Affin Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Affin Bank Bundle

Curious about Affin Bank's strategic framework? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational success. Discover how they achieve competitive advantage.

Unlock the full strategic blueprint behind Affin Bank's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Affin Bank actively collaborates with technology providers and fintech companies to bolster its digital banking capabilities. These partnerships are instrumental in developing and refining their mobile applications, enhancing core banking systems, and integrating cutting-edge technologies like advanced analytics and artificial intelligence. This strategic alignment directly supports Affin Bank's commitment to digital leadership and elevates the overall customer experience.

The bank's ongoing digital transformation journey, exemplified by the planned launch of a new digital core and a revamped mobile application in Q1 2025, underscores the critical role of these technology alliances. Such initiatives are designed to streamline operations, offer more personalized services, and maintain a competitive edge in the rapidly evolving financial landscape.

Affin Bank's strategic alliances with Generali Life Insurance Malaysia Berhad and Generali Insurance Malaysia Berhad are pivotal. These collaborations enable Affin Bank to offer a broad spectrum of financial products, including life and general insurance, thereby enhancing its value proposition to customers.

Through these key partnerships, Affin Bank effectively cross-sells insurance products, creating integrated financial solutions. This synergy allows them to cater to diverse customer needs, extending their reach beyond core banking services and fostering deeper customer relationships.

Affin Bank actively cultivates relationships with government agencies and Government-Linked Companies (GLCs). These collaborations are crucial for expanding its loan portfolio and attracting substantial deposit growth.

For instance, the Sarawak state government's strategic investment in Affin Bank, potentially increasing its stake, highlights the value of these partnerships. This move is anticipated to unlock significant opportunities for loan expansion and bolster deposit inflows, directly contributing to regional economic development initiatives.

Sustainability and ESG Partners

Affin Bank actively collaborates with sustainability experts like Chemsain Sustainability Sdn. Bhd. to integrate robust Environmental, Social, and Governance (ESG) principles across its operations. This partnership is crucial for developing and implementing effective sustainability strategies, ensuring compliance, and driving positive environmental and social impact.

Further strengthening its commitment to environmental stewardship, Affin Bank has partnered with Landasan Lumayan Sdn. Bhd. This collaboration directly supports initiatives like the Klang River cleaning project, demonstrating a tangible effort to improve local ecosystems. These partnerships are vital for Affin Bank to meet its ESG targets and contribute to a more sustainable future.

- Strategic Alignment: Partnerships with Chemsain Sustainability Sdn. Bhd. and Landasan Lumayan Sdn. Bhd. align Affin Bank's business objectives with critical ESG goals.

- SME Empowerment: These collaborations focus on equipping Small and Medium Enterprises (SMEs) with the knowledge and tools to adopt sustainable business practices, fostering a greener economy.

- Environmental Impact: Direct participation in environmental conservation, such as the Klang River cleaning project, showcases a hands-on approach to ecological responsibility.

- ESG Integration: The partnerships facilitate the embedding of ESG considerations into Affin Bank's core business model, enhancing its reputation and long-term value creation.

Industry Associations and Professional Bodies

Affin Bank actively engages with industry associations and professional bodies to stay informed about evolving regulations, best practices, and emerging market trends. This engagement is crucial for maintaining compliance and adapting to the dynamic financial landscape. For instance, in 2023, Affin Bank participated in events like the CGS International Malaysian Corporate Day, fostering connections and gaining insights into market sentiment and corporate strategies.

These partnerships are instrumental in facilitating knowledge exchange and driving collective industry advancement. By collaborating with peers and experts, Affin Bank contributes to and benefits from shared learning experiences. This can lead to the adoption of innovative solutions and a stronger overall financial sector in Malaysia.

Key benefits derived from these affiliations include:

- Enhanced Regulatory Awareness: Staying ahead of new financial regulations and compliance requirements.

- Industry Best Practices: Adopting and contributing to the highest standards of banking operations and customer service.

- Market Trend Identification: Gaining early insights into shifts in consumer behavior and economic conditions.

- Networking and Collaboration: Building relationships with other financial institutions and stakeholders for potential future collaborations.

Affin Bank's key partnerships extend to technology providers and fintech firms, crucial for its digital transformation, including a planned revamped mobile app in Q1 2025. Strategic alliances with Generali entities allow for cross-selling insurance products, enriching its financial solutions. Collaborations with government agencies and GLCs, like the Sarawak state government's potential investment, aim to boost loan portfolios and deposits.

What is included in the product

Affin Bank's Business Model Canvas outlines its strategy for serving diverse customer segments through various channels, delivering tailored value propositions like digital banking and Islamic finance, and leveraging key partnerships and resources to drive revenue and manage costs.

Affin Bank's Business Model Canvas offers a structured approach to identifying and addressing key customer pains, enabling the bank to design targeted solutions and value propositions.

It streamlines the process of understanding and alleviating customer frustrations by clearly outlining the customer segments and their associated problems.

Activities

Affin Bank's core activities revolve around providing a comprehensive suite of banking services. These include consumer banking, catering to individual needs with products like savings accounts and personal loans; commercial banking, supporting businesses with corporate financing and trade services; and investment banking, offering capital markets solutions and advisory. In 2024, Affin Bank continued to focus on enhancing its digital offerings to streamline these operations and improve customer experience, a trend observed across the Malaysian banking sector.

Affin Bank's digital transformation is a cornerstone, focusing on upgrading core systems and launching user-friendly mobile platforms like AffinAlways and AFFINMAX 2.0. This strategic push is designed to deepen customer relationships through digital channels and streamline internal operations.

In 2023, Affin Bank reported a significant increase in digital transactions, with mobile banking usage growing substantially, reflecting the success of these initiatives in driving digital adoption and engagement among its customer base.

Affin Islamic Bank Berhad, a key subsidiary, is central to Affin Bank's strategy, offering a full suite of Shariah-compliant financial products and services. This focus allows them to tap into a growing market segment seeking ethical and faith-based financial solutions.

The development and marketing of these Islamic banking solutions are crucial activities, ensuring adherence to Shariah principles across all offerings. This commitment caters to a specific, often underserved, market and strengthens Affin Bank's position as a provider of diverse financial options.

