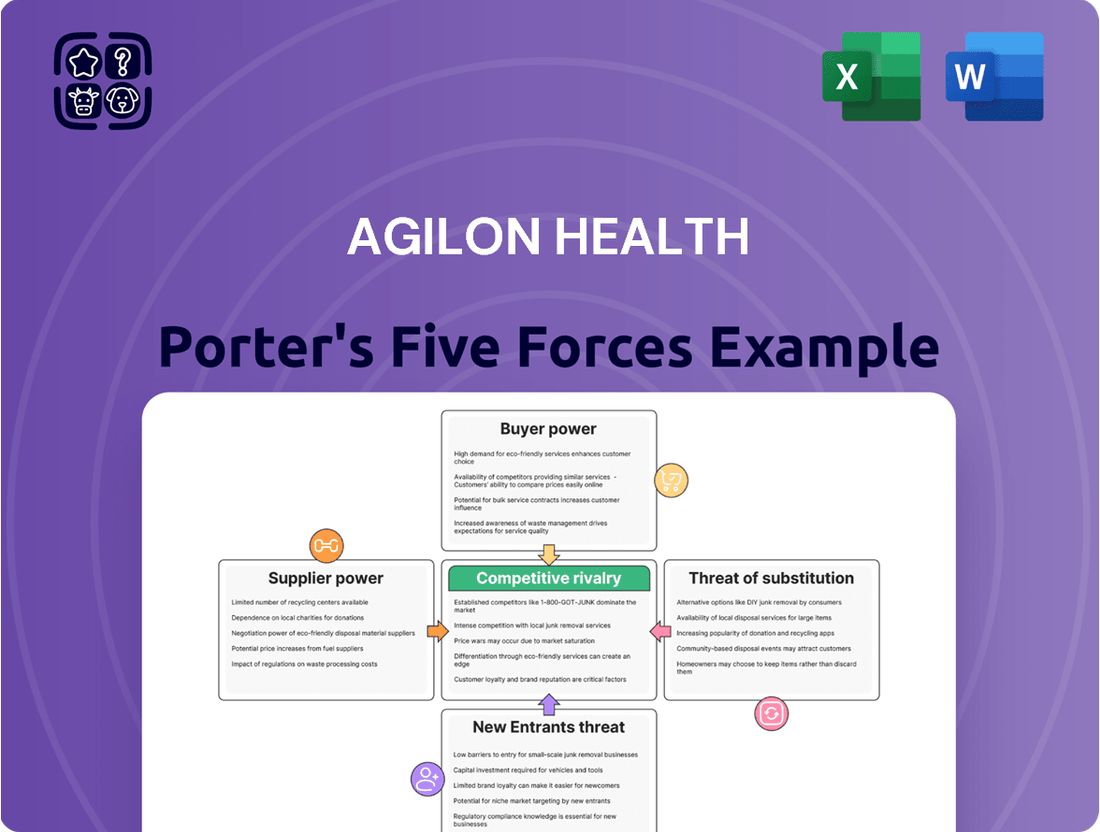

agilon health Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

agilon health Bundle

Agilon health navigates a complex landscape where buyer power, particularly from large health plans, significantly influences pricing and contract terms. The threat of new entrants is moderate, as establishing a robust network and navigating regulatory hurdles is challenging. However, the intensity of rivalry among existing players can be high, especially for primary care groups seeking to join value-based care platforms.

The threat of substitutes is also a key consideration, as alternative models for managing senior care and improving health outcomes exist. Furthermore, the bargaining power of suppliers, including technology providers and clinical support services, can impact agilon health's operational costs and efficiency.

The complete report reveals the real forces shaping agilon health’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Primary care physician groups are crucial partners for agilon health, essentially acting as their suppliers by providing patient panels and clinical services. Their bargaining power is a significant factor, often ranging from moderate to high.

Agilon health depends on these physician groups to grow its network and deliver quality care efficiently. The ability of these groups to negotiate favorable terms is amplified if they possess a unique patient demographic or hold a strong, established reputation within their local communities, thereby increasing their leverage.

