AEP Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AEP Bundle

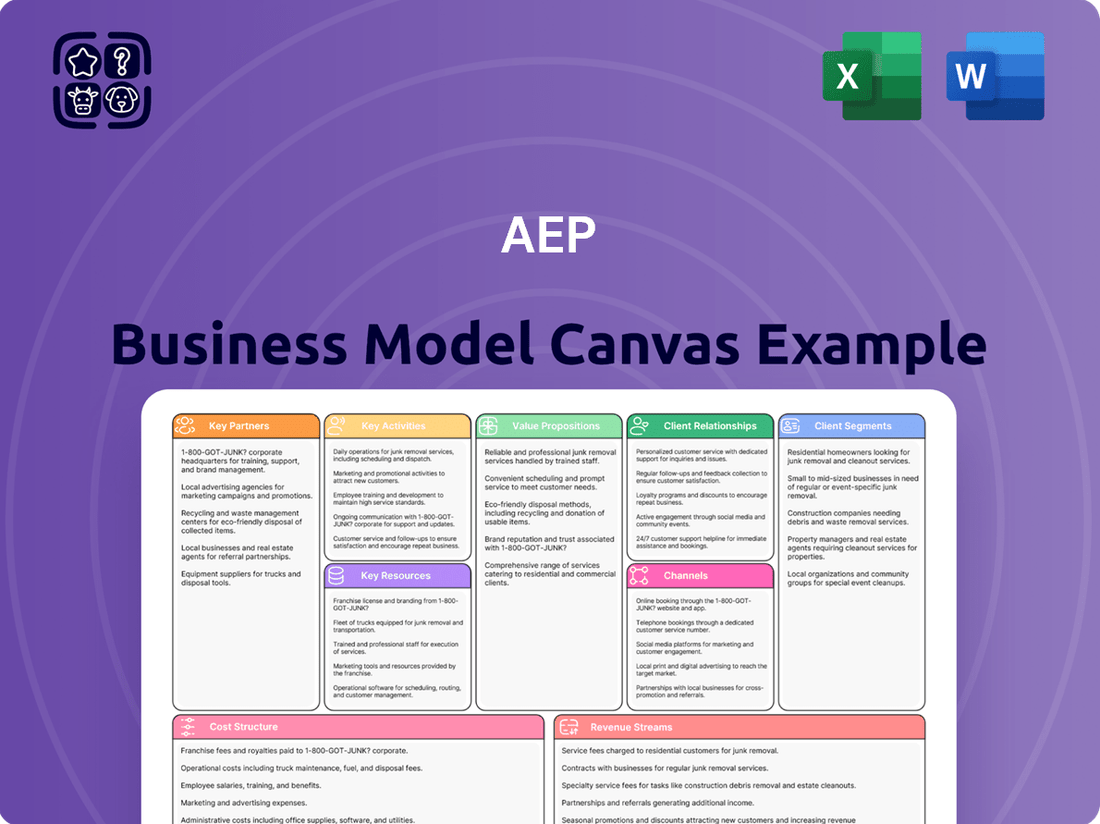

Curious about how AEP navigates the energy sector? This Business Model Canvas breaks down their customer relationships, revenue streams, and key resources. Discover the strategic framework that powers their operations and market position.

Partnerships

AEP's operational success hinges on robust partnerships with government and regulatory bodies across the 11 states it serves. These crucial relationships with state Public Utility Commissions (PUCs) and federal agencies like the Federal Energy Regulatory Commission (FERC) are fundamental for securing approvals on rates, greenlighting infrastructure projects, and ensuring ongoing compliance with evolving regulations.

These collaborations directly enable AEP to execute its ambitious capital expenditure plans and recover associated costs, which is a cornerstone of its financial stability and capacity to invest in vital grid modernization and clean energy initiatives. For instance, AEP's 2024 capital plan, totaling $4.4 billion, relies heavily on favorable regulatory treatment for its investments in transmission and distribution infrastructure.

Recent regulatory actions have significantly bolstered AEP's performance, with key rate case approvals in states like Ohio and Indiana providing the necessary clarity and financial support for its strategic investments. These approvals are critical for AEP to continue its transition towards a cleaner energy future, a process that requires substantial upfront capital and predictable returns.

AEP's key partnerships with technology and equipment suppliers are fundamental to its vast operations spanning power generation, transmission, and distribution. These include vital collaborations with providers of cutting-edge grid technologies, smart metering systems, and critical components for renewable energy installations such as wind turbines and solar panels.

These strategic alliances empower AEP to drive significant investments in grid modernization and the seamless integration of cleaner energy sources. For instance, these partnerships are instrumental in supporting AEP's ambitious $70 billion capital plan, which is heavily focused on upgrading infrastructure and expanding renewable energy capacity.

AEP's strategic shift towards cleaner energy sources necessitates robust collaborations with renewable energy developers and independent power producers. These partnerships are crucial for AEP to secure reliable access to wind, solar, and battery storage capacity, directly fueling its expansion of a clean energy portfolio.

Through Power Purchase Agreements (PPAs), AEP can lock in the supply of renewable energy, thereby reducing its dependence on traditional fossil fuels like coal. This strategy is central to AEP's objective of significantly increasing its clean energy generation capacity in the coming years, aligning with broader decarbonization goals.

Industrial and Commercial Customers (especially Data Centers)

AEP is seeing a surge in demand from major industrial and commercial clients, with data centers being a prime example, particularly in Ohio, Indiana, and Texas. This growth necessitates strong partnerships to manage their significant energy requirements.

These collaborations focus on creating long-term power purchase agreements and designing specialized energy solutions. This ensures AEP can meet the substantial load demands of these large users while also securing the necessary investment for infrastructure development.

- Securing Long-Term Agreements: AEP is actively negotiating multi-year contracts with key industrial and commercial customers, including data centers, to guarantee predictable revenue streams and provide a foundation for infrastructure investment.

- Tailored Energy Solutions: The company is developing customized energy plans and infrastructure upgrades to meet the specific, often intensive, power needs of these high-demand clients, ensuring reliability and efficiency.

- Cost Recovery Mechanisms: New tariff structures and contractual agreements are being implemented to ensure that these large customers directly contribute to the costs associated with the necessary grid enhancements and new generation capacity required to serve them.

- Strategic Infrastructure Development: Partnerships are crucial for identifying and funding the expansion of transmission and distribution networks to support the concentrated load growth from these major energy consumers.