In 2023, Affin Islamic Bank Berhad's financing portfolio demonstrated robust growth, contributing significantly to the Group's overall loan book. This segment’s expansion underscores the increasing demand for Shariah-compliant products and Affin Bank's successful engagement with this market.

Risk Management and Compliance

Affin Bank's key activities heavily rely on maintaining robust risk management frameworks and ensuring strict compliance with all relevant regulatory standards. This is fundamental to safeguarding its financial stability and reputation in the market. For instance, adhering to Malaysian Financial Reporting Standards, the Companies Act 2016, and Bursa Malaysia Listing Requirements are non-negotiable aspects of their operations.

These activities encompass a broad spectrum of risk mitigation strategies. This includes rigorous credit risk assessment to evaluate borrower creditworthiness, comprehensive operational risk management to identify and address potential disruptions, and unwavering adherence to corporate governance guidelines. These measures are crucial for building trust and ensuring the long-term viability of the bank.

In 2024, the financial sector continued to face evolving regulatory landscapes. Affin Bank's commitment to these principles is demonstrated through its ongoing investments in technology and talent to enhance its risk and compliance functions. For example, the bank actively participates in industry-wide initiatives aimed at strengthening financial resilience and combating financial crime, reflecting its proactive approach to risk management.

- Credit Risk Assessment: Implementing sophisticated models to evaluate loan applications and manage portfolio risk.

- Operational Risk Management: Establishing controls and procedures to minimize losses from inadequate or failed internal processes, people, and systems, or from external events.

- Regulatory Compliance: Ensuring adherence to all applicable laws, regulations, and guidelines set forth by Bank Negara Malaysia and other relevant authorities.

- Corporate Governance: Upholding high standards of ethical conduct, transparency, and accountability in all business dealings.

Branch Network Expansion and Optimization

Affin Bank is strategically expanding its physical branch network to bolster its presence in key growth areas. This includes targeted expansion in regions such as Penang, Johor, Sarawak, and Sabah, aiming to capture new customer segments and drive future revenue. The bank is also focusing on optimizing its existing branch operations to ensure efficiency and better serve its clientele.

This expansion is a cornerstone of Affin Bank's strategy to enhance geographical coverage and support its long-term objectives for loan and fee income growth. By increasing its footprint in underserved or high-potential markets, the bank aims to become more accessible and competitive across Malaysia.

- Branch Network Expansion: Plans to increase branch count in Penang, Johor, Sarawak, and Sabah.

- Geographical Reach: Enhancing presence in key Malaysian regions to access new customer bases.

- Revenue Growth: Supporting long-term loan and fee income generation through expanded physical touchpoints.

- Operational Optimization: Streamlining existing branch operations for improved efficiency and customer service.

Affin Bank's key activities are multifaceted, encompassing retail and commercial banking, digital platform development, and Islamic finance operations. They also prioritize robust risk management and regulatory compliance, alongside strategic physical branch expansion in key Malaysian regions.

In 2024, Affin Bank continued its digital transformation, enhancing its AffinAlways and AFFINMAX 2.0 platforms to improve customer experience and operational efficiency. Affin Islamic Bank Berhad, a vital subsidiary, saw continued growth in its Shariah-compliant financing portfolio, underscoring the demand for ethical financial products.

| Key Activity | Focus Area | 2024/2023 Highlight |

|---|---|---|

| Digital Banking | Platform enhancement & user experience | Increased digital transactions and mobile banking adoption |

| Islamic Banking | Shariah-compliant product development | Robust growth in financing portfolio for Affin Islamic Bank |

| Risk Management & Compliance | Adherence to regulations & governance | Investment in technology and talent for enhanced functions |

| Branch Network Expansion | Geographical reach in growth areas | Targeted expansion in Penang, Johor, Sarawak, and Sabah |

