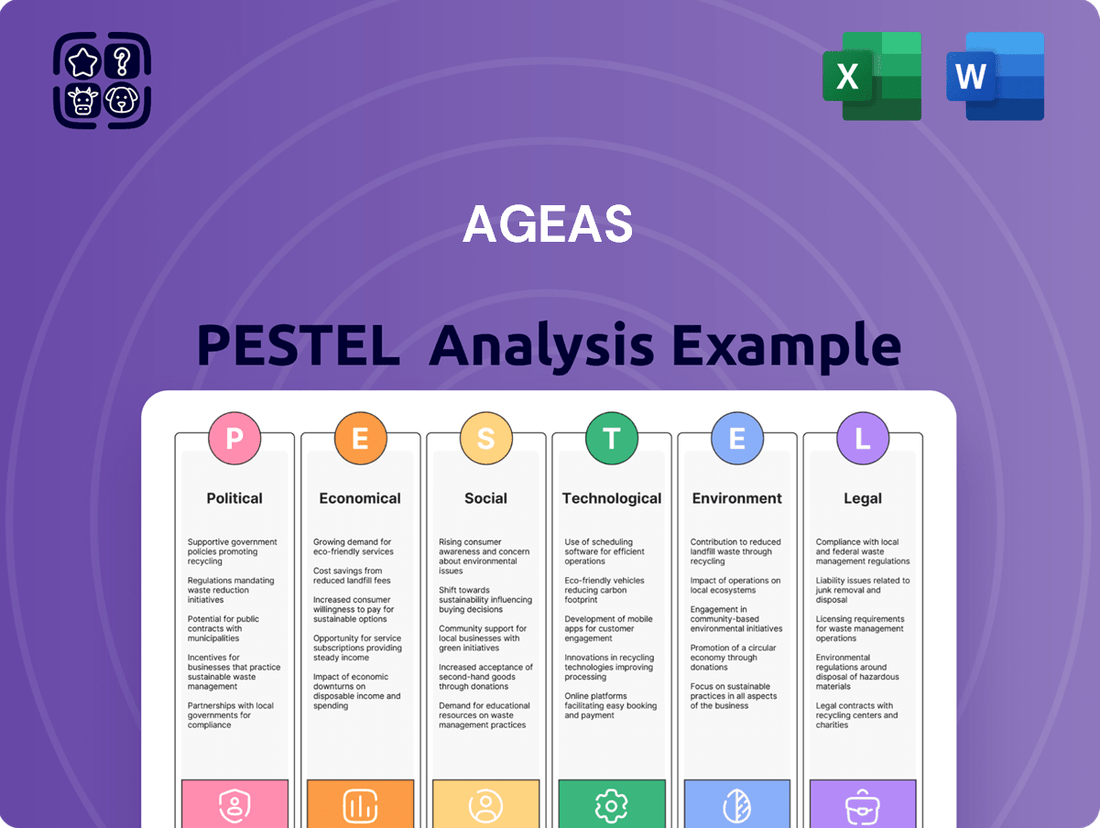

Ageas PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ageas Bundle

Navigate the complex external forces shaping Ageas’s future with our expertly crafted PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the insurer. Gain a competitive edge by leveraging these critical insights to refine your own strategic planning. Download the full PESTLE analysis now and unlock actionable intelligence to drive informed decisions and secure your market position.

Political factors

Government regulations significantly shape Ageas's operations across its international markets. For instance, the implementation of Solvency II in Europe mandates stringent capital requirements, directly influencing Ageas's financial strategy and product development. The company's 2024 report highlights its proactive engagement with upcoming regulations like the Corporate Sustainability Reporting Directive, demonstrating the critical need to adapt to evolving policy landscapes to ensure continued market access and profitability.

Ageas's global footprint, particularly its significant presence in Europe and Asia, makes geopolitical stability a critical factor. Political tensions or trade disputes in these regions can directly affect its operations, investment portfolios, and overall market performance, impacting both its life and non-life insurance businesses.

The company's strategic expansion into China, with the planned acquisition of a stake in Taiping Pension anticipated to finalize in the first half of 2025, underscores its sensitivity to the specific political and economic environments of its key operating countries. This move highlights the importance of navigating diverse national regulatory landscapes and maintaining strong international relations.

Government support, including tax incentives for products like pensions and health insurance, plays a crucial role in Ageas's growth strategy. For instance, in Belgium, tax benefits on life insurance and pension savings products encourage consumer uptake, directly benefiting Ageas's offerings in these segments. These incentives can drive demand and shape product development, aligning with Ageas's focus on capitalizing on the growing pension and savings market, which is further fueled by demographic trends like aging populations.

