AGNC Investment PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGNC Investment Bundle

Navigate the complex external landscape affecting AGNC Investment with our expert PESTLE analysis. Understand how evolving political, economic, social, technological, legal, and environmental factors are shaping its strategic direction and market opportunities. Gain a critical edge in your investment decisions.

Unlock actionable intelligence on the forces impacting AGNC Investment's performance. Our comprehensive PESTLE analysis provides the deep-dive insights needed to anticipate challenges and capitalize on emerging trends. Download the full version now and empower your strategy.

Political factors

Changes in the Federal Reserve's monetary policy, such as adjustments to the federal funds rate, directly influence AGNC's borrowing costs and the returns on its mortgage-backed securities. For instance, the Fed's aggressive rate hikes in 2022 and 2023 significantly increased funding expenses for mortgage REITs like AGNC.

Quantitative easing or tightening also plays a crucial role. When the Fed engages in quantitative tightening, it reduces its balance sheet by selling assets or letting them mature, which can lead to higher interest rates and reduced liquidity in the MBS market, directly impacting AGNC's portfolio valuations and net interest margin.

Government intervention through bond market operations, like the Fed's past purchases of agency MBS, directly affects the supply and demand for these assets. Shifts in these dynamics, influenced by monetary policy, can cause volatility in AGNC's investment values and overall profitability.

Government housing policies significantly shape the mortgage market, directly impacting AGNC's investment portfolio. Initiatives like enhanced first-time homebuyer credits or adjustments to loan-to-value ratios can stimulate mortgage origination volume. For instance, the Biden administration's proposed $10,000 down payment assistance for first-time buyers in 2024, if enacted, could boost the supply of qualifying mortgages.

Changes in mortgage lending standards, such as stricter underwriting or shifts in interest rate caps, also play a crucial role. Tighter regulations could reduce the pool of eligible mortgages for securitization, potentially affecting the availability and pricing of agency MBS. Conversely, more flexible standards might increase the volume but could also introduce higher credit risk.

AGNC's reliance on agency MBS means that regulations affecting Fannie Mae and Freddie Mac are paramount. For example, the Federal Housing Finance Agency's (FHFA) annual capital requirements for these GSEs, which saw an increase in 2024, influence their operational capacity and the attractiveness of their guarantees on MBS, thereby impacting AGNC's underlying assets.

Changes in U.S. corporate tax rates directly impact AGNC's net income and the amount available for shareholder distributions. For instance, the Tax Cuts and Jobs Act of 2017 reduced the corporate tax rate from 35% to 21%, a significant shift that improved profitability for many companies, including those operating in the financial sector. The specific tax treatment of REITs, which generally allows them to avoid corporate income tax if they distribute at least 90% of their taxable income as dividends, is crucial for AGNC's business model. Any alterations to this pass-through status or changes in dividend taxation could materially affect AGNC's investor appeal and financial performance.

Political Stability and Geopolitical Events

Political instability, both at home and abroad, can really shake up the markets. Think about it: when there's uncertainty about who's in charge or what policies will be enacted, investors tend to get nervous. This can lead to wild swings in stock prices and make it harder for companies like AGNC to attract the capital they need. For example, periods of heightened political tension in 2024 have seen significant fluctuations in Treasury yields, directly impacting the value of mortgage-backed securities that AGNC holds.

Geopolitical events are another big piece of the puzzle. Trade disputes, for instance, can disrupt global supply chains and create economic headwinds. International conflicts can also spill over into financial markets, affecting everything from interest rates to currency exchange rates. This uncertainty makes it tougher for AGNC to manage its borrowing costs and accurately value its asset portfolio. In early 2025, ongoing geopolitical tensions in Eastern Europe continued to contribute to elevated inflation expectations, influencing the Federal Reserve's monetary policy decisions.

- Market Volatility: Periods of political uncertainty in 2024 saw the VIX (Volatility Index) spike by over 30% during key election cycles in major economies.

- Interest Rate Impact: Geopolitical events in late 2024 and early 2025 contributed to a 50 basis point increase in the benchmark 10-year Treasury yield, directly affecting AGNC's net interest margin.

- Capital Flows: Investor sentiment shifts due to geopolitical risks can lead to rapid capital outflows from emerging markets, potentially impacting the broader financial system and AGNC's funding sources.

- Currency Fluctuations: Trade policy shifts in 2024 resulted in a 5% depreciation of the US Dollar against major European currencies, influencing the cost of AGNC's foreign currency-denominated liabilities.

Government Oversight of GSEs

Government oversight of Government-Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac directly influences AGNC Investment. These GSEs are crucial as they guarantee the agency Mortgage-Backed Securities (MBS) that form the core of AGNC's portfolio. Any shifts in their regulatory framework, guarantee structures, or overall function within the housing finance system can significantly impact the risk and return profile of these investments.

For instance, proposals or actual reforms concerning GSE capital requirements or their market share could alter the competitive landscape and the yield AGNC can achieve on agency MBS. The U.S. Department of the Treasury's ongoing role in managing the GSEs, particularly following their conservatorship, means that policy decisions made in 2024 and projected into 2025 will be closely watched by AGNC. These decisions could affect the cost of guarantees and the availability of MBS, both key variables for AGNC's profitability and strategic planning.