What You See Is What You Get

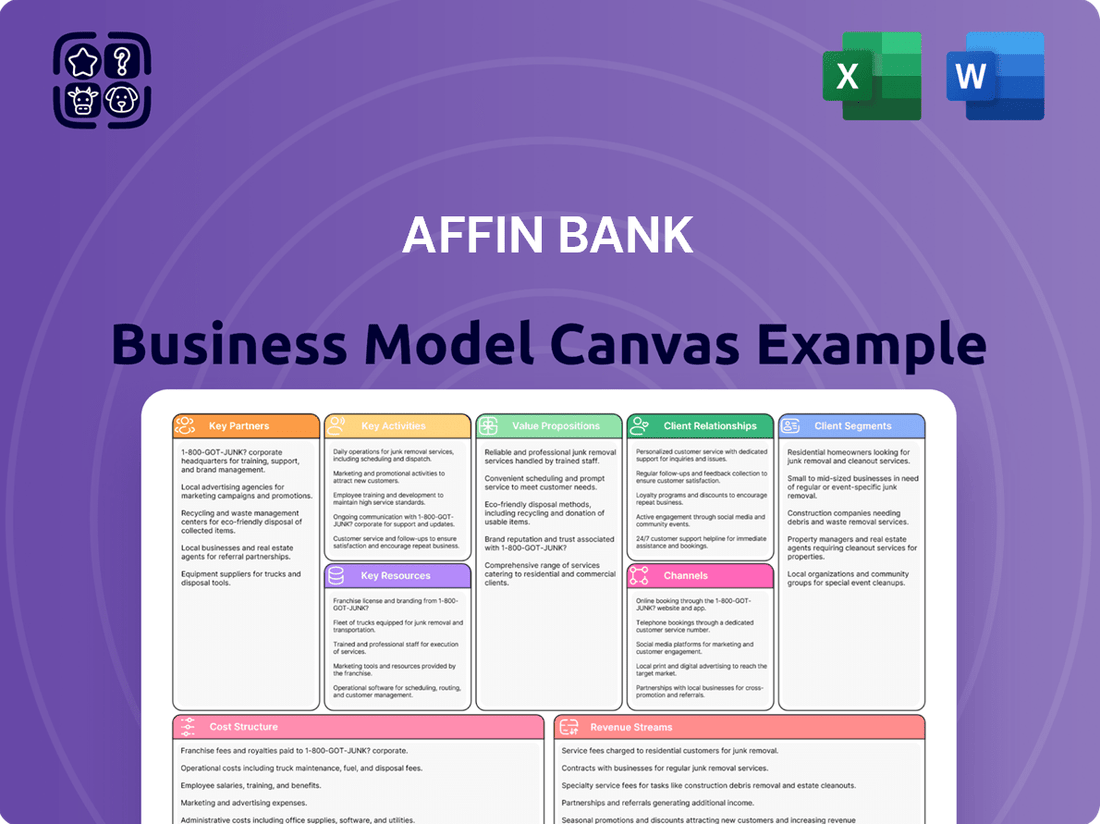

Business Model Canvas

The Affin Bank Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, unedited structure and content that will be delivered to you, ensuring no discrepancies or surprises. Once your order is processed, you will gain full access to this exact Business Model Canvas, ready for immediate use and customization.

Resources

Affin Bank's financial capital, comprising shareholder equity and customer deposits, is its bedrock. In 2024, the bank focused on strengthening its funding base, with customer deposits forming a significant portion.

The bank's Current Account and Savings Account (CASA) ratio is a key indicator of its funding stability and cost-efficiency. A healthy CASA ratio means more low-cost funds, directly boosting profitability.

Beyond deposits, Affin Bank also leverages access to interbank funding markets to manage its liquidity and meet its financial obligations. This diverse funding approach ensures operational resilience.

Affin Bank's human capital is a cornerstone of its operations, encompassing a diverse range of skills essential across its consumer, commercial, investment, and Islamic banking divisions. This expertise, found in financial analysts, relationship managers, IT specialists, and leadership, directly fuels innovation in product development, elevates customer service standards, and ensures the effective execution of the bank's strategic initiatives.

In 2024, Affin Bank continued to invest in its people, with a focus on upskilling and reskilling programs designed to meet the evolving demands of the financial sector. For instance, the bank reported a significant increase in training hours per employee, particularly in areas like digital banking and cybersecurity, reflecting a commitment to maintaining a competitive edge through enhanced expertise.

Affin Bank's technology infrastructure is built on advanced IT systems, including its core banking platform. This robust foundation supports all banking operations and digital service delivery.

Key digital platforms like the AffinAlways mobile app and AFFINMAX 2.0 are central to customer engagement and transaction processing. These platforms are continuously updated to offer seamless and secure user experiences.

The bank leverages sophisticated data analytics capabilities to gain insights into customer behavior and market trends. For instance, in 2023, Affin Bank reported a significant increase in digital transactions, underscoring the effectiveness of its digital platforms.

Brand Reputation and Trust

Affin Bank's established brand reputation and the trust it has cultivated among its customers and stakeholders in Malaysia are significant intangible assets. This strong reputation directly translates into customer loyalty, acting as a powerful magnet for attracting new clients and reinforcing its standing in the highly competitive Malaysian financial services landscape.

In 2024, Affin Bank continued to leverage its brand equity. For instance, its customer satisfaction scores remained robust, reflecting the trust placed in its services. This trust is a cornerstone for customer retention, with a significant portion of its retail banking base being long-term customers, a testament to the bank's consistent service delivery and commitment.

- Brand Recognition: Affin Bank is a well-recognized name in Malaysia, associated with reliability and financial stability.

- Customer Loyalty: The bank benefits from a loyal customer base, a direct result of its long-standing presence and commitment to customer service.

- Market Trust: In 2024, Affin Bank's market capitalization reflected investor confidence, underscoring the trust stakeholders place in its management and strategic direction.

Physical Branch Network and ATM Infrastructure

Affin Bank's extensive physical branch network and ATM infrastructure are cornerstones of its customer engagement strategy. These locations act as crucial points for daily banking needs, from simple transactions to personalized financial advice. As of the first quarter of 2024, Affin Bank operated over 100 branches nationwide, demonstrating a commitment to physical accessibility.

This physical presence is complemented by a robust ATM network, ensuring customers can access services conveniently. The bank continues to invest in expanding and modernizing this infrastructure, aiming to enhance customer experience and solidify its market reach across Malaysia. This strategic expansion is designed to capture new customer segments and strengthen relationships with existing ones.

- Branch Network: Over 100 physical branches across Malaysia as of Q1 2024.

- ATM Infrastructure: Significant ATM presence supporting widespread customer access.

- Strategic Focus: Ongoing expansion and modernization to broaden reach and improve service delivery.

Affin Bank's intellectual capital encompasses its proprietary software, data analytics capabilities, and the accumulated knowledge within its workforce. This includes the development of innovative digital banking solutions and the strategic insights derived from market analysis.

In 2024, the bank continued to refine its data analytics tools, enabling more personalized customer offerings and improved risk management. This focus on intellectual property is vital for maintaining a competitive edge in the digital age.

The bank’s intellectual capital also includes its established processes and methodologies for product development and service delivery, ensuring consistency and efficiency across its operations.

| Key Resource | Description | 2024 Focus/Data |

|---|---|---|

| Financial Capital | Shareholder equity and customer deposits | Strengthened funding base, significant CASA ratio |

| Human Capital | Skilled workforce across divisions | Increased training hours, focus on digital and cybersecurity skills |

| Technology Infrastructure | Core banking platform, digital apps | Continuous updates for seamless user experience, increased digital transactions |

| Brand Reputation | Trust and loyalty of customers and stakeholders | Robust customer satisfaction scores, high retention of long-term customers |

| Physical Infrastructure | Branch network and ATM infrastructure | Over 100 branches (Q1 2024), ongoing network modernization |

| Intellectual Capital | Proprietary software, data analytics, accumulated knowledge | Refined data analytics for personalization and risk management |

Value Propositions

Affin Bank provides a complete suite of financial offerings, encompassing consumer, commercial, and investment banking, alongside insurance. This integrated model serves as a convenient, single point of access for individuals, small and medium-sized enterprises (SMEs), and large corporations, simplifying their financial management.

