Ageas Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ageas Bundle

Ageas navigates a complex insurance landscape, facing intense rivalry, evolving customer demands, and the constant threat of new entrants. Understanding these dynamics is crucial for any stakeholder.

This brief overview only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Ageas’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of Ageas's suppliers, like reinsurers or crucial technology firms, is significantly influenced by how concentrated their markets are. If a small number of major companies provide essential services, they gain more leverage, which can translate into increased costs for Ageas. For instance, in the reinsurance sector, a few large global reinsurers often hold substantial market share, giving them considerable pricing power.

Suppliers providing highly specialized or unique services, such as proprietary actuarial software or niche data analytics platforms, wield significant bargaining power over Ageas. For instance, if a key vendor develops a unique risk modeling tool that significantly enhances Ageas's underwriting accuracy, Ageas might find it difficult to switch providers without incurring substantial costs or performance degradation.

The cost and complexity Ageas faces when changing suppliers directly influence the suppliers' bargaining power. If it's expensive and time-consuming for Ageas to switch, for example, due to the need for new IT system integrations or retraining staff on different platforms, it can create a dependency on current suppliers. This inflexibility naturally enhances the supplier's leverage in negotiations.

Importance of Supplier's Input to Ageas's Business

Suppliers providing inputs critical to Ageas's core insurance operations, such as risk transfer services from reinsurers or essential IT infrastructure, wield considerable power. Without these vital components, Ageas would face significant challenges in underwriting policies, managing claims efficiently, or processing vast amounts of data. The degree to which Ageas relies on a supplier's input directly amplifies that supplier's influence over Ageas.

For instance, the reinsurance market is a key area where supplier power is evident. Ageas, like many insurers, relies on reinsurers to manage its exposure to large or catastrophic events. In 2023, the global reinsurance market capacity remained robust, though pricing continued to be influenced by factors like climate change impacts and inflation, giving reinsurers leverage in negotiations.

- Reinsurer Dependence: Ageas's ability to offer comprehensive coverage for risks like natural disasters is heavily dependent on securing reinsurance capacity.

- IT Infrastructure: Essential IT systems for policy administration, claims processing, and data analytics are often provided by specialized vendors, creating reliance.

- Data Providers: Access to crucial data for actuarial modeling and risk assessment from external data providers can also represent a source of supplier power.

- Specialized Services: Certain niche services, such as fraud detection or cybersecurity solutions, may be provided by a limited number of expert suppliers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Ageas's insurance market significantly amplifies their bargaining power. If suppliers, such as technology providers or distribution partners, were to establish their own insurance offerings, they would directly compete with Ageas, compelling the company to concede to supplier demands to avoid this competitive pressure.

This potential for forward integration by suppliers is a crucial factor influencing their leverage. For instance, a major automotive manufacturer could, in theory, offer its own branded insurance products to its vehicle buyers, thereby bypassing traditional insurers like Ageas. Such a move would fundamentally alter the supplier-customer dynamic.

However, the practical realization of this threat for suppliers entering the insurance sector is often constrained by substantial barriers. These include the immense capital investment required to underwrite insurance policies and navigate complex regulatory frameworks, which are typically very high in the insurance industry, thereby limiting the immediate impact of this specific threat on Ageas.

Key considerations regarding this threat include:

- Direct Competition: Suppliers establishing their own insurance operations would transform them from partners to rivals, directly impacting Ageas's market share.

- Capital and Regulatory Hurdles: The significant financial resources and stringent regulatory compliance needed to operate an insurance company act as a major deterrent for most potential suppliers.

- Strategic Alignment: For many suppliers, the core business of insurance may not align with their primary strategic objectives, making forward integration a less attractive proposition.

Ageas faces moderate bargaining power from its suppliers, primarily reinsurers and specialized IT providers. The concentration within the reinsurance market, where a few large players dominate, grants them significant pricing influence. For instance, in 2023, global reinsurance capacity remained strong, but pricing was still affected by inflation and climate events, allowing reinsurers to negotiate favorable terms.

The switching costs for Ageas are a key factor. If integrating new IT systems or retraining staff is complex and expensive, suppliers gain leverage. This is particularly true for providers of unique actuarial software or data analytics platforms, where finding comparable alternatives can be challenging and costly.