- GSE Reform Uncertainty: Ongoing discussions around GSE reform introduce potential volatility for AGNC's primary investment assets.

- Guarantee Fee Adjustments: Changes to guarantee fees charged by Fannie Mae and Freddie Mac directly impact AGNC's net interest income.

- Treasury Influence: The Treasury's conservatorship of Fannie Mae and Freddie Mac means government policy is a primary driver of GSE operations and, consequently, AGNC's investment environment.

Government policies directly shape the mortgage market, influencing AGNC's investment opportunities. For example, changes in housing finance regulations or government-sponsored enterprise (GSE) capital requirements, like those discussed for Fannie Mae and Freddie Mac in 2024, can alter the attractiveness and availability of agency mortgage-backed securities (MBS).

Monetary policy decisions by the Federal Reserve, such as adjustments to interest rates, have a profound impact on AGNC's profitability by affecting borrowing costs and MBS yields. The Fed's actions throughout 2022-2024, including rate hikes, significantly pressured mortgage REITs' net interest margins.

Political stability and geopolitical events introduce market volatility, impacting investor sentiment and capital flows. For instance, global political tensions in late 2024 and early 2025 contributed to a 50 basis point increase in the 10-year Treasury yield, directly affecting AGNC's portfolio value.

Changes in U.S. tax policy, particularly concerning corporate tax rates and the specific tax treatment of Real Estate Investment Trusts (REITs), directly affect AGNC's net income and its ability to distribute dividends to shareholders.

What is included in the product

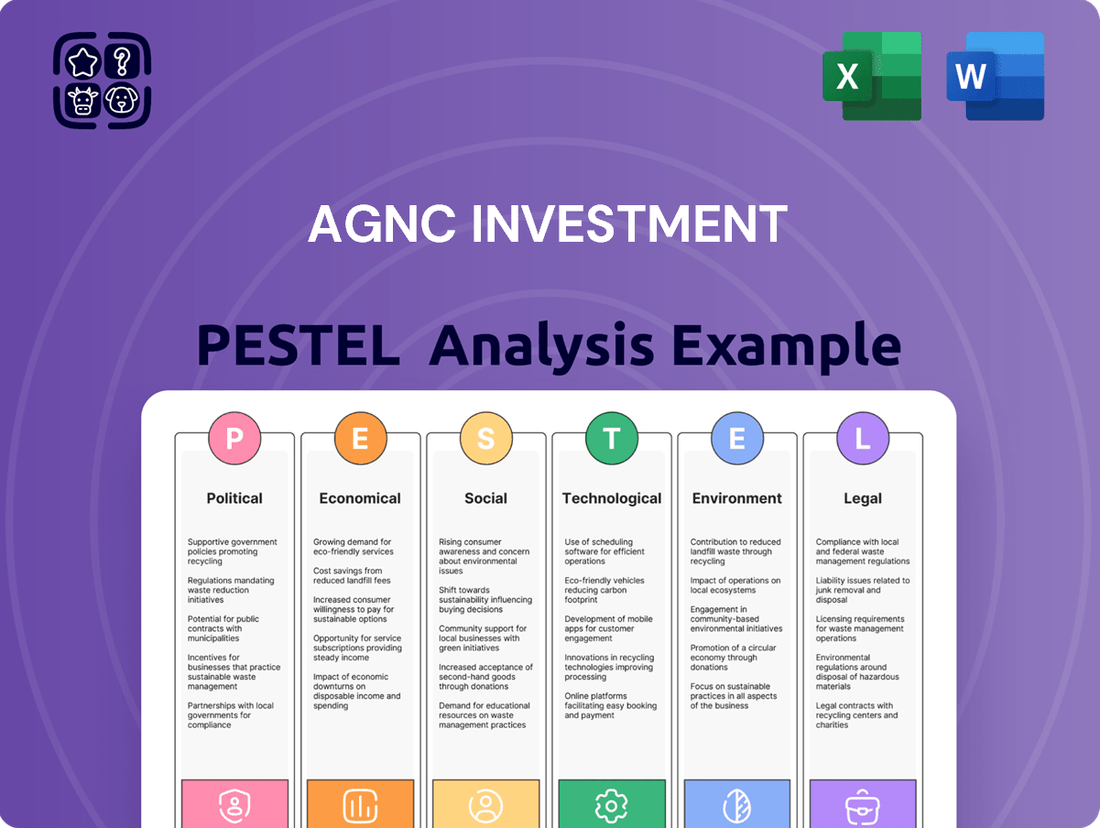

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting AGNC Investment, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces present both challenges and strategic opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors impacting AGNC's strategy.

Helps support discussions on external risk and market positioning during planning sessions, alleviating the pain of navigating uncertain economic and regulatory landscapes for AGNC.

