Ageas Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ageas Bundle

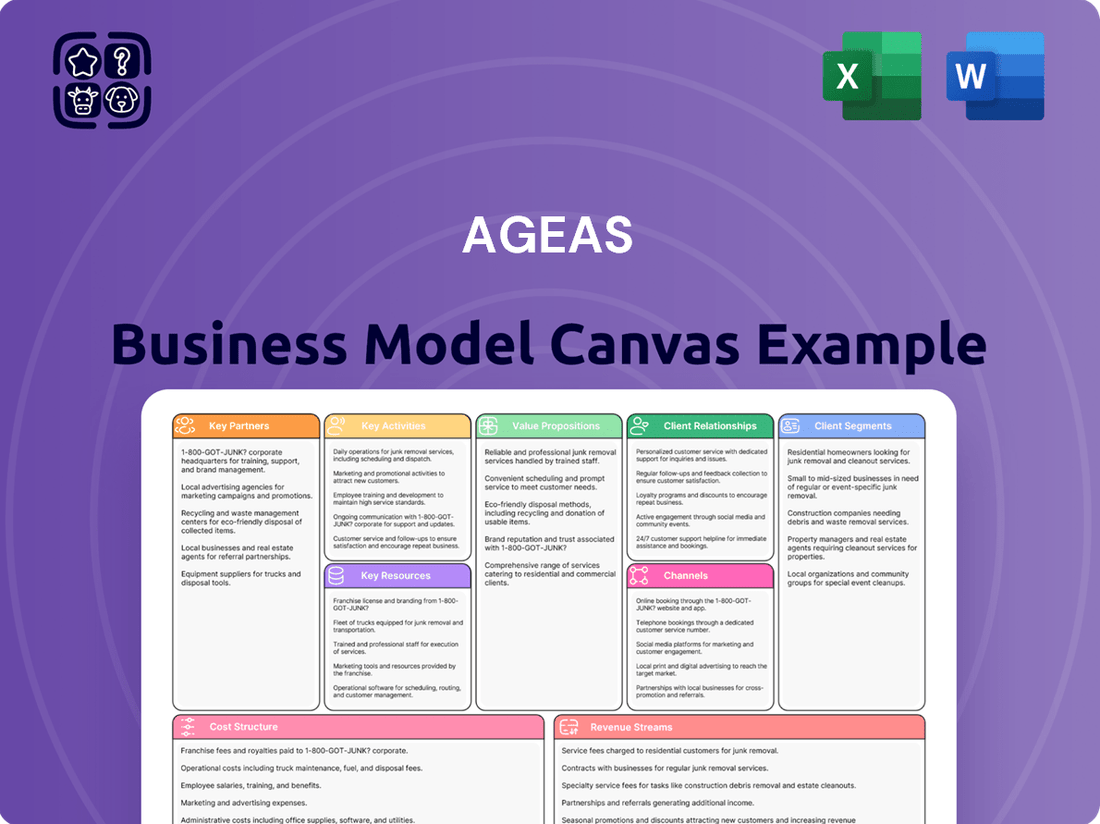

Unlock the core components of Ageas's success with their Business Model Canvas. Discover how they connect with customers, deliver value, and generate revenue in the insurance sector. This canvas offers a concise yet powerful overview of their strategic framework.

Ready to dissect Ageas's winning strategy? Our full Business Model Canvas provides a comprehensive, section-by-section breakdown of their operations, from key resources to cost structure. Download it now to gain a competitive edge.

Partnerships

Ageas cultivates robust, enduring partnerships with prominent banks throughout Europe and Asia. For instance, their collaborations with Millennium BCP in Portugal, Akbank in Turkey, and KBank in Thailand are foundational to their strategy.

These strategic bancassurance alliances are instrumental in distributing a comprehensive suite of life and non-life insurance products. By tapping into the banks' vast customer networks and sophisticated digital infrastructures, Ageas effectively expands its market reach.

This integrated approach allows Ageas to seamlessly embed insurance solutions directly into everyday banking services. Consequently, they can engage customers through financial institutions they already trust, enhancing accessibility and convenience.

Ageas leverages a robust network of affinity partners and brokers to broaden its market presence and serve diverse customer needs. A prime illustration is its 20-year exclusive agreement with Saga in the UK, specifically targeting motor and home insurance for individuals over 50. This strategic alliance underscores Ageas's commitment to specialized market segments.

Further solidifying its distribution channels, Ageas actively nurtures relationships with its broker partners. The recent renewal of its partnership with Brown & Brown, for instance, is designed to bolster the distribution of personal lines insurance products, ensuring wider accessibility and customer service.

Ageas is actively partnering with emerging digital platforms, viewing them as crucial new avenues for sales, moving beyond established bancassurance ties. This strategy involves collaborations with prominent price comparison sites, such as Quotezone.co.uk, and investigating opportunities for embedded insurance solutions directly within other digital services.

These digital collaborations are designed to harness technological advancements for wider product distribution, effectively reaching a growing segment of digitally inclined consumers. For instance, in 2024, the UK insurance market saw continued growth in comparison site usage, with platforms like Quotezone playing a significant role in customer acquisition for insurers like Ageas.

Technology and Innovation Partners

Ageas collaborates with technology and innovation partners, focusing on data and Artificial Intelligence to boost its capabilities. These alliances are crucial for developing cutting-edge tools, like AI-driven coaching for their insurance advisors, which aims to improve client interactions and efficiency. In 2023, Ageas reported a significant increase in its digital transformation investments, with a substantial portion allocated to AI and data analytics initiatives, underscoring their commitment to innovation.

The company leverages these partnerships to implement real-time pricing technologies, allowing for more dynamic and customer-centric insurance product offerings. This strategic integration of AI is designed to make insurance more accessible and tailored to individual needs. For instance, Ageas’s recent pilot programs utilizing AI for risk assessment have shown promising results in reducing processing times by up to 20%.

- AI-Powered Advisor Coaching: Enhancing customer service and sales effectiveness through intelligent guidance for insurance professionals.

