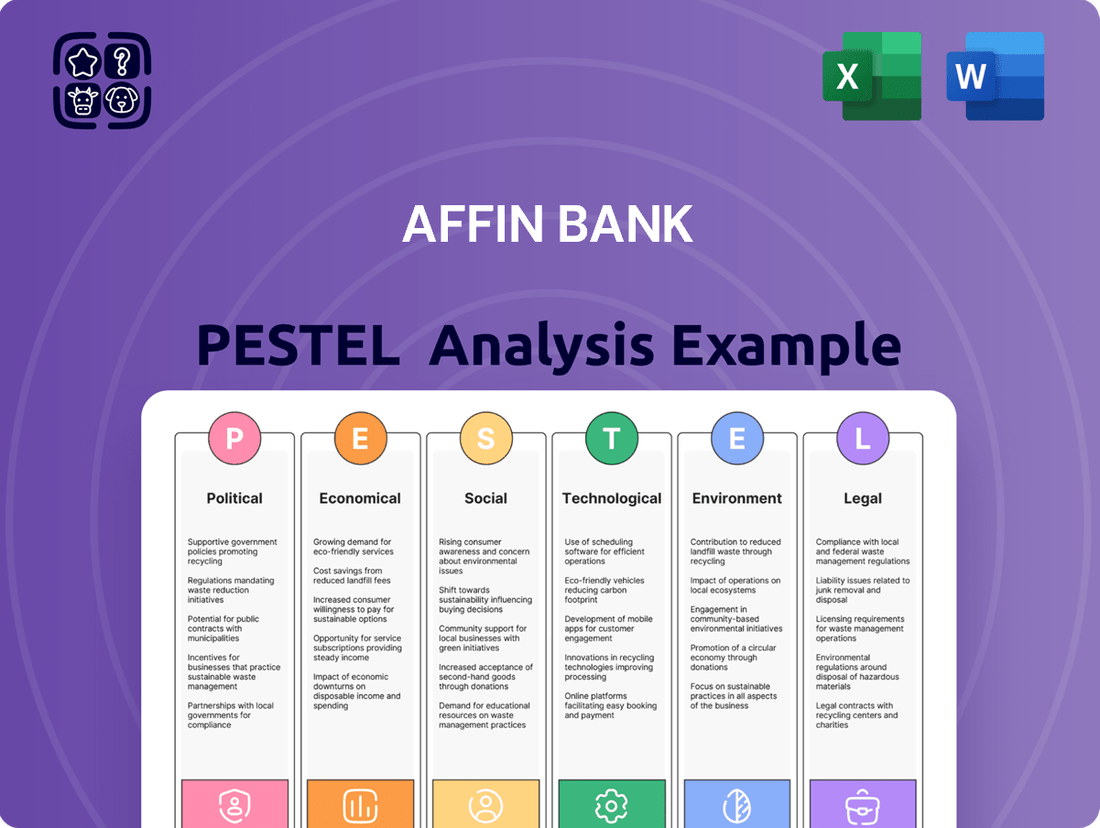

Affin Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Affin Bank Bundle

Unlock the strategic advantages of Affin Bank's external environment with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, technological advancements, social shifts, legal frameworks, and environmental concerns are shaping its trajectory. This in-depth report provides actionable insights for investors and strategists. Download the full version now and gain a competitive edge.

Political factors

Affin Bank operates within Malaysia's political landscape, which has seen concerted efforts towards fostering stable governance. The current unity government's mandate prioritizes driving economic growth and implementing crucial structural reforms, potentially creating a more favorable and predictable operating environment for the banking sector.

Government budgets, such as the projected Budget 2025, signal strategic allocations towards key economic development initiatives and fiscal consolidation. These fiscal plans are vital as they can create a more predictable environment for financial institutions like Affin Bank, influencing lending opportunities and overall economic sentiment.

Bank Negara Malaysia (BNM) remains the primary architect of Malaysia's financial landscape, actively shaping the operating environment for institutions like Affin Bank. BNM’s ongoing focus on digital banking, evidenced by its framework for digital bank licenses, alongside initiatives like the Regulatory Sandbox, directly influences Affin Bank's strategic investments in technology and innovation. As of late 2024, BNM continues to refine capital adequacy requirements, impacting how banks manage risk and allocate resources.

