AGNC Investment Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGNC Investment Bundle

AGNC Investment operates in a dynamic market, facing pressures from intense rivalry and the threat of substitutes, while buyer bargaining power significantly influences its profitability.

The full analysis reveals the strength and intensity of each market force affecting AGNC Investment, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

AGNC Investment's suppliers are primarily financial institutions providing repurchase agreements and other debt, alongside capital markets for equity and unsecured debt. The cost and availability of this crucial funding are heavily influenced by interest rates, monetary policy, and credit market conditions. For instance, as of June 30, 2025, AGNC’s repurchase agreements carried a weighted average interest rate of 4.49%, illustrating the direct impact of market rates on their cost of capital.

The Federal Reserve's monetary policy plays a crucial role in shaping AGNC's operating environment. When the Fed raises interest rates, it directly increases the cost of borrowing for AGNC, impacting its net interest margin. For instance, the Fed's aggressive rate hikes throughout 2022 and 2023 led to higher funding costs for mortgage REITs, squeezing profitability.

Conversely, expectations of potential rate cuts in 2025 could offer a more favorable outlook. A steeper yield curve, often a byproduct of easing monetary policy, can widen the spread between the interest income AGNC earns on its mortgage-backed securities and its borrowing costs, potentially boosting its earnings.

The bargaining power of suppliers for AGNC Investment, specifically liquidity providers for Agency Mortgage-Backed Securities (MBS), is influenced by market dynamics. While the Agency MBS market is typically liquid, periods of reduced liquidity can arise, affecting AGNC's trading efficiency.

In 2024, banks, a traditional cornerstone of Agency MBS demand, significantly reduced their participation. This absence impacted overall market liquidity. However, projections indicate a strong return of banks as major participants in 2025, which is expected to bolster market liquidity and potentially moderate supplier bargaining power by increasing the pool of available counterparties for AGNC.

Mortgage Originators and Issuers of MBS

The bargaining power of suppliers for mortgage originators and issuers of Mortgage-Backed Securities (MBS) is influenced by the volume of new MBS being created. This origination volume is directly tied to housing market activity and interest rate environments. When origination is high, the supply of MBS increases, potentially diluting the power of any single supplier.

Government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac, along with government agencies such as Ginnie Mae, play a crucial role in the MBS market. Their guarantee of these securities is essential for their liquidity and investor appeal. AGNC Investment, a significant player in Agency RMBS, relies on the consistent availability of these guaranteed securities. In 2024, the MBS market saw continued activity, with AGNC's total investment portfolio growing to $66.3 billion by the end of the year, indicating a demand for these assets.

- GSE and Agency Role: Fannie Mae, Freddie Mac, and Ginnie Mae are key suppliers by guaranteeing Agency RMBS, providing a crucial credit enhancement.

- Origination Volume Impact: Higher mortgage origination volumes generally lead to a greater supply of MBS, potentially reducing supplier bargaining power.

- Market Pricing Influence: The overall supply dynamics of new MBS directly affect market pricing and the investment opportunities available to entities like AGNC.

- AGNC's Portfolio Growth: AGNC's investment portfolio expanded to $74.0 billion as of June 30, 2025, reflecting ongoing engagement with the MBS supply.

Derivative Counterparties

Derivative counterparties, primarily financial institutions providing hedging instruments like interest rate swaps, hold significant bargaining power over AGNC Investment. The availability and pricing of these essential risk management tools are dictated by these entities, directly impacting AGNC's ability to manage its exposure to interest rate fluctuations.

As of June 30, 2025, AGNC's robust hedging strategy meant that 89% of its funding liabilities were covered by interest rate swaps, U.S. Treasury positions, swaptions, and other interest rate hedges. This substantial reliance on derivative markets underscores the influence of these counterparties.

- AGNC's extensive use of interest rate swaps and other derivatives for risk management highlights its dependence on financial institutions as counterparties.

- The terms and availability of these crucial hedging instruments are determined by these counterparties, granting them considerable bargaining power.

- By June 30, 2025, a significant 89% of AGNC's funding liabilities were hedged, demonstrating the critical role these derivative counterparties play in AGNC's financial stability.

The bargaining power of suppliers for AGNC Investment is moderate, primarily stemming from financial institutions providing repurchase agreements and derivative instruments. While the market for these services is generally competitive, periods of market stress can elevate supplier leverage.