- Real-Time Pricing Technologies: Offering dynamic and competitive pricing based on up-to-the-minute data.

- Data Analytics for Personalization: Utilizing insights to create more relevant and accessible insurance solutions.

- Controlled AI Integration: Ensuring responsible and effective deployment of AI to benefit both customers and the business.

Reinsurance Counterparties

Ageas strategically partners with external reinsurers, alongside its internal Ageas Re arm, to manage and diversify its risk portfolio. These relationships are crucial for accessing third-party capital and enhancing the group’s financial resilience. For instance, in 2023, Ageas Re actively participated in various reinsurance treaties, demonstrating a commitment to leveraging external capacity to support its underwriting activities.

These key partnerships with reinsurance counterparties are vital for Ageas's ability to underwrite larger risks and maintain a stable solvency position. By engaging with a diverse set of reinsurers, Ageas can optimize its capital allocation and ensure it has the necessary financial backing to meet its obligations, even in challenging market conditions.

- Diversification of Risk: Ageas Re and external reinsurers allow for the spreading of risk across multiple entities, reducing the impact of large claims on any single party.

- Access to Capital: Partnerships provide access to additional capital beyond Ageas's own balance sheet, enabling greater underwriting capacity.

- Financial Stability: A robust reinsurance strategy, including external relationships, underpins Ageas's overall financial strength and ability to absorb unexpected losses.

Ageas's key partnerships are a cornerstone of its distribution and innovation strategy, encompassing bancassurance, affinity groups, brokers, and digital platforms. These alliances are critical for expanding market reach and accessing diverse customer segments.

The company actively collaborates with technology providers, particularly in AI and data analytics, to enhance its operational efficiency and product development. For example, Ageas’s 2023 investments in digital transformation significantly boosted its AI capabilities, aiming to personalize customer experiences and streamline processes.

Strategic reinsurance partnerships, including those with its internal Ageas Re division, are vital for managing risk and ensuring financial stability. These relationships provide access to third-party capital, bolstering Ageas's underwriting capacity and overall resilience.

| Partnership Type | Key Examples/Focus | Strategic Importance | 2024 Relevance |

|---|---|---|---|

| Bancassurance | Millennium BCP, Akbank, KBank | Distribution via bank networks | Continued expansion in core European and Asian markets. |

| Affinity & Brokerage | Saga (UK), Brown & Brown | Targeted market segments, product distribution | Strengthening relationships for specialized insurance offerings. |

| Digital Platforms | Quotezone.co.uk | Online sales channels, embedded insurance | Harnessing digital growth for customer acquisition. |

| Technology & AI | Data analytics, AI coaching | Operational efficiency, innovation | Investing in AI for improved risk assessment and customer service. |

| Reinsurance | Ageas Re, external reinsurers | Risk diversification, capital access | Maintaining financial resilience and underwriting capacity. |

What is included in the product

A detailed breakdown of Ageas's insurance operations, mapping its customer segments, value propositions, and distribution channels.

This canvas outlines Ageas's key resources, activities, and partnerships, highlighting revenue streams and cost structure.

The Ageas Business Model Canvas offers a structured approach to visualize and refine insurance strategies, alleviating the pain of complex planning and communication.

It provides a clear, one-page overview of Ageas's operations, simplifying the identification of key value propositions and customer segments to address market challenges.

Activities

Ageas's central operations revolve around underwriting a broad spectrum of insurance products, spanning life, non-life, and health categories. This includes specialized offerings for pensions, motor vehicles, and property, effectively covering a wide array of risks.

A significant aspect of their business model is the ongoing development of innovative and customized insurance products. This proactive approach ensures they remain responsive to changing customer preferences and dynamic market conditions, a strategy that has seen them launch new digital offerings in 2024 to enhance customer experience.

Furthermore, Ageas is committed to developing sustainable insurance solutions. This commitment is evident in their focus on products that not only provide financial security but also address pressing societal challenges, aligning with broader ESG (Environmental, Social, and Governance) principles that are increasingly important for investors and consumers alike.

Ageas's key activities revolve around efficient claims management and robust customer servicing. This involves the entire lifecycle of a claim, from its initial report to the final resolution, ensuring fairness and speed to maintain customer trust.

In 2024, Ageas continued to focus on optimizing its claims handling processes. For instance, in its Belgian operations, the company aimed to further reduce average claim settlement times, a critical factor in customer satisfaction.

Beyond claims, Ageas provides comprehensive customer servicing. This support extends throughout the policyholder's engagement with the company, offering assistance and guidance at various touchpoints.

Ageas actively manages its substantial investment portfolio, deploying premiums and its own capital to achieve financial returns and bolster long-term stability. This strategic asset management is a cornerstone of its business, directly impacting profitability and its capacity to meet future obligations.

The company is deeply committed to responsible investment practices. A key objective is achieving net-zero greenhouse gas emissions across its investment portfolio by 2050, demonstrating a forward-looking approach to environmental, social, and governance (ESG) principles. This includes significant investments in sustainable initiatives, aligning financial growth with societal well-being.

Distribution Channel Management

Ageas actively cultivates a multifaceted distribution network, encompassing bancassurance partnerships, a dedicated agent force, independent brokers, and a growing emphasis on digital channels. This strategic approach aims to optimize sales efficiency and broaden market penetration across its European and Asian operations.

The group's distribution channel management is crucial for its market presence. In 2024, Ageas continued to invest in digitalizing its sales processes, aiming for a more seamless customer experience. This digital push is supported by ongoing efforts to strengthen relationships with traditional partners.

Significant strides were made in diversifying Ageas's distribution channels throughout 2024. This diversification is key to mitigating risks and capturing a wider customer base. The company reported a notable increase in sales originating from non-traditional channels, reflecting the success of its strategic investments in digital and partnership development.

- Bancassurance: Ageas leverages its strong ties with banking partners to offer insurance products, a significant contributor to its sales volume.

- Agents and Brokers: A robust network of tied agents and independent brokers remains a cornerstone of Ageas's distribution strategy, providing personalized customer service.