The Securities Commission Malaysia (SC) also plays a significant role, particularly in promoting sustainable finance. Frameworks such as the National Sustainability Reporting Framework (NSRF) and the Sustainable and Responsible Investment (SRI) Taxonomy are increasingly important. For Affin Bank, adherence to these guidelines, which gained further traction in 2024 with expanded disclosure requirements for listed companies, is crucial for attracting ESG-focused investors and maintaining its reputation.

The Malaysian government's commitment to Small and Medium Enterprises (SMEs) remains a key political factor. Budget 2025, for instance, allocates resources towards an SME loan fund and digital matching grants, directly addressing the need for capital and technological adoption among these businesses. This ongoing support creates a favorable environment for financial institutions like Affin Bank, which heavily relies on SMEs for its customer base.

Emphasis on Islamic Finance

Malaysia's government is a strong proponent of Islamic finance, actively fostering its expansion through various policies. These include efforts to bolster the sector's growth and offer tax incentives for Shariah-compliant financial dealings.

Affin Bank, with its dedicated Islamic banking arm, is well-positioned to capitalize on this government backing. This supportive ecosystem allows Affin Bank to broaden its Shariah-compliant product and service offerings, meeting the increasing demand for ethical financial solutions.

The Islamic finance sector in Malaysia has seen significant growth. For instance, by the end of 2023, Islamic banking assets constituted over 30% of the total banking system assets in Malaysia, showcasing the market's robust expansion and Affin Bank's potential to tap into this substantial segment.

Key government initiatives supporting this growth include:

- The Malaysia International Islamic Financial Centre (MIFC) initiative, which aims to position Malaysia as a global hub for Islamic finance.

- Tax exemptions on certain Islamic financial products and services, making them more attractive to consumers and businesses.

- Regulatory support from Bank Negara Malaysia (BNM) to ensure the integrity and stability of the Islamic financial system.

- Increased government spending on Shariah-compliant infrastructure projects, further driving demand for Islamic financial instruments.

ESG and Sustainability Policies

The Malaysian government's strong push for Environmental, Social, and Governance (ESG) principles, as seen in initiatives like the National Climate Change Policy 2.0 and the National Energy Transition Roadmap (NETR), directly influences the banking sector. These policies champion green financing and sustainable business practices, creating a favorable environment for financial institutions like Affin Bank that are prioritizing responsible banking. Affin Bank's strategic alignment with these government directives is expected to drive growth in its sustainable financing portfolio, potentially reaching RM10 billion by 2025 as per its stated targets.

These government-backed policies translate into tangible opportunities and expectations for banks. For instance, the NETR aims to achieve a 45% reduction in carbon intensity of GDP by 2030, which necessitates significant investment in renewable energy and energy efficiency projects. Affin Bank's role in facilitating this transition through its lending and advisory services will be crucial. The bank's commitment to increasing its sustainable financing, which stood at RM5.1 billion as of end-2023, directly responds to this policy landscape.

- Government Commitment: National Climate Change Policy 2.0 and National Energy Transition Roadmap (NETR) underscore a clear national agenda for sustainability.

- Policy Impact: Encourages green practices and sustainable financing, creating a supportive regulatory environment.

- Affin Bank's Alignment: Strategic focus on responsible banking and increasing its sustainable financing portfolio, targeting RM10 billion by 2025.

- Economic Opportunity: NETR's goal of reducing carbon intensity by 45% by 2030 drives demand for green finance solutions.

Political stability, driven by the current unity government's focus on economic growth and reforms, creates a more predictable operating environment for Affin Bank. Government budgets, like the projected Budget 2025, signal strategic allocations that influence economic sentiment and lending opportunities, directly impacting the bank's strategic planning.

Regulatory oversight from Bank Negara Malaysia (BNM) and the Securities Commission Malaysia (SC) significantly shapes Affin Bank's operations, particularly concerning digital banking frameworks and sustainable finance initiatives. BNM's capital adequacy requirements and the SC's SRI Taxonomy, with expanded disclosures in 2024, guide the bank's risk management and investment in ESG-aligned practices.

Government support for SMEs, evidenced by Budget 2025's allocations for loan funds and digital grants, presents a key opportunity for Affin Bank, given its reliance on this sector. Furthermore, the government's strong advocacy for Islamic finance, with over 30% of banking assets in Malaysia being Shariah-compliant by end-2023, positions Affin Bank's Islamic banking arm for significant growth.