The threat of suppliers integrating forward into Ageas's core insurance business is currently low due to high capital requirements and regulatory complexities in the insurance sector. While theoretically possible, for example, an automotive manufacturer offering its own insurance, the practical barriers remain substantial, limiting this pressure on Ageas.

| Supplier Type | Key Considerations | Impact on Ageas |

|---|---|---|

| Reinsurers | Market concentration, capital availability, pricing influenced by global events (e.g., climate, inflation) | Moderate to High: Affects cost of risk transfer and ability to underwrite large risks. 2023 saw continued pricing pressure from reinsurers. |

| IT & Software Providers | Specialization, proprietary technology, integration complexity | Moderate: Reliance on critical systems for operations. Switching can be costly and disruptive. |

| Data Providers | Data uniqueness, accessibility, cost | Low to Moderate: Essential for actuarial modeling, but alternatives often exist. |

What is included in the product

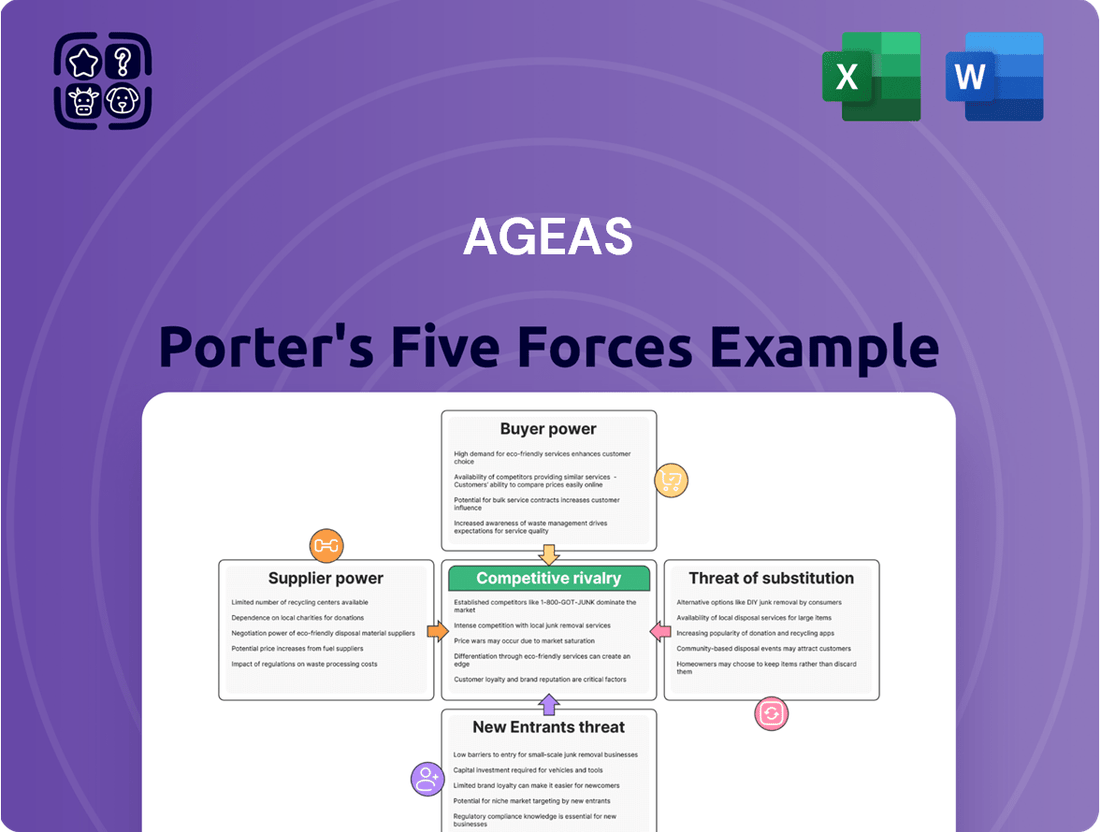

This analysis dissects the competitive forces impacting Ageas, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the insurance sector.

Understand the competitive landscape instantly with a visual representation of each force, allowing for targeted strategic adjustments.

Customers Bargaining Power

Ageas's customers, both individuals and businesses, exhibit significant price sensitivity, particularly when insurance products are viewed as undifferentiated commodities. This means customers are prone to comparing quotes from various providers to secure the most affordable premium. For instance, in the competitive auto insurance market, a 2024 report indicated that over 60% of consumers actively sought multiple quotes before renewing their policies.