In 2024, Affin Bank reported a net profit of RM1.01 billion, demonstrating its robust financial performance across its diverse product lines. This strong outcome reflects the bank's ability to effectively serve a broad customer base with tailored financial solutions.

Affin Bank champions 'Unrivalled Customer Service,' focusing on crafting personalized financial solutions that align with each customer's unique goals. This customer-centric approach is a cornerstone of their business model, ensuring clients feel understood and supported in their financial journeys.

A prime example of this commitment is the introduction of Affin Diventium, a specialized offering designed for Ultra-High-Net-Worth Individuals. This initiative provides bespoke financial advisory services, demonstrating the bank's dedication to delivering tailored expertise for its most discerning clients.

Affin Bank's commitment to digital convenience is evident in its ongoing transformation, highlighted by the launch of its new digital core and the AffinAlwaysX mobile app. This strategic move aims to deliver a truly seamless and user-friendly banking experience for all customers.

This digital leadership empowers users with timely and personalized financial solutions, making banking more accessible and efficient. By prioritizing innovation, Affin Bank ensures its customers can manage their finances with ease, anytime and anywhere.

Shariah-Compliant Offerings

Affin Islamic Bank Berhad offers a unique value by providing innovative Shariah-compliant financial products and services. This focus attracts clients who prioritize ethical and Islamic finance principles, establishing Affin as a significant contributor in this specialized market.

Their Shariah-compliant offerings are designed to meet the growing demand for ethical investments and banking. For instance, in 2023, the Islamic finance sector in Malaysia continued its robust expansion, with total assets reaching RM1.38 trillion, demonstrating a clear market opportunity.

Affin Islamic's commitment to this segment is reflected in its diverse product suite, which includes:

- Savings and Current Accounts that adhere to Shariah principles, offering a safe and ethical way to manage funds.

- Financing solutions such as home and personal financing, structured to comply with Islamic law, avoiding interest-based transactions.

- Investment products that align with Shariah screening criteria, providing opportunities for ethical wealth growth.

- Digital banking services integrated with Shariah-compliant features, ensuring accessibility and convenience for all customers.

Commitment to Sustainability and Responsible Banking

Affin Bank is actively integrating sustainability into its core operations, aligning with Environmental, Social, and Governance (ESG) principles. This commitment is designed to attract customers and investors who prioritize responsible banking, underscoring the bank's dedication to a positive corporate ethos.

The bank aims to significantly increase the proportion of its loan book dedicated to ESG financing. For instance, in 2024, Affin Bank continued its focus on green financing initiatives, with a specific target to grow its sustainable finance portfolio. This strategic move not only addresses growing market demand but also positions Affin Bank as a leader in responsible financial practices within the region.

- ESG Integration: Affin Bank prioritizes ESG principles across its business, aiming to embed sustainability into its decision-making processes and product offerings.

- Sustainable Financing Growth: The bank has set ambitious targets for its ESG-related loan book, reflecting a commitment to channeling capital towards environmentally and socially beneficial projects.

- Customer and Investor Appeal: This focus on sustainability resonates with a growing segment of customers and investors who seek financial institutions with a strong commitment to responsible business practices.

- Corporate Ethos: Affin Bank's dedication to sustainability showcases a responsible corporate identity, enhancing its reputation and long-term value proposition.

Affin Bank offers a comprehensive financial ecosystem, providing everything from personal banking and SME solutions to corporate and investment services, all under one roof. This integrated approach simplifies financial management for a diverse clientele, from individuals to large enterprises.

The bank's commitment to customer-centricity is demonstrated by its focus on personalized financial advice, exemplified by specialized offerings like Affin Diventium for high-net-worth individuals. This tailored approach ensures clients receive solutions that precisely match their unique financial aspirations.

Affin Bank is enhancing customer experience through significant digital investments, including a new core banking system and the AffinAlwaysX mobile app, to provide seamless and accessible financial services. This digital transformation aims to deliver timely, personalized solutions, making banking more convenient than ever.

Affin Islamic Bank distinguishes itself by offering a robust suite of Shariah-compliant products, catering to the growing demand for ethical financial solutions. This strategic focus taps into a significant market segment, reinforcing Affin's position in Islamic finance.

The bank's dedication to sustainability and ESG principles is a key value proposition, attracting clients and investors who prioritize responsible banking. Affin Bank is actively growing its sustainable finance portfolio, aiming to channel capital towards positive environmental and social impact.

| Value Proposition | Description | Key Metric/Example |

|---|---|---|

| Comprehensive Financial Solutions | Integrated consumer, commercial, and investment banking, plus insurance. | RM1.01 billion net profit in 2024, reflecting broad service effectiveness. |

| Personalized Customer Service | Tailored financial advice and solutions for individual needs. | Affin Diventium offering for Ultra-High-Net-Worth Individuals. |

| Digital Convenience | Seamless banking experience via new digital core and mobile app. | AffinAlwaysX mobile app launch for enhanced accessibility. |

| Shariah-Compliant Offerings | Innovative financial products adhering to Islamic principles. | Serving the growing Malaysian Islamic finance market (RM1.38 trillion total assets in 2023). |

| Commitment to Sustainability (ESG) | Integrating ESG principles into operations and financing. | Focus on growing the sustainable finance portfolio and ESG-related loan book. |

Customer Relationships

Affin Bank cultivates deep, personalized connections, especially within its Affin Diventium private banking and for significant corporate clients. Dedicated relationship managers are key, offering bespoke financial guidance and solutions to meet individual client needs.

Affin Bank enhances customer relationships through robust digital engagement, exemplified by its AffinAlways mobile app and AFFINMAX 2.0 platform. These digital channels empower customers with self-service capabilities, allowing for seamless account management and transaction processing, thereby fostering convenience and accessibility.

In 2024, Affin Bank continued to prioritize digital transformation, aiming to deepen customer interaction. While specific engagement metrics for these platforms are proprietary, the industry trend shows a significant shift towards digital banking, with a substantial portion of transactions and inquiries being handled through mobile applications. This digital-first approach is crucial for meeting evolving customer expectations for immediate and on-demand financial services.

