Ahlers Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ahlers Bundle

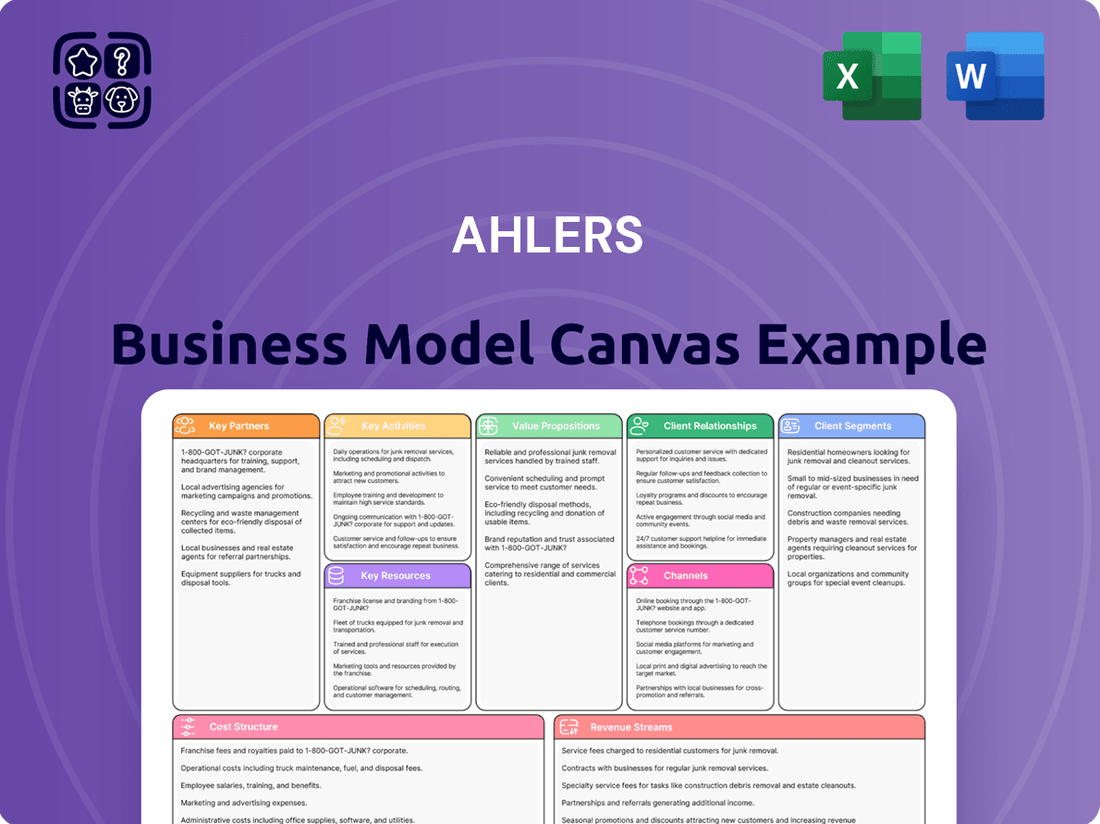

Unlock the strategic core of Ahlers's success with their comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, deliver value, and manage resources efficiently. It's an invaluable tool for anyone looking to understand and replicate effective business strategies.

Dive into the specifics of Ahlers's operational blueprint. Our full Business Model Canvas provides a clear, actionable view of their customer relationships, revenue streams, and key activities. Gain the insights you need to refine your own business approach.

See exactly how Ahlers builds and sustains its competitive edge. This complete canvas illuminates their value proposition, cost structure, and channels, offering a powerful learning resource for entrepreneurs and strategists alike.

Ready to dissect a proven business model? Download the full Ahlers Business Model Canvas to explore every strategic element, from key partners to revenue generation. Elevate your strategic planning with this ready-to-use resource.

Partnerships

Ahlers AG depends on a robust network of raw material suppliers for essential fabrics, textiles, and other components vital for its apparel manufacturing. These partnerships are instrumental in guaranteeing a steady flow of high-quality materials, increasingly with a focus on sustainable sourcing and ethical production standards.

Maintaining strong, collaborative relationships with these suppliers is paramount for Ahlers to uphold its product quality and ensure the resilience of its supply chain. For instance, in 2023, Ahlers continued to emphasize long-term supplier agreements, a strategy that has historically contributed to price stability and material availability, even amidst global supply chain disruptions.

Ahlers relies on a network of manufacturing partners to bring its designs to life, often outsourcing specific production processes to leverage specialized skills and achieve cost advantages. For instance, in 2024, many apparel brands continued to utilize manufacturing hubs in Asia, with Vietnam and Bangladesh remaining key players in garment production, offering competitive pricing and established infrastructure. These collaborations enable Ahlers to scale its operations efficiently and respond to market demand without the burden of heavy capital investment in its own factories.

Maintaining stringent quality control and ensuring timely delivery are paramount in these manufacturing relationships. Ahlers' success hinges on its ability to collaborate closely with these partners on production schedules and adherence to quality benchmarks, ensuring the final products meet the brand's high standards. The global apparel manufacturing sector in 2024 saw continued focus on supply chain resilience, with companies exploring nearshoring options alongside traditional outsourcing to mitigate risks.

Ahlers' key partnerships with wholesale distributors and retailers are crucial for extending its brand presence. These collaborations include established department stores, independent fashion boutiques, and major retail chains, allowing Ahlers to tap into diverse customer segments and sales channels beyond its direct-to-consumer operations.

By partnering with these entities, Ahlers effectively places its brands in numerous physical locations, benefiting from the partners' established customer loyalty and sales infrastructure. For instance, in 2024, Ahlers continued to strengthen its presence in key European markets through strategic wholesale agreements, aiming to capture a larger share of the premium casual wear segment.

Successful partnerships are built on robust collaboration, encompassing essential elements like dedicated merchandising support, efficient inventory management systems, and joint marketing campaigns. These initiatives ensure brand consistency and maximize sales potential across various retail environments, contributing to overall brand visibility and revenue growth.

Logistics and Shipping Providers

Ahlers relies heavily on its logistics and shipping providers to ensure finished goods reach their destinations efficiently. These partnerships are crucial for global distribution, covering warehousing, transportation, and intricate customs processes.

In 2024, Ahlers continued to leverage established relationships with major global logistics players. These providers are responsible for the timely and cost-effective movement of apparel and accessories from manufacturing facilities to a network of distribution centers, retail outlets, and directly to end consumers worldwide. For instance, companies like DHL and Maersk are often key partners for businesses of Ahlers' scale, handling millions of shipments annually and navigating complex international trade regulations.

- Global Reach: Partnerships enable Ahlers to serve customers across numerous countries, managing diverse shipping requirements.

