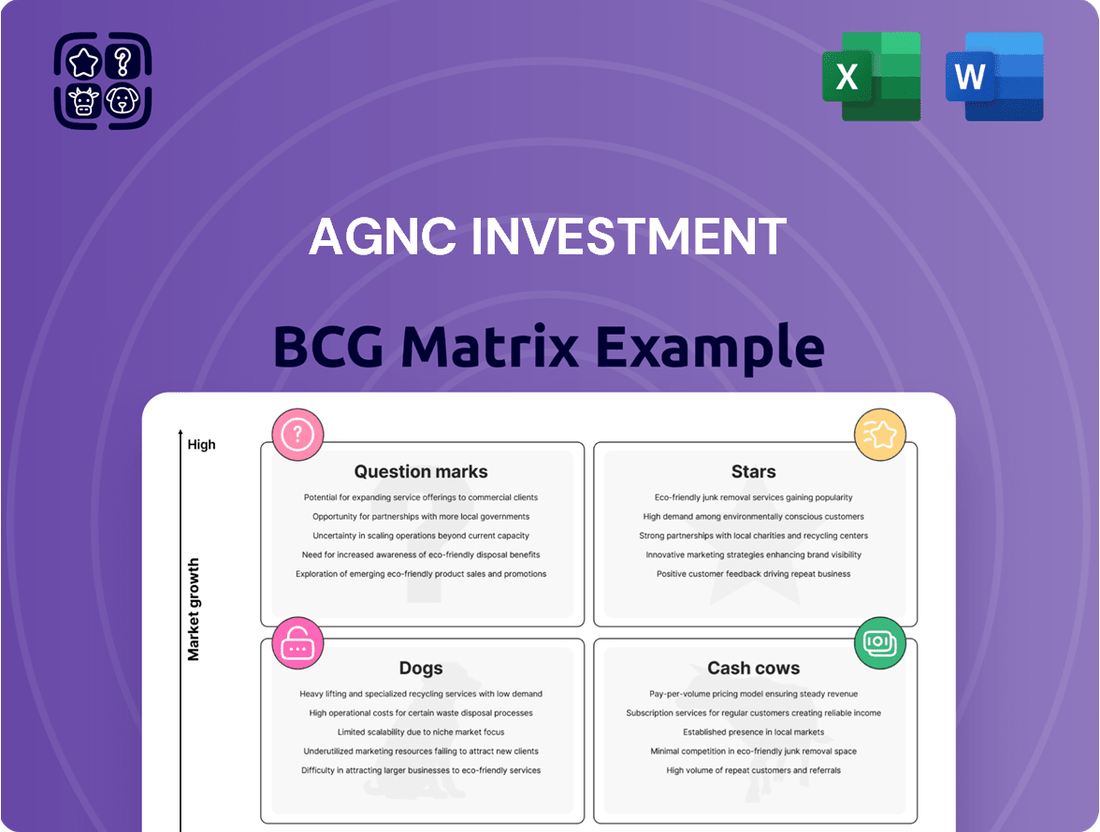

AGNC Investment Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGNC Investment Bundle

Understand AGNC Investment's strategic positioning with our BCG Matrix preview, highlighting key areas of strength and potential growth. See which of their assets are generating consistent returns and which require closer examination.

This glimpse is just the start. Unlock the full BCG Matrix report to reveal detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing AGNC Investment's portfolio and maximizing future returns.

Stars

AGNC Investment's substantial and growing portfolio of Agency Mortgage-Backed Securities (MBS) is a cornerstone of its strategy. As of March 31, 2025, this portfolio stood at approximately $78.9 billion, expanding to $74.0 billion by June 30, 2025, showcasing AGNC's significant market presence in government-guaranteed mortgage assets.

This robust asset base underscores AGNC's role as a key player in facilitating liquidity within the U.S. housing market. The sheer scale of its Agency MBS holdings positions the company as a leader in this vital sector.

AGNC Investment Corp. consistently offers a compelling dividend yield, frequently surpassing 15%, making it a prime choice for investors prioritizing income. This strong yield is a key differentiator, attracting a dedicated base of income-seeking shareholders.