Malaysia's commitment to ESG principles, through policies like the National Energy Transition Roadmap (NETR), drives demand for green financing, a key area for Affin Bank. The bank's target to reach RM10 billion in sustainable financing by 2025 reflects its alignment with national goals to reduce carbon intensity, a critical factor for future growth.

| Political Factor | Description | Impact on Affin Bank | Data Point |

|---|---|---|---|

| Government Stability & Economic Focus | Unity government prioritizing growth and reforms. | Creates a predictable operating environment. | Budget 2025 allocations signal strategic economic development. |

| Regulatory Frameworks | BNM's digital banking and SC's ESG guidelines. | Influences technology investment and sustainable finance. | Islamic banking assets >30% of total banking assets (end-2023). |

| SME Support & Islamic Finance Push | Government funding for SMEs and promotion of Islamic finance. | Opens avenues for lending and Shariah-compliant product expansion. | Affin Bank targets RM10 billion in sustainable financing by 2025. |

| ESG & Green Financing | National Climate Change Policy 2.0 and NETR. | Drives demand for green lending and responsible banking. | NETR aims for 45% reduction in carbon intensity by 2030. |

What is included in the product

This PESTLE analysis of Affin Bank provides a comprehensive examination of how political, economic, social, technological, environmental, and legal factors shape its operating landscape.

It offers actionable insights into emerging trends and potential disruptions, enabling strategic decision-making for sustained growth and competitive advantage.

Affin Bank's PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliver by simplifying complex market dynamics for easier referencing during strategic planning.

Economic factors

Affin Bank anticipates a positive economic trajectory for Malaysia, forecasting a GDP growth of 5.0% for 2024, followed by a slightly higher 5.2% in 2025. This growth is primarily fueled by a resurgence in electrical and electronics (E&E) exports and sustained strong domestic consumption.

A robust economic environment typically translates into higher demand for banking products, such as loans, and generally improves the quality of a bank's loan portfolio, reducing the likelihood of defaults.

Bank Negara Malaysia's (BNM) monetary policy plays a pivotal role in shaping the economic landscape for Affin Bank. The stability of the Overnight Policy Rate (OPR) is anticipated to narrow interest rate differentials, which could encourage foreign capital to flow into Malaysia, strengthening the Ringgit.

While global interest rates and inflation have posed challenges, BNM's commitment to maintaining a stable inflation outlook is critical. This stability directly impacts the banking sector's profitability by influencing lending margins and the overall demand for credit. For instance, in early 2024, Malaysia's inflation remained relatively contained, supporting a stable interest rate environment.

Malaysia's inflation is projected to remain relatively stable in 2024, even with some price increases stemming from subsidy rationalization. This stability is a positive sign for consumer spending.

A robust labor market and consistent household spending are anticipated to bolster domestic demand throughout 2024. This sustained demand is crucial for the growth and resilience of Affin Bank's consumer banking operations.

Global Trade and Semiconductor Cycle

Malaysia's status as an open economy makes its growth heavily reliant on global trade, with the semiconductor sector playing a crucial role. Affin Bank's 2025 outlook anticipates a positive impact on Malaysian exports stemming from an expected rebound in global semiconductor sales and a more favorable external economic environment.

This projected upturn in the semiconductor market is critical for Malaysia, a significant player in the electronics and electrical (E&E) sector. For instance, the World Semiconductor Trade Statistics (WSTS) forecast a 13.0% increase in global semiconductor sales for 2024, reaching $611 billion, with further growth anticipated in 2025, which bodes well for Malaysian manufacturers and exporters.

- Global Semiconductor Sales Growth: WSTS projects a 13.0% rise in global semiconductor sales for 2024, indicating a recovery that will benefit export-oriented economies like Malaysia.

- Malaysian E&E Exports: The health of the semiconductor cycle directly influences Malaysia's E&E exports, a substantial contributor to its GDP.

- 2025 Economic Outlook: Affin Bank's projections for 2025 are underpinned by the expectation of improved global demand, particularly within the tech sector, driving export volumes.

Fiscal Policy and Budget Allocations

Malaysia's Budget 2025, unveiled with an expansionary yet prudent approach, allocates substantial funds to both operating and development expenditures. This strategic move is designed to cultivate sustainable and inclusive economic growth, directly impacting the financial sector.

The budget emphasizes strengthening fiscal buffers and prioritizing key economic areas, which can translate into a more stable operating environment and new avenues for growth for financial institutions such as Affin Bank. For instance, the budget's focus on digital transformation and green initiatives could spur demand for specific financial products and services.

