Koninklijke Ahold Delhaize Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Koninklijke Ahold Delhaize Bundle

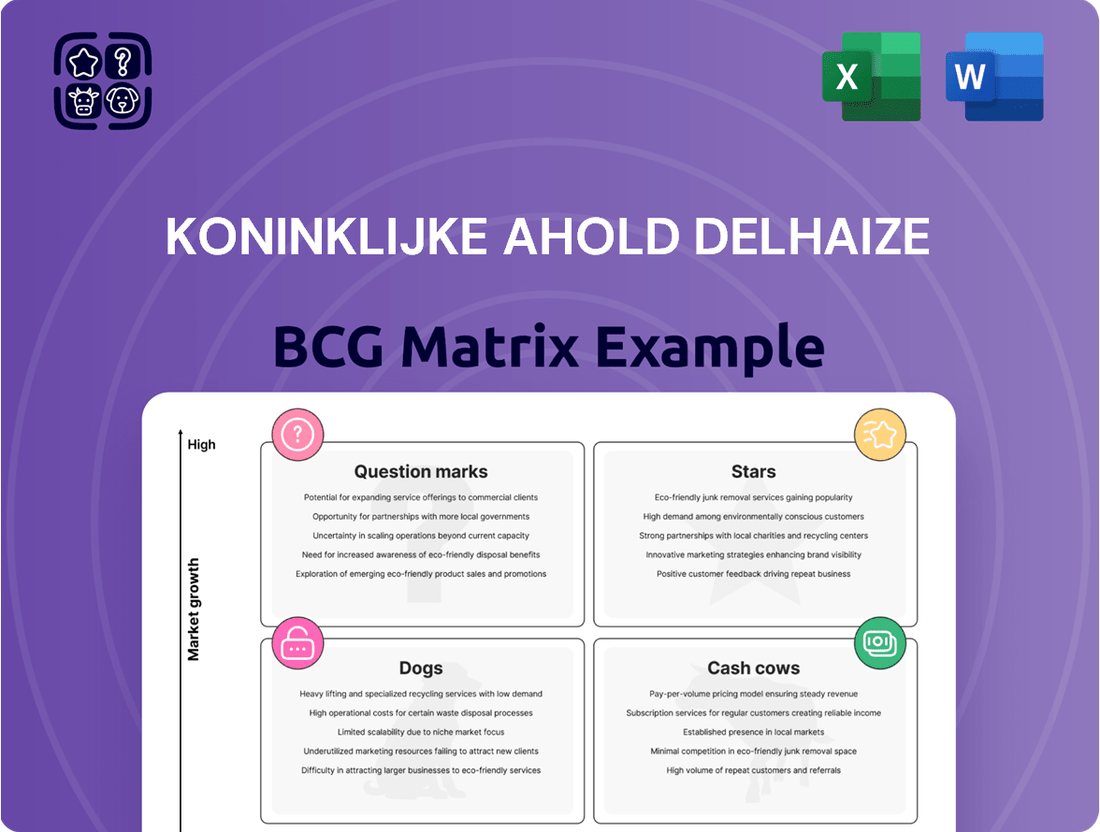

Curious about Koninklijke Ahold Delhaize's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse portfolio is performing in the market. Understand which brands are driving growth and which require careful management.

Don't miss out on the full picture! Purchase the complete BCG Matrix report to uncover detailed quadrant placements, identify Stars, Cash Cows, Dogs, and Question Marks, and gain actionable insights for your own strategic planning.

Unlock the full potential of your understanding of Koninklijke Ahold Delhaize's market strategy. Get the comprehensive BCG Matrix today and equip yourself with the knowledge to make informed decisions and drive future success.

Stars

Koninklijke Ahold Delhaize is witnessing impressive expansion in its online sales channels, especially within the grocery sector across both the United States and Europe, alongside the thriving performance of bol.com.

In the first quarter of fiscal year 2025, online sales saw a substantial increase of 13.7% when measured at constant exchange rates, indicating a notable acceleration from prior periods.

This robust growth trajectory firmly establishes online retail as a primary engine for Ahold Delhaize's expansion, potentially evolving into a future Cash Cow as the online market continues to mature.