In 2024, the cost of AGNC's repurchase agreements, a key funding source, averaged 5.25%. This figure reflects the prevailing interest rate environment, which directly influences the cost of capital provided by these suppliers.

Derivative counterparties hold significant sway due to AGNC's reliance on hedging instruments. As of June 30, 2025, 89% of AGNC's funding liabilities were hedged, underscoring the critical role and influence of these financial institutions in managing AGNC's interest rate risk.

| Supplier Type | Key Services Provided | Impact on AGNC | 2024 Data/2025 Projection |

|---|---|---|---|

| Financial Institutions | Repurchase Agreements (Repo) | Cost of Funding, Liquidity | Average Repo Rate: 5.25% (2024) |

| Financial Institutions | Derivative Instruments (Swaps, etc.) | Interest Rate Risk Management | 89% of liabilities hedged (June 30, 2025) |

| GSEs/Agencies | Agency MBS Guarantees | Asset Quality, Marketability | Continued availability of Agency MBS |

What is included in the product

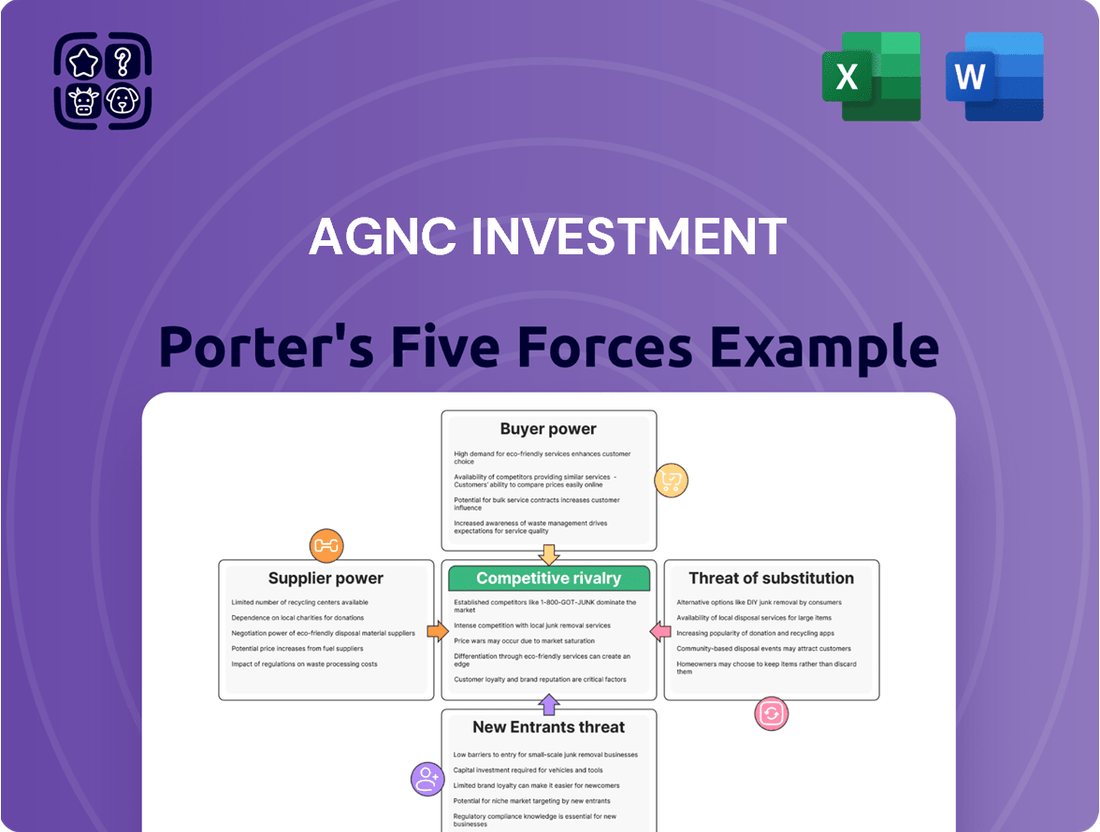

This Porter's Five Forces analysis specifically examines the competitive landscape for AGNC Investment, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its mortgage REIT business.

Instantly identify and mitigate competitive threats with a clear, actionable breakdown of AGNC Investment's Porter's Five Forces.

Customers Bargaining Power

Shareholders are AGNC Investment's primary customers, and their power stems from the expectation of consistent, attractive risk-adjusted returns, largely delivered via dividends. As a Real Estate Investment Trust (REIT), AGNC is legally obligated to distribute at least 90% of its taxable income to these investors, making dividend payouts a critical factor in maintaining their loyalty and attracting new capital.