The company's commitment to consistent monthly dividend payments is a hallmark of its shareholder return strategy. For instance, AGNC declared a dividend of $0.12 per share for multiple months in early 2025, underscoring this reliability. Cumulatively, AGNC has distributed an impressive $14.7 billion to common stockholders since its founding, highlighting its dedication to returning value.

AGNC Investment Corp. employs a robust risk management framework, focusing on a proactive and defensive stance in its portfolio. This includes sophisticated hedging strategies designed to navigate the complexities of fluctuating interest rates, a critical element for mortgage REITs.

As of the first quarter of 2025, AGNC demonstrated its commitment to mitigating interest rate risk by hedging approximately 91% of its funding liabilities. This extensive hedging coverage is a testament to their strategy of protecting book value and maintaining stability in a dynamic financial landscape.

Competitive Funding Advantages

AGNC Investment Corp. leverages its wholly-owned broker-dealer, Bethesda Securities, LLC, to secure competitive funding. This strategic asset provides access to a wider range of counterparties, enabling AGNC to source wholesale funding at potentially more favorable rates.

This funding efficiency is crucial for maximizing spread income, a key driver of profitability for mortgage REITs. By minimizing borrowing costs, AGNC strengthens its competitive standing and its capacity for cost management.

- Access to Diverse Counterparties: Bethesda Securities facilitates relationships with numerous financial institutions, diversifying funding sources and reducing reliance on any single provider.

- Wholesale Funding Rates: The broker-dealer structure allows AGNC to tap into wholesale funding markets, often achieving lower interest rates compared to retail funding.

- Spread Income Enhancement: Lower funding costs directly contribute to a wider net interest margin, boosting the company's ability to generate profitable spread income.

- Cost Management Leadership: Efficient funding is a cornerstone of AGNC's strategy to maintain a leading position in operational cost efficiency within the sector.

Optimistic Outlook for Agency MBS

Despite a volatile market, AGNC Investment Corp.'s management and several analysts maintain a positive outlook on Agency Mortgage-Backed Securities (MBS). They believe current valuations present attractive return prospects, especially when leveraged.

AGNC has strategically pivoted to higher-coupon Agency MBS. This move aims to enhance prepayment probability and bolster cash flow visibility, signaling a confidence in this asset class.

- Optimistic Valuation: AGNC sees compelling return opportunities in Agency MBS at current price levels.

- Strategic Shift: Focus on higher-coupon Agency MBS for improved prepayment and cash flow predictability.

- Leveraged Potential: Management highlights the attractive return potential of these assets on a leveraged basis.

- Market Confidence: This positive market view, coupled with strategic positioning, designates Agency MBS as a 'Star' segment for AGNC.

AGNC's Agency Mortgage-Backed Securities (MBS) are a clear 'Star' in its BCG matrix. The company's substantial holdings, approximately $78.9 billion as of March 31, 2025, and $74.0 billion by June 30, 2025, demonstrate significant market share and growth potential in a stable, government-guaranteed sector.

The consistent, high dividend yield, often exceeding 15%, further solidifies the 'Star' status by attracting income-focused investors and generating strong cash flow. AGNC's strategic shift towards higher-coupon MBS enhances prepayment visibility and cash flow, reinforcing its position as a high-performing asset.

The company's robust risk management, including hedging 91% of funding liabilities in Q1 2025, protects the value of these MBS assets. This strategic approach, coupled with market confidence in their valuations, marks Agency MBS as a core, high-potential segment for AGNC.

| Metric | Value (as of Q1 2025/mid-2025) | Significance for Stars |

|---|---|---|

| Agency MBS Portfolio Size | ~$78.9 billion (Mar 31, 2025) ~$74.0 billion (Jun 30, 2025) |

High market share, indicating strong position. |

| Dividend Yield | >15% (frequently) | Attracts investors, generates consistent income. |

| Hedging of Funding Liabilities | ~91% | Protects asset value and income stability. |

| Strategic Focus | Higher-coupon Agency MBS | Enhances cash flow predictability and returns. |

What is included in the product

Highlights which units to invest in, hold, or divest for AGNC Investment.

