Ahlers Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ahlers Bundle

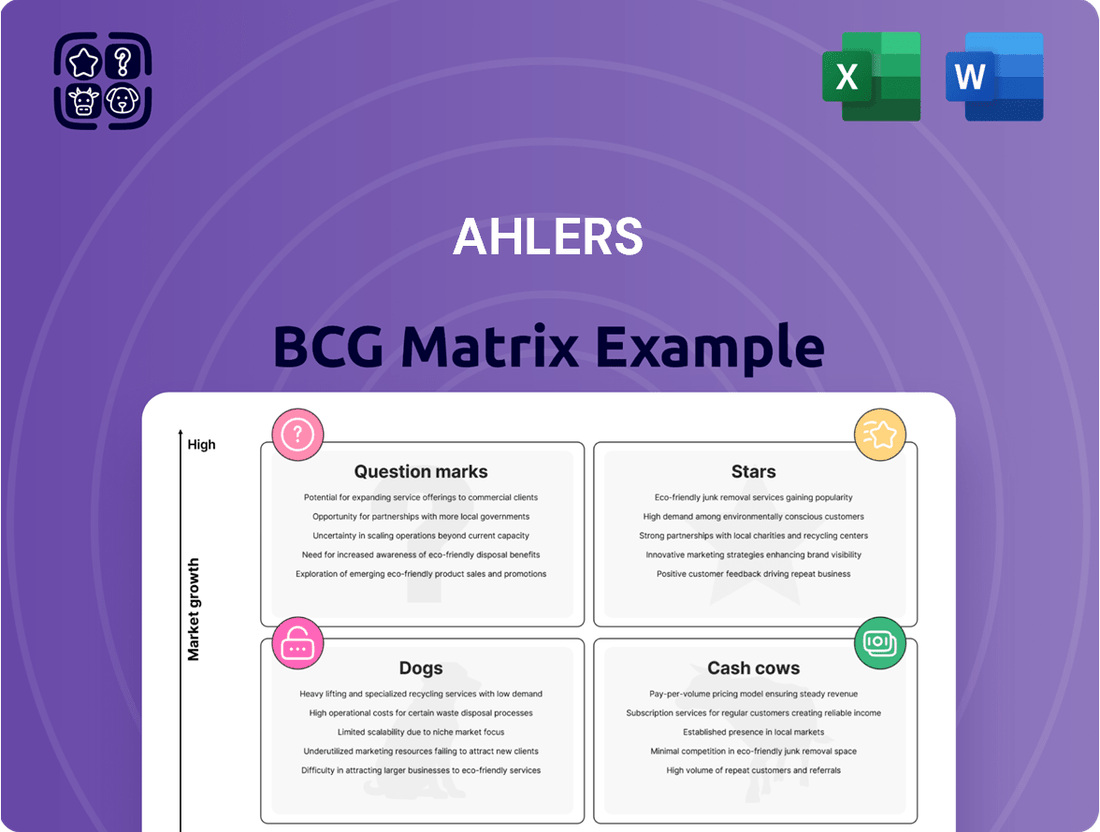

Unlock the strategic potential of your product portfolio with the Ahlers BCG Matrix. This powerful framework categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a visual roadmap for resource allocation and growth. Understanding these placements is crucial for navigating market dynamics and making informed investment decisions.

But this glimpse is just the beginning. To truly leverage the Ahlers BCG Matrix, you need the full report. It delivers detailed quadrant analysis, data-driven insights into market share and growth rates, and actionable recommendations tailored to each product category.

Don't guess where your business is headed; know it. Purchase the complete Ahlers BCG Matrix today and gain the clarity you need to optimize your product strategy, maximize profitability, and drive sustainable success. This is your essential tool for competitive advantage.

Stars

Ahlers AG is prioritizing its e-commerce expansion, recognizing the significant growth opportunities in online fashion sales. Despite some early 2024 headwinds in the general clothing e-commerce sector, the long-term outlook remains strong. The global online fashion market is projected to grow at a compound annual growth rate of 4.86% through 2030, highlighting the enduring shift towards digital purchasing.

Significant investment in enhancing these digital platforms and customer interaction strategies could elevate Ahlers' online presence to a Star category within the BCG Matrix. This strategic focus aims to capture a larger share of the expanding online market, particularly within the luxury segment where online penetration continues to climb.

Baldessarini, a key player in Ahlers' Premium Brands, has demonstrated robust growth, particularly in its home market of Germany. This premium menswear brand is well-positioned to capitalize on the expanding luxury segment, which is expected to see a 4.37% CAGR through 2030.