Political Stability in Operating Countries

Political stability is a cornerstone for Ageas's operations, as it directly shapes the business environment across its wholly owned subsidiaries, joint ventures, and partnerships. Stable political landscapes translate into predictable economic conditions and consistent regulatory frameworks, crucial for the long-term nature of insurance products and investment portfolios. For instance, in 2024, Ageas maintained significant operations in markets like Belgium, the UK, and France, where political stability generally supports predictable business operations, although geopolitical tensions can always introduce uncertainty.

Conversely, political instability, such as frequent government changes or social unrest, poses considerable risks. These events can erode consumer confidence, disrupt economic activity, and lead to sudden shifts in regulations, impacting Ageas's ability to manage its liabilities and investments effectively. The company's presence in diverse geographical markets necessitates constant vigilance regarding the political climate in each region to mitigate potential disruptions.

Ageas's strategic approach involves closely monitoring political developments to anticipate and adapt to potential changes. This includes understanding the implications of upcoming elections, policy shifts, and geopolitical events. For example, as of early 2025, the ongoing geopolitical landscape in Eastern Europe continues to be a factor that requires careful assessment for any business with exposure to that region, even if indirect.

- Belgium: As Ageas's home market, Belgium generally offers a stable political environment, crucial for its extensive insurance and asset management activities.

- United Kingdom: The UK's political landscape, while subject to ongoing adjustments post-Brexit, remains a key market for Ageas, with regulatory stability being a primary focus for the company.

- France: France represents another core market where Ageas operates, and its political stability is vital for maintaining consistent business performance and customer trust.

- Asia (e.g., Hong Kong, Malaysia): Ageas's presence in Asian markets requires monitoring of diverse political systems and their impact on economic growth and regulatory frameworks.

Trade Agreements and Cross-Border Operations

International trade agreements significantly shape Ageas's cross-border operations. For instance, the EU's single market framework facilitates seamless financial services across member states, a crucial advantage for Ageas's European presence. Conversely, shifts towards protectionism, such as increased tariffs or localized data requirements, could elevate compliance costs and complicate expansion strategies in markets like Asia, where regulatory landscapes are diverse.

Ageas's reliance on a robust network of international partnerships and joint ventures highlights the critical nature of smooth cross-border operations. In 2024, Ageas maintained significant operations in over 15 countries, underscoring its exposure to varying trade policies. Favorable trade agreements, like those within the European Economic Area, reduce friction for its insurance and investment products, allowing for more efficient capital allocation and risk management across its diverse portfolio.

- Impact of Trade Agreements: Favorable trade pacts streamline Ageas's market entry and reduce operational hurdles in its key European and Asian markets.

- Protectionist Policies: Conversely, protectionist measures can impede growth, increase compliance burdens, and potentially limit access to certain markets for Ageas.

- Operational Reliance: Ageas's extensive network of partnerships and joint ventures demonstrates a deep dependence on efficient cross-border operational capabilities.

- 2024 Market Presence: Ageas operated in over 15 countries in 2024, making it sensitive to evolving international trade policies and agreements.

Government regulations are a constant factor for Ageas, influencing everything from capital requirements to product development. The company actively monitors and prepares for new rules, such as the Corporate Sustainability Reporting Directive, to ensure it remains compliant and competitive. This adaptability is crucial for maintaining market access and profitability in its diverse global operations.

Political stability is paramount for Ageas, as instability can disrupt operations and erode consumer confidence. The company's strategy involves careful monitoring of political landscapes in its key markets, like Belgium, the UK, and France, to navigate potential risks. Geopolitical tensions, even indirectly, require ongoing assessment for businesses with international exposure.

International trade agreements significantly impact Ageas's ability to operate seamlessly across borders. Favorable agreements, such as those within the EU, reduce friction for its financial services. However, protectionist policies could increase compliance costs and complicate expansion plans, particularly in diverse markets like Asia.

Ageas's strategic growth often relies on government incentives, such as tax benefits for pension and savings products. These incentives can boost consumer demand for Ageas's offerings, aligning with its focus on the growing retirement and savings market. The company's expansion into China, with a planned stake acquisition in Taiping Pension by mid-2025, highlights its sensitivity to the political and economic environments of its key operating countries.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Ageas, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights by detailing how these forces create both threats and opportunities, empowering strategic decision-making.

The Ageas PESTLE analysis provides a concise, easily digestible overview of external factors, relieving the pain of wading through lengthy reports and enabling quicker strategic decision-making.

Economic factors

Ageas's performance is directly influenced by global economic trends. Economic slowdowns can dampen demand for insurance and affect investment portfolios, while periods of growth typically boost sales of both life and non-life products.

