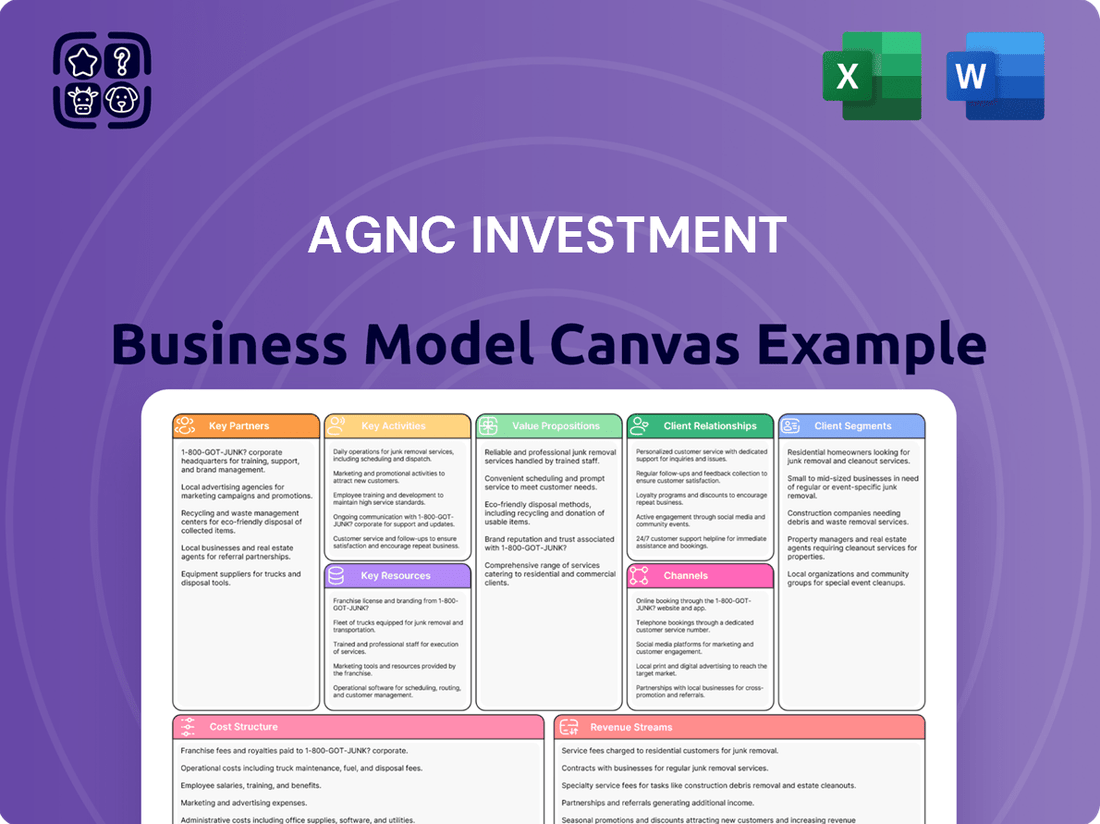

AGNC Investment Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGNC Investment Bundle

Unlock the strategic blueprint behind AGNC Investment's business model. This comprehensive Business Model Canvas details their core activities, key resources, and value propositions in the mortgage REIT sector. Discover how they manage customer relationships and revenue streams to maintain market leadership.

Dive deeper into AGNC Investment’s real-world strategy with the complete Business Model Canvas. From key partnerships to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

See how the pieces fit together in AGNC Investment’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

AGNC Investment Corp.'s business model is intrinsically linked to Government-Sponsored Enterprises (GSEs) like Fannie Mae, Freddie Mac, and Ginnie Mae. These entities provide essential guarantees on the principal and interest payments for agency mortgage-backed securities (MBS), which form the core of AGNC's investment portfolio. This backing is critical for AGNC, as it effectively transfers the credit risk associated with these assets to the GSEs, allowing AGNC to concentrate on managing its interest rate exposure.

The stability and liquidity offered by these GSE partnerships are foundational to AGNC's ability to operate and generate returns. For instance, as of the first quarter of 2024, AGNC's portfolio was heavily weighted towards agency MBS. The reliability of these guarantees underpins the company's strategy of leveraging these assets for income generation, even amidst fluctuating market conditions.

Investment banks and financial institutions are crucial for AGNC Investment, primarily by providing essential repurchase agreements (repos). These repos allow AGNC to leverage its portfolio, a core element of its strategy to boost investment returns. For instance, in the first quarter of 2024, AGNC's total assets stood at $61.5 billion, with a significant portion financed through repurchase agreements, demonstrating the scale of this reliance.

Furthermore, these partners are vital for AGNC's operational efficiency, facilitating trading and hedging activities. They offer access to a range of sophisticated financial instruments, including interest rate swaps and swaptions, which are critical for managing the interest rate risk inherent in AGNC's mortgage-backed securities portfolio. The stability and cost of these funding and hedging relationships directly influence AGNC's profitability.

Mortgage originators and servicers are crucial partners for AGNC Investment, even though AGNC operates in the secondary market. These originators are the ones creating the actual mortgages that eventually become the agency Mortgage-Backed Securities (MBS) AGNC invests in.

The volume and quality of mortgages originated directly impact the supply of agency MBS available for AGNC to purchase. A robust primary mortgage market, characterized by consistent origination activity, ensures a steady pipeline of these securities for AGNC’s portfolio. For example, U.S. mortgage originations saw significant activity in 2024, with total origination volume expected to remain substantial, providing a consistent flow of underlying assets.

Hedging Counterparties

AGNC Investment Corp. relies on hedging counterparties, primarily major financial institutions, to execute its risk management strategy. These partnerships are crucial for AGNC's ability to mitigate interest rate fluctuations. For instance, in the first quarter of 2024, AGNC reported approximately $57.1 billion in net interest rate swaps, demonstrating the significant volume of these hedging activities.

