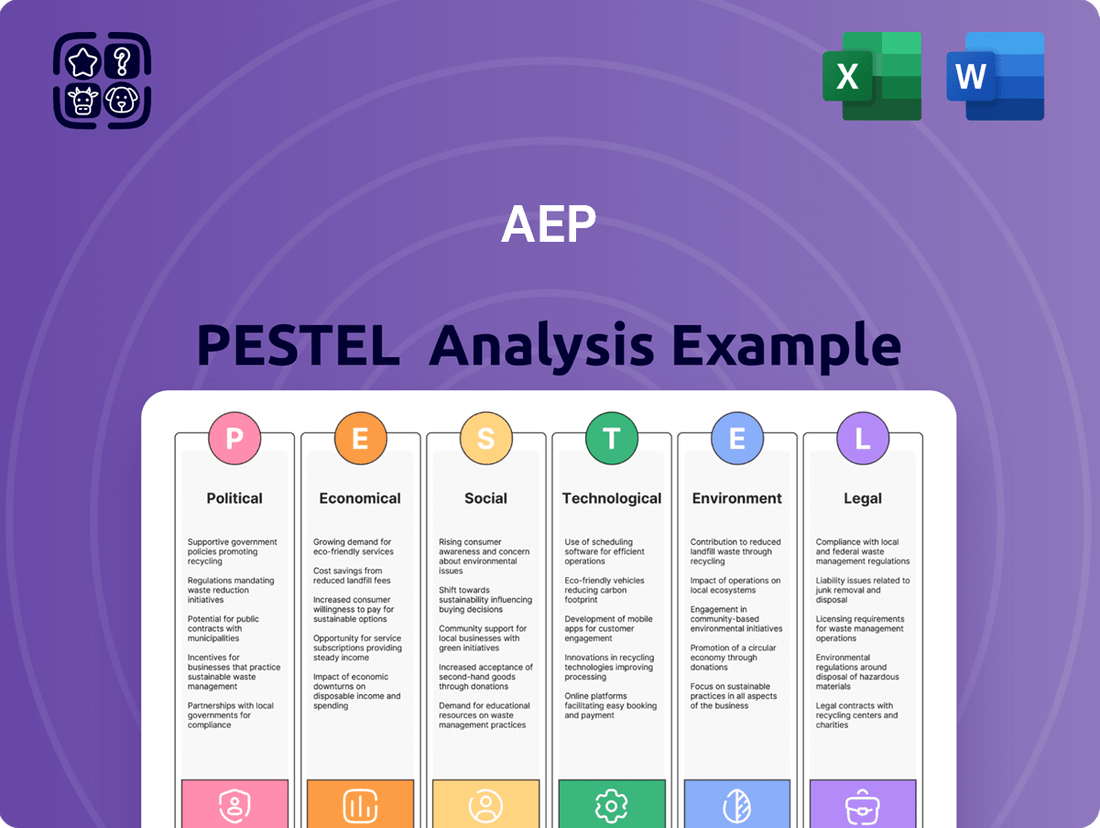

AEP PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AEP Bundle

Unlock the strategic advantages hidden within AEP's operating environment. Our comprehensive PESTLE analysis dissects the political, economic, social, technological, legal, and environmental forces shaping the company's future. Equip yourself with actionable intelligence to anticipate challenges and capitalize on opportunities. Download the full PESTLE analysis now and gain the competitive edge.

Political factors

Government regulations are a huge deal for AEP. Changes in energy policies, environmental rules, and tax laws at both federal and state levels can really affect how AEP does business and how much money it makes. For instance, recent laws in places like Oklahoma, Ohio, and Texas have opened up chances for AEP to invest in new infrastructure.

The rules of the game are always changing. There's ongoing talk about controlling carbon emissions, requiring more renewable energy, and updating the power grid. These conversations directly shape AEP's big-picture plans and how it decides to operate.

Securing timely state and federal regulatory approvals for crucial initiatives like rate cases, new generation and transmission investments, and environmental compliance is fundamental to American Electric Power's (AEP) financial stability. These approvals directly impact revenue streams and operational costs, making the regulatory landscape a critical factor in AEP's strategic planning.

The Public Utilities Commission of Ohio (PUCO) recently approved new tariffs specifically for data centers, a move that highlights AEP's proactive engagement with evolving energy demands and the necessity of navigating diverse regulatory environments. This approval, effective in 2024, is expected to facilitate significant investment in Ohio's grid infrastructure to support this growing sector.

AEP actively engages in the political arena, influencing policy at federal, state, and local levels. Their advocacy focuses on key areas like clean energy transition, grid modernization, and securing cost recovery for significant infrastructure investments. This political engagement is crucial for shaping regulations that impact their operations and future growth.