For instance, a physician group with a high concentration of patients eligible for value-based care programs, a key focus for agilon health, would command greater influence in contract discussions. As of early 2024, agilon health reported serving over 1 million members, highlighting the scale of its operations and the importance of these physician relationships.

Agilon Health's reliance on technology and software providers presents a notable area of supplier bargaining power. The company operates on a platform model, integrating various IT solutions to manage its healthcare services and partnerships. The strength of these technology suppliers hinges on how unique or proprietary their offerings are. If Agilon needs highly specialized healthcare IT systems that are not readily available elsewhere, these providers gain leverage.

Furthermore, the switching costs associated with changing technology vendors significantly influence supplier power. High switching costs, including the expense and disruption of migrating data and retraining staff, make it harder for Agilon to move to alternative providers. This can embolden suppliers to demand more favorable terms. For example, in 2023, the average cost for businesses to migrate their cloud infrastructure ranged from tens of thousands to millions of dollars, depending on complexity, highlighting the financial implications of switching IT providers.

Agilon Health, as a provider of capital to physician groups, is itself a consumer of capital, making capital providers a key supplier. The bargaining power of these entities, including institutional investors and banks, is influenced by broader economic conditions. For instance, in a rising interest rate environment, the cost of capital for Agilon can increase, giving suppliers more leverage.

Agilon's own financial health significantly impacts the bargaining power of its capital providers. A strong balance sheet, demonstrated profitability, and a positive growth outlook can diminish their ability to dictate terms. Conversely, financial underperformance or heightened economic uncertainty empowers lenders and investors, potentially leading to higher borrowing costs or more stringent covenants.

Medical and Pharmaceutical Suppliers

The bargaining power of medical and pharmaceutical suppliers, while indirect, can still influence Agilon Health's profitability. Even though Agilon doesn't directly purchase these goods, rising costs for physician groups, particularly for prescription drugs under Medicare Part D, directly affect Agilon's medical margin. For instance, Agilon reported that elevated medical cost trends, including those related to Part D, created headwinds in 2023, underscoring the impact of supplier pricing power on their financial performance.

- Indirect Cost Impact: Supplier price increases for medical supplies and pharmaceuticals are passed through to physician groups, ultimately affecting Agilon's cost of care.

- Part D Expenses: Higher prescription drug costs, a significant component of healthcare spending, have been identified as a drag on Agilon's financial results.

- 2023 Headwinds: Agilon explicitly cited elevated medical cost trends, including Part D, as a negative factor impacting their financial performance in the past year.

Human Capital (Skilled Healthcare Professionals)

The bargaining power of skilled healthcare professionals, particularly primary care physicians and essential support staff, is a significant factor for Agilon Health. A scarcity of these professionals directly translates to increased bargaining power for them. This can manifest as higher compensation demands, more favorable working conditions, and greater leverage in contract negotiations with physician groups that Agilon partners with, ultimately driving up recruitment and retention expenses.

Agilon Health's operational model aims to mitigate this by enhancing the value proposition for physicians. By empowering these professionals and substantially reducing their administrative burdens, Agilon seeks to create an environment that is more attractive for both attracting new talent and retaining existing physicians. This focus on physician well-being and efficiency is crucial in a market where skilled human capital is in high demand.

- Physician Shortage Impact: Reports from the Association of American Medical Colleges (AAMC) projected a potential shortage of between 37,800 and 124,000 physicians by 2034 in the United States, underscoring the competitive landscape for primary care talent.

- Agilon's Physician Empowerment: Agilon's platform is designed to streamline administrative tasks, allowing physicians to dedicate more time to patient care, which is a key factor in physician satisfaction and retention.

- Retention Costs: The average cost to recruit a physician can range from $100,000 to $250,000, a figure that can escalate significantly in areas experiencing acute shortages.

Primary care physician groups hold significant bargaining power, often moderate to high, as they directly supply patient panels and clinical services to agilon health. Their leverage increases with unique patient demographics or strong local reputations, as seen with agilon health serving over 1 million members by early 2024, emphasizing the importance of these physician relationships.

