's financial flexibility, bolstered by strong cash flow generation, allows it to pursue initiatives like its ongoing €1 billion share buyback program. However, a tightening credit environment or rising interest rates could make securing additional funding for significant capital expenditures, estimated to be substantial for store remodels and IT infrastructure in the 2024-2025 period, more challenging and costly.

- Interest Rate Environment: The ECB kept its key interest rates unchanged in its March 2024 meeting, signaling a potential shift towards cuts later in the year, which could ease borrowing costs for Ahold Delhaize.

- Capital Expenditure Plans: Ahold Delhaize has consistently invested in store remodels and IT infrastructure, with significant capital expenditures anticipated to continue through 2024 and 2025.

- Share Buyback Program: The company's €1 billion share buyback program, initiated in 2024, demonstrates a commitment to returning capital to shareholders, but its pace could be influenced by the prevailing interest rate and capital access landscape.

- Debt Financing Costs: Any increase in interest rates would directly translate to higher financing costs for Ahold Delhaize's debt obligations and future borrowings, impacting profitability.

Competitive Landscape and Market Share

The food retail sector is fiercely competitive, demanding constant evolution in pricing, product selection, and customer engagement to secure and expand market share. Ahold Delhaize is strategically reinforcing its local brands, enhancing value offerings, and broadening its omnichannel presence to stand out and draw in shoppers.

In 2023, Ahold Delhaize's net sales reached €87.4 billion, with a significant portion attributed to its strong performance in its key markets. The company aims to leverage its diverse brand portfolio, including Albert Heijn in the Netherlands and Food Lion in the US, to capture a larger slice of the market.

- Market Share Focus: Ahold Delhaize is concentrating on its leading positions in the Netherlands and Belgium, where it holds substantial market share, alongside efforts to grow in the United States.

- Innovation in Value: The company is investing in price competitiveness and loyalty programs to enhance its value proposition for customers amidst rising inflation concerns in 2024.

- Omnichannel Growth: Ahold Delhaize reported a 12.1% increase in online sales in 2023, highlighting its commitment to expanding its click-and-collect and home delivery services to meet evolving consumer habits.

- Brand Differentiation: By emphasizing the unique strengths of each local brand, Ahold Delhaize seeks to create distinct customer experiences that foster loyalty and drive repeat business.

The economic landscape for Ahold Delhaize in 2024 and 2025 is characterized by persistent inflation, influencing consumer spending habits and necessitating a focus on price competitiveness. While economic growth projections remain stable, currency fluctuations, particularly between the Euro and US Dollar, continue to impact reported earnings and capital expenditure costs.

Interest rates pose a key economic factor, affecting Ahold Delhaize's borrowing costs and the feasibility of its €1 billion share buyback program initiated in 2024. The company must navigate these financial conditions to support its significant capital expenditures planned for store remodels and IT upgrades through 2025.

Ahold Delhaize's market performance is directly tied to the economic health of its operating regions, with 2023 net sales reaching €87.4 billion. The company's strategy to bolster local brands and enhance its omnichannel presence, which saw a 12.1% increase in online sales in 2023, aims to capture market share amidst varying economic conditions.

Same Document Delivered

Koninklijke Ahold Delhaize PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Koninklijke Ahold Delhaize covers all key political, economic, social, technological, legal, and environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Ahold Delhaize's market landscape, enabling informed strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed breakdown of each PESTLE element, offering a thorough understanding of the opportunities and threats facing this global retail giant.

Sociological factors

Consumers are increasingly prioritizing healthier and more sustainable food choices, a trend directly impacting Ahold Delhaize's product offerings and how it sources its goods. This shift means the company is actively curating its inventory to meet these evolving demands.

Ahold Delhaize is committed to making these better-for-you and environmentally conscious products readily available and affordable for everyone. For example, in 2023, the company reported that its own-brand healthy food sales grew by 7.4%, demonstrating a tangible response to this consumer preference and its success in supporting healthier living.

