agilon health Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

agilon health Bundle

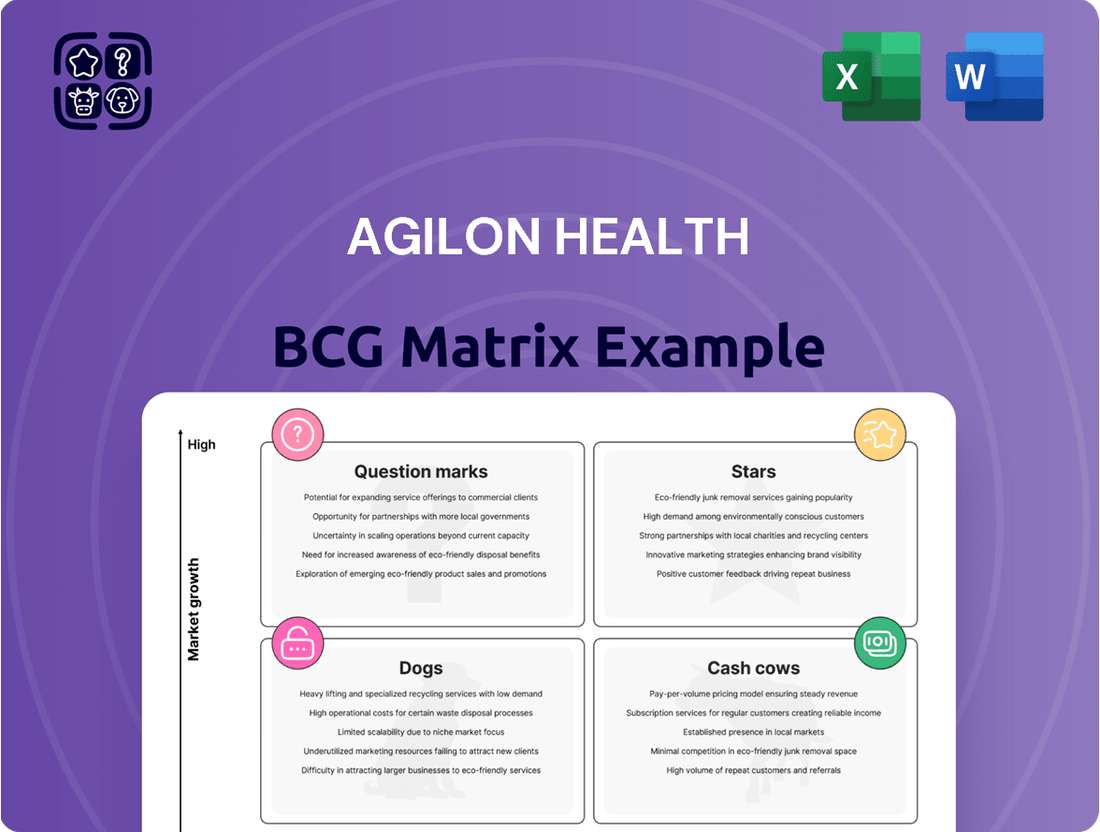

Understand agilon health's strategic position with a glance at its BCG Matrix. See which of their ventures are poised for growth (Stars), generating steady revenue (Cash Cows), underperforming (Dogs), or require careful consideration (Question Marks).

This preview offers a glimpse into the dynamic portfolio of agilon health, highlighting the critical balance between market share and growth potential across their various initiatives.

To truly unlock strategic advantages and make informed decisions about resource allocation, a deeper dive is essential.

Purchase the full agilon health BCG Matrix report for a comprehensive, data-driven analysis that will empower you to navigate their market landscape with confidence.

Gain actionable insights into their current product mix and a clear roadmap for future investment and strategic development.

Don't miss out on the opportunity to leverage this powerful strategic tool for your own business planning.