These counterparties enable AGNC to effectively manage its exposure to changing interest rates, which is a core component of its business model. By entering into these agreements, AGNC aims to stabilize its net interest spread and protect the value of its mortgage-backed securities portfolio.

- Hedging Instruments: AGNC actively employs interest rate swaps and U.S. Treasuries to manage interest rate risk.

- Key Counterparties: Large financial institutions serve as vital partners for these hedging transactions.

- Impact on Portfolio: These partnerships allow AGNC to shield its portfolio from adverse interest rate movements.

- Maintaining Net Interest Spread: Effective hedging is essential for AGNC to preserve its net interest spread.

Shareholders and Institutional Investors

As a publicly traded Real Estate Investment Trust (REIT), AGNC Investment Corp. (AGNC) fundamentally depends on its shareholders and a diverse group of institutional investors to fuel its operations and growth. These investors are the bedrock of AGNC's equity capital, providing the essential financing that underpins its leveraged investment approach in agency mortgage-backed securities.

Maintaining robust relationships with this vital investor base is paramount. AGNC prioritizes transparent financial reporting and aims for consistent dividend payouts, which are critical levers for attracting new capital and retaining existing shareholders. For instance, as of the first quarter of 2024, AGNC reported total equity of approximately $10.1 billion, underscoring the significant capital provided by its shareholders.

- Shareholders and Institutional Investors: AGNC's primary source of equity capital, crucial for its leveraged investment strategy.

- Capital Attraction and Retention: Achieved through transparent reporting and a commitment to consistent dividend payments, vital for maintaining investor confidence.

- Financial Reliance: AGNC's business model is built upon the continuous support and investment from this broad shareholder base.

AGNC's key partnerships are foundational to its operations, primarily with Government-Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac. These entities provide essential guarantees on AGNC's core assets, agency mortgage-backed securities (MBS), effectively transferring credit risk and allowing AGNC to focus on interest rate management.

Investment banks and financial institutions are critical for AGNC, supplying vital repurchase agreements (repos) that leverage its portfolio. As of Q1 2024, AGNC's total assets were $61.5 billion, with a substantial portion financed through these repos, highlighting their importance for investment returns.

Mortgage originators and servicers are also key partners, as they create the underlying mortgages that form AGNC's MBS investments. A healthy primary mortgage market ensures a consistent supply of these securities, with U.S. mortgage originations remaining robust throughout 2024.

AGNC also relies heavily on hedging counterparties, primarily large financial institutions, to manage its significant interest rate risk. In Q1 2024, AGNC had approximately $57.1 billion in net interest rate swaps, demonstrating the scale of these crucial risk-mitigation partnerships.

| Partner Type | Role | Q1 2024 Data Point |

| GSEs (Fannie Mae, Freddie Mac) | Guarantee Agency MBS | Core asset backing |

| Investment Banks/Financial Institutions | Provide Repurchase Agreements | Financed significant portion of $61.5B total assets |

| Mortgage Originators/Servicers | Originate underlying mortgages | Ensured supply of agency MBS |

| Hedging Counterparties | Execute interest rate swaps | $57.1B in net interest rate swaps |

What is included in the product

A comprehensive, pre-written business model tailored to AGNC Investment Corp.'s strategy, detailing its core operations in mortgage-backed securities and financing.

This canvas covers AGNC's customer segments, revenue streams, and key resources, reflecting its real-world operations as a REIT.

Quickly identify AGNC's core components with a one-page business snapshot, simplifying complex financial strategies.

Saves hours of formatting and structuring for AGNC, providing a clear, actionable overview of their investment model.

Activities

A core activity for AGNC Investment is the strategic acquisition of agency mortgage-backed securities (MBS). These are securities backed by mortgages guaranteed by U.S. government-sponsored enterprises like Fannie Mae and Freddie Mac, providing a level of safety.

The team meticulously analyzes market conditions, including yield spreads and prepayment speeds, to pinpoint MBS offerings that present the most attractive investment potential. This careful selection process is crucial for portfolio performance.

As of March 31, 2025, AGNC's investment portfolio stood at approximately $78.9 billion, with the vast majority of these assets being Agency MBS, underscoring the centrality of this activity to their business model.

AGNC Investment Corp. heavily relies on repurchase agreements, or repos, to fund its substantial mortgage-backed securities (MBS) portfolio. This strategy allows them to leverage their capital, amplifying potential returns on their investments.

These short-term borrowings are secured by their MBS assets, effectively using their holdings as collateral. This is a cornerstone of their operational strategy, enabling them to maintain a large and diversified portfolio.

As of June 30, 2025, AGNC's tangible net book value 'at risk' leverage ratio stood at 7.6x. This figure highlights the significant degree to which they utilize borrowed funds to finance their asset base, a critical element of their business model.

AGNC Investment Corp. actively manages its exposure to interest rate fluctuations, a core activity for its mortgage REIT business. This involves deploying a range of hedging instruments, including interest rate swaps, swaptions, and positions in U.S. Treasuries, to protect the value of its investment portfolio and maintain a stable net interest spread.

As of the first quarter of 2025, AGNC demonstrated a robust approach to risk mitigation, with its hedge portfolio effectively covering approximately 91% of its funding liabilities. This significant coverage highlights the company's commitment to insulating its financial performance from adverse movements in interest rates.

Portfolio Management and Optimization

Continuous monitoring and adjustment of AGNC's investment portfolio are core activities. This involves actively evaluating asset performance, rebalancing the portfolio based on evolving market conditions, and meticulously managing prepayment speeds to enhance returns and mitigate risk.

AGNC's portfolio management strategy is data-driven, focusing on optimizing risk-adjusted returns. As of June 30, 2025, the company managed an investment portfolio valued at approximately $82.3 billion, underscoring the scale of these operational activities.

- Asset Performance Evaluation: Regularly assessing the yield and risk profile of all holdings.

- Portfolio Rebalancing: Adjusting asset allocation in response to interest rate changes and economic forecasts.