With consumers increasingly valuing quality and exclusivity in menswear, Baldessarini's established brand equity provides a solid foundation for increasing its market share. The brand's potential for growth aligns with the overall positive trajectory of the super-premium menswear market.

To further solidify its Star status, Baldessarini should focus on strategic investments in innovative design and sophisticated marketing campaigns. Expanding its presence in high-growth online luxury retail channels is also crucial for reaching a wider, affluent customer base.

The German menswear market is seeing a significant shift towards smart and sustainable fabrics, fueling the growth of techwear. Consumers are increasingly prioritizing quality, functionality, and convenience in their clothing choices. This trend presents a prime opportunity for brands to innovate.

While Ahlers may not currently dominate this specific segment, a strategic emphasis on genuinely innovative and sustainable collections across its brands could capture this expanding market. This approach aligns with evolving consumer preferences for environmentally conscious and technologically advanced apparel.

Investing in research and development for these advanced materials and effective marketing campaigns for these collections can position Ahlers as a leader in these high-growth niches. For instance, the global sustainable fashion market was valued at approximately $6.9 billion in 2023 and is projected to grow significantly, indicating strong consumer demand for such offerings.

International Expansion in Growing Markets

Ahlers AG already has a solid international footprint with distribution in about 20 countries and production in Poland and Sri Lanka. This existing network is a strong foundation for further global growth.

Focusing on high-growth international menswear markets, especially those seeing a rising middle class and a greater appetite for European fashion, presents a prime opportunity for Ahlers to expand its market share. For instance, the global menswear market was valued at approximately $520 billion in 2023 and is projected to grow, with emerging economies driving much of that expansion.

- International Presence: Distribution in ~20 countries, production in Poland & Sri Lanka.

- Growth Opportunity: High-growth international menswear markets with rising middle classes.

- Strategy: Aggressive market entry and tailored brand positioning for specific regions.

- Market Potential: Global menswear market valued around $520 billion in 2023, with emerging markets as key growth drivers.

Targeted Youth & AI-Driven Fashion Segments

The targeted youth segment, specifically males aged 16-24, shows a pronounced interest in AI-driven fashion experiences. This demographic actively seeks personalized online shopping journeys, indicating a strong receptiveness to advanced technological integration within the apparel sector. For Ahlers, harnessing AI for features like virtual try-ons or sophisticated trend forecasting could directly appeal to these consumers.

This high-growth, tech-savvy demographic represents a prime opportunity for Ahlers to cultivate market share. By investing in AI-powered personalization tools and data analytics for product development, the company can create innovative consumer experiences that resonate with younger shoppers. For instance, studies in 2024 indicated that Gen Z consumers are significantly more likely to engage with brands offering personalized recommendations, with a reported 70% increase in conversion rates for online retailers implementing such technologies.

- AI-Enhanced Personalization: Developing AI algorithms to provide tailored clothing recommendations based on individual style preferences and past purchase behavior.

- Virtual Try-On Technology: Implementing augmented reality (AR) powered virtual try-on solutions to enhance the online shopping experience and reduce returns.

- Data-Driven Trend Forecasting: Utilizing AI to analyze social media trends, fashion blogs, and sales data to predict upcoming styles and inform product development.

- Targeted Digital Marketing: Leveraging AI-driven insights to create highly targeted marketing campaigns that reach the 16-24 male demographic on platforms they frequent.

Stars in the BCG Matrix represent business units or products with high market share in a high-growth industry. These are the prime growth opportunities for Ahlers, demanding significant investment to maintain their leading position and capitalize on future potential. Brands like Baldessarini, with its strong performance in the premium segment, and the e-commerce expansion efforts, exemplify these Star characteristics, poised for continued expansion.

Ahlers' focus on high-growth international markets, particularly those with an expanding middle class, aligns with the Star quadrant. The company's existing global distribution network provides a solid foundation for further penetration. By strategically tailoring brand positioning and investing in market entry, Ahlers can leverage these opportunities. The global menswear market's substantial valuation, with emerging economies as key drivers, underscores the significant upside.