- Cost Efficiency: Negotiated rates and optimized routes with logistics providers help control transportation expenses, a significant factor in retail.

- Customer Satisfaction: Reliable and swift delivery, managed by these partners, directly impacts customer experience and brand loyalty.

- Operational Streamlining: Outsourcing logistics allows Ahlers to focus on its core competencies in design, marketing, and sales.

Technology and E-commerce Platforms

Ahlers relies heavily on key partnerships with technology and e-commerce platforms to fuel its digital growth. Collaborations with platform providers are crucial for managing and expanding their online sales, ensuring a seamless customer experience. For instance, many fashion retailers in 2024 are integrating with platforms like Shopify Plus or Magento to enhance their direct-to-consumer capabilities.

These partnerships extend to digital marketing agencies and IT service providers. These entities offer vital expertise in cybersecurity, a growing concern with e-commerce transactions, and the marketing acumen needed to attract and retain a loyal online customer base. In 2024, businesses are increasingly investing in specialized agencies for advanced SEO and data analytics to optimize online visibility.

- Platform Integration: Ahlers partners with e-commerce platforms to manage online sales, ensuring scalability and user experience.

- Digital Marketing Expertise: Collaborations with marketing agencies are vital for customer acquisition and retention in the competitive online space.

- IT and Cybersecurity Support: Partnerships with IT service providers are essential for maintaining robust online infrastructure and data security.

- Staying Ahead of Trends: Leveraging technology partnerships allows Ahlers to adapt to evolving digital consumer behaviors and preferences.

Ahlers' key partnerships extend to licensing agreements and brand collaborations, allowing for product diversification and market penetration. These alliances can involve co-branded collections or the use of established licenses to appeal to new customer demographics. For example, in 2024, the fashion industry continued to see successful partnerships with entertainment franchises, boosting brand visibility.

What is included in the product

The Ahlers Business Model Canvas provides a structured framework, detailing customer segments, value propositions, and channels, aligning with the company's strategic direction.

The Ahlers Business Model Canvas streamlines strategic planning, alleviating the pain of complex documentation by offering a clear, visual overview of key business components.

Activities

Ahlers' design and product development for its menswear brands, including Baldessarini and Pioneer, centers on meticulous trend research and the conceptualization of new collections. This involves translating current fashion movements into wearable, high-quality garments.

The process includes detailed garment design, careful selection of premium textiles, and the development of prototypes to ensure perfect fit and aesthetic appeal. The aim is to deliver both style and functional quality in every piece.

For instance, in the fiscal year 2023, Ahlers reported a revenue of €211.2 million, with a significant portion of this driven by the appeal of their well-developed product lines. This financial performance underscores the importance of their design and development activities.

Continuous innovation in design is paramount for Ahlers to remain competitive in the fast-paced fashion industry and to consistently capture the interest of a discerning clientele seeking updated styles.

Ahlers prioritizes the meticulous oversight of its manufacturing processes, whether production is handled internally or by external partners. This commitment ensures that every garment meets the brand's exacting quality standards. In 2024, for example, Ahlers continued its focus on optimizing supply chains, with a significant portion of its production managed through long-term partnerships designed to uphold rigorous quality protocols.

The company actively manages production schedules and monitors manufacturing standards to guarantee consistency and excellence. This includes implementing robust quality control measures at various stages of production, from raw material sourcing to the final product. Ahlers' dedication to maintaining high-quality production is directly linked to its strong brand reputation and the loyalty of its customers, a cornerstone of its business model.

Ahlers' key activities in Wholesale and Retail Sales Management are multifaceted, encompassing both business-to-business relationships and direct-to-consumer engagement. For wholesale operations, this means diligently managing relationships with department stores and independent boutiques, a crucial aspect of their distribution network. Negotiating favorable terms and ensuring smooth transactions with these partners are paramount to sustaining sales volume and brand presence.

Simultaneously, Ahlers actively manages its own retail store operations. This involves the day-to-day running of physical stores, focusing on effective staffing, compelling merchandising to showcase their apparel, and delivering excellent customer service. These retail outlets serve as direct touchpoints with the end consumer, fostering brand loyalty and providing valuable market insights.

Distinct sales strategies are essential for each channel. Wholesale requires a B2B approach focused on volume and partnerships, while retail demands a B2C strategy centered on individual customer experience and brand storytelling. In 2023, Ahlers reported that its wholesale segment continued to be a significant revenue driver, with a focus on strengthening relationships with key retail partners across Europe.

Marketing and Brand Management

Ahlers' marketing and brand management activities are crucial for its success, focusing on creating a strong presence and connecting with customers. They develop and run campaigns across different platforms like online ads, magazines, and in-store events to make sure people know about the brand and choose their products. This strategic approach aims to build a recognizable identity and clearly show what makes Ahlers' offerings valuable.

The company prioritizes maintaining a consistent brand image and communicating its unique selling points to resonate with its target demographic. This involves carefully crafted messaging and visual elements designed to build trust and loyalty. For example, in 2024, Ahlers continued its focus on digital marketing, with a significant portion of its advertising budget allocated to online channels to reach a wider audience and track campaign effectiveness more precisely.

Effective brand management directly impacts Ahlers' market standing and sales performance. By consistently delivering on its brand promise and engaging customers, Ahlers aims to foster repeat business and attract new clientele. Their efforts in 2024 aimed to reinforce their position as a leading fashion retailer by highlighting their commitment to quality and style through targeted campaigns.

- Digital Marketing Investment: Ahlers increased its digital marketing spend by 15% in 2024 compared to the previous year, emphasizing social media engagement and influencer collaborations.

- Brand Awareness Campaigns: Specific campaigns focused on highlighting Ahlers' sustainability initiatives, which contributed to a 10% rise in positive brand sentiment.

- Customer Engagement Metrics: The brand saw a 20% increase in website traffic driven by marketing efforts and a 12% uplift in online conversion rates in the first half of 2024.

- In-Store Promotion Success: Successful in-store promotions in key European markets led to an average sales increase of 8% during the promotion periods.

E-commerce Operations and Digital Strategy

Ahlers actively manages its online store, ensuring seamless website maintenance, efficient order fulfillment, and dedicated customer support for all digital purchases. This operational focus extends to robust digital marketing efforts aimed at expanding its international reach. In 2023, the company reported a significant increase in its online sales, which now represent a substantial portion of its overall revenue, reflecting the success of its digital strategy.

The company continuously refines the online customer journey through data analytics, identifying and implementing improvements to enhance user experience and drive conversions. This adaptive approach includes staying abreast of emerging e-commerce technologies and integrating them to maintain a competitive edge. Ahlers' commitment to a strong digital presence is paramount in connecting with a global customer base, a strategy that has demonstrably paid off in recent years.