- Digital Platforms: The group is increasingly focusing on developing and enhancing its digital channels, including direct-to-consumer online sales and mobile applications, to meet evolving customer preferences.

- Market Reach: This multi-channel approach allows Ageas to effectively reach diverse customer segments across its key markets in Europe and Asia.

Strategic Planning and Digital Transformation

Ageas's strategic planning is a cornerstone, highlighted by its Elevate27 strategy, which sets ambitious goals for profitable growth and leadership in technical insurance through 2027. This forward-looking approach ensures the company remains agile in a dynamic market.

Digital transformation is central to Elevate27, with a significant emphasis on integrating Data & AI across operations. This initiative aims to streamline processes, personalize customer interactions, and foster innovation throughout the entire insurance value chain, driving efficiency and competitive advantage.

- Strategic Focus: Elevate27 strategy (2025-2027) prioritizes profitable growth and technical insurance leadership.

- Digital Integration: Leveraging Data & AI to enhance efficiency and customer experience.

- Operational Excellence: Driving improvements across the value chain through digital capabilities.

Ageas's key activities include underwriting a diverse range of insurance products, from life and health to non-life, with a focus on developing innovative and sustainable solutions. They also manage a significant investment portfolio, aiming for financial returns while adhering to responsible investment practices, including a commitment to net-zero emissions by 2050.

Furthermore, efficient claims management and comprehensive customer servicing are vital, ensuring customer trust and satisfaction, as seen in their 2024 efforts to reduce claim settlement times. The company also cultivates a broad distribution network, increasingly leveraging digital channels alongside traditional ones like bancassurance and brokers to expand market reach.

Strategic planning, particularly the Elevate27 strategy, guides their pursuit of profitable growth and leadership in technical insurance, with digital transformation and the integration of Data & AI being central to achieving operational excellence and enhancing customer experience.

| Key Activity | Description | 2024 Focus/Data |

| Insurance Underwriting | Developing and offering a wide range of insurance products. | Launch of new digital offerings to enhance customer experience. |

| Claims Management | Efficiently handling insurance claims from reporting to resolution. | Reducing average claim settlement times in Belgian operations. |

| Investment Management | Managing investment portfolios for financial returns and stability. | Commitment to net-zero emissions across investment portfolio by 2050. |

| Distribution | Utilizing bancassurance, agents, brokers, and digital channels. | Increased sales from non-traditional channels; continued investment in digital sales processes. |

| Strategic Planning | Executing the Elevate27 strategy for growth and digital transformation. | Emphasis on integrating Data & AI across operations. |

Full Version Awaits

Business Model Canvas

The Ageas Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered to you, ensuring complete transparency. Once your order is processed, you will gain full access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Ageas leverages its strong financial capital as a cornerstone of its business model. In 2024, the company reported total gross inflows of EUR 18.5 billion, showcasing significant operational scale and market penetration. This substantial inflow of funds directly contributes to its robust financial position.

The insurer's financial strength is further underscored by its impressive Solvency II ratio, which stood at 218% in 2024. This high ratio indicates a substantial buffer of capital above regulatory requirements, providing considerable financial stability and a strong capacity for undertaking new business and managing risks.

Furthermore, Ageas maintains substantial liquid assets, which are crucial for meeting short-term obligations and capitalizing on investment opportunities. This financial flexibility, combined with consistently strong financial results, empowers Ageas to pursue strategic growth initiatives and maintain operational resilience.

Ageas leverages its skilled human capital, comprising approximately 50,000 employees spread across 13 countries, to deliver its core insurance services. This extensive and engaged workforce is fundamental to the company's operations and its ability to innovate within the insurance sector.

The company's commitment to its people is evident through its recognition as a 'Top Employer' in multiple regions. This designation highlights Ageas's significant investments in talent development, fostering a supportive work environment, and nurturing employee growth, all of which contribute to a highly capable team.

This robust and skilled workforce is absolutely essential for Ageas to provide comprehensive insurance solutions and to drive forward its innovation agenda. Their expertise ensures the quality of service and the development of new offerings that meet evolving customer needs.

Ageas leverages its 200-year heritage to maintain a robust and trusted brand reputation as a leading multinational insurance group. This established presence, recognized across its operating markets, cultivates significant customer loyalty and simplifies the formation of strategic partnerships, a critical advantage in the competitive insurance landscape.

Advanced Technology and Data Capabilities

Ageas's advanced technology and data capabilities are fundamental to its operations, with significant investments in data analytics and Artificial Intelligence. These technologies are crucial for understanding customer behavior, optimizing product development, and enhancing operational efficiency across all business segments. The company utilizes AI for tasks ranging from personalized customer interactions to sophisticated fraud detection, aiming to provide tailored insurance solutions and streamline claims processing.

In 2024, Ageas continued to expand its digital footprint, with a focus on data-driven insights to inform strategic decisions and improve customer experience. The company employs real-time pricing models that leverage vast datasets to offer competitive and accurate premiums. These technological assets are not just tools but core enablers of Ageas's competitive advantage in the insurance market.

- Data Analytics: Ageas utilizes advanced data analytics to gain deep insights into customer needs and market trends, informing product innovation and marketing strategies.

- Artificial Intelligence: AI is integrated across the business for enhanced customer service, automated underwriting, and improved fraud detection, leading to greater efficiency and accuracy.

- Real-time Pricing: Sophisticated pricing models powered by real-time data allow Ageas to offer dynamic and competitive product pricing, adapting quickly to market changes.

- Digital Transformation: Continuous investment in digital capabilities supports the development of personalized offerings and seamless customer journeys, reinforcing Ageas's position as a technology-forward insurer.

Extensive Distribution Network and Partnerships

Ageas leverages an extensive distribution network, a cornerstone of its business model. This includes a robust array of wholly-owned subsidiaries, strategic joint ventures, and enduring partnerships with prominent financial institutions.

These collaborations extend to key distributors such as banks, agents, brokers, and increasingly, digital platforms. This diversified approach ensures Ageas can effectively tap into various customer segments across its core European and Asian markets.