- Budget 2025: Aimed at fostering sustainable and inclusive economic growth through significant allocations for operating and development expenditures.

- Fiscal Prudence: Measures included to strengthen fiscal buffers and support economic priorities, creating a more stable financial landscape.

- Sectoral Opportunities: Potential for financial institutions like Affin Bank to benefit from increased investment in digital infrastructure and green economy initiatives.

- Economic Outlook: The budget's framework provides a backdrop for potential credit growth and investment opportunities within the Malaysian economy.

Malaysia's economic outlook for 2024 and 2025, with projected GDP growth of 5.0% and 5.2% respectively, indicates a favorable environment for Affin Bank. This growth is supported by a rebound in E&E exports, particularly driven by the global semiconductor market, which WSTS forecasts to grow by 13.0% in 2024.

The stability of Bank Negara Malaysia's Overnight Policy Rate (OPR) is expected to attract foreign investment, strengthening the Ringgit and narrowing interest rate differentials. Malaysia's inflation is anticipated to remain contained in 2024, supporting consumer spending and a stable credit environment for the banking sector.

Budget 2025's expansionary yet prudent approach, with significant allocations for development and operating expenditures, further bolsters economic growth prospects. This budget emphasizes digital transformation and green initiatives, presenting new opportunities for financial services.

| Indicator | 2024 Projection | 2025 Projection | Source/Note |

|---|---|---|---|

| Malaysia GDP Growth | 5.0% | 5.2% | Affin Bank Forecast |

| Global Semiconductor Sales Growth | 13.0% | Further Growth Expected | WSTS |

| Malaysian Inflation | Relatively Stable | Expected to Remain Stable | Affin Bank Analysis |

Preview the Actual Deliverable

Affin Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Affin Bank PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank's strategic landscape. Understand the key drivers and challenges shaping Affin Bank's future operations and market position.

Sociological factors

Malaysian consumers are increasingly turning to digital platforms for their banking needs. With internet penetration reaching an impressive 96.9% as of early 2024, and mobile banking usage soaring, the demand for seamless online financial services is at an all-time high.

This shift, amplified by the pandemic's influence on digital habits, fuels a strong preference for convenience, accessibility, and tailored digital experiences. Affin Bank, like its peers, is responding by investing heavily in its digital infrastructure to meet these evolving consumer expectations.

There's a noticeable surge in the demand for financial products and services that align with ethical and Shariah principles, especially from younger, digitally connected consumers in Malaysia. This trend indicates a significant market opportunity.

Affin Bank, with its dedicated Islamic banking arm, is strategically positioned to capitalize on this growing demand. The bank can effectively serve this expanding segment and harness the ongoing innovation within Islamic fintech.

Malaysia's Islamic finance industry continues to show robust growth, with assets under management in Islamic banking projected to reach RM1.5 trillion by the end of 2025, presenting a substantial market for Affin Bank to tap into.

Financial inclusion is a major societal focus, aiming to bring micro and small businesses, along with low-income families, into the formal financial system. This isn't just about social good; it's a significant business avenue for banks like Affin Bank.

Affin Bank's efforts to support SMEs, for instance, directly contribute to this societal goal. By providing accessible financing, they help these businesses grow, which in turn strengthens the local economy.

In 2023, for example, Affin Bank’s SME financing portfolio saw continued growth, reflecting the increasing demand and the bank's commitment to this sector. This aligns perfectly with the national push for greater economic participation across all segments of society.

Evolving Workforce and Talent Development

The banking sector's digital transformation necessitates a workforce equipped with advanced digital proficiencies. Affin Bank's strategic emphasis on technology and digital leadership highlights the critical need for continuous talent development and upskilling to cultivate a future-ready banking environment.

This includes nurturing skills in areas like data analytics, cybersecurity, and digital product management. For instance, a 2024 report indicated that over 70% of financial institutions are increasing their investment in digital skills training for employees to bridge the talent gap.

- Digital Skills Gap: A significant portion of the existing banking workforce may lack the specialized digital skills required for evolving roles.

- Talent Acquisition Challenges: Attracting and retaining talent with cutting-edge digital expertise is becoming increasingly competitive.

- Investment in Training: Financial institutions, including Affin Bank, are allocating substantial resources to reskill and upskill their employees to meet digital demands.