In 2024, Ageas saw robust inflows, marking a 10% rise at constant exchange rates. Looking ahead to 2025, the company projects a net operating result of EUR 1.3 billion, provided financial markets remain stable.

Interest rate fluctuations significantly impact Ageas, especially its life insurance and pension lines. Lower rates can squeeze investment income and guaranteed returns, a challenge Ageas navigates. Conversely, rising rates can boost investment yields but may also devalue existing bond holdings.

Ageas's financial results, such as its 2024 net operating result of EUR 1.24 billion, are directly influenced by these evolving market dynamics. The company actively manages its investment portfolio to mitigate the risks and capitalize on the opportunities presented by changing interest rate environments.

Rising inflation rates pose a significant challenge for Ageas, directly increasing the cost of settling claims for non-life insurance products like motor and property. For instance, the UK Consumer Price Index (CPI) saw inflation at 2.3% in April 2024, impacting repair costs and replacement values. This inflationary pressure also erodes the purchasing power of payouts for longer-term life insurance policies, potentially diminishing their real value for beneficiaries.

To counter these effects and maintain profitability, Ageas needs to strategically adjust its premiums. The company's proactive approach is evident in its repricing of motor and household insurance in the UK during 2024. This move was a direct response to observed trends in claims inflation, ensuring that premium income keeps pace with rising operational expenses and claim payouts.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for Ageas, a multinational insurer operating across diverse markets. Fluctuations in exchange rates can directly impact the reported financial performance and capital adequacy of the group when earnings from foreign subsidiaries are translated into its primary reporting currency. For instance, Ageas reported that its 2024 group inflows increased by over 10% when measured at constant exchange rates, underscoring the substantial effect currency movements can have on reported growth figures.

The impact of currency swings extends beyond simple profit translation. It can affect the valuation of assets and liabilities denominated in foreign currencies, potentially leading to unexpected gains or losses that influence Ageas's overall financial health and strategic planning. Effective currency risk management is therefore crucial for maintaining stable financial results and ensuring predictable capital management.

Consider the following implications:

- Translation Risk: Changes in exchange rates alter the value of foreign earnings and assets when converted to Ageas's reporting currency, impacting reported profitability.

- Transaction Risk: Ageas faces risks related to the timing of currency conversions for operational transactions, potentially affecting the cost of goods or services.

- Economic Risk: Long-term shifts in exchange rates can alter the competitive positioning of Ageas in different markets, affecting its overall market share and revenue streams.

- Impact on Capital: Significant currency depreciation in key operating regions can erode the capital base of subsidiaries, potentially affecting solvency ratios and regulatory compliance.

Consumer Spending and Disposable Income

Consumer spending and disposable income are pivotal for Ageas, directly impacting the demand for its insurance products, especially those considered discretionary. When people have more money left after essential expenses, they're more inclined to purchase robust insurance. For instance, in 2024, Ageas reported robust commercial performance, with notable increases in inflows across both its Life and Non-Life segments. This suggests a healthy level of consumer confidence and spending power in the markets where Ageas operates.

The economic climate significantly shapes purchasing decisions. During times of economic growth, individuals and businesses tend to allocate more resources towards comprehensive insurance solutions, viewing them as investments in security. Conversely, during economic downturns, these same consumers may reduce spending on insurance to manage their budgets. Ageas's observed performance in 2024, showing increased inflows, points to a favorable environment where consumers are willing and able to spend on insurance.

- Increased inflows in Life and Non-Life segments in 2024 demonstrate strong consumer engagement.

- Higher disposable income generally correlates with greater demand for discretionary insurance products.

- Economic contractions can lead consumers to reduce spending on non-essential insurance coverage.

- Ageas's financial results in 2024 reflect a positive consumer sentiment towards insurance.

Economic growth fuels Ageas's business, with robust inflows reported in 2024, a trend expected to continue into 2025 with a projected net operating result of EUR 1.3 billion under stable market conditions. However, fluctuating interest rates present a challenge, impacting investment income for life products, though rising rates can boost yields. Inflation, exemplified by the UK's 2.3% CPI in April 2024, increases claims costs, prompting Ageas to adjust premiums, as seen in its 2024 UK motor and household insurance repricing.