For instance, in 2024, Ageas continued to emphasize its digital distribution channels, reporting a significant increase in online policy sales, contributing to its overall market penetration. The company's commitment to these partnerships allows for broader customer reach and tailored product offerings.

- Wholly-owned subsidiaries: Providing direct control over distribution and customer service.

- Joint ventures and partnerships: Expanding market access and product reach through collaboration with financial institutions and distributors.

- Key distribution channels: Including banks, agents, brokers, and digital platforms to serve diverse customer needs.

- Market penetration: The network facilitates reaching a wide spectrum of customer segments across Europe and Asia.

Ageas's key resources are multifaceted, encompassing strong financial capital, a dedicated workforce, a trusted brand built over two centuries, advanced technological capabilities, and an extensive distribution network.

The company's financial strength is evident in its 2024 Solvency II ratio of 218% and EUR 18.5 billion in gross inflows, providing stability and capacity for growth. Its approximately 50,000 employees are crucial for service delivery and innovation, recognized by Top Employer accolades in multiple regions.

Technologically, Ageas invests heavily in data analytics and AI for customer insights and operational efficiency, exemplified by its real-time pricing models. This integrated approach ensures a competitive edge and personalized customer experiences across its global operations.

| Key Resource | Description | 2024 Data/Impact |

| Financial Capital | Strong capital base for operations and risk management | EUR 18.5 billion gross inflows; 218% Solvency II ratio |

| Human Capital | Skilled and engaged global workforce | Approx. 50,000 employees; recognized Top Employer |

| Brand Reputation | 200-year heritage fostering trust and loyalty | Established presence across 13 countries |

| Technology & Data | Advanced analytics, AI, and digital platforms | Focus on data-driven insights and real-time pricing |

| Distribution Network | Wholly-owned subsidiaries, JVs, and partnerships | Banks, agents, brokers, and digital platforms |

Value Propositions

Ageas provides a broad range of insurance solutions, encompassing life, non-life sectors like motor and property, and pension plans, thereby offering extensive protection for both individuals and businesses. This commitment to comprehensive risk coverage is central to their value proposition, aiming to shield clients from unforeseen financial hardships and ensure their long-term stability.

In 2023, Ageas reported a strong performance, with its underlying profit reaching €1.4 billion, demonstrating its capacity to effectively manage and underwrite diverse risks across its portfolio. This financial strength underpins the security Ageas offers, allowing customers to navigate life's uncertainties with greater confidence.

Ageas excels at crafting insurance products precisely matched to the distinct and changing needs of both individual and business clients. This dedication to customization is evident in specialized policies designed for specific demographics, such as the over 50s market, and for small to medium-sized enterprises (SMEs).

The company’s approach prioritizes delivering immediate value while also looking ahead to anticipate and address future customer requirements. For instance, in 2024, Ageas continued to refine its digital platforms, enabling faster policy adjustments and personalized coverage recommendations, a key factor in retaining customers in a competitive market.

Ageas leverages its 200-year heritage and profound technical insurance knowledge to establish itself as a trusted and insightful partner. This extensive experience translates into high-quality, dependable services.

The company's commitment to long-term relationships with both customers and distributors is a cornerstone of its value proposition. This focus on enduring connections fosters stability and mutual growth.

In 2023, Ageas reported a net profit of €1.1 billion, underscoring its financial strength and the effectiveness of its long-term strategic approach. This consistent performance reinforces its image as a reliable partner.

Innovation and Digital Accessibility

Ageas prioritizes innovation, actively using data and artificial intelligence to create sophisticated insurance solutions and improve customer interactions. This commitment extends to digital accessibility, aiming to make insurance simpler and more inclusive through user-friendly online portals and mobile apps.

The company is dedicated to exploring emerging technologies to consistently deliver enhanced value to its customer base. In 2024, Ageas continued to invest in its digital transformation, with a significant portion of its operational budget allocated to technology development and data analytics initiatives.

- Digital First Approach: Ageas is enhancing its digital platforms to offer seamless online policy management and claims processing, aiming for a 20% increase in digital customer interactions by the end of 2024.

- AI-Powered Solutions: The insurer is integrating AI for personalized product recommendations and risk assessment, projecting a 15% improvement in underwriting efficiency through these tools in 2024.

- Customer Experience Enhancement: Investments in mobile applications and online self-service tools are designed to boost customer satisfaction scores by 10% in the coming year.

- Data-Driven Product Development: Ageas leverages customer data analytics to identify unmet needs and develop innovative insurance products, with several new offerings launched in early 2024 based on these insights.

Commitment to Sustainability and Societal Impact

Ageas demonstrates a deep commitment to sustainability and societal impact, extending its value proposition beyond traditional insurance. This commitment is woven into its core business strategy, focusing on Environmental, Social, and Governance (ESG) principles to create long-term value for all stakeholders.

The company actively develops sustainable products and services designed to address pressing societal needs. For instance, Ageas is a significant player in the European insurance market, and its 2024 initiatives reflect a growing emphasis on climate-resilient solutions and products that support social well-being.

Ageas's responsible investment strategy is a key component of its sustainability efforts. By integrating ESG criteria into its investment decisions, the company aims to generate financial returns while simultaneously contributing to a more sustainable and inclusive global economy. This approach saw Ageas managing a substantial portfolio of assets with a growing proportion allocated to sustainable investments in 2024, aligning with global climate goals.

- Sustainable Product Development: Ageas is innovating in areas like green insurance policies and products that support the transition to a low-carbon economy.

- Responsible Investment: The company prioritizes investments in companies and projects that demonstrate strong ESG performance, contributing to positive societal and environmental outcomes.

- Addressing Societal Challenges: Ageas focuses on solutions for key societal trends, including the challenges of an aging population and the impacts of climate change, through its insurance and financial services.

- Contribution to a Better World: Ultimately, Ageas aims to be a force for good, fostering a more sustainable and inclusive future through its business operations and corporate citizenship.