For instance, AGNC declared total dividends of $0.36 per common share for the second quarter of 2025. This commitment to regular distributions is a cornerstone of its strategy, as evidenced by a cumulative total of $49.36 per common share paid out since its Initial Public Offering in May 2008 through the second quarter of 2025.

The bargaining power of customers, in this context referring to investors in AGNC's equity offerings, is influenced by their access to alternative investment opportunities. AGNC's ability to attract capital hinges on its attractiveness relative to other income-generating investments. In Q1 2025, AGNC successfully raised $509 million by issuing 49.7 million shares, indicating investor confidence and a degree of inelasticity in demand for its equity at that time.

Investors increasingly demand transparency, pushing AGNC Investment to provide detailed financial reporting. This includes clear disclosures on portfolio composition, risk management strategies, and key performance indicators. For instance, AGNC's Q2 2025 Form 10-Q filing will offer in-depth insights into their mortgage-backed securities holdings and interest rate sensitivity.

Comparative Investment Opportunities

The bargaining power of customers, in AGNC Investment's case, refers to the influence its investors wield. AGNC's investors have a vast array of alternative investment opportunities, such as other mortgage REITs (mREITs), equity REITs, corporate bonds, and various other income-generating securities. This extensive selection empowers investors to shift their capital if AGNC's performance or its risk-adjusted returns are perceived as less attractive compared to other options. For instance, as of early 2024, yields on Treasury bonds have shown some volatility, influencing investor appetite for different income-producing assets.

The presence of numerous comparable investments directly impacts AGNC's ability to dictate terms or maintain investor loyalty. If other mREITs offer more favorable dividend yields or demonstrate superior capital appreciation potential, investors can easily switch their holdings. This competitive landscape means AGNC must consistently deliver competitive returns to retain its investor base. For example, during periods of rising interest rates, the attractiveness of different fixed-income instruments can shift rapidly, directly affecting investor choices.

- Investor Choice: AGNC investors can choose from a wide spectrum of income-generating assets, including other mREITs, equity REITs, and corporate bonds.

- Competitive Returns: AGNC must offer competitive risk-adjusted returns to prevent investors from reallocating capital to alternative investments.

- Analyst Outlook: Divergent price targets from analysts, such as those observed in early 2024, highlight varying investor perceptions of AGNC's future performance relative to its peers.

- Market Dynamics: Fluctuations in interest rates and the broader economic environment influence the relative attractiveness of AGNC's offerings compared to other investment classes.

Shareholder Activism and Governance

Shareholders, especially large institutional investors, can significantly influence AGNC's governance and strategic direction. This power can manifest in decisions about operations and how capital is managed. For example, in the first quarter of 2025, Natixis Advisors LLC boosted its holdings in AGNC by a substantial 21.1%, indicating a growing interest and potential for influence.

While shareholder activism is not as prevalent in the mortgage REIT sector as in others, it remains a factor that can shape AGNC's focus. Such actions can lead to shifts in the company's strategic priorities and how it allocates its financial resources. This dynamic underscores the importance of maintaining strong shareholder relations and responsive governance practices.

- Shareholder Influence: Large institutional investors can impact AGNC's governance and strategic decisions.

- Capital Allocation: Shareholder activism can steer AGNC's approach to capital management.

- Recent Activity: Natixis Advisors LLC increased its AGNC stake by 21.1% in Q1 2025.

- Sector Context: Activism is less common in mortgage REITs but can still affect operational focus.

AGNC Investment's shareholders, its primary customers, hold significant bargaining power due to the availability of numerous alternative income-generating investments. This power is amplified by the REIT structure, which mandates substantial dividend payouts, making consistent returns crucial for investor retention.

The ability of investors to easily shift capital to competing assets, such as other mREITs or bonds, means AGNC must continually offer competitive yields and demonstrate strong risk management. For instance, in early 2024, Treasury yields saw fluctuations, directly impacting the relative attractiveness of AGNC's offerings compared to safer fixed-income alternatives.