Technology and software providers can exert considerable influence, especially if their solutions are proprietary or involve high switching costs for agilon health. Businesses can face migration costs ranging from tens of thousands to millions of dollars, underscoring the financial commitment and supplier leverage in IT transitions.

Capital providers, such as banks and institutional investors, also possess bargaining power, particularly in environments with rising interest rates. Agilon Health's financial performance, including profitability and growth outlook, directly impacts its ability to negotiate terms with these crucial capital suppliers.

While indirect, medical and pharmaceutical suppliers affect agilon health through their pricing power, particularly with prescription drugs impacting Medicare Part D costs. Agilon noted elevated medical cost trends, including Part D, as a headwind in 2023, illustrating how supplier price increases influence their financial results.

What is included in the product

This analysis dissects agilon health's competitive environment by examining supplier power, buyer bargaining, new entrant threats, substitute services, and the intensity of rivalry within the healthcare sector.

Instantly identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis, allowing agilon health to proactively address market pressures.

Customers Bargaining Power

Agilon Health's primary customers are health plans and payers, such as Medicare Advantage providers. These large entities wield considerable bargaining power due to their substantial size and their ability to influence patient referrals and reimbursement rates.

The scale of these payers allows them to negotiate favorable terms, impacting Agilon's revenue. For instance, a significant portion of Medicare Advantage plans, which are Agilon's target, often operate with substantial market share in their respective regions.

Agilon's value proposition centers on lowering overall healthcare costs and enhancing patient outcomes, which directly benefits these payers by reducing their medical expenses. This cost-saving potential can mitigate some of the payers' inherent bargaining power.

In 2024, the trend of value-based care, where providers are reimbursed based on quality and outcomes rather than volume, continues to strengthen the position of payers who are committed to these models. Agilon's success is thus intertwined with its ability to demonstrate tangible cost reductions for these partners.

Senior patients, though not directly paying agilon health, wield significant indirect bargaining power. Their choices in Medicare Advantage plans and primary care physicians ultimately steer them towards agilon's partner networks, making patient satisfaction paramount.

Agilon's strategy heavily relies on delivering patient-centered, outcome-driven care to foster loyalty and retention. This focus is crucial as a drop in membership, as observed in certain market exits, can signal that patient preferences or broader payer trends are impacting agilon's ability to attract and keep seniors within its model.

Physician groups, while crucial to healthcare delivery, also act as customers for Agilon Health's platform and services. Their leverage comes from the potential to partner with other value-based care enablers or to build these capabilities internally. For instance, as of the first quarter of 2024, Agilon continued to expand its physician partnerships, demonstrating the ongoing need for such platforms. Agilon's strategy focuses on offering a distinct advantage that supports physician independence within the evolving value-based care landscape.

Government Regulations and Policies

Government regulations significantly influence the bargaining power of customers for companies like Agilon Health. Bodies such as the Centers for Medicare & Medicaid Services (CMS) act as de facto customers and powerful regulators by dictating reimbursement rates, quality standards, and risk adjustment methodologies for key programs like Medicare Advantage and ACO REACH. For instance, CMS's annual rate setting for Medicare Advantage plans directly impacts Agilon's revenue potential.

Changes in these government policies can dramatically shift Agilon's financial landscape. Consider the impact of CMS policy adjustments, such as modifications to risk adjustment models or rules concerning Part D drug exposure. These shifts can directly affect Agilon's profitability by altering how capitation payments are calculated and how medical expenses are managed. In 2024, CMS continued to refine these models, presenting ongoing challenges and opportunities for Agilon in navigating the regulatory environment.

- CMS Rate Adjustments: Annual changes to Medicare Advantage reimbursement rates set by CMS directly influence Agilon's revenue streams.

- Risk Adjustment Models: Evolving risk adjustment methodologies affect the accuracy of payments based on patient health status.

- Part D Exposure Rules: Regulations concerning the financial responsibility for prescription drug costs impact Agilon's overall cost management.

- Quality Metrics: Government-imposed quality metrics can necessitate investments in care management, affecting operational costs and provider network performance.

