Ahlers SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ahlers Bundle

Ahlers is a company poised for growth, leveraging its established brand and strong customer loyalty. However, a deeper dive reveals potential market shifts and competitive pressures that could impact its trajectory.

Want the full story behind Ahlers' competitive advantages, potential threats, and internal capabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and decision-making.

Strengths

Ahlers AG's strength lies in its diverse brand portfolio, encompassing names like Baldessarini, Pierre Cardin, Otto Kern, Pioneer Jeans, and Jupiter. This variety allows the company to target a broad spectrum of consumers, from those seeking premium business attire to individuals looking for casual wear or specialized workwear. This multi-brand strategy is a significant advantage in the fashion industry.

This brand diversification effectively spreads risk, reducing the company's dependence on any single brand's performance or prevailing fashion trends. For example, while Baldessarini targets the higher-end market, Pioneer Jeans caters to a more accessible segment, ensuring a wider revenue base.

By offering products across different price points and styles, Ahlers can achieve greater market penetration. In 2023, the company's menswear segment, driven by these diverse brands, generated a substantial portion of its revenue, highlighting the success of this approach in reaching varied customer segments.

Ahlers boasts a significant international footprint, with distribution companies established in approximately 20 countries across the globe. This extensive network is a key strength, granting the company broad market access and the ability to effectively reach diverse customer bases for its portfolio of brands.

The company's strategic production facilities, located in Poland and Sri Lanka, further bolster its global operations by enhancing supply chain flexibility and operational efficiency. This dual-location manufacturing strategy allows for optimized production and distribution, mitigating risks and responding effectively to market demands.

Demonstrating a proactive approach to growth, Ahlers continues to invest in strengthening its global presence. The recent establishment of a new office in Ho Chi Minh City, Vietnam, exemplifies this commitment, signaling an intent to tap into and expand within emerging markets and further solidify its international reach.

Ahlers AG boasts over 90 years of experience in the fashion industry, a testament to its deep operational knowledge and enduring presence. This extensive history, dating back to its founding, has equipped the company with a unique ability to adapt and thrive amidst shifting consumer preferences and market dynamics. For instance, the company has successfully navigated numerous economic downturns and fashion cycles, demonstrating remarkable resilience.

Commitment to Quality and Sustainability

Ahlers AG is strongly committed to producing modern, functional, high-quality menswear, with a growing emphasis on sustainability across its brands. This dedication resonates with an increasing consumer preference for ethically sourced and environmentally responsible products. For example, in their 2023 financial reporting, Ahlers highlighted ongoing investments in sustainable materials and production processes, aiming to reduce environmental impact. This strategic focus not only meets market demands but also strengthens the company's brand image among a socially conscious demographic.

The company's logistics division, Ahlers Logistics, actively supports this commitment by prioritizing sustainable supply chain management. They assist clients in minimizing their carbon footprints, demonstrating a broader corporate responsibility. This integrated approach to sustainability, from product to delivery, positions Ahlers favorably in a market increasingly driven by environmental considerations. For instance, Ahlers Logistics reported a measurable reduction in CO2 emissions for key clients during 2024 through optimized route planning and greener transport solutions.

- Emphasis on Quality: Ahlers produces modern, functional, and high-quality menswear.

- Sustainability Focus: The company prioritizes environmentally conscious and ethical production methods.

- Logistics Support: Ahlers Logistics champions sustainable supply chain management to reduce carbon footprints.

- Market Alignment: This commitment aligns with growing consumer demand for sustainable and responsible brands.

Advanced IT and Supply Chain Management

Ahlers demonstrates significant strength in its advanced IT and supply chain management capabilities. The company has strategically invested in robust IT infrastructure, notably implementing Microsoft Dynamics AX and the Porini Apparel & Textile system. These integrated platforms are crucial for efficiently managing complex business processes within the apparel sector.

These technological investments enable a high level of automation and control throughout Ahlers' supply chain. This extends from handling consignment business to orchestrating international deliveries, ensuring smooth and predictable operations across its global network. This technological backbone is vital for a company with extensive international reach.