Demographic shifts, particularly aging populations and changing household compositions, significantly influence consumer behavior and product demand for Ahold Delhaize. For instance, in 2024, the proportion of individuals aged 65 and over continues to grow across its key markets, leading to increased demand for convenience, health-focused products, and accessible store formats.

Ahold Delhaize actively responds to these demographic trends by adapting its store formats, such as smaller, more neighborhood-focused stores, and expanding its online and delivery services. The company also curates product ranges to meet the evolving needs of diverse age groups and household structures, from single-person households to larger families.

Urbanization is a significant driver for Koninklijke Ahold Delhaize, as more people move to cities, their demand for convenient shopping solutions intensifies. This trend directly fuels the growth of the company's e-commerce operations and its various store formats designed to cater to busy urban lifestyles.

Ahold Delhaize is actively responding to this by expanding its online presence and click-and-collect services, making it easier for urban dwellers to access groceries and household essentials. For instance, in 2023, its online sales continued to grow, reflecting the increasing consumer preference for digital shopping channels.

Community Engagement and Social Responsibility

Consumers today have a heightened expectation for businesses to actively participate in and benefit their local communities. This societal shift means that Ahold Delhaize's commitment to social responsibility is not just a nicety, but a core business imperative.

Ahold Delhaize actively demonstrates this through various programs. For instance, in 2023, the company facilitated the donation of over 137 million kilograms of food to food banks across its operating regions, significantly impacting food security. They also invest in local events and champion initiatives focused on creating diverse and inclusive work environments, directly contributing to the well-being and social fabric of the communities they serve.

- Food Bank Donations: In 2023, Ahold Delhaize donated over 137 million kg of food, supporting food security initiatives.

- Local Event Support: The company actively sponsors and participates in community events, fostering local connections.

- Inclusive Workplaces: Initiatives are in place to promote diversity and inclusion, reflecting a commitment to social equity.

Workforce Diversity, Equity, and Inclusion

Ahold Delhaize actively promotes workforce diversity, equity, and inclusion (DEI) as a core sociological driver. This commitment impacts how the company attracts and retains talent, shaping its corporate culture. Ahold Delhaize strives to foster a workplace where every associate feels heard and valued, aligning with its broader sustainability goals.

The company's focus on DEI is not just about social responsibility; it's a strategic imperative for building a resilient and innovative workforce. By embracing diverse perspectives, Ahold Delhaize can better understand and serve its diverse customer base across its operating markets. This approach is integral to its long-term success and its aim to be a leading food retail group.

- Talent Attraction: A strong DEI reputation enhances Ahold Delhaize's appeal to a broader talent pool, including younger generations who prioritize inclusive work environments.

- Employee Retention: Creating a sense of belonging and fairness through DEI initiatives contributes to higher employee satisfaction and reduced turnover, a critical factor in the retail sector.

- Innovation and Performance: Diverse teams are often linked to increased creativity and problem-solving capabilities, potentially boosting business performance and market responsiveness.

Societal expectations for businesses to contribute positively to their communities are growing, making social responsibility a key business element for Ahold Delhaize. The company actively supports food security, with over 137 million kilograms of food donated to food banks in 2023, demonstrating a tangible commitment to social well-being.

Technological factors

The retail sector is undergoing a profound transformation driven by the swift evolution of e-commerce and digital innovations. Koninklijke Ahold Delhaize is strategically channeling significant investments into bolstering its omnichannel capabilities, encompassing robust online platforms, intuitive mobile applications, and sophisticated digital loyalty programs. This focus aims to deliver a unified and seamless experience for customers, bridging the gap between physical stores and digital touchpoints, thereby fueling sales expansion.

In 2023, Ahold Delhaize reported that its online sales reached €10.5 billion, a testament to the growing consumer preference for digital shopping channels. The company’s ongoing commitment to enhancing its digital infrastructure and customer engagement strategies is crucial for maintaining competitiveness in this dynamic market.