Ageas offers comprehensive insurance, covering life, non-life, and pensions, providing robust financial protection for individuals and businesses. This broad spectrum of coverage aims to shield clients from unexpected financial shocks and ensure their ongoing stability.

The company tailors insurance products to meet the specific, evolving needs of both individuals and businesses, evident in specialized offerings for segments like seniors and SMEs. This focus on personalized solutions ensures relevance and customer satisfaction.

Ageas builds enduring relationships with customers and distributors, fostering mutual growth and stability through its commitment to long-term partnerships. This client-centric approach reinforces trust and loyalty.

Ageas actively integrates innovation, utilizing data and AI to enhance insurance solutions and customer interactions, promoting digital accessibility through user-friendly platforms. In 2024, significant investments in digital transformation and data analytics underscored this commitment.

| Value Proposition Aspect | Description | Supporting Data/Initiative (2023/2024) |

|---|---|---|

| Comprehensive Protection | Broad range of life, non-life, and pension insurance products. | Underlying profit of €1.4 billion in 2023, demonstrating strong risk management. |

| Tailored Solutions | Customized products for diverse client needs (e.g., seniors, SMEs). | Continued refinement of digital platforms for personalized coverage in 2024. |

| Long-Term Relationships | Focus on building lasting connections with customers and distributors. | Net profit of €1.1 billion in 2023 highlights strategic stability. |

| Digital Innovation | Leveraging AI and data for enhanced solutions and customer experience. | Aiming for 20% increase in digital customer interactions by end of 2024. |

Customer Relationships

Ageas is committed to enhancing customer relationships through a blend of personalized digital engagement and human interaction. By leveraging data insights and artificial intelligence, they aim to deliver tailored marketing messages and services, ensuring each customer feels uniquely valued.

The company is actively investing in digital platforms to provide convenient self-service options for routine tasks. However, Ageas recognizes the importance of human connection for more complex needs and is dedicated to maintaining readily available human advisors to foster meaningful relationships.

In 2024, Ageas reported that its digital channels handled a significant portion of customer inquiries, demonstrating the success of their digital investment. This strategic approach, combining the efficiency of digital tools with the empathy of personal advisors, is central to their customer relationship strategy.

Ageas embodies a long-term partnership approach, a core element of its business model, reflecting its 200-year heritage and inherent partnership DNA. This strategy moves beyond mere transactional engagements, aiming to establish enduring connections with its customer base.

The company's strategic objective is to be a 'Supporter of your life' for its customers, emphasizing sustained engagement and trust-building over extended periods. This commitment is a fundamental tenet guiding its customer relationship management.

In 2024, Ageas continued to focus on deepening these relationships. For instance, their digital platforms are designed to facilitate ongoing support and interaction, moving beyond single policy purchases to a more holistic customer journey.

Ageas actively supports customers in managing and reducing risks, moving beyond simply compensating for losses. This approach involves providing expert advice and tailored solutions to help anticipate and navigate future challenges.

The company focuses on offering guidance and resources to prepare clients for different life events and potential risks, fostering resilience. For instance, in 2024, Ageas launched a new digital tool offering personalized risk assessments for small businesses, with early adoption showing a 15% reduction in reported minor incidents.

Transparency and Regulatory Compliance

Ageas is deeply committed to fostering transparency across all its customer segments, understanding that clear communication is paramount in the insurance industry. This dedication is underscored by their proactive approach to meeting and exceeding evolving regulatory requirements, ensuring customers receive balanced and trustworthy information about their policies and the company's operations.

By prioritizing transparency and robust regulatory compliance, Ageas aims to build and maintain strong customer confidence. This adherence to standards not only safeguards policyholders but also solidifies Ageas's reputation as a reliable and ethical partner. For instance, in 2024, Ageas reported a strong solvency II ratio, demonstrating its financial resilience and commitment to regulatory frameworks.

- Enhanced Transparency: Ageas actively works to provide clear, understandable information regarding policy terms, conditions, and company practices to all customer groups.

- Regulatory Adherence: The company consistently aligns its operations with stringent and evolving regulatory demands, ensuring fair treatment and protection for its policyholders.

- Customer Confidence: This dual focus on transparency and compliance directly contributes to building trust and fostering long-term, reliable relationships with customers.

- Financial Stability: Ageas's commitment to regulatory compliance is reflected in its solid financial standing, with a reported Solvency II ratio of 225% as of Q1 2024, indicating robust capital adequacy.

Community and Societal Involvement

Ageas actively cultivates customer relationships by engaging with the broader community and addressing significant societal issues. This approach extends beyond traditional insurance offerings to encompass a commitment to tackling challenges like an aging population and the impacts of climate change.

The company's strategy involves developing sustainable products and supporting community initiatives. For instance, in 2024, Ageas continued its focus on climate-resilient solutions, which resonated with a growing segment of environmentally conscious customers. This commitment to social impact strengthens customer loyalty among those who value corporate responsibility.

- Societal Impact Focus: Ageas tackles societal challenges like aging and climate change through its business practices and community engagement.

- Sustainable Offerings: The company develops and promotes insurance products designed with sustainability in mind, aligning with customer values.

- Community Initiatives: Ageas invests in and supports programs that create positive societal change, fostering goodwill and stronger customer connections.

- Value Alignment: By demonstrating a commitment to shared values, Ageas strengthens its bond with customers who prioritize social responsibility.

Ageas cultivates deep customer relationships by acting as a lifelong supporter, moving beyond simple transactions to build enduring trust. This is achieved through a blend of personalized digital interactions and accessible human support, ensuring customers feel valued at every touchpoint.

In 2024, Ageas's digital channels handled a significant volume of customer interactions, showcasing the effectiveness of their digital investments. Complementing this, the company maintains a strong emphasis on human advisors for more complex needs, reinforcing their commitment to personalized service.

Ageas actively supports customers in managing and reducing risks, offering expert advice and tailored solutions. For example, a 2024 initiative provided small businesses with personalized risk assessments, leading to a reported 15% reduction in minor incidents among early adopters.