Financial Institutions and Investors

AEP's relationships with financial institutions and investors are foundational for funding its extensive capital expenditure plans. These partnerships are crucial for securing the necessary debt financing, equity investments, and strategic alliances to support its multi-billion-dollar initiatives in transmission, distribution, and advanced generation technologies.

For instance, AEP has actively engaged with major investment firms. In 2023, AEP announced a significant transaction where KKR and PSP Investments acquired equity interests in AEP's transmission businesses, demonstrating a clear strategy to leverage external capital for infrastructure development. This type of partnership allows AEP to accelerate its investments in grid modernization and clean energy infrastructure.

- Securing Capital: Access to debt and equity markets through strong relationships with banks and investment funds is vital for AEP's growth strategy.

- Strategic Equity Investments: Partnerships with firms like KKR and PSP Investments provide capital for transmission assets, enabling AEP to fund large-scale projects.

- Financing Infrastructure: These relationships are essential for financing AEP's multi-billion-dollar investments in modernizing its transmission and distribution networks and developing new, sustainable energy sources.

AEP's strategic partnerships with technology and equipment suppliers are critical for its operational efficiency and its transition to cleaner energy. These collaborations provide access to advanced grid technologies, smart metering, and components for renewable energy projects. For example, AEP's 2024 capital plan of $4.4 billion includes significant investments in grid modernization, relying on these supplier relationships for essential equipment and expertise.

These partnerships are instrumental in supporting AEP's broader $70 billion capital investment plan, which focuses on upgrading infrastructure and expanding renewable energy capacity. By working with leading suppliers, AEP can effectively integrate new technologies and drive its clean energy initiatives forward.

| Partner Type | Role in AEP's Business Model | Impact/Example |

|---|---|---|

| Government & Regulatory Bodies | Approvals for rates, infrastructure projects, and compliance | Securing favorable rate case approvals in Ohio and Indiana in 2023, supporting AEP's $4.4 billion 2024 capital plan. |

| Technology & Equipment Suppliers | Providing grid technologies, smart meters, renewable energy components | Essential for AEP's $70 billion capital plan, enabling grid modernization and renewable integration. |

| Renewable Energy Developers & IPPs | Supplying wind, solar, and battery storage capacity | Facilitating Power Purchase Agreements (PPAs) to increase clean energy generation. |

| Industrial & Commercial Clients | Driving demand for energy and infrastructure investment | Long-term agreements with data centers in Ohio, Indiana, and Texas to meet significant load growth. |

| Financial Institutions & Investors | Providing debt financing, equity investments | KKR and PSP Investments acquired equity in AEP's transmission businesses in 2023, supporting infrastructure development. |

What is included in the product

A detailed, visually organized framework that breaks down the core components of a business, from customer relationships to revenue streams.

It provides a clear, concise overview of how a company creates, delivers, and captures value, serving as a strategic planning tool.

The AEP Business Model Canvas helps overcome the pain of scattered strategic thinking by providing a structured framework to visualize and align all key business elements.

It alleviates the frustration of complex, multi-page business plans by condensing essential components into a single, easily understandable page.

Activities

AEP's core activity is generating electricity across a diverse fuel mix. In 2024, this includes substantial contributions from coal, natural gas, and nuclear power, alongside an increasing focus on renewables such as wind and solar.

The company is actively managing its existing generation fleet to ensure reliability and efficiency. This involves ongoing maintenance and operational improvements across its various power plant types.

A key strategic focus is the transition to cleaner energy sources. By 2030, AEP aims to have 80% of its electricity generated from renewables and other clean sources, marking a significant shift away from coal.

AEP's primary activities revolve around operating and maintaining one of the nation's largest electric transmission systems and an extensive distribution network. This ensures the reliable delivery of electricity to millions of customers across 11 states.

Key to this operation is substantial and continuous investment in infrastructure. These investments focus on upgrades, essential maintenance, and expansion projects designed to meet increasing electricity demand and bolster the resilience of the grid against disruptions.

For 2024, AEP has outlined significant capital investment plans specifically targeting transmission and distribution infrastructure. For instance, the company projected capital expenditures of $7.2 billion in 2024, with a substantial portion allocated to transmission and distribution improvements, reflecting a commitment to modernizing its essential services.

AEP is actively investing in modernizing its electric grid, a crucial activity for future growth and reliability. This includes deploying smart meter technology across its service territories, which allows for more granular data collection and two-way communication. In 2024, AEP continued its commitment to grid modernization, with significant capital expenditures allocated to these initiatives.

Advanced analytics and automation are central to AEP's grid modernization strategy. These technologies enable faster detection and restoration of outages, improving overall service reliability for customers. By integrating distributed energy resources, such as solar and battery storage, AEP is building a more resilient and flexible grid.

This heavy investment in technology integration is driven by the need to meet increasing energy demand and enhance customer service. For instance, AEP's 2024 capital plan included billions dedicated to grid enhancements, reflecting the company's focus on building a smarter, more efficient energy future.

Regulatory and Stakeholder Engagement

AEP's key activities heavily involve engaging with regulatory bodies like the Public Utility Commission of Texas (PUCT) and the Federal Energy Regulatory Commission (FERC). This engagement is critical for securing approvals on significant capital investments, such as the proposed $3.2 billion wind energy project in Oklahoma, which requires regulatory sign-off. AEP actively participates in rate cases to ensure fair cost recovery for infrastructure upgrades and the transition to cleaner energy sources.

Effective stakeholder engagement extends to policymakers and community leaders to advocate for supportive energy policies. For instance, AEP's lobbying efforts focus on legislation that facilitates grid modernization and the integration of renewable energy. These efforts directly impact AEP's ability to recover costs associated with these investments, influencing its financial performance and future growth prospects.

- Regulatory Filings: AEP regularly submits detailed filings for rate adjustments and capital project approvals to state and federal agencies.

- Policy Advocacy: The company actively participates in industry groups and directly communicates with lawmakers to shape energy policy.

- Stakeholder Relations: Maintaining positive relationships with customers, environmental groups, and local communities is crucial for project success.

- Compliance: Adhering to a complex web of environmental and operational regulations is a fundamental activity.

Customer Service and Energy Management Programs

AEP's key activities revolve around delivering dependable and cost-effective energy while empowering customers to control their consumption. This includes robust customer support, proactive energy efficiency programs, and customized solutions for major industrial and commercial clients. AEP is committed to improving customer satisfaction and promoting energy conservation.

For instance, in 2024, AEP continued to invest in grid modernization and smart meter technology, aiming to provide customers with more real-time data and control over their energy use. These initiatives are crucial for managing demand and supporting the integration of renewable energy sources. The company's focus on customer service extends to offering various energy management programs designed to reduce usage and lower bills.

