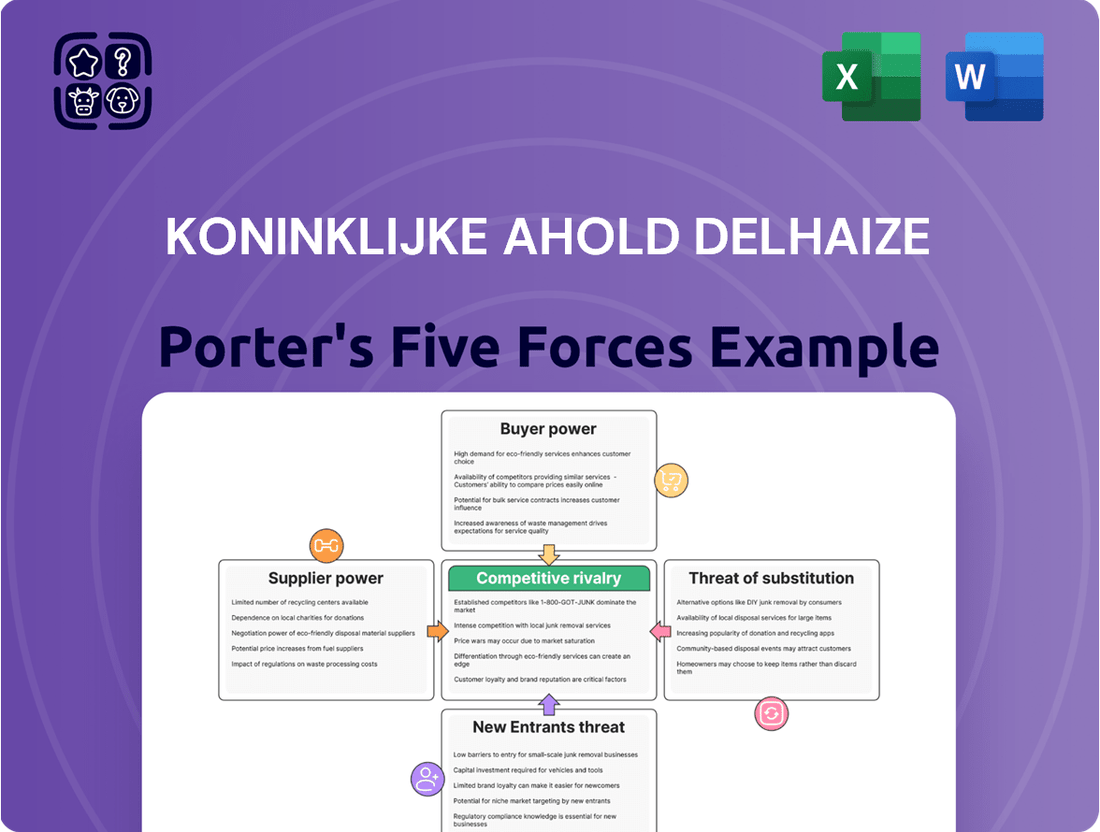

Koninklijke Ahold Delhaize Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Koninklijke Ahold Delhaize Bundle

Koninklijke Ahold Delhaize faces intense competition, with significant buyer power from consumers and a moderate threat from new entrants in the grocery sector. Understanding the nuances of supplier bargaining power and the potential impact of substitute products is crucial for strategic advantage.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Koninklijke Ahold Delhaize’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Koninklijke Ahold Delhaize's bargaining power with suppliers is influenced by supplier concentration. While Ahold Delhaize's vast procurement network generally dilutes individual supplier leverage, specific branded or specialized goods can see higher supplier concentration. This means a few key suppliers might hold more sway over pricing and terms for those particular product categories.

For many standard grocery items, the uniqueness is low, meaning suppliers have less sway. However, when Ahold Delhaize features proprietary own-brand products or sources unique fresh produce, the suppliers behind these items can command more bargaining power. This is particularly true if these items involve specialized production processes or unique sourcing relationships.