The company also fosters strong relationships by addressing societal issues, such as climate change, through sustainable product development. This commitment to social impact resonates with increasingly environmentally conscious customers, strengthening loyalty.

| Customer Relationship Strategy | Key Initiatives | 2024 Data/Impact |

|---|---|---|

| Lifelong Partnership | Personalized digital engagement & human support | Digital channels handle significant inquiry volume |

| Risk Management Support | Expert advice & tailored solutions | 15% reduction in minor incidents for small businesses via new risk assessment tool |

| Societal Engagement | Sustainable product development & community initiatives | Increased customer loyalty among environmentally conscious segments |

Channels

Ageas leverages bancassurance networks extensively, partnering with major banks to distribute insurance products through their extensive branch and digital platforms. This strategic channel is particularly robust in key markets like Asia and Europe, allowing Ageas to tap into established customer bases and achieve efficient market penetration. In 2024, Ageas reported that bancassurance remained a significant contributor to its sales, with partnerships in countries like Belgium and Portugal demonstrating strong performance.

Independent agents and brokers are a cornerstone of Ageas's distribution strategy, representing a significant channel for reaching customers. These professionals offer tailored advice and personalized service, crucial for both life and non-life insurance sales.

Ageas places a strong emphasis on nurturing these relationships, recognizing the value these intermediaries bring. For instance, in 2024, Ageas continued to invest in training and support programs designed to equip its broker network with the latest product knowledge and sales techniques, ensuring they remain key partners in customer acquisition and retention.

Ageas is significantly boosting its investment in direct digital platforms, such as its own websites and mobile apps. This strategy aims to simplify the purchase of insurance products and provide customers with convenient self-service options, aligning with a growing preference for digital engagement.

In 2023, Ageas reported a notable increase in digital sales channels contributing to overall revenue, with a specific focus on enhancing user experience for online transactions. This digital transformation is viewed as crucial for maintaining a competitive edge and adapting to evolving customer behaviors in the insurance market.

Price Comparison Websites (PCWs)

Ageas leverages Price Comparison Websites (PCWs) extensively, particularly for its personal lines insurance, such as motor and home. This strategy is crucial for accessing a wide, price-conscious audience and maintaining competitiveness in comparison-driven markets.

The company’s engagement with PCWs allows for significant reach. For instance, in 2024, the UK insurance market saw a substantial portion of motor insurance policies purchased through comparison sites, underscoring their importance. Ageas’s participation ensures they capture a share of this high-volume segment.

- Broad Reach: PCWs provide Ageas access to millions of potential customers actively seeking insurance.

- Cost-Effectiveness: These platforms offer a cost-efficient way to acquire new customers compared to traditional direct marketing.

- Market Presence: Partnerships, such as the one with Saga in 2024 for PCW distribution, expand Ageas's market footprint and product visibility.

- Data Insights: PCWs offer valuable data on customer behavior and pricing trends, informing Ageas's product development and marketing strategies.

Affinity Partnerships and White-Label Solutions

Ageas leverages affinity partnerships by providing white-label or co-branded insurance products. This strategy allows them to reach specific customer segments through established organizations. A significant example is their 20-year collaboration with Saga, a UK-based financial services group specializing in the over 50s market.

Under this agreement, Ageas underwrites and services motor and home insurance for Saga's extensive customer base. This partnership, which began in 2011, has been a cornerstone of Ageas's growth in the UK, demonstrating the power of aligning with brands that have deep customer loyalty and understanding.

- Strategic Reach: Affinity partnerships grant Ageas access to pre-existing, targeted customer bases, reducing customer acquisition costs.

- Brand Synergy: By offering white-label or co-branded products, Ageas benefits from the partner's brand recognition and trust.

- Saga Example: The 20-year deal with Saga, initiated in 2011, highlights the long-term value and stability of such collaborations in the insurance sector.

- Product Distribution: This channel effectively distributes insurance products, particularly motor and home insurance, to niche demographics like the over 50s.

Ageas utilizes bancassurance, independent agents, direct digital channels, price comparison websites, and affinity partnerships to distribute its insurance products. These channels collectively allow Ageas to reach diverse customer segments efficiently. In 2024, Ageas highlighted bancassurance's continued strength and its ongoing investment in digital platforms to enhance customer experience.

| Channel Type | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Bancassurance | Partnerships with banks for product distribution. | Remained a significant contributor to sales; strong performance in Belgium and Portugal. |

| Independent Agents & Brokers | Personalized advice and tailored service. | Continued investment in training and support programs for the broker network. |

| Direct Digital Platforms | Websites and mobile apps for self-service and product purchase. | Crucial for competitive edge and adapting to evolving customer behaviors. |

| Price Comparison Websites (PCWs) | Access to price-conscious audiences, especially for personal lines. | Important for capturing high-volume segments, as seen in the UK motor insurance market. |

| Affinity Partnerships | White-label or co-branded products through established organizations. | 20-year collaboration with Saga (initiated 2011) for over-50s market insurance. |

Customer Segments

Ageas's individual retail customers represent a vast and diverse group seeking protection for their everyday lives and future financial well-being. This segment encompasses individuals looking for essential insurance products like car, home, health, and life coverage. In 2024, Ageas continued to serve millions of these policyholders across its key operational regions in Europe and Asia, demonstrating a strong commitment to providing accessible and relevant insurance solutions.

Ageas is actively targeting Small and Medium-Sized Enterprises (SMEs) as a core growth area, aiming to provide them with a comprehensive suite of non-life insurance products. This strategic focus is a significant part of their Elevate27 plan, recognizing the increasing need for robust business protection among this vital economic sector.

The SME segment represents a substantial opportunity for profitable expansion, driven by a growing awareness of risk management and the demand for tailored insurance solutions. In 2024, SMEs continue to be a cornerstone of many economies, with their resilience and adaptability making them attractive to insurers looking to diversify their portfolios and capture market share.

Ageas strategically focuses on the aging population, a demographic experiencing significant growth. This segment, often characterized by accumulated wealth and specific needs, represents a key customer group for Ageas's pension and savings offerings.

