Affin Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Affin Bank Bundle

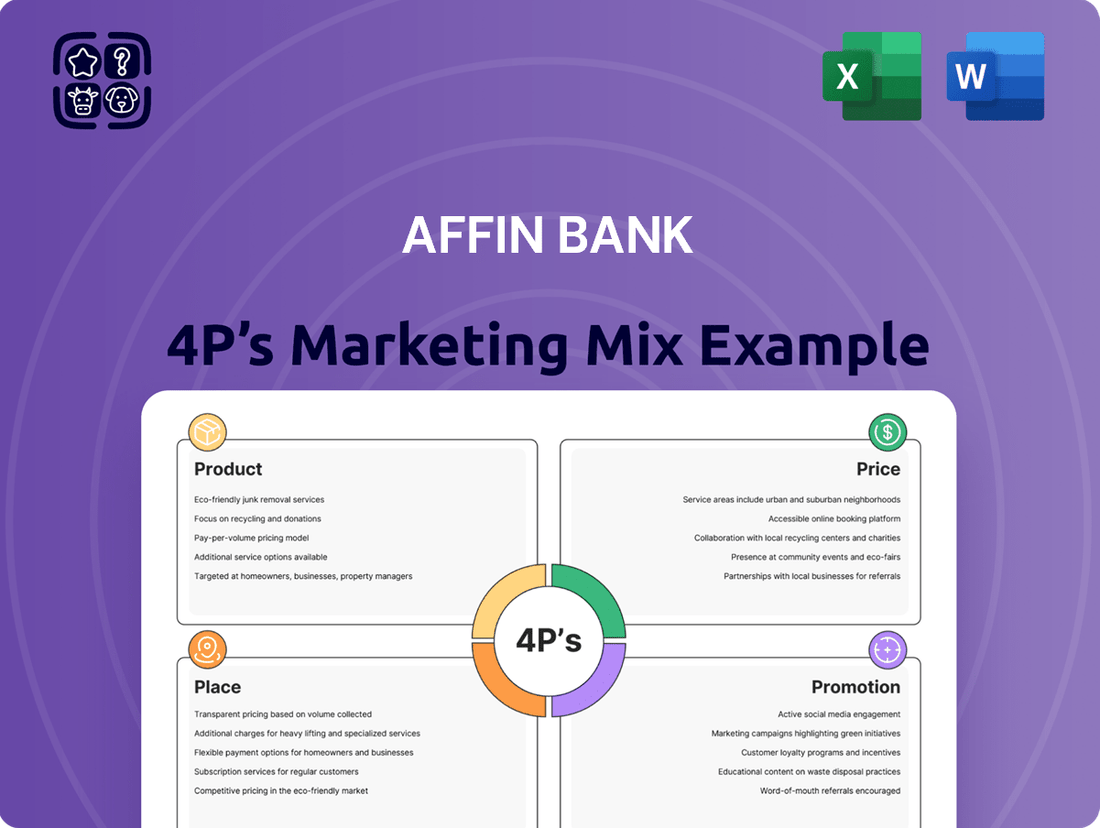

Affin Bank's marketing strategy is a carefully orchestrated symphony of Product, Price, Place, and Promotion. Discover how their diverse product portfolio, competitive pricing, strategic distribution channels, and targeted promotions create a compelling customer experience.

Unlock the full story behind Affin Bank's success. This comprehensive 4Ps Marketing Mix Analysis provides actionable insights into their product innovation, pricing architecture, channel reach, and communication effectiveness, saving you valuable research time.

Go beyond the surface-level understanding of Affin Bank's marketing. Our complete analysis delves into each of the 4Ps, offering a ready-to-use, editable report perfect for business professionals, students, and consultants seeking strategic depth.

Product

Affin Bank's product strategy is built on a foundation of comprehensive banking services, encompassing everything from everyday consumer banking needs to sophisticated investment banking solutions. This broad portfolio includes retail banking, business banking, and wealth management, ensuring a complete financial ecosystem for its customers.

The bank's commitment to serving a diverse clientele is evident in its tailored offerings for individuals, small and medium-sized enterprises (SMEs), and large corporations. This inclusive approach allows Affin Bank to address a wide spectrum of financial requirements across different market segments.