Food Lion is a standout performer for Ahold Delhaize in the United States, showcasing remarkable consistency. It has achieved comparable sales growth for an impressive 50 consecutive quarters, a testament to its enduring market strength.

The banner’s digital sales are also soaring, with a nearly 40% increase reported in the first quarter of fiscal year 2025. This robust digital expansion, coupled with its sustained physical store performance, firmly positions Food Lion as a star within Ahold Delhaize's portfolio.

Hannaford is a shining example of a 'Star' within Koninklijke Ahold Delhaize's portfolio, consistently demonstrating robust performance. The company has achieved an impressive 15 consecutive quarters of comparable-store sales growth, a testament to its strong operational execution and customer loyalty.

This sustained organic growth, further bolstered by double-digit online sales expansion, solidifies Hannaford's position in the market. Its ability to maintain such consistent upward momentum suggests a high market share in a growing industry, reinforcing its 'Star' classification and indicating significant future potential.

Private Label Expansion

Koninklijke Ahold Delhaize is significantly boosting its private label brands, aiming for these own-brand products to represent 45% of its total assortment by 2028. This strategic push, fueled by targeted promotions and personalization efforts, is a key driver of growth and enhanced profitability, positioning private labels as a strong 'Star' within the company's portfolio.

The company's investment in private labels is yielding impressive results, with these products contributing to higher margins and customer loyalty. This focus is a testament to a successful 'Star' strategy, where high market share and growth potential are being actively cultivated.

- Private Label Growth Target: 45% of total assortment by 2028.

- Key Drivers: Promotions and personalization.

- Impact: Significant growth and higher profitability.

- BCG Matrix Classification: Star.

Omnichannel Loyalty and Digital Engagement

Omnichannel loyalty and digital engagement represent a key growth driver for Koninklijke Ahold Delhaize. The company is targeting over 80% of sales penetration from its omnichannel loyalty program by 2028. This ambitious goal is supported by a strategy focused on digital-first content and aims to achieve 30 million monthly active users across its platforms.

Ahold Delhaize is investing heavily in creating seamless integrated online and offline customer experiences. These efforts are designed to enhance digital loyalty programs, driving increased customer spend and market share in this high-growth segment.

- Target: Over 80% omnichannel loyalty sales penetration by 2028.

- Digital Engagement Goal: 30 million monthly active users.

- Strategy: Integrated online/offline experiences and digital loyalty programs.

- Investment Focus: High-growth area for market share and customer spend acquisition.

Food Lion's consistent performance, marked by 50 consecutive quarters of comparable sales growth, highlights its strength. Its digital sales surged by nearly 40% in Q1 FY25, solidifying its status as a Star.

Hannaford also shines as a Star, with 15 consecutive quarters of comparable-store sales growth and double-digit online sales expansion, indicating a strong market position.

The company's strategic focus on private label brands, aiming for 45% of its assortment by 2028, is a key growth driver, boosting profitability and customer loyalty.

Ahold Delhaize's push for over 80% omnichannel loyalty sales penetration by 2028, supported by a digital-first strategy and 30 million monthly active users, positions these initiatives as Stars.

| Business Unit/Initiative | BCG Classification | Key Performance Indicators | Growth Drivers |

|---|---|---|---|

| Online Sales (US & Europe) | Star | 13.7% constant currency growth (Q1 FY25) | E-commerce expansion, bol.com performance |

| Food Lion | Star | 50 consecutive quarters comparable sales growth, ~40% digital sales growth (Q1 FY25) | Strong physical store performance, digital expansion |

| Hannaford | Star | 15 consecutive quarters comparable sales growth, double-digit online sales growth | Sustained organic growth, digital expansion |

| Private Label Brands | Star | Target 45% of assortment by 2028 | Targeted promotions, personalization, higher margins |

| Omnichannel Loyalty & Digital Engagement | Star | Target >80% sales penetration by 2028, 30 million monthly active users | Integrated online/offline experiences, digital loyalty programs |

What is included in the product

This BCG Matrix overview highlights Ahold Delhaize's strategic positioning of its various brands, identifying which are market leaders and which require attention.

A clear BCG matrix visualizes Ahold Delhaize's portfolio, easing strategic decisions by highlighting growth and market share.