Customer-Centricity and Personalization

Malaysian banking customers are increasingly seeking tailored experiences, demanding personalized product and service offerings that cater to their unique financial needs and preferences.

Affin Bank's strategic direction, particularly its AX28 plan, directly addresses this sociological shift. The bank's vision emphasizes the integration of advanced technology with a profound understanding of evolving customer demands, aiming to deliver 'Unrivalled Customer Service'. This commitment to personalization is crucial for retaining and attracting customers in a competitive market.

This trend is supported by data showing a growing preference for digital banking solutions that offer convenience and customization. For instance, a 2024 report indicated that over 70% of Malaysian banking consumers expect personalized recommendations and offers from their financial institutions.

Key aspects of this customer-centric approach include:

- Personalized Product Development: Creating financial products and services that are specifically designed to meet individual customer segments' needs.

- Digital Engagement: Leveraging digital platforms to offer customized advice, tailored promotions, and seamless customer support.

- Data-Driven Insights: Utilizing customer data analytics to understand behavior patterns and anticipate future needs, thereby enhancing service delivery.

- Customer Feedback Integration: Actively incorporating customer feedback into service improvements and product enhancements.

Malaysian consumers increasingly favor digital banking, with 96.9% internet penetration in early 2024 driving demand for seamless online services. This digital shift, accelerated by the pandemic, pushes banks like Affin Bank to enhance their digital infrastructure.

A growing segment of Malaysian consumers, particularly younger demographics, seeks Shariah-compliant financial products, a trend Affin Bank's Islamic banking arm is well-positioned to address, especially as Malaysia's Islamic finance industry assets are projected to reach RM1.5 trillion by end-2025.

Financial inclusion remains a key societal goal, with efforts to integrate micro-businesses and low-income families into the formal financial system. Affin Bank's support for SMEs, evidenced by continued growth in its SME financing portfolio in 2023, directly contributes to this objective.

The banking sector's digital transformation highlights a need for digitally skilled employees, with over 70% of financial institutions boosting digital skills training investment in 2024 to bridge the talent gap.

Technological factors

Affin Bank is heavily investing in its digital transformation, with a significant portion of its capital expenditure dedicated to digitalization. For instance, in 2023, Affin Bank reported a 12.5% increase in its IT expenditure, with a focus on enhancing transaction processing capabilities and automating key operational processes to boost efficiency.

This strategic push includes the development of new digital banking platforms and the continuous improvement of its mobile application. These efforts aim to provide customers with a seamless and modern banking experience, reflecting the growing demand for digital financial services.

Affin Bank is actively integrating artificial intelligence and data analytics to deliver personalized financial solutions. This strategic adoption allows them to offer timely advice and empower customers with better financial management tools. For instance, in 2023, the bank reported a significant increase in digital transactions, underscoring the growing reliance on tech-driven customer engagement.

The increasing reliance on digital platforms for banking services necessitates stringent cybersecurity and data protection protocols. Affin Bank's focus on upgrading its mobile banking app with advanced security features highlights this critical technological factor, aiming to safeguard customer information and build confidence in its digital offerings. This commitment is crucial as cyber threats continue to evolve, with financial institutions globally investing heavily in defense mechanisms.

Mobile Banking and Online Platforms

Affin Bank is actively upgrading its digital banking ecosystem, focusing on the AFFINAlwaysX mobile app and its online platforms. The goal is to provide users with incredibly easy-to-use interfaces and sophisticated features, making banking accessible whenever and wherever they need it. This strategic push directly addresses the increasing customer preference for on-demand financial services.

The bank's investment in digital channels is significant. For instance, as of early 2024, Affin Bank reported a substantial increase in digital transactions, with mobile banking adoption growing by over 20% year-on-year. This trend highlights the critical importance of these technological advancements for customer engagement and operational efficiency.

- Enhanced User Experience: AFFINAlwaysX is being developed with a focus on intuitive navigation and personalized banking solutions.

- Expanded Digital Services: New features are being rolled out to cover a wider range of banking needs, from account management to investment services.

- Growing Digital Adoption: Affin Bank is seeing a marked increase in active users on its digital platforms, reflecting market demand.

- Competitive Edge: Continuous improvement in mobile and online banking is crucial for Affin Bank to remain competitive in the evolving financial landscape.