Stars

Agilon Health is aggressively broadening its reach by forging new alliances with physician groups. In 2025 alone, the company announced five significant new partnerships, marking its debut in Illinois while simultaneously deepening its presence in Kentucky, Minnesota, and North Carolina.

This strategic push into both nascent and established territories signals robust growth prospects. These newly entered markets are poised to become substantial contributors to future revenue streams for Agilon Health.

Agilon Health continues to hold a significant presence in the Medicare Advantage (MA) market, boasting 491,000 members as of the first quarter of 2025. This substantial membership base in a key growth sector highlights its strategic importance.

While some market withdrawals have led to a minor overall membership dip, the sustained focus on Medicare Advantage is a clear indicator of the company's commitment to this lucrative segment. This strategic direction positions these member groups as potential cash cows for future revenue generation.

Agilon Health's core Total Care Model is seeing significant uptake, empowering physicians to fully embrace value-based care arrangements. This strategic focus on improving patient outcomes while simultaneously driving down healthcare expenditures positions Agilon Health at the forefront of a rapidly expanding sector. As of the first quarter of 2024, Agilon reported that its physician partners were managing approximately 426,000 lives under value-based contracts, a testament to the model's growing appeal and demonstrated success.

Strategic Technology and Clinical Investments

Agilon Health is strategically allocating capital towards technology and clinical initiatives to bolster its platform and fuel expansion. These investments are vital for refining operations, improving patient care, and enhancing data analytics capabilities—critical elements in a dynamic healthcare landscape.

For 2024, Agilon Health's focus on technology is evident in its ongoing development of advanced data analytics and AI tools. These investments aim to provide deeper insights into patient populations and predict health trends more accurately, thereby optimizing care management and reducing costs.

- Technology Investments: Agilon Health is enhancing its proprietary platform to streamline administrative tasks and improve data interoperability across its network of physician partners.

- Clinical Program Enhancement: The company is expanding its evidence-based clinical programs, focusing on chronic disease management and preventative care to improve member outcomes.

- Data and Analytics: Significant resources are being directed towards sophisticated data analytics capabilities, enabling proactive identification of at-risk patients and personalized care interventions.

- Operational Efficiency: Investments in technology are designed to automate processes, reduce overhead, and allow physicians to spend more time on patient care, a key driver of value in 2024.

Strong Physician Partnership Model

Agilon Health's "Strong Physician Partnership Model" positions it favorably within the BCG matrix, showcasing its ability to attract and retain top physician practices. This strategic approach has cultivated a network of over 3,000 primary care physicians, underscoring the company's robust market presence and the success of its collaborative framework.

This extensive network is a critical asset, facilitating the scalability of agilon's value-based care model. By fostering these strong relationships, agilon Health is effectively driving high-quality and cost-effective patient care.

- Physician Network Growth: Agilon Health has successfully onboarded over 3,000 primary care physicians.

- Value-Based Care Focus: The partnership model is central to scaling their value-based care initiatives.

- Market Strength Indicator: The ability to attract and retain physicians signals a strong market position.

Agilon Health's Stars, characterized by their strong physician partnerships and robust Medicare Advantage membership, represent key growth drivers. The company's successful onboarding of over 3,000 primary care physicians fuels the scalability of its value-based care model. With 491,000 Medicare Advantage members in Q1 2025, these segments are poised to generate significant future revenue.

| Category | Metric | Value (as of Q1 2025) | Significance |

|---|---|---|---|

| Physician Partnerships | Number of Primary Care Physicians | Over 3,000 | Enables scalability of value-based care |

| Medicare Advantage | Total Members | 491,000 | Key growth segment, potential revenue driver |

| New Market Expansion | New Partnerships in 2025 | 5 | Indicates aggressive growth and market penetration |

What is included in the product

The agilon health BCG Matrix offers insights into its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

Quickly visualize Agilon Health's portfolio, alleviating the pain of strategic uncertainty.