This heightened price sensitivity directly translates into increased bargaining power for Ageas's customers. When a large segment of the customer base prioritizes cost above all else, it compels Ageas to engage in aggressive price competition. This dynamic can exert downward pressure on premiums, potentially leading to squeezed profit margins for the company if not managed strategically.

Customers wield significant bargaining power when numerous alternative insurance providers or substitute risk management solutions exist. This abundance of choices empowers them to seek better terms and pricing, directly impacting Ageas's ability to command premium prices. For instance, the global insurance market is highly competitive, with thousands of insurers offering a wide array of products.

The ease with which customers can switch to a competitor, or even consider self-insurance or alternative financial instruments like derivatives, further amplifies their leverage. In 2024, the digital transformation in insurance has lowered switching costs considerably, making it easier for consumers to compare and move between providers. Ageas must therefore focus on differentiating its product offerings and customer service to foster loyalty and mitigate this customer-driven pressure.

Customer switching costs significantly influence their bargaining power with Ageas. If it's simple and cheap for customers to switch to another insurer, they have more leverage to demand better terms. For instance, in 2023, the average cost for a UK consumer to switch car insurance providers was estimated to be around £50 in lost no-claims bonuses or administrative fees, a relatively low barrier.

Ageas actively works to increase these switching costs, making it less attractive for customers to leave. They achieve this by offering bundled insurance products, such as home and motor insurance together, which creates a more integrated and potentially more costly package to untangle. Loyalty programs that reward long-term customers also play a role in discouraging customers from seeking alternative providers.

Furthermore, Ageas focuses on delivering superior customer service, aiming to build strong relationships that transcend price alone. When customers feel valued and well-supported, they are less likely to incur the effort and potential risk of switching, even if a competitor offers a slightly lower premium. This focus on customer retention is crucial in mitigating the bargaining power of customers.

Customer Information Availability

Customers today have unprecedented access to information, significantly boosting their bargaining power. Online comparison sites and readily available pricing data empower individuals to easily evaluate Ageas's insurance products against those of its competitors. This transparency forces Ageas to maintain competitive pricing and terms to attract and retain customers.

The ability to compare policies, premiums, and coverage details online means customers can identify the most advantageous offers. For instance, in the UK motor insurance market, comparison sites are crucial. In 2024, it's estimated that over 80% of consumers use comparison websites when purchasing car insurance, directly impacting how insurers like Ageas must position themselves. This informed customer base can negotiate better deals, pushing Ageas to be more flexible with its offerings.

- Informed Customers: Increased access to market data via online platforms enhances customer knowledge.

- Competitive Pressure: Transparency in pricing and offerings forces Ageas to remain competitive.

- Negotiation Leverage: Well-informed customers are better equipped to negotiate favourable terms and pricing.

- Market Trends: In 2024, a significant majority of consumers rely on comparison tools, highlighting the impact of information availability on insurer strategy.

Volume of Purchase by Customers

The volume of purchases by customers is a significant factor in their bargaining power within the insurance industry. Large corporate clients or institutional customers who buy substantial amounts of insurance coverage wield considerable influence. For instance, if a major corporation procures millions in annual premiums, Ageas would likely need to offer competitive pricing and customized policy features to win and keep their business.

This leverage allows these high-volume buyers to negotiate for:

- Discounted premium rates

- Bespoke policy terms and conditions

- Enhanced claims handling or specialized risk management services

Ageas, like other insurers, must carefully manage these relationships, balancing the need to secure large accounts with maintaining profitability. In 2024, the trend of consolidation among large businesses means fewer, but larger, potential clients, amplifying this bargaining power.

Ageas's customers, especially those in highly competitive segments like auto insurance, demonstrate significant price sensitivity. In 2024, data shows over 60% of consumers actively sought multiple quotes, directly increasing their bargaining power and putting downward pressure on premiums. This focus on cost can impact Ageas's profit margins if not strategically managed.

The availability of numerous alternatives and low switching costs further empowers Ageas's customers. With the digital transformation in 2024 making it easier to compare and switch providers, customers can more readily negotiate better terms. Ageas counters this by bundling products and implementing loyalty programs to retain its customer base.

Customers' bargaining power is amplified by their increasing access to information. In 2024, an estimated 80% of UK consumers use comparison websites for car insurance, enabling them to easily evaluate Ageas's offerings against competitors. This transparency necessitates competitive pricing and flexible terms from Ageas.