Ahold Delhaize actively works to manage this by increasing its own-brand portfolio. In 2023, own brands represented a significant portion of sales, with the company aiming for continued growth in this area. This strategy directly counters the bargaining power of national brand suppliers by offering consumers comparable alternatives that Ahold Delhaize controls more closely.

Switching costs for Ahold Delhaize can be substantial, particularly when a supplier change necessitates extensive adjustments to its intricate supply chains, the integration of new IT infrastructure, or the renegotiation of intricate, long-term agreements. These operational hurdles can deter quick supplier changes.

However, for many commodity products, the barriers to switching suppliers are considerably lower. This allows Ahold Delhaize to maintain flexibility, readily shifting between providers to secure favorable terms and ensure consistent supply without incurring significant disruption.

The company's strategic 'Save for Our Customers' initiative directly addresses cost optimization, a key component of which involves meticulously evaluating and improving its sourcing strategies. In 2023, Ahold Delhaize reported net sales of €82.4 billion, highlighting the scale at which supplier relationships and cost management impact overall financial performance.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into retail operations for a company like Ahold Delhaize is generally considered low. This is primarily because establishing and managing a retail grocery chain demands substantial capital investment, complex logistics, extensive infrastructure, and specialized retail expertise, which most food product suppliers lack.

While theoretically, very large agricultural cooperatives or dominant food manufacturers might possess the resources to consider such a move, it is an uncommon strategy within the broad grocery sector. For instance, in 2024, the average capital expenditure for opening a new supermarket can range from $2 million to $10 million, a significant barrier for most suppliers.

- Low Forward Integration Threat: Suppliers typically lack the capital and expertise to enter the complex retail grocery market.

- High Entry Barriers: Significant investment in infrastructure, logistics, and brand building deters supplier forward integration.

- Limited Examples: Few food producers have successfully integrated forward into large-scale grocery retail, especially in established markets like Europe or the US.

Importance of Ahold Delhaize to Suppliers

Ahold Delhaize holds significant sway with many of its suppliers, especially smaller and regional businesses. For these entities, Ahold Delhaize often represents a substantial portion of their revenue, thereby limiting their own ability to negotiate favorable terms. For instance, in 2023, the company's commitment to local sourcing meant that a considerable percentage of its product assortment came from local and regional suppliers, making them more reliant on Ahold Delhaize's business.

For larger, multinational suppliers, Ahold Delhaize is an important client, but typically not their sole or even primary customer. This means these larger suppliers have more diversified revenue streams and, consequently, greater bargaining power. However, Ahold Delhaize's strategic focus on building strong, long-term relationships with its suppliers, including those that are larger, helps to mitigate potential power imbalances.

- Ahold Delhaize's significant customer base for many suppliers, particularly smaller ones, curtails their negotiation leverage.

- For major global suppliers, Ahold Delhaize is a key, but not dominant, market presence.

- The company's strategic emphasis on fostering robust supplier relationships, including local sourcing initiatives, influences supplier dynamics.

- In 2023, Ahold Delhaize continued to emphasize its partnerships with local producers, solidifying its position as a crucial buyer for these businesses.

Koninklijke Ahold Delhaize's bargaining power with suppliers is influenced by supplier concentration and the uniqueness of products. While Ahold Delhaize's scale generally dilutes individual supplier leverage, specialized or proprietary items can empower certain suppliers. The company's strategy of expanding its own brands, which represented a significant portion of sales in 2023, directly counters the power of national brand suppliers by offering controlled alternatives.

Switching costs for Ahold Delhaize can be high for complex supply chains, but are low for commodity products, offering flexibility. The company's focus on cost optimization, as seen in its 'Save for Our Customers' initiative, involves rigorous sourcing strategy evaluation. With net sales of €82.4 billion in 2023, efficient supplier management is crucial for financial performance.

The threat of suppliers integrating forward into retail is low due to the substantial capital, infrastructure, and expertise required. Opening a new supermarket in 2024 can cost between $2 million and $10 million, a significant barrier for most food producers.