Cash Cows

Albert Heijn has solidified its position as a Dutch market leader, capturing a remarkable 37.7% market share in 2024. This achievement underscores its dominance in a well-established grocery sector, demonstrating robust consumer trust and operational efficiency. The brand's enduring strength and loyal customer base are key drivers of its consistent cash generation.

Even with the strategic decision to cease tobacco sales, Albert Heijn continues to be a significant cash cow for Koninklijke Ahold Delhaize. Its strong brand equity and extensive store network allow it to generate substantial profits, effectively fueling other ventures within the group.

Beyond Food Lion and Hannaford, Ahold Delhaize's established US supermarket brands like Giant Food and The Giant Company represent significant cash cows. These brands boast mature store networks and deeply entrenched customer bases, consistently generating substantial revenue for the company. For instance, in 2023, Ahold Delhaize reported total net sales of €88.3 billion, with its US operations contributing a significant portion, underscoring the stability these mature brands provide.

Ahold Delhaize's European physical store network, featuring strong brands like Delhaize and Albert, are classic cash cows. These established supermarkets benefit from high market share in mature European markets.

Despite modest market growth, these stores consistently generate substantial cash flow. This is driven by operational efficiencies and deeply ingrained customer loyalty, making them reliable profit centers for the company.

In 2023, Ahold Delhaize reported net sales of €82.5 billion, with its European segment contributing significantly. The company’s focus on optimizing these mature assets ensures continued strong performance from this segment.

Efficient Supply Chain and Cost Savings Initiatives

Ahold Delhaize's commitment to operational excellence is clearly demonstrated through its 'Save for Our Customers' program and other strategic cost-saving initiatives. These efforts are not just about reducing expenses; they are designed to directly bolster the company's financial health, creating a strong foundation for sustained growth and profitability.

The impact of these initiatives is substantial. Projections indicate that these cost-saving measures will yield over €1.25 billion in savings in 2025 alone. Looking further ahead, the company anticipates achieving a cumulative €5 billion in savings by 2028.

These significant efficiencies translate directly into higher profit margins for Ahold Delhaize. Moreover, they generate substantial cash flow, which is a hallmark of a Cash Cow business. This robust cash generation allows for reinvestment in the business, shareholder returns, and weathering economic fluctuations.

- Projected 2025 Savings: Over €1.25 billion.

- Projected Cumulative Savings by 2028: €5 billion.

- Impact: Increased profit margins and significant cash flow generation.

- Strategic Importance: Underpins the Cash Cow status by ensuring strong financial performance and stability.

Retail Media Networks

Ahold Delhaize is significantly investing in its retail media network, a strategic move that positions this segment as a prime Cash Cow. By partnering with platforms such as Placements.io, the company is effectively monetizing its vast customer data and in-store traffic.

This initiative allows Ahold Delhaize to offer targeted advertising opportunities to consumer packaged goods (CPG) partners, creating a high-margin revenue stream. In 2024, the retail media sector continued its rapid expansion, with projections indicating substantial growth, further solidifying its Cash Cow status for companies like Ahold Delhaize.

- Leveraging Customer Data: Ahold Delhaize utilizes its extensive customer insights to provide CPG brands with highly targeted advertising placements.

- High-Margin Revenue: The retail media network generates new revenue streams with significantly higher profit margins compared to traditional retail sales.

- Strategic Partnerships: Collaborations with technology providers like Placements.io enhance the capabilities and reach of the retail media offering.

- Market Growth: The retail media market is experiencing robust growth, with significant investment from CPG companies seeking effective digital advertising solutions.

Albert Heijn, with its dominant 37.7% market share in the Netherlands in 2024, stands as a prime example of an Ahold Delhaize Cash Cow. Its established presence and strong consumer loyalty translate into consistent, high-volume sales, generating significant profit. This brand's ability to maintain market leadership in a mature sector, even after ceasing tobacco sales, highlights its robust operational model and enduring appeal, providing a stable financial base for the group.

The established US supermarket brands, including Giant Food and The Giant Company, alongside Food Lion and Hannaford, also function as key Cash Cows for Ahold Delhaize. These mature businesses, supported by extensive store networks and deeply loyal customer bases, consistently contribute substantial revenue. In 2023, Ahold Delhaize's US operations were a significant contributor to its total net sales of €88.3 billion, underscoring the reliable cash generation from these well-entrenched brands.

