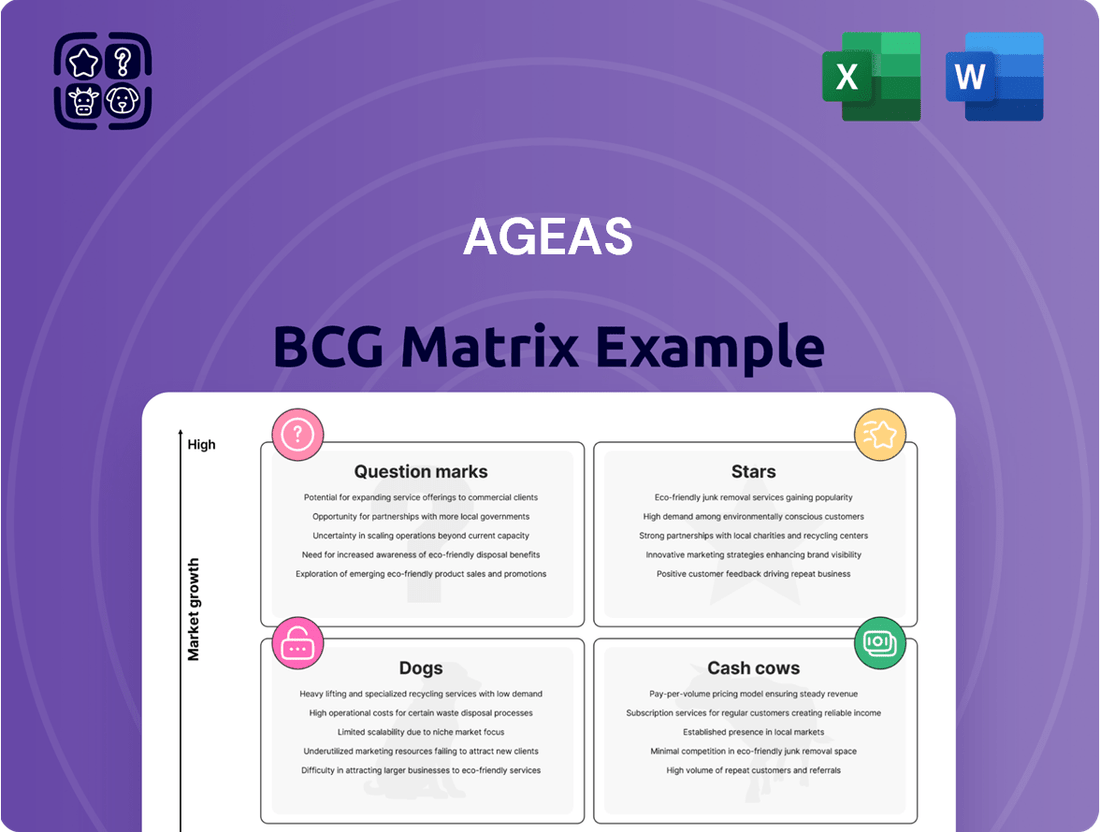

Ageas Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ageas Bundle

Uncover the strategic positioning of Ageas's diverse portfolio with our insightful BCG Matrix preview. See where their offerings fall as Stars, Cash Cows, Dogs, or Question Marks, and understand the implications for future growth.

This glimpse into Ageas's market performance is just the beginning. Purchase the full BCG Matrix report for a comprehensive breakdown, including detailed quadrant analysis and actionable strategic recommendations to optimize your investment decisions.

Stars

Asia Life Insurance, a key component of Ageas's portfolio, is positioned as a Star in the BCG Matrix. In 2024, this segment experienced a robust 7% surge in inflows across crucial markets like China, Malaysia, and India. This impressive growth is a testament to high customer retention and sustained sales performance in these dynamic Asian economies.

The company's strategic emphasis on expanding its footprint in Asia underscores its strong market share and the region's high growth potential. This continued investment reflects confidence in the sector's ability to generate significant returns, solidifying its Star status within Ageas's strategic framework.