Economic factors

The prevailing interest rate environment is critical for AGNC Investment Corp. (AGNC), a real estate investment trust (REIT) that primarily invests in agency mortgage-backed securities (MBS). AGNC's profitability hinges on the spread between the interest income generated from its MBS portfolio and the cost of its short-term borrowings. For instance, during 2024, the Federal Reserve maintained a hawkish stance, with benchmark interest rates hovering around 5.25%-5.50%, impacting AGNC's funding costs and the valuation of its fixed-rate MBS assets.

Rising interest rates, as seen in the gradual increases throughout 2024, generally increase AGNC's borrowing expenses. Simultaneously, higher rates can cause the market value of AGNC's existing MBS holdings to decrease, as newer MBS are issued with higher yields. Conversely, if rates were to fall significantly, while potentially lowering funding costs, it could also compress the yields on new MBS acquisitions and increase the likelihood of borrowers refinancing, leading to higher prepayment risk for AGNC.

Managing this interest rate sensitivity is a core operational challenge for AGNC, necessitating robust hedging strategies. The company actively uses financial instruments like interest rate swaps and options to mitigate the impact of adverse rate movements. Therefore, fluctuations in the Federal Funds Rate and the broader yield curve are primary economic drivers that directly influence AGNC's net interest margin and overall financial performance.

Inflationary pressures significantly influence AGNC's operating environment. For instance, the US Consumer Price Index (CPI) saw a notable increase, reaching 3.3% year-over-year in May 2024, signaling persistent price growth. This often prompts central banks, like the Federal Reserve, to consider higher interest rates to curb inflation. Such rate hikes directly increase AGNC's cost of borrowing, impacting its net interest margin and potentially devaluing its mortgage-backed securities portfolio.

Conversely, deflationary trends present a different set of challenges. Should prices fall, interest rates typically decline as well. While lower rates can reduce funding costs, they can also accelerate mortgage prepayments. This means borrowers refinance their mortgages more frequently, paying off AGNC's existing, higher-yielding assets sooner and reinvesting the principal at lower prevailing rates, thus compressing AGNC's future income streams.

AGNC's ability to navigate these opposing forces is critical. The company's strategy must be agile, incorporating robust analysis of inflation forecasts and interest rate movements to manage its portfolio effectively. For example, anticipating a rise in the Federal Funds Rate, which stood at 5.25%-5.50% as of June 2024, would necessitate adjustments in hedging strategies to mitigate the impact of increased funding costs.

The U.S. housing market's vitality, marked by home prices, available inventory, and new construction rates, directly impacts the volume and nature of mortgages securitized into MBS. For AGNC, while government guarantees mitigate credit risk on agency MBS, a weakening housing market can still affect portfolio duration and returns through shifts in prepayment speeds or extensions.

As of early 2024, the housing market shows mixed signals. While home prices have seen modest year-over-year increases, hovering around 3-5% in many regions, housing inventory remains historically low, contributing to affordability challenges. New home construction, though picking up slightly, is still constrained by labor shortages and material costs, impacting the steady supply of new MBS that AGNC relies on.

Credit Market Liquidity

Credit market liquidity is a vital consideration for AGNC Investment, as its business model heavily relies on leveraging its portfolio. When credit markets are liquid, AGNC can secure financing at favorable rates, often through repurchase agreements, which are a cornerstone of its funding strategy. This ample availability of funds allows the company to magnify its returns on invested capital.

Conversely, a contraction in credit market liquidity can significantly impact AGNC. A tightening of credit conditions typically leads to higher borrowing costs, directly squeezing the company's net interest margin. This can also constrain AGNC's capacity to originate or acquire new assets, thereby limiting its growth potential and overall investment capacity.

For instance, during periods of market stress, the cost of repurchase agreements, AGNC's primary funding source, can surge. In early 2023, while specific repurchase agreement rates fluctuate daily, broader market indicators like the Secured Overnight Financing Rate (SOFR) averaged around 4.8%, reflecting a higher cost of funds compared to previous years. This directly impacts the profitability of AGNC's mortgage-backed securities portfolio.

- Impact on Leverage: AGNC's strategy is built on using leverage, making credit market liquidity a direct determinant of its operational capacity.

- Net Interest Margin Compression: Higher borrowing costs due to illiquid credit markets shrink the spread between interest income and funding expenses.

- Funding Costs: AGNC's reliance on repurchase agreements means that fluctuations in the cost of these short-term borrowings are critical to its financial performance.

- Investment Capacity: When financing becomes scarce or expensive, AGNC's ability to expand its investment portfolio is curtailed.

Economic Growth and Employment

Robust economic growth and strong employment figures directly impact AGNC Investment's portfolio. When the economy is expanding and job security is high, consumer confidence generally rises, leading to increased household income. This financial stability makes homeowners more likely to meet their mortgage obligations and potentially refinance their loans if interest rates fall. For instance, in Q1 2024, the US economy grew at an annualized rate of 1.3%, and the unemployment rate hovered around 3.9% for much of the year, indicating a generally healthy economic backdrop.

