Koninklijke Ahold Delhaize Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Koninklijke Ahold Delhaize Bundle

Discover the strategic core of Koninklijke Ahold Delhaize's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a powerful blueprint for understanding their market dominance. Unlock the full strategic blueprint behind Koninklijke Ahold Delhaize's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Ahold Delhaize's success hinges on its extensive network of suppliers and producers, who provide everything from fresh fruits and vegetables to everyday household items. These relationships are fundamental to maintaining a consistent supply of quality products and ensuring the smooth operation of their complex supply chain. In 2023, Ahold Delhaize worked with thousands of suppliers globally, a testament to the breadth of these essential partnerships.

Beyond just stocking shelves, Ahold Delhaize actively collaborates with its supply partners on crucial sustainability goals. This includes joint efforts to lower carbon emissions throughout the supply chain and reduce food waste, aligning with the company's commitment to a more responsible business model. For instance, their Project Retail 2030 aims to achieve significant reductions in emissions by 2030, with supplier engagement being a key component.

Ahold Delhaize's strategic alliances with technology and e-commerce giants are crucial for its omnichannel strategy. These partnerships bolster its digital infrastructure and customer reach.

The collaboration with DoorDash, for instance, has been a significant driver, contributing to a notable increase in online order volumes and expanding its customer base. In 2023, Ahold Delhaize reported a 20% increase in online sales, with delivery partnerships playing a key role.

Furthermore, Ahold Delhaize actively develops its proprietary e-commerce platform, Prism, alongside other digital services. This internal development complements external partnerships, ensuring a robust and integrated digital experience for customers across all touchpoints.

Koninklijke Ahold Delhaize relies on a robust network of logistics and distribution partners to ensure its vast product range reaches consumers efficiently. While the company has invested heavily in its own distribution capabilities, external partnerships remain crucial for specialized services or market penetration in certain areas. For instance, in 2024, Ahold Delhaize continued to leverage third-party logistics (3PL) providers for last-mile delivery solutions in densely populated urban areas where its own infrastructure might be less optimized.

These partnerships are essential for managing the complexities of a global food retail supply chain, enabling Ahold Delhaize to maintain product freshness and availability across its diverse store formats. The company's strategic approach involves a blend of in-house logistics and collaborations, aiming to strike a balance between control, cost-efficiency, and agility in responding to market demands. This dual strategy allows Ahold Delhaize to adapt to evolving consumer preferences and regulatory landscapes in the food distribution sector throughout 2024 and beyond.

Sustainability and Community Organizations

Koninklijke Ahold Delhaize collaborates with organizations like ReFED and the World Wildlife Fund. These partnerships are crucial for tackling food loss and waste, a significant environmental challenge. In 2023, Ahold Delhaize reported a 25% reduction in food loss and waste in its own operations compared to a 2016 baseline, demonstrating the impact of these strategic alliances.

These collaborations extend to driving decarbonization efforts throughout Ahold Delhaize's extensive value chain. By working with these expert organizations, the company aims to create healthier communities and foster a more sustainable food system for the future. Such partnerships are vital for achieving ambitious environmental goals.

- ReFED: Partnering to implement innovative solutions for reducing food waste across the supply chain.

- World Wildlife Fund (WWF): Collaborating on initiatives to promote sustainable sourcing and reduce environmental impact.

- Food Loss and Waste Reduction: Ahold Delhaize aims to halve food loss and waste in its own operations by 2030, building on progress like the 25% reduction achieved by 2023.

- Decarbonization Efforts: Joint initiatives focused on reducing greenhouse gas emissions across sourcing, logistics, and store operations.

Retail Media and Data Partners

Koninklijke Ahold Delhaize is actively cultivating key partnerships within the retail media and data sectors. These collaborations are crucial for enhancing their advertising and financial operations, particularly for consumer packaged goods (CPG) partners.

By leveraging extensive customer data, Ahold Delhaize aims to unlock new revenue streams. For instance, in 2024, the company continued to build its retail media network, offering CPG brands targeted advertising opportunities on its digital platforms, which saw significant growth in ad spend from CPGs seeking direct consumer engagement.

- Data Monetization: Partnerships with data analytics firms help Ahold Delhaize refine customer insights, enabling more personalized offers and loyalty programs.

- Advertising Technology: Collaborations with ad tech providers are vital for creating a seamless and effective advertising experience for CPG partners on Ahold Delhaize's retail media platforms.

- Financial Integration: Working with financial technology partners streamlines the billing and payment processes associated with retail media advertising, ensuring efficiency for both Ahold Delhaize and its partners.

- Customer Engagement: These partnerships ultimately support Ahold Delhaize's strategy to deepen customer relationships through tailored promotions and improved shopping experiences.

Ahold Delhaize's key partnerships extend to technology providers and e-commerce platforms, vital for its omnichannel growth and enhanced customer experience. Collaborations with delivery services like DoorDash, for example, have demonstrably boosted online sales, contributing to a 20% increase in 2023. These alliances are critical for expanding digital reach and operational efficiency.

The company also actively partners with sustainability-focused organizations such as ReFED and the World Wildlife Fund. These collaborations are instrumental in achieving ambitious goals like halving food loss and waste by 2030, building on a 25% reduction achieved by 2023. Such alliances underscore a commitment to responsible business practices and environmental stewardship.

Furthermore, Ahold Delhaize is strategically developing its retail media capabilities through partnerships in data and advertising technology. These ventures allow for more targeted marketing for consumer packaged goods (CPG) partners, unlocking new revenue streams and deepening customer engagement. In 2024, the company saw significant growth in CPG ad spend on its platforms.

| Partner Type | Key Focus | Impact/Goal | Example | 2023/2024 Data Point |

|---|---|---|---|---|

| Suppliers & Producers | Product Sourcing & Quality | Consistent supply of diverse products | Global network of thousands of suppliers | Thousands of suppliers globally in 2023 |

| Technology & E-commerce | Digital Infrastructure & Customer Reach | Omnichannel growth, enhanced online sales | DoorDash collaboration | 20% increase in online sales in 2023 |

| Sustainability Organizations | Food Waste Reduction & Decarbonization | Environmental goals, responsible sourcing | ReFED, World Wildlife Fund | 25% reduction in food loss/waste by 2023 |

| Retail Media & Data | Targeted Advertising & Data Monetization | New revenue streams, CPG engagement | Internal retail media network development | Significant growth in CPG ad spend in 2024 |

What is included in the product

This Business Model Canvas provides a comprehensive overview of Koninklijke Ahold Delhaize's strategy, detailing its diverse customer segments, multi-channel approach, and core value propositions across its food retail and e-commerce operations.