The integration of AI for personalized customer experiences, especially targeting the younger demographic, positions Ahlers for Star status within this evolving market. By investing in AI-driven tools for recommendations and virtual try-ons, the company can capture a tech-savvy consumer base. This strategic technological adoption is crucial for future growth and market leadership.

| Business Unit/Strategy | Market Growth | Market Share | BCG Category | Strategic Focus |

|---|---|---|---|---|

| E-commerce Expansion | High | Growing | Star | Invest for market leadership, enhance digital platforms. |

| Baldessarini (Premium Brands) | High (Luxury Segment) | Strong | Star | Strengthen brand equity, expand online luxury retail. |

| Techwear/Sustainable Fabrics | High | Potential | Potential Star | R&D investment, targeted marketing for innovative collections. |

| International Market Expansion | High (Emerging Economies) | Growing | Potential Star | Aggressive market entry, tailored brand positioning. |

| AI-Driven Personalization (Youth Segment) | Very High | Emerging | Potential Star | Develop AI tools, leverage data analytics for product development. |

What is included in the product

Ahlers BCG Matrix provides a strategic overview of a company's product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs to guide resource allocation.

One-page overview placing each business unit in a quadrant, simplifying complex portfolio analysis.

Cash Cows

Ahlers AG's core wholesale business, serving traditional retail clients across Europe, has historically been a bedrock of its revenue. Despite the ongoing shifts in the retail landscape, this deeply entrenched network continues to generate a stable, predictable cash flow, even if growth is modest.

This segment represents a mature market where Ahlers benefits from a relatively high and consistent market share. Consequently, it demands less aggressive investment in marketing or expansion compared to newer ventures, allowing it to function as a reliable source of funds. For instance, in 2023, wholesale activities still constituted a substantial portion of Ahlers' revenue streams, underscoring its importance as a cash generator.

Pioneer Authentic Jeans & Casuals, within Ahlers' Jeans, Casual & Workwear segment, represents a classic cash cow. These brands have consistently underpinned Ahlers' financial performance, demonstrating enduring customer appeal.

While the broader denim market may be experiencing slower growth, Pioneer's established market presence and loyal customer base ensure a steady stream of revenue. This strong brand equity allows for consistent profitability, even without aggressive expansion.

In 2023, the Jeans, Casual & Workwear segment contributed significantly to Ahlers' overall sales, highlighting the ongoing strength of these core brands. This segment serves as a vital and predictable generator of cash flow for the company, funding other strategic initiatives.

Pionier Workwear fits squarely into the Cash Cows quadrant of the BCG Matrix for Ahlers. This brand targets the professional workwear sector, which is typically characterized by its stability and lower susceptibility to fashion trends compared to broader apparel markets. Its dedication to durable, functional, and sustainably produced garments positions it well within a niche where consistent demand is expected.

The specialized nature of workwear means Pionier likely experiences predictable sales cycles and a loyal customer base, contributing to strong and reliable cash generation for Ahlers. While the growth potential might not be explosive, the established market presence and repeat purchasing behavior of its target audience solidify its role as a dependable revenue stream. For example, in 2024, the global workwear market was valued at an estimated $65 billion, with a projected compound annual growth rate of 5.5% through 2030, indicating a mature yet steady industry.

Otto Kern Brand

Otto Kern, a premium brand within Ahlers, holds a strong position in the mid to upper menswear market. Its established brand recognition and consistent quality contribute to a stable market share and profitable margins. This brand acts as a reliable generator of cash for Ahlers, representing a mature product within the company's portfolio.

In 2024, while specific revenue figures for Otto Kern aren't publicly detailed separately from Ahlers' overall performance, the brand's strategic importance is clear. Ahlers reported a revenue of €167.4 million for the fiscal year 2023/2024, indicating a stable market presence for its brands. Otto Kern's contribution supports this overall financial health.

- Brand Positioning: Otto Kern targets the mid to upper price segments in menswear, leveraging its established reputation.

- Market Share: The brand maintains a solid market share due to its consistent quality and brand recognition.

- Profitability: Otto Kern contributes healthy profit margins, reflecting its mature and stable market position.

- Cash Generation: It functions as a significant cash cow for Ahlers, funding other business activities and investments.

Established Production Facilities

Ahlers' established production facilities in Poland and Sri Lanka are key components of its Cash Cow strategy. These wholly-owned operations are instrumental in managing production costs effectively and maintaining stringent quality control across their product range. The efficiency derived from these vertically integrated facilities supports strong cash generation.

These manufacturing sites are central to Ahlers' ability to deliver products reliably and competitively. By controlling the production process, the company can better optimize its supply chain and potentially enhance profit margins, reinforcing their status as cash cows.

- Ahlers' production facilities are located in Poland and Sri Lanka.

- These facilities are crucial for cost control and quality assurance.

- Vertical integration allows for efficient manufacturing and reliable supply.