Large corporate clients represent another significant source of customer bargaining power. In 2024, business consolidation means fewer, larger clients, increasing their leverage to negotiate discounted rates and bespoke policy terms. Ageas must balance securing these substantial accounts with maintaining profitability.

Same Document Delivered

Ageas Porter's Five Forces Analysis

This preview showcases the complete Ageas Porter's Five Forces analysis, offering a detailed examination of competitive forces within the insurance industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden content. You'll gain instant access to this professionally formatted analysis, ready to be utilized for strategic decision-making.

Rivalry Among Competitors

Ageas operates in European and Asian insurance markets that are quite crowded with competitors. These range from massive global insurance companies to strong national players, and even smaller, specialized firms focusing on specific insurance types. This sheer number and variety of competitors mean Ageas constantly faces intense rivalry.

In 2024, the European insurance sector, for example, saw continued consolidation, but still hosts numerous players. In Germany, a key market for Ageas, the number of insurance companies remained substantial, with both direct insurers and intermediaries actively competing. Similarly, in Asia, particularly in markets like China and India, the insurance landscape is dynamic, with a growing number of domestic and international companies vying for a larger piece of the market.

The intensity of competitive rivalry in the insurance sector is notably influenced by the industry's growth rate. Mature or slow-growing markets often see heightened competition as insurers vie for existing customers, leading to aggressive pricing strategies and substantial marketing expenditures. For instance, in 2023, the global insurance market experienced moderate growth, with specific segments like cyber insurance showing much higher expansion rates, attracting more aggressive competition.

When the overall industry growth is sluggish, companies are compelled to gain market share from competitors, intensifying price wars and driving up the costs of customer acquisition and retention. This dynamic was evident in several European non-life insurance markets in 2024, where subdued economic conditions led to increased price sensitivity among consumers and more aggressive competitive tactics from insurers seeking to maintain or grow their revenue bases.

Conversely, rapidly expanding segments within the insurance industry, such as insurtech or specialized lines like renewable energy insurance, tend to foster a more collaborative or at least less cutthroat competitive environment. These growing areas present opportunities for multiple players to expand without directly eroding each other's market share, at least in the initial stages of growth.

Ageas aims to stand out in the insurance market by focusing on service quality, digital advancements, and distinctive product offerings, moving beyond commoditized options. This strategy is crucial because when differentiation is weak and customers can easily switch providers, price wars become more common, intensifying competition.

For instance, in 2023, Ageas reported a strong customer retention rate, partly attributed to its investments in digital tools that enhance customer experience. High switching costs, often built through loyalty programs or integrated services, also play a significant role in reducing competitive rivalry by making it less attractive for customers to move to a competitor.

Strategic Stakes and Exit Barriers

Ageas faces intense competition when strategic stakes are high, such as aiming for market leadership or substantial investment in a particular region. This drive to dominate or recoup significant investments fuels aggressive strategies among players. For instance, in the competitive European insurance market, where Ageas operates, companies often engage in price wars or extensive marketing campaigns to capture market share, especially in mature segments.

High exit barriers further intensify rivalry by keeping companies locked into the market. These barriers can include specialized IT systems, brand loyalty built over years, or regulatory requirements that make exiting costly and complex. In 2024, the insurance sector continues to see consolidation, but many smaller or regional players remain due to these entrenched barriers, contributing to a crowded competitive landscape.

- High strategic stakes: Companies like Ageas may invest heavily in digital transformation and customer acquisition, leading to aggressive competition for market share in key European markets.

- Exit barriers: Significant investments in legacy IT infrastructure and long-term distribution agreements can make it difficult for insurers to withdraw from certain markets, even if profitability declines.

- Intensified rivalry: The combination of high stakes and exit barriers means that companies are often compelled to compete fiercely, even in less profitable segments, to maintain their market position and justify their continued presence.

Competitive Strategies Employed

Competitive rivalry within the insurance sector is intense, with players like Ageas actively engaging in aggressive pricing, substantial advertising campaigns, and continuous product innovation. Expanding distribution networks is also a key strategy to reach a wider customer base. Ageas needs to remain highly attuned to these competitive dynamics, adapting its own strategies to counter rivals' moves.

The current landscape sees digital transformation and a strong focus on customer-centric approaches as critical battlegrounds. Insurers are investing heavily in technology to enhance customer experience and streamline operations. For instance, in 2024, many insurers reported significant increases in their digital channel adoption rates, with some seeing over 70% of new business originating online.