Affin Bank offers dedicated customer service through multiple channels, including a responsive call center, knowledgeable branch staff, and convenient online inquiry forms. This multi-channel approach ensures customers can easily reach out for assistance, reflecting their commitment to providing unrivalled customer service.

Community Engagement and Financial Literacy Programs

Affin Bank actively cultivates customer relationships through dedicated community engagement and financial literacy programs. These initiatives are designed to build trust and foster long-term loyalty by providing tangible value beyond traditional banking services.

In 2024, Affin Bank continued its commitment to community development. For example, its SME empowerment programs provided crucial support to local businesses, enhancing their operational capabilities and financial understanding. These efforts directly contribute to stronger, more resilient local economies.

Furthermore, Affin Bank's financial literacy outreach aims to equip individuals with essential money management skills. By offering workshops and educational resources, the bank empowers customers to make more informed financial decisions, solidifying its role as a trusted financial partner.

- Community Support: Affin Bank's CSR activities in 2024 focused on areas like education and environmental sustainability, creating positive brand perception and deeper community ties.

- SME Empowerment: Initiatives like mentorship and access to capital for small and medium enterprises in 2024 aimed to foster growth and build lasting relationships with business clients.

- Financial Literacy: Programs conducted throughout 2024 reached thousands of participants, enhancing their financial knowledge and reinforcing Affin Bank's commitment to customer well-being.

Feedback Mechanisms and Service Improvement

Affin Bank prioritizes understanding its customers through active feedback collection. This involves utilizing channels like customer surveys and direct engagement to identify areas for enhancement in their banking products and services.

A key indicator of success in customer relationships is a strong Net Promoter Score (NPS). For instance, in 2023, the Malaysian banking sector saw an average NPS of +25, suggesting that while customer satisfaction is generally positive, there's always room for banks like Affin to differentiate themselves by fostering even greater loyalty and advocacy.

- Actively solicit feedback: Affin Bank implements regular customer surveys and encourages direct interaction to gather insights.

- Respond to feedback: The bank analyzes feedback to identify trends and implement service improvements.

- Monitor NPS: A high Net Promoter Score is a target, reflecting strong customer satisfaction and loyalty.

- Service enhancement: Continuous improvement of products and services is driven by customer input.

Affin Bank focuses on personalized relationships, particularly for its private banking clients and major corporate accounts, leveraging dedicated relationship managers for tailored financial advice. Digital platforms like AffinAlways and AFFINMAX 2.0 are central to this strategy, offering customers convenient self-service options and enhancing engagement through a digital-first approach. In 2024, the bank continued investing in digital transformation to deepen these interactions, aligning with industry trends where mobile banking transactions are increasingly dominant.

| Customer Relationship Strategy | Key Initiatives | 2024 Focus/Impact |

|---|---|---|

| Personalized Engagement | Dedicated Relationship Managers | Bespoke financial guidance for private banking and corporate clients. |

| Digital Channels | AffinAlways Mobile App, AFFINMAX 2.0 | Enhanced self-service, seamless account management, driving digital adoption. |

| Community & Education | SME Empowerment, Financial Literacy Programs | Building trust and loyalty through value-added services and community support. |

| Feedback & Improvement | Customer Surveys, NPS Monitoring | Service enhancement based on direct customer input, aiming for higher loyalty. |

Channels

Affin Bank leverages its extensive branch network across Malaysia as a core component of its customer engagement strategy. These physical locations are crucial for a wide array of services, from initial account opening to complex loan processing, acting as direct conduits for customer relationships and transactions.

The bank's commitment to physical presence is underscored by its strategic plans for further expansion, aiming to broaden its geographical reach and accessibility. As of the first quarter of 2024, Affin Bank maintained over 100 branches nationwide, a testament to its dedication to serving diverse customer segments across urban and rural areas.

Affin Bank's digital banking platforms are central to its customer relationships. The AffinAlways mobile app caters to personal banking needs, offering a seamless experience for everyday transactions and account management. For its corporate clients, AFFINMAX 2.0 provides a comprehensive suite of online banking tools, facilitating efficient business operations.

These digital channels are key to Affin Bank's strategy of providing accessible and convenient banking services. By enabling customers to bank from anywhere, anytime, the bank strengthens its customer engagement and operational efficiency. This digital focus is crucial for meeting evolving customer expectations in the modern financial landscape.

Affin Bank's ATM network serves as a crucial customer touchpoint, offering round-the-clock access to fundamental banking functions like cash withdrawals, deposits, and balance checks. This digital infrastructure significantly enhances customer convenience, extending banking accessibility beyond traditional branch hours and locations.

In 2024, Affin Bank continued to leverage its ATM network to complement its physical branch presence, ensuring customers have convenient options for everyday transactions. This strategy is vital for maintaining customer engagement and providing essential services efficiently across Malaysia.

Direct Sales Force and Relationship Managers

Affin Bank leverages a dedicated direct sales force and relationship managers, especially within its commercial, corporate, and private banking divisions. This approach ensures personalized engagement, which is vital for cultivating and keeping high-value clients. These teams are instrumental in delivering bespoke financial solutions that meet the complex needs of these segments.

This direct channel is a cornerstone for client acquisition and retention, particularly for those requiring sophisticated financial products and advisory services. By fostering strong relationships, Affin Bank aims to deepen client loyalty and unlock cross-selling opportunities, driving revenue growth.

In 2024, Affin Bank continued to emphasize its relationship-driven model. For instance, the bank's focus on high-net-worth individuals within its private banking segment saw continued investment in personalized advisory services. While specific figures for the direct sales force's contribution to new client acquisition in 2024 are proprietary, the strategy prioritizes quality over quantity, focusing on substantial deal sizes and long-term client value.

- Dedicated Teams: Specialized sales and relationship management teams for corporate, commercial, and private banking clients.

- Client Focus: Emphasis on acquiring and retaining high-value clients through personalized service.

- Tailored Solutions: Offering customized financial products and advisory to meet specific client needs.

- Relationship Building: Fostering strong, long-term client relationships to drive loyalty and growth.

Strategic Partnerships and Affiliates

Affin Bank strategically leverages partnerships to broaden its service offerings and customer reach. Collaborations with entities like Generali enhance its insurance product portfolio, providing customers with comprehensive financial solutions through an extended ecosystem.