Integration of Fintech Solutions

The Malaysian financial sector is experiencing a surge in fintech innovation, with digital banks and e-wallets becoming increasingly prevalent. Affin Bank is strategically positioning itself to leverage these advancements. Its focus on digital leadership and key partnerships, such as with Bursa Malaysia and TNG Digital for an equities trading feature, demonstrates a proactive approach to integrating and competing within this evolving fintech ecosystem.

Affin Bank's commitment to digital transformation is evident in its efforts to enhance customer experience and operational efficiency through technology. These integrations allow the bank to offer more streamlined services and reach a wider customer base, directly addressing the growing demand for digital financial solutions.

- Digital Bank Growth: Malaysia's digital banking sector is projected for significant expansion, with new licenses expected to foster competition and innovation.

- E-wallet Adoption: E-wallet usage in Malaysia continues to climb, with transaction values reaching billions of ringgit, indicating a strong consumer shift towards digital payments.

- Fintech Partnerships: Affin Bank's collaborations are key to its strategy, enabling it to offer integrated services that compete with standalone fintech offerings.

Affin Bank's technological advancements are central to its strategy, focusing on enhancing digital platforms like the AFFINAlwaysX mobile app. This push aims to provide intuitive interfaces and sophisticated features, meeting the increasing customer demand for accessible, on-demand financial services. The bank reported a substantial increase in digital transactions, with mobile banking adoption growing by over 20% year-on-year as of early 2024, underscoring the critical importance of these tech upgrades for both customer engagement and operational efficiency.

| Technology Focus | Key Initiatives | Impact/Growth (2023-2024 Data) |

|---|---|---|

| Digital Transformation | Investment in IT, digitalization of processes | 12.5% increase in IT expenditure (2023) |

| Mobile Banking | Enhancement of AFFINAlwaysX app, advanced security features | Over 20% year-on-year growth in mobile banking adoption (early 2024) |

| AI & Data Analytics | Personalized financial solutions, data-driven insights | Significant increase in digital transactions noted (2023) |

| Fintech Integration | Partnerships for integrated services (e.g., Bursa Malaysia, TNG Digital) | Positioning to leverage growth in digital banks and e-wallets |

Legal factors

Affin Bank's operations are governed by the stringent regulations of Bank Negara Malaysia (BNM) and the Malaysian Companies Act 2016, ensuring adherence to capital adequacy ratios and risk management practices. For instance, BNM's Risk-Weighted Capital Adequacy Framework (RWCR) dictates minimum capital requirements, with the Common Equity Tier 1 (CET1) ratio for Malaysian banking institutions averaging around 13.5% as of late 2024, providing a stable operational environment.

Compliance with these legal frameworks is paramount, impacting everything from product development and customer data protection to anti-money laundering (AML) and counter-terrorism financing (CTF) measures. Failure to comply can result in significant penalties, underscoring the critical importance of robust legal and compliance departments within Affin Bank.

Affin Bank, like all financial institutions in Malaysia, operates under a robust framework of Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws. These regulations are critical for preventing financial crimes and safeguarding the integrity of the nation's financial system. Recent enforcement actions, such as the Bank Negara Malaysia's (BNM) ongoing supervision and potential penalties for non-compliance, underscore the continuous focus on these areas within the Malaysian banking sector.

Consumer protection laws are critical for financial institutions like Affin Bank, dictating fair treatment, transparent dealings, and robust complaint resolution mechanisms. Adherence to these regulations, such as those enforced by Bank Negara Malaysia, ensures customer trust and operational integrity.

Affin Bank's stated commitment to 'Unrivalled Customer Service' directly aligns with these legal mandates, aiming to build strong customer relationships through responsible financial practices. This focus is increasingly important as regulatory bodies in 2024 and 2025 continue to emphasize consumer rights in the digital banking age.

Data Privacy and Protection Regulations

Malaysia's Personal Data Protection Act (PDPA) continues to be a cornerstone for Affin Bank's operations, especially as digital engagement grows. The bank must meticulously adhere to these regulations when managing customer information across its diverse digital channels and services. This ensures trust and mitigates risks associated with data breaches.

Compliance with data privacy laws is not just a legal obligation but a strategic imperative for Affin Bank. In 2024, the global focus on data security intensified, with significant fines levied against institutions for non-compliance. Affin Bank's commitment to robust data protection practices, including secure data handling and transparent privacy policies, is therefore paramount for maintaining customer confidence and operational integrity. By 2025, the evolving landscape of data protection will likely demand even more sophisticated security measures and proactive compliance strategies.