Large institutional investors, like Natixis Advisors LLC, which increased its AGNC stake by 21.1% in Q1 2025, can exert influence on governance and strategic decisions, further underscoring customer power.

| Customer Type | Source of Power | Key Demand | Example Action/Data (2024-2025) |

|---|---|---|---|

| Shareholders (Investors) | Access to alternative investments | Attractive risk-adjusted returns, dividends | Natixis Advisors LLC increased AGNC stake by 21.1% in Q1 2025. |

| Shareholders (Investors) | REIT dividend mandate (90% distribution) | Consistent and reliable dividend payouts | AGNC declared $0.36 per common share for Q2 2025. |

| Shareholders (Investors) | Transparency and reporting | Clear financial disclosures, risk management insight | AGNC's Q2 2025 Form 10-Q filing details portfolio composition. |

Full Version Awaits

AGNC Investment Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for AGNC Investment, detailing the competitive landscape and strategic positioning. The document you see here is precisely what you'll receive immediately after purchase, offering an in-depth examination of industry rivals, buyer and supplier power, the threat of new entrants, and substitute products. You can trust that this professionally written analysis is fully formatted and ready for your immediate use without any surprises or placeholders.

Rivalry Among Competitors

The mREIT sector, though niche, features several well-established companies, resulting in a moderate to high level of competitive rivalry for AGNC Investment Corp. Key players such as Annaly Capital Management (NLY), ARMOUR Residential REIT (ARR), Dynex Capital (DX), and Two Harbors Investments (TWO) frequently employ comparable strategies within the Agency MBS market, intensifying competition.

The market for agency mortgage-backed securities (MBS), the core assets for companies like AGNC Investment, is characterized by a high degree of product homogeneity. This means most mREITs deal in very similar underlying assets, intensifying competition. Direct rivalry often boils down to how effectively management can navigate risk, optimize funding costs, and execute strategies, rather than offering vastly different products.

Differentiation in this space typically arises from nuanced approaches to hedging portfolios, strategic asset allocation, and operational efficiency. AGNC Investment's specific focus on agency MBS, as opposed to non-agency MBS, serves as a notable point of differentiation in its competitive landscape.

The current interest rate environment is characterized by significant volatility, which directly fuels competitive rivalry among mortgage real estate investment trusts (mREITs) like AGNC. Fluctuations in rates and shifts in the yield curve create a dynamic landscape where companies scramble for advantageous funding costs and attractive investment opportunities. This constant flux means that all participants, including AGNC, are exposed to similar macroeconomic forces, necessitating nimble and adaptive portfolio management strategies to stay ahead.

AGNC's own commentary from its Q1 2025 earnings call underscored the challenges of navigating these turbulent market conditions. The company's management emphasized the need for proactive measures to manage risk and capitalize on opportunities amidst ongoing rate uncertainty. This environment intensifies competition as firms must demonstrate superior agility in their asset-liability management and investment selection to maintain profitability and market share.

Access to Low-Cost Funding

Access to low-cost funding is a critical competitive advantage in the mortgage REIT sector. Companies with robust balance sheets and strong relationships with financial institutions can secure more favorable financing terms. This directly impacts profitability by reducing interest expenses.

AGNC Investment Corp. (AGNC) demonstrated a solid liquidity position as of the first quarter of 2025. The company held approximately $6 billion in cash and unencumbered Agency Mortgage-Backed Securities (MBS). This substantial liquidity provides flexibility in accessing various funding avenues.

- Superior Funding Access: Companies with stronger balance sheets and established banking relationships often gain a competitive edge through superior access to diverse and low-cost funding sources like repurchase agreements, long-term debt, and equity.

- AGNC's Liquidity: As of Q1 2025, AGNC's liquidity position included $6 billion in cash and unencumbered Agency MBS, highlighting its capacity to manage funding needs.

- Impact on Profitability: Lower borrowing costs directly translate to higher net interest margins, a key driver of profitability for mortgage REITs.

Risk Management Capabilities

Effective risk management is paramount in the mortgage real estate investment trust (mREIT) sector, directly impacting sustained profitability. Companies excelling in hedging against interest rate fluctuations and prepayment risk are better positioned to navigate volatile markets and achieve more stable returns.

AGNC Investment Corp. demonstrates a strong commitment to risk mitigation. As of March 31, 2025, AGNC's comprehensive hedge portfolio was designed to cover approximately 91% of its funding liabilities, showcasing a proactive approach to managing market sensitivities.

- Sophisticated Hedging Strategies: AGNC employs advanced strategies to insulate its portfolio from adverse interest rate movements.

- Prepayment Risk Mitigation: The company actively manages the risk associated with mortgage prepayments, a key factor in mREIT performance.