These alliances are crucial for expanding market presence and delivering value beyond traditional banking services. For instance, by partnering with Generali, Affin Bank can tap into a wider customer base for insurance needs, thereby increasing cross-selling opportunities and revenue streams.

Furthermore, affiliations with organizations focused on ESG initiatives allow Affin Bank to integrate sustainability into its business model, attracting environmentally conscious customers and investors. This approach diversifies revenue and strengthens brand reputation by aligning with global sustainability trends.

- Strategic Alliances: Partnerships with insurance providers like Generali offer integrated financial solutions, expanding service delivery channels.

- ESG Initiatives: Collaborations on environmental, social, and governance projects broaden the bank's appeal to socially responsible customers.

- Ecosystem Expansion: These affiliations create a more robust service ecosystem, offering customers a wider array of financial and related products.

- Indirect Channel Growth: Partnerships enable access to new customer segments and revenue streams through third-party distribution.

Affin Bank utilizes a multi-channel approach to reach its diverse customer base. This includes a robust physical branch network, complemented by extensive digital banking platforms like the AffinAlways mobile app and AFFINMAX 2.0 for corporate clients. The bank also maintains a widespread ATM network for convenient, round-the-clock access to essential services.

Beyond direct customer interaction, Affin Bank employs dedicated relationship managers and sales teams, particularly for its corporate and private banking segments, focusing on personalized service for high-value clients. Strategic partnerships, such as with Generali for insurance products, further extend its reach and service offerings, creating an integrated financial ecosystem.

| Channel Type | Description | Key Services Offered | 2024 Focus/Data Point |

|---|---|---|---|

| Physical Branches | Extensive network across Malaysia | Account opening, loan processing, complex transactions | Over 100 branches nationwide (Q1 2024) |

| Digital Platforms (AffinAlways, AFFINMAX 2.0) | Mobile app and online portal | Everyday transactions, account management, corporate banking tools | Continued enhancement for seamless user experience |

| ATM Network | Nationwide accessibility | Cash withdrawal, deposits, balance inquiries | Complemented physical branches for 24/7 access |

| Direct Sales & Relationship Managers | Personalized engagement | High-value client acquisition, bespoke financial solutions | Continued investment in private banking advisory |

| Partnerships (e.g., Generali) | Extended ecosystem | Integrated insurance products, cross-selling opportunities | Broadening service offerings and customer reach |

Customer Segments

Affin Bank serves a wide array of individuals and consumers, offering everything from basic savings and current accounts to more complex financial solutions. This includes personal loans, mortgages for aspiring homeowners, and a variety of credit card options designed to meet different spending habits and needs.

For those looking to grow their wealth, Affin Bank provides comprehensive wealth management services. This segment is crucial for the bank, as it represents the backbone of retail banking operations, driving deposits and fee income. In 2023, the Malaysian banking sector saw continued growth in retail loans, with mortgages remaining a significant contributor to overall loan portfolios.

Affin Bank recognizes the crucial role of Small and Medium-Sized Enterprises (SMEs) in the economy, offering tailored banking and financing solutions. These include commercial loans for growth, trade finance to facilitate international business, and efficient cash management services to optimize liquidity. In 2023, SMEs represented a significant portion of Malaysia's business landscape, contributing substantially to GDP, highlighting their importance to Affin Bank's customer base.

Beyond core financial products, Affin Bank actively supports SME development through various initiatives. The bank's commitment to empowering these businesses is evident in its engagement with Environmental, Social, and Governance (ESG) programs. These programs aim to foster sustainable growth and resilience within the SME sector, aligning with broader economic development goals.

Large corporate clients represent a cornerstone for Affin Bank, demanding sophisticated financial solutions. These include substantial corporate loans, intricate investment banking services, robust treasury solutions, and complex debt capital market transactions. Affin Hwang Investment Bank Berhad is instrumental in catering to these needs, offering a full spectrum of services designed for large enterprises.

In 2024, the Malaysian corporate loan market saw significant activity. For instance, large corporations are increasingly seeking financing for expansion and infrastructure projects, with total corporate loan growth estimated to be around 5-7% for the year. Affin Bank, through its dedicated teams, aims to capture a substantial share of this market by providing tailored financing and advisory services that support the strategic objectives of these major businesses.

Ultra-High-Net-Worth Individuals (UHNWIs)

Affin Bank's AFFIN Diventium initiative is designed to cater to Ultra-High-Net-Worth Individuals (UHNWIs), a segment that demands highly personalized and exclusive financial services. This strategic focus recognizes the unique needs of those with substantial wealth, who are looking for more than just standard banking.

UHNWIs are characterized by their pursuit of bespoke wealth management solutions, sophisticated investment strategies, and comprehensive financial advisory. They expect a high-touch service model that anticipates their needs and provides tailored guidance for wealth preservation and growth.

- Targeted Offerings: AFFIN Diventium provides exclusive private banking, personalized wealth management, and sophisticated financial advisory services specifically for UHNWIs.

- Client Expectations: This segment actively seeks bespoke and high-touch financial solutions, valuing discretion, expertise, and a deep understanding of their complex financial situations.

- Market Context: The global UHNWI population continued to grow, with Asia showing significant expansion in wealth accumulation, underscoring the strategic importance of this segment. For instance, in 2023, the number of UHNWIs globally saw an increase, with many Asian nations contributing to this trend.

Shariah-Compliant Clientele

Affin Islamic Bank Berhad caters to a distinct segment of customers who prioritize financial dealings aligned with Islamic law. This involves individuals and organizations actively seeking Shariah-compliant banking solutions.

These clients are looking for a range of products, including financing options, savings accounts, and investment vehicles that strictly adhere to Islamic principles, avoiding interest-based transactions and other prohibited activities.

- Shariah-Compliant Products: Offers a full suite of Islamic banking products, including Murabahah financing and Wadiah savings accounts.

- Ethical Investment: Provides investment opportunities that avoid industries like alcohol, gambling, and pork, aligning with ethical consumerism.