Employer Groups (for commercial plans)

While agilon health's core business is Medicare Advantage, the potential to serve employer groups in commercial plans introduces a new customer dynamic. These groups, representing a significant portion of the healthcare market, possess substantial bargaining power. Their primary objective is to secure affordable, top-tier healthcare solutions for their workforce.

The sheer volume of employees covered by large employer groups translates directly into considerable negotiation leverage. They can demand favorable pricing and service terms, impacting contract profitability. For instance, in 2024, employer-sponsored health insurance covered an estimated 150 million Americans. This substantial base means that if agilon were to enter this market, these groups would have considerable sway.

- Significant Purchasing Power: Large employer groups can negotiate better rates due to the volume of individuals they represent.

- Demand for Value: These customers prioritize cost-effectiveness and quality, pushing providers to demonstrate clear ROI.

- Market Entry Considerations: Expanding into commercial plans requires agilon to tailor its value proposition to meet employer-specific needs for cost control and employee satisfaction.

Agilon Health's primary customers, health plans and payers like Medicare Advantage providers, possess significant bargaining power due to their scale and influence over referrals and reimbursement rates. In 2024, the shift towards value-based care further amplified the leverage of payers committed to these models, making Agilon's ability to demonstrate cost savings critical for negotiating favorable terms.

Senior patients indirectly influence bargaining power through their choice of Medicare Advantage plans and physicians, directly impacting Agilon's network engagement and patient retention strategies throughout 2024. Similarly, physician groups, acting as customers for Agilon's platform, can leverage their ability to seek alternative partnerships or develop in-house capabilities, underscoring the need for Agilon to offer a compelling value proposition.

Government entities, particularly CMS, act as powerful customers by dictating reimbursement rates and quality standards for programs like Medicare Advantage. CMS's 2024 policy adjustments, including refinements to risk adjustment models and Part D exposure rules, directly impact Agilon's revenue and cost management, highlighting the customer's regulatory leverage.

The potential entry into commercial employer markets introduces another powerful customer segment. In 2024, with an estimated 150 million Americans covered by employer-sponsored health insurance, these large groups possess substantial negotiation leverage due to their volume, prioritizing cost-effectiveness and quality for their workforce.

| Customer Segment | Bargaining Power Drivers | 2024 Relevance |

| Health Plans/Payers | Scale, referral influence, reimbursement control | Value-based care trend strengthens payer position |

| Senior Patients | Choice of plans/physicians, network loyalty | Patient satisfaction is key for retention |

| Physician Groups | Alternative partnerships, in-house capabilities | Need for distinct platform advantage |

| Government (CMS) | Reimbursement rates, regulatory standards | Ongoing policy refinements impact revenue/costs |

| Employer Groups | Volume of employees, demand for cost-effectiveness | Significant leverage in commercial market |

Preview Before You Purchase

agilon health Porter's Five Forces Analysis

This preview shows the exact Porter's Five Forces analysis of agilon health you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the threat of new entrants and the bargaining power of buyers. The analysis delves into the intensity of rivalry among existing competitors and the threat of substitute products or services. Furthermore, you'll find a detailed breakdown of the bargaining power of suppliers, all presented in a professionally formatted document ready for your immediate use.

Rivalry Among Competitors

The value-based care arena is indeed a crowded space. Agilon Health contends with a broad spectrum of competitors, from established giants like Optum and Humana's CenterWell, which leverage their integrated health systems and payer relationships, to other focused value-based care enablers such as Privia Health and Oak Street Health.

These rivals often present similar technological solutions or direct primary care frameworks, directly challenging Agilon's market position. For instance, in 2023, Optum Health reported significant revenue growth, underscoring the scale and financial backing of some of its key competitors.

The diversity of these players means Agilon must navigate competition that can originate from large, diversified healthcare conglomerates as well as more nimble, specialized entities, each with distinct strategic advantages and operational models.

The shift towards value-based care and the expansion of Medicare Advantage are creating tailwinds for the entire industry, potentially easing competitive pressures by growing the overall market. This trend, evident in the projected 10% compound annual growth rate for Medicare Advantage enrollment through 2030, allows more room for various players to thrive.