The AGNC Investment BCG Matrix provides a clear, one-page overview of each business unit's market position, relieving the pain point of complex strategic analysis.

Cash Cows

AGNC Investment's substantial holdings in Agency mortgage-backed securities (MBS) function as its cash cow. These investments generate reliable income, bolstered by the guarantees of government-sponsored enterprises (GSEs) on principal and interest. This stability is a hallmark of these mature market assets, offering predictable cash flow with reduced credit risk.

Repurchase agreements, or repo funding, are a cornerstone of AGNC Investment's strategy for financing its Agency Mortgage-Backed Securities (MBS) portfolio. This is a mature and well-established funding method for the company.

This funding source, characterized by low growth but high market share for AGNC, enables the company to leverage its investments and boost returns. It essentially allows AGNC to profit from the difference between the yield on its MBS and the cost of its repo funding.

For instance, as of the first quarter of 2024, AGNC reported total assets of approximately $62.3 billion, with a significant portion financed through repurchase agreements. This reliance on leverage, while amplifying potential returns, is a deeply integrated and frequently employed aspect of their operational model.

AGNC Investment Corp.'s established monthly dividend payouts are a defining characteristic, signaling a mature business model with consistent cash flow. This regular distribution to shareholders underscores the company's ability to generate reliable returns from its investment portfolio.

For instance, AGNC's dividend yield has historically been a significant draw for investors. In 2024, the company continued its practice of distributing dividends, with specific payout amounts varying based on market conditions and portfolio performance, demonstrating a commitment to returning capital to its owners.

Disciplined Asset Selection and Modeling

AGNC Investment Corp.'s experienced team employs disciplined asset selection and sophisticated modeling techniques within the Agency Mortgage-Backed Securities (MBS) market, solidifying its position as a cash cow. This strategic approach focuses on optimizing returns from existing, mature assets.

By meticulously analyzing risk profiles and maximizing efficiency, AGNC ensures sustained profitability even in a low-growth environment. Their expertise in this sector allows for the maintenance of high profit margins.

- Disciplined Asset Selection: AGNC's team leverages deep market knowledge for strategic asset acquisition and management.

- Proven Modeling Techniques: Utilization of advanced financial models aids in risk assessment and return optimization.

- Agency MBS Market Focus: Specialization in this mature market segment contributes to stable, predictable cash flows.

- Efficiency and Profitability: Continuous optimization of existing assets ensures high profit margins.

Long-Term Shareholder Returns Track Record

AGNC Investment Corp. has demonstrated a strong track record of delivering favorable long-term returns to its shareholders, largely driven by consistent and substantial dividend income. This enduring performance, even through periods of market volatility, points to a well-established business model that reliably generates significant cash flow for its investors.

Their sustained position as a prominent entity within the mortgage real estate investment trust (mREIT) sector further solidifies this history of established performance. For instance, as of the first quarter of 2024, AGNC reported a book value per common share of $9.99, reflecting the underlying asset value supporting its shareholder returns.

- Consistent Dividend Payouts: AGNC has historically maintained a high dividend yield, a key component of its long-term shareholder return strategy.

- Market Resilience: The company's ability to generate returns across various market cycles highlights the robustness of its operational model.

- Industry Leadership: As a leading mREIT, AGNC's sustained presence indicates a mature and stable business generating predictable cash flows.

- Financial Stability: AGNC's balance sheet management, as evidenced by its book value, supports its capacity to continue delivering shareholder value.

AGNC Investment's Agency Mortgage-Backed Securities (MBS) portfolio serves as its primary cash cow. These assets, backed by government-sponsored enterprises, provide a stable and predictable income stream, a characteristic of mature, low-growth but high-market-share operations.

The company's reliance on repurchase agreements (repo funding) to finance this portfolio is a key element. This mature funding source, while low-growth, enables AGNC to leverage its investments and profit from the yield spread.

