Affin Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Affin Bank Bundle

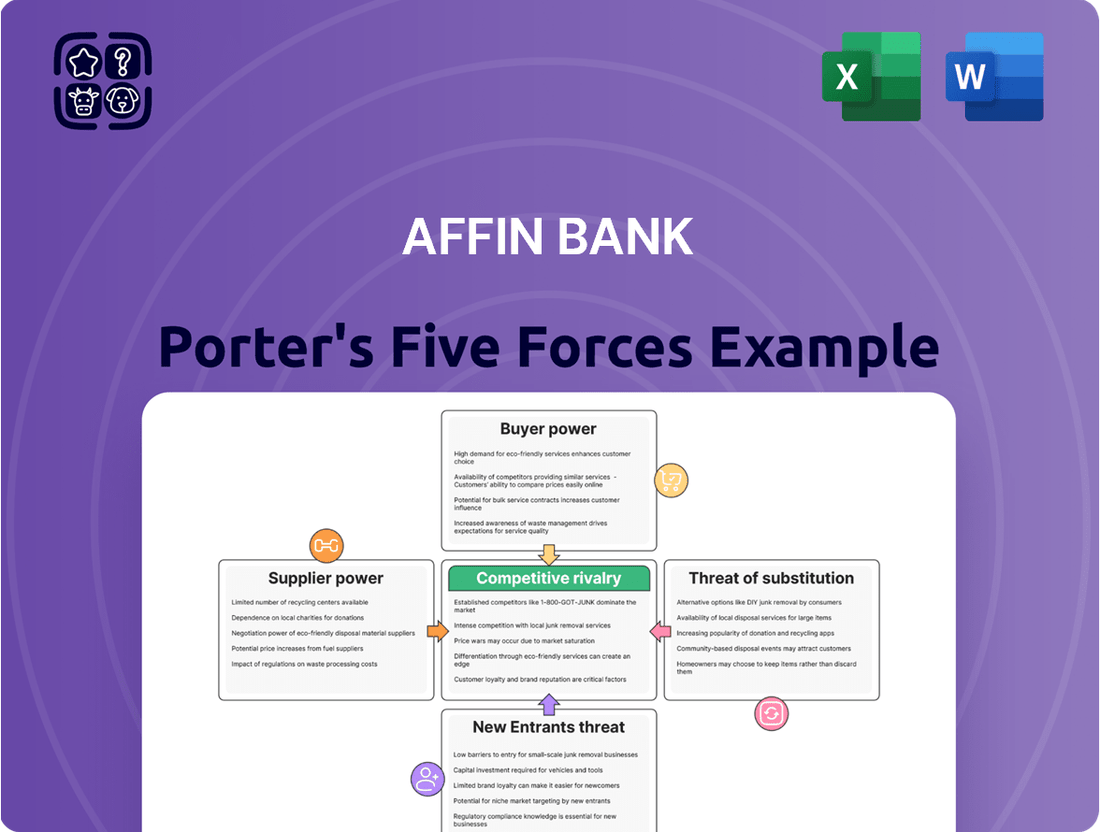

Affin Bank navigates a competitive landscape shaped by evolving customer demands and the persistent threat of new digital entrants. Understanding the interplay of these forces is crucial for strategic advantage.

The complete report reveals the real forces shaping Affin Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of capital providers, like depositors and investors, is a key factor for Affin Bank. Large depositors, particularly institutional clients or high-net-worth individuals, wield considerable influence. They can demand higher interest rates and more favorable terms for their money. This is especially true as the Malaysian banking sector anticipates slower earnings growth in 2025, leading to increased competition for deposits.

Affin Bank needs to strategically manage its cost of funds to secure and keep these vital deposits. With overall market deposit growth showing weakness, offering attractive products becomes even more crucial for banks to maintain a healthy funding base.

Affin Bank's push for digital transformation, including its new digital core and mobile banking platform, significantly amplifies the bargaining power of its technology and infrastructure providers. These specialized vendors, ranging from cloud service providers to cybersecurity firms, wield considerable influence because their services are mission-critical and switching costs for core banking systems are exceptionally high. For instance, the global cloud computing market, a key area for banks like Affin, was projected to reach over $1.3 trillion by 2024, indicating the substantial investment and reliance on these providers.