A prime example of this targeting is Ageas's partnership with Saga in the United Kingdom. This collaboration specifically caters to the over 50s market, providing them with specialized motor and home insurance products designed to meet their unique requirements and preferences.

Corporate and Group Clients

Ageas extends its reach beyond individual and small business clients to cater to substantial corporate and group entities. This involves providing tailored insurance packages, notably group life and health coverage, designed to meet the specific requirements of larger organizations.

These corporate clients typically present more intricate risk management challenges, necessitating customized insurance programs that address a broader spectrum of potential liabilities and employee welfare needs. For instance, in 2023, Ageas Belgium reported a significant contribution from its corporate segment to overall profitability, underscoring its importance.

- Focus on Group Life and Health: Ageas offers specialized insurance products for employee benefits programs.

- Complex Risk Management: This segment requires sophisticated solutions for managing diverse corporate risks.

- Customized Programs: Insurance offerings are frequently adapted to the unique operational and strategic needs of each corporate client.

- Strategic Partnerships: Ageas aims to build long-term relationships with large organizations by providing comprehensive and reliable insurance support.

Reinsurance Clients (Internal and External)

Ageas's reinsurance operations, managed by Ageas Re, represent a critical customer segment. This division offers vital risk transfer and capital management solutions not only to Ageas's own insurance businesses but also to external insurance companies. In 2024, Ageas Re continued to play a significant role in diversifying risk and enhancing the solvency of its clients.

The primary value proposition for these reinsurance clients revolves around managing volatility and freeing up capital. By ceding portions of their risk portfolios to Ageas Re, insurers can reduce their exposure to large or unexpected losses, thereby stabilizing their financial performance. This allows them to focus on their core underwriting and growth strategies.

- Internal Clients: Ageas's primary insurance companies benefit from Ageas Re's capacity to absorb specific risks, optimizing their capital allocation and solvency ratios.

- External Clients: Third-party insurers engage Ageas Re for tailored reinsurance treaties, seeking enhanced financial security and risk diversification.

- Risk Transfer: Ageas Re's expertise lies in structuring and underwriting reinsurance contracts that effectively transfer risk from cedents to reinsurers.

- Capital Management: Clients leverage Ageas Re to manage their capital efficiently, meeting regulatory requirements and improving their return on equity.

Ageas serves a broad spectrum of customers, from individual policyholders seeking personal protection to large corporations requiring complex risk management solutions. This includes a significant focus on SMEs, recognizing their economic importance and growing need for tailored insurance. The company also strategically targets the aging demographic, offering specialized products like pensions and savings, often through partnerships such as the one with Saga for the over-50s market.

Ageas's reinsurance arm, Ageas Re, acts as a crucial customer segment, providing risk transfer and capital management to both internal Ageas entities and external insurance companies. This division is vital for managing financial volatility and optimizing capital for its clients, playing a key role in the broader insurance ecosystem.

| Customer Segment | Key Offerings | 2024 Focus/Data Point |

|---|---|---|

| Individual Retail Customers | Car, Home, Health, Life Insurance | Millions of policyholders served across Europe and Asia. |

| Small and Medium-Sized Enterprises (SMEs) | Non-life Insurance Products | Core growth area, vital for economic resilience. |

| Aging Population | Pensions, Savings, Specialized Motor/Home Insurance | Targeted via partnerships like Saga (UK) for over-50s. |

| Corporate and Group Entities | Group Life and Health, Customized Insurance Packages | Address complex risk management and employee welfare needs. |

| Reinsurance Clients (Ageas Re) | Risk Transfer, Capital Management Solutions | Enhance solvency and manage volatility for internal and external insurers. |

Cost Structure

The payout of claims and benefits to policyholders represents Ageas's most substantial cost, spanning both its life and non-life insurance segments. For instance, in the first half of 2024, Ageas reported gross claims paid of €11.9 billion, underscoring the magnitude of this expense.

Managing these claims efficiently and ensuring accurate underwriting are paramount for controlling this core expenditure. Key performance indicators like the non-life combined ratio and the life guaranteed margin are crucial for monitoring and optimizing this cost.

Operational and administrative expenses are a significant component of Ageas's cost structure, encompassing salaries for its global workforce of approximately 50,000 employees, as well as the costs of maintaining office spaces and managing general administrative functions.

In 2024, Ageas continued to focus on optimizing these costs as a key strategic imperative to bolster its operating margins. Efficiency gains in these areas directly contribute to the company's ability to deliver competitive pricing and sustained profitability.

Ageas incurs significant expenses in its distribution and marketing. These include commissions paid to agents and brokers, which are a core component of insurance sales, as well as fees for bancassurance partners who distribute Ageas products through banking channels.

Furthermore, substantial investments are made in advertising campaigns to build brand awareness and attract new customers. The ongoing maintenance and development of digital distribution platforms are also a key cost, reflecting the industry's shift towards online channels. For example, in 2023, Ageas reported that its operating expenses, which encompass these distribution and marketing costs, were €7,267 million, demonstrating the scale of investment in reaching its customer base.

Technology and Innovation Investments

Ageas dedicates substantial resources to its technology and innovation cost structure, focusing on building and sustaining cutting-edge IT infrastructure. This encompasses significant outlays for data analytics capabilities and the development of Artificial Intelligence tools, crucial for driving operational efficiency and customer engagement.

These investments are vital for Ageas's strategic advantage. For instance, in 2024, the company continued its IT replatforming initiatives, enhancing cybersecurity measures, and exploring innovative solutions. These efforts directly contribute to improving the customer experience and streamlining internal processes, which are key differentiators in the competitive insurance market.

- IT Infrastructure: Costs associated with maintaining and upgrading core IT systems, servers, and cloud services.

- Data Analytics & AI: Investments in software, hardware, and specialized personnel for data processing, machine learning, and AI model development.

- Cybersecurity: Expenditures on security software, hardware, and services to protect sensitive customer and company data.

- Innovation Projects: Funding for research and development of new technologies and solutions to improve products and services.