The integration of these advanced systems directly translates into improved operational efficiency and enhanced responsiveness to dynamic market demands. Real-time data analysis capabilities empower Ahlers to make quicker, more informed decisions, a critical advantage in the fast-paced fashion industry. For instance, by tracking inventory and sales data in real-time, the company can optimize stock levels and adapt to changing consumer preferences more effectively.

Ahlers' commitment to cutting-edge IT and supply chain management provides a distinct competitive edge. It allows for the precise and agile management of intricate global operations, from sourcing raw materials to final product distribution. This sophisticated operational framework is a key enabler of the company's overall business strategy and its ability to navigate complex international markets successfully.

- Microsoft Dynamics AX and Porini Apparel & Textile integration

- High degree of automation and control in supply chain processes

- Improved operational efficiency and market responsiveness

- Enhanced ability to manage complex international deliveries

Ahlers AG's diverse brand portfolio, including Baldessarini, Pierre Cardin, and Pioneer Jeans, allows it to cater to a wide range of consumers and spread business risk effectively.

This multi-brand approach ensures broader market penetration, as seen in the significant revenue contribution from its menswear segment in 2023.

The company's extensive international footprint, with operations in approximately 20 countries, combined with strategic production sites in Poland and Sri Lanka, enhances its global reach and operational efficiency.

Ahlers' long history, exceeding 90 years, demonstrates its adaptability and resilience in navigating market changes and consumer trends.

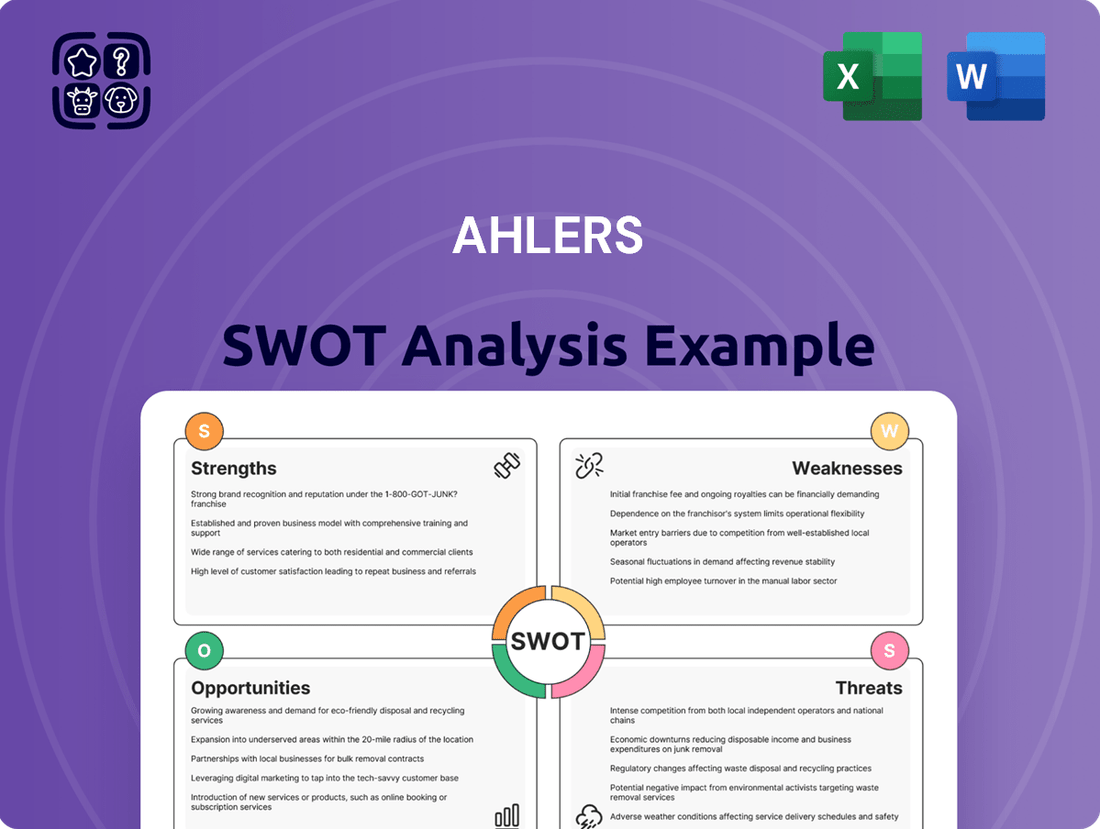

What is included in the product

Offers a full breakdown of Ahlers’s strategic business environment by detailing its internal strengths and weaknesses alongside external opportunities and threats.