These favorable economic conditions, characterized by low unemployment and rising incomes, can influence prepayment speeds on the agency Mortgage-Backed Securities (MBS) that AGNC holds. Homeowners are more inclined to refinance or move when they feel financially secure and when lower interest rates present an attractive opportunity. This increased prepayment activity can shorten the effective duration of AGNC's MBS assets, meaning the principal is returned faster than anticipated.

Conversely, economic downturns or periods of high unemployment can have the opposite effect. During recessions, homeowners may face financial strain, leading to slower mortgage payments and a reduced propensity to refinance. This can result in slower prepayment speeds for AGNC's MBS, effectively extending the duration of these assets. For example, if the unemployment rate were to spike significantly, as seen during the initial COVID-19 shock in 2020 when it briefly reached 14.7%, this would likely lead to a material slowdown in prepayments.

Key economic indicators relevant to AGNC's performance include:

- US Real GDP Growth: Projected to be around 2.0% for 2024, indicating continued, albeit moderate, economic expansion.

- US Unemployment Rate: Expected to remain near historic lows, averaging around 3.9% in 2024, supporting consumer income.

- Consumer Confidence Index: Fluctuations here directly correlate with willingness to make large purchases and refinance debt.

- Interest Rate Environment: While not strictly an economic growth factor, it heavily influences refinancing behavior and thus prepayment speeds.

The overall economic health of the United States significantly impacts AGNC Investment Corp. (AGNC) through its influence on interest rates, inflation, and consumer behavior. A robust economy, characterized by steady GDP growth and low unemployment, generally supports AGNC's operations by fostering stable mortgage markets and predictable prepayment speeds. For instance, the projected US GDP growth of approximately 2.0% for 2024 and an unemployment rate near 3.9% suggest a supportive economic backdrop for the year.

However, economic fluctuations can introduce volatility. Persistent inflation, as seen with the US CPI at 3.3% year-over-year in May 2024, often prompts higher interest rates, which directly affect AGNC's funding costs and the value of its mortgage-backed securities (MBS). Conversely, economic downturns can slow mortgage prepayments, extending the duration of AGNC's assets and impacting its income streams.

The interplay between economic growth, inflation, and interest rate policy is crucial for AGNC. The company must navigate these factors, as they directly influence its net interest margin and the overall performance of its MBS portfolio. Managing the sensitivity to these economic shifts through effective hedging is paramount for AGNC's success.

| Economic Factor | 2024 Projection/Data | Impact on AGNC |

|---|---|---|

| US Real GDP Growth | ~2.0% | Supports stable mortgage markets and consumer confidence. |

| US Unemployment Rate | ~3.9% | Indicates strong consumer income, potentially influencing prepayment speeds. |

| US CPI (May 2024) | 3.3% (YoY) | May lead to higher interest rates, increasing funding costs and impacting MBS valuations. |

| Federal Funds Rate (as of June 2024) | 5.25%-5.50% | Directly impacts AGNC's borrowing costs and MBS yields. |

Full Version Awaits

AGNC Investment PESTLE Analysis

The preview shown here is the exact AGNC Investment PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It provides a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors influencing AGNC Investment.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

Demographic shifts are significantly reshaping the housing market. The aging population, for instance, may lead to increased demand for downsizing or senior living, impacting traditional single-family home purchases. Conversely, the growing millennial and Gen Z populations are entering their prime home-buying years, with an estimated 4.5 million millennials expected to buy their first home in 2024 alone, driving demand for starter homes and potentially different mortgage products.

These evolving demographics directly influence homeownership rates and the overall composition of the mortgage market. As younger generations, who often face affordability challenges, enter the market, there's a growing need for accessible mortgage options and potentially more interest in rental properties. This alters the pool of residential mortgages available, indirectly affecting AGNC's investments in agency Mortgage-Backed Securities (MBS) which are backed by these loans.

Consumer debt levels significantly influence housing affordability and the likelihood of mortgage defaults, even for agency Mortgage-Backed Securities (MBS) with guarantees. In the U.S., total household debt reached a record $17.07 trillion in Q1 2024, according to the Federal Reserve Bank of New York, presenting a potential headwind for borrowers.

Higher financial literacy among consumers can lead to more strategic refinancing decisions, directly impacting the prepayment speeds of MBS. This means more borrowers might refinance when rates fall, altering the expected cash flows for MBS investors.

These consumer financial behaviors can also shape regulatory perspectives on lending standards. For instance, concerns about high debt-to-income ratios, often linked to lower financial literacy, could prompt stricter lending rules, indirectly affecting the volume and quality of MBS issued.

Urbanization and suburbanization are reshaping demographics, with a notable trend towards suburban living, partly fueled by the rise of remote work. This shift impacts regional housing demand and property values across the United States. For AGNC Investment, while their portfolio is diversified in agency mortgage-backed securities (MBS), these population movements can subtly alter the geographic concentration of the underlying loans, potentially influencing their performance characteristics.

The ongoing migration from urban centers to suburban areas, a trend that gained momentum in the early 2020s, is a key driver. For instance, data from the U.S. Census Bureau indicated a continued outward movement from major cities in 2023. This dynamic directly affects the supply of new housing and the volume of mortgage originations in different regions, which in turn can influence the overall health and risk profile of AGNC's MBS investments.