Further enhancing its market reach, Affin Bank provides Shariah-compliant financial products and services through its subsidiary, Affin Islamic Bank Berhad. This strategic offering caters to the growing demand for ethical and faith-based financial solutions, as evidenced by the Islamic finance sector’s continued expansion, with global Islamic finance assets projected to reach $4.9 trillion by 2025, according to industry reports.

Affin Bank is prioritizing its digital transformation, with significant investments directed towards enhancing online and mobile banking. This focus on digital products is exemplified by the upcoming launch of AffinAlwaysX, a completely reimagined mobile banking application, and a new enterprise payments platform aimed at simplifying business transactions. These advancements are key to delivering seamless, accessible banking services and increasing operational efficiency.

Affin Bank distinguishes its Product offering through specialized financial solutions designed to meet diverse client needs. This includes premium services like Affin Diventium, launched in September 2024, which caters to Ultra-High-Net-Worth Individuals with personalized wealth management.

The bank actively supports sustainable development by providing green financing for renewable energy projects, such as solar and biogas initiatives, aligning with global environmental goals. This segment saw a notable increase in demand for sustainable financing options throughout 2024.

Furthermore, Affin Bank extends its specialized product suite to support emerging businesses and educational pursuits, offering tailored financing options for start-ups and students. These targeted approaches highlight the bank's strategy to capture niche markets and foster economic growth.

Credit and Debit Card Offerings

Affin Bank offers a diverse portfolio of credit and debit cards, each designed to cater to different customer needs and spending habits. These cards come with attractive features like reward points, flexible payment options, and special discounts at partner merchants. For instance, their 'AFFIN 2024 Gold To Paris' campaign, which ran through 2024, aimed to boost card spending by offering a chance to win trips to Paris, demonstrating a proactive approach to customer engagement and acquisition.

The bank’s strategy focuses on driving card usage through targeted promotions and loyalty programs. This approach is evident in their continuous efforts to provide value-added benefits that go beyond basic transactional services. Affin Bank’s commitment to enhancing the cardholder experience is a key component of their product strategy, aiming to solidify their market position.

Key features and initiatives include:

- Reward Points: Earnable on everyday spending, redeemable for various lifestyle rewards.

- Fixed Payment Plans: Offering flexibility for larger purchases with manageable installments.

- Exclusive Discounts: Partnerships with retailers and service providers for special offers.

- Campaigns: Targeted promotions like the 'AFFIN 2024 Gold To Paris' to incentivize usage and attract new cardholders.

Investment and Wealth Management

Affin Bank, through its subsidiary Affin Hwang Investment Bank Berhad, provides a comprehensive suite of investment and wealth management solutions designed to foster client prosperity. This segment is crucial to the bank's product offering, addressing diverse financial goals.

The investment and wealth management arm offers a broad spectrum of products including unit trust investments, private trusts, ASNB VP, bonds/sukuk, and innovative gold investment accounts like AFFIN Emas-i/AFFIN Emas Account-i. These offerings are tailored to meet the evolving wealth growth and management requirements of its clientele.

In 2024, the Malaysian asset management industry saw continued growth, with total assets under management (AUM) reaching significant levels, reflecting strong investor confidence. Affin Hwang's participation in this market, offering diverse products such as sukuk which are increasingly popular for their ethical and stable returns, positions it to capitalize on these trends.

- Securities Trading: Facilitating access to capital markets for clients.

- Asset Management: Offering professionally managed funds across various asset classes.

- Investment Banking: Providing corporate finance and advisory services.

- Wealth Management: Curating personalized investment portfolios and trusts.

Affin Bank's product strategy is a multifaceted approach, offering a broad spectrum of financial solutions from everyday banking to specialized wealth management and Islamic finance. The bank continuously innovates, exemplified by upcoming digital platforms like AffinAlwaysX and specialized offerings such as Affin Diventium for high-net-worth individuals.