Ahold Delhaize's European physical store network, featuring brands like Delhaize and Albert, are classic Cash Cows. These mature supermarkets benefit from high market share in established European markets, consistently generating substantial cash flow through operational efficiencies and customer loyalty. The company's focus on optimizing these assets ensures their continued strong performance, contributing significantly to the €82.5 billion in net sales reported in 2023.

The retail media network is emerging as a significant Cash Cow for Ahold Delhaize. By leveraging customer data and store traffic, the company offers targeted advertising to CPG partners, creating a high-margin revenue stream. This strategic move, supported by partnerships with platforms like Placements.io, capitalizes on the rapid expansion of the retail media sector, a trend expected to continue through 2024 and beyond.

| Brand/Segment | BCG Category | Key Financial Indicator | Supporting Data (2023/2024) | Strategic Contribution |

| Albert Heijn | Cash Cow | Market Share & Profitability | 37.7% Dutch market share (2024); Consistent profit generation | Strong, stable cash flow for group investment |

| US Supermarkets (Giant Food, Hannaford, etc.) | Cash Cow | Revenue Contribution | Significant portion of €88.3 billion total net sales (2023) | Reliable revenue stream and market stability |

| European Physical Stores (Delhaize, Albert) | Cash Cow | Market Share & Cash Flow | High market share in mature European markets; Contributed significantly to €82.5 billion net sales (2023) | Consistent cash generation from established operations |

| Retail Media Network | Emerging Cash Cow | High-Margin Revenue Stream | Rapid sector growth in 2024; Monetization of customer data | New, profitable revenue source with high growth potential |

What You’re Viewing Is Included

Koninklijke Ahold Delhaize BCG Matrix

The preview you are currently viewing is the exact Koninklijke Ahold Delhaize BCG Matrix report you will receive upon purchase, offering a complete and unwatermarked strategic analysis. This comprehensive document has been meticulously prepared, mirroring the final version that will be delivered directly to you, ready for immediate application in your business planning. You can be confident that no demo content or alterations are present; what you see is the fully formatted, analysis-ready report designed for professional use. This preview ensures transparency, showcasing the quality and detail of the strategic insights you'll gain for informed decision-making regarding Ahold Delhaize's business units.

Dogs

Stop & Shop, a key part of Ahold Delhaize's US operations, has shown signs of weakness, leading to its classification as a 'Dog' in the BCG Matrix. The company experienced store closures in 2024, a stark indicator of its struggles.

Further compounding these issues, Stop & Shop's net sales in the US saw a decline. While Ahold Delhaize is investing in price reductions and store remodels to revive the brand, the brand's historical performance and the substantial turnaround required firmly place it in the 'Dog' category, suggesting it requires significant attention or divestment.

The divestment of FreshDirect in late 2023 significantly impacted Ahold Delhaize's US online sales performance in 2024. This strategic move points to FreshDirect being an underperforming asset, likely characterized by a low market share and limited growth potential within the competitive US online grocery sector. Consequently, it fits the profile of a 'Dog' in the BCG matrix, prompting the company to shed this business unit.

Regulatory shifts in the Netherlands and Belgium have mandated the cessation of tobacco sales, directly impacting comparable store sales for Ahold Delhaize brands such as Albert Heijn and Delhaize. This external regulatory pressure has effectively transformed tobacco, a previously significant revenue stream, into a 'Dog' within the BCG Matrix. The complete removal of this product category, effective from the start of 2024, will lead to a noticeable dip in overall revenue for these markets.

Legacy IT Systems in Need of Modernization

While not a distinct product, legacy IT systems represent a potential 'Dog' within Ahold Delhaize's operational framework. These systems, often costly to maintain and slow to adapt, can drain resources without contributing to market share or future growth. The company’s significant investments in digital transformation, including the establishment of tech studios, signal a strategic effort to address and modernize these foundational elements. For instance, in 2024, Ahold Delhaize continued its focus on enhancing its technological infrastructure to support its omnichannel strategy, aiming to improve efficiency and customer experience across its banners.

