AEP Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AEP Bundle

AEP's competitive landscape is shaped by powerful forces, from the bargaining power of its customers to the constant threat of new energy providers. Understanding these dynamics is crucial for any strategic decision-making within the utility sector.

The complete report reveals the real forces shaping AEP’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

American Electric Power (AEP) depends on a diverse range of fuel sources, including coal, natural gas, nuclear fuel, and components for renewable energy projects. The ability of these suppliers to dictate terms can shift significantly. Factors like volatile commodity prices, geopolitical events, and the sheer availability of certain resources directly impact AEP's operational expenses and how it strategically chooses its fuel mix.

For instance, in 2024, natural gas prices experienced considerable volatility, influenced by global demand and supply chain disruptions. This fluctuation directly affects AEP's fuel procurement costs, highlighting the significant bargaining power held by natural gas suppliers. Similarly, the availability and pricing of specialized components for wind and solar farms can be influenced by a limited number of manufacturers, granting them considerable leverage.

Suppliers of specialized equipment like turbines, transformers, and grid modernization technologies hold considerable sway. Their proprietary technologies and the substantial costs associated with switching vendors mean AEP is often reliant on them for critical infrastructure components. For instance, in 2024, the global market for grid modernization technologies was valued at over $25 billion, indicating the scale and importance of these specialized suppliers.

The availability of a skilled workforce, encompassing engineers, line workers, and IT professionals, is absolutely vital for AEP's day-to-day operations and ongoing maintenance efforts. A tight labor market, particularly in specialized areas, can significantly amplify the bargaining power of employees, leading to upward pressure on wages and potentially limiting AEP's operational agility. For instance, in 2024, the U.S. Bureau of Labor Statistics reported a persistent shortage of skilled trades, including electricians and power-line installers, which directly impacts utility companies like AEP.

Financial Capital Providers

Financial capital providers, such as banks and bondholders, wield significant influence over AEP. As a capital-intensive utility, AEP relies heavily on external financing for its extensive infrastructure upgrades and clean energy transitions. For instance, AEP issued $1.5 billion in senior unsecured notes in January 2024, with interest rates reflecting market conditions and investor sentiment.

The bargaining power of these providers is directly tied to the cost of capital. Factors like prevailing interest rates, AEP's creditworthiness, and the overall health of the credit markets determine the terms AEP can secure for its borrowing. AEP's credit ratings, which are closely monitored by investors, play a crucial role in this dynamic.

- Interest Rate Sensitivity: AEP’s borrowing costs are directly impacted by changes in benchmark interest rates, such as the Federal Reserve’s policy rates.

- Credit Market Conditions: The availability and cost of capital fluctuate with broader economic conditions and investor risk appetite.

- Financial Performance: AEP's profitability, cash flow generation, and debt levels directly influence its credit ratings and, consequently, the terms offered by capital providers.

- Investor Demand: For AEP’s debt offerings, strong investor demand can lead to more favorable interest rates, while weak demand can increase borrowing costs.

Environmental Compliance and Emission Control Suppliers

Suppliers of advanced emission control technologies and carbon capture solutions are experiencing increased bargaining power due to stricter environmental regulations. AEP, like other utilities, faces growing pressure to reduce its carbon footprint and comply with evolving standards, making these specialized suppliers more critical to its operations.

For instance, the U.S. Environmental Protection Agency (EPA) continues to refine regulations like the Mercury and Air Toxics Standards (MATS) and is anticipated to release new rules concerning greenhouse gas emissions from power plants. This regulatory environment directly boosts the leverage of companies providing the necessary equipment and services to meet these compliance demands. AEP's investment in environmental upgrades, such as flue gas desulfurization systems or selective catalytic reduction (SCR) units, highlights its reliance on these suppliers.

- Increased Demand for Compliance Technologies: Stricter environmental mandates, such as those related to SO2, NOx, and CO2 emissions, drive demand for specialized equipment and services.

- Supplier Specialization and Limited Alternatives: The highly technical nature of emission control and carbon capture technologies means there are often a limited number of qualified suppliers, concentrating power.

- Regulatory Uncertainty as a Leverage Point: Anticipation of future, more stringent regulations can lead suppliers to command higher prices for their solutions, as their offerings become essential for long-term operational viability.

- AEP's Capital Investments in Environmental Upgrades: Significant capital expenditures by AEP on emission control retrofits and new technologies directly translate to increased dependence on these specialized suppliers.