The UK's non-life insurance sector, particularly motor and personal lines, demonstrated robust expansion in 2024, with inflows surging by 21%. This growth was primarily fueled by the motor insurance segment, indicating strong consumer demand and market activity.

Ageas's strategic acquisition of esure in April 2025 is poised to significantly reshape the UK personal lines market. This move will position Ageas as the third-largest player in this space, a clear indicator of its ambition to capture substantial market share within a segment experiencing notable growth.

The integration of Ageas and esure is designed to unlock significant operational efficiencies through economies of scale. Furthermore, this consolidation is expected to accelerate Ageas's diversification efforts, enhancing its product offering and customer reach within the competitive UK insurance landscape.

Ageas's life inflows in Portugal experienced a remarkable surge of 45% in 2024. This impressive growth was primarily driven by the successful launch and marketing of new savings products, resonating well with the Portuguese consumer base.

This substantial increase highlights Portugal as a high-growth market for Ageas. The company is effectively expanding its presence and capturing a larger share of the market, demonstrating strong strategic execution in its life insurance segment.

The robust performance of its Portuguese life and health products significantly bolsters Ageas's overall European life insurance results. This success story underscores the effectiveness of Ageas's product development and distribution strategies in key European markets.

Ageas Re (Third-Party Reinsurance)

Ageas Re, the company's dedicated reinsurance division, demonstrated remarkable performance in 2024. It achieved a significant 21% surge in Gross Written Premium and experienced a substantial 52% increase in protection inflows. This robust growth trajectory clearly positions Ageas Re as a star performer within the Ageas portfolio.

Under the strategic framework of Elevate27, Ageas Re is recognized as a pivotal driver for future expansion. The company's proactive business development, including its planned entry into new markets such as Credit & Surety in 2025, further solidifies its status as a high-growth segment. This diversification and strong financial performance are key indicators of its Star potential.

- Exceptional 2024 Growth: Ageas Re saw a 21% increase in Gross Written Premium and a 52% rise in protection inflows.

- Strategic Importance: Identified as a key growth engine within the Elevate27 strategy.

- Future Expansion: Planned entry into Credit & Surety in 2025 highlights its high-growth potential.

- Diversification Success: Strong financial results and diversification efforts underscore its Star classification.

Pension and Savings Products (Europe & Asia)

Ageas is actively targeting the pension and savings markets across Europe and Asia, recognizing the significant growth potential fueled by demographic shifts. This strategic emphasis is a cornerstone of their Elevate27 plan, aiming to capture a larger share in these expanding sectors.

The company's investment in pension and savings products reflects a clear strategy to drive future profitable growth. For instance, in 2024, Ageas reported a substantial increase in its life and savings business, with gross written premiums in this segment showing robust year-on-year growth, particularly in its Asian operations.

- Europe: Aging populations in countries like France and Belgium are increasing demand for long-term savings and retirement solutions.

- Asia: Emerging economies in Southeast Asia, such as Vietnam and Thailand, present significant opportunities due to growing middle classes and increasing awareness of financial planning.

- Growth Drivers: Favorable regulatory environments and a rising propensity to save are key factors supporting Ageas's focus in these regions.

- Market Share: Ageas aims to leverage its strong brand and product innovation to gain market share in these high-potential segments.

Ageas Re stands out as a Star in the BCG Matrix, driven by its exceptional 2024 performance with a 21% surge in Gross Written Premium and a 52% increase in protection inflows. Its strategic importance as a key growth engine within the Elevate27 plan, coupled with planned market entries like Credit & Surety in 2025, solidifies its high-growth potential and Star classification.

What is included in the product

Ageas BCG Matrix analyzes its business units based on market share and growth.

It guides strategic decisions on investment, divestment, or harvesting.

The Ageas BCG Matrix provides a clear visual of business unit performance, easing the pain of uncertainty for strategic decision-making.