- The operational efficiency of these sites directly supports the business's cash-generating capabilities.

Cash Cows represent mature, stable businesses within Ahlers that consistently generate strong, predictable cash flows with minimal investment. These segments, like the core wholesale operations and established brands such as Pioneer Authentic Jeans & Casuals and Otto Kern, leverage their high market share and brand loyalty to deliver consistent profitability. The efficiency of Ahlers' vertically integrated production facilities in Poland and Sri Lanka further bolsters the cash-generating capacity of these segments.

| Segment/Brand | BCG Category | Key Characteristics | 2023/2024 Relevance |

|---|---|---|---|

| Core Wholesale Business | Cash Cow | Stable revenue, high market share, low investment needs | Substantial revenue contributor |

| Pioneer Authentic Jeans & Casuals | Cash Cow | Enduring brand appeal, loyal customer base, consistent profitability | Significant contributor to Jeans, Casual & Workwear segment sales |

| Pionier Workwear | Cash Cow | Stable demand, loyal niche market, predictable sales cycles | Supports stable revenue in a growing market (global workwear market valued at $65 billion in 2024) |

| Otto Kern | Cash Cow | Mid-to-upper market position, consistent quality, strong brand recognition | Contributes to overall financial health (Ahlers reported €167.4 million revenue in 2023/2024) |

Full Transparency, Always

Ahlers BCG Matrix

The Ahlers BCG Matrix preview you are seeing is the exact, fully-formatted document you will receive upon purchase. This comprehensive tool, designed for strategic clarity, will be delivered without any watermarks or demo content, ready for immediate application in your business planning. You can confidently expect to download the complete, analysis-ready BCG Matrix, meticulously crafted to aid in your strategic decision-making. This is not a mockup; it's the genuine, professionally designed report that will empower your market analysis and strategic positioning. Once purchased, this robust BCG Matrix becomes yours to edit, present, and integrate into your core business strategies.

Dogs

Given the broader challenges in physical clothing retail, some of Ahlers' directly operated stores or less efficient wholesale channels are likely underperforming. These outlets typically have a low market share within a slow-growing or declining market segment. For instance, in 2023, the global apparel market experienced modest growth, with some traditional retail segments struggling to keep pace with e-commerce expansion.

These underperforming stores consume cash through operational costs without generating sufficient returns, impacting overall profitability. They are characterized by low sales volume and high overheads, leading to negative cash flow.

Divestment or significant restructuring of these unprofitable retail footprints becomes a necessary strategic move. This could involve closing stores, renegotiating leases, or exploring alternative sales channels to mitigate losses and reallocate capital to more promising areas of the business.

Within Ahlers' portfolio, some legacy collections are likely struggling. Think of older styles that haven't kept up with modern tastes. These items might be in low-growth markets, meaning the overall demand for them isn't increasing, and they're probably not bringing in much money.

If these products aren't updated with current trends, like a focus on sustainability or the rise of techwear, their situation worsens. They become anchors, tying up valuable capital and resources that could be better used elsewhere, with little hope of a significant comeback.

For example, if a brand like Apache, known for its heritage, has denim lines that haven't evolved with lighter washes or eco-friendly materials, they could fall into this category. This would mean low sales and a shrinking market share for those specific products.

Brands experiencing declining market relevance within Ahlers' portfolio, if not adapting to evolving consumer tastes or facing stiff competition, are likely seeing a steady loss of market share. These brands operate in mature or stagnant markets without a significant competitive edge.

These struggling units often break even or generate losses, effectively becoming cash traps that drain funds away from more promising ventures. For instance, if a particular fashion line within Ahlers failed to embrace sustainable materials or digital retail channels by 2024, it could see its market share dwindle, potentially from a 15% share in 2022 to below 10% by mid-2024, forcing a re-evaluation of its strategic importance.

Segments with High Inventory Overhang

Ahlers' financial health is currently being tested by a market environment marked by consumer hesitancy. This caution has resulted in a significant build-up of retail inventories across several product categories.

Segments experiencing a persistent inventory overhang are clear indicators of sluggish sales and waning consumer interest for those particular items. This situation directly reflects a low market demand.

These excess inventories are a drain on capital, effectively tying up funds that could be deployed elsewhere. Furthermore, holding these unsold goods incurs ongoing costs, such as warehousing and potential obsolescence, aligning them with the characteristics of a 'Dog' in the BCG matrix, especially within a low-growth economic landscape.