Koninklijke Ahold Delhaize is heavily investing in data analytics and artificial intelligence to sharpen its competitive edge. These technologies are vital for streamlining operations, tailoring customer interactions, and boosting overall efficiency across its diverse retail brands. By integrating AI and automation, the company aims to unlock significant cost savings and deepen customer loyalty.

The company is actively deploying AI and automation in key areas such as supply chain management, distribution networks, in-store processes, and administrative tasks. For instance, in 2023, Ahold Delhaize reported that its ongoing investments in technology, including AI, were a significant driver of its strategic initiatives. While specific figures for AI-driven cost savings are proprietary, the company's focus on digital transformation underscores its commitment to leveraging these advancements for tangible business improvements.

Technological advancements in supply chain management are crucial for Koninklijke Ahold Delhaize, with automation and improved logistics directly impacting efficiency and cost reduction. These innovations are pivotal in maintaining a competitive edge in the retail sector.

Ahold Delhaize consistently invests in its supply chain infrastructure. For instance, in 2023, the company continued its rollout of automated fulfillment centers, contributing to a more streamlined and responsive distribution network, aiming to handle increased online order volumes.

Digital Payments and Cybersecurity

The growing adoption of digital payment systems, such as contactless cards and mobile wallets, means companies like Ahold Delhaize must invest heavily in cybersecurity. This is crucial for safeguarding sensitive customer information and ensuring the integrity of financial transactions. As of late 2024, reports indicated a cybersecurity incident impacting Ahold Delhaize, underscoring the persistent need for advanced digital security protocols to maintain customer trust and operational continuity.

The financial implications of robust cybersecurity are significant, with global spending on cybersecurity solutions projected to reach over $200 billion in 2025. For Ahold Delhaize, this translates to ongoing expenditure on threat detection, data encryption, and secure payment gateway integration. Failure to adequately protect digital payment infrastructure can lead to substantial financial losses from data breaches, regulatory fines, and reputational damage.

- Increased reliance on digital payments: Ahold Delhaize's customers increasingly opt for convenient digital payment methods.

- Cybersecurity incident in late 2024: This event highlighted the critical need for enhanced security measures.

- Investment in digital security: Companies are allocating substantial resources to protect customer data and transaction integrity.

- Projected global cybersecurity spending: Expected to exceed $200 billion in 2025, reflecting the industry-wide focus on digital safety.

Innovation in Retail Technology

Koninklijke Ahold Delhaize is heavily investing in retail technology to enhance customer experience and operational efficiency. The company is actively exploring and adopting advanced algorithms for dynamic pricing and sophisticated inventory management systems. This focus on innovation aims to streamline operations and provide a more personalized shopping journey for its customers.

Ahold Delhaize is developing unified customer applications, integrating various services to create a seamless digital experience. To foster technological advancements, they have established tech studios and host machine learning conferences. For example, in 2023, their focus on digital transformation and data analytics was a key driver in improving customer engagement and loyalty programs, with digital sales channels showing significant growth.

- Investment in AI and Machine Learning: Ahold Delhaize is leveraging AI for personalized promotions and optimizing supply chains, contributing to a projected 5-7% increase in customer retention by end of 2024.

- Unified Customer Apps: Development of integrated apps aims to consolidate loyalty programs, online ordering, and personalized offers, with a target of 15% higher engagement rates from app users in 2025.

- Tech Studios and Innovation Hubs: Establishing these centers allows for rapid prototyping and testing of new retail technologies, including autonomous checkout solutions and advanced data analytics platforms.

Koninklijke Ahold Delhaize is significantly investing in artificial intelligence and data analytics to optimize operations and personalize customer experiences. The company's digital sales channels saw substantial growth in 2023, indicating a strong consumer shift towards online platforms. These technological advancements are crucial for maintaining a competitive edge in the evolving retail landscape.

The company is actively enhancing its omnichannel capabilities, integrating online and in-store experiences through robust digital platforms and mobile applications. Ahold Delhaize's commitment to innovation is further demonstrated by its investment in tech studios and machine learning conferences, fostering rapid development of new retail technologies.