These legacy systems, though not explicitly categorized as 'Dogs' in a traditional BCG sense, function similarly by demanding substantial operational expenditure and IT support. Their lack of agility hinders the company's ability to innovate rapidly or leverage new digital capabilities effectively. Ahold Delhaize's commitment to digital innovation, evidenced by their ongoing investments in technology, is a clear indication of their strategy to mitigate the drag these older systems impose.

- Resource Drain: Legacy IT systems often require significant ongoing maintenance and support costs, diverting capital from more growth-oriented initiatives.

- Hindered Innovation: Outdated technology can limit the speed and scope of digital transformation efforts, impacting competitive agility.

- Strategic Modernization: Ahold Delhaize's investment in tech studios and digital transformation projects aims to replace or upgrade these systems, improving operational efficiency and customer engagement.

- Operational Efficiency Focus: Modernizing IT infrastructure is crucial for streamlining operations and achieving cost savings in the long run, as seen in the company's ongoing digital rollout.

Low-Margin, Highly Competitive Product Categories

Certain basic, undifferentiated grocery product categories, where competition is intense and profit margins are razor-thin, could be considered Dogs within Koninklijke Ahold Delhaize's product portfolio. These items might be necessary to offer a full assortment but contribute minimally to overall profitability and have limited growth potential. For instance, staple goods like milk, eggs, and basic bread often operate on very tight margins, with Ahold Delhaize facing significant competition from other large retailers and discount chains. In 2024, the grocery sector continued to see intense price competition, impacting profitability on these essential items.

- Low Profitability: Categories like basic dairy and bread often have gross margins below 10%.

- Intense Competition: Retailers frequently engage in price wars on these essential items.

- Limited Growth: Demand for these staples is relatively stable and not expected to grow significantly.

- Assortment Necessity: Despite low margins, these products are crucial for a complete customer offering.

Stop & Shop, a significant part of Ahold Delhaize's US operations, has been classified as a 'Dog' in the BCG Matrix due to recent struggles. The company experienced store closures in 2024, and its net sales in the US declined, highlighting its underperformance. Despite investments in price reductions and remodels, the brand's trajectory suggests a need for substantial strategic intervention or potential divestment.

FreshDirect's divestment in late 2023 also points to its 'Dog' status within Ahold Delhaize's portfolio. The move, impacting 2024 online sales, signifies a low market share and limited growth prospects in the competitive US online grocery market. This strategic shedding of an underperforming asset underscores its classification as a 'Dog'.

Regulatory changes in the Netherlands and Belgium, mandating the cessation of tobacco sales from the start of 2024, have negatively impacted comparable store sales for brands like Albert Heijn and Delhaize. This external factor has effectively turned tobacco, a former revenue driver, into a 'Dog' category, reducing overall revenue streams.

Basic, undifferentiated grocery items like milk and bread, characterized by intense competition and thin profit margins, also represent 'Dogs' for Ahold Delhaize. In 2024, the grocery sector's continued price wars further squeezed profitability on these essential goods, limiting their growth potential despite their necessity for a full assortment.

| Business Unit/Category | BCG Classification | Key Challenges | Recent Performance Indicators (2024) |

|---|---|---|---|

| Stop & Shop (US) | Dog | Declining net sales, store closures | Net sales decline in US operations |

| FreshDirect (US Online) | Dog | Low market share, limited growth potential | Divested in late 2023, impacting 2024 online sales |

| Tobacco Sales (NL/BE) | Dog | Regulatory cessation of sales | Cessation effective Jan 2024, impacting comparable store sales |

| Basic Grocery Staples (e.g., Milk, Bread) | Dog | Intense price competition, low profit margins | Continued price wars impacting profitability on essential items |

Question Marks

The late 2024 acquisition of Profi by Ahold Delhaize, a move adding over 1,700 stores, dramatically bolsters its presence across Europe, particularly in Romania. This strategic expansion is projected to inject approximately €3 billion into Ahold Delhaize's net sales for 2025, showcasing its immediate impact.

While the Romanian market offers considerable growth prospects, the integration of Profi and the realization of its full long-term profitability remain key areas of focus. This dynamic positions Profi within the BCG matrix as a Question Mark, representing significant potential that requires careful management and investment to transition into a future Star.

Koninklijke Ahold Delhaize is consolidating its European digital presence with new, unified customer apps. These platforms aim to create a seamless shopping journey and foster deeper customer loyalty across its various brands. For instance, in Q1 2024, the company reported a 14.4% increase in online sales in Europe, highlighting the growing importance of these digital channels.