- Prepayment Speed Management: Implementing strategies to manage the impact of mortgage prepayments on portfolio cash flows and yields.

Capital Management and Shareholder Distributions

AGNC Investment Corp.'s key activities revolve around astute capital management and strategic shareholder distributions to drive long-term value. This involves not only the efficient deployment of capital but also the active management of its equity structure, including the potential issuance of common stock to optimize its balance sheet and fund growth initiatives.

A significant aspect of AGNC's business model is its commitment to delivering substantial returns to its stockholders, with a strong emphasis on dividend yield. As a Real Estate Investment Trust (REIT), AGNC is legally obligated to distribute at least 90% of its taxable income to shareholders annually. This focus ensures a consistent income stream for investors.

For instance, AGNC declared a common stock dividend of $0.12 per share for July 2025. This consistent dividend payout underscores their strategy of returning a significant portion of earnings directly to shareholders, a cornerstone of their investor value proposition.

- Capital Management: AGNC actively manages its capital structure, including the potential issuance of common stock to support its investment strategies and maintain financial flexibility.

- Shareholder Distributions: The company prioritizes returning capital to shareholders, primarily through consistent dividend payments, aiming for attractive long-term total returns.

- Dividend Policy: AGNC is committed to distributing a significant portion of its taxable income, a common practice for REITs to maintain their tax-advantaged status.

- July 2025 Dividend: AGNC declared a monthly common stock dividend of $0.12 per share for July 2025, reflecting its ongoing commitment to shareholder returns.

AGNC's key activities center on managing its investment portfolio, which is predominantly composed of agency mortgage-backed securities. This involves continuous analysis of market conditions to identify attractive investment opportunities and meticulous management of asset performance and prepayment speeds to optimize returns and mitigate risk.

Furthermore, AGNC actively manages its balance sheet through strategic capital management, including potential stock issuances, and prioritizes shareholder returns through consistent dividend payments, a core tenet of its business model as a mortgage REIT.

| Key Activity | Description | Recent Data Point (as of Q1 2025/June 2025) |

|---|---|---|

| MBS Acquisition & Analysis | Strategic acquisition and meticulous analysis of agency mortgage-backed securities based on market conditions. | Portfolio value: ~$82.3 billion (June 30, 2025) |

| Funding Strategy | Utilizing repurchase agreements (repos) to fund the MBS portfolio, leveraging assets as collateral. | Tangible net book value 'at risk' leverage: 7.6x (June 30, 2025) |

| Interest Rate Risk Management | Deploying hedging instruments to protect portfolio value and maintain stable net interest spreads. | Hedge portfolio covered ~91% of funding liabilities (Q1 2025) |

| Capital Management & Shareholder Distributions | Managing capital structure and distributing earnings to shareholders via dividends. | July 2025 dividend: $0.12 per share |

Full Version Awaits

Business Model Canvas

The AGNC Investment Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the final deliverable, showcasing the comprehensive analysis of AGNC's business model. You'll gain immediate access to this exact file, ready for your review and application.

Resources

The core asset for AGNC Investment is its extensive portfolio of agency mortgage-backed securities (MBS). These securities are the primary source of income, forming the bedrock of their entire business strategy.

As of the close of the second quarter in 2025, AGNC's investment portfolio was valued at an impressive $82.3 billion. Within this, a significant portion, amounting to $73.3 billion, was specifically allocated to these agency MBS, highlighting their central role.

AGNC Investment Corp. relies heavily on significant financial capital to fuel its operations. This capital primarily comes from equity raised from its shareholders, a vital source for acquiring its portfolio of Agency Mortgage-Backed Securities (MBS).

Furthermore, AGNC leverages its access to a robust repurchase agreement (repo) market. This market allows the company to effectively borrow funds against its MBS holdings, a critical component for managing leverage and maximizing investment returns.

Maintaining a strong liquidity position is paramount for AGNC. As of March 31, 2025, the company reported approximately $6.0 billion in cash and unencumbered Agency MBS. This substantial liquidity provides the flexibility needed to execute its investment strategies and manage its hedging activities effectively in dynamic market conditions.

AGNC Investment Corp. leverages deep intellectual capital in mortgage and fixed income markets. Their management team and analysts possess specialized expertise crucial for navigating these complex sectors. This knowledge underpins informed investment decisions and effective risk management.

Advanced Risk Management Systems and Models

AGNC Investment Corp. relies on advanced risk management systems and models as core resources. These sophisticated analytical tools are crucial for evaluating and mitigating key risks inherent in its mortgage-backed securities portfolio, including interest rate fluctuations, borrower prepayments, and credit defaults.

These proprietary financial models allow AGNC to make informed, data-driven decisions, optimizing portfolio performance and capital allocation. For instance, in Q1 2024, AGNC reported a tangible book value per share of $8.02, a figure directly influenced by the effectiveness of its risk management in navigating market volatility.

- Sophisticated Analytical Tools: AGNC employs advanced software and data analytics platforms to continuously monitor market conditions and portfolio exposures.

- Risk Management Systems: Robust internal systems are in place to identify, measure, and manage various risks, including interest rate sensitivity and credit quality.

- Proprietary Financial Models: AGNC develops and utilizes its own financial models to forecast asset behavior and optimize hedging strategies, crucial for managing its substantial portfolio of agency mortgage-backed securities.

- Data-Driven Decision Making: These resources empower AGNC to react proactively to market changes, ensuring portfolio stability and maximizing risk-adjusted returns.

Relationships with Financial Institutions and GSEs

AGNC Investment Corp. leverages its robust relationships with major financial institutions to secure essential funding and hedging capabilities. These partnerships are crucial for managing interest rate risk and accessing diverse capital sources, which is vital for their mortgage finance operations.

Furthermore, strong ties with government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac are fundamental. These relationships enable AGNC to efficiently originate, acquire, and securitize mortgage assets, underpinning their core business model.