In 2023, Ahold Delhaize's online sales reached €10.5 billion, highlighting the increasing importance of digital channels. The firm is leveraging AI for personalized promotions, with a projected 5-7% increase in customer retention by the end of 2024. Furthermore, their unified customer apps aim for 15% higher engagement rates from users in 2025.

| Technology Area | Ahold Delhaize Focus | Impact/Goal |

|---|---|---|

| AI & Data Analytics | Personalized promotions, supply chain optimization | Projected 5-7% customer retention increase (end of 2024) |

| Omnichannel Platforms | Unified customer apps, seamless digital/physical integration | Targeting 15% higher engagement from app users (2025) |

| Automation | Fulfillment centers, logistics improvements | Streamlined distribution, handling increased online orders |

Legal factors

Ahold Delhaize operates in intensely competitive retail environments, necessitating strict adherence to antitrust and competition laws. These regulations are designed to prevent monopolistic behavior and ensure a level playing field for all market participants. For instance, the company's proposed acquisition of the Romanian supermarket chain Profi, valued at approximately €1.05 billion (around $1.13 billion USD based on recent exchange rates), underwent significant regulatory review by the European Commission in 2024 to ensure it wouldn't unduly harm competition within Romania.

Consumer protection laws significantly shape Ahold Delhaize's operations, particularly concerning product quality and advertising. For instance, in 2024, the European Union continued to enforce stringent regulations like the General Data Protection Regulation (GDPR), impacting how Ahold Delhaize collects and uses customer data. Non-compliance can lead to substantial fines, as seen in various cases across the retail sector.

Transparency in marketing is paramount. Ahold Delhaize must ensure all advertising claims are accurate and substantiated to avoid misleading consumers. The company’s commitment to responsible data handling is crucial for maintaining customer trust, especially as data privacy concerns remain a high priority for consumers and regulators alike.

Koninklijke Ahold Delhaize navigates a complex web of food labeling and advertising regulations, which are becoming increasingly stringent globally. For instance, in the European Union, the Food Information to Consumers (FIC) Regulation mandates detailed nutritional information and allergen declarations on all pre-packaged foods. Failure to comply can result in significant fines and reputational damage, as seen in various enforcement actions across member states throughout 2024 and early 2025.

The company must meticulously ensure that advertising claims, such as those related to health benefits or product origin, are substantiated and do not mislead consumers. Regulatory bodies in key markets like the United States (FDA) and the Netherlands (NVWA) are actively monitoring marketing practices. Ahold Delhaize's commitment to transparency in its 2024 sustainability reports highlights its awareness of these legal requirements and the potential for legal challenges if misrepresentation occurs.

Employment and Labor Laws

Koninklijke Ahold Delhaize must navigate a complex web of employment and labor laws across its global operations, covering aspects like working hours, minimum wages, and stringent workplace safety regulations. Failure to comply can lead to significant fines and reputational damage. For instance, in 2023, the company reported €87.3 billion in net sales, employing over 380,000 associates, highlighting the scale of its labor compliance obligations.

The company's commitment extends to its supply chain, with Standards of Engagement for suppliers specifically mandating adherence to fair labor principles. This includes prohibitions against child labor and forced labor, and requirements for safe working conditions. Ahold Delhaize's 2024 sustainability report will likely detail ongoing audits and initiatives to ensure these standards are met by its partners.

Key areas of legal focus for Ahold Delhaize include:

- Wage and Hour Compliance: Adhering to diverse national and regional minimum wage laws and overtime regulations.

- Workplace Safety Standards: Implementing and enforcing safety protocols to prevent accidents and ensure employee well-being, a critical factor given the retail and logistics environments.

- Non-Discrimination and Equal Opportunity: Upholding laws against discrimination based on gender, race, age, and other protected characteristics in hiring, promotion, and compensation.

- Labor Relations: Managing relationships with unions and works councils where applicable, respecting collective bargaining rights.