Affin Bank, like all financial institutions, hinges on its human capital. This includes everyone from seasoned loan officers and financial advisors to the crucial IT specialists and data scientists driving digital transformation. The availability and cost of these skilled individuals directly influence the bank's operational efficiency and its capacity for innovation.

In the current competitive landscape for talent, particularly for those with expertise in digital banking, cybersecurity, and advanced analytics, employees possess significant bargaining power. This can translate into demands for higher salaries, improved benefits, and more flexible working arrangements, directly impacting Affin Bank's labor costs and its ability to attract and retain top performers.

For instance, in 2024, the average salary for a data scientist in Malaysia, a key role for banks like Affin, saw an increase, reflecting the high demand for these skills. This trend underscores the growing leverage of specialized employees within the banking sector, forcing institutions to invest more in compensation and development to maintain a competitive edge.

Interbank Market and Wholesale Funding Sources

Banks like Affin Bank frequently tap into the interbank market and other wholesale funding sources to ensure they have enough liquidity and to finance their lending activities. In 2024, the Malaysian banking sector has seen a noticeable tightening in liquidity. This trend is reflected in rising loan-to-deposit ratios across the industry, indicating that banks are lending out a larger proportion of their deposits.

When liquidity becomes scarcer, financial institutions that provide funds in the interbank market or through wholesale financing gain more leverage. This increased bargaining power for suppliers of funds can directly impact Affin Bank by pushing up its funding costs. Consequently, this can affect Affin Bank's overall financial flexibility and its ability to operate efficiently.

- Interbank Lending Dependence: Affin Bank, like its peers, relies on interbank markets for short-term liquidity management and to support loan expansion.

- Tightening Liquidity in 2024: The Malaysian banking sector experienced a contraction in readily available funds, leading to higher competition for deposits and wholesale funding.

- Rising Loan-to-Deposit Ratios: As of late 2023 and into 2024, many Malaysian banks saw their loan-to-deposit ratios increase, signaling reduced liquidity buffers. For instance, some larger Malaysian banks reported LDRs exceeding 85% in early 2024.

- Increased Supplier Power: This tighter environment empowers wholesale funding providers, allowing them to command higher interest rates, thereby increasing Affin Bank's cost of funds.

Regulatory Bodies and Compliance Service Providers

Regulatory bodies, such as Bank Negara Malaysia (BNM), act as powerful, albeit non-traditional, suppliers to banks like Affin Bank. They dictate the operational landscape through licensing, capital adequacy requirements, and evolving compliance mandates.

Compliance service providers, offering specialized software and consulting, gain significant leverage due to the critical and niche nature of their expertise. Banks must invest in these services to meet stringent, and often changing, regulatory demands.

- Regulatory Influence: BNM's directives, including those for digital banking and e-money, directly impact Affin Bank's operational costs and strategic planning.

- Compliance Investment: In 2023, the financial sector globally saw increased spending on RegTech solutions, a trend expected to continue as regulations become more complex. This highlights the necessity for banks to engage with specialized providers.

- Niche Expertise: The specialized knowledge required for navigating complex financial regulations means service providers hold considerable bargaining power, as finding alternative solutions can be challenging and costly.

The bargaining power of suppliers for Affin Bank is multifaceted, encompassing capital providers, technology vendors, skilled employees, and wholesale funding sources. In 2024, a tighter liquidity environment in Malaysia increased the leverage of wholesale funding providers, driving up Affin Bank's cost of funds. Similarly, the demand for specialized skills in digital banking and data analytics empowered employees, leading to higher labor costs.

Affin Bank's reliance on critical technology infrastructure, such as cloud services, also grants significant power to its providers, especially given the high switching costs associated with core banking systems. The global cloud market's substantial growth underscores this dependency. Furthermore, regulatory compliance necessitates engagement with specialized service providers, who wield considerable influence due to the niche nature of their expertise.

| Supplier Type | Key Influence Factor | Impact on Affin Bank (2024/2025 Outlook) | Supporting Data/Trend |

|---|---|---|---|

| Capital Providers (Depositors) | Demand for higher interest rates | Increased cost of funds, competition for deposits | Slower earnings growth in Malaysian banking sector |

| Technology & Infrastructure Providers | Mission-critical services, high switching costs | Increased reliance, potential for higher service fees | Global cloud market projected over $1.3 trillion by 2024 |

| Skilled Employees | High demand for digital/analytics expertise | Higher salaries, increased labor costs | Increased average salary for data scientists in Malaysia (2024) |

| Wholesale Funding Providers | Tightening liquidity | Higher funding costs, reduced financial flexibility | Rising loan-to-deposit ratios in Malaysian banks (e.g., >85% for some in early 2024) |

| Regulatory Compliance Providers | Niche expertise, evolving regulations | Mandatory investment in specialized services | Increased global spending on RegTech solutions (2023 onwards) |

What is included in the product

This analysis dissects the competitive forces impacting Affin Bank, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the banking sector.