Provides a clear, actionable framework for identifying and addressing strategic challenges.

Weaknesses

Ahlers AG experienced a notable dip in its financial performance during the first quarter of the 2023/24 fiscal year. Sales revenues and earnings saw a significant decrease when compared to the same period in the prior year.

This decline is largely due to a combination of factors, including a tougher economic climate, consumers becoming more hesitant with their spending, and an excess of inventory within the retail sector.

These financial results highlight current operational challenges and market pressures that are directly affecting the company's profitability. For instance, sales revenue for Q1 2023/24 was €46.4 million, a decrease from €53.4 million in Q1 2022/23.

Consequently, the company faces a clear need to implement strategic adjustments to revitalize its financial trajectory and improve its market standing.

Ahlers operates within the German menswear market, a sector known for its fragmentation and fierce competition. This environment sees a crowded field of global fashion giants and agile local brands all vying for consumer attention and spending. For instance, in 2024, the German apparel market was valued at approximately €70 billion, with menswear representing a significant portion, highlighting the sheer scale of competition Ahlers faces.

This intense rivalry puts considerable pressure on Ahlers, impacting pricing strategies and potentially squeezing profit margins as companies compete on cost and value. It also makes it a constant challenge to capture and retain market share against a multitude of established and emerging competitors.

Successfully navigating this landscape necessitates a commitment to ongoing product innovation and the development of robust differentiation strategies to set Ahlers apart. Without these, maintaining a distinct and strong market position becomes increasingly difficult.

Ahlers AG's history includes significant legal challenges, notably the €3.5 million fine levied by the European Commission in late 2024. This penalty, shared with Pierre Cardin, stemmed from anti-competitive agreements that stifled cross-border sales and limited distribution to lower-priced retailers from 2008 to 2021. Such past compliance failures can negatively impact brand image and investor sentiment.

Impact of Restructuring and Personnel Reductions

Following its takeover by Röther Group in 2023, Ahlers AG initiated a significant restructuring. This included personnel reductions within its e-commerce and domestic retail sectors. Such measures, while intended to improve efficiency, can result in the loss of valuable institutional knowledge and disrupt ongoing initiatives. For instance, downsizing in the e-commerce division, a sector experiencing considerable market growth, might impede Ahlers' capacity to fully leverage digital expansion opportunities. This restructuring points to past financial challenges that necessitated such drastic actions.

The impact of these personnel reductions can be multifaceted. A loss of experienced staff in critical areas like e-commerce could slow innovation and responsiveness to market trends. Furthermore, the disruption inherent in restructuring may temporarily affect customer service and operational continuity. Ahlers' strategic decisions post-takeover, particularly regarding workforce adjustments in growth areas, will be crucial in determining its future market position.

- 2023 Takeover: Ahlers AG was acquired by Röther Group.

- Restructuring Measures: Personnel reductions were implemented in e-commerce and domestic retail.

- Potential Consequences: Loss of institutional knowledge and disruption to ongoing projects.

- Digital Strategy Impact: Reduced capacity to capitalize on e-commerce market growth.

Vulnerability to Consumer Caution and Inflation

The prevailing economic landscape of 2024 and 2025, characterized by elevated inflation and widespread economic uncertainty, is fostering a more circumspect approach to consumer spending. This trend is particularly impactful on the retail and consumer goods sectors, as individuals tend to re-evaluate their purchasing habits, favoring essential goods and actively seeking greater value for their money.

Ahlers AG, as a player in the fashion industry, is inherently exposed to these evolving consumer sentiments. A heightened focus on necessities and value-seeking behavior can translate into diminished demand for discretionary purchases, such as apparel, thereby exerting downward pressure on Ahlers' sales volumes and overall revenue streams.

- Consumer Spending Habits: Reports from late 2024 indicate a noticeable shift towards value-driven purchases, with consumers actively comparing prices and seeking discounts, impacting discretionary spending categories.

- Inflationary Impact: Persistent inflation in early 2025 continues to erode purchasing power, forcing consumers to allocate a larger portion of their budget to essential goods, thus limiting disposable income for fashion items.