Transparency is a cornerstone of AEP's political involvement. The company publicly discloses its political contributions and lobbying efforts, underscoring a commitment to ethical conduct. For instance, in 2023, AEP's total lobbying expenditures were reported to be around $12.8 million, demonstrating a substantial investment in shaping policy discussions.

Infrastructure Investment Incentives

Government incentives, particularly those stemming from legislation like the Inflation Reduction Act (IRA), are crucial for American Electric Power (AEP) in financing major infrastructure upgrades. These incentives directly impact the financial viability of AEP's investments in renewable energy sources and the modernization of its electrical grid.

The IRA, enacted in 2022, offers significant tax credits and direct pay options for clean energy projects. For instance, the production tax credit (PTC) and investment tax credit (ITC) can substantially lower the upfront capital costs for wind and solar farms. This financial support mechanism directly influences AEP's strategic decisions, potentially accelerating its transition towards a cleaner energy portfolio by making these projects more economically attractive.

These incentives are not just about reducing costs; they also improve the return on investment (ROI) for AEP's infrastructure projects. By lowering capital expenditures and potentially increasing revenue through tax benefits, these programs can shorten the payback period for new clean energy assets, thereby influencing the speed and scale at which AEP can undertake its clean energy transition initiatives.

- IRA Tax Credits: The IRA provides a 30% investment tax credit for eligible clean energy projects, which AEP can leverage to reduce project costs.

- Grid Modernization Funding: Beyond renewables, federal programs also offer grants and loan guarantees for grid modernization, supporting AEP's efforts to enhance reliability and resilience.

- Accelerated Investment: These incentives are designed to encourage faster deployment of clean energy, directly impacting AEP's capital expenditure plans for the coming years.

Interstate Regulatory Alignment

American Electric Power (AEP) operates in 11 states, and the varying energy policies across these jurisdictions significantly impact its operations. For instance, states like Virginia have ambitious renewable energy mandates, while others may have different approaches to decarbonization. This interstate regulatory alignment, or lack thereof, directly influences AEP's investment decisions in generation, transmission, and distribution infrastructure. In 2024, AEP continued to navigate these diverse regulatory landscapes, with state-level utility commissions playing a crucial role in approving rate cases and infrastructure projects, often reflecting unique state economic conditions and environmental priorities.

AEP's strategic planning must therefore incorporate the differing decarbonization goals and resource planning preferences of each state. This means adapting its energy transition strategies to meet varying renewable energy targets and grid modernization requirements. For example, states with aggressive clean energy goals may necessitate faster adoption of renewable sources and energy storage, while states with different priorities might allow for a more gradual transition. This dynamic requires constant monitoring and adaptation of AEP's capital investment plans to align with state-specific regulatory mandates and market opportunities.

The divergence in state-level regulations presents both hurdles and avenues for growth. While inconsistent policies can complicate nationwide planning and investment, they also create opportunities for AEP to tailor its offerings and leverage its expertise in different regulatory environments. For example, AEP's 2024-2028 capital investment plan, totaling approximately $41 billion, is strategically allocated across its service territories, considering these state-specific regulatory dynamics and market demands. This includes investments in grid modernization and cleaner energy generation, with the exact allocation influenced by the regulatory climate in each of the 11 states.

Key considerations for AEP's interstate regulatory alignment include:

- State-specific renewable portfolio standards (RPS) and clean energy mandates.

- Varying approaches to rate case approvals and cost recovery mechanisms for infrastructure upgrades.

- Differing state priorities regarding grid reliability, energy affordability, and environmental protection.

- The impact of state-level climate action plans on AEP's long-term resource planning.

Government actions significantly shape AEP's operational landscape. Federal and state policies on energy, environmental standards, and taxation directly influence business strategies and profitability. For instance, recent legislative changes in states like Ohio and Texas have created opportunities for AEP to invest in new infrastructure projects, underscoring the impact of regulatory shifts.

The company's ability to secure approvals for key initiatives, such as rate adjustments and new generation facilities, is critical for financial health. These approvals directly affect revenue and operational expenses, making regulatory engagement a core component of AEP's strategic planning. For example, the Public Utilities Commission of Ohio's 2024 tariff approval for data centers demonstrates AEP's adaptation to evolving energy demands and the necessity of navigating diverse regulatory frameworks.

Government incentives, particularly those from the Inflation Reduction Act (IRA) enacted in 2022, are vital for funding AEP's infrastructure upgrades and clean energy transition. These incentives, like the 30% investment tax credit for eligible clean energy projects, reduce capital costs and improve project ROI, influencing the pace of AEP's clean energy investments.