- Customer Support: AEP provides 24/7 customer service to address inquiries, outages, and billing issues, ensuring a seamless experience.

- Energy Efficiency Programs: In 2024, AEP offered various rebates and incentives for energy-efficient appliances and home improvements, encouraging customers to reduce their overall energy consumption.

- Demand Response: The company actively manages demand through programs that incentivize customers to reduce electricity use during peak hours, helping to stabilize the grid and lower costs.

- Industrial and Commercial Solutions: AEP partners with large businesses to develop tailored energy management strategies, including on-site generation and energy efficiency upgrades, to optimize their operations and reduce their carbon footprint.

AEP's key activities encompass managing its diverse generation fleet, which in 2024 includes significant contributions from coal, natural gas, and nuclear power, alongside a growing renewable portfolio. The company is also heavily invested in operating and modernizing its extensive transmission and distribution networks, ensuring reliable electricity delivery. A substantial portion of its 2024 capital expenditures, projected at $7.2 billion, is dedicated to these infrastructure upgrades and grid modernization efforts, including smart meter deployment.

Crucially, AEP actively engages with regulatory bodies and policymakers to secure approvals for major investments and to advocate for supportive energy policies. This includes navigating rate cases and seeking sign-off for projects like a $3.2 billion wind energy project. Simultaneously, the company focuses on customer empowerment through robust support, energy efficiency programs, and tailored solutions for large clients, aiming to enhance satisfaction and promote conservation.

| Activity Area | Key Actions | 2024 Focus/Data |

|---|---|---|

| Generation Operations | Operating diverse fuel mix (coal, gas, nuclear, renewables) | Increasing renewable generation; managing existing fleet reliability |

| Transmission & Distribution | Operating and upgrading infrastructure | $7.2 billion projected capital expenditures, with significant allocation to T&D; grid modernization initiatives |

| Regulatory & Policy Engagement | Securing approvals, advocating for policy | Rate cases, project approvals (e.g., wind project), policy advocacy for grid modernization |

| Customer Engagement | Customer support, efficiency programs, tailored solutions | Smart meter deployment, energy conservation incentives, demand response programs |

Full Version Awaits

Business Model Canvas

The AEP Business Model Canvas preview you are viewing is an exact replica of the document you will receive upon purchase. This means you are seeing the complete, professionally formatted file, ready for immediate use, with no alterations or missing sections. Once your order is confirmed, you will gain full access to this identical Business Model Canvas, allowing you to seamlessly implement its insights into your strategic planning.

Resources

AEP's extensive generation fleet is a cornerstone of its operations, encompassing roughly 29,000 megawatts of diverse power-producing assets. This robust capacity includes a significant mix of traditional sources like coal, natural gas, and nuclear power, ensuring a stable energy supply.

Crucially, AEP is actively expanding its renewable energy portfolio, with a growing share of generation coming from wind and solar projects. This strategic shift reflects a commitment to a cleaner energy future while still leveraging its established infrastructure to meet current demand across its service territory.

AEP's vast transmission and distribution network, encompassing over 40,000 miles of high-voltage lines and more than 225,000 miles of distribution lines, stands as the nation's largest electric transmission system. This extensive infrastructure is a cornerstone of their business model, enabling the reliable delivery of power to millions of customers across 11 states.

Significant capital investments are continuously directed towards maintaining and modernizing this critical asset. For instance, in 2024, AEP projected substantial investments in transmission and distribution infrastructure to enhance grid reliability and support the integration of renewable energy sources.

AEP's most critical resource is its highly skilled workforce, comprising nearly 16,000 employees. This team includes specialized engineers, experienced technicians, efficient operations personnel, and dedicated customer service professionals.

The collective expertise of these individuals is indispensable for managing AEP's intricate operations. This spans the entire energy value chain, from power generation and transmission to distribution and the ongoing modernization of the grid.

Furthermore, their knowledge is crucial for providing reliable customer support, ensuring seamless service delivery, and adapting to evolving energy technologies and customer needs.

Financial Capital and Investment Capacity

AEP's financial capital is a critical resource, underpinning its extensive capital expenditure plans. This substantial financial backing allows AEP to undertake significant infrastructure upgrades and invest in new generation projects, including those focused on the clean energy transition.

The company has outlined an impressive investment strategy, planning to deploy approximately $70 billion between 2025 and 2029. This investment is geared towards improving service reliability and supporting future growth initiatives.

- Financial Capital Access: AEP leverages its strong financial position to fund large-scale capital projects, essential for maintaining and modernizing its utility infrastructure.

- Multi-Billion Dollar Investment: The company's commitment to investing around $70 billion from 2025 to 2029 highlights its capacity to drive significant operational and strategic advancements.

- Infrastructure Modernization: This investment directly supports the upgrade of existing infrastructure, ensuring a more resilient and efficient energy delivery system.

- Clean Energy Transition: A significant portion of this capital is allocated to developing and integrating cleaner energy sources, aligning with evolving environmental standards and market demands.

Regulatory Assets and Licenses

AEP’s regulatory assets and licenses are critical resources, enabling its operation as a regulated utility across numerous states. These approvals and licenses, including established rate bases, are foundational to its business model, ensuring a stable and predictable revenue stream. This regulatory framework allows AEP to recover its investments and operating expenses, providing a degree of financial certainty.

These regulatory approvals are not just permissions; they are strategic assets that underpin AEP's financial stability and operational capacity. For instance, the ability to operate in multiple jurisdictions means AEP can leverage economies of scale and diversify its revenue sources. In 2024, AEP continued to actively manage its regulatory filings, seeking approvals for significant infrastructure investments aimed at modernizing the grid and integrating renewable energy sources.

- Regulatory Approvals: AEP holds numerous state-level approvals to operate as a regulated electric utility, allowing it to serve millions of customers.

- Established Rate Bases: These are the capital investments that AEP is permitted to recover from customers, providing a predictable revenue foundation.

- License to Operate: Essential operating licenses in each state are non-transferable and represent a significant barrier to entry for competitors.

- Predictable Revenue Streams: The regulated nature ensures that AEP can earn a fair return on its investments, contributing to financial stability.

AEP's key resources include its substantial generation capacity, extensive transmission and distribution network, skilled workforce, significant financial capital, and crucial regulatory assets and licenses.

These resources enable AEP to reliably deliver electricity, invest in grid modernization and clean energy, and maintain a stable financial footing within its regulated operating environment.