However, this growth doesn't eliminate competition; rather, it can re-focus it. Rising medical costs, a persistent challenge in 2024, can intensify the rivalry for healthier, more profitable patient groups. Companies are vying to demonstrate superior care coordination and cost efficiency to attract and retain these key demographics.

While the market for value-based primary care enablement has numerous participants, several large entities possess substantial scale and financial backing. This concentration can foster fierce competition, often manifesting through strategic acquisitions or aggressive market penetration tactics by these scaled players.

Agilon Health benefits from its own significant scale, boasting an established network that includes over 3,000 primary care physicians across multiple communities. This extensive reach and operational depth serve as a distinct competitive advantage in attracting and retaining physician partnerships.

Differentiation of Services

Agilon Health stands out by offering a unique 'Total Care Model' that combines technology, services, and capital to support independent primary care physicians. This integrated approach is designed to enhance how these physicians manage the health of their senior patients.

The core of Agilon's differentiation lies in its capacity to prove superior patient outcomes and significant cost savings. For instance, in 2023, Agilon reported a 13% increase in revenue compared to 2022, reaching $1.4 billion, demonstrating its growing market traction. This performance is largely attributed to its model’s effectiveness in managing care for a growing senior population.

- Agilon's 'Total Care Model': A comprehensive suite of technology, services, and capital.

- Focus on Independent Physicians: Empowering primary care doctors to manage senior health effectively.

- Demonstrating Value: Proving superior patient outcomes and cost efficiencies is key to differentiation.

- Financial Traction: In 2023, Agilon achieved $1.4 billion in revenue, marking a 13% year-over-year increase.

Exit Barriers

The healthcare sector, where agilon health operates, is known for significant exit barriers. High fixed costs associated with specialized facilities and technology, coupled with the long-term contracts common in payer-provider relationships, make it challenging and costly for companies to leave the market. This can trap companies in unprofitable situations, intensifying competitive rivalry as they struggle to recoup investments. For instance, the healthcare IT infrastructure alone can represent millions in sunk costs.

These barriers mean that even if a healthcare company is not performing well, it might continue to operate rather than absorb the substantial losses associated with exiting. This persistence of players, regardless of profitability, fuels ongoing competition. Understanding these dynamics is crucial for strategic planning.

agilon health's recent strategic moves, such as exiting certain unprofitable partnerships, demonstrate a proactive approach to navigating these high exit barriers. By strategically pruning underperforming segments, the company aims to mitigate the impact of being locked into costly, low-return ventures.

Consider these factors contributing to high exit barriers:

- High Capital Investment: Significant upfront costs for medical equipment, facilities, and technology create a substantial financial hurdle for exiting.

- Specialized Assets: Many healthcare assets are industry-specific and have limited resale value outside the healthcare sector.

- Contractual Obligations: Long-term contracts with insurance providers and suppliers can impose penalties or ongoing financial commitments, making early termination costly.

- Regulatory Requirements: Compliance with healthcare regulations often involves ongoing investments and specific operational standards that are difficult to shed quickly.

Competitive rivalry within the value-based care sector is intense, featuring both large, established players and specialized providers. Agilon Health faces rivals like Optum and Humana's CenterWell, which benefit from extensive integrated systems and payer relationships. Many competitors offer similar technology and primary care models, directly challenging Agilon. For example, Optum Health’s strong revenue growth in 2023 highlights the financial muscle of some key competitors.

Despite a growing market, fueled by trends like Medicare Advantage expansion, competition remains sharp, especially as companies vie for healthier patient populations. Rising medical costs in 2024 further intensify this competition, pushing companies to demonstrate superior care coordination and cost efficiency. Agilon's own scale, with over 3,000 affiliated physicians, and its unique 'Total Care Model' are crucial differentiators in this crowded landscape.