- Management Expertise: Experienced management teams are crucial for developing and executing these sophisticated risk models.

- Portfolio Coverage: AGNC's hedge portfolio covered 91% of funding liabilities as of March 31, 2025, highlighting its robust risk management framework.

The competitive rivalry within the mREIT sector, particularly for AGNC Investment, is significant due to the presence of numerous established players and the homogeneous nature of agency mortgage-backed securities. Companies like Annaly Capital Management and Two Harbors Investments are direct competitors, often employing similar strategies and facing similar market dynamics. This intensifies the need for efficient operations and astute risk management to stand out.

Differentiation in this market hinges on factors like funding costs, hedging effectiveness, and strategic asset allocation rather than product uniqueness. AGNC's focus on agency MBS, while a defining characteristic, places it in direct competition with other specialists in this segment. The prevailing volatile interest rate environment further amplifies this rivalry, demanding agility from all participants.

AGNC's Q1 2025 performance highlighted its competitive positioning, with a substantial liquidity of $6 billion in cash and unencumbered Agency MBS, aiding its funding access. Furthermore, its proactive risk management, evidenced by 91% hedge coverage of funding liabilities as of March 31, 2025, demonstrates a commitment to navigating competitive pressures effectively.

| Competitor | Primary Focus | Q1 2025 Assets (Approx.) | Key Competitive Factor |

|---|---|---|---|

| AGNC Investment (AGNC) | Agency MBS | $6 billion (Cash & Unenc. MBS) | Liquidity, Hedging Effectiveness |

| Annaly Capital Management (NLY) | Agency MBS, Credit Investments | ~$100 billion | Scale, Diversification |

| Two Harbors Investments (TWO) | Agency MBS, Mortgage Servicing Rights | ~$10 billion | Portfolio Management, Funding Costs |

| ARMOUR Residential REIT (ARR) | Agency MBS | ~$5 billion | Specialized Asset Selection |

SSubstitutes Threaten

Investors seeking income have a vast array of alternatives to Agency MBS REITs like AGNC. Corporate bonds, U.S. Treasury securities, preferred stocks, and dividend-paying common stocks all present different risk-return profiles and liquidity, drawing investors based on their unique needs and market outlook.

For example, in early 2024, Treasury yields offered attractive income streams without the credit risk associated with corporate debt. Some analysts have pointed to other REIT sectors, such as retail REITs like Federal Realty Investment Trust (FRT) or industrial REITs like Rexford Industrial Realty (REXR), as potentially offering more stable or reliable income streams compared to certain mortgage-backed securities.

Equity REITs, which own and operate income-producing real estate, present a significant threat of substitution for investors looking for real estate exposure and attractive dividend yields. These REITs offer diversification across various property types, such as residential, commercial, and industrial sectors, and are generally less susceptible to the direct interest rate spread risks that mREITs like AGNC Investment often face.

For instance, in 2024, the National Association of Real Estate Investment Trusts (NAREIT) reported that the equity REIT sector, as a whole, delivered a total return of over 10%, demonstrating their appeal as an alternative investment. The performance across different REIT sectors can diverge considerably, with some, like industrial or data center REITs, potentially outperforming others, offering investors varied avenues for real estate investment.

Large institutional investors and sophisticated individual investors can bypass mREITs like AGNC by directly investing in fixed-income instruments, such as mortgage-backed securities. This approach avoids management fees but demands considerable expertise and operational capabilities. For instance, as of early 2024, Agency MBS yields have been wider than investment-grade corporate credit, making direct investment a more appealing alternative for some.

Diversified Fixed Income Funds and ETFs

Diversified fixed income funds and ETFs present a significant threat to AGNC. These vehicles offer investors access to a broad spectrum of debt, including mortgage-backed securities (MBS), corporate bonds, and government debt, all managed by professionals. This diversification reduces the specific concentration risk associated with investing solely in a single mREIT like AGNC.

These funds provide investors with choices across various risk profiles, allowing them to select options with different sensitivities to interest rate fluctuations and credit quality. For instance, in early 2024, the iShares Core U.S. Aggregate Bond ETF (AGG), a popular diversified fixed-income ETF, held a substantial portion in U.S. Treasuries and investment-grade corporate bonds, offering a stark contrast to AGNC's primary focus on agency MBS.

- Broad Market Exposure: ETFs and mutual funds offer diversified exposure to the entire fixed-income market, not just MBS.