Ahold Delhaize holds considerable sway over smaller and regional suppliers, for whom it represents a substantial revenue source. In contrast, larger multinational suppliers have more diversified revenue streams, granting them greater bargaining power. However, Ahold Delhaize's focus on strong, long-term supplier relationships helps to balance these dynamics.

| Factor | Ahold Delhaize's Position | Impact on Bargaining Power |

|---|---|---|

| Supplier Concentration | Generally low due to scale, but higher for specialized/proprietary items. | Moderate to High for specific product categories. |

| Switching Costs | High for complex logistics/IT; Low for commodities. | Low for commodities, allowing flexibility; High for specialized items, limiting flexibility. |

| Forward Integration Threat | Low due to high capital and expertise requirements. | Low, as suppliers typically lack the resources to enter retail. |

| Supplier Dependence | High for smaller/regional suppliers; Moderate for large suppliers. | Low for smaller suppliers; Moderate for larger suppliers. |

What is included in the product

Explores market dynamics that deter new entrants and protect incumbents like Koninklijke Ahold Delhaize, while also assessing the bargaining power of suppliers and buyers.

Quickly identify and mitigate competitive threats by visualizing Ahold Delhaize's Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Customers in the food retail sector, including those shopping at Ahold Delhaize banners, exhibit significant price sensitivity. This is particularly true in 2024, with ongoing macroeconomic volatility and persistent increases in household expenses impacting purchasing decisions. Consumers are actively seeking value and are more likely to switch retailers or brands based on price differentials.

Ahold Delhaize is acutely aware of this price sensitivity and has made strategic price investments to remain competitive. For example, in 2023, the company highlighted its focus on affordability, which continued into 2024, aiming to mitigate the impact of inflation on its customer base. This strategy is crucial for retaining market share and attracting price-conscious shoppers.

The expansion of own-brand assortments is another key tactic Ahold Delhaize employs to address customer price sensitivity. These private label products typically offer a lower price point compared to national brands, providing customers with more affordable options. This not only caters to budget-conscious consumers but also enhances the retailer's overall value proposition and profitability.

Customers for Koninklijke Ahold Delhaize face a landscape brimming with choices, significantly amplifying their bargaining power. They can readily switch to competing supermarkets, the growing number of discount grocers, or the convenience of online grocery platforms. Specialized food outlets also cater to specific consumer needs, further fragmenting the market.

This abundance of alternatives means customers are not tied to a single retailer and can easily compare prices, quality, and promotions. For instance, in 2024, the European grocery market continued to see intense competition, with discounters like Aldi and Lidl gaining market share, putting pressure on traditional supermarkets. Ahold Delhaize's extensive store network and its investment in its omnichannel strategy, including its online presence and delivery services, are designed to retain customers by offering a compelling value proposition across different shopping preferences.

Customers today wield significant power due to unprecedented access to information. Digital platforms, price comparison tools, and online reviews empower shoppers to readily compare pricing, evaluate product quality, and discover promotions across various retailers. This transparency directly impacts Ahold Delhaize's ability to set prices and differentiate its offerings.

In response, Koninklijke Ahold Delhaize is actively enhancing its digital engagement strategies. By investing in robust loyalty programs and developing personalized offers, the company aims to foster deeper customer relationships and cultivate brand loyalty, thereby mitigating some of the inherent bargaining power customers possess through readily available information.

Switching Costs for Customers

Switching costs for customers in the grocery retail industry are generally quite low. Shoppers can readily move between physical stores or online grocery platforms without significant financial or effort-based barriers. This low switching cost directly amplifies customer bargaining power, as they have ample choice and can easily shift their spending to competitors offering better prices or experiences.

Koninklijke Ahold Delhaize actively works to mitigate this by fostering customer loyalty. Initiatives like their loyalty programs, which offer personalized discounts and rewards, aim to create a stickier customer base. For instance, in 2023, Ahold Delhaize's loyalty programs across its banners, such as Albert Heijn’s Bonus Card in the Netherlands and Stop & Shop’s rewards in the US, contributed to a significant portion of their sales, underscoring the importance of these programs in retaining customers.