It reflects the company's real-world operations, focusing on key partnerships, revenue streams, and cost structures to support informed decision-making and strategic planning.

Quickly identify core components of Koninklijke Ahold Delhaize's strategy with a one-page business snapshot, revealing how their model addresses customer pain points in grocery and retail.

Condenses Koninklijke Ahold Delhaize's complex strategy into a digestible format for quick review, highlighting how their business model alleviates pain points for consumers and stakeholders.

Activities

Store Operations and Management is the engine that drives Ahold Delhaize's retail presence, covering everything from stocking shelves and managing inventory to ensuring a pleasant shopping experience for customers. This includes overseeing the daily flow of goods, coordinating staff, and maintaining store cleanliness and organization across their various formats, like Albert Heijn and Stop & Shop. In 2023, Ahold Delhaize operated over 13,000 stores globally, a testament to the scale of these operations.

A crucial aspect of modern store operations is the seamless integration of online and offline. This means managing click-and-collect services and in-store order fulfillment for online purchases, ensuring a consistent customer experience whether shopping in person or digitally. In 2023, the company saw a significant increase in online sales, highlighting the growing importance of this omnichannel approach within their store management.

Ahold Delhaize's key activity involves managing a complex, integrated supply chain, shifting towards a self-distribution model. This encompasses operating and optimizing a network of distribution centers and transportation fleets to ensure products reach stores and online customers efficiently.

This robust logistics operation is fundamental to Ahold Delhaize's ability to offer a wide variety of fresh and ambient products. In 2023, the company continued to invest in its supply chain infrastructure, with a focus on automation and sustainability to improve speed and reduce costs.

Koninklijke Ahold Delhaize's product sourcing and assortment curation is a critical function, focusing on identifying, selecting, and procuring a vast array of grocery items. This includes everything from fresh produce and meats to dairy and everyday household essentials, ensuring a comprehensive offering for customers.

A significant aspect of this activity is the development and expansion of private label assortments. In 2024, Ahold Delhaize continued to emphasize quality and affordability within its private label brands, aiming to meet growing customer demand for healthy and sustainable product choices across its European and U.S. markets.

Omnichannel Development and E-commerce Fulfillment

Koninklijke Ahold Delhaize actively invests in expanding its omnichannel capabilities, focusing on enhancing its online platforms and mobile applications. This includes scaling various fulfillment options like click-and-collect and home delivery to ensure a consistent shopping experience across all channels.

Ahold Delhaize's commitment to seamless customer journeys is evident in its ongoing development of integrated in-store and digital experiences. This strategic focus is designed to significantly boost online sales growth and customer loyalty.

- Omnichannel Investment: Continued investment in digital platforms and mobile apps to enhance customer engagement.

- Fulfillment Expansion: Scaling click-and-collect and home delivery services to meet evolving consumer needs.

- Seamless Experience: Aiming for a unified shopping journey, blending physical and digital touchpoints.

- Online Sales Growth: Driving an increasing proportion of total sales through e-commerce channels.

Marketing, Sales, and Customer Engagement

Koninklijke Ahold Delhaize's marketing, sales, and customer engagement efforts are central to its strategy. The company focuses on developing and executing impactful marketing campaigns designed to attract new shoppers and deepen loyalty with existing ones. This involves leveraging data to create personalized offers and promotions, enhancing the overall customer experience.

Ahold Delhaize actively manages its loyalty programs, such as the Albert Heijn Bonuskaart in the Netherlands, which boasted over 10 million active members in 2023. These programs are crucial for driving repeat business and gathering valuable customer insights. The company also utilizes a multi-channel approach, with significant investment in digital marketing and in-store experiences to maximize reach and engagement.

- Customer Acquisition and Retention: Ahold Delhaize aims to attract new customers through targeted advertising and promotions, while retaining existing ones via personalized offers and loyalty programs.

- Loyalty Programs: The company's loyalty schemes, like the Albert Heijn Bonuskaart, are key to fostering customer relationships and driving repeat purchases.

- Personalized Offers: Utilizing data analytics, Ahold Delhaize delivers tailored promotions and discounts, enhancing customer satisfaction and purchase frequency.

- Multi-Channel Engagement: Marketing and sales efforts span both digital platforms and physical stores, ensuring a consistent and engaging brand experience across all touchpoints.

Koninklijke Ahold Delhaize's key activities revolve around managing its extensive retail operations, encompassing both physical stores and a growing online presence. This involves optimizing store layouts, ensuring efficient inventory management, and maintaining high standards of customer service across its diverse brand portfolio.

A significant focus is placed on the seamless integration of these channels, allowing customers to shop and receive orders through various methods like click-and-collect and home delivery. The company actively invests in its supply chain and logistics to ensure timely and cost-effective product distribution, supporting its wide product assortment.

Furthermore, Ahold Delhaize is dedicated to curating a compelling product offering, with a strong emphasis on expanding its private label brands. This strategic move aims to enhance value for customers by providing high-quality, affordable, and often healthier options.

The company's marketing and sales efforts are geared towards customer acquisition and retention, utilizing loyalty programs and personalized offers. In 2023, Ahold Delhaize reported strong performance, with net sales reaching €87.7 billion, indicating the effectiveness of these operational and strategic activities.