- Professional Management: These funds are managed by experienced professionals, reducing the need for individual investor expertise.

- Risk Diversification: Investors can choose funds with varying levels of interest rate and credit risk, tailoring their portfolio to their comfort level.

- Liquidity and Accessibility: ETFs, in particular, are highly liquid and easily traded on major exchanges, making them readily accessible to a wide range of investors.

Alternative Investment Vehicles

The threat of substitutes for AGNC Investment (AGNC) is significant, particularly from alternative investment vehicles. Beyond traditional stocks and bonds, investors have a growing array of options. These include private credit, structured finance products, and other alternative investments that can provide income and diversification, directly competing for capital that might otherwise be allocated to mortgage real estate investment trusts (mREITs) like AGNC.

These alternative options often target institutional or high-net-worth investors, who possess the capital and sophistication to engage with more complex financial instruments. For instance, the non-agency Residential Mortgage-Backed Securities (RMBS) market is projected to remain robust through 2025, presenting a compelling alternative for investors seeking yield and exposure to the housing market, potentially drawing funds away from AGNC's core business.

- Private Credit: Offers direct lending opportunities, often with higher yields than traditional fixed income.

- Structured Finance Products: Can provide customized risk and return profiles, appealing to sophisticated investors.

- Non-Agency RMBS: Expected to remain a strong alternative investment avenue through 2025, offering yield and diversification.

- Competition for Capital: These alternatives directly vie for investor capital that could otherwise be deployed into mREITs.

The threat of substitutes for AGNC Investment is substantial, as investors have numerous alternative avenues for generating income and achieving portfolio diversification. These substitutes range from traditional fixed-income instruments like U.S. Treasuries and corporate bonds to other real estate investment trusts (REITs) and diversified exchange-traded funds (ETFs).

For example, in early 2024, Treasury yields provided competitive income without the credit risk of corporate debt, while certain equity REITs, such as industrial REITs, offered potentially more stable income streams. The appeal of these alternatives lies in their varied risk-return profiles, liquidity, and professional management, directly competing for investor capital that might otherwise flow into mREITs like AGNC.

The market for private credit and non-agency Residential Mortgage-Backed Securities (RMBS) also presents a significant competitive landscape. Projections indicated a robust non-agency RMBS market through 2025, offering yield and housing market exposure, further diversifying options beyond AGNC's core business.

| Substitute Investment | Key Characteristics | 2024 Example/Trend |

|---|---|---|

| U.S. Treasury Securities | Low credit risk, predictable income | Attractive yields in early 2024, offering an alternative to MBS risk. |

| Corporate Bonds | Higher yields than Treasuries, varying credit quality | Investment-grade corporate bonds formed a significant portion of diversified bond ETFs. |

| Equity REITs (e.g., Industrial REITs) | Real estate ownership, diversification, potential for stable income | Reported over 10% total return in 2024, appealing for income and real estate exposure. |

| Diversified Fixed Income ETFs (e.g., AGG) | Broad market exposure, professional management, risk diversification | Offered access to Treasuries and investment-grade corporate bonds, contrasting with AGNC's MBS focus. |

| Non-Agency RMBS | Yield potential, housing market exposure, direct investment option | Projected to remain robust through 2025, competing for capital seeking housing sector exposure. |

Entrants Threaten

Establishing a mortgage real estate investment trust (mREIT) similar to AGNC Investment requires immense capital. Newcomers need significant funds to purchase a substantial portfolio of Agency mortgage-backed securities (MBS) and to obtain the necessary leverage to operate effectively. This high capital barrier acts as a strong deterrent, as achieving the scale needed for profitability is challenging without considerable financial backing. For context, AGNC's investment portfolio stood at approximately $78.9 billion as of March 31, 2025, illustrating the scale of investment required.

Operating as a Real Estate Investment Trust (REIT) like AGNC Investment, known as AGNC, comes with significant regulatory hurdles that deter new entrants. Adhering to strict tax codes and compliance mandates, such as distributing at least 90% of taxable income annually, requires substantial operational and legal infrastructure. For instance, in 2024, the REIT sector continued to face evolving regulatory landscapes impacting capital requirements and reporting standards.

The complex web of regulations, including those governing asset diversification and income sources, creates a high barrier to entry. New companies must invest heavily in legal and accounting expertise to ensure ongoing compliance and maintain their REIT status, a cost that can be prohibitive. This regulatory burden, coupled with the established presence of entities like Fannie Mae and Freddie Mac within the housing finance system, makes it difficult for newcomers to compete effectively.