- Retail Sector Vulnerability: The broader retail sector experienced a slowdown in non-essential goods sales throughout 2024, a trend expected to persist into 2025, directly affecting fashion retailers like Ahlers.

Ahlers faces significant challenges due to the highly competitive German menswear market, valued at approximately €70 billion in 2024. This intense rivalry pressures pricing strategies and can shrink profit margins, making market share retention difficult. Furthermore, the company's past compliance issues, including a €3.5 million fine in late 2024 for anti-competitive agreements, can damage its brand reputation and investor confidence.

Same Document Delivered

Ahlers SWOT Analysis

The preview you see is the actual Ahlers SWOT analysis document you’ll receive upon purchase. This ensures you know exactly what you're getting—no surprises, just professional quality. You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, providing you with the full, in-depth insights.

Opportunities

The digital fashion market is booming. Germany's online fashion sales were estimated to reach over €20 billion in 2023 and are projected to climb further, with e-commerce expected to account for a substantial portion of total apparel sales by 2025. This presents a significant opportunity for Ahlers AG to bolster its online presence.

Ahlers can seize this by enhancing its digital infrastructure, offering a seamless and engaging online shopping journey, and refining its digital marketing efforts to attract and retain customers. Investing in user-friendly websites and mobile apps, alongside personalized recommendations, will be key.

There's a clear pathway to boost direct-to-consumer (DTC) sales through e-commerce, expanding Ahlers' reach beyond traditional brick-and-mortar stores. This allows for greater control over brand messaging and customer relationships, potentially leading to higher profit margins.

By prioritizing digital channels, Ahlers can tap into a broader customer base, both domestically and internationally, solidifying its market position. This strategic focus is essential for sustained growth and competitiveness in the evolving fashion landscape.

Consumers are increasingly prioritizing sustainability, with the global ethical fashion market projected to reach $9.1 billion by 2025, a significant increase from previous years. This trend presents a substantial opportunity for Ahlers AG to deepen its commitment to eco-friendly materials and transparent, ethical production. By further embedding circular fashion principles, such as repair, resale, and recycling programs, Ahlers can tap into this growing consumer demand.

Ahlers' existing focus on sustainable menswear positions it well to capitalize on this shift. By highlighting its eco-conscious practices and integrating more recycled and organic fabrics, the company can attract environmentally aware shoppers. This strategic alignment not only meets evolving consumer values but also anticipates future regulatory pressures, potentially offering a distinct competitive edge in the fashion industry.

The fashion industry is increasingly integrating technologies like AI and AR to personalize customer interactions. For Ahlers, this means opportunities to offer virtual try-ons and tailored product recommendations, enhancing the online shopping experience. For instance, by 2024, a significant portion of fashion retailers are expected to have implemented some form of AR technology to improve customer engagement.

Adopting digital product development and blockchain for supply chain transparency can also streamline Ahlers' operations. This not only boosts efficiency but also builds crucial consumer trust in the brand's ethical sourcing and production methods. By 2025, consumer demand for supply chain visibility is projected to rise, making these technologies a key differentiator.

Growth in German Menswear Market

The German menswear market is experiencing a robust growth trajectory, with projections indicating a Compound Annual Growth Rate (CAGR) of 5% between 2025 and 2030. This expansion is largely fueled by the resurgence of in-office work environments and a notable uptick in travel, both of which are stimulating renewed consumer interest in business and formal attire. Ahlers AG, with its strategic emphasis on catering to diverse segments within the menswear sector, is favorably positioned to capitalize on this expanding market. By adeptly tailoring its collections to address the evolving preferences and demands of this growing consumer base, Ahlers can unlock significant opportunities for increased revenue and market share.

Strategic International Supply Chain Optimization

Ahlers can seize opportunities by refining its international supply chain. Focusing on strategic routes, such as the Middle Corridor, and increasing its operational footprint in regions like Southeast Asia can significantly boost efficiency and lower logistics expenses. This strategic approach allows for greater agility in meeting worldwide market needs.

By actively managing its global supply chain, Ahlers AG can solidify its competitive standing and fuel its international expansion plans. This includes proactively navigating global disruptions and achieving cost savings.