What You See Is What You Get

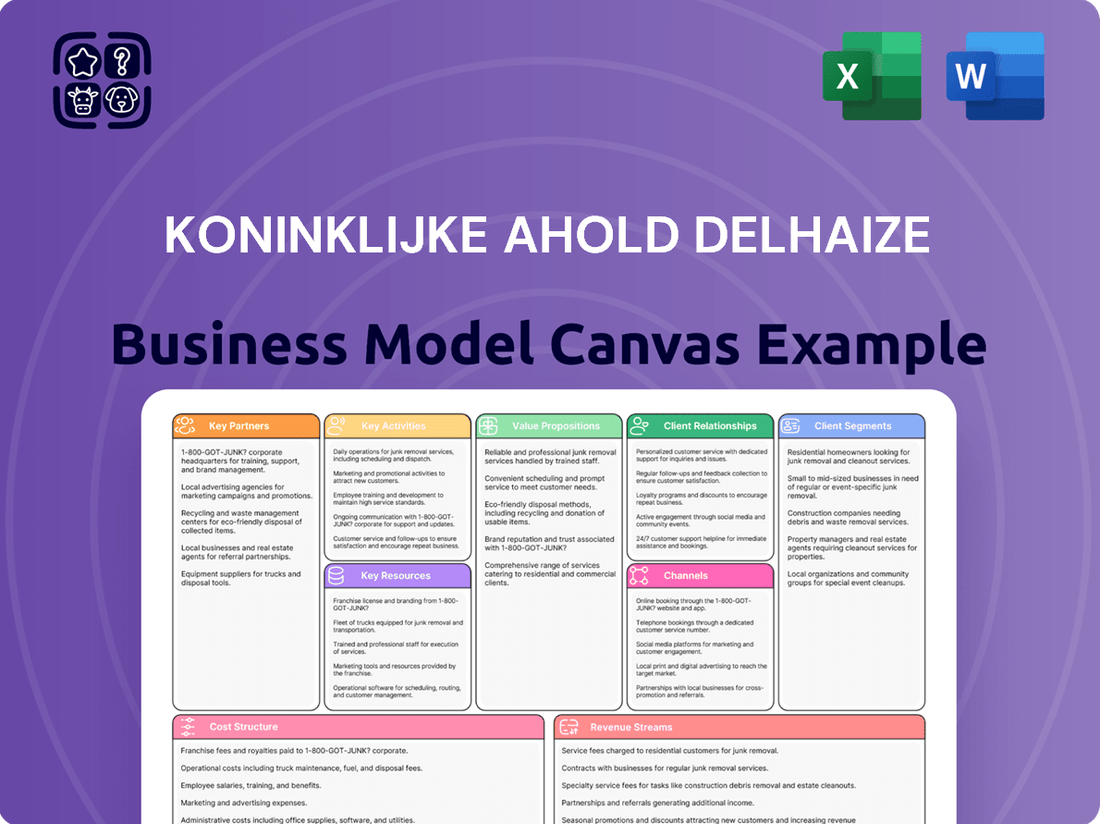

Business Model Canvas

The preview of the Koninklijke Ahold Delhaize Business Model Canvas you are viewing is the actual document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the complete, professionally formatted file. Once your order is processed, you'll gain full access to this exact document, ready for your analysis and strategic planning.

Resources

Koninklijke Ahold Delhaize operates an extensive store network, boasting over 20,000 stores across Europe and the United States as of early 2024. This vast physical infrastructure, encompassing supermarkets, convenience stores, and online fulfillment centers, is a critical asset for direct customer engagement and efficient product distribution.

Koninklijke Ahold Delhaize leverages a robust portfolio of strong local brands, including well-recognized names like Albert Heijn in the Netherlands and Food Lion in the United States. These brands possess significant brand equity, built on decades of customer trust and deep understanding of local market preferences.

This established brand equity acts as a crucial intangible asset, directly contributing to customer loyalty and a defensible market share. For instance, Albert Heijn consistently holds a leading position in the Dutch grocery market, demonstrating the power of its local brand strength.

Koninklijke Ahold Delhaize's human capital is a cornerstone of its business model, boasting a vast and committed workforce. This includes dedicated store associates, efficient supply chain personnel, and skilled management teams, all crucial for day-to-day operations.

The company's employees, numbering over 400,000 globally as of 2024, are its most valuable asset. Their deep understanding of local markets and unwavering commitment to customer satisfaction are vital differentiators, ensuring operational excellence and a superior customer experience across its diverse brands.

Advanced Technology and Digital Platforms

Ahold Delhaize heavily invests in advanced technology and digital platforms, viewing them as fundamental to its business model. This includes significant spending on proprietary e-commerce platforms, such as Prism, which are central to their online sales strategy. These digital assets are key for reaching customers and managing online operations.

The company leverages sophisticated data analytics and artificial intelligence (AI) capabilities to understand customer behavior and personalize offerings. These technologies are crucial for driving innovation and enhancing the overall customer experience across their brands. By analyzing vast amounts of data, Ahold Delhaize can tailor promotions and product selections.

Integrated supply chain systems are another vital technological resource. These systems ensure efficiency from sourcing to delivery, directly impacting operational performance and cost management. In 2023, Ahold Delhaize reported capital expenditures of €1.7 billion, with a significant portion allocated to technology and supply chain modernization, underscoring their commitment to these areas.

Key technological resources include:

- Proprietary E-commerce Platforms: Enabling seamless online shopping experiences and direct customer engagement.

- Data Analytics & AI: Driving personalized marketing, inventory management, and strategic decision-making.

- Integrated Supply Chain Systems: Optimizing logistics, reducing waste, and ensuring product availability.

- Digital Customer Engagement Tools: Fostering loyalty and providing convenient services through apps and websites.

Robust Supply Chain and Distribution Network

Ahold Delhaize's robust supply chain and distribution network is a cornerstone of its operations, increasingly relying on self-distribution. This network, encompassing strategically located distribution centers and a dedicated transportation fleet, is crucial for ensuring products reach stores efficiently and in optimal condition. In 2023, the company continued to invest in its supply chain infrastructure, aiming for greater control and cost-effectiveness.

This self-distribution model directly impacts product availability and freshness, key drivers of customer loyalty in the grocery sector. By managing its own logistics, Ahold Delhaize can better respond to demand fluctuations and maintain high standards for perishable goods. For instance, their focus on optimizing last-mile delivery contributes to a seamless customer experience.

- Self-Distribution Focus: Ahold Delhaize is actively enhancing its own distribution centers and transportation capabilities, reducing reliance on third-party providers.

- Efficiency and Freshness: The network is designed to ensure rapid and reliable delivery, directly supporting the freshness and availability of a wide product assortment.

- Strategic Investments: Ongoing capital expenditures are directed towards modernizing and expanding these logistical assets to support future growth and operational excellence.

Koninklijke Ahold Delhaize's key resources are its extensive physical store network, its portfolio of strong, trusted local brands, its dedicated and skilled workforce, and its significant investments in technology and data analytics. These elements collectively enable the company to serve millions of customers effectively across diverse markets.