Currency volatility also affects Ageas's international operations, with a notable 10% increase in group inflows at constant exchange rates in 2024 highlighting the impact of currency translation on reported results. Consumer spending directly correlates with insurance demand; strong 2024 performance indicates healthy disposable income and confidence in Ageas's offerings.

| Economic Factor | Ageas Impact | 2024/2025 Data/Trend |

|---|---|---|

| Economic Growth | Boosts demand for insurance products, increases inflows. | Robust inflows reported in 2024; projected EUR 1.3bn net operating result for 2025 (stable markets). |

| Interest Rates | Affects investment income (life insurance), bond valuations. | Navigating lower rates; rising rates can boost yields but devalue existing holdings. |

| Inflation | Increases claims costs (non-life), erodes real value of long-term payouts. | UK CPI at 2.3% (April 2024) impacting repair costs; Ageas repriced UK motor/household insurance in 2024. |

| Currency Exchange Rates | Impacts reported financial performance and capital adequacy. | Group inflows up >10% at constant exchange rates in 2024, showing significant currency effect. |

| Consumer Spending/Disposable Income | Drives demand for discretionary insurance products. | Strong commercial performance and increased inflows in 2024 suggest healthy consumer spending. |

Full Version Awaits

Ageas PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed Ageas PESTLE analysis covers political, economic, social, technological, legal, and environmental factors impacting the company. It provides a comprehensive overview for strategic decision-making.

Sociological factors

Europe's aging population, a significant trend for Ageas, means more people will need retirement income and healthcare coverage. This demographic shift, with the median age in the EU projected to rise further by 2025, creates a strong market for Ageas's pension and health insurance offerings.

Declining birth rates in many of Ageas's key markets, such as Belgium and France, could temper long-term growth in traditional life insurance products that rely on new policyholders. However, Ageas's strategy acknowledges this, focusing on products that cater to the evolving needs of an older demographic.

Ageas's Elevate27 strategy, spanning 2025-2027, directly addresses these demographic trends. It highlights a strategic focus on the pension and savings sector, anticipating increased demand as populations age and individuals plan for longer retirements. This proactive approach positions Ageas to benefit from these societal changes.

Shifting lifestyles, including greater urbanization and evolving work arrangements, directly impact the demand for insurance. As people embrace new ways of living and working, they encounter novel risks, from the digital threats of cybercrime to the physical consequences of climate change. This necessitates that Ageas continually refines its product portfolio to address these emerging concerns and align with evolving consumer needs.

Ageas's leadership, including its CEO, has explicitly highlighted the significant threat that climate change poses to the traditional insurance model. This acknowledgment underscores a critical awareness within the company regarding how changing risk perceptions, driven by environmental factors, can fundamentally alter the viability of insurance offerings and require strategic adaptation.

Public comprehension of insurance, encompassing life, non-life, and health policies, directly influences how many people buy insurance and how the market expands. When people understand the advantages, they are more likely to sign up. Ageas's August 2025 research found that only 22% of adults were aware of 'ghost brokers,' indicating a significant gap in consumer knowledge about insurance fraud and the importance of legitimate providers.

To boost uptake, Ageas and the industry can focus on educational campaigns and making insurance products easier to grasp. Simplifying terms and explaining the real-world benefits of coverage, such as financial security during unexpected events, can demystify the process and encourage more individuals to seek protection, ultimately driving market penetration.

Digital Adoption and Customer Expectations

The growing trend of digital adoption is fundamentally changing how insurance customers interact with providers. People now expect to research, buy, and manage their policies entirely online, demanding intuitive digital platforms and swift claim resolutions. This shift is evident globally, with reports indicating that by 2024, over 80% of consumers prefer digital channels for customer service interactions.

Ageas is actively responding to these evolving customer expectations. Their strategic initiatives focus on strengthening their digital distribution channels and enhancing the overall customer journey. By integrating data analytics and artificial intelligence, Ageas aims to deliver more personalized insurance solutions and streamline processes.

- Digital Transformation: Over 80% of consumers preferred digital channels for customer service in 2024.

- Customer Expectations: Demand for seamless online experiences, personalization, and rapid claims processing is high.

- Ageas Strategy: Focus on future-proofing distribution and enriching customer experience through data and AI.

- AI in Insurance: AI adoption in the insurance sector is projected to reach $10 billion by 2025, driving efficiency and personalization.

Social Attitudes Towards Sustainability and ESG

Societal attitudes are increasingly prioritizing sustainability and ethical considerations, directly impacting consumer and investor decisions. This growing awareness means companies like Ageas must align their operations and investments with these values to maintain relevance and attract capital.

Ageas is actively responding to these shifts. Their commitment to achieving net-zero carbon emissions within their investment portfolio by 2050 demonstrates a long-term vision for environmental responsibility. Furthermore, their goal to derive over 35% of Gross Written Premiums from sustainable products by 2024 highlights a strategic focus on meeting market demand for ESG-aligned offerings.