The company's ability to access capital, estimated at approximately $70 billion for 2025-2029, directly fuels its infrastructure upgrades and strategic shift towards renewables.

Furthermore, its regulatory approvals and established rate bases are foundational, providing predictable revenue streams and a competitive advantage.

| Key Resource | Description | 2024/2025 Data Point |

|---|---|---|

| Generation Capacity | Diverse power-producing assets | Approx. 29,000 megawatts |

| Transmission & Distribution Network | Nation's largest electric transmission system | Over 40,000 miles of high-voltage lines |

| Workforce | Skilled employees across operations | Nearly 16,000 employees |

| Financial Capital | Funds for infrastructure and growth | Planned $70 billion investment (2025-2029) |

| Regulatory Assets & Licenses | State-level operating approvals | Enables operation in 11 states |

Value Propositions

AEP's core value proposition centers on delivering electricity that is both dependable and budget-friendly to its vast customer base, which includes millions of households and businesses. This commitment is underpinned by substantial ongoing investments in modernizing its extensive infrastructure and diversifying its energy generation portfolio to ensure consistent supply and price stability.

In 2024, AEP continued to prioritize infrastructure upgrades, aiming to enhance reliability and reduce the frequency and duration of power outages. For instance, the company has been actively investing in grid modernization projects, including smart grid technologies and undergrounding power lines in vulnerable areas, to combat the impact of severe weather events.

The pursuit of affordable electricity is supported by AEP's strategic approach to energy sourcing. By leveraging a mix of generation technologies, including renewables and efficient fossil fuel plants, the company strives to manage fuel costs and operational expenses, ultimately translating into more stable and predictable rates for its customers.

AEP's commitment to grid modernization, including smart meter deployment, directly enhances customer service. These investments, totaling billions of dollars, are designed to boost reliability and speed up outage restoration. For instance, in 2024, AEP continued its significant investments in upgrading infrastructure, aiming to reduce the frequency and duration of power disruptions.

Through advanced technologies, AEP provides customers with better energy management tools, fostering greater control over consumption and costs. This focus on innovation in 2024 supports a more resilient and efficient electrical system, ultimately delivering a superior service experience.

AEP's commitment to a cleaner energy future resonates with environmentally conscious customers and stakeholders. The company is actively investing in renewable generation sources, demonstrating a tangible shift towards a more sustainable energy portfolio.

This transition is underscored by AEP's ambitious environmental targets. By 2030, AEP aims to achieve an 80% reduction in carbon dioxide emissions compared to 2005 levels, a significant step in mitigating climate change. Ultimately, the company has set a goal for net-zero emissions by 2045.

Support for Economic Development and Growth

AEP actively champions economic development by guaranteeing a robust and dependable power supply, crucial for the expansion of commercial and industrial sectors. This includes supporting the burgeoning demand from data centers and the establishment of new manufacturing operations within its service areas.

By strategically investing in and upgrading its infrastructure, AEP is well-positioned to meet the escalating energy needs of businesses. This proactive approach directly facilitates business growth and fosters significant job creation across the communities it serves.

- Reliable Power for Growth: AEP's commitment to infrastructure ensures consistent electricity, vital for industries like manufacturing and data centers, which are key drivers of regional economies.

- Enabling Expansion: Investments in grid modernization and capacity allow businesses to scale operations, a critical factor in attracting new investment and retaining existing enterprises.

- Job Creation Catalyst: By reliably powering new and expanding businesses, AEP directly contributes to job growth, with examples seen in the significant investments in renewable energy projects creating thousands of construction and operational jobs. For instance, in 2024, AEP announced plans for substantial investments in transmission infrastructure to support economic growth, anticipating the need for increased power capacity.

Transparent and Regulated Operations

Operating as a regulated utility, American Electric Power (AEP) provides a predictable framework for its customers and investors. This regulatory oversight, established by state and federal bodies, ensures a degree of transparency in AEP's operations and pricing structures. For instance, in 2024, AEP continued to navigate the complex regulatory landscape, seeking approvals for significant infrastructure investments designed to modernize its grid and integrate renewable energy sources. This process inherently involves public filings and hearings, offering visibility into the company's strategic plans and financial needs.

This regulated environment fosters trust and stability, crucial for long-term relationships. Customers benefit from predictable rates, while investors gain confidence from a business model that is less susceptible to market volatility compared to unregulated entities. AEP's 2024 capital expenditure plans, totaling billions, are subject to these regulatory reviews, underscoring the transparency inherent in its business model. The company's commitment to grid modernization, including investments in smart grid technologies and renewable energy integration, is directly tied to these approved regulatory frameworks.

- Regulatory Oversight: State and federal commissions set rates and approve major capital investments, ensuring transparency.

- Predictable Framework: This structure offers stability for customers and investors, reducing market-driven uncertainties.

- Customer Trust: Transparency in pricing and operations builds confidence and supports long-term customer relationships.

- Investor Confidence: The regulated nature of AEP's business provides a more predictable revenue stream, attracting stable investment.

AEP delivers reliable and affordable electricity, enhanced by significant investments in grid modernization and a diverse energy portfolio. This ensures consistent supply and price stability for millions of residential and business customers.

In 2024, AEP's focus on infrastructure upgrades, including smart grid technologies and undergrounding power lines, aimed to boost reliability and reduce outage impacts. The company's strategy of sourcing energy from a mix of renewables and efficient fossil fuels helps manage costs, leading to more stable customer rates.

AEP provides customers with advanced energy management tools, giving them more control over their energy use and costs. This innovation supports a more resilient and efficient electrical system, improving the overall service experience.

AEP is committed to a cleaner energy future, actively investing in renewable generation sources to meet ambitious environmental targets, including an 80% reduction in CO2 emissions by 2030 and net-zero emissions by 2045.

The company's robust and dependable power supply is a key enabler of economic development, supporting the growth of sectors like data centers and manufacturing, and fostering job creation within its service territories.

| Value Proposition | Key Actions/Investments (2024 Focus) | Customer/Business Benefit |

|---|---|---|

| Reliable and Affordable Electricity | Grid modernization, smart grid tech, diverse generation portfolio | Consistent supply, price stability, reduced outages |

| Enhanced Customer Control | Advanced energy management tools, smart meter deployment | Greater control over consumption and costs |

| Sustainable Energy Future | Investment in renewables, CO2 emission reduction targets | Alignment with environmental consciousness, cleaner energy |

| Economic Development Support | Infrastructure upgrades, capacity expansion | Facilitates business growth, job creation |

Customer Relationships

AEP operates multiple dedicated customer service channels, including robust call centers and accessible online portals, to efficiently handle inquiries, manage accounts, and resolve customer issues. This multi-channel approach ensures customers can connect with AEP through their preferred method, fostering a responsive and supportive experience.