Instantly identify and mitigate competitive threats with a clear, actionable breakdown of Affin Bank's industry landscape.

Customers Bargaining Power

Retail and consumer customers are wielding more influence thanks to increased market transparency and the ease of comparing financial products online. Digital-first banking solutions further empower them to switch providers for better rates, reduced fees, or improved digital services. For instance, in 2024, the average customer acquisition cost for banks globally continued to be a significant expense, highlighting the challenge of retaining customers in a competitive landscape.

Affin Bank is actively addressing this by emphasizing its commitment to 'Unrivalled Customer Service' and launching an enhanced mobile banking platform. These initiatives are designed to foster greater customer loyalty and reduce churn, making it harder for customers to be enticed away by competitors.

Small and Medium-sized Enterprises (SMEs) represent a significant customer segment for banks like Affin Bank. While individually they might not wield immense power, collectively and particularly those with robust financial health and varied banking requirements, they can exert considerable influence. For instance, in 2024, SMEs in Malaysia continued to be a vital engine of economic growth, contributing significantly to GDP. This makes them attractive to financial institutions, allowing them to negotiate for more favorable loan interest rates, reduced service charges, and customized financial products that better suit their operational needs.

Large corporate and institutional clients possess considerable bargaining power with Affin Bank. This stems from the sheer volume of their business, their intricate financial needs, and their capacity to secure funding from multiple avenues. For instance, in 2023, major corporations often negotiated terms for significant loan facilities, directly impacting the pricing and service packages offered by banks.

These clients frequently initiate competitive bidding for banking services, compelling institutions like Affin to present more attractive pricing and bespoke financial solutions. Their sophisticated demands necessitate specialized offerings in areas such as investment banking and complex commercial lending, further amplifying their leverage.

Access to Information and Digital Tools

Customers today have unprecedented access to financial information and digital tools, significantly boosting their bargaining power. Comparison websites and readily available data empower them to easily find the best rates and services, diminishing the information gap between them and financial institutions like Affin Bank. This means customers can quickly identify superior offerings, forcing banks to compete more aggressively on price and service quality.

The proliferation of digital banking platforms and comparison tools means customers can effortlessly switch providers if they find better deals elsewhere. For instance, in 2024, many Malaysian consumers actively utilized online platforms to compare mortgage rates, leading to increased competition among banks to offer more attractive loan packages. This ease of switching directly translates to higher customer bargaining power.

- Informed Decisions: Customers leverage online comparison sites to assess interest rates, fees, and service quality across multiple banks.

- Reduced Switching Costs: Digital banking makes it simpler and faster for customers to move their accounts to a competitor offering better terms.

- Competitive Pressure: Banks like Affin Bank must continuously enhance their digital offerings and pricing strategies to retain customers in this transparent market.

- Data-Driven Choices: With access to extensive financial data, customers are less reliant on individual bank advice and more inclined to trust objective comparisons.

Low Switching Costs in Digital Channels

The increasing ease of switching financial providers through digital channels significantly amplifies customer bargaining power. While traditional banking relationships might have involved some friction to change, the digital age has dramatically reduced these barriers. For instance, by mid-2024, many neobanks and digital-first financial institutions in Malaysia, including those competing with Affin Bank, offer onboarding processes that can be completed in under 10 minutes, allowing for rapid account opening and fund transfers.

This streamlining of digital onboarding means customers can effortlessly move their accounts and services to competitors, putting pressure on existing providers like Affin Bank to offer more competitive rates and services. The proliferation of e-wallets and payment gateways further simplifies the process of shifting transaction volumes, as users can easily link new bank accounts. Affin Bank's strategic investments in enhancing its digital banking platforms, such as its mobile app and online services, are a direct acknowledgment and response to this evolving customer dynamic, aiming to retain customers by offering a seamless digital experience.

- Digital Onboarding Speed: Many Malaysian digital banks aim for account opening completion in under 10 minutes as of 2024.