- Growing Market: The global Islamic finance market is substantial, with Malaysia being a key player, demonstrating a strong demand for these services. For instance, as of late 2023, Malaysia's Islamic banking assets represented a significant portion of the total banking system assets.

Affin Bank's customer segments are diverse, ranging from individual consumers seeking everyday banking and wealth growth to large corporations requiring complex financial solutions. The bank also focuses on the crucial SME sector, offering tailored financing and support, and has a dedicated offering for Ultra-High-Net-Worth Individuals through AFFIN Diventium. Additionally, Affin Islamic Bank caters to those preferring Shariah-compliant financial services.

| Customer Segment | Key Offerings | 2024 Market Insight |

|---|---|---|

| Individuals & Consumers | Savings, Current Accounts, Personal Loans, Mortgages, Credit Cards | Retail loan growth in Malaysia is expected to remain steady, with mortgages a key driver. |

| SMEs | Commercial Loans, Trade Finance, Cash Management, ESG Programs | SMEs are vital to Malaysia's GDP, with continued demand for financing to support expansion. |

| Large Corporate Clients | Corporate Loans, Investment Banking, Treasury Solutions, Debt Capital Markets | Corporate loan growth projected at 5-7% in 2024, driven by infrastructure and expansion projects. |

| Ultra-High-Net-Worth Individuals (UHNWIs) | Private Banking, Wealth Management, Financial Advisory | Global UHNWI population continues to expand, with Asia showing strong wealth accumulation trends. |

| Shariah-Compliant Customers | Islamic Financing, Wadiah Savings Accounts, Shariah-Compliant Investments | The global Islamic finance market is robust, with Malaysia a significant contributor. |

Cost Structure

Personnel costs are a major expense for Affin Bank, encompassing salaries, benefits, and ongoing training for its workforce. In 2023, the bank reported staff-related expenses as a significant component of its overall operating expenditure, reflecting the investment in its human capital.

Affin Bank's strategies, such as implementing early retirement schemes (ERS), can directly influence these personnel costs. For instance, such programs can lead to a reduction in headcount and associated salary outlays in the immediate term, though they may also involve upfront costs.

Affin Bank's cost structure is significantly influenced by its branch network and establishment expenses. These include the ongoing costs of rent, utilities, and maintaining the physical infrastructure for its branches. For instance, in 2023, Affin Bank reported operating expenses of RM 1.8 billion, a portion of which is directly attributable to its extensive branch operations.

The bank's strategy to increase its physical presence through new branch openings directly translates to higher recurring operating costs. This expansion, while aimed at broader customer reach, necessitates additional investment in property, staffing, and technology for each new location, impacting the overall cost base.

Affin Bank's commitment to technology and digital transformation involves substantial ongoing costs. These include significant investments in upgrading its IT infrastructure, modernizing digital core systems, and continuously developing its mobile banking application.

These expenditures are essential for staying competitive in the evolving financial landscape. For instance, in 2023, the banking sector saw a notable increase in technology spending, with many institutions allocating a larger portion of their budgets to digital initiatives to improve customer experience and operational efficiency.

Furthermore, robust cybersecurity measures represent a critical and recurring cost. Protecting customer data and ensuring the integrity of digital platforms requires substantial and consistent investment to counter growing cyber threats.

Marketing and Promotion Expenses

Affin Bank allocates significant resources to marketing and promotion to drive customer acquisition and product uptake. These expenses cover a wide array of activities, from digital advertising on social media platforms and search engines to traditional media buys and targeted promotional campaigns. In 2024, the bank continued its focus on digital channels, which often offer more measurable ROI, alongside efforts to build brand awareness and loyalty.

The bank's marketing strategy in 2024 emphasized digital transformation and customer-centric approaches. This included investment in content marketing, social media engagement, and personalized digital advertising to reach a broader audience and highlight specific banking solutions. The goal is to attract new customers and deepen relationships with existing ones by showcasing Affin Bank's value proposition.

- Digital Advertising: Significant spend on online ads across platforms like Google, Facebook, and Instagram to target specific demographics.

- Content Marketing: Creation of educational and engaging content, such as blog posts, webinars, and financial guides, to attract and retain customers.

- Brand Campaigns: Investment in broader advertising initiatives across television, radio, and print to enhance brand recognition and recall.

- Promotional Offers: Development and marketing of special offers, discounts, and loyalty programs to incentivize new account openings and product usage.

Regulatory and Compliance Costs

Affin Bank incurs significant expenses related to regulatory and compliance costs, a crucial element of its cost structure. These outlays are essential for adhering to the stringent banking regulations set forth by Malaysian authorities like Bank Negara Malaysia, ensuring operational integrity and risk mitigation. For instance, in 2023, the banking sector in Malaysia saw increased spending on compliance technology and personnel to meet evolving Anti-Money Laundering (AML) and Know Your Customer (KYC) standards.

These costs encompass a range of activities, including external audit fees, legal counsel for advisory services and dispute resolution, and the ongoing investment in robust internal control systems. Maintaining these frameworks is not just a legal necessity but also a strategic imperative to build and sustain customer trust and market reputation. The bank’s commitment to these areas directly impacts its ability to operate smoothly and avoid potential penalties.

- Audit Fees: Costs incurred for independent financial audits to ensure accuracy and compliance with accounting standards.

- Legal Costs: Expenses for legal advice, contract reviews, and managing litigation or regulatory inquiries.

- Compliance Technology: Investment in software and systems for monitoring transactions, managing data privacy, and reporting.

- Risk Management Frameworks: Expenditure on developing and maintaining policies, procedures, and personnel for credit, market, and operational risk.

Affin Bank's cost structure is heavily weighted towards personnel expenses, reflecting its substantial workforce and investment in talent. In 2023, staff-related costs were a significant operational expenditure. The bank's strategic use of programs like early retirement schemes can directly influence these costs by managing headcount and associated salary outlays.

The bank's extensive branch network and associated infrastructure represent another major cost. Rent, utilities, and maintenance for its physical locations contribute significantly to operating expenses, with RM 1.8 billion reported in operating expenses in 2023, a portion of which is tied to these outlets. Expanding this network further increases recurring operational costs.