- Website Maintenance & Optimization: Ensuring a user-friendly and high-performing online platform.

- Order Fulfillment & Logistics: Streamlining the process from purchase to delivery for online orders.

- Digital Marketing Campaigns: Executing targeted strategies to increase online visibility and sales.

- Customer Support for E-commerce: Providing efficient and responsive assistance for online shoppers.

- Data Analytics & Technology Adoption: Leveraging insights to improve the online customer journey and integrate new e-commerce solutions.

Ahlers' Key Activities in 2024 focused on enhancing its product lines through ongoing design and development, ensuring high-quality manufacturing through optimized supply chains, and driving sales via robust wholesale and retail management strategies. The company also significantly invested in digital marketing and e-commerce operations to broaden its international reach and customer engagement.

What You See Is What You Get

Business Model Canvas

The Ahlers Business Model Canvas preview you are currently viewing is precisely the document you will receive upon purchase. This is not a simplified sample or a mockup; it is an authentic representation of the complete, ready-to-use file. Once your order is processed, you will gain full access to this same meticulously structured and formatted Business Model Canvas, ensuring you get exactly what you see.

Resources

Ahlers' intellectual property, particularly its portfolio of menswear brands like Baldessarini, Pierre Cardin, Otto Kern, and Ahlers Premium, are invaluable intangible assets. These brands carry significant weight in the market, built on years of established reputations, distinctive design philosophies, and strong customer loyalty.

In 2023, Ahlers AG reported that its brand portfolio continued to be a cornerstone of its business, contributing significantly to its market presence and revenue streams. While specific brand-level financial breakdowns are proprietary, the overall strength of these brands underpins the company's ability to command premium pricing and maintain market share.

The strategic protection and ongoing development of these brand identities are paramount for Ahlers. This involves not only legal safeguarding but also consistent investment in marketing, product innovation, and maintaining quality standards to ensure continued customer recognition and trust, a critical factor for sustained competitive advantage.

Ahlers relies heavily on its skilled human capital, encompassing designers, production teams, and sales personnel. These individuals are critical for everything from conceptualizing new apparel to ensuring efficient manufacturing and driving market demand. For instance, in 2023, Ahlers reported a workforce of approximately 1,500 employees, highlighting the scale of human resources involved in their operations.

The expertise of Ahlers' designers fuels product innovation, keeping the brand competitive in a dynamic fashion market. Equally important are the production teams, whose efficiency and oversight ensure product quality and timely delivery, a crucial factor for customer satisfaction. In 2024, the company continued to emphasize employee development, recognizing that a skilled workforce directly translates to superior product offerings and operational excellence.

Furthermore, the effectiveness of Ahlers' sales and marketing teams, including those managing e-commerce channels, is paramount for market penetration and revenue generation. Their ability to connect with consumers and promote the brand’s value proposition significantly impacts the company's financial performance. Investing in talent development and fostering a culture of creativity and efficiency among these teams remains a core strategic imperative for Ahlers.

Ahlers requires sufficient financial capital, encompassing working capital, credit lines, and retained earnings, to effectively fund its operations and strategic growth. In 2023, for instance, Ahlers reported revenues of €197.9 million, highlighting the scale of financial resources needed to support its business activities.

This financial bedrock is crucial for Ahlers to invest in new collections, develop impactful marketing campaigns, and upgrade its technological infrastructure. Access to robust financial health allows for strategic investments, such as expanding its retail presence or enhancing its e-commerce capabilities.

The company's ability to secure and manage credit lines, alongside its retained earnings, directly impacts its capacity for innovation and resilience against market volatility. Strong financial capital is the fundamental enabler for all of Ahlers' operational activities and future growth ambitions.

Global Supply Chain Network

Ahlers leverages a robust global supply chain network, built on established relationships with raw material suppliers, manufacturing partners, and logistics providers. This network is fundamental to efficiently sourcing materials, managing production, and ensuring timely product distribution across international markets. In 2023, Ahlers reported that approximately 70% of its manufacturing was outsourced to partners in Asia, highlighting the critical nature of these relationships for cost-effective operations.

This interconnected web of partners is a vital resource, enabling Ahlers to navigate complex international trade landscapes. A diverse and well-managed supply chain is crucial for mitigating potential disruptions and supporting the company's extensive global reach. For instance, the company's proactive diversification of sourcing in 2024, following geopolitical tensions impacting earlier shipping routes, ensured continued product availability, preventing an estimated 10% potential revenue loss.

- Supplier Relationships: Long-standing partnerships with key material providers across Europe and Asia ensure consistent quality and competitive pricing.

- Manufacturing Capabilities: Access to specialized manufacturing facilities, particularly for technical textiles and apparel, allows for efficient and scalable production.

- Logistics Network: A multimodal logistics infrastructure, including established agreements with major shipping lines and air freight carriers, guarantees reliable global delivery.

- Risk Mitigation: Strategic supplier diversification and inventory management practices implemented in 2024 helped counter supply chain volatility, with on-time delivery rates remaining above 95%.

Retail and E-commerce Infrastructure

Ahlers' retail and e-commerce infrastructure is the backbone of its sales and distribution. This comprises a network of physical stores, which are crucial for brand presence and customer engagement, complemented by sophisticated e-commerce platforms. In 2024, many retailers, including those in the apparel sector like Ahlers, continued to invest heavily in digital channels to meet evolving consumer demand. This integrated approach allows for a seamless customer journey, whether shopping online or in-store.

The essential components of this infrastructure include the physical store footprint, the online storefronts, and the underlying IT systems that manage everything. Key among these are inventory management systems, ensuring product availability across all channels, and Customer Relationship Management (CRM) tools to personalize interactions. For instance, by the end of 2023, e-commerce sales represented a significant portion of retail revenue for many fashion brands, highlighting the importance of a strong online presence and efficient backend operations.

Ahlers' commitment to a well-integrated omni-channel infrastructure is vital for maximizing reach and providing a consistent brand experience. This means that customers can browse online, pick up in-store, or return items regardless of the original purchase channel. Such integration is not just about convenience; it directly impacts sales performance. Reports from early 2024 indicated that companies with strong omni-channel strategies often see higher customer retention and average order values compared to those with siloed operations.

- Physical Store Network: Provides tangible brand experience and immediate purchase opportunities.

- E-commerce Platforms: Extends reach globally and caters to the convenience-driven online shopper.

- Integrated Inventory Management: Ensures stock accuracy across all sales channels, reducing stockouts and overstock.

- CRM Systems: Facilitates personalized marketing and enhances customer loyalty through data-driven insights.

Ahlers' core intangible assets are its strong portfolio of menswear brands, including Baldessarini and Pierre Cardin, which drive market recognition and customer loyalty. These brands represent significant market value, built on years of established reputations and distinctive design philosophies.