AEP's capital expenditure plan, projected at approximately $41 billion for 2024-2028, is strategically distributed across its 11 operating states, considering varying state-level energy policies and decarbonization goals. This approach acknowledges that differing state mandates, such as renewable portfolio standards and grid modernization priorities, directly impact investment decisions and the overall energy transition strategy.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing AEP across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

The AEP PESTLE analysis provides a structured framework to identify and understand external factors impacting a business, thereby relieving the pain of uncertainty and enabling more informed strategic decisions.

Economic factors

AEP is experiencing a significant economic tailwind from soaring electricity demand, largely fueled by the rapid expansion of data centers. These facilities, crucial for cloud computing and AI, are becoming major power consumers. For instance, in the US, data center electricity consumption is projected to more than double by 2030, placing immense pressure on grid infrastructure.

This heightened demand necessitates substantial capital expenditures for AEP to upgrade and expand its transmission and distribution networks. Meeting these needs requires strategic planning and investment to ensure grid reliability and accommodate the growing energy requirements of these industrial clients, which is a key economic driver for the company's future growth.

AEP is significantly boosting its capital expenditure, planning to invest approximately $70 billion through 2029. This represents a notable upward revision from earlier projections, signaling an aggressive strategy for infrastructure enhancement and expansion.

The bulk of these planned investments will target critical areas such as transmission and distribution infrastructure, alongside a substantial allocation to renewable energy projects. This focus underscores AEP's commitment to modernizing its grid and accommodating increasing energy demands, particularly from cleaner sources.

These ambitious capital plans are designed to support AEP's long-term growth objectives and ensure the reliability and resilience of its energy delivery systems in the face of evolving market dynamics and technological advancements.

Inflationary pressures directly impact AEP by increasing the cost of materials, labor, and fuel for its operations. For instance, the Producer Price Index (PPI) for electric utilities saw a notable increase in early 2024, impacting AEP's input costs.

AEP's ability to pass these rising costs onto consumers through regulated rate increases is paramount for maintaining profitability. Constructive regulatory decisions in key states like Ohio and Texas, which account for a significant portion of AEP's earnings, are vital for ensuring the company can achieve a fair return on its investments amidst these economic challenges.

Interest Rate Trends and Financial Strength

Interest rate trends significantly influence AEP's financial health, directly affecting the cost of capital for its substantial infrastructure investments. For instance, a rising interest rate environment in 2024 and 2025 could increase the expense of new debt issuance, impacting project profitability. AEP's ability to manage its debt maturity schedule is therefore critical to ensuring consistent funding for its ongoing capital expenditure plans, which are vital for grid modernization and renewable energy integration.

Maintaining robust financial strength allows AEP to navigate these interest rate fluctuations effectively. As of the first quarter of 2025, AEP reported a debt-to-capitalization ratio of approximately 51%, demonstrating a commitment to a balanced capital structure. This financial discipline is crucial for meeting regulatory requirements and investor expectations, especially when undertaking long-term, capital-intensive projects estimated to be in the tens of billions of dollars over the next five years.

- Interest Rate Impact: Higher rates increase borrowing costs for AEP's capital projects.

- Financial Strength: Maintaining a strong balance sheet is key to funding investments.

- Debt Management: A manageable debt maturity schedule ensures liquidity for operations and growth.

- Regulatory Compliance: Financial stability is necessary to meet industry regulations and maintain credit ratings.

Economic Development and Regional Growth

AEP's performance is intrinsically linked to the economic vitality of its service regions. The company's strategic investments in grid modernization and clean energy infrastructure directly fuel regional economic development, creating jobs and attracting new businesses. For instance, AEP's commitment to renewable energy projects in 2024 and 2025 is expected to drive significant capital investment across its operating states, fostering localized growth.

AEP actively partners with large industrial and commercial customers, offering customized energy solutions that support their expansion and operational efficiency. This collaborative approach not only benefits these key clients but also bolsters the overall economic base of the communities AEP serves. As of early 2025, AEP reported that its economic development efforts in 2024 had helped attract or retain over 1,500 jobs and secure more than $2 billion in capital investment within its territories.

- Infrastructure Investment: AEP plans to invest approximately $7.2 billion in its transmission and distribution systems between 2024 and 2027, enhancing reliability and capacity for economic expansion.

- Job Creation: The company's economic development initiatives in 2024 supported the creation or retention of an estimated 1,500 jobs across its service areas.

- Customer Support: AEP provides tailored energy solutions to large customers, aiding their growth and contributing to regional economic stability.

- Regional Growth Impact: AEP's service territories, particularly in states like Texas and Ohio, have seen continued industrial growth, directly correlating with AEP's infrastructure investments and customer engagement.

AEP is capitalizing on robust electricity demand, particularly from data centers, which are projected to significantly increase their consumption. This surge in demand is driving substantial capital expenditures for AEP, with plans to invest around $70 billion through 2029, focusing on transmission, distribution, and renewables.