Data Protection and Privacy Regulations (e.g., GDPR)

Koninklijke Ahold Delhaize navigates a complex web of data protection laws across its operating regions, with GDPR in Europe being a prime example. Compliance is critical, as evidenced by the significant fines levied against companies for data breaches. For instance, in 2023, a major retail chain faced a €1.2 million penalty for GDPR violations related to customer data handling.

Ahold Delhaize's commitment to safeguarding customer and employee data directly impacts its legal standing and financial health. Failure to adhere to these regulations can result in substantial penalties, reputational damage, and loss of customer trust. The company must continuously invest in robust data security measures and privacy frameworks to mitigate these risks.

- GDPR Fines: Companies can face penalties up to 4% of global annual revenue or €20 million, whichever is higher.

- Data Breach Costs: The average cost of a data breach in 2024 is projected to reach $4.73 million globally.

- Consumer Trust: A significant majority of consumers (over 70% in recent surveys) consider data privacy a key factor when choosing brands.

- Regulatory Scrutiny: Data protection authorities worldwide are increasing their oversight and enforcement actions.

Ahold Delhaize must navigate stringent competition laws, as demonstrated by the European Commission's review of its €1.05 billion Profi acquisition in 2024. Consumer protection laws, including GDPR, significantly impact data handling, with potential fines for non-compliance. The company also faces rigorous food labeling and advertising regulations, requiring accurate claims and detailed product information to avoid penalties.

Employment laws covering wages, safety, and non-discrimination are critical, especially given Ahold Delhaize's over 380,000 associates in 2023. Supply chain adherence to fair labor principles, including prohibitions on child labor, is also legally mandated. Data protection remains a key legal focus, with GDPR penalties potentially reaching 4% of global annual revenue, and the average data breach cost projected at $4.73 million in 2024.

| Legal Area | Key Regulations/Considerations | Impact/Risk for Ahold Delhaize | Relevant Data/Examples |

|---|---|---|---|

| Competition Law | Antitrust regulations, merger reviews | Ensuring fair market practices, potential acquisition hurdles | Profi acquisition review (2024), €1.05 billion value |

| Consumer Protection | Product safety, accurate advertising, data privacy (GDPR) | Maintaining product quality, transparent marketing, data security investment | GDPR fines up to 4% global revenue, 2024 data breach cost: $4.73 million |

| Employment Law | Minimum wage, working hours, workplace safety, non-discrimination | Compliance with diverse labor laws, managing large workforce | 380,000+ associates (2023), €87.3 billion net sales (2023) |

| Supply Chain Standards | Fair labor principles, prohibition of child/forced labor | Ensuring ethical sourcing, supplier audits | Supplier Standards of Engagement |

Environmental factors

Koninklijke Ahold Delhaize is actively tackling climate change, setting aggressive goals to cut greenhouse gas (GHG) emissions. They aim for net-zero operations by 2040 and a net-zero value chain by 2050, a significant commitment in the retail sector.

Key strategies include transitioning to renewable energy sources and managing refrigerants more sustainably, which are crucial for reducing their operational footprint. In 2023, Ahold Delhaize reported a 25% reduction in Scope 1 and 2 emissions compared to their 2018 baseline, demonstrating tangible progress.

The company also emphasizes supplier engagement to address Scope 3 emissions, which represent the majority of their carbon impact. This collaborative approach is vital for achieving their ambitious 2050 net-zero target, reflecting a growing industry trend toward supply chain decarbonization.

Koninklijke Ahold Delhaize is actively addressing food waste, a key environmental concern, with ambitious goals to reduce waste relative to food sales. For instance, in 2023, the company reported a 24% reduction in food waste intensity compared to 2016 levels, demonstrating tangible progress towards its sustainability targets.

The company's strategy involves minimizing unsaleable products through improved inventory management and operational efficiencies. Furthermore, Ahold Delhaize actively collaborates with food banks and charitable organizations, donating surplus food to combat hunger and support communities, thereby aligning environmental responsibility with social impact.

Ahold Delhaize is actively working to make its supply chain more sustainable. This includes tackling issues like deforestation and encouraging better farming methods. They're also pushing their suppliers to set goals for cutting down emissions, aiming to lower the carbon footprint of the products they sell and guide customers toward more eco-friendly choices.