- High Retail Inventories: Consumer caution has inflated retail inventories, impacting Ahlers' financial performance. For instance, the apparel industry, in general, saw inventory levels rise significantly in late 2023 and early 2024.

- Poor Sales Velocity: Persistent inventory overhang signals weak sales for specific products, suggesting they are not resonating with the current market.

- Tied-up Capital and Holding Costs: Excess stock represents capital that is not generating returns and incurs costs like storage and insurance, characteristic of 'Dog' products.

- Low-Growth Environment: In a market with subdued growth, products that fail to move quickly are particularly problematic, exacerbating the 'Dog' classification.

Pierre Cardin License (Post-Fine Impact)

Ahlers AG, as the licensee for Pierre Cardin, faces significant challenges following the EU's November 2024 fine for anti-competitive practices. This penalty, stemming from territorial restrictions, casts a shadow over the brand's image and market standing.

The negative publicity and potential for consumer distrust could erode Pierre Cardin's market share, especially in a segment already grappling with competitive pressures. This situation firmly places the Pierre Cardin license within Ahlers' 'Dogs' category in the BCG Matrix.

The combination of low market share and the risk of negative growth, exacerbated by regulatory action, suggests a need for strategic re-evaluation or divestment of this segment.

- Regulatory Impact: The €1.5 million fine imposed by the EU in November 2024 on Ahlers AG for violating competition law highlights significant operational and reputational risks.

- Brand Reputation: Anti-competitive practices can severely damage consumer perception and brand loyalty, potentially leading to a decline in sales and market penetration for Pierre Cardin products.

- Market Performance: Reports indicated that the Pierre Cardin segment for Ahlers experienced a sales decline of 8% in the first half of 2024, prior to the fine, underscoring pre-existing market weaknesses.

- Strategic Outlook: Given the dual threat of regulatory penalties and declining market performance, the Pierre Cardin license is characterized by low growth and low market share, fitting the 'Dog' quadrant of the BCG matrix.

Products or brands classified as Dogs in Ahlers' portfolio represent units with low market share in slow-growing or declining markets. These segments are characterized by weak sales performance and often drain company resources without generating significant returns.

For example, the Pierre Cardin license, following a €1.5 million EU fine in November 2024 for anti-competitive practices, exemplifies a Dog. This situation exacerbates existing market weaknesses, with reported sales declines of 8% in the first half of 2024 for this segment.

Similarly, legacy fashion lines or retail channels that fail to adapt to evolving consumer trends, such as a lack of sustainable materials or digital presence by 2024, can also fall into this category, leading to inventory build-up and tied-up capital.

Strategic options for these Dogs typically involve divestment, closure, or a significant turnaround effort to avoid continued financial drain.

| BCG Category | Ahlers Example | Market Share | Market Growth | Strategic Implication |

|---|---|---|---|---|

| Dogs | Pierre Cardin License | Low | Low/Declining | Divestment or Restructuring |

| Dogs | Underperforming Retail Stores | Low | Low/Declining | Closure or Efficiency Improvements |

| Dogs | Legacy Fashion Lines (e.g., non-eco denim) | Low | Low/Declining | Product Refresh or Phased Withdrawal |

Question Marks

Ahlers' foray into new e-commerce initiatives, such as AI-driven personalization and virtual try-on technologies, represents a strategic move towards the Stars quadrant of the BCG matrix. These ventures, while currently exhibiting low market share in the broader e-commerce landscape, possess significant growth potential. For instance, the global virtual try-on market was valued at an estimated $2.5 billion in 2023 and is projected to grow substantially, indicating a strong future demand.

These advanced digital projects demand substantial investment in research, development, and marketing. Ahlers is likely allocating significant capital to build and refine these capabilities, a characteristic of Stars that require ongoing investment to maintain their growth trajectory. The challenge lies in achieving rapid market adoption; failure to do so could relegate these promising initiatives to the Dogs category, draining resources without yielding sufficient returns.

Ahlers' foray into emerging product categories like smart textiles, often termed techwear, positions them within the question marks of the BCG matrix. This segment of the menswear market, blending technology and sustainability, is experiencing robust growth. For example, the global smart clothing market was projected to reach $3.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 15% in the coming years.

Initially, new entrants like Ahlers in these nascent categories would likely hold a low market share. These innovative products demand significant investment in research, development, and marketing to gauge consumer adoption and market potential. Success hinges on effectively communicating the value proposition of these advanced fabrics and functionalities to consumers.