- Enhanced Efficiency: Streamlining routes and expanding facilities can lead to faster delivery times and reduced lead times, critical for maintaining a competitive edge in the fast-paced logistics sector.

- Cost Reduction: Optimizing logistics through strategic route selection and regional facility expansion can directly translate to lower transportation and warehousing costs, improving overall profitability. For instance, a 10% reduction in freight costs for a company like Ahlers could translate to millions in savings annually, based on industry benchmarks for freight expenditure.

- Improved Responsiveness: A more agile supply chain allows Ahlers to react quicker to shifts in global demand, enabling them to capitalize on emerging market opportunities and mitigate the impact of unforeseen market changes.

- Resilience to Disruptions: Diversifying supply chain routes and strengthening regional presence makes Ahlers less vulnerable to geopolitical events or natural disasters that might impact single, critical pathways.

The digital fashion market continues its upward trajectory, with German online fashion sales projected to exceed €20 billion in 2023 and further growth anticipated by 2025, presenting a prime opportunity for Ahlers to strengthen its online presence and direct-to-consumer sales.

Ahlers can capitalize on the growing consumer demand for sustainability, a market expected to reach $9.1 billion by 2025, by emphasizing its eco-friendly materials and transparent production processes.

The adoption of technologies like AI and AR offers Ahlers a chance to enhance customer experiences through personalized recommendations and virtual try-ons, with a significant portion of fashion retailers expected to implement AR by 2024.

The German menswear market is set to grow at a CAGR of 5% between 2025 and 2030, driven by increased in-office work and travel, positioning Ahlers to benefit from renewed demand for business and formal wear.

Optimizing its international supply chain by exploring routes like the Middle Corridor and expanding in Southeast Asia offers Ahlers significant opportunities for efficiency gains and cost reductions, estimated to save millions annually if freight costs are reduced by 10%.

Threats

The German menswear market, where Ahlers AG primarily operates, is characterized by intense competition and significant fragmentation. This means there are many brands, both local and global, all trying to capture customer interest. For instance, the German apparel market was valued at approximately €33.7 billion in 2023, with a substantial portion dedicated to menswear, highlighting the sheer number of players and the limited share each can command.

This crowded landscape often forces companies into price competition, which can directly squeeze profit margins. Brands must constantly innovate to stand out. Ahlers AG, like its competitors, faces the challenge of differentiating its brands, such as Baldessarini and Pierre Cardin, amidst a market where consumer loyalty can be fleeting and new trends emerge rapidly.

The presence of numerous established brands alongside agile, emerging niche players means Ahlers must continually invest in marketing and product development to maintain its position. Failure to adapt to these dynamic competitive pressures could lead to a gradual erosion of market share, impacting overall revenue and profitability for the company.

Economic uncertainty continues to cast a shadow over consumer spending in 2025, with lingering inflation impacting purchasing power. This cautious sentiment directly affects discretionary items such as fashion apparel, potentially leading consumers to favor value-driven purchases and essential goods over trend-driven styles.

For fashion retailers like Ahlers AG, this translates into a risk of reduced sales volumes and revenue as consumers postpone or scale back non-essential purchases. The ongoing macroeconomic headwinds create a challenging operating environment, necessitating strategic adjustments to navigate subdued demand.

Ahlers faces mounting threats from increasing regulatory scrutiny on sustainability, particularly within the European Union. Impending regulations like the Ecodesign for Sustainable Products Regulation (ESPR) and directives on supply chain due diligence are set to significantly impact operations, demanding greater transparency on environmental and social impacts.

These evolving legal frameworks require companies to provide detailed information on carbon emissions and material usage, posing compliance challenges. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD) mandates extensive reporting for many companies, with phased implementation beginning in 2024 for large public interest entities, which could include suppliers or partners of Ahlers.

Failure to adhere to these stringent sustainability requirements can lead to substantial penalties, including fines, and severe reputational damage. This also translates to increased operational costs as companies must invest in data collection, reporting systems, and potentially re-engineer their supply chains to meet new standards.

Adapting to these evolving legal landscapes necessitates significant investment in new technologies, processes, and expertise. Ahlers will need to make strategic adjustments to its business model and supply chain management to ensure compliance and mitigate these risks effectively.