Plastic Packaging and Waste Reduction

Koninklijke Ahold Delhaize is making significant strides in reducing virgin plastic within its own-brand primary packaging. This proactive approach directly addresses the growing global concern over plastic waste and the urgent need for more sustainable alternatives throughout the retail sector.

The company's commitment is reflected in its ambitious targets and ongoing initiatives. For instance, by the end of 2023, Ahold Delhaize aimed to ensure that 100% of its own-brand plastic packaging is recyclable, reusable, or compostable. This aligns with broader environmental objectives and consumer demand for eco-conscious products.

- 100% recyclable, reusable, or compostable own-brand plastic packaging by end of 2023.

- Focus on reducing virgin plastic content across all own-brand products.

- Commitment to phasing out problematic and unnecessary plastic packaging.

- Investment in innovative packaging solutions and collaborations to drive change.

Water Management and Biodiversity

While Ahold Delhaize's direct reporting on water management might be less prominent than other environmental aspects, the company implicitly addresses these concerns through its supplier expectations. These expectations mandate adherence to environmental legislation concerning biodiversity and ecosystems, which directly impacts water resources and species health. For instance, in 2023, Ahold Delhaize continued its commitment to sustainable sourcing, with a significant portion of its private label products adhering to enhanced environmental standards, indirectly supporting better water stewardship and biodiversity protection among its supply chain partners.

The company's focus on responsible sourcing extends to critical areas like deforestation and sustainable fish stock management, both of which are intrinsically linked to water quality and the health of aquatic ecosystems. By requiring suppliers to comply with regulations in these areas, Ahold Delhaize aims to mitigate negative impacts on biodiversity and water resources. This approach acknowledges that effective environmental management requires a broad perspective, encompassing the entire value chain.

Key aspects of Ahold Delhaize's approach include:

- Supplier Compliance: Ensuring suppliers meet environmental laws related to biodiversity and ecosystems.

- Deforestation Mitigation: Working to eliminate deforestation from its supply chains, protecting vital habitats and water sources.

- Sustainable Fisheries: Promoting responsible fish stock management to maintain marine biodiversity and healthy aquatic environments.

- Broader Environmental Commitments: Integrating water and biodiversity considerations within its overarching sustainability goals.

Koninklijke Ahold Delhaize is deeply invested in environmental stewardship, setting ambitious targets for emissions reduction and waste management. Their commitment to net-zero operations by 2040 and a net-zero value chain by 2050 underscores a significant shift towards sustainability in the retail sector.

The company is actively reducing its environmental footprint through renewable energy adoption and improved refrigerant management, evidenced by a 25% reduction in Scope 1 and 2 emissions by 2023 compared to 2018. Furthermore, Ahold Delhaize is tackling food waste, achieving a 24% reduction in food waste intensity by 2023 relative to 2016 levels, while also focusing on making 100% of its own-brand plastic packaging recyclable, reusable, or compostable by the end of 2023.

Their strategy extends to supply chain sustainability, addressing deforestation and promoting responsible farming practices, with a strong emphasis on supplier engagement to lower the carbon impact of products. This comprehensive approach also includes safeguarding biodiversity and water resources through stringent supplier compliance with environmental laws.

| Environmental Metric | Target/Status | Year | Progress |

|---|---|---|---|

| Net-zero operations | Achieve by | 2040 | |

| Net-zero value chain | Achieve by | 2050 | |

| Scope 1 & 2 GHG Emissions Reduction | 25% reduction vs 2018 | 2023 | On track |

| Food waste intensity reduction | 24% reduction vs 2016 | 2023 | On track |

| Own-brand plastic packaging | 100% recyclable, reusable, or compostable | End of 2023 | Targeted |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Koninklijke Ahold Delhaize is informed by a comprehensive review of official company reports, financial statements, and investor relations materials. We also integrate data from reputable market research firms and industry publications to capture current trends and competitive landscapes.