Suppliers of essential fuels like coal and natural gas can exert significant bargaining power on American Electric Power (AEP), especially during periods of price volatility or supply chain disruptions. In 2024, the fluctuating costs of natural gas directly impacted AEP's operational expenses, demonstrating the leverage held by these energy providers. Furthermore, the limited number of manufacturers for specialized renewable energy components also grants them considerable influence over pricing and availability.

The bargaining power of suppliers is amplified when they offer proprietary technologies or when switching costs for AEP are high, particularly for critical infrastructure components like turbines and grid modernization equipment. In 2024, the market for grid modernization technologies exceeded $25 billion, underscoring the importance and concentration of power among these specialized suppliers.

AEP also faces increased supplier power from providers of advanced emission control and carbon capture technologies, driven by stricter environmental regulations. The U.S. EPA's ongoing refinement of emissions standards, including anticipated new rules for greenhouse gases, elevates the importance of these specialized suppliers, directly impacting AEP's compliance investments.

| Supplier Type | Key Products/Services | Factors Influencing Bargaining Power | 2024 Impact Example |

| Fuel Providers | Coal, Natural Gas | Commodity price volatility, global demand, supply chain disruptions | Natural gas price fluctuations increased AEP's fuel procurement costs. |

| Equipment Manufacturers | Turbines, Transformers, Grid Modernization Tech | Proprietary technology, high switching costs, market concentration | The $25B+ grid modernization market highlights supplier leverage. |

| Environmental Technology Providers | Emission Control Systems, Carbon Capture | Stricter environmental regulations, specialized expertise, limited alternatives | Anticipated EPA rules increased demand and pricing power for compliance solutions. |

What is included in the product

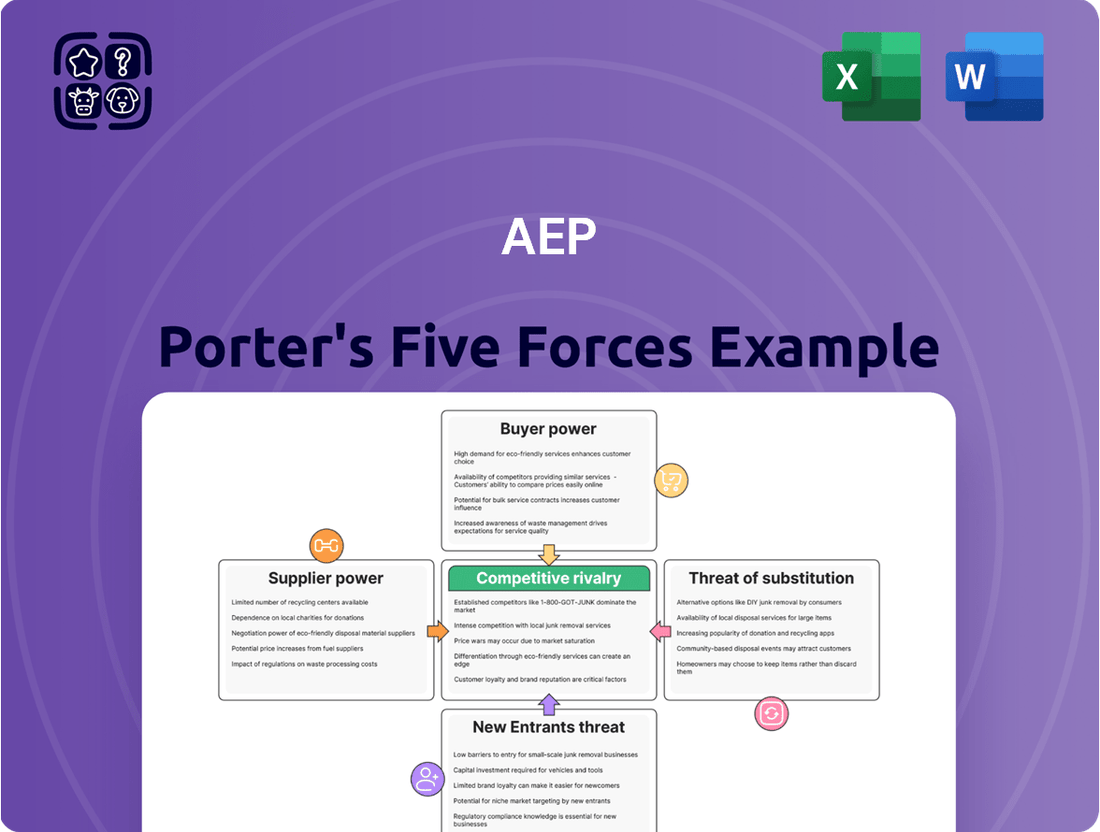

Analyzes the five competitive forces impacting AEP's industry to understand its profitability and strategic positioning.