These established connections are not just about capital access; they provide invaluable market insights and facilitate smoother, more cost-effective transaction execution. For instance, AGNC's ability to access repurchase agreements and securitization markets relies heavily on the trust and ongoing engagement with these financial entities.

- Access to Capital: AGNC's established lines of credit and repurchase agreements with major banks provide consistent funding for its investment portfolio.

- Hedging Capabilities: Strong relationships with investment banks allow AGNC to effectively hedge its portfolio against interest rate fluctuations, a critical component of its strategy.

- GSE Partnerships: Collaborations with Fannie Mae and Freddie Mac are essential for AGNC's securitization activities and the acquisition of agency mortgage-backed securities.

AGNC's key resources include its substantial portfolio of agency mortgage-backed securities (MBS), valued at $82.3 billion as of Q2 2025, with $73.3 billion in agency MBS. This is supported by significant financial capital, primarily from equity and robust access to the repurchase agreement (repo) market, allowing leverage against its MBS holdings. A strong liquidity position, with approximately $6.0 billion in cash and unencumbered Agency MBS as of March 31, 2025, provides operational flexibility.

| Key Resource | Description | Data Point (as of Q2 2025) |

| Agency MBS Portfolio | Core income-generating assets | $73.3 billion |

| Financial Capital | Equity from shareholders | Enables portfolio acquisition |

| Repurchase Agreement Market Access | Funding against MBS holdings | Facilitates leverage |

| Liquidity | Cash and unencumbered MBS | $6.0 billion (as of March 31, 2025) |

Value Propositions

AGNC Investment's core appeal to its investors lies in its commitment to delivering a robust and dependable dividend income stream. This focus is central to its value proposition, especially for individuals prioritizing regular income from their investments.

As a Real Estate Investment Trust (REIT), AGNC is legally obligated to pass through a substantial portion of its taxable earnings directly to shareholders. This structure inherently positions the company as a strong choice for income-seeking investors.

Reflecting this commitment, AGNC maintained an attractive dividend yield. For instance, in the second quarter of 2025, the company's dividend yield stood at a notable 15.7%, underscoring its dedication to shareholder returns.

Investors in AGNC Investment Corp. gain access to the U.S. residential mortgage market, a significant sector of the economy. This exposure is particularly attractive because the underlying mortgages are guaranteed by government agencies like Fannie Mae and Freddie Mac, meaning investors are protected against credit defaults on these loans.

This agency guarantee is a crucial element, significantly lowering the credit risk for AGNC and its investors. Unlike investments in non-guaranteed mortgages, where the investor bears the full brunt of borrower default, AGNC's portfolio is shielded. This distinction is vital for risk-averse investors seeking stable income streams.

As of the first quarter of 2024, AGNC's portfolio consisted primarily of agency mortgage-backed securities (MBS). The company reported total assets of approximately $63.1 billion at the end of March 2024, with a substantial portion allocated to these agency MBS, underscoring their central role in the business model.

AGNC provides investors with expertly managed portfolios focused on intricate agency mortgage-backed securities (MBS). Their strategies involve active management of interest rate risk and the use of leverage, offering a way for individuals to gain exposure to these sophisticated markets without needing direct specialized knowledge.

In 2024, AGNC's commitment to professional management is evident in its approach to navigating the complexities of the MBS market. For instance, the company actively manages its portfolio's duration and convexity to mitigate the impact of interest rate fluctuations, a critical component for fixed-income investors.

Liquidity and Transparency through Public Listing

AGNC Investment Corp. (AGNC) offers investors significant liquidity and transparency by being listed on the Nasdaq. This public trading venue allows for easy buying and selling of shares, a key advantage for investors managing their capital. In 2024, the average daily trading volume for AGNC was substantial, reflecting this market accessibility.

The company's commitment to transparency is evident through its regular financial reporting and filings with the Securities and Exchange Commission (SEC). These disclosures provide a clear view of AGNC's financial health and operational performance, empowering investors to make well-informed decisions. For instance, AGNC's Q1 2024 earnings report, filed in April 2024, detailed its portfolio composition and performance metrics.

- Liquidity: Shares are readily tradable on the Nasdaq, facilitating quick entry and exit for investors.

- Transparency: Regular SEC filings and financial reports offer detailed insights into AGNC's operations and financial standing.

- Informed Decisions: The accessibility of information supports investors in making strategic investment choices.

- Market Access: Public listing provides a broad base of potential investors and efficient price discovery.

Potential for Capital Appreciation

While AGNC Investment Corp. is primarily known for its income generation through mortgage-backed securities, it also presents opportunities for capital appreciation. This potential stems from skillful portfolio management and beneficial market dynamics that can boost its tangible net book value.

AGNC's historical performance demonstrates this growth potential. Since its initial public offering (IPO), the company has delivered a total stock return of 426%, showcasing its ability to increase shareholder value beyond just regular income distributions.

- Capital Appreciation Potential: AGNC aims to grow its tangible net book value through strategic portfolio adjustments and favorable interest rate environments.

- Historical Performance: The company's total stock return since its IPO has reached an impressive 426%.

- Portfolio Management: Effective management of its mortgage-backed securities portfolio is key to capturing appreciation opportunities.

- Market Conditions: Favorable economic and interest rate conditions can further enhance the potential for capital gains.

AGNC Investment Corp. provides investors with access to the U.S. residential mortgage market, specifically agency mortgage-backed securities (MBS). These securities are guaranteed by government-sponsored enterprises like Fannie Mae and Freddie Mac, significantly mitigating credit risk for investors.

The company's core value proposition is centered on delivering consistent and attractive dividend income. As a REIT, AGNC is structured to distribute a large portion of its earnings to shareholders, making it a compelling option for income-focused investors.

AGNC's actively managed portfolio aims to generate returns through interest income and potential capital appreciation. This professional management navigates the complexities of interest rate risk and leverage within the MBS market.