Cash Cows

Agilon Health’s established Medicare Advantage partnerships in mature markets are prime examples of cash cows within the BCG matrix. These collaborations, where Agilon boasts a high market share, are consistently generating substantial cash flow. For instance, in 2024, Agilon continued to see strong performance from its long-standing partnerships, benefiting from optimized operational efficiencies and deep patient engagement that minimize the need for significant new capital infusion.

These mature relationships are characterized by streamlined processes and a well-entrenched patient base, meaning they require minimal ongoing investment to maintain their profitability. This allows Agilon to leverage existing infrastructure and expertise, ensuring a steady and predictable revenue stream. The company's focus on these established markets underscores their role as reliable profit generators, contributing significantly to Agilon’s overall financial health.

Agilon Health's mature Accountable Care Organization Realizing Essential Access, Benefits, and Efficiency (ACO REACH) programs are performing exceptionally well. These established programs are currently achieving medical margins exceeding $100 per member per month (PMPM). The company has a clear objective to further increase these margins, targeting a range of $150 to $200 PMPM in the long term.

Having successfully navigated the initial setup and investment phases, these mature ACO REACH programs are now in a strong position to generate substantial cost savings. This efficiency directly translates into positive contributions to Agilon Health's Adjusted EBITDA, showcasing the financial viability and growth potential of these initiatives.

agilon health's integrated palliative care model, embedded within primary care, exemplifies a strong Cash Cow. This mature service has demonstrated a proven ability to reduce hospitalizations and enhance patient quality of life by enabling more time at home.

The model's effectiveness translates into significant cost savings for the healthcare system and improved patient outcomes, establishing it as a reliable and high-value revenue generator. In 2024, agilon health continued to expand this model, leveraging its established success without the need for substantial new market investment or innovation.

Efficient Operational Infrastructure

Agilon Health's efficient operational infrastructure is a cornerstone of its Cash Cow status in the BCG Matrix. The company focuses on maintaining strict control over operating costs by leveraging its scaled infrastructure and significant technology investments. This robust operational backbone enables the effective management of its current partnerships and patient populations, directly contributing to high profit margins from its existing services.

This operational discipline is crucial for generating consistent returns. For instance, agilon health reported a gross profit margin of 19.5% in the first quarter of 2024, demonstrating the profitability of its core services, which are supported by this efficient infrastructure.

- Scaled Infrastructure: Agilon Health benefits from a well-established operational backbone that supports efficient management of its growing network of partners.

- Technology Investments: Ongoing investments in technology drive operational efficiencies, reducing costs and improving service delivery.

- Cost Discipline: A strong emphasis on operating cost discipline ensures that the company maintains high profit margins on its current revenue streams.

- Profitability: The efficient infrastructure allows agilon health to generate substantial profits from its existing partnerships and patient base.

Long-Term Payer Contracts

Long-term payer contracts in established markets are Agilon Health's cash cows, offering reliable and predictable revenue. These agreements, especially those finalized for 2025 with enhanced terms and quality incentives, signify mature partnerships that consistently generate cash flow. The cost of growth associated with these established relationships is notably lower.

Agilon Health's strategy leverages these long-term payer contracts as stable income generators. For instance, in 2024, the company continued to expand its network of physician partners, underpinning the stability of these existing revenue streams. The predictable nature of these cash flows allows Agilon to reinvest in other areas of its business.

- Stable Revenue: Long-term contracts ensure a consistent income stream from established markets.

- Predictable Cash Flow: Mature relationships generate reliable cash flow with minimal volatility.

- Lower Growth Costs: Established markets require less investment for continued revenue generation.

- 2025 Contract Enhancements: Improved terms and quality incentives for 2025 further solidify this cash cow status.

Agilon Health's mature Medicare Advantage partnerships represent core cash cows, characterized by high market share and consistent cash generation. These established relationships, such as those in their ACO REACH programs, are yielding impressive medical margins, exceeding $100 per member per month (PMPM) in 2024, with a target to reach $150-$200 PMPM.