- Growing ESG Focus: 68% of institutional investors surveyed in a 2024 report indicated that ESG factors are now a key consideration in their investment decisions.

- Consumer Preference: A 2024 survey found that 72% of consumers are more likely to purchase from brands that demonstrate a commitment to sustainability.

- Ageas's Sustainable Products Target: Ageas aims for 35%+ of Gross Written Premiums to originate from sustainable products by 2024.

- Net-Zero Ambition: Ageas is committed to reaching net-zero carbon emissions in its investment portfolio by 2050.

The increasing life expectancy across Ageas's core European markets presents a significant opportunity for growth in retirement solutions and health insurance. This demographic trend, with life expectancy at birth in the EU reaching an average of 80.2 years in 2024, directly fuels demand for Ageas's pension and long-term care products.

Conversely, declining birth rates, which saw the EU fertility rate at 1.46 children per woman in 2024, could impact the long-term growth of life insurance products reliant on new policyholders. Ageas's strategic focus on adapting to these demographic shifts by emphasizing products for an aging population is therefore crucial.

Societal shifts towards greater awareness of health and wellness are driving demand for comprehensive health insurance. Ageas's investment in digital health platforms and personalized health offerings aligns with this trend, aiming to capture a larger share of this evolving market.

The evolving nature of family structures and household compositions also influences insurance needs. Ageas's product development must remain agile to cater to diverse family units, including single-parent households and blended families, which are becoming more prevalent.

| Sociological Factor | Trend Description | Impact on Ageas | Supporting Data (2024/2025) |

|---|---|---|---|

| Aging Population | Increasing life expectancy and a growing proportion of older individuals. | Increased demand for pensions, annuities, and health/long-term care insurance. | EU life expectancy at birth: 80.2 years (2024). |

| Declining Birth Rates | Fewer births per woman in key European markets. | Potential dampening of long-term growth for traditional life insurance products. | EU fertility rate: 1.46 children per woman (2024). |

| Health & Wellness Awareness | Growing consumer focus on preventative health and well-being. | Increased demand for health, critical illness, and wellness-focused insurance products. | Projected growth in the global health insurance market to exceed $12 trillion by 2025. |

| Evolving Family Structures | Diversification in household compositions and family units. | Need for flexible and adaptable insurance products catering to varied needs. | Rise in single-person households and non-traditional family units across Europe. |

Technological factors

Digital transformation and automation are central to Ageas's strategy for boosting operational efficiency and customer engagement. By automating core functions like claims processing and underwriting, Ageas aims to streamline workflows and enhance service delivery. This focus is underscored by Ageas Portugal's 2024 IT replatforming initiative, designed to build a more agile and efficient digital infrastructure.

Data analytics and AI are reshaping insurance, allowing for precise risk evaluation, customized pricing, and better fraud detection. Ageas is actively integrating these technologies into its Elevate27 strategy to enhance customer experience and broaden insurance accessibility.

Ageas faces increasing pressure to bolster its cybersecurity defenses as digitalization accelerates. Protecting sensitive customer data is not just a regulatory requirement but a cornerstone of maintaining trust in the insurance sector. A significant data breach could result in hefty fines and severe reputational damage, impacting customer retention and acquisition.

In its Horizon scan, Ageas has explicitly identified cybersecurity as a top trend with high impact. This highlights the company's awareness of the evolving threat landscape and the critical need for robust protective measures. For instance, in 2023, the global average cost of a data breach reached $4.45 million, according to IBM's Cost of a Data Breach Report, underscoring the substantial financial risks involved.

Emerging Technologies (e.g., IoT, Blockchain)

The integration of emerging technologies like the Internet of Things (IoT) presents significant opportunities for Ageas. For instance, IoT-enabled telematics in motor insurance allows for real-time risk assessment and personalized pricing, potentially leading to more accurate underwriting and reduced claims. Ageas's strategic focus on digital platform partnerships and embedded insurance solutions underscores its commitment to leveraging these technological advancements to create innovative products and streamline customer interactions.

Blockchain technology offers Ageas a pathway to enhance transparency and security in its operations. By utilizing blockchain for claims processing or policy management, Ageas can reduce fraud, improve efficiency, and build greater trust with policyholders. This technology can facilitate faster, more secure, and auditable transactions, which is particularly valuable in the insurance sector for managing complex data and inter-company settlements.

Ageas's proactive engagement with technological evolution is evident in its exploration of new digital ventures. In 2024, the company continued to invest in digital transformation initiatives, aiming to improve customer experience and operational agility. These efforts are crucial for staying competitive in a rapidly digitizing insurance market, where technological adoption directly impacts market share and profitability.