- Low Switching Costs: Customers can easily switch between grocery retailers due to minimal financial or effort barriers.

- Enhanced Bargaining Power: This ease of switching gives customers significant leverage over retailers.

- Ahold Delhaize's Retention Strategy: The company focuses on loyalty programs and creating engaging shopping experiences to keep customers.

- Loyalty Program Impact: In 2023, loyalty programs played a crucial role in Ahold Delhaize's sales, demonstrating their effectiveness in customer retention.

Customer Concentration

Koninklijke Ahold Delhaize benefits from a highly fragmented customer base, serving millions of individual shoppers across its various banners. This widespread customer distribution significantly dilutes the bargaining power of any single customer or small group of customers. For instance, in 2023, Ahold Delhaize reported serving over 50 million households weekly across its operations, underscoring the vastness and dispersion of its customer reach.

The sheer volume of individual customers means that the company is not overly reliant on any particular segment or large buyer. This fragmentation is a key factor in limiting the ability of customers to demand lower prices or more favorable terms. While individual customers have limited power, their collective purchasing decisions, influenced by factors like economic conditions and competitor promotions, can still exert pressure.

- Fragmented Customer Base: Ahold Delhaize's millions of individual customers prevent any single entity from wielding significant power.

- Low Customer Concentration: The company's broad reach across diverse demographics and geographies minimizes dependence on any specific customer group.

- Collective Influence: While individual power is low, widespread consumer trends and economic shifts can collectively impact demand and pricing.

- 2023 Metrics: Serving over 50 million households weekly demonstrates the scale of customer dispersion, limiting individual bargaining leverage.

Customers hold considerable bargaining power in the grocery sector due to a wide array of choices, including competing supermarkets, discounters, and online platforms. This ease of switching, with generally low switching costs, allows consumers to readily compare prices and promotions, forcing retailers like Ahold Delhaize to remain competitive. In 2024, the intense competition, particularly from discounters, continues to pressure pricing strategies.

Ahold Delhaize counters this by focusing on customer loyalty through programs and investments in its omnichannel presence to retain shoppers. The company's extensive own-brand offerings also provide more affordable options, directly addressing customer price sensitivity. For example, in 2023, loyalty programs were a significant contributor to sales across its banners, highlighting their effectiveness in mitigating customer bargaining power.

The sheer volume of Ahold Delhaize's individual customers, serving millions of households weekly, dilutes the power of any single shopper. This broad customer base limits the ability of any one customer to negotiate terms. However, collective consumer behavior, influenced by economic factors and competitor actions, can still exert market pressure.

| Factor | Impact on Ahold Delhaize | Mitigation Strategies |

| Price Sensitivity | High, especially in 2024 due to economic volatility. | Strategic price investments, expanded own-brand assortments. |

| Availability of Alternatives | Significant, with numerous competitors and online options. | Omnichannel strategy, loyalty programs, store network. |

| Low Switching Costs | Customers can easily move between retailers. | Loyalty programs, personalized offers, enhanced shopping experience. |

| Fragmented Customer Base | Dilutes individual customer power. | Focus on broad customer reach, not reliant on specific segments. |

Full Version Awaits

Koninklijke Ahold Delhaize Porter's Five Forces Analysis

This preview showcases the complete Koninklijke Ahold Delhaize Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the retail sector. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing information. You can confidently proceed with the understanding that this professionally crafted analysis is ready for your immediate use and review.

Rivalry Among Competitors

The food retail sector is intensely competitive, featuring a wide array of businesses from global giants to neighborhood shops and digital disruptors. This diversity encompasses discount grocers, conventional supermarkets, and niche or specialty stores, all vying for market share.

In 2024, Ahold Delhaize faces this crowded landscape, where players like Walmart, Amazon (through Whole Foods and Amazon Fresh), and Kroger are significant competitors in the United States, while in Europe, rivals such as Schwarz Group (Lidl, Kaufland) and Aldi are major forces. The sheer number and varied business models of these competitors intensify rivalry, pressuring margins and demanding constant innovation in pricing, product assortment, and customer experience.