- Aggressive Pricing: Competitors frequently adjust premiums to capture market share, forcing Ageas to balance profitability with competitive pricing.

- Product Innovation: The introduction of new insurance products, often tailored to emerging risks like cyber threats or climate change impacts, is a key differentiator.

- Digital Transformation: Investments in AI, data analytics, and online platforms are crucial for improving customer engagement and operational efficiency.

- Distribution Network Expansion: Broadening reach through partnerships, online portals, and traditional agent networks remains a vital strategy for growth.

Competitive rivalry is a significant force for Ageas, given the crowded nature of the European and Asian insurance markets. This intense competition is fueled by high strategic stakes, as companies vie for market leadership, and substantial exit barriers, such as legacy IT systems and long-term agreements, which keep players entrenched. Consequently, insurers often engage in aggressive pricing, extensive marketing, and continuous product innovation to gain an edge.

| Key Competitive Tactics | Description | 2024 Trend Example |

| Aggressive Pricing | Adjusting premiums to attract or retain customers. | In mature European markets, price sensitivity increased due to economic conditions, leading to more competitive pricing. |

| Product Innovation | Developing new insurance products for emerging risks. | Growth in cyber insurance and climate-related products saw increased innovation and competition. |

| Digital Transformation | Investing in technology for customer experience and efficiency. | Many insurers reported digital channel adoption rates exceeding 70% for new business in 2024. |

| Distribution Expansion | Broadening reach through various channels. | Partnerships and online portals remained key for expanding customer access. |

SSubstitutes Threaten

The threat of substitutes for Ageas is significant, particularly from large corporations and public entities that choose self-insurance or establish captive insurance companies. This strategy allows them to directly manage their own risks, especially for predictable losses, effectively bypassing traditional insurers like Ageas.

By internalizing risk management, these entities reduce the demand for commercial insurance lines, thereby shrinking Ageas's potential market share. For instance, in 2024, the global captive insurance market was projected to continue its growth, with many large enterprises leveraging these structures to optimize their risk financing and potentially reduce costs compared to purchasing external policies.

Government social security and welfare programs can indeed act as substitutes for Ageas's private insurance offerings in various markets. For instance, robust public pension schemes can lessen the demand for private retirement and life insurance products. In 2024, many European nations continue to maintain comprehensive social safety nets, which directly influences the market penetration of private long-term care and disability insurance.

The extent to which these public programs substitute for private insurance varies significantly by country. In nations with extensive state-funded healthcare, the need for private health insurance is naturally reduced, impacting Ageas's potential market share for such products. For example, the United Kingdom's National Health Service (NHS) provides a baseline of healthcare services, influencing the demand for supplementary private health coverage compared to countries with less developed public healthcare systems.

Sophisticated clients facing large or complex risks increasingly turn to Alternative Risk Transfer (ART) mechanisms. These include instruments like catastrophe bonds and insurance-linked securities, which effectively shift risk to capital markets. This growing trend presents a substitution threat, particularly for specialized risk segments traditionally handled by insurers like Ageas.

Preventative Technologies and Risk Mitigation

Technological advancements are increasingly offering alternatives to traditional insurance by actively preventing or reducing risks. For instance, the proliferation of smart home devices, like leak detectors and advanced security systems, directly mitigates property damage claims. In 2024, the smart home market saw continued growth, with an estimated 40% of US households owning at least one smart device, contributing to a reduction in certain types of insurance claims.

Similarly, the widespread adoption of telematics in vehicles, which monitors driving behavior, is a key factor in lowering motor accident rates. Data from 2024 indicates that telematics-insured drivers can experience up to a 20% reduction in accident frequency compared to their non-telematics counterparts. These technologies, by addressing the root causes of potential losses, can diminish the perceived necessity for comprehensive insurance coverage, thereby acting as a significant substitute.

Furthermore, breakthroughs in medical diagnostics and preventative healthcare, such as AI-powered early disease detection and personalized wellness programs, also serve as substitutes. These innovations empower individuals to manage their health more proactively, potentially reducing the reliance on health insurance for treating preventable conditions. The global digital health market, valued in the hundreds of billions of dollars by 2024, reflects this trend toward technologically-driven health risk mitigation.

- Smart Home Adoption: Approximately 40% of US households owned at least one smart device in 2024, contributing to risk reduction.

- Telematics Impact: Telematics-insured drivers showed up to a 20% lower accident frequency in 2024.