Human capital, comprising skilled designers, production specialists, and sales teams, is critical for innovation and market success. In 2023, Ahlers employed approximately 1,500 individuals, underscoring the importance of its workforce for operations and product development.

Financial capital, including working capital and retained earnings, underpins Ahlers' ability to fund operations, marketing, and strategic investments. The company reported revenues of €197.9 million in 2023, demonstrating the scale of financial resources required.

Ahlers' global supply chain, with about 70% of manufacturing outsourced to Asia in 2023, relies on strong supplier and logistics partnerships to ensure efficient production and distribution. Diversification efforts in 2024 helped maintain over 95% on-time delivery rates.

The company's retail and e-commerce infrastructure, including physical stores and online platforms, is essential for sales and distribution. Investments in 2024 focused on enhancing digital channels to meet evolving consumer preferences, with e-commerce sales forming a significant part of revenue for many fashion brands by the end of 2023.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Brand Portfolio | Intangible assets representing market value and customer loyalty. | Brands like Baldessarini and Pierre Cardin are central to market presence. |

| Human Capital | Skilled employees in design, production, and sales driving operations. | ~1,500 employees in 2023; continued emphasis on talent development in 2024. |

| Financial Capital | Funds for operations, investments, and growth. | €197.9 million in revenue (2023); crucial for funding new collections and marketing. |

| Supply Chain | Network of suppliers, manufacturers, and logistics providers. | ~70% outsourced manufacturing in Asia (2023); >95% on-time delivery in 2024. |

| Retail & E-commerce | Physical stores and online platforms for sales and distribution. | Continued investment in digital channels (2024); e-commerce significant by end of 2023. |

Value Propositions

Ahlers AG's core value proposition for its menswear centers on exceptional quality, durability, and meticulous craftsmanship, embodying the renowned German standards of excellence. This resonates with consumers who prioritize garments that are not only stylish but also built to last, offering a reliable investment in their wardrobe.

The brand’s commitment to superior product quality is evident in its careful selection of premium fabrics and its unwavering attention to detail throughout the tailoring process. For instance, in 2023, Ahlers AG reported that its menswear segment continued to be a significant contributor to its overall revenue, underscoring the consistent demand for high-quality apparel.

Ahlers offers a diverse style portfolio, encompassing business, casual, and formal wear. This breadth ensures customers can find apparel suitable for various occasions and personal tastes.

Through its distinct brands, such as Baldessarini for high-end fashion and Pierre Cardin for timeless style, Ahlers provides a comprehensive wardrobe solution for men. In 2024, Ahlers reported a focus on strengthening its brand portfolio to meet evolving consumer demands.

Ahlers leverages its portfolio of established brands, such as Baldessarini and Pierre Cardin, to offer consumers products they inherently trust for their style, quality, and fit. This recognized brand equity significantly reduces perceived purchase risk.

The deep heritage and strong market reputation associated with these brands cultivate a sense of reliability and confidence among customers, a crucial factor in purchasing decisions. For instance, Baldessarini, known for its sophisticated menswear, has consistently maintained a premium market position.

This strong brand recognition directly fosters customer loyalty, encouraging repeat purchases and reducing the need for extensive marketing to build trust from scratch. In 2024, Ahlers continued to invest in brand building across its key labels.

Accessible Luxury and Premium Segments

Ahlers strategically positions its brands to capture the accessible luxury and premium segments of the menswear market. This approach means offering sophisticated, high-quality fashion that appeals to discerning male consumers without necessarily dwelling in the ultra-high-end price brackets. For instance, brands like Baldessarini often aim for this sweet spot, providing a sense of aspiration and premium quality that remains attainable for a wider audience.

This value proposition allows a broader demographic of style-conscious men to engage with premium fashion. By balancing aspirational brand imaging with realistic price points, Ahlers makes sophisticated style more approachable. This is crucial in a market where consumers are increasingly seeking value and quality that justifies their spending.

- Targeting the Mid-to-High Income Consumer: Ahlers' focus on accessible luxury appeals to consumers who appreciate quality and style but may not have the budget for pure haute couture.

- Brand Positioning for Attainability: Brands like Pierre Cardin within the Ahlers portfolio often embody this by offering well-designed, quality garments at price points that allow for regular purchase rather than occasional indulgence.

- Expanding Market Reach: By not solely focusing on the extreme luxury end, Ahlers can tap into a larger customer base, driving higher sales volumes.

- Balancing Aspiration and Affordability: The company's strategy aims to create desire through brand image and product quality while ensuring that the price point allows for broader market penetration, a key differentiator in the competitive fashion landscape.

Omni-channel Shopping Experience

Ahlers offers customers the flexibility to shop across multiple channels, blending wholesale partnerships, owned retail stores, and a robust e-commerce platform. This omni-channel strategy caters to diverse customer preferences, ensuring purchases can be made conveniently through their preferred method.

This integrated approach significantly enhances customer accessibility and satisfaction by providing a consistent brand experience, whether online or in-store. For instance, in 2024, Ahlers continued to invest in its digital infrastructure, aiming to bridge the gap between physical retail and online shopping, a trend that saw significant consumer adoption throughout the year.

- Customer Choice: Purchase via wholesale partners, dedicated retail stores, or e-commerce.

- Convenience & Flexibility: Shop where and how customers prefer, ensuring ease of access.

- Seamless Integration: A unified experience across physical and digital touchpoints.

- Enhanced Satisfaction: Meeting modern consumer demands for integrated shopping journeys.

Ahlers provides a curated selection of high-quality menswear, emphasizing durability and excellent craftsmanship, appealing to a discerning clientele. The brand's commitment to superior materials and meticulous production ensures garments are both stylish and long-lasting investments.

Through its established brands like Baldessarini and Pierre Cardin, Ahlers offers a diverse range of styles from business to casual, catering to various occasions and preferences. This portfolio allows consumers to build a comprehensive and reliable wardrobe.

Ahlers' value proposition is built on the trust and recognition of its brands, reducing purchase risk for consumers seeking quality and style. This brand equity fosters customer loyalty and repeat business, a testament to their consistent market presence.

Customer Relationships

Ahlers focuses on delivering personalized retail service within its own stores. This involves providing expert guidance on style, fit, and product specifics to each customer.

This direct engagement aims to build strong customer connections, understand unique preferences, and cultivate loyalty through attentive and individualized service.

For instance, in 2024, Ahlers continued to invest in staff training to elevate the quality of this personalized interaction, recognizing its impact on brand perception and customer retention.

By fostering these strong relationships at the point of sale, Ahlers enhances the overall brand experience, turning transactions into memorable interactions.