While the broader food retail sector is largely mature, Koninklijke Ahold Delhaize actively pursues growth through both internal development and strategic acquisitions. Its 'Growing Together' strategy is specifically designed to achieve growth rates exceeding those of the conventional grocery market.

For the full year 2024, Ahold Delhaize reported a 1.2% increase in comparable sales, excluding gasoline sales, demonstrating its ability to gain traction in a competitive landscape.

Product differentiation in the grocery sector, a market often characterized by similar core offerings, presents a significant hurdle. Ahold Delhaize tackles this by cultivating a diverse stable of robust local brands, each with its own loyal customer base and unique market positioning.

The company actively expands its private label range, offering consumers distinctive choices that often provide better value and a perceived higher quality compared to national brands. This strategy directly addresses the commodity nature of many grocery items by creating unique product identities.

Ahold Delhaize's commitment to promoting healthier product options, including a growing selection of organic and free-from items, further carves out a differentiated niche. This focus appeals to an increasingly health-conscious consumer base, setting them apart from competitors.

By investing in and enhancing its omnichannel capabilities, Ahold Delhaize provides a seamless and convenient shopping experience across both physical stores and online platforms. This integrated approach, coupled with personalized services, creates a differentiated customer journey that fosters loyalty.

Exit Barriers

High exit barriers in food retail, such as substantial investments in physical stores and distribution networks, make it difficult for companies like Ahold Delhaize to divest underperforming assets. These fixed costs, coupled with long-term lease agreements and the need to manage a large workforce, create significant financial and operational hurdles when considering market exits.

Ahold Delhaize's strategic decisions in 2024, including the closure of several underperforming Stop & Shop locations, highlight these challenges. The process of exiting these specific markets involved not only the physical closure of stores but also managing lease terminations and employee transitions, demonstrating the complexity and cost associated with such moves.

The ongoing restructuring efforts within the grocery sector underscore the persistence of these exit barriers. For instance, the retail industry in the US, where Stop & Shop operates, continues to grapple with optimizing store footprints and managing the costs associated with closing less profitable units, a trend that is expected to persist through 2025.

These factors contribute to a situation where companies may delay or absorb losses from struggling divisions rather than undertaking costly and complex exits. The capital tied up in real estate and infrastructure means that exiting a market is rarely a simple or quick decision for major food retailers.

Strategic Commitments of Competitors

Competitors in the food retail sector are aggressively investing in key strategic areas to gain an edge. This includes substantial commitments to expanding e-commerce operations, undertaking significant price investments to attract and retain customers, and prioritizing sustainability initiatives which are increasingly important to consumers.

Ahold Delhaize is actively responding to this competitive landscape with its 'Growing Together' strategy. This plan involves considerable investments aimed at bolstering its omnichannel capabilities, driving digital transformation across its brands, and implementing cost-saving measures to enhance its overall competitiveness and market position.

- E-commerce Investments: Competitors are pouring billions into online platforms and delivery infrastructure. For instance, many major European retailers have reported double-digit growth in their online sales in 2023 and early 2024.

- Price Competitiveness: Retailers are engaging in price wars, with many announcing significant price freezes or reductions on essential items. This is a direct response to inflationary pressures and consumer sensitivity to price.

- Sustainability Focus: Commitments to reducing food waste, improving packaging, and sourcing ethically are becoming standard. Many companies have set ambitious targets for carbon neutrality by 2030.

- Ahold Delhaize's 'Growing Together' Strategy: This strategy includes €1 billion in investments for omnichannel and sustainability initiatives, alongside €2 billion in cost savings, aiming to fuel profitable growth and customer loyalty through 2025.