- PDPA Compliance: Affin Bank must ensure all digital platforms and services strictly adhere to the Personal Data Protection Act 2010.

- Customer Data Security: Implementing advanced cybersecurity measures to protect sensitive customer information from unauthorized access or breaches.

- Regulatory Scrutiny: Anticipating increased regulatory oversight and potential penalties for data privacy violations in the coming years.

- Digital Trust: Building and maintaining customer trust through transparent data handling practices and a strong commitment to privacy.

ESG-Related Disclosure Requirements

Malaysia's regulatory environment is increasingly focused on environmental, social, and governance (ESG) factors. The Securities Commission Malaysia introduced the National Sustainability Reporting Framework (NSRF) in 2023, aiming to standardize sustainability disclosures for listed companies. Bursa Malaysia has also bolstered its sustainability reporting requirements, pushing companies to provide more comprehensive data on their ESG performance.

As a publicly traded entity, Affin Bank is obligated to adhere to these evolving disclosure mandates. This includes reporting on climate-related risks and opportunities, aligning with global trends and investor expectations for transparency. For instance, the framework encourages reporting aligned with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations.

Key aspects of these legal factors for Affin Bank include:

- Mandatory ESG Reporting: Compliance with the NSRF and Bursa Malaysia's enhanced sustainability reporting guidelines is now a legal requirement for listed entities.

- Climate-Related Disclosures: Affin Bank must provide clear information on its climate-related risks and strategies, reflecting growing regulatory and stakeholder demands.

- Evolving Standards: The legal framework is dynamic, requiring continuous monitoring and adaptation of disclosure practices to remain compliant with emerging ESG regulations.

Affin Bank operates under a strict regulatory framework, including Bank Negara Malaysia (BNM) guidelines and the Companies Act 2016, which mandate capital adequacy and robust risk management. For example, BNM's Risk-Weighted Capital Adequacy Framework (RWCR) ensures banks maintain sufficient capital, with Common Equity Tier 1 (CET1) ratios for Malaysian banks averaging around 13.5% in late 2024, providing a stable operating environment.

Compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) laws is critical, with ongoing supervision and potential penalties from BNM for non-compliance. Furthermore, consumer protection laws, enforced by BNM, dictate fair treatment and transparent dealings, essential for maintaining customer trust and operational integrity, especially with the digital banking growth anticipated through 2025.

The Personal Data Protection Act (PDPA) governs Affin Bank's handling of customer information, a crucial aspect for digital engagement. In 2024, intensified global focus on data security means significant fines can be levied for breaches, making Affin Bank's commitment to advanced cybersecurity and transparent privacy policies vital for customer confidence and compliance by 2025.

Malaysia's push for Environmental, Social, and Governance (ESG) reporting, through initiatives like the Securities Commission Malaysia's National Sustainability Reporting Framework (NSRF) and Bursa Malaysia's enhanced guidelines, legally obligates Affin Bank to disclose climate-related risks and strategies, aligning with global trends and investor expectations for transparency.

| Legal Factor | Key Requirement | Impact on Affin Bank | Relevant Period |

|---|---|---|---|

| Capital Adequacy | Maintain minimum capital ratios (e.g., CET1) | Ensures financial stability and operational capacity | Ongoing (CET1 ~13.5% late 2024) |

| AML/CTF Compliance | Adhere to anti-financial crime regulations | Mitigates legal penalties and reputational risk | Ongoing (BNM supervision) |

| Data Protection (PDPA) | Secure customer data and ensure privacy | Builds customer trust and avoids data breach penalties | Ongoing (intensified in 2024/2025) |

| ESG Reporting | Disclose sustainability and climate-related information | Meets regulatory obligations and investor demands | Mandatory for listed entities (NSRF from 2023) |

Environmental factors

Affin Bank is actively working to shrink its environmental impact, particularly focusing on cutting carbon emissions. This commitment is evident in their strategic partnerships, such as collaborating with DHL Express to support sustainable aviation fuel initiatives, aiming to reduce the carbon intensity of air travel.

Further demonstrating their dedication to climate-neutral operations, Affin Bank has implemented tangible changes like installing solar panels across various branches. These efforts directly contribute to lowering their reliance on fossil fuels and reducing their overall carbon footprint.

Affin Bank's commitment to responsible banking is evident in its strategic pillar focused on 'Responsible Banking with Impact.' The bank is actively working to grow its sustainable financing portfolio, aiming to channel more capital towards environmentally and socially beneficial projects.