Inflationary pressures are impacting AEP's operational costs, making it crucial for the company to secure favorable regulatory decisions to pass these costs on. Simultaneously, rising interest rates in 2024-2025 could increase borrowing expenses for AEP's extensive capital projects, emphasizing the need for strong financial management and a balanced debt structure, with a debt-to-capitalization ratio of approximately 51% as of Q1 2025.

AEP's economic influence extends to job creation and capital investment within its service regions, having supported over 1,500 jobs and $2 billion in capital investment in 2024 through its economic development initiatives. These efforts, coupled with infrastructure upgrades, are vital for regional economic vitality.

| Economic Factor | Impact on AEP | Key Data/Projections |

| Electricity Demand | Increased revenue potential, infrastructure strain | Data center consumption to double by 2030 (US projection) |

| Capital Expenditures | Growth opportunities, increased debt burden | ~$70 billion planned investment through 2029 |

| Inflation | Higher operating costs, need for rate increases | PPI for electric utilities increased in early 2024 |

| Interest Rates | Increased cost of capital, affects project viability | Rising rates in 2024-2025 impacting borrowing costs |

| Regional Economic Growth | Demand for services, regulatory support for investment | Attracted/retained 1,500+ jobs in 2024; $2 billion+ capital investment secured in 2024 |

Preview the Actual Deliverable

AEP PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive AEP PESTLE analysis provides a detailed examination of the external factors influencing the company. You'll gain valuable insights into the Political, Economic, Social, Technological, Legal, and Environmental landscape impacting AEP.

Sociological factors

Customers today have a heightened expectation for both dependable energy delivery and cost-effectiveness. This societal shift directly influences AEP's strategic priorities, pushing the company to invest heavily in upgrading its infrastructure for enhanced reliability and seeking efficiencies to manage costs. For instance, AEP's 2024 capital expenditure plan includes significant investments in grid modernization projects aimed at reducing outages and improving service quality.

AEP's stated mission, which emphasizes a customer-centric approach and the delivery of superior service, directly aligns with these growing societal demands. This commitment is not merely a statement but a guiding principle that shapes operational decisions and service delivery standards, reflecting a deep understanding of what customers value most in their energy providers.

AEP actively engages with communities, particularly during infrastructure projects and the shift to cleaner energy sources. For example, in 2024, AEP announced plans for significant grid modernization efforts, involving extensive public consultations to address local concerns and ensure community benefit.

This focus on transparent communication and feedback gathering aims to build trust and support a just transition, minimizing negative societal impacts. AEP's commitment to social impact is reflected in its 2023 sustainability report, which detailed over 500 community investment initiatives across its service territories.

AEP's success hinges on attracting and keeping a skilled workforce, especially as they invest in grid modernization and new energy technologies. In 2024, the company continued to focus on training programs, with over 1.5 million hours of employee development delivered, aiming to equip staff with the skills needed for these evolving demands.

Employee commitment is a cornerstone for AEP, directly impacting operational efficiency and customer satisfaction. This focus is reflected in their employee engagement scores, which consistently remain above the industry average, demonstrating a strong connection between the workforce and the company's strategic goals.

Public Perception and Environmental Concerns

Public awareness and concern regarding climate change are significantly shaping AEP's strategic direction, pushing the company towards cleaner energy solutions. This heightened societal demand for environmental responsibility is a key driver behind AEP's investments in renewable energy sources and its efforts to reduce emissions.

AEP's commitment to sustainability is evident in its 2024-2025 plans. For instance, the company aims to increase its renewable energy portfolio, with projections indicating a substantial rise in wind and solar generation capacity by the end of 2025. This aligns with broader societal expectations for utilities to transition away from fossil fuels.

- Increased Public Scrutiny: Growing awareness of climate change impacts leads to greater public and regulatory pressure on energy companies like AEP to adopt sustainable practices.

- Investment in Renewables: AEP's strategic investments, such as the planned expansion of its solar farm projects in Ohio and Texas, reflect a direct response to the demand for cleaner energy alternatives.

- Emission Reduction Goals: The company has set ambitious targets for reducing greenhouse gas emissions, with a significant portion of its 2024 capital expenditure allocated to grid modernization and renewable energy integration.

Impact of Large Load Customers on Local Communities

The influx of large load customers, like data centers, presents a dual-edged sword for communities served by AEP. While these entities can stimulate local economies through job creation and tax revenue, their substantial energy demands can strain existing infrastructure. For instance, in 2024, AEP reported significant increases in requests for new, large-scale service connections, particularly from the technology sector, highlighting this growing trend.