Competitive rivalry is fierce in the food retail sector, with Ahold Delhaize facing global giants and local players. The company's comparable sales growth of 1.2% in 2024, excluding gasoline, shows its efforts to navigate this intense environment. Key competitors like Walmart and Schwarz Group (Lidl, Kaufland) are making significant investments in e-commerce and price competitiveness, forcing Ahold Delhaize to do the same through its 'Growing Together' strategy.

| Competitor Action | Ahold Delhaize Response | Impact on Rivalry |

|---|---|---|

| Aggressive e-commerce expansion by rivals | €1 billion investment in omnichannel capabilities | Intensifies online competition, necessitates seamless customer experience |

| Price wars and promotions on essential items | Focus on cost savings and private label expansion | Pressures margins, requires efficient operations and value proposition |

| Growing consumer demand for sustainability | Commitment to sustainability initiatives in 'Growing Together' strategy | Differentiates brands, requires investment in ethical sourcing and waste reduction |

SSubstitutes Threaten

The threat of substitutes for Koninklijke Ahold Delhaize is considerable, driven by a growing array of alternative shopping channels. Consumers increasingly have access to options like farmers' markets, niche specialty food stores, direct-to-consumer meal kit services, and local produce subscription boxes. These alternatives directly address specific consumer desires for enhanced freshness, locally sourced products, or unique convenience factors, diverting potential sales from traditional grocery formats.

The threat of substitutes for Ahold Delhaize is amplified when alternatives provide a superior price-performance trade-off. For instance, if meal kit delivery services or even the growing trend of home gardening offer greater convenience or cost efficiencies compared to traditional grocery shopping, they become more compelling substitutes. Ahold Delhaize's strategic emphasis on its value-oriented own brands and ongoing price investments is a direct response to mitigate this threat by ensuring competitive pricing for its core offerings.

Customer willingness to switch from traditional grocery offerings is shaped by convenience, health trends, and the appeal of novel products. For instance, Ahold Delhaize's Albert Heijn in the Netherlands saw a significant uptick in demand for healthier and plant-based options, reflecting this evolving consumer preference.

The growing popularity of plant-based diets and a surge in home gardening activities highlight a clear shift. Many consumers are now more open to exploring alternatives to conventional grocery items, directly impacting the threat of substitutes for established retailers like Ahold Delhaize.

In 2024, the market for plant-based foods continued its robust expansion, with global sales projected to reach hundreds of billions of dollars. This trend means consumers have more readily available and often competitively priced substitutes for many traditional meat and dairy products sold in supermarkets.

Changing Consumer Preferences

Evolving consumer preferences are a significant factor in the threat of substitutes for Ahold Delhaize. Customers increasingly seek healthier, more sustainable, and convenient food options, which can lead them to explore alternatives beyond traditional grocery stores. For instance, a growing number of consumers are turning to meal kit delivery services or specialized online grocers that cater to specific dietary needs or offer a more curated selection. This shift directly impacts the demand for the broad range of products typically found in a large supermarket.

Ahold Delhaize is actively addressing these changing tastes by strategically incorporating healthier food offerings and robust omnichannel solutions into its business model. The company has been expanding its private label healthy food ranges and investing in its online platform and delivery capabilities to meet the demand for convenience. In 2023, Ahold Delhaize reported that its own brands, many of which focus on healthier options, continued to perform well, contributing to overall sales growth.

- Growing demand for plant-based alternatives: Retailers offering a wider variety of plant-based products see increased customer traffic, drawing shoppers away from traditional meat and dairy sections.

- Rise of specialty online grocers: Services focusing on organic, local, or ethnic foods provide a direct substitute for consumers seeking niche products not always readily available in mainstream supermarkets.

- Convenience of meal kit services: Companies like HelloFresh and Blue Apron offer pre-portioned ingredients and recipes, directly competing with the need to shop for and prepare meals from scratch.

- Focus on sustainability: Consumers are increasingly influenced by a brand's environmental impact, making ethically sourced or low-waste options from substitute providers more attractive.

Technological Advancements in Food Preparation and Delivery

Technological advancements are significantly altering how consumers access food, presenting a potent threat of substitution for traditional grocery retailers like Ahold Delhaize. Innovations such as sophisticated meal kit delivery services, the rise of ghost kitchens preparing food for delivery only, and enhanced food preservation methods offer convenient alternatives that bypass the need for in-store grocery shopping. These evolving consumption patterns directly challenge the established grocery model by providing ready-to-eat or easily prepared meals with a focus on convenience and speed.