These ventures require minimal new capital due to streamlined operations and deep patient engagement, allowing Agilon to benefit from optimized efficiencies. The company’s focus on these stable income streams, bolstered by long-term payer contracts that often see enhancements for future years, underscores their role as reliable profit centers.

Agilon's efficient operational infrastructure, including scaled technology investments and cost discipline, directly supports the profitability of these cash cows. For example, a gross profit margin of 19.5% was reported in Q1 2024, reflecting the strong returns from these established services.

| Metric | 2024 Status/Target | Significance |

|---|---|---|

| ACO REACH Medical Margin (PMPM) | > $100 | Demonstrates high profitability from mature programs |

| Target ACO REACH Medical Margin (PMPM) | $150 - $200 | Indicates future growth potential within existing operations |

| Gross Profit Margin (Q1 2024) | 19.5% | Highlights efficiency and profitability of core services |

What You See Is What You Get

agilon health BCG Matrix

The agilon health BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis, crafted by industry experts, will be delivered without any watermarks or demo content, ensuring you get a professional, ready-to-use strategic tool. You can confidently use this preview as a direct representation of the high-quality, actionable insights that will be yours to download and integrate into your business planning.

Dogs

Agilon Health has strategically exited certain unprofitable partnerships and payer contracts. This move resulted in a decrease in total members on the platform in Q1 2025, a deliberate step to refine operations.

These exited ventures likely represented cash traps. Characterized by low market share and high costs, they were not contributing positively to the company's financial health. For instance, the company reported a net loss of $11 million in Q1 2024, highlighting the impact of such less productive relationships.

Certain geographic markets for agilon health have struggled to meet profitability targets or have faced significant hurdles in expanding their operations. These underperforming segments are now being de-emphasized or exited entirely.

These areas are characterized by low growth prospects and a limited market share, meaning they consume valuable resources without generating adequate returns. For instance, in 2024, agilon health's performance review indicated that several smaller, less developed markets were contributing negatively to overall profitability, tying up capital that could be better allocated to more promising ventures.

This strategic shift is crucial for optimizing resource allocation and focusing on markets where agilon health can achieve greater scale and profitability. The company aims to streamline its operations by shedding these low-yield segments, thereby improving its financial efficiency and capacity for growth in stronger markets.

Agilon Health is strategically reducing its exposure to markets or contracts that have historically shown high Medicare Part D impact. These areas, while once a part of their portfolio, proved to be detrimental to medical margins due to their low-growth and low-profitability characteristics.

For instance, in 2023, agilon health actively worked to decrease its reliance on these specific contract types. This move is aimed at reallocating resources towards more profitable and growth-oriented segments of the healthcare market.

The company's focus is shifting away from these high Part D exposure areas, which have consistently presented challenges to their overall financial performance and medical margin stability.

Inefficient Legacy Systems/Processes

Legacy operational systems or processes within Agilon Health that remain disconnected from its core 'purpose-built platform' can be categorized as dogs in the BCG matrix. These inefficiencies can lead to increased operational costs and hinder the company’s ability to scale effectively. For instance, if Agilon still relies on manual data entry for certain patient onboarding processes, this would represent a dog, consuming valuable time and resources.

These outdated elements directly impact profitability by adding unnecessary expenses without offering a significant competitive edge. In 2024, many healthcare organizations faced pressures to modernize IT infrastructure; any Agilon processes not aligned with digital transformation efforts would fall into this category. Such systems divert capital and human resources that could otherwise be invested in innovation or expanding the core platform’s capabilities.

- Data Silos: Operational data trapped in non-integrated legacy systems prevents a unified view of patient care and financial performance.

- Increased Administrative Burden: Manual workarounds for system incompatibilities lead to higher labor costs and potential for errors.

- Limited Scalability: Inefficient legacy processes can create bottlenecks, restricting Agilon’s ability to onboard new partners or manage a growing patient population.

- Higher Cost-to-Serve: The overhead associated with maintaining and operating these older systems directly reduces profit margins per member.