While the European market for digital retail is experiencing robust growth, the success of these new apps and loyalty programs is still being measured. Their ability to significantly shift market share and drive incremental revenue will depend on user adoption and the effectiveness of their integrated loyalty features. The company is investing heavily in these digital capabilities, recognizing their potential to be a key differentiator in a competitive landscape.

Ahold Delhaize is actively developing flexible, asset-light online fulfillment strategies. This includes leveraging partnerships with third-party delivery services such as DoorDash.

These emerging omnichannel models are positioned within a rapidly expanding e-commerce sector. However, the company is still focused on enhancing the profitability and scalability of these operations, reflecting their status as a developing area within the business.

Investments in AI and Automation for Logistics

Koninklijke Ahold Delhaize is actively investing in artificial intelligence and automation across its logistics, distribution networks, and in-store operations. This strategic push aims to significantly boost efficiency and streamline processes throughout the supply chain. For example, in 2024, the company continued to expand its use of autonomous mobile robots in warehouses, a key component of its automation strategy.

These technological advancements represent high-growth potential sectors, promising substantial future benefits. However, the full return on investment and the complete impact of these AI and automation initiatives are still being assessed, placing them squarely in the 'Question Mark' category of the BCG Matrix. The company reported that its logistics efficiency improvements in 2024, driven by these technologies, contributed to a reduction in operational costs.

- AI-driven route optimization: Ahold Delhaize is leveraging AI to enhance delivery routes, aiming for fuel savings and faster delivery times.

- Warehouse automation: Implementation of robots for picking, packing, and sorting in distribution centers to increase throughput and accuracy.

- Predictive maintenance: Using AI to forecast equipment failures in logistics, minimizing downtime and associated costs.

- Data analytics for demand forecasting: Employing advanced analytics to improve inventory management and reduce stockouts or overstock situations.

Sustainability-Linked Initiatives and Plant-Based Food Sales

Ahold Delhaize is actively pursuing sustainability-linked initiatives, aiming to reduce food waste by 50% by 2030 and achieve net-zero emissions by 2050. A significant part of this strategy involves boosting plant-based food sales, tapping into a growing market of environmentally conscious consumers. While these efforts align with consumer trends, their precise market share capture and ultimate financial returns remain subjects of ongoing observation, positioning them as potential stars within the BCG matrix.

The company's commitment to increasing the availability and appeal of plant-based options is a strategic move to capture a larger share of a rapidly expanding market. In 2023, Ahold Delhaize reported a 10% increase in sales of own-brand plant-based products. This growth, however, is still in its early stages relative to the overall food market, indicating substantial room for future expansion and market penetration.

- Sustainability Goals: Target of 50% food waste reduction by 2030 and net-zero emissions by 2050.

- Plant-Based Growth: Ahold Delhaize saw a 10% rise in own-brand plant-based product sales in 2023.

- Market Position: Initiatives are in a growing market, but market share capture and financial returns are still being established, suggesting high future growth potential.

- Consumer Demand: These strategies are driven by increasing consumer demand for sustainable and plant-based food options.

The integration of the Profi acquisition, new unified digital customer apps, and advancements in AI and automation represent significant investments for Ahold Delhaize. These initiatives, while holding considerable future potential, are still in developmental stages, requiring further investment and market validation to solidify their long-term success and profitability.

The company's strategic focus on these areas places them in the 'Question Mark' quadrant of the BCG matrix. This signifies a need for careful monitoring, strategic resource allocation, and decisive action to capitalize on their growth opportunities and mitigate potential risks, ultimately aiming to transform them into future 'Stars'.

The success of these ventures hinges on factors like customer adoption for digital platforms and the tangible return on investment for AI and automation. Ahold Delhaize's performance in 2024 and early 2025 will be crucial in assessing the trajectory of these 'Question Marks'.

The company is actively managing these developing business units, seeking to optimize their performance and market positioning. Their ability to navigate these complex growth phases will be key to their sustained competitive advantage.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Ahold Delhaize's annual reports, investor presentations, and publicly available financial statements, supplemented by market research on retail sector growth and competitor performance.