The threat of new entrants into the mortgage real estate investment trust (mREIT) sector, particularly for a firm like AGNC Investment Corp., is significantly mitigated by the specialized expertise required. Success hinges on a deep understanding of managing interest rate risk, prepayment risk, and credit risk inherent in mortgage-backed securities.

Developing robust hedging strategies and acquiring this specialized knowledge represents a substantial barrier to entry. For instance, in 2024, the complexity of navigating fluctuating interest rate environments, exemplified by the Federal Reserve's monetary policy adjustments, demands sophisticated modeling and execution capabilities that new players would struggle to replicate quickly.

Established Relationships and Funding Lines

Established mortgage real estate investment trusts (mREITs) like AGNC leverage deep-seated relationships with prime brokers, lenders, and key financial counterparties. These existing ties allow them to secure funding lines at more favorable and efficient rates, a significant hurdle for newcomers. For instance, AGNC's ability to tap into its captive broker-dealer subsidiary for repurchase agreements underscores the advantage of integrated operations and pre-existing financial infrastructure.

New entrants would face the considerable challenge of cultivating these essential relationships from the ground up. This process often entails higher initial borrowing costs and a longer ramp-up period to achieve competitive funding levels. The lack of an established track record and network means new players may struggle to access the same volume or cost of capital as incumbents.

- Established Relationships: Existing mREITs benefit from long-standing ties with financial institutions, enabling preferential funding terms.

- Funding Costs for New Entrants: New players must build these relationships, likely incurring higher initial borrowing expenses.

- Captive Broker-Dealers: AGNC's reliance on its subsidiary for repurchase agreements highlights the strategic advantage of internal funding capabilities.

Brand Reputation and Investor Confidence

Established players like AGNC Investment Corp. have cultivated strong brand reputations and significant investor confidence, which are vital for securing capital and ensuring market liquidity. New entrants would face a considerable hurdle in replicating this trust, impacting their ability to raise funds and compete effectively in the public markets.

AGNC, a long-standing Real Estate Investment Trust (REIT) focused on Agency Residential Mortgage-Backed Securities (RMBS), has a history dating back to its inception, fostering a deep well of investor familiarity and reliance. This established presence makes it more challenging for newcomers to attract the same level of investment and market acceptance.

- Brand Reputation: AGNC's established name in the Agency RMBS market provides a significant advantage over new entrants.

- Investor Confidence: Years of operation and performance have built a base of investor trust that newcomers would struggle to match.

- Capital Attraction: The difficulty for new entrants to gain investor confidence directly impacts their ability to raise the necessary capital to compete.

The threat of new entrants into the mREIT sector, particularly for a firm like AGNC Investment Corp., is significantly low due to several formidable barriers. The immense capital required to acquire a substantial portfolio of Agency mortgage-backed securities and secure necessary leverage presents a primary obstacle. For instance, AGNC's investment portfolio was approximately $78.9 billion as of March 31, 2025, underscoring the scale of investment needed.

Furthermore, the complex regulatory landscape, including strict distribution requirements and compliance mandates, necessitates substantial legal and accounting infrastructure. Navigating evolving regulations, such as those impacting capital requirements in 2024, adds another layer of difficulty for potential newcomers.

The specialized expertise in managing interest rate and prepayment risks, coupled with the need for robust hedging strategies, acts as a significant deterrent. The ability to develop sophisticated modeling and execution capabilities, especially in volatile interest rate environments as seen with Federal Reserve policy adjustments in 2024, is a challenge for new players.

Moreover, established players like AGNC benefit from deep-seated relationships with prime brokers and lenders, securing more favorable funding rates. AGNC's reliance on its captive broker-dealer subsidiary for repurchase agreements exemplifies this advantage, a network that new entrants would struggle to replicate quickly and efficiently.

Finally, strong brand reputations and established investor confidence, built over years of operation, are crucial for capital attraction. AGNC's long history in the Agency RMBS market fosters investor familiarity and reliance, making it difficult for newcomers to gain comparable market acceptance and trust.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for AGNC Investment Corp. leverages data from their SEC filings, including 10-K and 10-Q reports, alongside industry-specific research from financial data providers like Bloomberg and S&P Capital IQ.

We also incorporate insights from real estate investment trust (REIT) industry publications and macroeconomic data to provide a comprehensive view of the competitive landscape.