- E-wallet Integration: The ease of linking multiple bank accounts to popular e-wallets reduces customer inertia.

- Competitive Pressure: Lower switching costs force banks to compete more aggressively on fees and interest rates.

- Affin Bank's Digital Focus: Investments in digital transformation are crucial for customer retention in this environment.

Customers, both individual and corporate, possess significant bargaining power due to increased market transparency and the ease of switching providers. This is amplified by digital platforms that facilitate easy comparison of financial products and services.

In 2024, the average customer acquisition cost for banks globally remained a key expense, underscoring the challenge of retaining customers in a competitive market where switching is increasingly frictionless. Affin Bank's focus on enhancing its digital offerings and customer service aims to mitigate this.

SMEs, as a collective, can negotiate favorable terms due to their importance as economic drivers. Large corporate clients, by virtue of their transaction volumes and multiple funding options, exert even greater influence on pricing and service customization.

| Factor | Impact on Bargaining Power | Affin Bank's Response |

|---|---|---|

| Market Transparency & Digital Comparison | High; customers easily compare rates and fees. | Enhancing digital platforms and customer service. |

| Ease of Switching (Digital Onboarding) | High; reduced friction to move accounts. | Streamlining digital processes for a seamless experience. |

| SME Economic Importance | Moderate to High; SMEs negotiate for tailored financial solutions. | Offering customized products and competitive rates. |

| Large Corporate Needs & Volume | Very High; clients demand bespoke services and competitive pricing. | Proactive engagement and competitive bidding for large accounts. |

What You See Is What You Get

Affin Bank Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Affin Bank's competitive landscape through Porter's Five Forces, analyzing the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the banking sector. This comprehensive analysis provides actionable insights into the strategic positioning of Affin Bank.

Rivalry Among Competitors

The Malaysian banking sector is a battleground, with giants like Maybank, CIMB, Public Bank, and Hong Leong Bank constantly vying for market share. These established domestic players compete fiercely across consumer, commercial, and investment banking, utilizing aggressive pricing, innovative products, and vast branch networks to attract and retain customers. Affin Bank must navigate this intense rivalry, which saw the Malaysian banking sector's total assets grow to RM2.3 trillion by the end of 2023, highlighting the sheer scale of competition.

The Malaysian banking landscape is experiencing heightened competition with the emergence of new digital banks like GXBank, AEON Bank, and Boost Bank, which commenced operations in late 2023 and early 2024. This move by Bank Negara Malaysia directly targets tech-savvy consumers, intensifying rivalry in digital service offerings.

Furthermore, the burgeoning Malaysian fintech sector presents a substantial competitive threat. Companies specializing in payments, digital lending, and e-wallets are increasingly offering specialized financial solutions that cater to specific market needs, thereby challenging traditional banking models.

Competitive rivalry in the banking sector, including for Affin Bank, significantly pressures Net Interest Margins (NIM). Intense competition for deposits and the dynamic nature of interest rates can squeeze the difference between what banks earn on loans and what they pay on deposits. For instance, in early 2024, many Malaysian banks saw their NIMs impacted by rising funding costs, even as loan growth remained steady.

Affin Bank itself anticipates a normalization of its NIM by the first half of 2025. However, it foresees short-term compression as a strategic move to focus on acquiring clients with higher credit quality. This deliberate choice means accepting potentially lower initial margins for the sake of long-term portfolio health. This margin pressure underscores the critical need for robust cost management strategies and proactive efforts to diversify revenue beyond traditional interest income.

Product and Service Homogeneity

Many core banking products, like savings accounts and standard loans, are often seen as very similar across different financial institutions. This similarity, or homogeneity, can turn competition into a price war. Banks then need to stand out through better customer service, easier digital tools, or extra benefits.

Affin Bank is actively working to counter this product homogeneity. Their strategy leans into offering more tailored solutions and leading in digital banking advancements. This approach aims to create a distinct value proposition beyond just the basic product features.

- Product Similarity: Traditional banking products like savings accounts and personal loans are often perceived as interchangeable between banks.

- Price-Based Competition: This homogeneity frequently drives competition based on interest rates and fees, squeezing profit margins.

- Differentiation Strategies: Banks like Affin Bank focus on enhancing customer experience, digital accessibility, and unique value-added services to stand out.