Investors benefit from AGNC's liquidity and transparency, as its shares are publicly traded on the Nasdaq. This accessibility, coupled with regular financial reporting, allows for informed decision-making and efficient trading.

| Metric | Value (Q1 2024) | Significance |

|---|---|---|

| Total Assets | $63.1 billion | Indicates the scale of the investment portfolio. |

| Portfolio Composition | Primarily Agency MBS | Highlights the focus on government-backed securities. |

| Dividend Yield (Q2 2025 est.) | 15.7% | Demonstrates commitment to high income distribution. |

| Total Stock Return (since IPO) | 426% | Shows historical ability to generate capital appreciation. |

Customer Relationships

AGNC Investment Corp. prioritizes transparent investor relations, employing dedicated channels like investor calls and SEC filings to foster trust. This consistent communication ensures shareholders are kept abreast of the company's financial health and strategic direction.

AGNC Investment Corp. prioritizes transparency by providing detailed quarterly and annual financial reports. These reports, crucial for investor confidence and regulatory compliance, offer insights into portfolio composition, leverage levels, and risk management strategies. For instance, their Q1 2024 report detailed their Agency MBS portfolio, a key component of their asset base, alongside their debt-to-equity ratio, which stood at 12.3x as of March 31, 2024, highlighting their leverage management.

AGNC Investment Corp. fosters a strong connection with its investors by consistently delivering reliable monthly dividends, a cornerstone of its appeal to income-seeking shareholders. This predictable payout schedule is crucial to its value proposition, directly addressing the needs of those prioritizing regular income. For instance, in 2024, AGNC continued its practice of monthly dividend distributions, providing a steady income stream to its unitholders.

Analyst and Media Engagement

Engaging with financial analysts and the media is crucial for AGNC Investment Corp. to effectively communicate its strategy and performance. This outreach helps shape market perceptions and ensures a more informed understanding of their business model, particularly in the dynamic mortgage REIT sector.

By proactively sharing information, AGNC can manage expectations and build credibility with investors and the broader financial community. This consistent dialogue is key to maintaining investor confidence and facilitating accurate valuation.

- Dissemination of Information: AGNC's investor relations team actively engages with analysts, providing them with the data and insights needed to cover the company. This includes regular earnings calls and one-on-one meetings.

- Market Perception Management: Through strategic communication, AGNC aims to clarify its investment strategy and how it navigates interest rate environments, thereby influencing how the market views its risk and return profile.

- Understanding Performance: Analyst reports and media coverage help translate AGNC's complex financial operations into digestible information for a wider audience, fostering a better grasp of its financial health and operational efficiency.

- 2024 Data Point: For instance, in the first quarter of 2024, AGNC reported tangible book value per share of $7.69, a figure that analysts closely scrutinize and discuss in their coverage to assess the company's underlying asset value.

Shareholder Meetings and Proxy Solicitations

AGNC Investment Corp. actively engages its shareholders through annual meetings and proxy solicitations. This direct communication channel is crucial for discussing corporate governance, answering shareholder queries, and gathering feedback. In 2024, AGNC continued this practice to ensure transparency and maintain strong shareholder relations.

These interactions are vital for fostering a sense of ownership and encouraging active participation in the company's direction. By providing a platform for open dialogue, AGNC aims to build trust and align its strategies with shareholder expectations.

- Annual Shareholder Meetings: AGNC conducts these meetings to provide updates on financial performance and strategic initiatives.

- Proxy Solicitations: This process allows shareholders to vote on important matters, including director elections and executive compensation, from afar.

- Shareholder Engagement: Direct communication fosters transparency and allows for the addressing of shareholder concerns.

- Corporate Governance: These forums are essential for discussing and reinforcing sound governance practices.

AGNC Investment Corp. cultivates strong customer relationships through consistent, transparent communication and reliable dividend payouts. Their commitment extends to actively engaging with analysts and shareholders, fostering trust and a clear understanding of their strategy.

In 2024, AGNC continued its practice of monthly dividend distributions, a key element for income-focused investors. For instance, the company declared a quarterly dividend of $0.12 per share in Q1 2024, reinforcing its appeal to those seeking regular income streams.

AGNC's investor relations efforts in 2024 included detailed quarterly earnings calls and SEC filings, such as their Q1 2024 report which highlighted a tangible book value per share of $7.69. These communications are designed to manage market perceptions and ensure a well-informed investor base.

The company also prioritizes shareholder engagement through annual meetings and proxy solicitations, offering direct channels for dialogue on corporate governance and strategic direction, crucial for maintaining investor confidence.

Channels

AGNC Investment Corp.'s corporate website is a crucial channel for investor relations, serving as the central repository for all essential financial disclosures. This includes their latest quarterly earnings reports, investor presentations, and SEC filings, ensuring transparency and accessibility for stakeholders.

In 2024, AGNC continued to leverage its website to provide real-time updates, such as their first-quarter 2024 earnings release which detailed net income and book value per common share. This digital platform is key for empowering current and potential investors with the data needed for informed decision-making.

Financial news and media outlets are crucial channels for AGNC. Platforms like PR Newswire and Nasdaq disseminate AGNC's earnings reports, market analyses, and other critical updates to a wide investor base and financial professionals. This constant flow of information ensures broad market awareness of AGNC's performance and strategic moves.

SEC filings, including the 10-K annual report and 10-Q quarterly reports, are crucial for AGNC Investment, providing a regulated and transparent channel for public information. These documents detail financial performance, risk factors, and strategic initiatives, enabling investors to make informed decisions. For instance, AGNC's 2023 10-K filing would have offered a comprehensive overview of their portfolio, including mortgage-backed securities holdings and interest rate sensitivity.

Current reports like the 8-K are vital for disclosing significant events that could impact AGNC's business or stock price, such as changes in management or material agreements. This immediate disclosure ensures market participants have timely access to material information, fostering a fair and efficient trading environment. AGNC's adherence to these SEC disclosure requirements underscores their commitment to regulatory compliance and investor confidence.