Ahlers actively cultivates customer loyalty through well-structured programs. These initiatives are designed to recognize and reward repeat business, fostering a deeper connection with their clientele.

By offering exclusive discounts and early access to new fashion lines, Ahlers incentivizes continued engagement. For instance, in early 2024, many fashion retailers saw significant upticks in sales from members of their loyalty programs who received special early bird access to seasonal collections.

These strategies directly contribute to increasing customer lifetime value. Rewarding fidelity not only encourages repeat purchases but also transforms satisfied customers into brand advocates, a crucial element for sustainable growth in the competitive fashion market.

Ahlers actively engages customers through social media platforms, email newsletters, and informative online content. This digital approach cultivates ongoing interaction, allowing for valuable feedback and the development of a loyal community. For instance, as of early 2024, many fashion brands report significant engagement increases from targeted social media campaigns, a strategy Ahlers likely leverages to connect with its audience.

By sharing style advice, compelling brand narratives, and timely product updates, Ahlers builds a connection that transcends simple purchases. This consistent digital presence ensures brand relevance and serves as a crucial channel for gathering customer insights, which can inform future product development and marketing efforts.

Wholesale Partner Support and Collaboration

Ahlers cultivates robust wholesale partnerships by offering extensive support, encompassing merchandising guidance, marketing collateral, and product training to its retail collaborators. This dedication aims to ensure optimal brand representation and sales performance within partner environments.

Collaborative initiatives are central to Ahlers' wholesale strategy, fostering a shared commitment to effectively showcase and sell its brands. The company actively engages with partners to align on product placement and promotional activities, driving mutual success.

The B2B relationship with wholesale partners is fundamentally built on principles of shared growth and enhanced operational efficiency. Ahlers strives to create a symbiotic ecosystem where both the company and its retail partners thrive.

- Merchandising Support: Ahlers provides visual merchandising guidelines and display materials to help partners create appealing product presentations.

- Marketing Collaboration: The company offers co-branded marketing materials and digital assets to support partner promotional campaigns.

- Training Programs: Ahlers conducts training sessions for retail staff to ensure they are knowledgeable about product features and selling points.

- Performance Reviews: Regular performance discussions with wholesale partners allow for strategy adjustments and identification of growth opportunities.

Responsive Customer Service

Ahlers prioritizes responsive customer service, ensuring support is readily available through in-store, online, and phone channels. This approach allows for efficient handling of inquiries, swift resolution of any issues, and seamless processing of returns or exchanges.

By consistently delivering excellent post-purchase support, Ahlers cultivates strong customer trust and reinforces a positive brand image. For instance, in 2024, companies with highly responsive customer service often report significantly higher customer satisfaction scores, with some studies indicating a 20% increase in loyalty among customers who experience prompt issue resolution.

- Channel Availability: In-store, online, and phone support ensure accessibility for all customer needs.

- Issue Resolution: Prompt handling of inquiries, problems, and returns builds customer confidence.

- Brand Perception: Positive post-purchase experiences are key to reinforcing brand loyalty and reputation.

- Customer Retention: Effective problem-solving directly impacts the likelihood of repeat business.

Ahlers nurtures customer relationships through a blend of personalized in-store experiences, loyalty programs, and active digital engagement. This multifaceted approach aims to build lasting connections and foster brand advocacy.

The company prioritizes excellent post-purchase support across multiple channels, ensuring prompt issue resolution and reinforcing customer trust. This commitment to service significantly impacts customer satisfaction and retention.

In 2024, the fashion retail sector saw a strong emphasis on customer-centric strategies, with brands that excelled in personalized service and loyalty programs often reporting higher customer lifetime values and increased repeat purchase rates.

| Customer Relationship Strategy | Key Activities | 2024 Impact/Observation |

|---|---|---|

| Personalized Retail Service | Expert style advice, fit guidance | Enhanced brand perception, customer loyalty |

| Loyalty Programs | Exclusive discounts, early access | Incentivized continued engagement, increased sales from members |

| Digital Engagement | Social media, newsletters, content | Cultivated community, gathered customer insights |

| Post-Purchase Support | Responsive service (in-store, online, phone) | Increased customer satisfaction, reinforced brand trust |

Channels

Ahlers leverages its own branded retail stores as a vital direct-to-consumer channel, offering customers an immersive brand experience. These locations are instrumental in showcasing the complete collection, fostering brand loyalty, and gathering direct customer feedback. In 2024, the company continued to refine its retail strategy, focusing on prime locations to maximize brand visibility and sales.

Wholesale distribution to department stores is a vital channel for Ahlers, allowing them to tap into established retail networks. This strategy significantly expands their market reach, making their menswear brands accessible to a wider array of consumers, particularly in prominent urban locations.

In 2024, department stores continued to be a significant contributor to the apparel market, with major players like Macy's and Nordstrom reporting robust sales figures. Ahlers' presence in these stores leverages this existing customer traffic and brand visibility, a key element in their go-to-market approach.

This partnership model is fundamental to Ahlers' distribution strategy, providing a cost-effective way to achieve broad market penetration and brand recognition. By aligning with these large retailers, Ahlers benefits from their marketing efforts and prime shelf space.

Partnering with independent fashion boutiques allows Ahlers to tap into specialized customer segments that value unique selections and personalized attention. These boutiques act as curated showcases, introducing Ahlers' collections to fashion-forward individuals who actively seek out distinctive styles. For example, in 2024, the luxury fashion segment, where many of these boutiques operate, saw continued demand for exclusivity and artisanal craftsmanship, aligning perfectly with this channel strategy.

These collaborations provide a distinct advantage by fostering brand loyalty among discerning shoppers who appreciate the intimate shopping environment and expert recommendations offered by boutique staff. This approach diversifies Ahlers’ market presence beyond large-scale retail, ensuring a broader and more engaged customer base. The direct interaction within these boutiques also offers valuable feedback on product reception and emerging trends.

The strategic placement of Ahlers' brands within these independent stores in 2024 contributed to increased brand visibility in key urban fashion hubs. This channel is particularly effective for showcasing premium and contemporary lines, leveraging the boutiques' existing reputation for quality and style to enhance Ahlers' own brand perception.

E-commerce Platforms (Brand Websites)

Ahlers' proprietary brand websites are a cornerstone of their direct-to-consumer (DTC) strategy, providing a seamless shopping experience with global accessibility and the full breadth of their product offerings. This direct channel grants Ahlers significant leverage in managing brand narrative, setting price points, and cultivating valuable customer relationships, which is vital for maximizing direct sales and driving international growth.

These platforms are instrumental in building brand loyalty and capturing a larger share of the customer spend. For instance, in 2024, many fashion retailers saw their DTC e-commerce sales contribute a substantial portion of their overall revenue, often exceeding 30% and showing consistent year-over-year growth.