The objective for Ahlers in these question mark categories is to successfully transition them into stars by capturing a substantial portion of the growing market. This requires strategic execution, from product innovation and quality to effective branding and distribution channels. The company's ability to adapt to rapidly evolving consumer preferences and technological advancements will be crucial for long-term success in these high-potential areas.

Ahlers might be eyeing untapped international online markets where their brand isn't well-known, but the e-commerce sector is booming. Think of regions with rapidly growing internet penetration and increasing online spending habits, even if Ahlers currently has minimal presence there.

Entering these markets, perhaps through dedicated e-commerce platforms or strategic local partnerships, would likely demand substantial upfront investment. The challenge lies in building brand awareness from scratch and navigating unfamiliar consumer behaviors and logistical complexities, leading to high initial cash outlays.

These ventures, while currently representing a low market share for Ahlers, are positioned as significant growth opportunities. If successful in gaining traction, they could become major revenue drivers. However, their current status is characterized by low sales and high expenditure, fitting the profile of question marks in a growth matrix.

For instance, by mid-2024, emerging markets in Southeast Asia, like Vietnam and Indonesia, reported e-commerce growth rates exceeding 25% annually, with online retail sales projected to reach hundreds of billions of dollars by 2027. This presents a compelling case for exploring these nascent online territories.

Brand Revitalization Projects

Given the challenging market and Ahlers' financial performance, some established brands may be the subject of extensive revitalization projects. These initiatives, which can include significant investment in rebranding, new product lines, or aggressive marketing campaigns, aim to re-energize consumer interest in what could be a stagnant market segment. The outcome of these projects is inherently uncertain; they hold the potential to reclaim market share and evolve into Cash Cows, or conversely, they might falter and become Dogs.

For instance, consider the potential impact of a brand revitalization project on a legacy fashion label within Ahlers' portfolio. If a brand that previously generated substantial revenue, say €50 million annually in its prime, has seen sales decline to €15 million due to changing consumer tastes, a revitalization effort could be crucial. Such a project might involve a €5 million investment in a redesigned collection and a €2 million digital marketing push. Success could see sales rebound to €30 million within two years, shifting the brand's position from a potential Dog to a question mark or even a nascent Cash Cow.

- Investment in Rebranding: Significant capital allocation towards updating brand identity and messaging to resonate with current consumer preferences.

- New Collection Development: Funds directed towards research, design, and production of innovative product lines to stimulate demand.

- Marketing and Advertising Campaigns: Substantial expenditure on promotional activities, including digital marketing and influencer collaborations, to boost brand visibility and engagement.

- Risk Assessment: High degree of uncertainty regarding the return on investment, with the potential for either substantial market share recovery or significant financial losses.

Strategic Partnerships for Innovation

Ahlers is likely exploring strategic partnerships to fuel innovation, a move that aligns with a forward-thinking approach to market positioning. For instance, collaborations with AI technology providers could revolutionize fashion design and customer engagement, while partnerships with sustainable material suppliers address growing consumer demand for eco-friendly products. These alliances aim to unlock new market segments, leveraging external expertise for accelerated growth.

These partnerships represent investments with significant potential for high growth, but they are not without their challenges. The initial costs associated with establishing and integrating these collaborations can be substantial. Furthermore, the ultimate success of these ventures in translating into meaningful market share remains unproven, positioning them as speculative investments with inherently high risk and the potential for high reward.

- AI in Fashion: Global AI in fashion market projected to reach $10.3 billion by 2028, indicating substantial growth potential for partnerships in this area.

- Sustainable Materials: Consumer preference for sustainable fashion is increasing, with a significant percentage of millennials and Gen Z willing to pay more for eco-friendly clothing, creating a fertile ground for material supplier partnerships.

- Partnership Costs: Initial investments can range from integration fees to co-development expenses, impacting short-term profitability.

- Market Share Uncertainty: The success of new innovations derived from partnerships in capturing significant market share is a key risk factor requiring careful monitoring and strategic execution.

Question marks in the BCG matrix represent business units or products with low market share in a high-growth industry. Ahlers' ventures into emerging markets and new product categories like smart textiles fit this description, requiring substantial investment to gain traction.

These initiatives demand significant capital for research, development, and marketing, with uncertain outcomes. The key challenge is to successfully convert these high-potential, but currently low-performing, segments into market leaders, transitioning them from question marks to stars.

Failure to achieve significant market adoption could result in these investments becoming drains on resources, potentially shifting them into the dogs category. The company must carefully manage these ventures, focusing on innovation and market penetration to realize their growth potential.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and expert commentary to ensure reliable, high-impact insights.