In 2024, the online grocery market continues its robust expansion, with services like meal kits seeing sustained growth. For instance, the global meal kit delivery service market was projected to reach over $20 billion by 2025, indicating a significant shift in consumer preferences towards convenient, pre-portioned meal solutions. This trend directly competes with traditional grocery sales, as consumers opt for these services to save time on meal planning and preparation.

Ahold Delhaize is actively responding to this threat by bolstering its own digital capabilities and e-commerce investments. The company's focus on enhancing its online platforms and delivery infrastructure aims to capture a share of this growing market and retain customer loyalty.

- Meal Kit Growth: The meal kit delivery market is a direct substitute, offering convenience that bypasses traditional grocery shopping.

- Ghost Kitchens: These delivery-only kitchens further fragment the food market, providing another alternative to grocery stores.

- Digital Investment: Ahold Delhaize's commitment to e-commerce is crucial for competing with these technologically driven substitutes.

- Consumer Behavior Shift: The increasing demand for convenience is a key driver behind the threat of substitutes in the food retail sector.

The threat of substitutes for Ahold Delhaize is significant, fueled by evolving consumer preferences for convenience, health, and unique offerings. Alternatives like meal kit services, specialty online grocers, and even home gardening directly challenge traditional grocery shopping. For example, the global meal kit delivery service market was projected to exceed $20 billion by 2025, showcasing a substantial shift towards these convenient substitutes.

These substitutes often provide a superior price-performance trade-off, especially when factoring in time savings. Ahold Delhaize's strategy to counter this involves strengthening its own brands, particularly healthier options, and enhancing its omnichannel capabilities. In 2023, the company noted strong performance from its own brands, indicating a successful response to the demand for value and quality.

The growing popularity of plant-based diets and a focus on sustainability further amplify the threat. Consumers are increasingly seeking ethically sourced or low-waste options, which can be found through specialized providers. The plant-based food market's continued expansion in 2024, with global sales reaching hundreds of billions, highlights the availability of compelling alternatives to traditional grocery products.

Technological advancements also play a crucial role, with ghost kitchens and enhanced food preservation methods offering new ways for consumers to bypass traditional grocery stores. Ahold Delhaize's investment in its digital platforms and e-commerce infrastructure is vital to remaining competitive in this dynamic landscape.

| Substitute Category | Key Characteristics | Impact on Ahold Delhaize | Examples | 2024 Market Trend |

| Meal Kit Services | Convenience, pre-portioned ingredients, reduced food waste | Direct competition for meal solutions, reduces need for grocery shopping | HelloFresh, Blue Apron | Sustained growth, exceeding $20 billion global market projection |

| Specialty Online Grocers | Niche products (organic, local, ethnic), curated selection | Appeals to specific consumer needs not always met by broad-range supermarkets | Thrive Market, Farmdrop | Continued expansion, catering to health-conscious and ethically-minded consumers |

| Plant-Based Alternatives | Health benefits, sustainability, ethical considerations | Reduces demand for traditional meat and dairy products | Beyond Meat, Impossible Foods, Oatly | Robust expansion, hundreds of billions in global sales |

| Direct-to-Consumer (DTC) & Local Sourcing | Farm-fresh produce, unique artisanal products, transparency | Offers perceived higher quality and supports local economies, bypassing traditional retail | Local CSAs, farmers' markets, artisanal food producers | Increasing consumer interest in traceability and local impact |

Entrants Threaten

The sheer capital required to establish a significant presence in the food retail sector, akin to Ahold Delhaize's operations, acts as a formidable barrier. Building and maintaining a network of supermarkets, distribution centers, and sophisticated logistics systems demands billions of dollars. For instance, in 2023, Ahold Delhaize invested €1.7 billion in capital expenditures, primarily for store upgrades, new store openings, and supply chain enhancements, illustrating the scale of investment needed.