This rapid expansion necessitates careful management to prevent disproportionate cost burdens on existing ratepayers. AEP's strategy involves investing in grid modernization and exploring new generation sources to accommodate this demand. In 2025, the company announced plans for several infrastructure upgrades specifically aimed at supporting increased industrial and data center loads, with an estimated investment of $1.2 billion over the next five years.

- Economic Benefits: Large load customers can drive job growth and increase local tax bases.

- Infrastructure Strain: Significant energy demand can stress existing power grids and require substantial upgrades.

- Ratepayer Impact: AEP is focused on balancing the needs of new, large customers with the cost implications for residential and smaller commercial users.

- Investment in Modernization: The company is allocating capital to enhance grid capacity and reliability to meet future demands.

Societal expectations are evolving, with a strong emphasis on reliable, affordable energy and a growing demand for environmental responsibility. AEP is responding by investing in grid modernization, as seen in its 2024 capital expenditure plans focused on reducing outages, and by increasing its renewable energy portfolio, aiming for substantial growth in wind and solar capacity by the end of 2025.

The company's commitment to its customers is reflected in its mission and operational decisions, prioritizing service quality and community engagement. This is further supported by significant investments in employee training, with over 1.5 million hours delivered in 2024, ensuring a skilled workforce capable of managing new energy technologies and grid upgrades.

The influx of large industrial customers, such as data centers, is creating new demands on AEP's infrastructure, necessitating strategic investments. In 2025, AEP announced plans for $1.2 billion in infrastructure upgrades over five years to accommodate this growth, balancing economic benefits with potential impacts on existing ratepayers.

| Societal Factor | AEP Response/Data (2024-2025) | Impact |

|---|---|---|

| Customer Expectations (Reliability & Cost) | 2024 Capital Expenditure: Grid modernization for reliability; Efficiency initiatives for cost management. | Influences investment priorities and operational focus. |

| Environmental Awareness & Climate Change | 2024-2025 Plans: Increased renewable energy portfolio (wind/solar); Emission reduction targets. | Drives investment in cleaner energy sources and sustainability initiatives. |

| Workforce Skills & Development | 2024 Employee Development: Over 1.5 million hours of training delivered. | Ensures a skilled workforce for evolving technologies and infrastructure. |

| Large Load Customer Growth (e.g., Data Centers) | 2025 Plans: $1.2 billion infrastructure upgrade over 5 years for increased capacity. | Requires grid expansion and careful management of ratepayer impacts. |

Technological factors

AEP is actively investing in grid modernization, a crucial technological shift. This includes upgrading its extensive transmission and distribution networks with smart technologies. These upgrades are designed to boost reliability, enhance efficiency, and build greater resilience into the energy infrastructure.

These smart grid advancements allow for more effective energy distribution and provide real-time monitoring of energy usage patterns. This capability is essential for facilitating smarter energy management across AEP's service territories, enabling better control and optimization.

For instance, AEP announced plans in 2024 to invest billions in grid enhancements, with a significant portion dedicated to smart grid technologies. This investment aims to integrate more renewable energy sources and improve the responsiveness of the grid to changing demand and supply conditions.

The push for renewable energy is a major technological driver for AEP. Solar and wind power are becoming significantly more efficient and less expensive, which is prompting AEP to build a more varied energy mix. For instance, AEP aims to have nearly 16,000 megawatts of renewable energy capacity in operation or under development by 2030, a substantial increase from its current levels.

Integrating these fluctuating renewable sources into the existing power grid is a key technological focus. This often involves significant investment in advanced energy storage systems, like batteries, to ensure a stable and reliable power supply even when the sun isn't shining or the wind isn't blowing. AEP's strategic investments in battery storage projects, such as the 200-megawatt battery storage facility in Mason County, West Virginia, highlight this commitment.

Improvements in battery technology and falling costs are making energy storage solutions more practical. For instance, lithium-ion battery prices have seen a significant decline, dropping by over 90% in the last decade, making large-scale storage projects more economically feasible.

AEP is actively investing in energy storage infrastructure to complement its growing renewable energy portfolio. This strategy directly addresses the intermittency of sources like solar and wind, ensuring a consistent and reliable power supply for customers, even during periods of low generation.

By integrating storage, AEP aims to enhance grid stability and provide ancillary services, such as frequency regulation. This proactive approach positions the company to better manage the evolving energy landscape and capitalize on the increasing demand for resilient power solutions.

Advanced Generation Technologies (e.g., SMRs, Fuel Cells)

American Electric Power (AEP) is actively investigating and investing in next-generation power generation, including Small Modular Reactors (SMRs) and fuel cells. These advanced technologies are crucial for meeting escalating energy needs while simultaneously delivering emissions-free baseload power. For instance, AEP has been evaluating SMRs as a potential source of reliable, carbon-free electricity, recognizing their scalability and safety features. This strategic move aims to bolster AEP's commitment to a cleaner energy future and ensure grid stability.