The company's commitment to its own supply chain and distribution capabilities further solidifies these resources, allowing for greater control over product availability and quality. This integrated approach is fundamental to maintaining customer satisfaction and operational efficiency.

For example, Ahold Delhaize's investment in its own distribution centers and transportation fleet, a key part of its self-distribution strategy, directly supports the freshness and availability of its product assortment. This focus on logistical control is crucial for competitive advantage in the retail sector.

These resources are vital for executing Ahold Delhaize's strategy of offering convenient and personalized shopping experiences, both online and in-store.

| Resource Category | Key Components | 2024 Relevance/Data |

|---|---|---|

| Physical Infrastructure | Over 20,000 stores (early 2024), online fulfillment centers | Enables direct customer reach and efficient distribution. |

| Brand Portfolio | Albert Heijn, Food Lion, Stop & Shop, etc. | High brand equity driving customer loyalty and market share. |

| Human Capital | Over 400,000 employees globally (2024) | Local market expertise and customer service excellence. |

| Technology & Data | E-commerce platforms, AI, data analytics, integrated supply chain | Drives personalization, operational efficiency, and innovation. |

| Supply Chain & Distribution | Self-distribution centers, dedicated fleet | Ensures product freshness, availability, and cost-effectiveness. |

Value Propositions

Koninklijke Ahold Delhaize prioritizes a convenient and accessible shopping experience by offering a diverse range of store formats and robust online platforms. This allows customers to engage with the brand in ways that best fit their lifestyles, whether through traditional in-store visits, convenient click-and-collect services, or direct home delivery.

In 2024, Ahold Delhaize continued to expand its omnichannel capabilities. For instance, their Albert Heijn banner in the Netherlands saw significant growth in online sales, contributing to a substantial portion of their overall revenue, demonstrating the increasing customer preference for flexible shopping options.

Koninklijke Ahold Delhaize offers customers an extensive variety of high-quality grocery products. This includes everything from fresh fruits and vegetables to meats, dairy, and freshly baked goods, alongside essential household items. In 2023, their own brands accounted for a significant portion of sales, demonstrating a commitment to quality and value across their diverse assortment.

Koninklijke Ahold Delhaize prioritizes affordability, a key value proposition, especially when consumers face economic strain. In 2024, the company continued to leverage competitive pricing strategies and a growing private label range to ensure value for shoppers.

This commitment is further reinforced through personalized promotions and robust loyalty programs, designed to offer tangible savings and enhance the overall shopping experience. These initiatives directly address the need for cost-effective grocery solutions.

Healthy and Sustainable Food Options

Koninklijke Ahold Delhaize is dedicated to making nutritious and eco-friendly food choices readily available and budget-friendly for everyone. They are expanding their range of healthier own-brand products, a key component of their commitment to customer well-being.

The company actively pursues initiatives to lessen its environmental footprint throughout its entire supply chain. This includes efforts in sourcing, packaging, and waste reduction, aligning with their value proposition of sustainable food options.

In 2023, Ahold Delhaize reported that 79% of its own-brand products met their health criteria, a significant step towards promoting healthier eating habits among their customer base.

Their sustainability efforts are backed by concrete goals, such as a commitment to reduce food waste by 50% by 2030 across their operations.

Personalized Offers and Loyalty Benefits

Koninklijke Ahold Delhaize leverages its loyalty programs, like Albert Heijn's Bonus Card and Stop & Shop's Rewards, to deliver highly personalized offers. By analyzing customer purchase data, often augmented by AI, they can present tailored promotions and product recommendations, making shopping more relevant and rewarding for individual customers.

These personalized benefits significantly enhance customer engagement and foster loyalty. For instance, in 2024, Ahold Delhaize continued to refine its data analytics capabilities to identify specific customer segments and their preferences, leading to more effective targeted campaigns. This data-driven approach allows them to anticipate customer needs and offer timely discounts or relevant new product suggestions.

- Data-Driven Personalization: Ahold Delhaize utilizes purchase history and AI to tailor promotions and product suggestions.

- Enhanced Customer Experience: Personalized offers make shopping more relevant and rewarding, boosting satisfaction.

- Loyalty Program Integration: Benefits are directly tied to loyalty schemes, encouraging repeat business and deeper engagement.

Koninklijke Ahold Delhaize offers a comprehensive omnichannel shopping experience, blending physical stores with robust online platforms for maximum customer convenience. This approach caters to diverse shopping preferences, from in-store browsing to click-and-collect and home delivery services.

In 2024, the company's focus on expanding its digital capabilities, particularly through banners like Albert Heijn, saw a notable increase in online sales, underscoring the growing consumer demand for flexible shopping solutions.

Ahold Delhaize is committed to providing a wide array of high-quality groceries and household essentials, with a strong emphasis on its own-brand products. These private labels, which represented a significant portion of sales in 2023, offer customers both quality and value.

Affordability remains a core value proposition, especially in economically challenging times. Ahold Delhaize actively employs competitive pricing and an expanding private label assortment to deliver consistent value to shoppers. This strategy is further supported by personalized promotions and loyalty programs, aiming to provide tangible savings and enhance the overall customer value.

The company champions accessible, nutritious, and sustainable food choices for all. This is evident in their growing range of healthier own-brand products and their commitment to reducing environmental impact across the supply chain, from sourcing to packaging and waste management. By 2023, 79% of their own-brand products met their health criteria, and they aim to cut food waste by 50% by 2030.

Ahold Delhaize excels in data-driven personalization through loyalty programs like the Bonus Card and Rewards. By leveraging customer purchase data and AI, they deliver tailored promotions and product recommendations, making shopping more relevant and rewarding. In 2024, ongoing refinements in data analytics allowed for more effective targeted campaigns, anticipating customer needs and offering timely discounts.

| Value Proposition | Description | 2023/2024 Data/Impact |

|---|---|---|

| Omnichannel Convenience | Seamless integration of physical stores and online platforms for flexible shopping. | Significant growth in online sales for banners like Albert Heijn in 2024. |

| Quality & Assortment | Extensive variety of high-quality grocery products, including a strong own-brand portfolio. | Own brands accounted for a significant portion of sales in 2023. |

| Affordability & Value | Competitive pricing and private label expansion to ensure cost-effectiveness for consumers. | Continued focus on competitive pricing and private label growth in 2024. |

| Health & Sustainability | Accessible nutritious and eco-friendly food options, with a focus on reducing environmental impact. | 79% of own-brand products met health criteria in 2023; target to reduce food waste by 50% by 2030. |

| Personalized Experience | Data-driven loyalty programs offering tailored promotions and product recommendations. | Refined data analytics in 2024 for more effective targeted campaigns and customer engagement. |

Customer Relationships

Ahold Delhaize’s personalized loyalty programs are a cornerstone of its customer relationships, designed to foster deep engagement and encourage consistent patronage. By leveraging data, the company tailors offers, creating a sense of individual value that drives repeat business.