The company prioritizes responding to customer needs with increased efficiency and cost-effectiveness. For instance, in 2024, AEP continued to invest in digital self-service options, aiming to reduce average handling times for common queries and improve overall customer satisfaction metrics.

AEP actively engages with local communities through various outreach programs, open houses, and partnerships with community organizations. This fosters goodwill, addresses local concerns, and keeps communities informed about infrastructure projects and energy initiatives. For instance, in 2024, AEP continued its commitment to community investment, contributing over $18 million to various non-profit organizations and local initiatives across its service territories.

AEP actively engages customers through comprehensive energy efficiency programs and educational resources designed to foster reduced consumption and better cost management. These initiatives are crucial for building strong customer relationships by providing tangible value and support.

In 2024, AEP continued to emphasize these programs, offering services like home energy checkups and smart meter insights. These tools empower customers with data to understand and control their energy usage, a key component of customer retention and satisfaction.

Furthermore, AEP provides incentives for energy-saving upgrades, making it easier for customers to invest in efficiency. For instance, in some regions, customers could receive rebates for installing high-efficiency appliances or improving insulation, directly translating program benefits into cost savings for the customer.

Tailored Solutions for Large Customers

AEP crafts bespoke energy solutions for its major commercial and industrial clients, recognizing their substantial and often increasing power requirements, such as those from data centers. These customized agreements and infrastructure investments are designed to fulfill unique energy demands effectively.

This approach allows AEP to meet the specific needs of large customers while also managing potential rate adjustments for other customer groups. For instance, in 2024, AEP continued to engage with large industrial partners on infrastructure upgrades to support their growth, a strategy that benefits both parties by ensuring reliable power supply and operational efficiency.

- Customized Service Agreements: AEP designs service agreements that align with the precise operational needs and growth projections of large industrial and commercial clients.

- Infrastructure Development: The company invests in and develops specialized infrastructure to support the significant and evolving load demands of major customers.

- Rate Impact Mitigation: By structuring tailored solutions for large users, AEP aims to minimize the direct impact of infrastructure investments on the rates paid by other customer segments.

- Data Center Support: AEP actively works with data center operators to provide the robust and reliable energy infrastructure necessary for their operations, a key focus in 2024 as demand for these facilities surged.

Regulatory Dialogue and Transparency

AEP's customer relationships are significantly influenced by regulatory dialogues, particularly during rate cases and the approval of service plans. These processes are publicly scrutinized, fostering a degree of transparency in how the company operates and serves its customer base.

This regulatory oversight ensures accountability, as AEP must justify its proposed rates and service strategies to both regulators and the public. For instance, in 2023, AEP filed several rate cases across its operating companies, with outcomes directly impacting customer bills and service levels.

- Regulatory Filings: AEP regularly engages with state Public Utility Commissions (PUCs) and the Federal Energy Regulatory Commission (FERC).

- Rate Cases: These proceedings determine the prices customers pay for electricity and related services, involving extensive data submission and public hearings.

- Service Plans: AEP's investments in infrastructure modernization and renewable energy projects are often outlined and approved through these regulatory frameworks.

- Transparency: Public access to regulatory filings and decisions allows customers and stakeholders to understand AEP's operational and financial plans.

AEP builds strong customer relationships through diverse support channels, including call centers and online portals, ensuring efficient issue resolution and account management. The company prioritizes digital self-service options to enhance customer experience and operational efficiency, as seen in its 2024 investments aimed at reducing query handling times.

Community engagement is a cornerstone of AEP's approach, with significant investment in local initiatives and outreach programs to foster goodwill and transparency. In 2024, AEP's commitment to community investment exceeded $18 million, supporting non-profits and local projects across its service territories.

AEP actively empowers customers with energy efficiency programs and educational resources, offering tools like home energy checkups and smart meter insights to promote cost management and reduced consumption. These initiatives, including rebates for energy-saving upgrades, directly benefit customers by lowering their energy bills and fostering a sense of partnership.

For large commercial and industrial clients, AEP provides customized energy solutions and infrastructure development to meet significant power demands, such as those from data centers. These tailored agreements, exemplified by 2024 infrastructure upgrades with industrial partners, ensure reliable power supply and operational efficiency for major customers.

| Customer Relationship Strategy | Key Initiatives | 2024 Focus/Data | Impact |

| Multi-channel Support | Call centers, online portals, self-service options | Investment in digital self-service, aiming to reduce average handling times | Improved customer satisfaction, operational efficiency |

| Community Engagement | Outreach programs, partnerships, open houses | Over $18 million invested in community initiatives | Enhanced goodwill, informed stakeholders |

| Energy Efficiency Programs | Home energy checkups, smart meter insights, rebates | Continued emphasis on customer empowerment for cost management | Reduced consumption, cost savings for customers |

| Bespoke Solutions for C&I Clients | Customized agreements, infrastructure development | Support for data center growth, infrastructure upgrades with industrial partners | Reliable power supply, operational efficiency for large clients |

Channels

AEP's extensive transmission and distribution networks are its core channels, physically delivering electricity to millions of customers. These networks, comprising thousands of miles of high-voltage transmission lines and countless miles of distribution infrastructure, are the backbone of its operations.

In 2023, AEP invested over $7.5 billion in capital expenditures, with a significant portion allocated to modernizing and expanding its transmission and distribution systems. This ongoing investment ensures the reliability and efficiency of electricity delivery.

AEP leverages its website as a primary digital channel, allowing customers to easily pay bills, report outages, and track energy consumption. In 2024, AEP's website saw millions of unique visitors, highlighting its importance for customer engagement and self-service.

The company also offers mobile app functionality, further enhancing convenience for users who prefer on-the-go access to account management and service updates. These digital platforms are crucial for efficient customer interaction and information sharing.

Customer service centers and call centers are vital for AEP, acting as direct lines for customer inquiries, issue reporting, and support. These hubs are essential for ensuring timely resolution of customer needs, fostering satisfaction and loyalty.

In 2024, AEP continued to invest in these channels, recognizing their importance in customer engagement. While specific call volume data for AEP's centers isn't publicly detailed, the utility sector generally handles millions of customer interactions annually, addressing everything from billing questions to outage reports.