AGNC's consistent dividend payouts further underscore its cash cow status, reflecting reliable cash flow generation from its established asset base.

| Metric | Q1 2024 Value | Significance |

|---|---|---|

| Total Assets | $62.3 billion | Indicates the scale of operations supporting cash flow generation. |

| Book Value per Common Share | $9.99 | Reflects the underlying asset value supporting shareholder returns. |

| Dividend Payouts | Consistent monthly distributions | Demonstrates reliable cash flow and commitment to shareholders. |

Full Transparency, Always

AGNC Investment BCG Matrix

The AGNC Investment BCG Matrix preview you see is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks or demo content, just a professional, analysis-ready document designed for strategic clarity. You can trust that the insights and structure presented here are precisely what you'll download and can begin utilizing for your business planning. This is the actual, uncompromised BCG Matrix report, ready for your immediate use upon completion of your purchase.

Dogs

AGNC Investment Corp. exhibits characteristics of a 'dog' within the BCG framework due to significant declines in its tangible net book value per common share. This metric, reflecting the intrinsic value of the company's assets after accounting for intangible assets and liabilities, has shown a concerning downward trend.

Specifically, AGNC's tangible net book value per common share was reported at $8.25 as of March 31, 2025. This figure further decreased to $7.81 per share by June 30, 2025, indicating a persistent erosion of capital. Such a decline suggests the company is facing challenges in growing or even preserving its equity base, particularly in response to prevailing market conditions.

AGNC Investment's portfolio, despite hedging efforts, faces significant risks from fluctuating interest rates and widening mortgage-backed security (MBS) spreads. This sensitivity can directly impact earnings and overall financial performance.

For instance, during periods of sharp interest rate increases in 2024, the value of AGNC's Agency MBS holdings experienced downward pressure, potentially leading to realized losses if sold. Unfavorable spread widening, where the yield on MBS increases relative to Treasury yields, further exacerbates this issue, making existing investments less attractive and potentially trapping capital.

The company's comprehensive income and economic returns are thus directly tied to these external market forces. A widening of Agency MBS spreads by 10 basis points, for example, could translate to a material decline in the net asset value of AGNC's portfolio, impacting its profitability and investor returns.

AGNC Investment's Net Interest Margin (NIM) faces pressure, particularly as older, lower-cost interest rate swaps expire. This erosion of their NIM directly impacts the profitability of their primary operations, suggesting a potential 'dog' classification if this trend persists. For instance, in the first quarter of 2024, AGNC reported a net interest income of $378 million, a decrease from the previous year, partly attributable to these changing hedge costs.

Impact of Prepayment Risk

Prepayment risk, the possibility that homeowners will pay off their mortgages early, directly impacts the income AGNC Investment Corp. (AGNC) receives from its mortgage-backed securities (MBS). When interest rates fall, homeowners are incentivized to refinance, paying off their existing, higher-interest mortgages and thus prepaying the principal on the MBS AGNC holds. This means AGNC receives its principal back sooner than anticipated, often when reinvestment opportunities offer lower yields.

In the second quarter of 2025, an observed uptick in prepayment speeds meant that AGNC's portfolio experienced a tangible reduction in expected future interest income. This scenario directly reduces the effective duration of AGNC's assets, meaning the securities behave more like shorter-term investments, which typically yield less. For instance, a portfolio that was expected to yield 5% might see its effective yield drop if prepayments force the reinvestment of principal at a 3.5% rate.

The constant threat of rising prepayments necessitates continuous portfolio management and hedging strategies to mitigate potential losses. Failure to effectively manage this risk can lead to a significant drag on AGNC's overall financial performance, impacting earnings per share and book value. The sensitivity of AGNC's portfolio to interest rate changes, amplified by prepayment risk, remains a critical factor in its valuation and strategic planning.

- Prepayment Risk: Homeowners refinancing or paying off mortgages early reduces AGNC's expected interest income.

- Q2 2025 Impact: Increased prepayment rates led to lower-than-anticipated returns on certain AGNC securities.

- Yield Reduction: Early principal repayment forces reinvestment at potentially lower market rates, decreasing overall portfolio yield.

- Portfolio Management: Ongoing monitoring and hedging are crucial to offset the negative impact of prepayment risk on AGNC's performance.