This strategic focus translates into exploring new opportunities within sustainable sectors and creating tailored financing solutions. For instance, Affin Bank is developing green financing options specifically for renewable energy projects like solar and biogas installations, supporting the transition to a lower-carbon economy.

In 2023, Affin Bank reported a 12% increase in its sustainable financing portfolio, reaching RM1.5 billion. The bank has set a target to double this figure to RM3 billion by the end of 2025, demonstrating a clear and ambitious growth trajectory in green investments.

Affin Bank is actively pursuing sustainable operations, evidenced by its initiatives to cut down on water and paper consumption. These efforts reflect a growing awareness of the environmental impact of banking operations.

The bank's new headquarters, achieving both Green Building Index (GBI) and LEED Gold certifications, underscores a significant commitment to energy efficiency and broader environmental mitigation strategies. This physical manifestation of their green policy is a key indicator of their long-term environmental focus.

Environmental Risk Management in Lending

Affin Bank is actively integrating Environmental, Social, and Governance (ESG) risk factors into its lending processes. This strategic shift involves a thorough assessment of the environmental footprint of businesses and projects seeking finance, directly supporting Bank Negara Malaysia's guidelines on managing climate-related risks.

This commitment is crucial as global financial institutions increasingly prioritize sustainability. For instance, in 2024, the financial sector saw a significant rise in green bond issuances, reflecting a growing investor demand for environmentally conscious investments. Affin Bank's proactive stance positions it to navigate these evolving market dynamics and regulatory expectations.

- ESG Integration: Affin Bank is embedding ESG criteria into its credit risk evaluation framework.

- Climate Risk Alignment: The bank is aligning its practices with Bank Negara Malaysia's climate risk management policies.

- Market Trends: The global financial market is experiencing a surge in demand for sustainable finance options.

- Risk Mitigation: This approach helps mitigate potential financial losses arising from environmental liabilities and regulatory changes.

Biodiversity and Ecosystem Protection

Affin Bank's corporate social responsibility (CSR) efforts actively engage in environmental stewardship, notably through its support for projects like the rehabilitation of the Klang River. This initiative directly addresses the critical need for biodiversity and ecosystem protection, aiming to restore ecological balance within a vital urban waterway.

These environmental programs underscore Affin Bank's dedication to broader ecological well-being, recognizing the interconnectedness of financial institutions with environmental health. Such actions contribute to a more sustainable future by preserving natural resources and habitats.

- Klang River Rehabilitation: Affin Bank has actively participated in initiatives to clean and restore the Klang River, a significant urban ecosystem.

- Biodiversity Focus: The bank's environmental CSR strategy prioritizes projects that directly contribute to the protection and enhancement of local biodiversity.

- Ecosystem Health: By supporting ecosystem protection, Affin Bank aims to improve the overall health and resilience of natural environments within its operational areas.

Affin Bank is actively reducing its environmental footprint through initiatives like solar panel installations at branches and a focus on sustainable financing. The bank aims to double its sustainable financing portfolio to RM3 billion by the end of 2025, up from RM1.5 billion in 2023.

The bank's commitment extends to its operations, with efforts to decrease water and paper consumption and achieving Green Building Index and LEED Gold certifications for its new headquarters, emphasizing energy efficiency.

Affin Bank integrates ESG risk factors into its lending, aligning with Bank Negara Malaysia's climate risk management guidelines and responding to the growing global demand for sustainable investments, evidenced by a significant rise in green bond issuances in 2024.

Furthermore, Affin Bank engages in environmental stewardship through CSR projects, such as supporting the rehabilitation of the Klang River to protect biodiversity and improve ecosystem health.

| Environmental Initiative | Target/Status | Year |

|---|---|---|

| Sustainable Financing Portfolio Growth | Doubling to RM3 billion | By end of 2025 |

| Sustainable Financing Portfolio Value | RM1.5 billion | 2023 |

| New Headquarters Certification | Green Building Index (GBI) & LEED Gold | Achieved |

| Klang River Rehabilitation Support | Active participation | Ongoing |

PESTLE Analysis Data Sources

Our Affin Bank PESTLE Analysis is built on a robust foundation of data from official government reports, reputable financial institutions, and leading market research firms. We meticulously gather insights on political stability, economic indicators, technological advancements, and social trends to ensure comprehensive coverage.