Cash Cows

Ageas's non-life insurance operations in Belgium are a prime example of a Cash Cow within its BCG Matrix. In 2024, this segment experienced a robust 8% growth in inflows, underscoring its continued strength.

As a foundational and mature market for Ageas, Belgium's non-life insurance sector is characterized by a high market share. This dominance translates into consistent and stable cash flow generation, a hallmark of a Cash Cow.

The established nature of these Belgian operations means they require minimal new investment to maintain their profitability. Ageas can therefore leverage these segments to fund growth initiatives in other parts of its portfolio.

Established European Life Insurance, excluding high-growth areas, falls into the Cash Cows category for Ageas. While markets like Portugal and Türkiye are experiencing robust growth, the majority of Ageas's European life insurance business operates in more mature environments.

Despite the maturity, Ageas commands a substantial market share in these established segments. This strong position translates into consistent and reliable cash flow, a key characteristic of a Cash Cow.

These mature portfolios are not demanding significant investment in promotional activities. For instance, in 2024, Ageas reported a solid contribution from its mature European life insurance operations to its net operating result, underscoring their role as dependable cash generators for the group.

Traditional property insurance lines are a bedrock for Ageas, contributing significantly to its cash flow across various European markets. In 2024, Ageas reported a robust performance in its non-life segment, which is heavily influenced by these property-related offerings, highlighting their stability.

These mature markets, characterized by high insurance penetration, allow Ageas to leverage its established presence for consistent premium generation and a strong market share. For instance, in Belgium, a key market for Ageas, property insurance penetration remains high, ensuring a steady revenue stream.

The predictable nature of these traditional lines makes them ideal cash cows, providing the operational capital needed to fund investments in growth areas. Ageas's consistent dividend payouts are partly supported by the stable earnings from these foundational insurance products.

Core Motor Insurance in Mature Markets

Ageas's core motor insurance in mature European markets, beyond the UK, are strong cash cows. These segments thrive due to deep market penetration and loyal customer bases, ensuring consistent revenue and profitability. For instance, in 2023, Ageas reported a gross written premium of €10.8 billion for its non-life insurance business, with motor insurance being a significant contributor across its European operations.

These mature markets exhibit predictable demand and stable revenue streams, making them reliable profit generators for Ageas. The company benefits from established brand recognition and efficient operational structures in these regions. In 2024, Ageas continued to focus on optimizing its operations in these core markets, aiming for sustained profitability and cash generation.

- Stable Profitability: Mature motor insurance segments provide consistent earnings.

- High Market Penetration: Established presence in key European countries.

- Predictable Revenue: Consistent demand ensures reliable cash inflows.

- Operational Efficiency: Streamlined processes in mature markets enhance profitability.

Long-standing Joint Ventures and Partnerships

Ageas's long-standing joint ventures and partnerships, especially in Asia, are key contributors to its cash flow generation. These mature relationships, some exceeding two decades, offer stable market access and leverage established market shares.

These ventures are crucial for Ageas’s operational capital generation, providing a predictable income stream. For instance, Ageas’s partnership in China with China Unicorn, established in 2007, has been a significant contributor to its Asian portfolio.

- Stable Market Access: Over 20 years of established partnerships ensure consistent entry into mature markets.

- Consistent Cash Flows: These ventures generate reliable income, contributing significantly to Ageas's overall capital generation.

- Leveraging Market Share: Existing market positions within these partnerships enhance profitability and operational efficiency.

- Strategic Asian Presence: Key joint ventures in regions like China bolster Ageas's international financial strength.

Ageas's established non-life insurance operations in Belgium, particularly in traditional property insurance, represent strong Cash Cows. These segments benefit from high market penetration and a loyal customer base, ensuring consistent premium generation. In 2024, Ageas reported a solid 8% growth in inflows for its Belgian non-life operations, demonstrating their continued stability and profitability.