Non-Strategic Payer Contracts

Non-Strategic Payer Contracts in Agilon Health's BCG Matrix represent agreements with health plans that offer limited growth potential or unfavorable financial terms. These are typically contracts that don't align with Agilon's long-term vision for profitability and strategic market positioning.

Agilon actively seeks to exit these types of payer contracts. The focus is on divesting from relationships where the market share within that specific payer is small and doesn't contribute meaningfully to the company's overall strategic objectives. This allows Agilon to reallocate resources to more promising partnerships.

- Low Growth Prospects: Contracts with payers showing minimal membership growth or limited opportunities for expansion are identified.

- Unfavorable Terms: Agreements with reimbursement rates or risk-sharing models that negatively impact Agilon's profitability are reviewed for exit.

- Strategic Misalignment: Payer relationships that do not support Agilon's core mission of empowering primary care physicians are considered non-strategic.

- Resource Reallocation: Exiting these contracts allows Agilon to focus on high-growth, strategically aligned partnerships, enhancing overall portfolio performance.

Agilon Health’s “Dogs” are its unprofitable partnerships and legacy operational systems. These segments, characterized by low growth and high costs, consume resources without generating adequate returns. For example, the company has intentionally exited certain payer contracts that negatively impacted medical margins, as seen in their Q1 2024 net loss of $11 million.

These underperforming areas, such as smaller, less developed geographic markets identified in 2024 performance reviews, are being de-emphasized or exited entirely. This strategic pruning aims to optimize resource allocation towards more profitable ventures and improve overall financial efficiency.

Agilon’s focus is shifting away from high Medicare Part D exposure areas, which presented challenges to financial performance and medical margin stability. In 2023, the company actively worked to decrease its reliance on these specific contract types, reallocating resources towards more profitable segments.

Legacy operational systems or processes not integrated with Agilon's core platform, like manual data entry, represent dogs. These inefficiencies increase operational costs and hinder scalability, diverting capital and resources from innovation and core platform expansion.

| Category | Description | Impact | Example Data Point |

|---|---|---|---|

| Unprofitable Partnerships | Low growth, unfavorable financial terms, strategic misalignment | Resource drain, reduced profitability | Q1 2024 Net Loss: $11 million |

| Legacy Systems | Disconnected, inefficient, manual processes | Increased costs, limited scalability, data silos | Continued reliance on manual data entry in certain patient onboarding processes |

| Underperforming Markets | Low profitability targets, limited expansion hurdles | Negative contribution to profitability, capital tied up | Smaller, less developed markets contributing negatively in 2024 |

| High Part D Exposure Contracts | Low growth, low profitability, detrimental to medical margins | Reduced medical margins, financial performance challenges | Active decrease in reliance on these contracts in 2023 |

Question Marks

Agilon Health's expansion into new states, such as its planned entry into Illinois in 2025, positions it within a high-growth market where its current market share is minimal. This strategic move into nascent operations necessitates substantial investment.

Significant capital will be deployed for physician onboarding, building essential infrastructure, and establishing a robust operational framework. The objective is to gain a strong foothold and capture a meaningful share of the market.

For instance, in 2024, agilon health announced its expansion into several new markets, including the Northeast region, underscoring its commitment to tapping into underserved areas with significant growth potential. This pattern is expected to continue with its Illinois launch.

agilon health is strategically moderating its intake of new Medicare Advantage members for 2025. This deliberate slowdown is aimed at prioritizing profitability over rapid expansion.

The company anticipates that these new members, while entering a robust market, will initially have lower volumes. This means they are considered question marks in the BCG Matrix, requiring a period to demonstrate their profitability and potential for scalable growth.

Agilon health's investments in unproven technology enhancements fall into the question mark category of the BCG matrix. These are initiatives like early-stage digital health platforms or novel care coordination models that are still being tested and refined. While they hold promise for revolutionizing patient care and driving future revenue, their current impact on the company's market share and profitability is uncertain.