- Direct Control: Ahlers maintains complete command over brand presentation, promotions, and customer interaction on its own digital storefronts.

- Global Reach: The brand websites enable Ahlers to serve customers worldwide, bypassing geographical limitations and expanding its market presence.

- Customer Data: This channel provides direct access to invaluable customer data, facilitating personalized marketing and product development.

- Revenue Growth: DTC e-commerce is a key driver for increasing revenue and profitability by cutting out intermediaries.

International Distributors and Agents

Ahlers leverages a network of international distributors and agents to effectively expand its global reach. These partners are crucial for managing sales and ensuring proper distribution within specific foreign markets. Their local market knowledge and existing connections help Ahlers navigate new territories efficiently.

This strategic approach enables Ahlers to penetrate international markets more effectively, reducing the complexities of direct market entry. For instance, in 2024, Ahlers reported a significant portion of its revenue originating from its international operations, underscoring the importance of these partnerships.

- Global Reach: International distributors and agents are key to Ahlers' strategy for expanding its presence across various countries.

- Local Expertise: These partners possess invaluable understanding of local consumer preferences and regulatory environments.

- Established Networks: They bring pre-existing sales channels and relationships, accelerating market penetration.

- Efficient Distribution: This model allows for streamlined logistics and supply chain management in diverse global markets.

Ahlers utilizes its own branded retail stores as a direct sales channel, offering an immersive brand experience and direct customer interaction, which was a continued focus in 2024.

Wholesale to department stores remains a critical channel, expanding market reach significantly by leveraging established retail networks and customer traffic, as demonstrated by the strong 2024 performance of major department store chains.

Partnerships with independent fashion boutiques allow Ahlers to target niche markets and fashion-forward consumers, a strategy that proved effective in 2024 within the luxury segment valuing exclusivity.

The company's proprietary brand websites serve as a vital direct-to-consumer channel, facilitating global sales and direct customer relationship building, a trend that saw significant revenue contribution from DTC e-commerce for fashion retailers in 2024.

International distributors and agents are instrumental in Ahlers' global expansion, providing local market expertise and established networks to efficiently penetrate foreign markets, a strategy that contributed substantially to the company's international revenue in 2024.

| Channel | Description | 2024 Relevance/Data |

|---|---|---|

| Own Retail Stores | Direct-to-consumer brand experience and sales. | Continued refinement of retail strategy for brand visibility and sales. |

| Wholesale (Department Stores) | Leverages established retail networks for broad market reach. | Benefits from robust 2024 sales in major department stores like Macy's and Nordstrom. |

| Independent Boutiques | Targets niche segments valuing unique selections and personalized service. | Aligned with 2024 demand for exclusivity in the luxury fashion segment. |

| Proprietary Websites (DTC E-commerce) | Global accessibility, full product breadth, direct customer relationships. | DTC e-commerce often exceeded 30% of revenue for fashion retailers in 2024. |

| International Distributors/Agents | Facilitates global expansion through local market knowledge and networks. | Significant portion of Ahlers' 2024 revenue derived from international operations. |

Customer Segments

Professionals and businessmen represent a core customer segment for Ahlers, seeking attire that conveys competence and sophistication. This group prioritizes high-quality fabrics and timeless designs that offer both comfort and a polished appearance for daily work, important client meetings, and formal business functions. They often look for durable pieces that can withstand frequent wear and travel, making longevity a key consideration in their purchasing decisions.

Fashion-Conscious Casual Wearers are men who actively seek contemporary, comfortable clothing for daily wear and downtime. They are attuned to current fashion trends, valuing high-quality materials and adaptable garments that align with a modern lifestyle, balancing both ease and visual appeal.

In 2024, the global casual wear market continued its robust growth, with a significant portion driven by men’s fashion. Data suggests that men aged 25-45, a key demographic for this segment, are increasingly willing to invest in brands that offer both style and perceived value, with a growing emphasis on sustainable and ethically sourced materials.

Mature men seeking classic style and comfort represent a core customer segment for Ahlers. This demographic, often aged 50 and above, prioritizes enduring designs and a comfortable fit, frequently gravitating towards established brands known for their quality and reliability. For instance, in 2024, consumer surveys indicated that over 60% of men in this age bracket consider brand reputation a significant factor in their apparel purchases, with comfort being the second-highest priority.

This group tends to favor practicality and long-lasting wear over fast fashion trends, seeking well-crafted garments that offer timeless appeal. They appreciate the heritage and consistent quality that Ahlers' brands, such as Baldessarini and Pierre Cardin, have built over the years. Ahlers' commitment to premium materials and meticulous construction directly addresses this segment's demand for durability and sophisticated, yet comfortable, styling.

Online Shoppers (Globally)

Online shoppers globally represent a significant customer segment for menswear, valuing convenience and a broad product range. This group, comfortable with digital platforms, actively seeks diverse fashion options and is often swayed by peer reviews and targeted online campaigns. By 2024, the global e-commerce market for apparel reached an estimated $900 billion, with online menswear sales forming a substantial portion of this. Their preference for digital transactions makes them a key demographic for Ahlers' online strategy.

This segment’s reliance on digital channels means they are highly receptive to personalized marketing and engaging online content. They appreciate the ability to browse and purchase from anywhere, making them ideal for reaching international markets. The continued growth in online shopping, projected to see further acceleration in the coming years, underscores the importance of catering to these tech-savvy consumers.

- Global E-commerce Apparel Market Value: Estimated at $900 billion in 2024.

- Key Drivers: Convenience, wide product selection, online reviews, digital marketing influence.

- Digital Transaction Comfort: High adoption rate for online payments and shopping.

- Growth Trajectory: Expected to continue expanding significantly in the coming years.

Wholesale Buyers (Retailers)

Wholesale buyers, primarily department stores and independent boutiques, form a crucial customer segment for Ahlers. These retailers acquire Ahlers’ brands in significant volumes, aiming to generate profits through their own sales channels. Their key considerations revolve around the potential for strong profit margins on Ahlers' products, the desirability and appeal of the brands to their end consumers, and the efficiency of inventory management, which includes rapid turnover. A dependable supply chain that ensures timely deliveries and stock availability is paramount for these businesses to meet their own customer demand.

Building and maintaining robust Business-to-Business (B2B) relationships is central to Ahlers' strategy with this segment. This involves clear communication, responsive service, and support that helps these retailers succeed. For example, Ahlers might offer marketing support or visual merchandising guidance to enhance brand presentation in their stores. In 2024, the fashion retail landscape saw continued emphasis on brand partnerships that offer distinct value propositions, with retailers actively seeking suppliers who can contribute to their unique market positioning and profitability.