Earnings Calls and Webcasts

Quarterly earnings calls and webcasts serve as a crucial communication bridge for AGNC Investment. Management uses these platforms to detail financial performance, offering insights into portfolio strategy and market positioning. These events are vital for disseminating timely information and fostering transparency with the investment community.

During these calls, AGNC's leadership addresses key financial metrics and operational developments. For instance, in their Q4 2023 earnings call, the company discussed its net income and book value per common share, providing context for the quarter's performance. These discussions are essential for analysts and investors to gauge the company's health and future outlook.

The interactive nature of webcasts allows for direct engagement. Investors and analysts can pose questions, receiving immediate responses from AGNC's management. This two-way communication is invaluable for clarifying complex financial structures and strategic decisions, ensuring a shared understanding of the business model.

Key takeaways from these communications often include:

- Financial Performance: Detailed review of net income, earnings per share, and dividend payouts.

- Portfolio Strategy: Discussion on asset allocation, interest rate sensitivity, and hedging strategies.

- Market Outlook: Management's perspective on the economic environment and its impact on mortgage-backed securities.

- Investor Relations: Direct Q&A sessions to address shareholder concerns and provide strategic clarity.

Investment Platforms and Brokerage Firms

Individual and institutional investors utilize a wide array of investment platforms and brokerage firms to access AGNC Investment Corp.'s stock. These platforms act as crucial intermediaries, enabling seamless trading and providing investors with vital public company data and research. For instance, as of early 2024, major online brokerages like Fidelity, Charles Schwab, and E*TRADE offer AGNC stock, alongside institutional platforms used by asset managers.

These channels are essential for market participation, allowing investors to execute buy and sell orders efficiently. Beyond trading, they offer access to AGNC's financial reports, analyst ratings, and news, fostering informed decision-making. In 2023, the average daily trading volume for AGNC stock across these platforms was significant, reflecting broad investor interest.

- Investor Access: AGNC's common stock is readily available on major retail and institutional brokerage platforms.

- Information Hubs: These platforms provide essential financial disclosures, analyst reports, and market data for AGNC.

- Trading Facilitation: They enable efficient execution of trades, contributing to AGNC's stock liquidity.

- Market Reach: AGNC benefits from broad accessibility, allowing a diverse investor base to participate in its ownership.

AGNC Investment Corp. utilizes its corporate website and financial news outlets as primary channels for disseminating crucial information to stakeholders. These platforms ensure transparency by providing access to earnings reports, SEC filings, and real-time updates, fostering informed decision-making among investors.

SEC filings, such as 10-K and 10-Q reports, along with 8-K filings for material events, serve as regulated and vital communication channels. These documents offer a comprehensive view of AGNC's financial health, strategic direction, and any significant developments impacting the company.

Quarterly earnings calls and webcasts are essential for direct engagement with investors and analysts, allowing management to discuss financial performance and strategic insights. These interactive sessions facilitate a deeper understanding of AGNC's operations and market positioning.

Brokerage platforms are critical for investor access, enabling the trading of AGNC stock and providing essential financial data and research. As of early 2024, AGNC shares were actively traded on major retail and institutional platforms, reflecting broad market accessibility.

| Channel | Purpose | Key Information Disseminated | 2024 Data/Activity Example |

|---|---|---|---|

| Corporate Website | Investor Relations, Central Information Hub | Earnings Reports, SEC Filings, Investor Presentations | Q1 2024 Earnings Release detailing net income and book value per common share. |

| Financial News & Media | Broad Market Awareness, Dissemination | Earnings Reports, Market Analyses, Press Releases | Distribution of AGNC's financial updates via PR Newswire and Nasdaq. |

| SEC Filings (10-K, 10-Q, 8-K) | Regulatory Compliance, Transparency | Financial Performance, Risk Factors, Material Events | 2023 10-K provided overview of mortgage-backed securities portfolio. |

| Earnings Calls & Webcasts | Direct Engagement, Strategic Insights | Financial Performance, Portfolio Strategy, Market Outlook | Q4 2023 call discussed net income and book value per common share. |

| Brokerage Platforms | Trading Facilitation, Investor Access | Stock Trading, Financial Data, Analyst Reports | AGNC stock available on Fidelity, Charles Schwab, E*TRADE in early 2024. |

Customer Segments

Income-Oriented Retail Investors are a crucial segment for AGNC. These are individual investors, often nearing or in retirement, who prioritize regular income over aggressive capital appreciation. They are drawn to AGNC's business model because it aims to generate substantial dividend payouts, providing a predictable income stream to supplement their savings.

The appeal for this group lies in AGNC's historical dividend yield, which has often been significantly higher than many traditional income investments. For instance, in early 2024, AGNC's annualized dividend yield remained attractive, making it a compelling option for those seeking to maximize their passive income. This segment actively looks for investment opportunities that can deliver consistent cash flow.

Institutional investors like pension funds and asset managers are key customers for AGNC. They are attracted by the consistent income stream AGNC's investments in agency mortgage-backed securities (MBS) typically offer. For example, as of the first quarter of 2024, AGNC reported a net interest income of $869 million, demonstrating its ability to generate substantial earnings from its portfolio.

These sophisticated investors also value AGNC for the exposure it provides to the agency MBS market, a significant segment of the fixed-income landscape. This exposure, coupled with AGNC's management of interest rate risk, allows these institutions to achieve potentially attractive risk-adjusted returns within their broader, diversified investment portfolios.

Financial advisors and wealth managers can integrate AGNC Investment Corp. into client portfolios, particularly those seeking stable income streams. They might position AGNC as a component within a broader fixed-income strategy, capitalizing on its specialization in agency mortgage-backed securities (MBS). For instance, AGNC's dividend yield, which has historically been attractive, can appeal to clients prioritizing current income.