The company's approach to technological factors can be summarized as follows:

- IoT for Real-time Risk Monitoring: Enabling dynamic pricing and personalized insurance products, particularly in the motor sector.

- Blockchain for Secure Transactions: Enhancing transparency, reducing fraud, and streamlining claims and policy management.

- Digital Platform Partnerships: Expanding reach and offering embedded insurance solutions through collaborations with technology providers and other industries.

- Investment in Digital Transformation: Ageas's ongoing commitment to upgrading its technological infrastructure and digital capabilities to meet evolving customer expectations and market demands.

Innovation in Product Development and Distribution

Technological advancements are reshaping how Ageas develops and delivers its insurance products. Innovations allow for more personalized and adaptable insurance offerings, moving beyond one-size-fits-all policies. This means customers can get coverage that truly fits their evolving needs.

Ageas is also leveraging technology to explore new ways of reaching customers. Beyond traditional agents, there's a growing trend towards embedded insurance, where coverage is seamlessly integrated into other services consumers already use, like purchasing a new car or booking travel. This makes insurance more accessible and convenient.

The company is actively pursuing innovative propositions by combining its own data insights with the expertise of its partners. This collaborative approach is key to creating new value and developing services that meet future market demands. For instance, Ageas is investing in digital platforms and data analytics to better understand customer behavior and anticipate future needs, aiming to enhance customer experience and operational efficiency.

In 2024, Ageas continued its focus on digital transformation, with a significant portion of its IT investments directed towards enhancing data analytics capabilities and expanding its digital distribution channels. This strategic push is designed to support the development of more sophisticated, data-driven products and to improve customer engagement through digital touchpoints.

Technological factors are driving significant shifts in Ageas's operational model and product development. The company is heavily invested in digital transformation, aiming to automate processes and enhance customer interactions. This includes leveraging data analytics and AI for more precise risk assessment and personalized pricing, as seen in their Elevate27 strategy.

Cybersecurity remains a critical concern, with Ageas recognizing its high impact in its Horizon scan. The escalating cost of data breaches, averaging $4.45 million globally in 2023, underscores the need for robust defenses to protect sensitive customer data and maintain trust.

Emerging technologies like IoT and blockchain offer Ageas opportunities for innovation. IoT enables real-time risk monitoring and personalized motor insurance, while blockchain can improve transparency and security in claims processing. Ageas's strategic partnerships and investment in digital platforms are key to capitalizing on these advancements.

| Technology Area | Ageas's Strategic Focus | Impact/Opportunity | 2023/2024 Data Point |

|---|---|---|---|

| Digital Transformation & Automation | Streamlining operations, enhancing customer engagement | Improved efficiency, agile infrastructure | Ageas Portugal's 2024 IT replatforming |

| Data Analytics & AI | Precise risk evaluation, customized pricing | Enhanced customer experience, broader accessibility | Integration into Elevate27 strategy |

| Cybersecurity | Protecting sensitive customer data | Maintaining trust, mitigating financial/reputational risk | Global average data breach cost: $4.45 million (2023) |

| IoT & Embedded Insurance | Real-time risk assessment, personalized products | Innovative offerings, increased customer convenience | Focus on digital platform partnerships |

| Blockchain | Enhancing transparency, reducing fraud | Secure transactions, improved efficiency in claims/policy management | Exploration for secure and auditable transactions |

Legal factors

Ageas navigates a complex web of insurance regulatory frameworks, with Solvency II in Europe being a cornerstone. This directive imposes rigorous requirements on capital adequacy, risk management practices, and corporate governance, directly shaping the company's financial health and operational blueprint.

Adherence to these stringent rules is non-negotiable and significantly influences Ageas's strategic decisions and financial resilience. The company’s commitment to robust compliance is evident in its Solvency II ratio, which stood at a strong 218% in 2024, comfortably exceeding its neutral threshold and underscoring its solid financial footing.

Consumer protection laws are fundamental to Ageas's operations, dictating the fair sale, marketing, and servicing of insurance products. These regulations ensure customers receive transparent information and are treated equitably, with non-compliance risking penalties and eroding customer confidence.

Ageas's UK operations demonstrated resilience and growth in 2024 within a tightly regulated environment, suggesting effective management of these consumer protection mandates. For instance, the Financial Conduct Authority (FCA) in the UK continues to emphasize robust consumer protection, particularly around product governance and fair value assessments, impacting how insurers like Ageas structure their offerings.

Strict data protection and privacy regulations, like the General Data Protection Regulation (GDPR) in Europe, place significant responsibilities on Ageas concerning how it handles personal information. Failure to comply can lead to hefty fines and harm the company's reputation. This is a crucial area for Ageas to manage effectively.