Significant investments in technology and digital transformation are crucial, covering IT infrastructure upgrades and mobile app development. In 2023, the banking sector saw increased tech spending, with institutions like Affin Bank allocating more to digital initiatives for improved customer experience and efficiency. Cybersecurity measures are also a critical, ongoing expense to protect digital platforms.

Marketing and promotion costs are substantial, covering digital advertising, content marketing, and brand campaigns to drive customer acquisition. In 2024, the focus remained on digital channels for measurable ROI and brand building. Promotional offers and loyalty programs are also key expenditures to incentivize customer engagement.

Regulatory and compliance costs are essential, involving adherence to strict banking regulations from bodies like Bank Negara Malaysia. These costs include audit fees, legal counsel, and investment in compliance technology, with the banking sector in Malaysia increasing spending on AML and KYC standards in 2023. Robust internal control systems and risk management frameworks are also key areas of expenditure.

| Cost Category | Description | 2023 Relevance | 2024 Focus |

|---|---|---|---|

| Personnel Costs | Salaries, benefits, training | Significant operational expenditure | Ongoing investment in human capital |

| Branch Network & Infrastructure | Rent, utilities, maintenance | RM 1.8 billion in operating expenses (partly attributed) | Costs associated with expansion strategies |

| Technology & Digital Transformation | IT upgrades, digital systems, cybersecurity | Increased sector spending in 2023 | Essential for competitiveness and customer experience |

| Marketing & Promotion | Digital ads, content, brand campaigns | Focus on digital channels | Customer acquisition and brand awareness |

| Regulatory & Compliance | Audits, legal, compliance tech, risk management | Increased AML/KYC spending in sector | Ensuring operational integrity and trust |

Revenue Streams

Affin Bank's core revenue generation hinges on Net Interest Income (NII), the profit derived from the spread between interest earned on its assets, such as loans and investments, and interest paid on its liabilities, like customer deposits and borrowings. This is the bank's bread and butter, forming the bedrock of its financial performance.

In 2024, Affin Bank's NII demonstrated resilience, driven by strategic loan growth, especially within its community banking segment. This focus on expanding its loan portfolio, coupled with prudent management of its interest-earning assets and interest-bearing liabilities, directly fuels its NII performance.

Affin Bank generates significant revenue through its non-interest income, often called fee and commission income. This diversification is key to its business model, moving beyond just earning from loans.

In 2024, Affin Bank's fee and commission income streams are robust, driven by services like wealth management, stockbroking, and advisory offerings. These fees contribute substantially to the bank's overall profitability, showcasing its ability to monetize a wide range of financial services.

Affin Islamic Bank Berhad generates revenue from Shariah-compliant financing and banking solutions. This segment is a key growth area for the group, contributing significantly to overall profitability.

In 2024, Islamic banking revenue is a vital component of Affin Bank's financial performance, reflecting the increasing demand for ethical and faith-based financial products. This growing segment underscores Affin Bank's commitment to serving a diverse customer base with inclusive banking options.

Investment Banking Income

Affin Bank's investment banking arm, Affin Hwang Investment Bank Berhad, generates significant revenue through various financial advisory and capital markets services. This includes fees earned from advising corporations on mergers, acquisitions, and corporate restructuring, as well as income from underwriting new debt and equity issuances. Securities trading activities also contribute to this revenue stream, catering to institutional investors and corporate clients seeking to manage their portfolios.

In 2024, Affin Hwang Investment Bank Berhad reported robust performance in its investment banking segment. For instance, the bank was actively involved in several key corporate finance deals, contributing to its advisory fee income. Underwriting activities saw a notable increase, particularly in the equity capital markets, reflecting renewed investor confidence and corporate fundraising needs.

- Advisory Fees: Income derived from M&A advisory, corporate restructuring, and strategic financial planning for corporate clients.

- Underwriting: Revenue generated from guaranteeing the issuance and sale of new securities (equity and debt) for corporations and governments.

- Securities Trading: Profits from the buying and selling of stocks, bonds, and other financial instruments on behalf of clients and for the bank's own account.

Insurance Underwriting and Related Income

Affin Bank's revenue streams are significantly bolstered by income generated from insurance underwriting activities. This income originates from its associated companies, Generali Life Insurance Malaysia Berhad and Generali Insurance Malaysia Berhad.

This insurance segment provides a crucial diversification of the Group's revenue, moving beyond its primary banking operations. For instance, in the first quarter of 2024, Affin Bank reported a net profit of RM137.5 million, with contributions from its insurance ventures playing a role in this overall financial performance.

The Group benefits from:

- Underwriting income from life insurance policies via Generali Life Insurance Malaysia Berhad.

- Premiums and fees derived from general insurance products through Generali Insurance Malaysia Berhad.

- A diversified revenue base that reduces reliance on traditional banking services.

Affin Bank's revenue streams are diverse, encompassing net interest income, fee and commission income, Islamic banking, investment banking, and insurance. This multi-faceted approach ensures resilience and broad market engagement.

In 2024, the bank saw strong performance across these segments. Net interest income benefited from loan growth, while fee income was boosted by wealth management and stockbroking services. Islamic banking continued its upward trajectory, and investment banking activities, including advisory and underwriting, showed significant engagement.

The insurance segment, through its partnerships with Generali, also contributed to overall profitability, demonstrating a well-rounded revenue generation strategy.

| Revenue Stream | Key Activities | 2024 Performance Indicator |

|---|---|---|

| Net Interest Income | Loan portfolio growth, deposit management | Resilient growth driven by community banking loans |

| Fee & Commission Income | Wealth management, stockbroking, advisory | Robust contribution from diverse financial services |

| Islamic Banking | Shariah-compliant financing and banking | Vital component, reflecting increasing demand for ethical finance |

| Investment Banking | M&A advisory, underwriting, securities trading | Strong performance in corporate finance deals and equity capital markets |

| Insurance | Life and general insurance underwriting | Contributed to overall net profit, diversifying revenue |

Business Model Canvas Data Sources

The Affin Bank Business Model Canvas is informed by a blend of internal financial reports, customer transaction data, and extensive market research. These sources provide a comprehensive view of customer behavior, operational efficiency, and market opportunities.