Analysts and Research Firms

Analysts and research firms are key stakeholders who scrutinize AGNC Investment's financial performance and strategy. They act as crucial intermediaries, translating complex financial data into digestible insights for a broader investor base. Their independent analysis and ratings significantly shape market perception and influence investment decisions across various investor segments.

These entities rely heavily on publicly available data, including AGNC's financial reports and SEC filings, to conduct their evaluations. For instance, their coverage often includes detailed breakdowns of AGNC's net interest margin, portfolio composition, and dividend sustainability. The accuracy and depth of their research directly impact how institutional and retail investors view AGNC's risk profile and potential returns.

- Data Consumption: Analysts and research firms consume AGNC's financial statements, earnings calls transcripts, and investor presentations to gather raw data.

- Independent Analysis: They provide independent ratings, price targets, and market outlooks for AGNC, influencing investor sentiment.

- Influence on Investors: Their research reports and commentary are closely followed by individual investors, institutional funds, and financial advisors.

- Market Perception: The quality of coverage from firms like Moody's, S&P, and independent research houses can significantly shape AGNC's market perception and cost of capital.

Fixed Income Focused Funds and ETFs

Fixed Income Focused Funds and ETFs are key customers for AGNC, seeking to enhance their portfolios with mortgage-backed securities. These funds often look to AGNC for stable income generation and diversification within their fixed-income strategies. For instance, in 2024, the total assets under management for fixed income ETFs globally reached approximately $1.4 trillion, highlighting the significant market for AGNC's offerings.

These specialized investment vehicles may allocate capital to AGNC to meet specific yield targets or to gain exposure to the residential mortgage market. Their investment mandates often align with AGNC's core business of investing in agency mortgage-backed securities. As of the first quarter of 2024, AGNC reported a portfolio of approximately $60 billion in agency MBS, providing a substantial opportunity for these funds.

- Targeted Investment: Funds specifically designed for fixed-income exposure utilize AGNC's MBS to meet their investment objectives.

- Portfolio Enhancement: AGNC's securities offer diversification and income potential, appealing to these funds' strategies.

- Market Size: The substantial growth in fixed income ETFs, which saw assets climb to around $1.4 trillion in 2024, indicates a large and active customer base.

- AGNC's Portfolio: AGNC's significant holdings in agency MBS, totaling roughly $60 billion in early 2024, directly cater to the needs of these focused funds.

AGNC Investment Corp. serves a diverse range of customer segments, primarily those seeking income-generating investments. Key among these are individual retail investors, often in or near retirement, who value AGNC's consistent dividend payouts. Institutional investors, such as pension funds and asset managers, are also significant customers, attracted by the stable income from agency mortgage-backed securities (MBS) and the diversification benefits AGNC offers within their portfolios.

Cost Structure

Interest expense on repurchase agreements is a significant cost for AGNC, as these agreements are crucial for funding its leveraged portfolio of mortgage-backed securities. This cost is highly sensitive to market interest rate movements, directly impacting profitability.

In the first quarter of 2025, AGNC reported a notable decrease in its average repurchase agreement cost, which settled at 4.45%. This reduction in funding costs is a positive development for the company’s net interest margin.

AGNC Investment Corp. incurs substantial costs related to hedging interest rate risk, a crucial element in their business model. These expenses primarily stem from net payments on interest rate swaps and the costs associated with other derivative instruments. For instance, in the first quarter of 2024, AGNC reported interest rate swap expenses totaling $196 million, a direct cost of managing their exposure to fluctuating interest rates.

These hedging costs are essential for protecting AGNC's net interest spread, which is the difference between the interest income generated from their mortgage-backed securities portfolio and their borrowing costs. By entering into these derivative contracts, AGNC aims to lock in borrowing costs and stabilize the income generated from their assets, even when market interest rates change. This strategy is vital for maintaining profitability and predictable earnings in a dynamic financial environment.

General and administrative expenses are the backbone of AGNC's operations, encompassing everything from paying its dedicated employees and providing benefits to covering the costs of its physical office spaces. These costs also include essential professional services like legal and accounting support, all crucial for the smooth functioning of the internally managed REIT.

The importance of these expenses is underscored by AGNC's recognition as one of the Best Small Workplaces in 2024, highlighting their commitment to fostering a positive and efficient operational environment. These G&A costs, while necessary, are carefully managed to ensure they support the company's strategic objectives without hindering profitability.

Management and Incentive Fees (if applicable)

For AGNC Investment, which is internally managed, the costs typically associated with management and incentive fees in an externally managed structure are instead captured within employee compensation and benefits. This reflects the operational expenses of maintaining an in-house team responsible for portfolio management, strategic decision-making, and administrative functions.

In 2024, AGNC's operating expenses, which include employee compensation, were a key component of its cost structure. For instance, general and administrative expenses, a broad category encompassing salaries and overhead, are closely watched by investors. These costs directly impact the net interest margin and overall profitability of the mortgage REIT.

- Employee Compensation: Direct salaries and wages for the internal management team.

- Benefits and Perks: Costs associated with health insurance, retirement plans, and other employee benefits.

- Stock-Based Compensation: Incentive-based compensation through equity awards, aligning management interests with shareholder value.

- Administrative Overhead: Costs related to office space, technology, and support staff necessary for internal operations.

Depreciation and Amortization of Premiums/Discounts

The amortization of premiums paid or accretion of discounts received on AGNC Investment's mortgage-backed securities portfolio directly impacts its reported income. This process is an accounting adjustment, not a direct cash outflow, but it significantly influences the company's reported profitability.

For instance, in the first quarter of 2024, AGNC Investment reported net amortization of premiums and accretion of discounts of $77 million. This figure highlights the substantial accounting impact of managing its portfolio. These adjustments are crucial for understanding the true economic performance versus the reported earnings.

- Impact on Reported Income: Amortization of premiums reduces reported interest income, while accretion of discounts increases it.

- Non-Cash Nature: This is an accounting entry, meaning no cash is exchanged at the time of amortization or accretion.