The bank’s product suite also includes a diverse range of credit and debit cards, supported by engaging campaigns like the 'AFFIN 2024 Gold To Paris' to drive customer acquisition and usage. Furthermore, Affin Bank, through Affin Hwang Investment Bank Berhad, provides robust investment and wealth management services, including unit trusts and sukuk, tapping into the growing Malaysian asset management market.

| Product Category | Key Offerings | Target Audience | Recent Initiatives/Data |

|---|---|---|---|

| Retail Banking | Current Accounts, Savings Accounts, Loans, Credit/Debit Cards | Individuals | 'AFFIN 2024 Gold To Paris' campaign boosted card spending. |

| Business Banking | SME Financing, Corporate Loans, Trade Finance, Payments Platform | SMEs, Corporations | New enterprise payments platform in development. |

| Wealth Management | Unit Trusts, Private Trusts, Bonds/Sukuk, Gold Accounts | High-Net-Worth Individuals, Investors | Affin Diventium launched Sept 2024; Malaysian AUM growth in 2024. |

| Islamic Banking | Shariah-Compliant Accounts, Financing, Investments | Muslims, Ethically-Minded Investors | Global Islamic finance assets projected to reach $4.9 trillion by 2025. |

What is included in the product

This analysis provides a comprehensive breakdown of Affin Bank's marketing mix, examining its Product offerings, Pricing strategies, Place (distribution) channels, and Promotion activities to reveal its market positioning.

Simplifies the complex 4Ps of Affin Bank's marketing strategy into actionable insights, alleviating the pain of information overload for busy executives.

Provides a clear, concise overview of Affin Bank's marketing 4Ps, easing the burden of understanding their strategic approach for quick decision-making.

Place

Affin Bank's extensive branch network is a cornerstone of its marketing mix, ensuring strong physical accessibility for customers across Malaysia. The bank plans a significant expansion, growing from 130 branches in 2024 to 146 by the close of 2025, with a target of 180 branches by 2028. This strategic move is designed to deepen its reach, especially in growth-focused areas like Penang, Johor, Sarawak, and Sabah, directly supporting objectives for increased loan and fee income.

Affin Bank is enhancing its digital presence with platforms like AffinAlways Retail Internet Banking and Mobile Internet Banking, alongside AFFINMAX for corporate users. This commitment to digital accessibility is crucial in today's market, where customers expect seamless online transactions. The bank's proactive approach is further evidenced by the upcoming launch of AffinAlwaysX, a next-generation mobile banking application designed for superior user experience and convenience.

Affin Bank leverages its network of Automated Teller Machines (ATMs) and self-service terminals to offer convenient cash withdrawals and a range of other banking services. By 2025, the bank plans to integrate these touchpoints into a centralized enterprise payments platform, a move projected to enhance operational efficiency and customer experience. This initiative aligns with the broader industry trend of digital transformation in financial services.

Beyond traditional ATMs, Affin Bank also provides Automated Safe Deposit Lockers, offering customers a secure and accessible solution for storing valuable items. This expansion into enhanced self-service options underscores the bank's commitment to meeting diverse customer needs through technology-driven convenience and security.

Strategic Partnerships and Collaborations

Affin Bank actively pursues strategic partnerships to broaden its market presence and enhance its service portfolio. A prime example is its collaboration with MUFG Bank (Malaysia) Berhad, designed to foster stronger business ties between Malaysia and Japan. These alliances are crucial for increasing market penetration and delivering more comprehensive financial solutions to a wider customer base.

These collaborations are instrumental in Affin Bank's growth strategy, enabling access to new customer segments and facilitating cross-border business opportunities. By leveraging the strengths of its partners, Affin Bank can offer integrated financial products and services that cater to evolving customer needs.

- Expanded Reach: Partnerships allow Affin Bank to tap into new markets and customer demographics it might not otherwise reach.

- Enhanced Service Offerings: Collaborations enable the integration of specialized financial services, providing customers with a more complete suite of solutions.

- Synergistic Growth: By combining resources and expertise, Affin Bank and its partners can achieve mutual growth and market share expansion.

- Risk Mitigation: Strategic alliances can also help distribute risks associated with new market entry or product development.

Customer Service and Support Channels

Affin Bank extends its customer service beyond simple physical and digital interactions. They provide a comprehensive suite of support channels designed for accessibility and convenience. This includes robust call centers, responsive email support, and the option to schedule personalized calls with bank representatives, ensuring customers receive timely and relevant assistance for all their banking needs.