Community Outreach and Local Offices

AEP actively connects with its service territories through a network of local offices and widespread community outreach initiatives. These touchpoints are crucial for disseminating information about services, rates, and upcoming projects, while also serving as vital channels for public feedback. For instance, in 2024, AEP continued its commitment to transparent communication through numerous public meetings and town halls across its operating states, directly engaging with thousands of customers.

This direct engagement fosters stronger relationships and allows AEP to be more responsive to the unique needs and concerns of each community it serves. By understanding local priorities, AEP can better tailor its investments and operational strategies. The company's community outreach efforts in 2024 included sponsoring over 50 local events and participating in more than 100 community advisory panels.

Key aspects of AEP's community outreach include:

- Local Office Presence: Maintaining accessible physical locations for customer service and information.

- Public Meetings and Forums: Hosting events to discuss service plans, rate changes, and address customer questions.

- Community Event Sponsorship: Actively participating in and supporting local events to build goodwill and visibility.

- Feedback Mechanisms: Establishing channels for customers to voice concerns and provide input on AEP's operations.

Regulatory Filings and Public Hearings

Regulatory filings and public hearings are essential communication channels for AEP within the utility sector. These forums allow AEP to formally present its proposed rate changes, infrastructure investments, and operational performance to state public utility commissions and the broader public. This process ensures transparency and accountability, which are paramount in a heavily regulated industry.

These interactions are not about direct sales but rather about gaining approval for essential business operations and investments. For instance, AEP's 2024 capital investment plan, projected to be in the billions, requires extensive regulatory review and public input before implementation. These filings detail everything from planned grid upgrades to renewable energy projects, directly impacting AEP's ability to serve its customers and pursue strategic growth.

Key aspects of these channels include:

- Formal Submission of Rate Cases: AEP regularly submits detailed rate cases to state commissions, outlining the need for adjustments in electricity prices based on operating costs, capital expenditures, and desired rate of return. For example, in 2024, AEP Ohio filed a significant rate case seeking to recover investments in modernizing the grid.

- Public Hearings for Stakeholder Input: These hearings provide a platform for customers, consumer advocates, and other interested parties to voice concerns and provide feedback on AEP's proposals. This feedback can influence commission decisions on rate adjustments and project approvals.

- Transparency in Financial Performance: Regulatory filings also include comprehensive reports on AEP's financial health and operational efficiency, allowing commissions and the public to scrutinize the company's performance against established benchmarks.

- Approval of Major Projects: Significant infrastructure projects, such as new transmission lines or renewable energy facilities, require specific regulatory approval through these filing and hearing processes. AEP's ongoing investments in wind and solar power, totaling billions in 2024, are subject to this oversight.

AEP's physical infrastructure, its transmission and distribution networks, remains its most critical channel for delivering electricity. These vast networks are constantly being upgraded, with AEP investing billions annually to ensure reliability and efficiency. In 2023 alone, AEP's capital expenditures exceeded $7.5 billion, with a substantial portion dedicated to these essential delivery systems.

Digital channels, including AEP's website and mobile app, are increasingly vital for customer interaction, facilitating bill payments, outage reporting, and account management. Millions of unique visitors accessed AEP's website in 2024, underscoring its role in customer self-service and engagement.

Community outreach and local engagement through physical offices and public forums are key to AEP's operations, fostering relationships and gathering feedback. In 2024, AEP participated in over 100 community advisory panels and sponsored more than 50 local events, demonstrating its commitment to local presence.

Regulatory filings and public hearings serve as crucial channels for AEP to gain approval for its operations and investments, ensuring transparency and accountability. AEP's 2024 capital investment plans, which involve billions in grid modernization and renewable energy projects, are subject to rigorous review through these processes, including significant rate case filings like the one by AEP Ohio in 2024.

| Channel Type | Key Functions | 2024 Activity Example | Investment Focus |

| Transmission & Distribution Networks | Physical electricity delivery | Ongoing grid modernization | Billions in capital expenditures |

| Website & Mobile App | Customer self-service, information access | Millions of unique website visitors | Digital platform enhancement |

| Local Offices & Community Outreach | Customer support, public engagement | 100+ community advisory panels | Building local relationships |

| Regulatory Filings & Public Hearings | Rate approvals, project oversight | AEP Ohio rate case filing | Securing investment recovery |

Customer Segments

Residential customers are the backbone of AEP's operations, encompassing individual households throughout its extensive 11-state service area. These customers depend on AEP for consistent, safe, and cost-effective electricity to power their daily lives, making them a crucial segment of the company's overall customer base.

AEP is committed to meeting the energy demands of these millions of households. In 2024, AEP continued its focus on grid modernization and reliability improvements designed to benefit these residential users, ensuring they have the power they need when they need it.

With a vast network serving approximately 5.6 million customers, AEP's residential segment represents a significant portion of its revenue and operational focus. The company's investments in infrastructure aim to enhance the customer experience for these individual households.

Commercial customers represent a vital segment for AEP, encompassing a wide range of businesses from small local shops to large industrial facilities. These businesses have varied energy requirements that AEP addresses by providing reliable electricity and, increasingly, specialized energy management services designed to optimize their operations and reduce costs.

The demand from this sector is significant and growing. In 2024, AEP observed a substantial 10.6% increase in commercial load. This growth is largely attributed to positive economic development, indicating that more businesses are expanding or setting up operations within AEP's service territories, thereby increasing their energy consumption.

Industrial customers, such as manufacturing plants and factories, represent a vital segment for AEP, requiring substantial and often specialized electricity. AEP focuses on delivering a reliable and ample power supply to sustain their operations and facilitate expansion.

These industrial users are significant drivers of electricity demand, notably contributing to load growth in regions like Texas. For instance, in 2024, industrial sector electricity consumption in the U.S. saw a notable increase, reflecting the ongoing demand from these energy-intensive operations.

Governmental and Municipal Entities

Governmental and municipal entities represent a crucial customer segment for AEP, encompassing local, state, and federal government facilities. These organizations rely on AEP for essential electricity to power public services, maintain vital infrastructure, and illuminate streetlights, directly impacting community well-being and safety.

AEP actively collaborates with these public sector partners, tailoring energy solutions to meet specific operational demands and contributing to community development initiatives. This partnership underscores AEP's role in supporting the foundational needs of public administration and urban infrastructure.

- Public Infrastructure: Powering essential services like water treatment plants, public transportation systems, and administrative buildings.

- Community Lighting: Ensuring streetlights and public area illumination for safety and accessibility.

- Economic Development Support: Providing reliable energy to attract and sustain businesses within municipal boundaries.