High Payout Ratio and Potential Dividend Vulnerability

AGNC Investment Corp.'s substantial dividend yield, while attractive, is shadowed by a potentially high payout ratio. This can signal vulnerability, especially if earnings falter or interest rates remain persistently challenging.

A payout ratio exceeding 100%, such as the reported 423.53% in some periods, indicates that AGNC may be distributing more cash than it generates. This is a red flag for long-term income stability, suggesting the dividend might be at risk if the company's financial performance deteriorates.

- Dividend Yield: AGNC's dividend yield often stands out, attracting income-focused investors.

- Payout Ratio Concerns: Historically, AGNC's payout ratio has shown significant fluctuations, sometimes exceeding 100%, raising sustainability questions. For example, in Q1 2024, the company reported a net income available to common stockholders of $147 million, with dividends paid of $764 million, resulting in a payout ratio far exceeding 100%.

- Interest Rate Sensitivity: As a mortgage REIT, AGNC's profitability is highly sensitive to interest rate movements, which can directly impact its earnings and ability to cover dividends.

- Potential for Dividend Reduction: The elevated payout ratio, coupled with interest rate volatility, creates a scenario where a dividend cut could be a necessary measure to preserve capital.

AGNC Investment Corp.'s position as a 'dog' in the BCG matrix is reinforced by its declining tangible net book value per share, which fell from $8.25 on March 31, 2025, to $7.81 by June 30, 2025. This erosion of equity, coupled with a Net Interest Margin (NIM) under pressure due to expiring lower-cost interest rate swaps, indicates a business with low growth and low market share. The company's sensitivity to interest rate fluctuations and widening MBS spreads, as evidenced by potential declines in net asset value from a 10 basis point spread widening, further solidifies its 'dog' status, suggesting challenges in generating sustainable returns.

| Metric | Q1 2024 | Q2 2025 | Q3 2025 (Est.) |

|---|---|---|---|

| Tangible Net Book Value Per Share | $8.50 | $7.81 | $7.50 |

| Net Interest Income | $378 million | $350 million | $330 million |

| Payout Ratio | 423.53% | 450.00% | 475.00% |

| Agency MBS Spread (Basis Points) | 85 | 95 | 105 |

Question Marks

AGNC Investment views periods where Agency Mortgage-Backed Securities (MBS) spreads widen relative to benchmark rates as attractive entry points for generating future returns. For instance, during periods of significant market stress in early 2024, certain Agency MBS sectors experienced widening spreads, offering a higher yield pickup compared to Treasuries.

These widening spread opportunities are categorized as question marks within the BCG Matrix due to their inherent duality. They represent high-growth potential if AGNC can effectively capture value through strategic purchases, but they also demand substantial capital allocation and are subject to the risk of continued spread volatility, potentially impacting profitability.

The ultimate success of capitalizing on these opportunistic investments is heavily reliant on precise market timing and flawless execution. For example, if AGNC were to invest heavily in MBS just before spreads unexpectedly tightened further, the anticipated return would be diminished, highlighting the sensitivity to market movements.

AGNC Investment Corp's strategic adjustments, like reducing non-agency mortgage-backed securities (MBS) and boosting holdings in higher-coupon Agency MBS, are classic 'question marks' in a BCG-like matrix. These moves are calculated gambles to enhance returns and cash flow predictability amidst fluctuating market conditions. For instance, as of the first quarter of 2024, AGNC reported a substantial portfolio, and the specific allocation shifts within this vast pool are key indicators of their strategic direction.

AGNC Investment Corp. (AGNC) heavily relies on leverage to boost its returns in the mortgage REIT sector. However, this strategy faces significant scrutiny as interest rates fluctuate unpredictably. In 2024, the Federal Reserve's monetary policy adjustments create a dynamic environment where AGNC's leverage amplifies both potential profits and downside risks.

The core of the question mark lies in AGNC's capacity to dynamically adjust its leverage in response to evolving rate scenarios. For instance, if rates rise faster than anticipated, the cost of AGNC's borrowed funds increases, potentially eroding net interest margins. Conversely, a swift decline in rates could lead to substantial gains if managed effectively.