- Affin Bank's Focus: The bank's strategic emphasis on personalized financial solutions and digital innovation is designed to mitigate the impact of product commoditization.

Strategic Initiatives for Market Share Growth

Competitive rivalry in the Malaysian banking sector is intense, with players like Affin Bank actively implementing strategies to capture greater market share. These initiatives often involve expanding loan portfolios, enhancing asset quality, and bolstering digital offerings to attract and retain customers.

Affin Bank's AX28 Strategic Plan underscores this competitive drive, outlining ambitious growth targets and a commitment to expanding its branch network. This strategic push is a direct response to the dynamic and highly contested landscape of Malaysian banking.

- Loan Portfolio Expansion: Malaysian banks are focusing on growing their lending activities across various sectors.

- Digital Transformation: Significant investments are being made in digital banking platforms and services to improve customer experience.

- Asset Quality Improvement: Efforts are concentrated on managing and reducing non-performing loans to strengthen financial health.

- Branch Network Growth: Strategic expansion of physical presence, as seen in Affin Bank's plans, aims to increase accessibility and reach.

The competitive rivalry within Malaysia's banking sector is exceptionally high, impacting Affin Bank significantly. Established players like Maybank and CIMB, alongside newer digital entrants, are aggressively competing for customers, driving down margins on core products. This intense competition, evidenced by the RM2.3 trillion in total assets in the Malaysian banking sector by the end of 2023, forces banks to differentiate through service and digital innovation.

Affin Bank's strategic response includes focusing on client acquisition with higher credit quality, even if it means short-term Net Interest Margin (NIM) compression. This proactive approach aims to build a stronger, more resilient customer base amidst the fierce competition for deposits and loans, which saw NIMs pressured across the industry in early 2024 due to rising funding costs.

| Competitor | Key Competitive Actions | Impact on Affin Bank |

|---|---|---|

| Maybank, CIMB, Public Bank | Aggressive pricing, extensive branch networks, product innovation | Pressure on NIM, need for enhanced customer retention strategies |

| Digital Banks (GXBank, AEON Bank, Boost Bank) | Targeting tech-savvy consumers with digital-first offerings | Increased competition in digital services, need for rapid digital transformation |

| Fintech Companies | Specialized digital lending, payment solutions, e-wallets | Disruption of traditional banking models, potential loss of market share in niche areas |

SSubstitutes Threaten

The proliferation of digital payment platforms and e-wallets presents a substantial threat to Affin Bank. These services, like Touch 'n Go eWallet and GrabPay, offer enhanced convenience and user experience, directly competing with traditional banking payment methods.

In 2024, Malaysia saw continued strong growth in digital payments, with e-wallets becoming increasingly integrated into daily transactions. For instance, the total transaction value for e-wallets in Malaysia was projected to reach over USD 15 billion by the end of 2024, indicating a significant shift in consumer behavior away from conventional banking services.

These platforms are expanding their offerings beyond simple payments, venturing into areas like micro-investments and loans, thereby capturing a broader share of the financial services market and potentially reducing customer reliance on traditional banks like Affin Bank.

Peer-to-peer (P2P) lending and crowdfunding platforms present a significant threat of substitutes for Affin Bank. These platforms offer alternative avenues for capital, directly competing with traditional bank loans, especially for small and medium-sized enterprises (SMEs) and individual borrowers. For instance, in 2023, the global P2P lending market was valued at approximately USD 75.2 billion and is projected to grow substantially, indicating a strong shift towards these alternative financing methods.

These digital platforms often provide quicker approval processes and potentially more accommodating terms compared to conventional banking. This appeal can draw away customers who find traditional loan applications lengthy or restrictive. The increasing adoption of these fintech solutions means a growing portion of the lending market, particularly for unsecured personal loans and startup funding, is moving away from established institutions like Affin Bank, thereby diminishing the demand for their core lending services.

The threat of substitutes for Affin Bank's investment and wealth management services is significant, driven by the proliferation of online brokerage platforms and robo-advisors. These digital alternatives offer lower fees and greater accessibility, particularly appealing to younger, tech-savvy investors. For instance, the global robo-advisor market was valued at approximately $2.5 billion in 2023 and is projected to grow substantially, indicating a clear shift in customer preference away from traditional channels.

These substitutes directly challenge banks by allowing customers to manage their portfolios independently, bypassing traditional advisory services and potentially eroding fee-based revenue streams for institutions like Affin Bank. The ease of opening accounts and executing trades online means customers no longer need to rely solely on their bank for investment management, increasing competitive pressure.