- Digital Health Growth: The global digital health market's substantial valuation in 2024 highlights the trend in preventative health technology.

Peer-to-Peer (P2P) Insurance Models

Peer-to-peer (P2P) insurance models are emerging as a potential threat of substitutes for Ageas. These models allow groups of individuals to pool their premiums to cover each other's risks, offering a community-driven alternative to traditional insurance providers. While currently small in scale, P2P insurance could disrupt specific market segments by providing lower costs and more transparent operations.

The P2P insurance market, though nascent, is showing growth. For instance, by the end of 2023, several P2P platforms had collectively insured millions of dollars in assets, demonstrating a tangible, albeit small, market presence. Ageas actively tracks these developments, recognizing their potential to attract customers seeking alternative risk-sharing mechanisms.

- Emerging P2P Insurance: Groups pool premiums to cover mutual risks, offering a community-based alternative.

- Nascent but Growing: P2P insurance is a developing threat, with platforms showing increasing user adoption and insured value.

- Potential Niche Disruption: These models could challenge traditional insurers in specific, community-focused segments.

The threat of substitutes for Ageas is multifaceted, encompassing self-insurance, government programs, alternative risk transfer, and technological advancements. These alternatives directly impact Ageas's market share by offering cost efficiencies, comprehensive coverage, or risk mitigation strategies that bypass traditional insurance models.

Self-insurance and captive insurance are particularly relevant for large corporations aiming to manage predictable losses directly, reducing reliance on external insurers. In 2024, the captive insurance market continued its expansion, with many enterprises leveraging these structures for optimized risk financing. Government social security programs also substitute for private insurance, especially in areas like retirement and healthcare, with European nations in 2024 maintaining robust social safety nets that influence private insurance demand.

Alternative Risk Transfer (ART) mechanisms, such as catastrophe bonds, shift risk to capital markets, posing a threat to specialized insurance segments. Technological innovations like smart home devices and telematics further reduce insurable events; by 2024, approximately 40% of US households owned smart devices, and telematics-insured drivers saw up to a 20% reduction in accident frequency. Digital health solutions are also growing, valued in the hundreds of billions by 2024, promoting proactive health management and potentially lowering health insurance needs.

| Substitute Category | Description | 2024 Impact/Trend |

|---|---|---|

| Self-Insurance/Captives | Corporations managing own risks | Continued market growth, cost optimization focus |

| Government Programs | Social security, welfare, public healthcare | Reduced demand for private retirement and health insurance in countries with strong safety nets |

| Alternative Risk Transfer (ART) | Catastrophe bonds, insurance-linked securities | Shifting specialized risks to capital markets |

| Technology (Risk Prevention) | Smart home devices, telematics, digital health | Lowered frequency of claims, proactive risk management |

Entrants Threaten

The insurance sector demands immense capital. For instance, in 2024, solvency capital requirements for insurers in the European Union, governed by Solvency II, necessitate robust financial buffers. These regulations ensure companies can absorb shocks and pay claims, making it incredibly difficult for newcomers to amass the necessary funds to enter the market and compete with established entities like Ageas.

Entering the insurance sector is significantly challenging due to stringent regulatory requirements and the need for various licenses. These legal and bureaucratic obstacles demand substantial investment in time, capital, and specialized knowledge, effectively deterring many potential newcomers.

For instance, in 2024, the European Union continued to enforce robust solvency regulations like Solvency II, requiring insurers to hold significant capital reserves and adhere to strict governance standards. This complexity makes it difficult for smaller, less-resourced entities to establish a foothold.

Ageas, as an established player, benefits from its existing compliance infrastructure and deep understanding of these regulatory landscapes. This allows them to operate more efficiently and with less friction compared to new entrants who must build these capabilities from scratch.

The insurance sector, including companies like Ageas, is fundamentally built on trust. Established brands have a significant advantage because consumers are more likely to place their financial security with a name they recognize and trust. For instance, in 2024, major insurers continued to leverage their long-standing reputations, a factor that new entrants must overcome through significant marketing efforts and demonstrable reliability.

New companies entering the market face a steep uphill battle in building this crucial credibility. It's not just about offering competitive prices; it's about convincing potential customers that their policies and claims handling are dependable. This often necessitates substantial investments in advertising and customer service, a barrier that can deter many aspiring competitors.