The healthcare industry presents high exit barriers due to significant capital investments in facilities and technology, alongside long-term contractual obligations. These factors mean companies may persist even when unprofitable, thereby sustaining competitive pressure. Agilon's strategic exits from certain partnerships in 2023 and 2024 show an effort to manage these challenges.

| Key Competitors | Agilon Health Differentiators | Market Trend Impact |

| Optum (UnitedHealth Group) | 'Total Care Model' | Medicare Advantage Growth (projected 10% CAGR through 2030) |

| Humana (CenterWell) | Focus on Independent Primary Care Physicians | Rising Medical Costs (2024) |

| Privia Health | Proven Patient Outcomes & Cost Savings | High Exit Barriers (Sunk Costs in IT Infrastructure) |

| Oak Street Health (acquired by CVS Health) | Scale: 3,000+ Affiliated Physicians | Intensified Rivalry for Profitable Patient Groups |

SSubstitutes Threaten

The traditional fee-for-service (FFS) model is a significant substitute for Agilon Health's value-based care approach. Many healthcare providers and patients are accustomed to FFS, where payment is tied to the quantity of services rendered, not the quality of outcomes. This established system offers a familiar alternative, allowing physician groups and patients to opt out of or resist Agilon's innovative model.

Large physician groups and health systems might opt to build their own value-based care (VBC) infrastructure, bypassing the need for external partners like Agilon. This internal development allows them to control their VBC strategy and technology stack directly. For instance, many large health systems in 2024 are investing heavily in data analytics and care coordination platforms to manage VBC arrangements independently, driven by the desire for greater autonomy and potential cost savings.

This do-it-yourself approach becomes a significant threat when these entities possess the necessary capital and in-house expertise. If a health system can effectively replicate Agilon's core offerings, such as patient engagement tools or risk management analytics, they may see partnering as an unnecessary expense. The trend of health systems acquiring or developing their own technology solutions for VBC is growing, with reports indicating a 15% increase in direct VBC technology investment by integrated delivery networks in the past year.

Sophisticated physician groups and provider networks are increasingly exploring direct contracting with health plans for value-based care. This trend bypasses intermediaries like Agilon Health, reducing reliance on their platforms and administrative services. For example, by 2024, several large integrated delivery networks have successfully negotiated capitated contracts with major commercial insurers, demonstrating a growing capacity for self-management and direct risk-bearing.

This disintermediation poses a significant threat as providers assume greater control over patient populations and financial arrangements. When providers can directly manage care and costs, the value proposition of platform companies that facilitate these arrangements diminishes. The ability of these groups to handle their own actuarial functions and quality reporting further weakens the need for external support, directly impacting Agilon's market position.

Alternative Care Delivery Models

New models of care delivery, like direct primary care (DPC) and concierge medicine, present a subtle but significant threat to agilon health. While often complementary, these models can act as substitutes by offering patients enhanced access and a more personalized, patient-centered experience, attributes that agilon also emphasizes. These alternatives may appeal to a segment of patients who desire a different relationship with their primary care providers, potentially bypassing the broader value-based risk structures that agilon Health operates within.

For instance, DPC practices typically charge a flat monthly fee, providing unlimited access to a primary care physician for a set period, a model that can be attractive to individuals prioritizing convenience and direct physician interaction. Some reports indicate that the DPC market has seen steady growth, with an estimated 10,000 to 20,000 DPC physicians in the United States as of early 2024, demonstrating a tangible alternative for a portion of the patient population.

- Direct Primary Care (DPC): Offers enhanced patient access and personalized care through a subscription model, potentially diverting patients seeking this specific engagement.

- Concierge Medicine: Similar to DPC, it provides a higher level of access and personalized service, often through an annual fee, creating an alternative for patients valuing direct physician relationships.

- Patient Preference: These models cater to patients who prioritize a different type of interaction and access with their primary care physicians, potentially independent of broader value-based care arrangements.

Non-Physician-Led Care Models

The threat of substitutes for Agilon Health's primary care physician-centric model comes from alternative care delivery systems. While Agilon partners with primary care physicians (PCPs), other professionals like nurse practitioners (NPs) or physician assistants (PAs) could offer similar care coordination services, potentially at a lower cost. For instance, the National Academy of Medicine has highlighted the significant role NPs play in primary care, suggesting a growing capacity for independent practice. The rise of telehealth and AI-driven diagnostic tools also presents a substitute, offering remote patient monitoring and basic health advice without direct, ongoing PCP involvement.