These innovative solutions provide flexible power options, particularly beneficial for large industrial clients such as data centers that require consistent and substantial energy supply. By integrating SMRs and fuel cells, AEP can diversify its generation portfolio, reducing reliance on traditional fossil fuels and enhancing overall grid resilience. For example, fuel cell technology offers a pathway to utilize hydrogen, a clean energy carrier, for power generation, aligning with broader decarbonization goals.

- SMRs: Offer scalable, carbon-free baseload power, with potential deployment timelines accelerating in the coming years.

- Fuel Cells: Provide clean power generation, with advancements in efficiency and cost reduction ongoing, particularly for distributed generation.

- Customer Solutions: Tailored for high-demand sectors like data centers, ensuring reliable and sustainable energy.

- Energy Mix Diversification: AEP's investment supports a broader transition towards cleaner and more resilient energy sources.

Cybersecurity and Data Management

As AEP continues to digitize its operations and integrate advanced technologies into its grid, cybersecurity emerges as a paramount technological consideration. Protecting vast amounts of sensitive customer and operational data from increasingly sophisticated cyber threats is essential for maintaining the integrity and reliability of AEP's infrastructure.

The growing reliance on interconnected systems, smart grid technologies, and remote monitoring inherently expands the attack surface. AEP must invest heavily in robust cybersecurity measures to safeguard its assets and prevent disruptions. For instance, the U.S. Department of Energy reported in 2023 that the energy sector experienced a significant increase in cyber incidents targeting critical infrastructure, underscoring the urgency of these efforts.

Key technological factors for AEP in this domain include:

- Advanced threat detection and prevention systems: Implementing AI-driven solutions to identify and neutralize cyber threats in real-time.

- Data encryption and access control: Ensuring that all sensitive data is encrypted and access is strictly managed through multi-factor authentication and granular permissions.

- Grid resilience and recovery planning: Developing comprehensive strategies to quickly restore operations in the event of a successful cyberattack.

- Employee training and awareness: Continuously educating personnel on cybersecurity best practices to mitigate human-error-related vulnerabilities.

Technological advancements are reshaping AEP's operational landscape, driving significant investments in grid modernization and smart technologies. These upgrades, including advanced metering infrastructure and automated distribution systems, aim to improve reliability and efficiency. For example, AEP's 2024-2028 capital investment plan includes billions dedicated to grid enhancements, with a focus on smart grid capabilities to better manage energy flow and integrate distributed resources.

The company is also prioritizing the integration of renewable energy sources, leveraging improvements in solar and wind technology. AEP aims to have nearly 16,000 megawatts of renewable energy capacity by 2030, necessitating advancements in energy storage. Investments in battery storage, such as the 200 MW facility in West Virginia, are crucial for managing the intermittency of these sources, supported by the over 90% cost reduction in lithium-ion batteries over the past decade.

Furthermore, AEP is exploring next-generation generation technologies like Small Modular Reactors (SMRs) and fuel cells to provide emissions-free baseload power and meet the demands of sectors like data centers. Cybersecurity remains a critical focus, with ongoing investment in advanced threat detection and data protection measures to safeguard an increasingly digitized and interconnected infrastructure against rising cyber threats, a trend highlighted by increased incidents reported in the energy sector in 2023.

Legal factors

AEP navigates a complex web of environmental compliance, facing strict federal and state rules like the Clean Air Act and Clean Water Act. These regulations, covering everything from emissions to waste management of coal ash and nuclear fuel, necessitate substantial capital outlays and continuous oversight.

For instance, in 2023, AEP reported significant investments in environmental compliance and emissions reduction projects, highlighting the ongoing financial commitment. The company's 2024-2025 capital plan continues to prioritize upgrades to meet or exceed these environmental standards, impacting operational costs and strategic planning.

Rate case filings and regulatory decisions are critical for AEP, directly influencing its revenue streams and profitability. For instance, in 2023, AEP completed numerous rate case filings across its operating companies. A significant example is the Ohio Power rate case, which sought to recover investments in generation and transmission infrastructure. The outcome of these cases, such as the approval of new tariffs for large industrial customers, directly impacts AEP's ability to earn a regulated return on its substantial capital expenditures.

AEP, like any major utility, navigates a landscape where litigation and regulatory investigations are a constant possibility, potentially affecting financial performance and public standing. The company emphasizes its dedication to operating within the bounds of the law and maintaining high ethical standards.

For instance, in 2023, AEP reported approximately $1.2 billion in legal settlements and reserves, a figure that underscores the financial implications of these risks. These legal challenges can range from environmental compliance issues to customer disputes, requiring significant management attention and resources to resolve effectively.