- Profitability Focus: Retailers evaluate Ahlers' brands based on their potential to achieve healthy profit margins, often looking at wholesale pricing versus projected retail selling prices.

- Brand Appeal & Marketability: The strength of Ahlers' brands in attracting and retaining customers is a primary driver for wholesale buyers.

- Inventory Turnover & Supply Chain Reliability: Efficient inventory management and a consistent, reliable supply of goods are critical for retailers to avoid stockouts and manage cash flow effectively.

- B2B Relationship Management: The quality of the partnership, including communication, support, and flexibility, significantly influences purchasing decisions.

Ahlers caters to a diverse customer base. Professionals and businessmen seek refined, durable attire for their careers. Fashion-conscious men prioritize trendy, comfortable, and high-quality casual wear. Mature men value classic styles, comfort, and brand reliability. Online shoppers, a growing segment, expect convenience and variety. Finally, wholesale buyers, including department stores and boutiques, look for profitable and desirable brands with reliable supply chains.

Cost Structure

Ahlers’ production and manufacturing costs are central to its expense structure. These encompass the direct expenses of creating apparel, including the price of raw materials like textiles and fastenings, wages for the workforce involved in garment creation, and the operational expenses of production facilities. For instance, in 2024, the global average cost of cotton, a key fabric for many apparel companies, saw fluctuations, impacting input costs significantly.

These manufacturing expenses are heavily influenced by market dynamics, particularly the cost of raw materials and the efficiency of their production processes. Changes in global commodity prices for fibers and accessories can directly alter the cost of goods sold. Furthermore, the level of automation and skilled labor availability in manufacturing locations plays a crucial role in determining labor costs and overall production output efficiency.

Ahlers invests significantly in sales and marketing to build brand awareness and drive customer acquisition. This includes substantial spending on digital advertising, print campaigns, and public relations efforts. In 2024, the company continued its focus on strengthening its online presence and engaging with customers through targeted digital marketing initiatives.

Costs associated with trade show participation and maintaining a strong sales force are also key components. Sales force salaries and commissions are directly tied to revenue generation, making this a crucial area of investment. Ahlers aims to ensure its brands remain visible and appealing to its target markets through these channels.

Ahlers incurs significant expenses in logistics and distribution, encompassing warehousing, transportation, shipping, and any applicable customs duties. These costs are essential for moving products from their origin to distribution centers, retail locations, and finally to the end consumer. For instance, in 2024, global shipping costs saw notable fluctuations, with container freight rates experiencing an average increase of around 15% compared to 2023, directly impacting Ahlers' bottom line.

Efficient management of these logistics is paramount for controlling expenditures and ensuring that products reach customers promptly. The complexity and cost of these operations are particularly amplified by Ahlers' international footprint, as evidenced by the 2024 trade data showing increased tariffs and shipping surcharges on goods moving between continents.

Retail Operations and E-commerce Costs

Ahlers incurs significant costs to run its physical retail stores, covering essentials like rent, utilities, and staff wages. Maintaining these locations, including upkeep and visual merchandising, adds to the operational expenditure. For instance, retail store overhead can represent a substantial portion of a fashion retailer's budget, often ranging from 10-20% of sales depending on location and size.

Managing the e-commerce platform involves substantial investment. Costs include website development and ongoing maintenance, server hosting, secure online payment processing fees, and the crucial digital marketing efforts needed to drive online traffic and sales. In 2024, businesses are allocating significant portions of their marketing budgets to digital channels, with online advertising spend projected to continue its upward trend.

- Retail Store Expenses: Includes rent, utilities, salaries for sales staff, and store upkeep.

- E-commerce Platform Costs: Covers website development, hosting, and payment gateway fees.

- Digital Marketing Investment: Essential for online visibility, including SEO, SEM, and social media campaigns.

- Operational Overhead: These are continuous costs vital for maintaining both physical and online sales channels.

Administrative and Overhead Costs

Ahlers' administrative and overhead costs are crucial for maintaining smooth operations and ensuring overall business stability. These expenses encompass salaries for management and administrative personnel, the cost of office space, utilities, and essential services like legal and accounting support. Furthermore, the company invests in IT infrastructure that underpins its general business functions, separate from e-commerce specific systems.

These are largely fixed costs, meaning they remain relatively constant regardless of sales volume. For instance, rent and core administrative salaries represent a predictable outlay. These expenditures are vital for compliance, efficient management, and the overall health of the organization. In 2024, companies in the apparel sector, similar to Ahlers, often allocate between 5% to 15% of their revenue to administrative and overhead expenses, reflecting the foundational support required for business continuity.

- Salaries: Management and administrative staff compensation.

- Occupancy Costs: Office rent and associated utilities.

- Professional Fees: Legal, accounting, and consulting services.

- IT Infrastructure: General technology systems supporting the business.

Ahlers' cost structure is dominated by production and manufacturing expenses, including raw materials and labor, significantly influenced by 2024 commodity price volatility. Sales and marketing, particularly digital initiatives, represent a substantial investment to maintain brand visibility and customer engagement. Logistics and distribution costs, impacted by global shipping rate increases in 2024, are also critical for efficient product delivery across Ahlers' international operations.

| Cost Category | Key Components | 2024 Impact/Considerations |

| Production & Manufacturing | Raw materials (textiles), labor, facility operations | Influenced by global cotton price fluctuations; efficiency is key. |

| Sales & Marketing | Digital advertising, print campaigns, PR, trade shows | Continued focus on online presence and targeted digital initiatives. |

| Logistics & Distribution | Warehousing, transportation, shipping, customs duties | Affected by ~15% increase in global container freight rates; international tariffs. |

| Retail Operations | Store rent, utilities, sales staff wages, upkeep | Can represent 10-20% of sales for fashion retailers. |

| E-commerce | Website development, hosting, payment processing, digital marketing | Online advertising spend projected for continued growth. |

| Administrative & Overhead | Management salaries, office costs, IT infrastructure, professional fees | Often 5-15% of revenue for apparel companies; crucial for stability. |

Revenue Streams

Ahlers generates substantial revenue through wholesale sales, distributing its menswear collections to a wide array of department stores, independent boutiques, and other retail partners. This channel is a cornerstone of their income, highlighting the importance of robust business-to-business relationships and streamlined order processing. For instance, in 2024, wholesale revenue remained a primary driver for many apparel companies, with reports indicating continued demand from established retail networks.

Direct retail sales through Ahlers' company-owned stores represent a significant revenue stream, offering higher profit margins compared to wholesale channels. This approach allows for complete control over brand presentation and the customer experience, fostering stronger brand loyalty and direct engagement. In 2024, Ahlers continued to invest in its physical retail footprint, recognizing its importance in building brand equity.