This multi-channel strategy is crucial for customer satisfaction and retention. For instance, as of Q1 2024, Affin Bank reported a significant increase in digital engagement, with over 70% of customer queries being resolved through online channels. However, the availability of human interaction via phone and scheduled calls remains vital for addressing more complex issues or for customers who prefer direct communication.

- Call Centers: Offering direct voice support for immediate issue resolution.

- Email Support: Providing a documented channel for inquiries and feedback.

- Scheduled Callbacks: Allowing customers to arrange specific times for expert assistance, enhancing convenience.

- Digital Self-Service: Complementing human support with online FAQs and chatbots for instant information access.

Affin Bank's physical presence is expanding significantly, with plans to grow from 130 branches in 2024 to 146 by the end of 2025, aiming for 180 by 2028. This expansion targets key growth areas to boost loan and fee income. Complementing this, the bank is enhancing its digital platforms, including AffinAlways Retail Internet Banking and Mobile Internet Banking, along with the upcoming AffinAlwaysX for a superior user experience.

Self-service options are also a focus, with ATMs and terminals being integrated into a centralized payments platform by 2025 for greater efficiency. Beyond digital and ATM services, Affin Bank offers Automated Safe Deposit Lockers for secure storage. Strategic partnerships, such as the one with MUFG Bank (Malaysia) Berhad, are crucial for market penetration and offering comprehensive financial solutions.

| Aspect | 2024 Status | 2025 Target | 2028 Target |

|---|---|---|---|

| Branches | 130 | 146 | 180 |

| Digital Platform Focus | AffinAlways Retail/Mobile, AFFINMAX | Launch of AffinAlwaysX | Continued enhancement |

| ATM/Self-Service | Existing network | Centralized Payments Platform Integration | Further integration and service expansion |

| Strategic Partnerships | Active (e.g., MUFG Bank) | Ongoing expansion | Deepened collaborations |

Preview the Actual Deliverable

Affin Bank 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Affin Bank's 4P's Marketing Mix is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Affin Bank leverages digital marketing extensively, showcasing promotions like the 'Grow & Gain with AFFIN 2025 Campaign' and the 'AFFIN 2024 Gold To Paris' initiative. These campaigns are prominently featured on their official website and disseminated through reputable financial news portals, ensuring broad online visibility.

These digital campaigns are designed to drive customer engagement by offering tangible benefits. Customers can earn rewards such as cashbacks, participate in prize draws, or accumulate reward points for completing specific eligible transactions, thereby incentivizing participation and fostering loyalty.

Affin Bank's 50th anniversary was marked by the 'AFFIN 50 Years, 50 Prizes' Golden Jubilee Campaign, a significant promotional event. This initiative aimed to boost brand engagement by offering substantial rewards, including a RM1,000,000 grand prize and other exclusive incentives.

Such milestone campaigns are crucial for increasing public awareness and reinforcing brand loyalty. In 2024, financial institutions are increasingly leveraging anniversary celebrations to reconnect with customers and attract new ones, as seen with Affin Bank's substantial prize offerings.

Affin Bank actively employs targeted promotions to drive uptake of its diverse financial products. For instance, campaigns often feature attractive 0% installment plans on credit card purchases, a strategy that saw credit card spending in Malaysia increase by an estimated 15% year-on-year in early 2024, according to industry reports.

Furthermore, the bank rolls out quick cash offers, appealing to immediate liquidity needs, and provides special incentives for unit trust investments, aiming to boost customer engagement with wealth management solutions. These focused marketing efforts are crucial for differentiating Affin Bank’s offerings and capturing market share in a competitive financial landscape.

Public Relations and Media Announcements

Affin Bank actively engages in public relations and media announcements to communicate its financial achievements, strategic alliances, and new offerings. For instance, in early 2024, Affin Bank reported a net profit of RM1.1 billion for the financial year ended December 31, 2023, a significant increase from the previous year, which was widely disseminated through press releases.

This consistent flow of information, including details on their corporate social responsibility efforts, ensures that investors, customers, and the general public remain well-informed. Such transparency is crucial for building trust and reinforcing Affin Bank's reputation in the competitive banking sector.

- Financial Performance: Regular press releases detail quarterly and annual financial results, such as the RM1.1 billion net profit for FY2023.