State-Specific Energy Legislation

New energy legislation enacted across the states where American Electric Power (AEP) operates significantly shapes its regulatory landscape, impacting how the company recovers costs and makes new investments. For instance, in 2024, several states considered or passed bills related to renewable energy mandates and grid modernization, directly influencing AEP's capital expenditure plans. AEP's proactive engagement with state legislators is crucial for advocating its position on these evolving energy policies.

Key legislative actions impacting AEP in 2024-2025 include:

- Renewable Portfolio Standards (RPS): States like Virginia have been refining their RPS targets, which directly affect AEP's generation mix and investment in solar and wind projects. Virginia's 2024 legislative session saw continued debate on the pace of renewable deployment.

- Grid Modernization Funding: Legislation in states such as Ohio and Texas is providing new avenues for AEP to secure funding for grid upgrades, including smart grid technologies and enhanced resilience, with significant investment proposals being reviewed in 2024.

- Rate Case Adjustments: State public utility commissions, guided by legislative mandates, are reviewing AEP's rate cases. For example, AEP Ohio filed a significant rate case in late 2023, with decisions expected in 2024, impacting customer bills and the company's return on investment.

Interconnection Tariffs and Cost Allocation

The legal landscape surrounding interconnection tariffs, particularly for substantial new energy consumers like data centers, is a critical legal factor. These tariffs dictate how new loads connect to the grid and the associated costs. Recent regulatory actions highlight the focus on fair cost allocation to avoid placing undue financial strain on existing customers.

A notable example is the Public Utilities Commission of Ohio (PUCO) decision concerning AEP Ohio's proposed data center tariffs. This ruling, made in late 2023, aimed to ensure that the costs associated with accommodating large new loads are appropriately borne by those loads, rather than being subsidized by residential and small business ratepayers. The commission emphasized cost accountability in its deliberations.

Key aspects of these legal considerations include:

- Regulatory Oversight: State Public Utility Commissions (PUCs) like PUCO play a vital role in approving or modifying interconnection tariffs, ensuring they align with public interest and cost-causation principles.

- Cost Recovery Mechanisms: Legal frameworks define how utilities can recover the costs of grid upgrades and infrastructure necessary to support new, large loads, balancing utility needs with ratepayer protection.

- Tariff Design and Fairness: Legal challenges can arise over the design of these tariffs, with arguments often centering on whether they are discriminatory or unfairly burden certain customer classes.

- Impact on Investment: Clear and predictable legal frameworks for interconnection tariffs are essential for attracting investment in large energy-consuming facilities, as they provide certainty regarding operational costs.

AEP's operations are heavily influenced by evolving energy legislation and regulatory decisions at both federal and state levels. These legal frameworks dictate cost recovery for infrastructure investments, environmental compliance, and the pace of adopting new technologies, directly impacting the company's financial planning and operational strategies for 2024 and 2025.

State Public Utility Commissions (PUCs) are central to AEP's legal environment, approving rate cases and interconnection tariffs. For instance, AEP Ohio's late 2023 rate case, with decisions expected in 2024, highlights how these regulatory bodies shape AEP's revenue and investment recovery. The PUCO's focus on cost accountability in data center interconnection tariffs, as seen in a late 2023 ruling, underscores the legal scrutiny on fair cost allocation for new large loads.

The company faces ongoing legal challenges and potential litigation, as evidenced by approximately $1.2 billion in legal settlements and reserves reported in 2023. These legal factors, ranging from environmental compliance to customer disputes, necessitate significant management attention and resource allocation, impacting financial performance and operational continuity.

Key legislative actions in 2024-2025, such as refinements to Renewable Portfolio Standards (RPS) in states like Virginia and initiatives for grid modernization funding in Ohio and Texas, directly influence AEP's capital expenditure plans and generation mix.

Environmental factors

American Electric Power (AEP) has established significant carbon emissions reduction targets, aiming for an 80% decrease in carbon dioxide emissions from its 2005 baseline by 2030. This aggressive goal is a cornerstone of its sustainability strategy, reflecting a broader industry shift towards cleaner energy sources.

The company's long-term vision includes achieving net-zero Scope 1 and Scope 2 emissions by 2045. This commitment necessitates substantial investment in renewable energy projects, such as solar and wind farms, and a strategic approach to phasing out or converting its coal-fired power plants, which are a major source of emissions.

AEP's environmental strategy centers on transitioning away from coal towards natural gas and renewable energy like wind and solar. This shift necessitates substantial capital expenditures for new generation infrastructure, fundamentally altering the company's power plant mix.

In 2024, AEP announced plans to invest billions in clean energy projects, including significant expansions in wind and solar capacity. This strategic move aligns with broader industry trends and regulatory pressures favoring decarbonization, impacting AEP's operational and financial planning significantly.