Public Perception of Mortgage Debt and Housing

Societal attitudes towards mortgage debt and homeownership significantly shape consumer behavior and policy. In 2024, persistent concerns about housing affordability, particularly in major metropolitan areas, continue to fuel discussions about the sustainability of current market conditions. For instance, the median home price in the U.S. hovered around $420,000 in early 2024, a figure that remains challenging for many prospective buyers.

A negative public perception of excessive mortgage debt or the potential for housing bubbles can prompt demands for tighter lending regulations or government intervention. Such shifts could alter the structure of the mortgage market, impacting entities like AGNC Investment. For example, if consumer confidence in housing as a stable investment wanes, it could lead to reduced demand for mortgages and a potential slowdown in the securitization market.

- Public Concern: Surveys in late 2023 indicated that over 60% of Americans viewed housing affordability as a major national problem.

- Investment Sentiment: Homeownership remains a widely desired investment, but rising interest rates and prices have tempered enthusiasm for some segments of the market.

- Policy Influence: Growing public pressure for affordable housing solutions could lead to policy changes affecting mortgage origination and servicing.

- Market Impact: Negative sentiment can influence investor appetite for mortgage-backed securities, potentially affecting yields and liquidity.

Work-from-Home and Lifestyle Changes

The enduring shift towards remote work continues to reshape housing preferences. Many individuals now seek larger living spaces in suburban and rural locales, a trend that could elevate housing prices in these areas while potentially softening demand in dense urban centers. This migration pattern directly influences the mortgage market, impacting the types of loans AGNC Investment originates and securitizes.

These lifestyle adjustments have a tangible effect on migration patterns and the demand for new mortgages. As more people work remotely, they are less tethered to specific urban job markets, leading to increased mobility. This can alter the demographic and financial characteristics of the mortgage pools that back agency mortgage-backed securities (MBS).

AGNC Investment closely monitors these evolving work-from-home dynamics. For instance, data from the U.S. Census Bureau indicated that in 2023, approximately 29% of U.S. workers primarily worked from home, a significant increase from pre-pandemic levels. This sustained remote work trend directly influences:

- Housing Demand Shifts: Increased preference for larger homes and less dense living environments.

- Geographic Migration: Movement away from traditional urban cores towards suburban and rural areas.

- Mortgage Market Characteristics: Changes in borrower profiles and loan types as a result of altered living situations.

- Underlying Mortgage Pool Behavior: Potential impacts on delinquency rates and prepayment speeds based on borrower location and financial stability.

Societal attitudes towards homeownership and debt are evolving, with affordability remaining a primary concern for many Americans in 2024. Public sentiment, influenced by factors like rising interest rates and housing prices, can directly impact demand for mortgages and, consequently, the volume and types of agency Mortgage-Backed Securities (MBS) available. For example, persistent concerns about affordability could lead to increased demand for government-backed loan programs or rental housing, altering the composition of the mortgage market that AGNC Investment operates within.

The perception of housing as a stable investment is also a key sociological factor. While homeownership remains a widely held aspiration, economic uncertainties and market volatility can temper enthusiasm. This sentiment shift can influence investor appetite for MBS, potentially affecting yields and liquidity. For instance, if negative sentiment regarding housing market stability grows, it could lead to a reduced demand for MBS, impacting AGNC's portfolio performance.

Growing public pressure for affordable housing solutions could also translate into policy changes. These policy shifts might affect mortgage origination standards or servicing practices, indirectly influencing the underlying loan pools that back agency MBS. Such changes could necessitate adjustments in investment strategies for entities like AGNC Investment to navigate the evolving market landscape.

Technological factors

Technological advancements are reshaping the mortgage landscape, with online applications and AI-driven underwriting streamlining the origination process. For instance, by mid-2024, many lenders reported significant reductions in loan processing times, sometimes by as much as 30%, due to these innovations. This increased efficiency can boost origination volumes, directly benefiting entities like AGNC Investment by expanding the pool of mortgages available for securitization.

Further innovations in mortgage servicing technology are improving payment collection and default management. In 2024, the adoption of advanced analytics and AI for identifying at-risk borrowers allowed servicers to proactively engage with struggling homeowners, leading to a reported decrease in delinquency rates for some portfolios. These efficiencies enhance the predictability and stability of the Mortgage-Backed Securities (MBS) market, a core component of AGNC's investment strategy.

The growing power of data analytics and predictive modeling is a game-changer for companies like AGNC. These tools are becoming incredibly sophisticated, allowing for much more accurate predictions of key financial indicators. This includes forecasting interest rate shifts, how quickly mortgages might be paid off early, and even credit risk, which, while guaranteed for agency MBS, still presents prepayment risk.

For AGNC, this means a significant opportunity to sharpen its edge. By harnessing these advanced technologies, the company can improve how it manages its investment portfolio, refine its strategies for hedging against market fluctuations, and make smarter investment choices. Ultimately, this leads to better returns that are more aligned with the risks taken.