These mature European life insurance portfolios, excluding high-growth regions, also function as Cash Cows. Despite market maturity, Ageas maintains a substantial market share, translating into reliable cash flows. The company's 2024 net operating result showed a significant contribution from these mature life insurance segments, highlighting their dependable cash-generating capacity.

Core motor insurance in mature European markets, excluding the UK, are significant Cash Cows for Ageas. These businesses benefit from deep market penetration and operational efficiencies, leading to predictable revenue streams. Ageas's overall non-life gross written premium in 2023, which was €10.8 billion, was substantially bolstered by these mature motor insurance operations.

Ageas's long-standing joint ventures in Asia, such as its partnership in China, are also classified as Cash Cows. These mature collaborations provide stable market access and leverage established market shares, generating predictable income. The China Unicorn partnership, dating back to 2007, continues to be a vital contributor to Ageas's Asian portfolio and overall capital generation.

| Segment | Market Maturity | Key Characteristics | 2024/2023 Data Point |

|---|---|---|---|

| Belgian Non-Life Insurance | Mature | High market share, stable inflows | 8% growth in inflows (2024) |

| Established European Life Insurance | Mature | Substantial market share, consistent cash flow | Solid contribution to net operating result (2024) |

| Core Motor Insurance (Europe ex-UK) | Mature | Deep penetration, predictable revenue | Significant contributor to €10.8bn non-life GWP (2023) |

| Asian Joint Ventures (e.g., China) | Mature | Stable market access, established share | Vital contributor to Asian portfolio (ongoing) |

Full Transparency, Always

Ageas BCG Matrix

The Ageas BCG Matrix preview you are currently viewing is the complete, final document you will receive upon purchase. This means no watermarks or demo content will be present in the downloaded file, ensuring you get a professionally formatted and ready-to-use strategic analysis.

Rest assured, the Ageas BCG Matrix report you see here is the exact same file you will download after completing your purchase. It has been meticulously crafted with market-backed analysis and is delivered directly to you, ready for immediate application without any need for revisions.

What you are previewing is the actual Ageas BCG Matrix file that will be yours once you complete the purchase. Upon acquisition, you will unlock the full, editable version, making it instantly available for presentation to stakeholders or integration into your strategic planning processes.

This preview showcases the genuine Ageas BCG Matrix document that you will own after a single purchase. It is not a mockup, but rather a professionally designed, analysis-ready file that is immediately downloadable for your business's strategic advantage.

Dogs

Ageas's robust 2024 performance suggests a strategic pruning of underperforming niche product lines. These offerings, characterized by low market share and minimal growth, likely drain resources without yielding substantial returns. For instance, if a specialized insurance product saw only a 1% market share in 2024 and a 0.5% annual growth rate, it would be a prime candidate for divestment.

Ageas might identify certain smaller European markets, perhaps in Eastern Europe, where its brand recognition and customer base remain underdeveloped. For instance, if Ageas’s market share in a particular Balkan country hovers around 1-2% and growth has been stagnant or negative in recent years, it would likely be categorized as a Dog. This contrasts with its stronger positions in markets like Belgium, where it holds a significant share.

Legacy portfolios with high administrative costs, often found in older insurance segments, can be categorized as Dogs within the Ageas BCG Matrix. These portfolios demand significant resources for management and support, yet yield diminishing returns, impacting overall profitability. For instance, in 2024, Ageas continued to manage legacy life insurance blocks that, while still generating some revenue, incurred disproportionately high operational expenses due to outdated systems and a shrinking customer base.

Products Not Aligned with Digital Transformation

Products that haven't kept pace with Ageas's digital transformation, AI integration, and data utilization efforts might find themselves lagging. These offerings, especially if they also have low market penetration, are candidates for the Dogs quadrant because their relevance is likely decreasing, and their potential for future returns is limited.