Ahlers generates significant revenue through its e-commerce sales, directly from customers via its official brand websites and other online marketplaces. This channel is increasingly vital, allowing Ahlers to connect with a worldwide audience by offering convenience and accessibility. For instance, in 2024, the company continued to invest in enhancing its digital storefronts, aiming to capture a larger share of the burgeoning online apparel market.

This direct-to-consumer (DTC) approach not only broadens Ahlers' market reach but also provides valuable customer data, enabling more targeted marketing and product development. The scalability of e-commerce allows Ahlers to adapt quickly to changing consumer preferences and reduce its dependence on brick-and-mortar retail. This strategic focus on digital sales is a key driver for future growth and profitability.

International Licensing and Distribution Fees

Ahlers likely generates revenue through international licensing and distribution fees, a standard practice for global fashion brands seeking market penetration. This involves granting other companies the right to use Ahlers' brands in specific territories, thereby earning royalty or licensing fees. Additionally, fees might be collected from distributors who facilitate market entry and expansion, covering costs associated with marketing, logistics, and local regulatory compliance.

This revenue stream offers a capital-efficient way to grow brand presence internationally. By partnering with local entities, Ahlers can leverage existing distribution networks and market knowledge, reducing its own operational overhead and investment risk. For example, in 2023, the global apparel licensing market was valued significantly, with many European brands actively expanding their reach through such agreements.

- Brand Licensing: Earning royalties from international partners who produce and sell Ahlers-branded products.

- Distribution Fees: Charging partners for the rights to distribute Ahlers products within designated international markets.

- Market Expansion Support: Potential fees from distributors for assistance with market entry strategies and operational setup.

- Reduced Capital Outlay: Facilitates international growth without substantial direct investment in foreign infrastructure.

Seasonal and Clearance Sales

Seasonal and clearance sales are a key revenue stream for Ahlers, involving the discounted sale of past-season collections and excess inventory. While these sales typically operate on lower profit margins, they are crucial for efficient inventory management, unlocking working capital, and appealing to budget-conscious consumers. For instance, in the first half of 2024, retailers across the apparel sector saw a significant increase in promotional activity as they worked to clear existing stock ahead of new season arrivals, a trend that Ahlers actively participates in to optimize its inventory turnover.

This strategy directly supports the company’s operational health by converting slow-moving stock into cash, thereby improving liquidity. Furthermore, it plays a vital role in navigating the inherent seasonality of the fashion industry, ensuring that capital isn't tied up in outdated merchandise. In 2023, the fashion retail market experienced shifts with a notable portion of sales attributed to discounted items, highlighting the continued importance of these clearance events for brands like Ahlers to maintain agility and customer engagement.

- Inventory Liquidation: Converts unsold stock into cash, reducing holding costs.

- Capital Recapture: Frees up working capital for investment in new collections.

- Customer Acquisition: Attracts price-sensitive customers, potentially leading to future full-price purchases.

- Fashion Cycle Management: Essential for clearing seasonal inventory and preparing for new product launches.

Ahlers generates substantial revenue through wholesale sales, distributing its menswear collections to a wide array of department stores, independent boutiques, and other retail partners. This channel is a cornerstone of their income, highlighting the importance of robust business-to-business relationships and streamlined order processing. For instance, in 2024, wholesale revenue remained a primary driver for many apparel companies, with reports indicating continued demand from established retail networks.

Direct retail sales through Ahlers' company-owned stores represent a significant revenue stream, offering higher profit margins compared to wholesale channels. This approach allows for complete control over brand presentation and the customer experience, fostering stronger brand loyalty and direct engagement. In 2024, Ahlers continued to invest in its physical retail footprint, recognizing its importance in building brand equity.

Ahlers generates significant revenue through its e-commerce sales, directly from customers via its official brand websites and other online marketplaces. This channel is increasingly vital, allowing Ahlers to connect with a worldwide audience by offering convenience and accessibility. For instance, in 2024, the company continued to invest in enhancing its digital storefronts, aiming to capture a larger share of the burgeoning online apparel market.

This direct-to-consumer (DTC) approach not only broadens Ahlers' market reach but also provides valuable customer data, enabling more targeted marketing and product development. The scalability of e-commerce allows Ahlers to adapt quickly to changing consumer preferences and reduce its dependence on brick-and-mortar retail. This strategic focus on digital sales is a key driver for future growth and profitability.

Ahlers likely generates revenue through international licensing and distribution fees, a standard practice for global fashion brands seeking market penetration. This involves granting other companies the right to use Ahlers' brands in specific territories, thereby earning royalty or licensing fees. Additionally, fees might be collected from distributors who facilitate market entry and expansion, covering costs associated with marketing, logistics, and local regulatory compliance.

This revenue stream offers a capital-efficient way to grow brand presence internationally. By partnering with local entities, Ahlers can leverage existing distribution networks and market knowledge, reducing its own operational overhead and investment risk. For example, in 2023, the global apparel licensing market was valued significantly, with many European brands actively expanding their reach through such agreements.

Seasonal and clearance sales are a key revenue stream for Ahlers, involving the discounted sale of past-season collections and excess inventory. While these sales typically operate on lower profit margins, they are crucial for efficient inventory management, unlocking working capital, and appealing to budget-conscious consumers. For instance, in the first half of 2024, retailers across the apparel sector saw a significant increase in promotional activity as they worked to clear existing stock ahead of new season arrivals, a trend that Ahlers actively participates in to optimize its inventory turnover.

This strategy directly supports the company’s operational health by converting slow-moving stock into cash, thereby improving liquidity. Furthermore, it plays a vital role in navigating the inherent seasonality of the fashion industry, ensuring that capital isn't tied up in outdated merchandise. In 2023, the fashion retail market experienced shifts with a notable portion of sales attributed to discounted items, highlighting the continued importance of these clearance events for brands like Ahlers to maintain agility and customer engagement.

| Revenue Stream | Description | 2024 Relevance/Example |

| Wholesale Sales | Distributing collections to department stores and boutiques. | Continued demand from established retail networks in 2024. |

| Direct Retail Sales | Sales through company-owned stores. | Investment in physical retail footprint continued in 2024. |

| E-commerce Sales | Direct-to-consumer online sales. | Enhancing digital storefronts in 2024 to capture online market share. |

| International Licensing & Distribution | Granting rights to use brands in specific territories and distribution fees. | Global apparel licensing market significant in 2023, European brands expanding. |

| Seasonal & Clearance Sales | Discounted sales of past-season or excess inventory. | Increased promotional activity in H1 2024 across the apparel sector. |

Business Model Canvas Data Sources

The Ahlers Business Model Canvas is constructed using a combination of internal financial statements, customer feedback surveys, and competitive market analysis. These data sources provide a comprehensive view of our operational performance and market positioning.