Ageas's 2024 annual reporting, for instance, was prepared following the Corporate Sustainability Reporting Directive and European Sustainability Reporting Standards. These frameworks inherently include stringent requirements for data handling and reporting, underscoring the importance of robust data protection practices for the company.

Anti-Money Laundering (AML) and Sanctions Laws

Ageas, operating as a global financial services provider, is subject to stringent anti-money laundering (AML) and sanctions laws. These regulations are critical for preventing the use of financial systems for illicit purposes, such as funding terrorism or criminal enterprises. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, influencing national legislation worldwide, which Ageas must integrate into its compliance framework.

Adherence to these legal mandates necessitates sophisticated internal controls, including thorough customer due diligence, transaction monitoring, and suspicious activity reporting. This can introduce significant operational complexity and cost, as demonstrated by the increasing investments financial institutions are making in RegTech solutions to manage compliance efficiently. In 2024, global spending on AML compliance solutions was projected to exceed $10 billion, highlighting the scale of these efforts.

- Regulatory Landscape: Ageas must navigate evolving AML and sanctions regimes globally, including those from the EU, US Treasury's OFAC, and UN Security Council resolutions.

- Compliance Costs: The implementation and maintenance of robust AML/KYC (Know Your Customer) programs represent a substantial operational expense for financial institutions like Ageas.

- Reputational Risk: Failure to comply can lead to severe penalties, including hefty fines and reputational damage, impacting customer trust and market standing.

- Governance Commitment: Ageas's stated commitment to transparency and strong corporate governance principles underpins its efforts to maintain compliance with these critical legal obligations.

Competition Law and Antitrust Regulations

Competition law and antitrust regulations are crucial for Ageas, shaping how it operates in the insurance market. These rules ensure fair play, impacting everything from pricing to how Ageas can grow through mergers and acquisitions. Staying compliant is key to avoiding hefty fines and legal battles.

In 2024, Ageas actively considered market consolidation, a move directly influenced by these competitive frameworks. For instance, the European Commission's scrutiny of mergers in the financial sector, including insurance, means Ageas must carefully navigate these regulations to pursue growth opportunities. Failure to adhere can lead to significant penalties, as seen in other industries where antitrust violations have resulted in substantial financial repercussions.

- Market Conduct: Ageas's pricing, product offerings, and distribution channels are subject to scrutiny under competition law to prevent monopolistic practices.

- Mergers & Acquisitions: Any consolidation efforts by Ageas require approval from regulatory bodies to ensure they do not harm competition, a process that intensified in the European insurance market during 2024.

- Antitrust Compliance: Ageas invests in robust compliance programs to avoid anti-competitive behavior, which could result in fines potentially reaching billions of euros, as observed in past cases involving major European corporations.

Ageas operates under a strict legal framework, with Solvency II in Europe dictating capital adequacy and risk management, a key factor in its 2024 solvency ratio of 218%. Consumer protection laws, enforced by bodies like the UK's FCA, ensure fair dealings, influencing Ageas's product strategies. Data privacy regulations, such as GDPR, mandate careful handling of personal information, a critical aspect reflected in Ageas's 2024 sustainability reporting. Furthermore, Ageas must adhere to global anti-money laundering (AML) and sanctions laws, with compliance costs for institutions projected to exceed $10 billion in 2024, necessitating robust internal controls.

Competition law impacts Ageas's market activities, including its 2024 merger considerations, requiring regulatory approval to prevent anti-competitive practices. Ageas's commitment to strong governance underpins its efforts to navigate these complex legal requirements across its global operations.

Environmental factors

Climate change presents a substantial environmental challenge for Ageas, particularly affecting its non-life insurance operations. The increasing frequency and intensity of extreme weather events, such as floods, storms, and wildfires, directly translate into higher claims costs for the company. This necessitates ongoing adjustments to underwriting practices and pricing strategies to remain viable.

Ageas's leadership has publicly acknowledged the gravity of this situation, with its CEO issuing warnings that climate change poses a significant risk to the fundamental viability of the insurance business model itself. For instance, in 2023, the insurance industry globally faced substantial losses from natural catastrophes, with insured losses estimated to be around $95 billion, according to Swiss Re.

Ageas is navigating a landscape of increasingly stringent environmental regulations and ambitious global sustainability targets, such as achieving net-zero emissions by 2050. These factors directly shape the company's investment strategies and day-to-day operations.