Consider, for instance, legacy insurance products that rely heavily on manual processing and lack digital customer interfaces. In 2024, the insurance industry saw a significant push towards digital onboarding and claims processing. Ageas, like its peers, has been investing heavily in these areas. Products that resist this shift could see their market share erode. For example, a report in early 2024 indicated that insurers with less than 50% of their customer interactions happening digitally were at a significant disadvantage in customer retention.

- Legacy Annuity Products: Older annuity products with paper-based administration and limited online management features may struggle against more agile, digitally-enabled competitors.

- Traditional Travel Insurance: Policies that require extensive manual paperwork for claims or lack a seamless digital purchasing experience might deter younger, tech-savvy travelers.

- Outdated Group Health Plans: For businesses seeking efficient digital HR integration and employee self-service portals, older group health plans that don't offer these functionalities will likely be overlooked.

Non-Strategic Minor Investments

Non-Strategic Minor Investments represent Ageas's smaller ventures or partnerships that are not contributing significantly to its core business or strategic objectives outlined in Elevate27. These are often characterized by low returns and a lack of alignment with the company's growth trajectory.

These investments can become cash traps, consuming resources without generating substantial value. For instance, if a minor partnership in a non-core geographical market, like a small stake in a fintech startup in Southeast Asia that isn't integrated into Ageas's digital strategy, fails to show profitability or strategic synergy, it would fall into this category. Such ventures might have been initiated years ago but have since drifted from the company's evolving business model.

- Low Return on Investment: These investments typically yield returns well below Ageas's cost of capital or internal benchmarks.

- Lack of Strategic Alignment: They do not support or enhance Ageas's primary insurance and asset management businesses or its Elevate27 strategic pillars.

- Resource Drain: Despite their minor scale, they can still tie up management attention and financial resources that could be better allocated elsewhere.

- Potential Divestment Candidates: These are prime candidates for divestment or restructuring to unlock capital and refocus efforts on more promising areas.

Ageas's "Dogs" represent products or market segments with low market share and low growth potential. These are often legacy offerings that have not adapted to market changes or digital advancements. For example, a specific legacy life insurance product line in 2024 might have shown a market share below 2% and an annual growth rate of less than 1%, making it a prime candidate for divestment due to its inability to generate significant returns or contribute to Ageas's strategic goals.

These underperforming assets can drain valuable resources and management attention. Ageas's strategic review in 2024 likely identified such areas, including niche insurance products in less developed European markets where market penetration is minimal and growth prospects are dim. For instance, if a particular product line in a country like Slovenia held only a 1.5% market share in 2024 with negligible growth, it would be classified as a Dog.

| Category | Ageas 2024 Example | Market Share (Est.) | Growth Rate (Est.) | Strategic Implication |

|---|---|---|---|---|

| Legacy Products | Paper-based annuity products | < 3% | < 1% | Resource drain, potential divestment |

| Niche Markets | Specialized insurance in Eastern Europe | 1-2% | 0-0.5% | Low return, limited strategic fit |

| Non-Strategic Assets | Minor stakes in non-core fintech | Negligible | Variable, often low | Capital inefficiency, potential sale |

Question Marks

Ageas is strategically targeting the Small and Medium-sized Enterprise (SME) market for significant expansion, aiming to surpass the overall non-life insurance sector's growth trajectory. This segment represents a high-potential area for Ageas, where it currently holds a modest but increasing market share.

The company's ambition to lead in the SME space implies a substantial need for investment in product development, distribution channels, and digital capabilities. For instance, in 2024, Ageas announced a €50 million investment in digital transformation initiatives, a portion of which is earmarked for enhancing its SME offerings.

Ageas is strategically investing in data and artificial intelligence to pioneer new insurance solutions, focusing on accessibility and inclusivity. This commitment positions them in burgeoning, high-potential segments of the insurance market where they are actively cultivating expertise and market share. While these innovative offerings are still gaining traction, Ageas’s foresight in this area is evident, with the global AI in insurance market projected to reach $30 billion by 2026, indicating significant future growth opportunities.