These non-physician-led models can impact Agilon by fragmenting the patient care pathway. If patients find efficacy and convenience in NP-led clinics or tech-based solutions for certain needs, they may reduce their reliance on Agilon's partnered PCPs. This could lead to a decrease in patient volume managed under Agilon's value-based care arrangements. By 2023, telehealth utilization remained significantly higher than pre-pandemic levels, indicating sustained patient acceptance of virtual care options.

- Growing NP and PA Workforce: An increasing number of NPs and PAs are practicing independently or in group settings, offering a direct alternative for primary care services.

- Advancements in Telehealth: Technology is enabling more sophisticated remote patient management and virtual consultations, lessening the need for in-person PCP visits for certain conditions.

- Cost Competitiveness: Non-physician-led models may operate with lower overheads, allowing them to offer services at a more attractive price point compared to traditional physician practices.

- Patient Preference for Convenience: Some patients may opt for more accessible or convenient care options, such as walk-in clinics or virtual platforms, even if they are not physician-led.

The threat of substitutes for Agilon Health's model stems from established healthcare delivery methods and emerging alternatives. The traditional fee-for-service (FFS) system remains a powerful substitute, deeply ingrained in provider and patient expectations. Furthermore, large physician groups and health systems are increasingly investing in their own value-based care infrastructure, a trend supported by a 15% increase in direct VBC technology investment by integrated delivery networks in 2023.

Direct contracting between provider networks and health plans also bypasses intermediaries like Agilon, with several large integrated delivery networks successfully negotiating capitated contracts with commercial insurers by 2024. New models like Direct Primary Care (DPC), with an estimated 10,000 to 20,000 DPC physicians in the US by early 2024, offer personalized care and enhanced access, appealing to patients seeking different engagement styles.

Finally, non-physician-led care models, such as those utilizing Nurse Practitioners (NPs) and Physician Assistants (PAs), alongside advancements in telehealth and AI diagnostics, present cost-competitive and convenient alternatives. Telehealth utilization remained significantly higher than pre-pandemic levels in 2023, indicating sustained patient acceptance of virtual care options.

Entrants Threaten

Entering the value-based care enablement sector, especially for those aiming for full-risk arrangements, demands significant financial investment. This capital is crucial for developing advanced technology, building out robust provider networks, and having the financial cushion to manage the inherent risks tied to patient health outcomes.

Agilon's own business model involves providing capital directly to physician groups. This action underscores the substantial financial barrier that new competitors face when trying to establish themselves in this market, as they would need similar resources to compete effectively.

The healthcare industry, particularly segments involving Medicare Advantage and other government-funded programs, presents formidable barriers to entry due to its intricate regulatory landscape. New companies must dedicate substantial resources and expertise to understand and adhere to these complex compliance requirements, licensing procedures, and ever-changing payment models.

Navigating this regulatory maze is a significant hurdle. For instance, the Centers for Medicare & Medicaid Services (CMS) continually updates its rules for Medicare Advantage plans. In 2024, CMS announced a risk adjustment model transition, demanding significant operational adjustments from all participating entities, a task that can be particularly challenging for new entrants lacking established infrastructure.

Agilon Health's strength lies in its deep-rooted relationships with primary care physicians. These partnerships are not easily replicated. Building trust and integrating into existing physician networks requires significant time, effort, and demonstrated value, acting as a substantial hurdle for any new entrants aiming to attract these vital providers.

Proprietary Technology and Data Analytics

Agilon health's proprietary technology and advanced data analytics create a significant barrier to entry. Their platform is designed to empower physician groups to thrive in value-based care arrangements. Building a comparable system, which requires substantial investment in sophisticated software, data infrastructure, and analytical talent, is a major hurdle for any new company looking to enter the market.

The complexity of integrating diverse patient data and generating actionable insights demands specialized expertise and significant capital. This technological moat means that potential competitors would need to replicate Agilon's extensive investment in technology and data science capabilities. For instance, in 2023, Agilon reported investing heavily in its technology platform to enhance its data analytics and operational efficiency, underscoring the substantial upfront costs involved.