- Strategic Partnerships: Announcements highlight collaborations, like the digital banking initiatives with various tech partners in 2024.

- New Product Launches: Media outreach supports the introduction of innovative banking solutions and services.

- CSR Initiatives: Affin Bank uses its platform to showcase its commitment to community development and sustainability.

Financial Literacy and Community Engagement

Affin Bank actively fosters financial literacy and community engagement, recognizing their crucial role in building trust. For instance, their partnership with Chemsain for 'AFFIN SME BizChat 2025' aims to equip Small and Medium Enterprises with essential business knowledge. These efforts, while not direct sales pitches, cultivate a positive brand image and foster customer loyalty, indirectly drawing new clients to the bank.

These community-focused initiatives are vital for Affin Bank's long-term strategy. By investing in financial education, they empower individuals and businesses, creating a more robust economic ecosystem. In 2024, Affin Bank continued its commitment to supporting SMEs, with programs designed to enhance their operational efficiency and financial management skills, contributing to their growth and stability.

The impact of such engagement is significant, building a strong foundation of goodwill. This approach aligns with the broader trend in the financial sector where corporate social responsibility and community investment are increasingly valued by consumers. Affin Bank's dedication to these principles helps differentiate it in a competitive market, attracting customers who prioritize ethical and community-minded banking partners.

Affin Bank's promotional strategies are multifaceted, encompassing digital campaigns, milestone events, and targeted offers to drive customer acquisition and loyalty. These efforts are designed to highlight the bank's financial strength and commitment to customer value, as evidenced by their 2024 and 2025 initiatives.

The bank actively uses public relations and financial reporting to communicate its performance, such as the RM1.1 billion net profit for FY2023, reinforcing its image as a stable and growing institution. This transparency is key to building trust and attracting a wider customer base.

Furthermore, Affin Bank invests in community engagement and financial literacy programs, such as the 'AFFIN SME BizChat 2025', which builds goodwill and indirectly attracts new clients by demonstrating a commitment to economic development.

These promotional activities are crucial for differentiating Affin Bank in a competitive market, with initiatives like 0% installment plans on credit cards directly responding to market trends that saw credit card spending rise by an estimated 15% year-on-year in early 2024.

| Campaign/Initiative | Year | Objective | Key Features/Benefits |

|---|---|---|---|

| Grow & Gain with AFFIN | 2025 | Customer engagement, rewards | Cashbacks, prize draws, reward points |

| AFFIN 2024 Gold To Paris | 2024 | Customer engagement, participation | Prize draws, exclusive incentives |

| AFFIN 50 Years, 50 Prizes | Anniversary (2023/2024) | Brand engagement, customer loyalty | RM1,000,000 grand prize, exclusive rewards |

| 0% Installment Plans | Ongoing | Drive credit card uptake | Facilitates larger purchases, increases spending |

| AFFIN SME BizChat | 2025 | Financial literacy, community engagement | Equips SMEs with business knowledge |

Price

Affin Bank strategically adjusts its loan, financing, and deposit interest rates to remain competitive and responsive to market dynamics, including Bank Negara Malaysia's Overnight Policy Rate (OPR). This proactive approach ensures their offerings align with prevailing economic conditions.

For example, in the wake of a potential OPR adjustment in July 2025, Affin Bank demonstrated its agility by reducing key rates such as the Standardised Base Rate, Base Rate, and Base Lending Rate. This also extended to their fixed deposit rates, reflecting a commitment to offering attractive terms to customers.

Affin Bank's fee structure is designed for transparency, covering services from savings accounts to internet banking and cheque processing. This clarity aims to build trust and manage customer expectations regarding costs associated with their banking activities.

Notably, Affin Bank offers several fee-free transactions to encourage digital adoption and customer convenience. For instance, DuitNow Transfers up to RM5,000 are provided without charge, making everyday transactions more accessible. This aligns with broader industry trends where digital channels often come with reduced or waived fees.

Affin Bank strategically employs discounts and promotional offers to enhance its pricing strategy, making financial products more appealing. For instance, they offer 0% fixed payment plans on credit cards, a popular incentive for consumers seeking to manage larger purchases.

Furthermore, Affin Bank provides quick cash offers with competitive interest rates, directly addressing the immediate financial needs of its customer base. These initiatives are designed to attract new customers and deepen relationships with existing ones by offering tangible value and accessibility.