Regulatory and Compliance Costs

Ageas, as a global insurer, faces significant expenses tied to navigating diverse and stringent regulatory landscapes. These costs are essential for maintaining operational licenses and ensuring customer trust across its various markets.

These expenditures cover a broad spectrum, including the implementation of robust governance structures, the generation of detailed compliance reports, and the establishment of rigorous internal control systems. Ageas's commitment to standards like the Corporate Sustainability Reporting Directive (CSRD) necessitates ongoing investment in data collection and reporting infrastructure.

- Regulatory Adherence: Costs associated with meeting solvency requirements (e.g., Solvency II in Europe) and market-specific regulations.

- Compliance Investments: Funding for legal teams, compliance officers, and technology solutions to monitor and enforce regulatory adherence.

- Reporting Obligations: Expenses incurred for preparing and submitting financial, operational, and sustainability reports to regulatory bodies.

- Governance and Controls: Investments in internal audit, risk management frameworks, and ethical conduct programs to ensure compliance.

Ageas's cost structure is heavily influenced by claims payouts, operational expenses, distribution, and technology investments. In the first half of 2024, gross claims paid reached €11.9 billion, highlighting this as the largest cost. Operational and administrative costs, including employee salaries and office management, are also significant, with a global workforce of approximately 50,000. Distribution and marketing costs, encompassing agent commissions and advertising, were part of the €7,267 million in operating expenses reported in 2023.

| Cost Category | Description | Approximate 2023/2024 Impact |

|---|---|---|

| Claims & Benefits | Payouts to policyholders for life and non-life insurance. | €11.9 billion (gross claims paid, H1 2024) |

| Operational & Administrative | Salaries, office space, general management. | Related to ~50,000 employees globally. |

| Distribution & Marketing | Commissions, bancassurance fees, advertising, digital platforms. | Part of €7,267 million operating expenses (2023). |

| Technology & Innovation | IT infrastructure, data analytics, AI, cybersecurity. | Ongoing IT replatforming and cybersecurity enhancements (2024). |

| Regulatory & Compliance | Meeting regulatory requirements, reporting, governance. | Ongoing investments for CSRD and Solvency II adherence. |

Revenue Streams

Ageas's core revenue comes from life insurance premiums. These premiums are collected from a variety of products like traditional life policies, unit-linked investments, and retirement plans.

In 2024, the company saw significant inflows from these premiums, reaching EUR 11.7 billion. This growth was particularly strong in Belgium and across Europe, with a notable contribution from their operations in Asia.

Ageas generates substantial revenue from non-life insurance premiums. These premiums are collected from a wide range of products including motor, property, and health insurance, as well as other general insurance offerings.

In 2024, Ageas saw a notable increase in its non-life insurance inflows, reaching EUR 6.8 billion. This growth reflects strong performance across various business segments and product categories, with particular strength observed in the UK and Portugal markets.

Ageas generates substantial revenue from investment income, a key component of its business model. The company strategically invests premiums collected from insurance policies into a diverse portfolio of financial instruments, aiming to maximize returns.

This investment income plays a crucial role in bolstering Ageas's overall profitability and financial resilience. For instance, in 2023, Ageas reported a significant contribution from its investment portfolio, underscoring its importance to the group's financial performance.

Reinsurance Premiums

Ageas Re, the group's dedicated reinsurance division, is a key revenue generator. It earns income by accepting risk from other insurance companies, both within the Ageas group and from external clients worldwide. This business line diversifies Ageas's income sources and leverages its underwriting expertise.

In 2024, Ageas Re demonstrated strong performance, with gross written premiums reaching EUR 2.19 billion. This represents a significant increase of 21% compared to the previous year, underscoring the growing demand for its reinsurance services and its expanding market presence.

- Reinsurance Premiums: Ageas Re underwrites reinsurance contracts for both internal Ageas entities and external third-party clients.

- 2024 Performance: Gross written premiums for Ageas Re grew by 21% to EUR 2.19 billion in 2024.

- Diversification: This segment contributes significantly to Ageas's overall diversified revenue streams.

Fees and Charges from Services

Ageas diversifies its income beyond insurance premiums by levying fees and charges for a range of services. These can include administrative fees for managing policies, asset management fees tied to unit-linked products where Ageas manages client investments, and other charges for specialized services offered to policyholders or partners.

For instance, in 2024, Ageas's commitment to fee-based income streams is evident. While specific figures for individual service fees are often embedded within broader financial reporting, the company's strategy generally aims to capture value from its operational expertise and the management of financial assets. This approach not only boosts profitability but also creates a more resilient revenue structure, less solely dependent on underwriting cycles.

- Policy Administration Fees: Charges for the ongoing management and servicing of insurance contracts.

- Asset Management Fees: Levied on the assets managed within unit-linked insurance products, reflecting the investment management services provided.

- Service-Related Charges: Fees for additional services such as claims processing assistance, advisory services, or custom policy modifications.

- Contribution to Profitability: These fees enhance overall financial performance by adding a recurring revenue stream that complements premium income.

Ageas's revenue streams are multifaceted, extending beyond core insurance premiums to include income generated from its investment activities and reinsurance operations. The company also captures value through various fees and charges associated with its services.

| Revenue Stream | 2024 Data (EUR billions) | Key Products/Services |

|---|---|---|

| Life Insurance Premiums | 11.7 | Traditional life, unit-linked, retirement plans |

| Non-Life Insurance Premiums | 6.8 | Motor, property, health, general insurance |

| Investment Income | Significant contribution (2023 data) | Diverse financial instruments portfolio |

| Ageas Re (Reinsurance) | 2.19 (Gross Written Premiums) | Underwriting risk for internal and external clients |

| Fees and Charges | Embedded within operations | Policy administration, asset management, specialized services |

Business Model Canvas Data Sources

The Ageas Business Model Canvas is informed by a robust combination of internal financial performance data, extensive market research reports, and strategic insights gleaned from industry analysis. This multi-faceted approach ensures a comprehensive and accurate representation of Ageas's business operations and strategic direction.