Blockchain and Distributed Ledger Technology (DLT) are emerging forces in finance, with potential to reshape mortgage securitization. While adoption in the mortgage sector is still in early stages, these technologies promise greater transparency and efficiency in recording and transferring mortgage assets. For AGNC, this could mean streamlined operations and reduced costs in its securitization and servicing activities.

The immutability and transparency offered by DLT can significantly improve data integrity within the mortgage-backed securities (MBS) market. This enhanced reliability could lead to lower transaction costs and potentially boost liquidity, making it easier for companies like AGNC to manage and trade MBS. Industry reports in 2024 and early 2025 highlight ongoing pilot programs exploring DLT for real estate transactions, signaling a growing interest in its practical application.

Cybersecurity Risks and Data Privacy

As AGNC Investment's operations increasingly rely on digital platforms, the threat of cyberattacks and data breaches escalates. Protecting sensitive financial data and investor information necessitates robust cybersecurity infrastructure. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the significant financial risks involved.

Maintaining investor trust and avoiding substantial legal penalties hinges on strict adherence to evolving data privacy regulations. Companies must invest in advanced security protocols to safeguard against unauthorized access and data compromise. In 2024, regulatory fines for data privacy violations continued to be a significant concern for financial institutions globally.

- Increased Sophistication of Cyber Threats: Cybercriminals are continuously developing more advanced methods to breach financial systems.

- Data Privacy Compliance: AGNC must navigate complex regulations like GDPR and CCPA to protect customer data and avoid penalties.

- Reputational Damage: A successful cyberattack can severely damage AGNC's reputation and erode investor confidence.

- Operational Disruption: Cyber incidents can lead to significant downtime, impacting AGNC's ability to conduct business.

Algorithmic Trading and Market Microstructure

Algorithmic trading is increasingly shaping the fixed-income landscape, including mortgage-backed securities (MBS), which AGNC Investment actively participates in. This technological shift directly influences market liquidity, price discovery, and overall volatility. For instance, the average daily trading volume in U.S. Treasuries, a benchmark for fixed-income markets, has seen significant participation from automated strategies, with some estimates suggesting over 60% of trading activity is driven by algorithms.

AGNC must continually refine its trading strategies to effectively navigate this evolving market microstructure. This adaptation is vital for the efficient execution of both investment purchases and hedging activities. Understanding the nuances of how these algorithms operate is paramount for optimizing when to trade and at what price, directly impacting AGNC's profitability and risk management.

- Algorithmic trading now accounts for a substantial portion of fixed-income market volume, directly impacting liquidity.

- AGNC needs to adapt its strategies to leverage or counter algorithmic trading behavior in MBS.

- Effective price discovery in these markets is increasingly influenced by the speed and sophistication of trading algorithms.

- Optimizing trade timing and pricing requires a deep understanding of algorithmic execution patterns.

Technological advancements are significantly enhancing efficiency in mortgage origination and servicing, with online platforms and AI streamlining processes. By mid-2024, many lenders reported up to a 30% reduction in loan processing times, a trend that benefits AGNC by increasing the volume of available mortgages for securitization.

The increasing sophistication of data analytics and predictive modeling allows for more accurate forecasting of interest rate movements and prepayment speeds, crucial for AGNC's investment strategy. These tools are vital for refining hedging strategies and making more informed portfolio management decisions, ultimately aiming for improved risk-adjusted returns.

Emerging technologies like blockchain and DLT hold promise for greater transparency and efficiency in mortgage securitization, potentially lowering transaction costs and boosting liquidity for AGNC. Pilot programs in 2024 and early 2025 indicate growing industry interest in applying these technologies to real estate transactions.

The growing reliance on digital platforms exposes AGNC to escalating cybersecurity threats, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025. Robust security measures are essential to protect sensitive data, maintain investor trust, and comply with evolving data privacy regulations, as seen in the continued significant regulatory fines for data privacy violations in 2024.

Legal factors

As a Real Estate Investment Trust (REIT), AGNC Investment Corp. is bound by strict IRS regulations. A key requirement is distributing at least 90% of its taxable income to shareholders annually to maintain its favorable tax status. Failure to meet this threshold could jeopardize its REIT classification.

Changes in tax laws or how they are interpreted can directly affect AGNC's business model and the income it can pass on to investors. For instance, any shifts in the definition of qualifying income or allowable deductions for REITs would necessitate strategic adjustments.

AGNC's adherence to these intricate rules is not merely a compliance matter but a foundational element of its entire operational framework. For example, in 2023, AGNC reported taxable income that necessitated significant distributions to meet the 90% rule, underscoring the ongoing importance of this regulation.

Broader financial market regulations, like those from the Dodd-Frank Act, significantly shape AGNC's operating environment by influencing its counterparties. These rules affect banks and brokers, which are crucial for AGNC's hedging activities and its access to derivatives markets. For instance, changes in capital requirements for financial institutions can alter the pricing and availability of the financial instruments AGNC relies on.

Specifically, regulations concerning bank capital, the oversight of clearinghouses, and enhanced reporting requirements can directly impact AGNC's costs and its ability to hedge effectively. These regulatory shifts can influence the availability and expense of crucial hedging tools and financing, thereby having a tangible effect on AGNC's day-to-day operations and overall financial health. For example, increased capital buffers required for banks might lead to higher borrowing costs for AGNC.