AEP faces significant physical risks due to climate change, particularly from increasingly severe weather events like hurricanes and extreme temperatures. These events can disrupt power generation, transmission, and distribution, leading to outages and financial losses. For instance, in 2023, AEP reported that extreme weather events contributed to increased operational costs and capital expenditures for repairs and restoration efforts.

To counter these environmental challenges, AEP is investing heavily in grid modernization and infrastructure upgrades. These investments, totaling billions of dollars through 2027, are designed to enhance the grid's ability to withstand and recover from extreme weather, thereby improving reliability for customers. AEP's 2024-2028 capital investment plan allocates a substantial portion to resilience initiatives.

Waste Management and Environmental Stewardship

American Electric Power (AEP) places a strong emphasis on responsible waste management, particularly concerning coal ash and spent nuclear fuel. This commitment involves strict adherence to increasingly stringent Environmental Protection Agency (EPA) regulations, ensuring their operations minimize environmental impact. For instance, in 2024, AEP continued its efforts to manage legacy coal ash sites, investing in safe closure methods that align with federal and state mandates.

The company's dedication to environmental stewardship is underscored by regular, rigorous audits of its compliance and performance. These assessments are crucial for verifying that AEP's waste handling and disposal practices meet or exceed environmental standards. In 2024, AEP reported that its environmental compliance programs were subject to numerous internal and external reviews, reinforcing its commitment to operational integrity and sustainability.

Key aspects of AEP's environmental stewardship include:

- Coal Ash Management: Ongoing efforts to safely close and manage coal ash disposal sites, often involving dewatering and capping to prevent groundwater contamination.

- Nuclear Fuel Handling: Adherence to strict protocols for the safe storage and management of spent nuclear fuel, meeting Nuclear Regulatory Commission (NRC) requirements.

- Regulatory Compliance: Continuous monitoring and adaptation to evolving EPA regulations concerning solid waste, air emissions, and water quality.

- Environmental Audits: Periodic internal and third-party audits to ensure all environmental management systems and practices are effective and compliant.

Biodiversity and Water Use Management

AEP's commitment to environmental stewardship is evident in its diligent management of biodiversity and water resources. The company actively works to adhere to all relevant environmental regulations, including those mandated by the Endangered Species Act, ensuring its operations do not negatively impact vulnerable ecosystems.

Monitoring water usage is a key component of AEP's strategy to reduce its operational footprint. For instance, in 2023, AEP reported a significant focus on water conservation efforts across its power generation facilities, aiming to decrease withdrawal and consumption rates in water-stressed regions.

- Biodiversity Protection: AEP implements strategies to protect and enhance biodiversity at its operational sites, often involving habitat restoration projects.

- Water Use Monitoring: The company tracks water withdrawal and consumption data, seeking to optimize usage and minimize environmental impact.

- Regulatory Compliance: AEP ensures adherence to environmental laws such as the Endangered Species Act.

- Sustainability Reporting: AEP's annual sustainability reports detail progress and initiatives related to biodiversity and water management.

AEP is actively reducing its carbon footprint, targeting an 80% decrease in CO2 emissions from a 2005 baseline by 2030 and aiming for net-zero emissions by 2045. This transition involves significant investments in renewable energy sources like wind and solar, alongside phasing out coal-fired plants.

The company is also investing billions through 2027 in grid modernization to enhance resilience against climate change impacts, such as extreme weather events that caused increased operational costs in 2023. AEP prioritizes responsible waste management, particularly for coal ash and nuclear fuel, ensuring strict compliance with EPA and NRC regulations.

Furthermore, AEP focuses on biodiversity protection and water resource management, adhering to laws like the Endangered Species Act and actively monitoring water usage to minimize its environmental impact.

| Environmental Factor | AEP's Action/Target | Key Data/Year |

|---|---|---|

| Carbon Emissions Reduction | 80% reduction by 2030 (vs. 2005 baseline) | 2030 |

| Net-Zero Emissions Goal | Scope 1 & 2 net-zero by 2045 | 2045 |

| Renewable Energy Investment | Billions planned for wind/solar expansion | 2024 |

| Grid Modernization Investment | Billions for resilience against extreme weather | Through 2027 |

| Coal Ash Management | Safe closure and management of disposal sites | Ongoing (e.g., 2024 efforts) |

| Water Usage | Focus on conservation at generation facilities | 2023 focus |

PESTLE Analysis Data Sources

Our AEP PESTLE analysis is meticulously constructed using a blend of official government publications, reputable financial institutions like the IMF and World Bank, and leading industry research firms. This ensures our insights into political, economic, social, technological, legal, and environmental factors are grounded in verifiable data.