Established players like Ahold Delhaize leverage substantial economies of scale in procurement, logistics, and advertising, enabling them to maintain competitive pricing structures. For instance, Ahold Delhaize's extensive store network and efficient supply chain in 2024 allow for bulk purchasing discounts that new entrants would find difficult to match. This cost advantage presents a significant barrier, as newcomers would need massive initial investment to achieve comparable operational efficiencies.

Koninklijke Ahold Delhaize benefits from strong brand loyalty across its diverse portfolio of local banners, such as Albert Heijn in the Netherlands and Stop & Shop in the United States. This loyalty, cultivated over decades, presents a significant barrier for potential new entrants seeking to gain market share. For instance, Albert Heijn consistently holds a leading market share in the Dutch grocery sector, demonstrating the deep customer trust and habitual purchasing patterns that are difficult for newcomers to replicate.

Access to Distribution Channels

New players face significant hurdles in securing access to established distribution channels, a critical component for reaching customers effectively. Ahold Delhaize's extensive and efficient logistics network, spanning both Europe and the United States, represents a formidable barrier to entry. For instance, in 2023, the company operated over 1,200 stores and a robust e-commerce platform, supported by a sophisticated supply chain. This established infrastructure makes it exceptionally difficult and expensive for newcomers to replicate the same level of market penetration and delivery speed.

The capital investment required to build a comparable distribution network is immense. New entrants would need to invest billions in warehousing, transportation fleets, and technology to compete. This financial burden, coupled with the time needed to establish these operations, effectively deters many potential competitors.

- High Capital Outlay: Building a nationwide or even regional distribution network requires substantial upfront investment in infrastructure, vehicles, and technology.

- Established Relationships: Ahold Delhaize likely has long-standing relationships with suppliers and logistics providers, which can be difficult for new entrants to secure on favorable terms.

- Economies of Scale: The sheer volume of goods Ahold Delhaize moves through its network allows for significant economies of scale in distribution, leading to lower per-unit costs that are hard for smaller, new operations to match.

Regulatory Barriers

Regulatory barriers represent a significant threat of new entrants for Koninklijke Ahold Delhaize. The food retail sector is heavily regulated, encompassing stringent rules on food safety, product labeling, and environmental impact. For instance, in 2024, the EU continued to enforce its Farm to Fork Strategy, which aims for a more sustainable food system and imposes stricter requirements on food production and distribution, potentially increasing compliance costs for newcomers.

These regulations can act as a substantial deterrent, requiring new businesses to invest heavily in compliance infrastructure and expertise before even beginning operations. The complexity of navigating these diverse and evolving legal frameworks, which vary by region and country, adds another layer of difficulty. For example, meeting the detailed allergen labeling requirements mandated by regulations like the EU's FIC (Food Information to Consumers) Regulation requires robust internal processes and potentially costly system upgrades.

- Food Safety Standards: Compliance with national and international food safety regulations (e.g., HACCP principles) requires significant investment in quality control and supply chain management.

- Labeling Requirements: Evolving regulations on nutritional information, origin labeling, and allergen declarations necessitate sophisticated data management and printing capabilities.

- Environmental Regulations: Growing pressure to reduce waste, manage packaging sustainably, and minimize carbon footprints adds operational complexity and cost for new entrants.

- Licensing and Permits: Obtaining necessary licenses for food handling, retail operations, and potentially alcohol sales can be a lengthy and costly process, creating a barrier to entry.

The threat of new entrants for Koninklijke Ahold Delhaize is moderate. While the capital required for store networks and distribution is substantial, and brand loyalty is strong, regulatory hurdles and established relationships can be navigated by well-funded and strategic newcomers. The company's significant investments in 2024, such as continued upgrades and new store openings, reinforce the high investment threshold for potential competitors.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Koninklijke Ahold Delhaize is built upon a robust foundation of data, including the company's annual reports, investor presentations, and publicly available financial statements.

We also incorporate insights from reputable market research firms, industry publications, and competitor analysis reports to provide a comprehensive understanding of the competitive landscape.