These ventures require significant capital outlay, with agilon health allocating substantial resources to research, development, and initial deployment. For instance, in 2024, the company continued to invest in expanding its technology infrastructure to support value-based care models, though the exact returns on these specific new technologies are not yet fully quantifiable. The high risk associated with unproven technologies means they could either become significant growth drivers or fail to gain traction, leaving the company with unrecouped investments.

Expansion of ACO REACH and MSSP Penetration

Agilon Health sees a significant growth opportunity in expanding its Accountable Care Organization Realizing Equity, Access, and Community Health (ACO REACH) and Medicare Shared Savings Program (MSSP) penetration. Currently, only about 20% of their addressable market is utilizing these programs.

This low penetration suggests a prime area for investment and market share capture. However, achieving this expansion will necessitate substantial upfront investment to build out the necessary infrastructure and patient engagement strategies.

For instance, as of early 2024, the Centers for Medicare & Medicaid Services (CMS) reported that ACOs under the MSSP program served over 11 million Medicare beneficiaries. Agilon's goal is to tap into this vast pool, aiming to increase its participation from the current 20% penetration level.

- Low Current Penetration: Agilon Health's penetration in ACO REACH and MSSP programs stands at approximately 20%, highlighting a substantial untapped market.

- High Growth Potential: This low penetration signifies a significant opportunity for future growth and market share expansion within existing operational areas.

- Investment Requirement: Capturing a larger share of these programs will demand considerable investment to develop capabilities and acquire new participants.

- Market Opportunity: With millions of Medicare beneficiaries enrolled in ACO programs nationally, agilon is positioned to scale its reach effectively.

Strategic Partnerships in Early Stages

New, smaller physician partnerships, particularly in nascent markets for Agilon Health, are positioned as question marks within the BCG Matrix. These ventures represent opportunities for significant future expansion, but currently hold a small market share. Agilon Health's investment in these partnerships is crucial for their development into mature, profitable entities.

For example, Agilon Health's strategy involves identifying and nurturing these early-stage partnerships. In 2024, the company continued to expand its network, focusing on regions where its value-based care model can be effectively implemented. The success of these question mark partnerships is contingent on Agilon's ability to provide the necessary operational support and capital infusion to drive growth.

- High Growth Potential: These partnerships aim to capture new market segments.

- Low Current Market Share: They are in the initial phases of development.

- Significant Investment Required: Substantial resources are needed for maturation.

- Strategic Importance: They are key to Agilon's long-term market expansion.

Agilon Health's new market entries, such as its planned 2025 expansion into Illinois, represent classic question marks. These initiatives require significant upfront investment to build infrastructure and onboard physicians, aiming to establish a strong market presence from a low initial share. For example, in 2024, agilon health expanded into new areas like the Northeast, demonstrating this strategy of investing in high-potential but currently low-penetration markets.

The company's investments in unproven technology enhancements also fall into the question mark category. These are early-stage digital health platforms or novel care coordination models requiring substantial R&D and deployment capital, with uncertain future returns. In 2024, agilon health continued to invest in its technology infrastructure, but the specific impact of these new technologies on market share and profitability remains to be seen.

Agilon's goal to increase penetration in ACO REACH and Medicare Shared Savings Programs (MSSP), currently at around 20%, also aligns with the question mark profile. This represents a significant growth opportunity within an existing addressable market, but achieving it demands considerable investment in infrastructure and patient engagement. As of early 2024, the MSSP program alone served over 11 million beneficiaries nationally, highlighting the scale of this untapped potential.

New, smaller physician partnerships in nascent markets are also question marks for Agilon. These ventures have high growth potential but currently low market share, necessitating substantial investment and operational support to mature into profitable entities. Agilon's 2024 expansion efforts included nurturing such early-stage partnerships, crucial for its long-term market growth strategy.

BCG Matrix Data Sources

Our agilon health BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official regulatory reports to ensure reliable, high-impact insights.