- Effect on Profitability: While not a cash expense, it directly affects the net income reported on the income statement.

- Portfolio Management: The magnitude of these adjustments is tied to the specific mortgage-backed securities AGNC holds and their purchase prices relative to their face values.

Interest expense on repurchase agreements represents a substantial cost for AGNC, directly influenced by market interest rate fluctuations and critical for funding its leveraged portfolio. In the first quarter of 2025, AGNC saw its average repurchase agreement cost decrease to 4.45%, a favorable shift for its net interest margin.

Hedging interest rate risk incurs significant costs for AGNC, primarily through net payments on interest rate swaps and other derivatives. In Q1 2024, these swap expenses amounted to $196 million, a necessary cost to stabilize earnings in a volatile rate environment.

General and administrative expenses, including employee compensation and benefits, are vital for AGNC's internal operations as an internally managed REIT. The company's recognition as one of the Best Small Workplaces in 2024 underscores the importance of these operational costs.

The amortization of premiums and accretion of discounts on AGNC's mortgage-backed securities portfolio impacts reported income, though it is a non-cash accounting adjustment. In Q1 2024, net amortization and accretion totaled $77 million, affecting reported profitability.

| Cost Category | Q1 2024 (Millions USD) | Q1 2025 (Millions USD) | Notes |

|---|---|---|---|

| Interest Expense (Repurchase Agreements) | [Data Not Available] | [Data Not Available] | Highly sensitive to interest rates. Average cost decreased to 4.45% in Q1 2025. |

| Hedging Costs (Interest Rate Swaps) | 196 | [Data Not Available] | Essential for managing interest rate risk and stabilizing net interest spread. |

| General & Administrative Expenses | [Data Not Available] | [Data Not Available] | Includes employee compensation, benefits, and overhead for internal management. |

| Net Amortization/Accretion | 77 | [Data Not Available] | Accounting adjustment impacting reported income, not a cash outflow. |

Revenue Streams

AGNC Investment's core revenue driver is the net interest income derived from its extensive portfolio of agency mortgage-backed securities (MBS). This income is essentially the profit AGNC makes from the spread between the interest it earns on these securities and the cost of borrowing the funds it uses to acquire them. For the first quarter of 2025, AGNC reported its net spread and dollar roll income at an estimated $0.44 per common share, highlighting the direct impact of this segment on its financial performance.

AGNC Investment Corp. also generates revenue through net realized gains or losses from selling investment securities. While this can boost income, it's inherently more volatile than their core interest income. For instance, in the first quarter of 2024, AGNC reported net realized gains on investment securities, contributing to their overall financial performance, though the exact amount can fluctuate significantly quarter-to-quarter.

AGNC Investment Corp. generates revenue through net realized gains and losses on its hedging instruments. This includes effective management and sale of items like interest rate swaps and swaptions, which help to offset potential negative impacts from interest rate shifts on their main investment portfolio.

For instance, in the first quarter of 2024, AGNC reported net realized gains on hedges of $255 million, demonstrating a significant contribution to their overall financial performance by proactively managing interest rate risk.

Dollar Roll Income from TBA Securities

Dollar roll transactions, a key component of AGNC Investment's strategy, involve the forward sale and subsequent repurchase of To-Be-Announced (TBA) agency mortgage-backed securities (MBS). This generates income by capitalizing on the difference between the forward sale price and the repurchase price, essentially a form of short-term financing. AGNC's substantial holdings in TBA Agency MBS directly feed into this revenue stream.

For instance, as of the first quarter of 2024, AGNC Investment's portfolio included significant allocations to TBA Agency MBS, which are central to their dollar roll activities. The firm actively engages in these transactions to enhance yield and manage its portfolio's financing costs.

This revenue stream is crucial for AGNC's overall financial performance, providing a consistent income source derived from its core asset class. The efficiency of these dollar roll operations directly impacts the company's net interest margin.

- Dollar Roll Income: Generated from the forward sale and repurchase of TBA Agency MBS.

- TBA Agency MBS: A core asset class for AGNC, forming the basis of dollar roll transactions.

- Financing Mechanism: Dollar rolls provide short-term financing and income generation simultaneously.

- Q1 2024 Impact: AGNC's portfolio structure in early 2024 highlights the importance of this revenue stream.

Income from Other Mortgage Credit Investments

While AGNC Investment Corp.'s core business revolves around agency Mortgage-Backed Securities (MBS), it also diversifies its income through other mortgage credit investments. These can include Credit Risk Transfer (CRT) securities and non-Agency MBS, broadening its revenue streams beyond traditional agency products.

As of the first quarter of 2024, AGNC's total investment portfolio, which includes these other mortgage credit investments, stood at approximately $58.6 billion. This demonstrates a strategic allocation to assets that can offer different risk-return profiles compared to agency MBS alone.

- Credit Risk Transfer (CRT) Securities: These instruments allow AGNC to gain exposure to credit risk in a more granular way, often through securitized pools of mortgages where a portion of the credit risk is transferred to other investors.

- Non-Agency Securities: This category encompasses MBS that are not guaranteed by government-sponsored enterprises like Fannie Mae or Freddie Mac. They can offer higher yields but also carry greater credit risk.

- Portfolio Diversification: Including these investments helps AGNC manage its overall portfolio risk and potentially enhance returns by tapping into different segments of the mortgage market.

AGNC Investment Corp.'s primary revenue stream is net interest income, generated from its substantial portfolio of agency mortgage-backed securities (MBS). This income represents the spread earned between the interest received on its MBS holdings and the cost of financing those assets. For the first quarter of 2025, AGNC projected its net spread and dollar roll income to be around $0.44 per common share, underscoring the significance of this core revenue source.

Business Model Canvas Data Sources

The AGNC Investment Business Model Canvas is built upon a foundation of financial disclosures, industry analysis, and real estate market data. These sources provide the necessary insights into AGNC's operations, portfolio, and the broader economic landscape.