- Government Contracts: Securing long-term agreements for electricity supply to federal, state, and local government operations.

Data Centers and High-Load Growth Customers

Data centers and other high-load growth customers represent a crucial and expanding segment for AEP. These entities, including new manufacturing operations, are significantly increasing electricity demand across AEP's service areas, notably in Ohio, Indiana, and Texas.

AEP is proactively engaging with these customers, securing agreements and making necessary infrastructure investments to meet their substantial power needs. This strategic focus is essential for managing and capitalizing on this burgeoning demand.

- 24 Gigawatts: AEP has secured customer agreements for this amount of new load by the end of the decade.

- 75% Data Centers: A significant portion of this new load, three-quarters, is specifically from data center customers.

- Strategic Importance: This segment is vital for AEP's future growth and requires dedicated infrastructure planning.

AEP serves a diverse customer base, including millions of residential households, a wide array of commercial businesses, and large industrial facilities. The company also caters to governmental and municipal entities, powering essential public services and infrastructure.

A growing segment for AEP comprises data centers and other high-load customers, significantly increasing electricity demand across its service territories. In 2024, AEP secured agreements for 24 gigawatts of new load by the end of the decade, with approximately 75% of this coming from data centers.

This expansion highlights AEP's focus on meeting the evolving energy needs of various sectors, from everyday consumers to major industrial and technological operations, driving strategic investments in grid modernization and capacity.

| Customer Segment | Key Characteristics | 2024 Data/Insights |

|---|---|---|

| Residential | Individual households needing reliable, cost-effective electricity. | AEP serves millions of these customers, focusing on grid modernization. |

| Commercial | Small shops to large facilities with varied energy needs. | Observed a 10.6% increase in commercial load due to economic development. |

| Industrial | Manufacturing plants and factories requiring substantial power. | Significant drivers of load growth, particularly in regions like Texas. |

| Governmental/Municipal | Public facilities and infrastructure, including streetlights. | Partnerships for tailored energy solutions and community development. |

| Data Centers/High-Load | Entities with rapidly increasing electricity demand. | Secured 24 GW of new load agreements by 2030, 75% from data centers. |

Cost Structure

AEP’s largest cost driver is capital expenditure for its vast infrastructure. This includes significant investments in generation, transmission, and distribution networks to ensure reliability and accommodate future growth.

Historically, AEP outlined a five-year capital plan totaling $54 billion. Looking ahead, the company anticipates announcing a new, even larger capital plan, projected to be around $70 billion, underscoring its commitment to infrastructure development.

A substantial portion of these capital outlays is directed towards transmission and distribution projects. These investments are crucial for modernizing the grid, enhancing resilience, and integrating new energy sources.

Fuel and purchased power costs are a significant component of AEP's operating expenses. In 2024, these costs are heavily influenced by the volatile prices of natural gas and coal, as well as the dynamics of the wholesale electricity market.

For instance, fluctuations in natural gas prices directly impact AEP's generation costs. A significant increase in natural gas prices in late 2023 and early 2024, driven by global supply concerns, has put upward pressure on these expenses for AEP.

AEP also incurs costs from purchasing power on the wholesale market, which can be subject to real-time price changes and capacity market mechanisms. These purchased power costs are a crucial element in managing AEP's overall cost structure and ensuring reliable electricity supply to its customers.

Operations and Maintenance (O&M) expenses are a significant cost for AEP, encompassing the day-to-day running and upkeep of its vast energy infrastructure. These costs cover everything from managing power plants and maintaining transmission and distribution lines to ensuring efficient customer service operations.

For 2024, AEP's O&M expenses are projected to be substantial, reflecting the scale of its operations. For instance, in 2023, AEP reported operating expenses, which include O&M, of approximately $15.9 billion. This figure highlights the ongoing investment required to keep their systems reliable and efficient.

Key components within O&M include crucial activities like vegetation management along power lines to prevent outages and routine repairs to ensure the integrity of the grid. These ongoing efforts are vital for maintaining service quality and preventing costly disruptions.

Regulatory and Compliance Costs

Operating within the energy sector, particularly for a company like AEP, means navigating a complex web of regulations. These aren't just suggestions; they're mandates that require substantial investment to meet. Think about environmental standards for emissions, ensuring the safety of infrastructure, and adhering to numerous state and federal energy policies. These compliance efforts translate directly into operational expenses.

These costs encompass a wide range of activities. They include the expenses associated with preparing and submitting various regulatory filings, which often require specialized expertise and detailed data collection. Furthermore, potential legal proceedings or challenges related to regulatory compliance can add significant financial burdens. For instance, in 2024, utility companies often face ongoing investments in grid modernization to meet evolving reliability and cybersecurity regulations, a substantial portion of which falls under compliance costs.

- Environmental Compliance: Costs for emissions monitoring, pollution control technology upgrades, and waste management.

- Safety Standards: Investments in training, equipment, and infrastructure maintenance to meet stringent safety regulations.

- Regulatory Filings: Expenses for preparing and submitting reports, permits, and other documentation to government agencies.

- Legal and Lobbying: Costs associated with legal counsel for regulatory matters and lobbying efforts to influence policy.

Employee Compensation and Benefits

Employee compensation and benefits represent a significant cost for AEP, a large utility company. With a workforce of nearly 16,000 employees, substantial investments are made in salaries, wages, health insurance, retirement plans, and ongoing training to maintain a skilled and motivated team. These expenditures are fundamental to AEP's ability to operate and expand its services.

The company's commitment to its employees is reflected in its cost structure, where compensation and benefits are a primary driver. For instance, in 2024, AEP's total employee-related expenses were a major component of its overall operating budget, directly impacting profitability and the resources available for infrastructure development and technological upgrades. This investment is crucial for attracting and retaining talent in a competitive industry.

- Employee Salaries and Wages: A significant portion of AEP's cost structure is dedicated to competitive pay for its nearly 16,000 employees across various operational and administrative roles.

- Benefits Packages: Comprehensive health insurance, retirement contributions, and other employee benefits are a substantial cost, aiming to support employee well-being and retention.

- Training and Development: Ongoing investment in training programs ensures the workforce remains skilled in areas like grid modernization, renewable energy integration, and safety protocols, contributing to operational efficiency.

- Total Compensation Expenses: In 2024, these combined costs formed a major outlay, directly influencing AEP's financial performance and strategic investment capacity.

AEP's cost structure is heavily influenced by its substantial capital expenditures, projected to reach around $70 billion in its upcoming capital plan, a significant increase from its previous $54 billion five-year plan. These investments are primarily directed towards modernizing and expanding its transmission and distribution networks to ensure reliability and integrate new energy sources.