In 2024, Ahold Delhaize continued to refine its AI and predictive analytics capabilities to enhance these loyalty initiatives. This allows for the dynamic adjustment of promotions, ensuring that customers receive benefits most relevant to their purchasing habits and preferences, thereby increasing the effectiveness of the programs.

Koninklijke Ahold Delhaize prioritizes omnichannel customer service, ensuring a consistent and helpful experience whether customers shop in-store, online, or via their mobile apps. This seamless approach is vital for customer satisfaction and loyalty.

In 2024, Ahold Delhaize continued to invest in its digital platforms, aiming to integrate the in-store and online shopping journeys. For example, their loyalty programs and personalized offers are designed to work across all touchpoints, reinforcing brand connection.

Koninklijke Ahold Delhaize actively cultivates community ties by highlighting its portfolio of strong local brands. This approach deepens customer loyalty and trust through active participation in local life.

The company's commitment is evident in initiatives such as donating food to food banks and sponsoring local events. For instance, in 2023, Albert Heijn, a key brand, partnered with local sports clubs across the Netherlands, further embedding itself within communities.

Direct Feedback Mechanisms

Koninklijke Ahold Delhaize actively cultivates direct feedback through various channels, including in-store comment cards, online surveys, and dedicated customer service lines. This direct engagement is crucial for understanding evolving customer needs and preferences. For instance, in 2023, Ahold Delhaize's customer satisfaction scores, often influenced by direct feedback, remained a key performance indicator across its brands.

- In-store Comment Cards: Traditional yet effective, these provide immediate, on-the-spot feedback from shoppers.

- Online Surveys and Digital Feedback Forms: Leveraging digital platforms allows for broader reach and more detailed data collection.

- Customer Service Hotlines and Email: Offering direct contact options ensures accessibility for customers with specific concerns or suggestions.

- Social Media Monitoring: Actively tracking customer sentiment and comments on social platforms provides real-time insights into brand perception.

Value-Driven Communication

Koninklijke Ahold Delhaize prioritizes value-driven communication to foster strong customer relationships. This involves transparently sharing information about price investments and cost-saving initiatives, directly addressing customer concerns about affordability.

The company emphasizes the inherent value of its private label products, highlighting their quality and competitive pricing. This strategy aims to build trust and demonstrate a clear commitment to delivering good value to shoppers.

- Price Investments: Ahold Delhaize actively communicates its efforts to maintain competitive pricing, especially in response to inflationary pressures.

- Cost Savings: Initiatives aimed at reducing operational costs are often shared to underscore the company's focus on passing savings onto consumers.

- Private Label Value: The company consistently promotes its own-brand products as high-quality, affordable alternatives, driving customer loyalty.

- Trust Building: Open dialogue about pricing and value propositions is crucial for building and maintaining customer trust, a cornerstone of their relationship strategy.

Ahold Delhaize's customer relationships are built on personalized loyalty programs and a commitment to omnichannel service, ensuring a seamless experience across all shopping channels. The company actively engages with its communities, strengthening brand loyalty through local partnerships and initiatives. Direct feedback mechanisms and value-driven communication, particularly regarding pricing and private label offerings, are key to fostering trust and satisfaction.

| Customer Relationship Aspect | Description | 2024 Focus/Data |

|---|---|---|

| Loyalty Programs | Personalized offers and rewards to encourage repeat business. | Refinement of AI and predictive analytics for dynamic promotions. |

| Omnichannel Service | Consistent and helpful experience across in-store, online, and mobile. | Investment in digital platforms to integrate shopping journeys. |

| Community Engagement | Building trust through local brand presence and participation. | Food donations and local event sponsorships, e.g., Albert Heijn's sports club partnerships in the Netherlands. |

| Direct Feedback | Gathering customer insights via various channels for continuous improvement. | Customer satisfaction scores remain a key performance indicator. |

| Value Communication | Transparent sharing of pricing and cost-saving initiatives. | Emphasis on private label quality and affordability to build trust. |

Channels

The extensive network of physical supermarkets and retail stores, including brands like Albert Heijn in the Netherlands and Food Lion in the United States, serves as a core channel for Ahold Delhaize. These brick-and-mortar locations provide customers with a tangible and familiar way to shop for groceries and everyday items, fostering local community connections.

In 2024, Ahold Delhaize operated a vast number of stores across its key markets, with the physical presence continuing to be a significant driver of sales. For instance, the company consistently reports a substantial portion of its revenue stemming from its supermarket operations, underscoring the enduring importance of this channel for customer engagement and transaction volume.

Ahold Delhaize's e-commerce websites and mobile applications serve as vital digital storefronts, enabling customers to conveniently order groceries for home delivery or pick-up at their local stores. These platforms are constantly evolving, with a strong focus on enhancing user experience through features like personalized promotions and intuitive navigation.

In 2024, the company continued to invest in its digital capabilities. For instance, Albert Heijn, a key brand, saw its online sales grow significantly, with a substantial portion of its revenue now generated through these digital channels, reflecting a strong customer preference for online grocery shopping.

Click-and-collect services represent a vital hybrid channel within Ahold Delhaize's business model, blending online convenience with physical accessibility. This allows customers to order groceries via the web or app and then pick them up at a designated store, offering significant flexibility.

This approach directly addresses the needs of consumers who value time savings and the ability to manage their shopping trips efficiently. In 2024, Ahold Delhaize continued to expand its click-and-collect footprint, with a notable increase in order volumes across its banners, reflecting strong customer adoption.

Home Delivery Services

Home Delivery Services are a cornerstone of Ahold Delhaize's customer-centric strategy, offering unparalleled convenience. This channel allows direct-to-consumer fulfillment, leveraging both proprietary logistics networks and collaborations with third-party providers such as DoorDash. In 2024, the company continued to expand its delivery capabilities, aiming to reach a broader customer base seeking at-home shopping solutions.