Access to Distribution Channels

Established insurers, including Ageas, have cultivated robust and varied distribution channels. These include a strong network of agents and brokers, strategic partnerships with banks for bancassurance, and increasingly, direct-to-consumer online platforms. This extensive reach is a significant barrier for new entrants.

Newcomers face immense difficulty in replicating these established relationships and the broad market access that comes with them. Acquiring customers efficiently through these well-trodden paths is a major challenge for any new player attempting to enter the insurance market.

Building comparable distribution networks from scratch is not only expensive but also a protracted process. For instance, in 2024, the cost of customer acquisition in the insurance sector continued to rise, with some digital-first insurers reporting acquisition costs exceeding €100 per policy for certain product lines, highlighting the financial hurdle.

- Established Distribution Networks: Insurers like Ageas leverage deep relationships with agents, brokers, and bancassurance partners.

- Customer Acquisition Challenge: New entrants struggle to match this widespread reach and efficient customer acquisition capability.

- Cost and Time Investment: Developing new, effective distribution channels requires substantial financial resources and time.

- Market Penetration Difficulty: The cost of customer acquisition remains a significant barrier, with some estimates in 2024 placing it over €100 per policy in competitive segments.

Economies of Scale and Experience Curve Effects

Existing insurers, like Ageas, leverage significant economies of scale in operations such as underwriting, claims handling, and back-office administration. This allows them to spread fixed costs over a larger volume of business, resulting in lower per-unit costs and the ability to offer more competitive pricing. For instance, major insurers often have advanced IT systems and extensive branch networks that are cost-prohibitive for newcomers to replicate quickly.

Furthermore, a deep well of historical data and accumulated actuarial expertise forms a powerful experience curve advantage. This data is crucial for accurate risk assessment and pricing, enabling established players to price policies more precisely and profitably than new entrants who lack this extensive historical insight. By 2024, the insurance industry continued to see a trend where data analytics and AI integration further amplified the advantage of incumbents with vast datasets.

New entrants face considerable hurdles in matching these cost efficiencies and data-driven accuracy. They typically start with smaller operational footprints and limited historical data, making it challenging to compete on price or to accurately underwrite complex risks. This disparity in scale and experience creates a significant barrier to entry, as new companies must invest heavily to achieve comparable operational efficiencies and data sophistication.

- Economies of Scale: Large insurers can achieve lower operating costs per policy due to bulk purchasing power and efficient processing.

- Experience Curve: Incumbents benefit from years of data, refining pricing models and risk assessment capabilities.

- Data Advantage: Access to extensive historical claims and customer data allows for more accurate actuarial predictions.

- Barriers for Newcomers: Start-ups struggle to match the cost structures and data-driven insights of established insurers.

The threat of new entrants in the insurance sector, impacting companies like Ageas, is significantly mitigated by high capital requirements and stringent regulatory frameworks. For instance, in 2024, European insurers operating under Solvency II needed substantial financial reserves, making it difficult for new players to gather the necessary capital to compete effectively.

The need for extensive licensing and bureaucratic compliance further erects a substantial barrier. These processes demand considerable investment in time, money, and specialized legal expertise, deterring many potential market entrants. Ageas, with its established compliance infrastructure, navigates these complexities more efficiently than a new company would.

Building brand trust and customer loyalty is another significant hurdle. In 2024, established insurers continued to rely on their long-standing reputations to attract and retain clients. New entrants must invest heavily in marketing and demonstrate unwavering reliability to gain consumer confidence, a costly and time-consuming endeavor.

The established distribution networks of incumbent insurers, including Ageas's relationships with agents, brokers, and bancassurance partners, are difficult for newcomers to replicate. The cost of customer acquisition in 2024 remained high, with some estimates exceeding €100 per policy in certain segments, further discouraging new market participants.

Economies of scale and the experience curve also pose considerable challenges. Incumbents like Ageas benefit from lower per-unit costs due to their operational size and possess vast historical data for accurate risk assessment, a crucial advantage amplified by AI integration in 2024. New entrants lack this scale and data sophistication, hindering their ability to compete on price and underwriting accuracy.

Porter's Five Forces Analysis Data Sources

Our Ageas Porter's Five Forces analysis is built upon a robust foundation of data, including Ageas's official annual reports and investor presentations, complemented by industry-specific market research from reputable firms like Fitch Ratings and AM Best. We also incorporate insights from regulatory filings and economic databases to provide a comprehensive view of the competitive landscape.