In 2024, such promotional activities are crucial in a competitive banking landscape where customer acquisition costs are significant. For example, a 0% interest period on a new credit card can significantly drive uptake, especially for individuals looking to consolidate debt or finance large purchases without immediate interest charges.

Credit Terms and Financing Options

Affin Bank offers a diverse suite of financing options tailored to various customer needs, encompassing personal loans, automotive financing, and home mortgages. These products come with flexible credit terms designed to accommodate different financial situations. For instance, in 2024, Affin Bank partnered with Lotus Karz Sdn. Bhd. to provide attractive promotional offers, including 0% flat interest rates on select vehicle loans, making car ownership more accessible.

The bank's commitment to providing accessible credit is further demonstrated through its varied loan products. Customers can explore options for:

- Personal Financing: Unsecured loans for various personal needs.

- Car Loans: Financing for new and used vehicles with competitive interest rates.

- House Loans: Mortgages for property acquisition with extended repayment periods.

Value-Based Pricing for Premium Services

For Affin Bank's premium offerings, such as Affin Diventium Private Banking, pricing is strategically aligned with the high-touch, bespoke wealth management and financial advisory services tailored for Ultra-High-Net-Worth Individuals (UHNWIs). This value-based approach ensures that the cost directly correlates with the exclusivity and sophisticated financial solutions delivered.

The bank likely employs a tiered fee structure or a percentage-of-assets-under-management (AUM) model, reflecting the complexity and personalized nature of managing substantial portfolios. This strategy emphasizes the perceived value and the specialized expertise provided, rather than a cost-plus calculation.

- Value-Based Pricing: Fees are set based on the perceived worth of personalized wealth management and exclusive financial advisory services for UHNWIs.

- AUM Model: A common approach involves charging a percentage of the total assets managed, reflecting the scale and complexity of client portfolios.

- Service Exclusivity: The pricing reinforces the premium nature of services like Affin Diventium Private Banking, differentiating it from standard banking products.

- Market Benchmarking: Affin Bank would benchmark its premium service pricing against competitors in the private banking sector to ensure competitiveness while reflecting the value proposition.

Affin Bank's pricing strategy is multifaceted, balancing competitive interest rates on loans and deposits with transparent fee structures. They adjust rates in response to monetary policy, such as Bank Negara Malaysia's OPR, to remain attractive. For instance, in 2024, they offered 0% flat interest rates on select vehicle loans through partnerships, making financing more accessible.

Promotional discounts, like 0% fixed payment plans on credit cards, are key to driving customer acquisition and engagement. Fee transparency for services from savings accounts to internet banking builds trust, with initiatives like fee-free DuitNow Transfers up to RM5,000 encouraging digital adoption.

For premium services like Affin Diventium Private Banking, pricing is value-based, reflecting the bespoke wealth management for Ultra-High-Net-Worth Individuals. This likely utilizes an Assets Under Management (AUM) model, with fees benchmarked against competitors to underscore service exclusivity.

| Product/Service | Pricing Strategy | Key Features/Examples (2024/2025) |

|---|---|---|

| Loans & Financing | Competitive Interest Rates, Promotional Offers | 0% flat interest on select vehicle loans (Lotus Karz partnership); Flexible credit terms for personal, auto, and home loans. |

| Deposit Rates | Market-Responsive | Adjusted in line with OPR changes to offer attractive terms. |

| Fees | Transparent, Fee-Waivers for Digital Services | Clear fees for banking services; Fee-free DuitNow Transfers up to RM5,000. |

| Credit Cards | Promotional Discounts | 0% fixed payment plans; Quick cash offers with competitive rates. |

| Private Banking (Affin Diventium) | Value-Based, AUM Model | Pricing reflects bespoke wealth management for UHNWIs; Benchmarked against market for premium services. |

4P's Marketing Mix Analysis Data Sources

Our Affin Bank 4P's Marketing Mix Analysis is constructed using a robust blend of official company disclosures, including annual reports and investor presentations, alongside up-to-date market intelligence from industry reports and competitive analyses. This ensures a comprehensive understanding of Affin Bank's product offerings, pricing strategies, distribution channels, and promotional activities.