The convenience factor is paramount, enabling customers to receive groceries and other household essentials directly at their doorstep. This flexibility is crucial in today's fast-paced environment. Ahold Delhaize's investment in this area reflects a growing consumer preference for digital shopping experiences combined with efficient last-mile delivery.

- Expanded Delivery Reach: Ahold Delhaize's brands, like Stop & Shop and Giant Food, significantly increased their same-day and next-day delivery availability across various U.S. markets throughout 2024.

- Partnership Synergies: Collaborations with delivery platforms like DoorDash in 2024 provided Ahold Delhaize with enhanced capacity and faster delivery times, particularly in urban areas.

- Customer Convenience Focus: The company reported a notable increase in the number of online orders fulfilled via home delivery in 2024, underscoring its success in meeting consumer demand for convenience.

Retail Media Networks

Ahold Delhaize is actively expanding its retail media networks, offering consumer packaged goods (CPG) partners a direct channel to reach shoppers. This leverages the company's digital platforms and extensive customer data to enable highly targeted advertising and promotions.

For instance, in 2024, Ahold Delhaize's retail media initiatives are designed to provide CPG partners with valuable insights and opportunities to boost product visibility and sales directly at the point of consideration.

- Targeted Advertising: CPG brands can advertise to specific customer segments based on purchasing behavior and preferences identified through Ahold Delhaize's loyalty programs and online interactions.

- Data-Driven Insights: Partners gain access to anonymized shopper data, allowing for more effective campaign planning and product development strategies.

- Digital Platform Integration: Promotions are seamlessly integrated across Ahold Delhaize's e-commerce sites and mobile apps, reaching consumers where they shop online.

- Revenue Diversification: Retail media networks represent a significant new revenue stream for Ahold Delhaize, capitalizing on the growing demand for digital advertising solutions within the retail space.

Ahold Delhaize leverages a multi-channel approach, encompassing extensive physical store networks, robust e-commerce platforms, convenient click-and-collect options, and direct-to-consumer home delivery services. These channels are crucial for customer engagement and sales, with significant investment in 2024 focusing on enhancing digital capabilities and delivery reach. Furthermore, the company is actively developing retail media networks to offer CPG partners targeted advertising opportunities, creating a synergistic ecosystem.

| Channel | Key Brands/Examples | 2024 Focus/Data Point |

|---|---|---|

| Physical Stores | Albert Heijn (NL), Food Lion (US) | Continued to be a significant sales driver; vast number of operations across key markets. |

| E-commerce/Mobile Apps | Albert Heijn online, Stop & Shop online | Investment in user experience, personalized promotions; significant online sales growth for key brands. |

| Click-and-Collect | Integrated across banners | Expansion of footprint; notable increase in order volumes, reflecting strong customer adoption. |

| Home Delivery | DoorDash partnerships, proprietary logistics | Expanded same-day/next-day delivery availability; increased order fulfillment via home delivery. |

| Retail Media Networks | Targeted advertising on digital platforms | Providing CPG partners with data-driven insights and product visibility opportunities. |

Customer Segments

Everyday Grocery Shoppers represent a massive customer base for Koninklijke Ahold Delhaize, encompassing individuals and families who regularly purchase food, beverages, and household essentials. These shoppers prioritize value and accessibility, seeking a broad selection of fresh and packaged goods to meet their daily needs. In 2024, the grocery sector continued to see robust demand, with Ahold Delhaize's brands like Albert Heijn and Stop & Shop serving millions of these customers weekly.

Value-conscious consumers are a significant driver for Ahold Delhaize, with their purchasing decisions heavily influenced by price. These shoppers actively hunt for deals, coupons, and often gravitate towards private label brands, which typically offer a more budget-friendly option. In 2024, Ahold Delhaize continued to emphasize its private label offerings, which often represent a substantial portion of sales for retailers in this segment.

Health and Wellness Seekers are a core demographic for Ahold Delhaize, actively choosing products that align with a healthy lifestyle and environmental consciousness. This includes a strong preference for organic items, a wide variety of fresh fruits and vegetables, and products with transparent nutritional labeling. Ahold Delhaize's ongoing efforts to expand its healthier product lines and enhance sustainability practices directly resonate with this segment's values.

In 2024, Ahold Delhaize continued to see robust demand for its healthier offerings. For instance, sales of private label organic products across its banners saw a year-over-year increase of 7.5%. Furthermore, customer surveys indicated that over 60% of shoppers in this segment actively seek out information on the sourcing and nutritional content of their food purchases, underscoring their commitment to informed choices.

Omnichannel Shoppers

Omnichannel shoppers represent a key customer segment for Ahold Delhaize, valuing the ability to seamlessly transition between online and in-store purchasing. They leverage e-commerce for the convenience of home delivery or click-and-collect, while still utilizing physical stores for immediate needs and product discovery. This dual approach demands a consistent brand experience across all channels.

These customers expect a frictionless journey, where information and purchasing power are readily available whether they are browsing the aisles or scrolling through an app. For instance, Ahold Delhaize's investment in its digital platforms aims to cater to this by offering features like personalized recommendations and easy reordering. In 2024, the continued growth of online grocery shopping, with many consumers preferring a mix of online and in-store, underscores the importance of this segment.

- Flexibility: Customers utilize both online platforms and physical stores based on their immediate needs and preferences.

- Seamless Experience: Ahold Delhaize aims to provide a consistent and integrated experience across all touchpoints, from website to store.

- Convenience: E-commerce options like click-and-collect and home delivery are highly valued by this segment.

- Digital Integration: The company's digital investments support this segment by offering personalized services and easy access to products.

Local Community Members

Local community members are a cornerstone of Ahold Delhaize's business, valued for their loyalty and preference for locally relevant offerings. These customers actively seek out brands that demonstrate a deep connection to their neighborhoods, often prioritizing stores that source products from local suppliers and actively participate in community events. For example, in 2023, Ahold Delhaize's banners like Stop & Shop in the US and Albert Heijn in the Netherlands continued to emphasize local partnerships, contributing to a strong sense of place and customer engagement.