Non-Bank Financial Institutions and Specialized Lenders

Non-bank financial institutions and specialized lenders present a significant threat of substitution for Affin Bank. These entities, ranging from fintech startups to established alternative lenders, offer a diverse array of financial products like credit, insurance, and investment services that can directly compete with traditional banking offerings. Their agility and focus on specific market niches often allow them to create more attractive, tailored solutions for customers.

These specialized players can chip away at Affin Bank's market share by providing more personalized or cost-effective alternatives. For example, peer-to-peer lending platforms and digital payment providers offer convenient credit and transaction services that bypass traditional banking channels. In 2024, the global fintech market continued its robust growth, with alternative lending alone projected to reach hundreds of billions of dollars, highlighting the scale of this competitive pressure.

- Niche Lenders: Specialized lenders focusing on areas like small business loans or mortgages can offer more competitive rates or faster approvals than larger, more generalized banks.

- Fintech Innovations: Digital platforms provide alternative payment solutions, personal loans, and investment opportunities, directly challenging bank services.

- Insurance Substitutes: Insurtech companies and specialized insurance providers offer tailored policies that may be more appealing than those from a bank's insurance arm.

- Market Share Erosion: The increasing adoption of these non-bank alternatives means a growing portion of financial services transactions are occurring outside the traditional banking system.

Cryptocurrencies and Blockchain-based Financial Services

Cryptocurrencies and blockchain-based financial services are emerging as potential substitutes for traditional banking, though their widespread adoption for daily transactions is still developing. As these decentralized systems mature and regulatory clarity increases, they could offer alternative avenues for value storage, fund transfers, and transactions, potentially bypassing conventional banking channels.

By mid-2024, the global cryptocurrency market capitalization hovered around $2.5 trillion, indicating significant, albeit volatile, growth. This burgeoning sector presents a long-term threat to incumbent financial institutions like Affin Bank by offering alternative financial infrastructure.

- Growing Market Share: While still a fraction of the global financial system, the increasing market capitalization of cryptocurrencies signals a growing user base and acceptance.

- Decentralized Finance (DeFi): DeFi platforms, built on blockchain, offer lending, borrowing, and trading services without traditional intermediaries, directly challenging bank functions.

- Regulatory Evolution: As more countries establish clearer regulations for digital assets, the legitimacy and accessibility of these substitutes are likely to increase, posing a greater threat.

- Technological Advancements: Ongoing innovation in blockchain technology promises faster, cheaper, and more secure transactions, enhancing their appeal as alternatives to traditional payment systems.

The threat of substitutes for Affin Bank is substantial, stemming from digital payment platforms, P2P lending, online investment services, and non-bank financial institutions. These alternatives offer convenience, speed, and often lower costs, directly challenging traditional banking services.

In 2024, e-wallets in Malaysia were projected to exceed USD 15 billion in transaction value, showcasing a significant shift in consumer preference. Similarly, the global P2P lending market, valued at approximately USD 75.2 billion in 2023, highlights the growing appeal of alternative financing.

| Substitute Category | Key Offerings | Impact on Affin Bank | 2024 Market Trend/Data |

|---|---|---|---|

| Digital Payments & E-wallets | Convenient transactions, mobile payments | Reduces reliance on bank's payment systems | Malaysia e-wallet transaction value projected > USD 15 billion |

| P2P Lending & Crowdfunding | Alternative loans, faster approvals | Erodes traditional lending revenue | Global P2P lending market valued at USD 75.2 billion (2023) |

| Online Brokerages & Robo-advisors | Low-fee investing, self-directed portfolios | Decreases demand for wealth management services | Global robo-advisor market valued at USD 2.5 billion (2023) |

| Non-Bank Financial Institutions | Specialized loans, niche financial products | Chips away at market share in specific segments | Global fintech market continues robust growth; alternative lending in hundreds of billions |

Entrants Threaten

Bank Negara Malaysia's (BNM) decision to issue five digital bank licenses, with several already operational in 2023-2024, poses a substantial threat of new entrants to the Malaysian banking landscape. These digital banks, including GXBank, AEON Bank, and Boost Bank, are built for agility and digital-first experiences, directly challenging incumbents by targeting specific customer needs and introducing novel services.