Shifting Consumer Preferences Towards Secondhand and Value

A significant threat to Ahlers AG is the escalating consumer preference for secondhand apparel, driven by a desire for value and a departure from the traditional new-purchase model. This trend is particularly pronounced among younger consumers, who are increasingly embracing resale platforms and seeking out budget-friendly options. For instance, the global secondhand apparel market was projected to reach $350 billion by 2027, indicating substantial growth and a direct challenge to new apparel sales. If Ahlers fails to adapt by integrating circular economy principles or enhancing its value proposition, it could see market share eroded by both resale specialists and other value-focused retailers.

This shift in consumer behavior directly impacts the fast fashion consumption patterns that have historically fueled the apparel industry. Companies like Ahlers, whose business models may rely on frequent new collections, face a direct challenge from the growing popularity of pre-owned clothing.

- Growing Resale Market: The secondhand clothing market is expanding rapidly, offering consumers more affordable alternatives.

- Value-Conscious Consumers: A significant segment of the market prioritizes price and deals over purchasing brand new items.

- Environmental Concerns: Sustainability awareness is driving some consumers towards secondhand options to reduce their environmental footprint.

- Competitive Pressure: Failure to address this trend could lead to lost sales to resale platforms and other value-oriented competitors.

Potential for Supply Chain Disruptions and Rising Costs

The fashion industry, including companies like Ahlers AG, grapples with intricate supply chains that are vulnerable to a range of disruptions. Geopolitical shifts, trade disputes, and unexpected global events such as the lingering effects of the COVID-19 pandemic on logistics can create significant challenges. For instance, disruptions in key manufacturing regions can directly impact production timelines and the availability of materials.

These disruptions invariably translate into rising costs. Increased raw material prices, driven by scarcity or higher processing expenses, and escalating transportation and shipping fees, a trend observed globally throughout 2024, directly affect profitability. Ahlers AG, like its peers, faces these pressures which can erode profit margins if not effectively managed.

The fragmented nature of the fashion value chain, from sourcing raw materials to manufacturing and distribution, amplifies these risks. Discussions around sustainability in fashion often highlight this complexity, revealing numerous points where interruptions can occur. This intricate web means that a problem in one segment can have cascading negative effects across the entire operation.

Consequently, Ahlers AG's operational efficiency and overall profitability are susceptible to these external threats. The ability to navigate these supply chain complexities and mitigate cost increases will be crucial for maintaining a competitive edge in the dynamic fashion market. For example, companies that diversified their sourcing in 2024 reported greater resilience compared to those heavily reliant on single regions.

- Geopolitical Instability: Events like regional conflicts or sanctions can halt production or reroute shipments, increasing lead times and costs.

- Trade Tensions: Tariffs and trade barriers between countries can significantly raise the cost of imported raw materials and finished goods.

- Logistical Bottlenecks: Port congestion, container shortages, and rising fuel prices, as seen in 2024, continue to inflate transportation expenses.

- Climate Change Impacts: Extreme weather events can disrupt agricultural production of natural fibers or damage manufacturing facilities, leading to supply shortages.

Ahlers faces significant threats from the intensifying competition within the German menswear market, a sector valued at approximately €33.7 billion in 2023. This crowded landscape, filled with both established brands and agile niche players, necessitates continuous innovation and differentiation to avoid market share erosion.

The company must also contend with increasing regulatory scrutiny on sustainability, particularly in the EU, with directives like the Ecodesign for Sustainable Products Regulation impacting operations and demanding greater transparency. Failure to comply can result in penalties and reputational damage, requiring substantial investment in new technologies and processes.

Furthermore, the burgeoning secondhand apparel market, projected to reach $350 billion by 2027, presents a direct challenge to traditional new-purchase models, especially among younger consumers. Ahlers must adapt by integrating circular economy principles or enhancing its value proposition to counter this growing trend.

Supply chain disruptions, fueled by geopolitical instability, trade tensions, and logistical bottlenecks, also pose a considerable threat, leading to rising raw material and transportation costs, as exemplified by global shipping expenses in 2024.

SWOT Analysis Data Sources

This analysis is built upon comprehensive data, including Ahlers' official financial reports, detailed market research, and expert industry commentary to provide a robust and accurate SWOT assessment.