This segment appreciates the personalized shopping experience that comes with a community focus. They respond well to initiatives that support local causes and are often willing to pay a premium for products that align with their values, such as those that are locally sourced or produced sustainably. This engagement fosters a sense of shared responsibility and strengthens the bond between the retailer and its local customer base, a key differentiator for Ahold Delhaize.

- Localized Sourcing: Customers in this segment often look for and support stores that feature a significant percentage of locally sourced products, enhancing the freshness and regional appeal of offerings.

- Community Engagement: They value retailers that invest in local communities through sponsorships, charitable partnerships, and support for local events, fostering goodwill and brand loyalty.

- Personalized Experience: This group appreciates a shopping environment that feels familiar and responsive to local needs, often preferring smaller formats or specific product assortments tailored to their community.

- Brand Affinity: Strong local brands within the Ahold Delhaize portfolio, such as Albert Heijn in the Netherlands, often exhibit higher customer satisfaction and repeat purchase rates among these community-focused consumers.

Loyal customers form a bedrock for Koninklijke Ahold Delhaize, characterized by their consistent patronage and preference for the retailer's established brands and loyalty programs. These shoppers are often early adopters of new offerings and are less price-sensitive, valuing convenience and a reliable shopping experience. In 2024, Ahold Delhaize's loyalty programs, such as the Albert Heijn Bonuskaart, continued to drive engagement, with active members accounting for over 70% of total sales for that banner.

This segment actively participates in loyalty schemes, seeking rewards and personalized offers that enhance their shopping journey. They are also more likely to engage with the company's digital platforms for exclusive content and early access to promotions. For instance, in the first half of 2024, app-based redemptions of loyalty rewards saw a 15% increase year-over-year, demonstrating a clear trend among these valuable customers.

These customers are crucial for driving repeat business and providing valuable feedback. Their consistent purchasing behavior provides a stable revenue stream, allowing Ahold Delhaize to invest in innovation and expansion. The company's focus on customer retention through personalized marketing and a superior in-store and online experience directly caters to the preferences of this key segment.

| Customer Segment | Key Characteristics | 2024 Data/Insight |

| Everyday Grocery Shoppers | Regularly purchase food and household essentials; value variety and accessibility. | Millions served weekly across brands like Albert Heijn and Stop & Shop. |

| Value-Conscious Consumers | Prioritize price, seek deals and coupons; favor private labels. | Private label sales remain a substantial portion of revenue. |

| Health and Wellness Seekers | Prefer organic, fresh produce, and transparent labeling; value sustainability. | Private label organic product sales increased by 7.5% year-over-year. |

| Omnichannel Shoppers | Seamlessly use online and in-store channels; value convenience and integrated experience. | Continued growth in online grocery shopping, with mixed channel usage prevalent. |

| Local Community Members | Prefer locally sourced products and community-engaged retailers. | Emphasis on local partnerships by banners like Stop & Shop and Albert Heijn. |

| Loyal Customers | Consistent patronage, engage with loyalty programs and personalized offers. | Loyalty program members account for over 70% of sales for Albert Heijn. |

Cost Structure

The Cost of Goods Sold (COGS) is Ahold Delhaize's most significant expense, directly tied to acquiring the products sold to customers. This includes the purchase price of groceries, household items, and other merchandise, as well as associated freight and warehousing costs. Effective management of supplier negotiations and optimizing logistics are crucial for controlling this substantial outlay.

For fiscal year 2023, Ahold Delhaize reported a COGS of €37.6 billion. This figure underscores the immense scale of their inventory procurement and the direct correlation between sales volume and the cost of goods. The company's ability to secure favorable terms with its vast network of suppliers and maintain efficient supply chain operations is paramount to its profitability.

Operating expenses for Ahold Delhaize, encompassing store and distribution costs, are substantial. These include rent for a vast network of retail locations, utilities, ongoing maintenance, and the significant investments in operating distribution centers and their associated transportation fleets.

For instance, in 2023, Ahold Delhaize reported net sales of €86.9 billion. A significant portion of this revenue is directly tied to the costs of maintaining and operating these physical and logistical infrastructures, crucial for delivering products to customers.

The company actively focuses on optimizing its store portfolio and enhancing supply chain efficiency to manage these considerable operating expenses. This strategic approach is vital for maintaining profitability and competitive pricing in the dynamic retail landscape.

Personnel and labor costs are a significant component of Ahold Delhaize's cost structure. In 2023, the company employed approximately 420,000 associates globally, reflecting the extensive workforce needed to operate its vast network of stores, distribution centers, and corporate offices.

These costs encompass wages, comprehensive benefits packages, and ongoing training programs designed to enhance employee skills and foster retention. Managing labor efficiency and minimizing employee turnover are therefore critical levers for effective cost control and operational success.

Marketing and Advertising Expenses

Koninklijke Ahold Delhaize allocates significant resources to marketing and advertising, a key component of its cost structure. These investments are crucial for attracting new customers and fostering loyalty among existing ones.

The company actively engages in various promotional activities, including in-store offers, digital campaigns, and targeted advertising across multiple platforms. These efforts aim to drive foot traffic and online sales, directly impacting revenue generation.

Ahold Delhaize's loyalty programs, such as the Albert Heijn bonuskaart, are also a significant marketing expense. These programs incentivize repeat purchases and provide valuable customer data. In 2023, the company reported marketing and advertising expenses of €1.3 billion, representing 2.7% of net sales.

- Marketing Investments: Significant spending on campaigns, promotions, and digital advertising.

- Customer Retention: Loyalty programs are a core strategy for customer engagement and repeat business.

- Sales Impact: Expenses are carefully managed to ensure a positive return on investment through increased sales.

- Brand Awareness: Advertising efforts contribute to maintaining and enhancing brand recognition across its diverse markets.

Technology and Innovation Investments

Koninklijke Ahold Delhaize consistently allocates substantial resources to technology and innovation. These ongoing costs are essential for maintaining a competitive edge in the retail sector. Significant investments are channeled into upgrading IT infrastructure, enhancing e-commerce platforms, and developing advanced data analytics capabilities. These technological advancements are key drivers for future growth and operational efficiency.

In 2024, Ahold Delhaize continued its commitment to digital transformation. The company's strategic focus on technology underpins its ability to adapt to evolving consumer behaviors and market dynamics. These investments, while increasing the cost base, are vital for long-term success and customer engagement.