Fuel and purchased power costs are also a major expense, with 2024 figures reflecting volatile natural gas and coal prices, alongside wholesale electricity market dynamics. Operations and Maintenance (O&M) expenses, which include keeping its vast infrastructure running, were a significant part of the approximately $15.9 billion in operating expenses reported in 2023.

Regulatory compliance, encompassing environmental standards, safety protocols, and policy adherence, represents another substantial cost. Employee compensation and benefits for its nearly 16,000 employees are also a primary cost driver, covering salaries, wages, and comprehensive benefits packages.

| Cost Category | 2023 (Approximate) | 2024 Projection/Focus | Key Drivers |

|---|---|---|---|

| Capital Expenditure | $54 billion (previous 5-year plan) | ~$70 billion (new capital plan) | Infrastructure modernization, grid expansion, new energy integration |

| Fuel & Purchased Power | Included in operating expenses | Influenced by natural gas/coal prices, wholesale market | Energy commodity prices, market demand |

| Operations & Maintenance (O&M) | Part of ~$15.9 billion operating expenses | Substantial, ongoing | Plant management, line maintenance, customer service, vegetation management |

| Regulatory Compliance | Ongoing investment | Ongoing investment | Environmental standards, safety regulations, reporting, legal |

| Employee Compensation & Benefits | Major component of operating budget | Major component of operating budget | Salaries, wages, health insurance, retirement, training |

Revenue Streams

American Electric Power (AEP) generates the bulk of its revenue by selling electricity to residential customers. This income is generated within its regulated service territories, meaning the prices are set and approved by state public utility commissions. This regulatory oversight ensures a stable and predictable revenue stream for the company.

In 2023, AEP reported total operating revenues of $16.9 billion. A significant portion of this revenue is derived from its regulated utility operations, which include residential sales. For instance, AEP Ohio, a key subsidiary, saw its regulated electric revenue increase in 2023, reflecting approved rate adjustments and customer growth.

AEP generates revenue by selling electricity to commercial and industrial clients, often through regulated tariffs and custom contracts. This includes supplying power to large-scale operations such as data centers, which have significant energy demands.

This segment is a major contributor to AEP's financial performance, showing robust growth. For instance, in 2024, AEP reported that its commercial and industrial customer base accounted for a substantial portion of its total electricity sales, reflecting the ongoing demand from these sectors.

AEP generates revenue by offering transmission services across its vast high-voltage network. This critical infrastructure allows for the reliable movement of electricity, and the income derived from these services is a fundamental part of AEP's financial structure.

These transmission revenues are typically overseen by regulatory bodies, ensuring fair pricing and service levels. For instance, in 2024, AEP Transmission Holdco continued to be a significant contributor to the company's overall earnings, underscoring the importance of this revenue stream.

Wholesale Electricity Sales and Marketing

Beyond its regulated utility operations, AEP actively participates in wholesale electricity markets, generating significant revenue. This segment involves selling electricity produced by its own generation fleet and marketing power to other utilities and wholesale customers. In 2024, AEP's wholesale segment is expected to be a key contributor to its overall financial performance, capitalizing on market price fluctuations and demand.

These wholesale sales are crucial for optimizing AEP's generation assets. The company strategically buys and sells power to balance its portfolio, meet customer needs, and capture market opportunities. This dynamic approach allows AEP to leverage its diverse generation mix, including renewables and traditional sources, to its financial advantage in competitive environments.

- Wholesale Revenue Generation: AEP sells electricity from its own generation facilities into competitive wholesale markets.

- Market Participation: The company actively buys and sells power to meet demand and optimize its generation portfolio.

- 2024 Outlook: Wholesale sales are anticipated to be a significant revenue driver for AEP in the current year.

Ancillary Services and Other Charges

AEP diversifies its revenue through ancillary services and other charges beyond core electricity sales. These can include fees for specific customer programs and administrative costs, contributing to overall financial stability.

In 2024, AEP's regulated utility operations, which often encompass these additional charges, remained a significant portion of its business. For instance, recovery of costs associated with energy efficiency programs, mandated or encouraged by regulators, provides a predictable revenue stream. These programs aim to reduce energy consumption, and the associated costs are often passed through to customers over time, subject to regulatory approval.

Additional revenue streams can also arise from:

- Ancillary Services: Fees for services that support the reliable operation of the electric grid, such as frequency regulation or voltage support.

- Energy Efficiency Program Cost Recovery: Mechanisms allowing AEP to recoup investments made in customer energy efficiency initiatives.

- Regulated Fees: Charges for specific services or administrative functions approved by regulatory bodies, like connection fees or late payment charges.

- Other Services: Potential revenue from specialized services offered to customers, depending on regulatory frameworks and market opportunities.

AEP's revenue streams are primarily built upon regulated electricity sales to residential, commercial, and industrial customers within its service territories. These sales are governed by state public utility commissions, ensuring a stable revenue base. In 2023, AEP's total operating revenues reached $16.9 billion, with regulated utility operations forming the core of this figure.

Transmission services represent another critical revenue component, leveraging AEP's extensive high-voltage network. These revenues are also subject to regulatory oversight, contributing significantly to the company's financial stability. AEP Transmission Holdco, for example, continued to be a substantial earnings contributor in 2024.

Beyond regulated sales, AEP actively participates in wholesale electricity markets, selling power from its generation fleet. This segment capitalizes on market price fluctuations and demand, with wholesale sales expected to be a key driver in 2024. The company also generates income from ancillary services and the recovery of costs associated with energy efficiency programs, further diversifying its financial portfolio.

| Revenue Stream | Description | 2023/2024 Relevance |

| Regulated Sales (Residential, Commercial, Industrial) | Electricity sales within approved service territories. | Core revenue source, $16.9 billion total operating revenue in 2023. |

| Transmission Services | Fees for utilizing AEP's high-voltage network. | Significant contributor, AEP Transmission Holdco strong in 2024. |

| Wholesale Market Sales | Selling electricity from AEP's generation fleet into competitive markets. | Key driver expected for 2024, capitalizing on market dynamics. |

| Ancillary Services & Program Cost Recovery | Fees for grid support and recouping energy efficiency investments. | Diversifies revenue, provides predictable income streams. |

Business Model Canvas Data Sources

The AEP Business Model Canvas is built upon a foundation of extensive market research, internal operational data, and financial projections. These sources ensure a comprehensive understanding of customer needs, competitive landscapes, and revenue streams.