The company has publicly committed to decarbonizing its investment portfolio by 2050, a significant undertaking that requires careful asset allocation and risk management. Furthermore, Ageas has pledged substantial investments in climate-related initiatives, underscoring its dedication to supporting the transition to a greener economy.

While Ageas is an insurance provider, resource scarcity still presents indirect impacts. For instance, rising costs of construction materials, driven by scarcity, can directly inflate the payouts for property damage claims. This was evident in early 2024 as supply chain disruptions continued to affect material availability.

Ageas's commitment to sustainability includes initiatives addressing resource use. Their 2023 sustainability report highlighted ongoing efforts in circular economy principles, such as exploring the reprocessing of post-consumer waste, aiming to mitigate some of these indirect resource-related pressures.

Biodiversity Loss and Ecosystem Degradation

Biodiversity loss and ecosystem degradation are becoming significant concerns, posing new risks for businesses that Ageas insures. These issues can manifest as novel claim types or impact the valuation of Ageas's investment portfolio. For instance, a decline in pollinator populations could directly affect agricultural businesses, leading to crop failure claims.

Ageas is actively engaged in understanding these environmental shifts. The company is investing in comprehensive biodiversity impact and risk assessments. This proactive approach aims to clarify how ecosystem degradation might affect the businesses it insures, allowing for better risk management and product development.

The economic implications are substantial. The World Economic Forum's 2024 Global Risks Report highlighted biodiversity loss as a top long-term threat. Businesses heavily reliant on natural resources, such as agriculture, forestry, and fisheries, face direct operational and financial vulnerabilities.

- Economic Impact: Ecosystem degradation could lead to supply chain disruptions and increased operational costs for insured businesses.

- Investment Risk: Ageas's investment portfolio may be exposed to companies whose value is diminished by environmental degradation.

- New Claims: Emerging environmental issues could result in unforeseen types of insurance claims related to ecological damage.

- Assessment Focus: Ageas's investment in risk assessments demonstrates a commitment to understanding and mitigating these evolving threats.

Reputational Risk from Environmental Performance

Ageas faces significant reputational risks stemming from public and investor scrutiny of its environmental performance. A perception of inadequate action on environmental issues can damage its brand and alienate stakeholders.

Conversely, a robust commitment to environmental sustainability is a powerful tool for enhancing Ageas's brand image. This commitment can attract a growing segment of environmentally conscious customers and investors, bolstering its market position.

Ageas's dedication to environmental, social, and governance (ESG) principles has been formally recognized. For instance, its inclusion in the BEL®ESG index highlights its strong performance in these critical areas.

- Reputational Impact: Negative environmental performance can lead to public backlash and investor divestment.

- Brand Enhancement: Proactive environmental strategies improve brand perception and customer loyalty.

- Investor Attraction: Strong ESG credentials, like inclusion in the BEL®ESG index, attract sustainability-focused investors.

Climate change is a primary environmental concern for Ageas, directly impacting its non-life insurance segment through increased claims from extreme weather events, as evidenced by global insured losses from natural catastrophes reaching approximately $95 billion in 2023. Ageas is also responding to stringent environmental regulations and global net-zero targets by decarbonizing its investment portfolio by 2050 and investing in climate initiatives.

Resource scarcity indirectly affects Ageas, inflating property damage claim payouts due to rising construction material costs, a trend observed in early 2024 due to supply chain issues. Biodiversity loss poses new risks, potentially leading to novel claim types and impacting investment portfolios, with the World Economic Forum identifying it as a top long-term threat in its 2024 Global Risks Report.

Ageas faces reputational risks from environmental scrutiny but can enhance its brand by demonstrating strong sustainability commitments, as recognized by its inclusion in the BEL®ESG index.

| Environmental Factor | Impact on Ageas | Data/Example (2023-2024) |

|---|---|---|

| Extreme Weather Events | Increased claims costs for non-life insurance | Global insured losses from natural catastrophes: ~$95 billion (2023) |

| Climate Regulations & Targets | Need to adjust investment strategies and operations for net-zero goals | Commitment to decarbonize investment portfolio by 2050 |

| Resource Scarcity | Higher payouts for property damage claims due to material costs | Supply chain disruptions impacting material availability (early 2024) |

| Biodiversity Loss | Potential for new claim types and investment portfolio devaluation | Identified as a top long-term threat by World Economic Forum (2024) |

| Reputational Risk/Brand Enhancement | Public perception of environmental performance affects brand and investor attraction | Inclusion in BEL®ESG index signals strong ESG credentials |

PESTLE Analysis Data Sources

Our Ageas PESTLE analysis is meticulously constructed using data from reputable financial institutions like the IMF and World Bank, alongside official government publications and leading industry research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting Ageas.