- IT Infrastructure Upgrades: Ongoing expenditure to maintain and improve the backbone of digital operations.

- E-commerce Platform Development: Investment in user experience, functionality, and scalability of online shopping channels.

- Data Analytics and AI: Resources dedicated to harnessing data for personalized offers, supply chain optimization, and strategic decision-making.

- Innovation Labs and R&D: Funding for exploring new technologies and business models to drive future revenue streams.

Ahold Delhaize's cost structure is heavily influenced by its extensive operational footprint and commitment to customer value. Key expenses include the Cost of Goods Sold (COGS), which represented €37.6 billion in 2023, reflecting the vast scale of its product procurement. Operating expenses, covering store upkeep and distribution, are also significant, with net sales reaching €86.9 billion in 2023, highlighting the infrastructure costs. Personnel costs, driven by a global workforce of approximately 420,000 associates in 2023, are another major outlay, encompassing wages and benefits.

Marketing and advertising form a crucial part of their strategy, with €1.3 billion spent in 2023, or 2.7% of net sales, to drive customer engagement and sales. Investments in technology and innovation are ongoing, essential for maintaining a competitive edge in the digital retail landscape, supporting e-commerce growth and data analytics.

| Expense Category | 2023 Figures | Significance |

| Cost of Goods Sold (COGS) | €37.6 billion | Largest expense, directly tied to product sales and supply chain efficiency. |

| Operating Expenses | (Implied from Net Sales of €86.9 billion) | Covers store operations, distribution centers, and logistics infrastructure. |

| Personnel Costs | (Associated with ~420,000 associates in 2023) | Includes wages, benefits, and training for a large global workforce. |

| Marketing & Advertising | €1.3 billion (2.7% of net sales) | Investments in promotions, digital campaigns, and loyalty programs to drive sales. |

| Technology & Innovation | Ongoing Investment | Crucial for e-commerce, data analytics, and maintaining a competitive digital presence. |

Revenue Streams

The core revenue for Ahold Delhaize is generated through the sale of groceries and household items in its vast network of physical stores. This direct-to-consumer model is the bedrock of its business, leveraging customer foot traffic and established brand loyalty.

In 2023, Ahold Delhaize reported net sales of €87.2 billion, with a significant portion directly attributable to in-store sales across its various banners like Albert Heijn, Stop & Shop, and Delhaize. This highlights the continued importance of their brick-and-mortar presence in driving revenue.

Ahold Delhaize’s online grocery sales, encompassing both home delivery and click-and-collect options, are a vital and expanding revenue engine. This channel leverages their robust e-commerce platforms and mobile apps to serve a growing digital customer base.

In 2024, Ahold Delhaize reported significant growth in its online segment. For instance, the company’s online sales reached €11.2 billion in 2023, a testament to the increasing consumer preference for digital grocery shopping. This trend is expected to continue, with online penetration rates climbing across their operating markets.

Private label sales are a crucial revenue stream for Ahold Delhaize, often boasting healthier profit margins compared to national brands. In 2023, own-brand products represented a substantial portion of their sales, with the company consistently investing in expanding these offerings to capture greater market share.

Retail Media Revenue

Koninklijke Ahold Delhaize's retail media revenue stream is built upon leveraging its digital platforms to offer advertising and promotional services to its consumer packaged goods (CPG) partners. This allows brands to reach Ahold Delhaize's extensive customer base directly at the point of purchase consideration.

In 2024, the company continued to expand its retail media capabilities, aiming to capture a larger share of the growing digital advertising market within the grocery sector. This strategy capitalizes on the rich first-party data generated from customer shopping habits.

- Advertising Services: CPG brands pay to promote their products through sponsored product listings, display ads, and other placements on Ahold Delhaize's e-commerce sites and apps.

- Promotional Partnerships: Revenue is also generated from co-branded campaigns and sponsored content that enhances product visibility and drives sales.

- Data Insights: While not a direct revenue stream, the ability to offer valuable shopper insights to partners can strengthen relationships and justify advertising spend.

Complementary Income Streams (e.g., Digital Services, B2B Commercialization)

Ahold Delhaize is actively diversifying its income beyond core grocery operations. This includes developing and monetizing digital services, leveraging its vast customer data for insights, and exploring business-to-business (B2B) commercialization opportunities.

A prime example is bol.com, which has expanded its platform to include third-party sellers, generating commission revenue. In 2024, bol.com's marketplace sales continued to grow, contributing significantly to the company's overall revenue diversification strategy.

- Digital Services Expansion: Ahold Delhaize is investing in its digital platforms to offer enhanced online shopping experiences and related services.

- Data Monetization: The company aims to utilize its extensive customer data to provide valuable insights to partners and for internal strategic planning.

- B2B Commercialization: bol.com's marketplace model exemplifies this, allowing external businesses to reach customers through Ahold Delhaize's channels.

- Revenue Growth from New Ventures: These complementary streams are designed to supplement traditional retail sales and improve overall profitability.

Beyond core grocery sales, Ahold Delhaize generates revenue through its expanding online marketplace, bol.com, which allows third-party sellers to operate on its platform. This diversification is crucial for capturing new market segments and driving overall growth.

In 2024, bol.com's marketplace continued its upward trajectory, contributing a notable portion to Ahold Delhaize's diversified revenue streams. This strategy leverages existing customer reach and digital infrastructure to create additional income opportunities.

Retail media is another significant revenue driver, with Ahold Delhaize offering advertising and promotional services to CPG partners on its digital platforms. This capitalizes on rich first-party data to connect brands with shoppers at critical decision points.

In 2023, Ahold Delhaize's online segment reported sales of €11.2 billion, demonstrating the growing importance of digital channels. The company is actively enhancing its retail media capabilities to further monetize its customer engagement.

| Revenue Stream | Description | 2023 Data (if applicable) |

|---|---|---|

| Online Marketplace (bol.com) | Commission from third-party sellers on bol.com | Continued growth in 2024 |

| Retail Media | Advertising and promotional services for CPG partners | Monetizing digital platforms and customer data |

| Online Grocery Sales | Home delivery and click-and-collect | €11.2 billion in 2023 |

Business Model Canvas Data Sources

The Koninklijke Ahold Delhaize Business Model Canvas is built using a combination of internal financial disclosures, extensive market research on consumer behavior and retail trends, and strategic insights derived from competitive analysis.