Mortgage and lending laws, including those dictating origination, servicing, and foreclosure, directly shape the agency mortgage-backed securities (MBS) market where AGNC operates. For instance, the Consumer Financial Protection Bureau (CFPB) continues to enforce regulations like the Ability-to-Repay and Qualified Mortgage rules, impacting the types of mortgages that can be securitized. These regulations, alongside state-specific foreclosure statutes, influence borrower behavior and can affect prepayment speeds and the overall stability of AGNC's collateral pool.

Securities and Exchange Commission (SEC) Regulations

AGNC Investment Corp. operates under the watchful eye of the Securities and Exchange Commission (SEC), facing stringent regulations that govern its financial reporting and disclosures. As a publicly traded entity, adherence to these rules, including the timely submission of annual (10-K) and quarterly (10-Q) reports, is paramount for retaining investor trust and ensuring continued access to capital markets. For instance, AGNC filed its 2023 10-K on February 23, 2024, detailing its financial performance and strategic positioning.

Changes in SEC regulations can directly impact AGNC's operational costs and administrative workload. For example, evolving disclosure requirements related to environmental, social, and governance (ESG) factors, which the SEC has been increasingly emphasizing, could necessitate additional resources for data collection and reporting. These regulatory shifts are a constant consideration for financial institutions like AGNC.

- SEC oversight mandates rigorous financial reporting and disclosure for AGNC.

- Timely and accurate filings, such as the 2023 10-K, are critical for market confidence.

- Potential shifts in SEC regulations, particularly concerning ESG disclosures, can raise compliance expenses.

Contract Law and Repurchase Agreements

AGNC Investment Corp.'s reliance on repurchase agreements (repos) for leverage means contract law is a cornerstone of its operations. The enforceability of these agreements, particularly concerning collateral and default provisions, directly impacts AGNC's financial stability. For instance, a shift in how courts interpret collateral rights in repo transactions could alter the cost and availability of its short-term funding.

The legal landscape surrounding bankruptcy and financial contracts is constantly evolving, posing potential risks for AGNC. Changes in bankruptcy code, such as those affecting the treatment of secured creditors or the ability to reclaim collateral, could significantly disrupt AGNC's funding model. This necessitates a proactive approach to understanding and adapting to these legal shifts.

In 2024, the repo market remained a critical, yet complex, funding source for mortgage REITs like AGNC. While specific data on AGNC's repo agreements isn't publicly detailed in a way that allows for precise legal risk quantification, the overall market size and its sensitivity to regulatory changes underscore the importance of robust legal frameworks. The Financial Stability Oversight Council (FSOC) continues to monitor systemic risks in the financial markets, including those stemming from repo markets, indicating ongoing regulatory attention.

- Contractual Certainty: AGNC's ability to secure stable, short-term funding hinges on the predictable enforceability of its repo agreements.

- Bankruptcy Law Impact: Adverse changes in bankruptcy laws could jeopardize AGNC's access to collateral, impacting its liquidity.

- Regulatory Scrutiny: Ongoing oversight of financial markets by bodies like the FSOC means that changes affecting repo markets could have direct implications for AGNC.

- Collateral Management: The legal definition and protection of collateral within repo contracts are vital for AGNC's risk management and operational continuity.

AGNC's status as a REIT hinges on strict IRS adherence, requiring at least 90% of taxable income distribution annually. For example, AGNC's 2023 performance necessitated substantial distributions to meet this rule, highlighting its critical nature. Changes in tax legislation, particularly regarding qualifying income or deductions for REITs, could force significant operational adjustments.

Broader financial regulations, such as those stemming from Dodd-Frank, impact AGNC by influencing its counterparties and derivative markets. For instance, evolving bank capital requirements in 2024 can affect the pricing and availability of hedging instruments AGNC relies on, potentially increasing borrowing costs.

Mortgage and lending laws, including CFPB's enforcement of rules like Ability-to-Repay, shape the MBS market. These regulations influence borrower behavior and prepayment speeds, directly impacting the stability of AGNC's collateral pool.

SEC oversight dictates rigorous financial reporting, with timely filings like AGNC's February 23, 2024, 10-K crucial for market confidence. Emerging ESG disclosure requirements from the SEC could also increase AGNC's compliance expenses.

AGNC's reliance on repo agreements makes contract law vital, with enforceability of collateral and default provisions impacting funding stability. Changes in bankruptcy code could disrupt AGNC's funding model by altering collateral reclaim rights.

Environmental factors

Climate change presents tangible risks to the residential properties underpinning AGNC's agency mortgage-backed securities. More frequent and intense extreme weather events, such as hurricanes and wildfires, can damage or destroy homes. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, a record high, causing over $145 billion in damages. While agency MBS are guaranteed against credit risk, widespread property damage could lead to increased mortgage delinquencies and defaults in affected areas, impacting the overall health and liquidity of the mortgage market that AGNC operates within.