Impact of Future Federal Reserve Policy on Interest Rates

The Federal Reserve's future policy on interest rates presents a significant unknown for AGNC Investment. Should the Fed initiate rate cuts, it could provide a tailwind for AGNC's profitability and the valuation of its mortgage-backed securities portfolio. Conversely, a prolonged period of elevated rates or further hikes would likely continue to pressure AGNC's net interest margins, impacting its financial performance.

The company's strategic agility in navigating these potential shifts in monetary policy is crucial. AGNC's management will need to actively adjust its hedging strategies and portfolio composition to mitigate risks and capitalize on any emerging opportunities presented by evolving interest rate environments.

- Federal Reserve's Federal Funds Rate Target: As of mid-2024, the Federal Funds Rate target range remained elevated, impacting borrowing costs for entities like AGNC.

- Impact on AGNC's Net Interest Margin: Higher rates generally compress the difference between the interest income AGNC earns on its assets and the interest it pays on its liabilities.

- Portfolio Valuation Sensitivity: The value of AGNC's mortgage-backed securities is inversely related to interest rates; as rates rise, their market value tends to fall.

- Strategic Hedging: AGNC employs various financial instruments to hedge against interest rate risk, the effectiveness of which is tested by policy changes.

Technological Advancements in Portfolio Management

AGNC Investment's embrace of advanced data analytics and AI in portfolio management positions it as a question mark. These technologies offer the promise of more sophisticated risk assessment and predictive modeling, potentially leading to optimized returns. For instance, in 2024, the financial services industry saw significant investment in AI-driven trading platforms, with many firms reporting enhanced efficiency and decision-making capabilities.

While AGNC is actively exploring these technological frontiers, the ultimate impact on their market share and profitability remains to be seen. The successful integration of these tools will be crucial in translating potential into tangible performance gains. The company's ability to leverage these advancements to navigate complex market conditions, such as fluctuating interest rates observed throughout 2024, will be a key determinant of future success.

- Data Analytics: AGNC's investment in big data platforms allows for deeper insights into market trends and asset performance.

- AI and Machine Learning: The adoption of AI algorithms can improve predictive accuracy for interest rate movements and mortgage-backed securities pricing.

- Operational Efficiency: Technological upgrades aim to streamline back-office operations, reducing costs and improving execution speed.

- Competitive Edge: Successful implementation of these technologies could provide AGNC with a significant advantage in a highly competitive REIT market.

AGNC's strategic shifts in its portfolio, such as increasing exposure to higher-coupon Agency MBS and reducing non-agency holdings, are characteristic of question marks in the BCG matrix. These moves aim to enhance returns and cash flow predictability in a volatile market. For instance, during the first quarter of 2024, AGNC adjusted its asset allocation, reflecting a calculated approach to navigating market uncertainties.

The success of these portfolio adjustments hinges on AGNC's ability to accurately forecast interest rate movements and spread behavior. If market conditions move favorably, these investments could yield significant returns. However, adverse market shifts, such as unexpected spread tightening, could diminish the anticipated profitability, underscoring the inherent risk.

AGNC's reliance on leverage, a common practice in the mortgage REIT sector, amplifies both potential gains and losses, especially in the face of unpredictable interest rate changes. In 2024, the Federal Reserve's monetary policy decisions created a dynamic environment where AGNC's leverage strategy was constantly tested, impacting its net interest margins.

The company's capacity to dynamically adjust its leverage in response to evolving interest rate scenarios is a critical factor. For example, a faster-than-expected rise in rates could increase AGNC's borrowing costs, thereby squeezing its net interest margins.

| Metric | Q1 2024 Value | Significance for Question Marks |

|---|---|---|

| Net Interest Margin (NIM) | 1.05% (estimated) | Indicates profitability from interest rate spread; sensitive to leverage and rate changes. |

| Portfolio Yield | 4.85% (estimated) | Represents income from assets; higher yields on new acquisitions are key to question mark success. |

| Leverage Ratio | 7.3x (estimated) | Amplifies returns but also risk; dynamic management is crucial for question marks. |

BCG Matrix Data Sources

Our AGNC Investment BCG Matrix leverages comprehensive data, including AGNC's financial filings, market share data, and industry growth projections, to accurately position its business units.