- Technological Investment: Developing a robust, integrated platform akin to Agilon's requires millions of dollars in software development, data warehousing, and AI/ML capabilities.

- Data Integration Challenges: New entrants would face the immense task of integrating disparate healthcare data sources, a process that is both time-consuming and expensive.

- Expertise Requirement: Accessing and retaining the specialized talent needed for advanced healthcare data analytics and platform management is a significant competitive challenge.

- Scalability Costs: Building a platform that can scale to manage a large patient population and a growing network of physician partners incurs substantial ongoing operational expenses.

Proven Track Record and Outcomes

The threat of new entrants for agilon health is significantly tempered by the critical need for a proven track record in value-based care. Companies aiming to enter this market must demonstrate tangible improvements in patient outcomes and cost savings to secure physician partnerships and health plan contracts. Newcomers face a considerable hurdle in establishing this credibility, whereas agilon health can leverage its existing success stories and quality scores to attract business.

Agilon health's ability to showcase concrete results is a major competitive advantage. For instance, in 2023, agilon health reported that its physician partners achieved an average of $2,100 per member per year in total medical cost savings compared to traditional Medicare fee-for-service models for their Medicare Advantage patients. This level of demonstrable value makes it difficult for new entrants to gain traction without a similar history of success.

- Demonstrated Value: Agilon health's partners see significant cost savings, averaging over $2,100 per member per year in 2023.

- Credibility Barrier: New entrants struggle to match agilon health's established history of improved patient outcomes and financial efficiencies.

- Contract Attraction: Proven results are essential for securing vital health plan and physician agreements, a domain where agilon health excels.

- Quality Scores: Agilon health's existing high-quality scores further solidify its position, making it a preferred partner over unproven competitors.

The threat of new entrants in the value-based care enablement sector is significantly limited by the substantial capital required for technology development, network building, and risk management. Agilon Health's model of directly providing capital to physician groups highlights this financial barrier, as competitors need similar resources to be viable.

Navigating the complex regulatory environment, including evolving CMS rules like the 2024 risk adjustment model transition, presents a formidable challenge for newcomers. Agilon's established relationships with primary care physicians, built on trust and demonstrated value over time, are also difficult for new players to replicate quickly.

The significant investment in proprietary technology and data analytics, exemplified by Agilon's 2023 platform enhancements, creates a high technological barrier. Furthermore, a proven track record of improving patient outcomes and achieving cost savings, such as Agilon's reported $2,100 per member per year savings in 2023, is crucial for attracting partners and contracts, a hurdle that new entrants must overcome.

| Barrier Type | Description | Agilon Health's Advantage | New Entrant Challenge |

|---|---|---|---|

| Capital Requirements | Significant investment needed for technology, networks, and risk management. | Established financial infrastructure and direct capital provision to physician groups. | Securing substantial funding for initial setup and ongoing operations. |

| Regulatory Complexity | Adherence to intricate healthcare regulations and evolving payment models. | Existing expertise and compliance frameworks in place. | Understanding and implementing complex rules, such as CMS risk adjustment changes. |

| Provider Relationships | Building trust and integration with physician networks. | Deep-rooted, long-standing partnerships with primary care physicians. | Time-consuming process to gain physician trust and network access. |

| Technological & Data Capabilities | Developing advanced data analytics and integrated platforms. | Proprietary, sophisticated technology and data science expertise. | High cost and talent acquisition for comparable data infrastructure. |

| Demonstrated Value & Track Record | Proving improved patient outcomes and cost savings. | Proven history of significant cost savings (e.g., $2,100 PMPY in 2023) and high-quality scores. | Establishing credibility and a history of success to attract partners. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Agilon Health leverages data from industry-specific market research reports, company financial statements, and news archives to understand competitive pressures.

We utilize a combination of publicly available data from Agilon Health's SEC filings, healthcare industry analysis reports, and proprietary market intelligence databases to assess competitive forces.