Institutional investors are increasingly prioritizing Environmental, Social, and Governance (ESG) factors, which could steer capital away from companies with weaker ESG profiles. For AGNC, while its core business of agency mortgage-backed securities has a minimal direct environmental impact, its corporate governance and social responsibility efforts are under the spotlight. For instance, as of Q1 2024, the global ESG assets under management were projected to reach $33.9 trillion by 2026, highlighting the significant market shift.

AGNC's commitment to transparent ESG reporting can bolster its attractiveness to this growing pool of capital. Demonstrating strong governance, such as board diversity and executive compensation alignment with sustainability goals, alongside social initiatives, can differentiate AGNC in a competitive market. This focus is becoming crucial as many large pension funds and endowments, managing trillions in assets, now mandate ESG integration in their investment mandates.

As of 2024, the push for energy efficiency in residential buildings is gaining significant momentum, with many jurisdictions updating building codes to mandate higher insulation standards and more efficient HVAC systems. This trend directly influences the desirability and potential value of properties. For instance, in the US, the Inflation Reduction Act of 2022 offers substantial tax credits for energy-efficient home improvements, encouraging homeowners to invest in upgrades.

While AGNC Investment's core business revolves around agency mortgage-backed securities (MBS), these evolving environmental factors can indirectly shape the future composition of mortgage pools. Homes built or retrofitted to higher green building standards may exhibit different borrower characteristics, potentially impacting loan performance and prepayment speeds. Early indications suggest that homeowners in energy-efficient properties may experience lower utility costs, which could translate to more stable mortgage payments.

Water Scarcity and Resource Management

Water scarcity is an increasingly critical environmental factor that can directly influence the housing market, a core area for AGNC Investment. Regions experiencing significant water shortages may face limitations on new housing development and could see existing property values decline due to reduced habitability or increased costs for water management. For instance, in 2024, several Western US states continued to grapple with drought conditions, impacting construction permits and mortgage availability in affected areas.

These localized environmental risks are crucial for AGNC to consider in its portfolio assessment. Understanding the long-term viability of residential areas dependent on scarce water resources is a key component of comprehensive risk management. The financial implications can range from increased insurance premiums for properties in at-risk zones to potential defaults on mortgages secured by homes in areas facing severe water stress.

- Regional Water Stress: Areas like Arizona and California, significant housing markets, continue to face ongoing water management challenges, impacting development potential.

- Development Costs: Increased infrastructure investment for water conservation and supply in water-scarce regions can raise the cost of new housing.

- Property Value Impact: Studies in 2024 indicated a potential negative correlation between severe water scarcity and long-term residential property appreciation in specific markets.

Regulatory Pressure for Climate-Related Disclosures

Regulatory bodies, including the U.S. Securities and Exchange Commission (SEC), are increasingly mandating climate-related financial risk and opportunity disclosures. For AGNC Investment, this could translate into requirements to assess and report on climate risks embedded within its mortgage-backed securities (MBS) portfolio, even though it doesn't directly own physical real estate. This evolving regulatory landscape may introduce new reporting obligations and necessitate adjustments to existing risk management strategies.

For instance, the SEC's proposed climate disclosure rules, which were still under consideration and refinement through 2024 and into 2025, aim to standardize how companies report on climate impacts. While AGNC's business model is primarily financial, the underlying mortgages it holds are tied to physical properties susceptible to climate events. This means AGNC might need to develop methodologies to evaluate the climate resilience of the collateral backing its investments.

- SEC Proposed Rules: The SEC's ongoing work on climate disclosure rules could impact financial institutions like AGNC by requiring them to assess and report on climate-related risks within their portfolios.

- Portfolio Risk Assessment: AGNC may need to incorporate climate risk assessments into its due diligence and ongoing monitoring of MBS, considering factors like flood, wildfire, or hurricane exposure in the underlying property locations.

- Reporting Burden: Compliance with new disclosure requirements could increase operational costs and demand new expertise in climate risk analysis and reporting for AGNC.

Increasingly stringent environmental regulations, particularly concerning energy efficiency and carbon emissions, could influence property values and mortgage origination standards. As of 2024, many U.S. states and cities are updating building codes to require higher energy performance, which may indirectly affect the types of mortgages AGNC invests in.

The growing emphasis on ESG investing means that environmental factors are becoming more critical for institutional investors. AGNC's ability to demonstrate a commitment to sustainability and transparently report on its environmental considerations, even indirectly through its portfolio, can enhance its appeal to a significant and growing segment of the capital markets.

Extreme weather events, exacerbated by climate change, pose a direct risk to the physical assets underlying mortgage-backed securities. The record $145 billion in damages from 28 billion-dollar weather events in the U.S. in 2023, as reported by NOAA, underscores the potential for increased delinquencies and defaults in affected regions, impacting market liquidity.

PESTLE Analysis Data Sources

Our AGNC Investment PESTLE Analysis is built on a robust foundation of data from reputable financial news outlets, government housing and economic reports, and industry-specific market research. We integrate insights from regulatory bodies and economic forecasts to ensure a comprehensive understanding of the macro-environment.