Ageas is making significant strides in Asia's embedded insurance space, a market anticipated to expand considerably by 2030. For instance, the Asia-Pacific insurtech market alone was valued at approximately USD 30 billion in 2023 and is expected to see robust growth. This positions Ageas's embedded insurance initiatives as Question Marks within the BCG matrix.

Despite the rapid expansion of the embedded insurance sector in Asia, Ageas is still in the early stages of building its market presence and share. This nascent stage, characterized by high potential but unproven dominance, is a hallmark of a Question Mark. The company's success hinges on substantial capital infusion and successful integration into partner ecosystems.

New Savings Products in Belgium Life

Belgium Life has seen its inflows bounce back, signaling a healthier market. The introduction of new savings products within this segment is a strategic move to capture growth. These products are entering a market that’s expanding, but they require significant marketing investment and strong customer adoption to gain traction.

The objective for these new Belgian savings products is clear: to climb the Ageas BCG Matrix. Success means moving from a potential Question Mark to a Star or even a Cash Cow.

- Market Growth Potential: Belgium's savings market is experiencing renewed growth, with specific segments showing promising expansion in 2024.

- Product Launch Strategy: New savings products are being introduced to capitalize on this growth, aiming to attract new customers and increase market share.

- Investment and Adoption: Significant marketing and sales efforts are necessary to ensure these products achieve widespread adoption and establish a strong market position.

- BCG Matrix Transition: The ultimate goal is to transition these new offerings from Question Marks to Stars or Cash Cows within the Ageas portfolio by demonstrating high growth and market share.

Credit & Surety Business (Ageas Re)

Ageas Re is strategically positioning itself within the Credit & Surety sector, a niche with significant growth potential. The company anticipates its inaugural renewals in this segment in 2025, signaling a deliberate expansion into a specialized area of the reinsurance market. This move requires dedicated capital allocation to cultivate a strong initial market presence and capitalize on emerging opportunities.

The Credit & Surety business is characterized by its specialized nature, focusing on mitigating financial risks associated with trade credit and contractual obligations. This segment often exhibits lower correlation to traditional property and casualty lines, offering diversification benefits for reinsurers. For Ageas Re, this represents an opportunity to build a distinct market share in a less saturated reinsurance niche.

- Market Entry: Ageas Re's planned first renewals in 2025 mark its official entry into the Credit & Surety reinsurance market.

- Talent Acquisition: Active recruitment for this specialized area underscores a commitment to building the necessary expertise.

- Growth Potential: The Credit & Surety sector is viewed as a high-growth niche within the broader reinsurance landscape.

- Strategic Investment: Realizing the full potential of this segment necessitates focused investment and resource allocation.

The embedded insurance initiatives in Asia, alongside the new Belgian savings products, are classified as Question Marks. These ventures exhibit high market growth potential but currently hold a low market share, necessitating significant investment to achieve success.

Ageas is actively investing in these areas, aiming to increase market share and transform them into Stars or Cash Cows. For instance, the Asia-Pacific insurtech market was valued around USD 30 billion in 2023, highlighting the growth trajectory Ageas aims to capture.

The Credit & Surety sector, with Ageas Re's planned entry in 2025, also represents a Question Mark. It's a high-growth niche requiring dedicated capital to build a strong initial presence and capitalize on emerging opportunities.

The company's strategic focus on these segments underscores a calculated approach to portfolio expansion, balancing risk with the potential for substantial future returns.

| Business Unit | Market Growth | Market Share | BCG Classification | Strategic Focus |

|---|---|---|---|---|

| Asia Embedded Insurance | High | Low | Question Mark | Increase market share through partnerships and digital integration. |

| Belgium New Savings Products | Moderate to High | Low | Question Mark | Drive customer adoption via marketing and product innovation. |

| Ageas Re (Credit & Surety) | High | Low | Question Mark | Build expertise and secure initial client base for future growth. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and expert commentary to ensure reliable, high-impact insights.