Digital-first banking models can significantly lower entry barriers compared to traditional brick-and-mortar institutions. These new entrants often bypass the substantial capital outlays for physical branches, focusing instead on technology platforms. This allows them to scale rapidly and serve a wide customer base with a leaner operational structure.

For established players like Affin Bank, this presents a challenge. The agility of digital-first competitors forces them to accelerate their own digital transformation efforts. In 2024, the global fintech market was valued at over USD 2.5 trillion, a testament to the rapid growth and adoption of these new models.

Bank Negara Malaysia's (BNM) proactive approach to digital finance, including opening applications for digital insurer and takaful operator licenses, signals a potentially welcoming environment for new players. This regulatory development, as of early 2024, suggests a pathway for innovative firms to enter various financial segments, potentially increasing competition.

Access to Capital and Technology for Entrants

New players, especially digital banks, frequently benefit from substantial backing by major tech companies and existing financial institutions. This infusion of capital and technological know-how allows them to build sophisticated digital offerings and aggressive growth plans.

For instance, in 2024, several neobanks secured significant funding rounds, with some raising hundreds of millions of dollars, enabling substantial investments in user experience and marketing. This financial muscle allows them to compete effectively with established players.

- Significant Capital Inflows: Digital-first challengers often tap into venture capital and private equity, allowing for rapid scaling and technology development.

- Technological Prowess: Entrants can leverage cutting-edge cloud infrastructure and AI-driven analytics from the outset, bypassing legacy system limitations faced by incumbents.

- Agile Market Entry: With strong financial backing, new entrants can absorb initial operating losses and focus on rapid customer acquisition, potentially disrupting market share quickly.

Customer Adoption of Digital Services

The increasing customer adoption of digital services in Malaysia significantly lowers the threat of new entrants for banks like Affin Bank. As of 2024, digital payments and online banking are widely embraced, with Bank Negara Malaysia reporting a substantial increase in digital transaction volumes. This widespread comfort with digital platforms means new, digitally-native financial service providers face fewer hurdles in attracting customers. They can bypass the traditional need for extensive branch networks, which is a considerable cost saving, thereby making market entry more feasible.

This trend is further evidenced by the growing number of digital banks and fintech companies entering the Malaysian market. For instance, the successful launch of several digital banking licenses in 2024 by regulatory bodies indicates a deliberate effort to foster innovation and competition. A population already accustomed to managing their finances online and through mobile apps is naturally more open to exploring alternative digital banking solutions. This readily available customer base reduces the marketing and education costs for new entrants, directly impacting their ability to compete with established players.

- Digital Payment Growth: Malaysia's digital payment transaction value saw a significant surge, reaching an estimated RM2.5 trillion in 2024, up from RM1.8 trillion in 2023.

- Online Banking Penetration: Over 80% of Malaysian adults actively use online banking services, indicating a high level of digital financial literacy.

- Reduced Infrastructure Costs: New entrants can operate with minimal physical infrastructure, focusing capital on technology and customer acquisition, a stark contrast to traditional banks.

The threat of new entrants for Affin Bank is amplified by Malaysia's embrace of digital banking, evidenced by Bank Negara Malaysia issuing five digital bank licenses, with several operational by 2024.

These digital banks, like GXBank and AEON Bank, benefit from lower barriers to entry due to their digital-first models, bypassing the need for extensive physical branches and leveraging technological prowess.

With substantial capital inflows from investors and tech giants, new entrants can aggressively acquire customers, as seen with neobanks raising hundreds of millions in 2024, enabling them to compete effectively.

The widespread adoption of digital services in Malaysia, with digital payment transaction values estimated at RM2.5 trillion in 2024, further reduces customer acquisition hurdles for these new players.

| Metric | 2023 Value (Est.) | 2024 Value (Est.) | Impact on New Entrants |

|---|---|---|---|

| Digital Payment Transactions (RM Trillion) | 1.8 | 2.5 | Lower customer acquisition friction |

| Online Banking Penetration (%) | ~75 | >80 | Increased digital financial literacy |

| Digital Bank Licenses Issued | 5 | 5 | Directly enables new competition |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Affin Bank is built upon a foundation of robust data, drawing from the bank's official annual reports, financial statements, and investor relations disclosures. We supplement this with insights from reputable industry publications, market research reports, and macroeconomic indicators to provide a comprehensive view of the competitive landscape.