Quickly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces, simplifying complex market dynamics for strategic action.

Customers Bargaining Power

AEP's regulated monopoly status in its service territories significantly curtails the bargaining power of its customers. For instance, in Ohio, AEP Ohio operates as the sole transmission and distribution provider, meaning customers cannot switch to a different utility for these essential services, thereby limiting their ability to negotiate pricing or terms.

Large industrial and commercial customers, due to their significant electricity usage, can exert considerable bargaining power over AEP. For instance, in 2023, AEP's industrial customers accounted for a substantial portion of their total electricity sales, giving them leverage to negotiate more favorable terms. This can manifest as requests for customized tariffs reflecting their usage patterns or demands for enhanced service reliability, potentially impacting AEP's revenue streams and operational planning.

State public utility commissions and other regulatory bodies actively represent customer interests, ensuring fair electricity rates and dependable service from companies like AEP. This oversight acts as a crucial check, indirectly strengthening customer bargaining power by capping AEP's pricing potential and mandating service standards.

For instance, in 2024, AEP's rate cases before various state commissions involved extensive public input and scrutiny, demonstrating the direct impact of regulatory intervention on pricing. This process limits AEP's ability to unilaterally increase costs, providing a significant counter-balance to their market position.

Distributed Generation Adoption

The growing trend of distributed generation, like rooftop solar, significantly shifts power towards customers. As more households and businesses adopt these technologies, their dependence on traditional utility providers like AEP diminishes. This ability to generate their own power gives them leverage, as they have a viable alternative to purchasing electricity from the grid.

By 2024, the U.S. solar market continued its robust growth, with distributed solar capacity playing a key role. For instance, residential solar installations saw substantial increases, reflecting this customer empowerment. This trend directly impacts AEP's customer base, as it provides a tangible option to bypass standard utility services.

- Reduced Reliance: Customers generating their own power are less dependent on AEP's grid.

- Alternative Supply: Distributed generation offers a competitive alternative to utility-provided electricity.

- Increased Bargaining Power: This alternative strengthens customers' ability to negotiate or seek better terms.

Energy Efficiency Initiatives

Customers' increasing focus on energy efficiency initiatives directly influences AEP's operational and strategic planning. By adopting energy-saving technologies and participating in demand-side management programs, customers reduce their overall electricity consumption. This can indirectly impact AEP's revenue streams and necessitate adjustments in long-term generation capacity planning, offering a subtle form of leverage.

For instance, AEP's 2023 Integrated Resource Plan (IRP) highlights the company's commitment to managing demand growth, partly driven by customer efficiency efforts. In 2023, AEP reported that its energy efficiency programs helped customers save approximately 1.2 million megawatt-hours (MWh) of energy. This reduction in demand means fewer kilowatt-hours sold, directly affecting revenue projections.

- Reduced Demand Impact: Lower electricity usage by customers due to efficiency measures can lead to decreased sales volumes for AEP.

- Capacity Planning Influence: Customers' ability to manage their consumption forces AEP to be more precise in forecasting future generation needs, potentially avoiding overcapacity.

- Program Adoption Rates: The success and adoption rates of AEP's energy efficiency programs, such as smart meter installations and energy audits, directly correlate with the degree of customer leverage.

- Revenue Stream Sensitivity: AEP's revenue is directly tied to the amount of electricity sold, making customer-driven demand reduction a significant factor in financial performance.

While AEP's regulated status generally limits customer bargaining power, factors like large industrial users and distributed generation do provide leverage. Regulatory oversight, especially through rate cases in 2024, also acts as a significant check on AEP's pricing. The increasing adoption of distributed solar by 2024, with continued robust growth in the U.S. market, empowers customers by offering alternatives to utility-provided electricity.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Example |

|---|---|---|

| Regulated Monopoly | Lowers bargaining power, limits switching | AEP Ohio as sole transmission/distribution provider |

| Large Industrial Customers | Increases bargaining power due to volume | Substantial portion of 2023 electricity sales |

| Regulatory Oversight | Strengthens bargaining power via rate caps and service standards | 2024 rate cases with public input and scrutiny |

| Distributed Generation (Solar) | Increases bargaining power by providing alternatives | Continued robust growth of U.S. solar market in 2024 |

| Energy Efficiency Initiatives | Indirectly increases bargaining power via reduced demand | AEP customers saved ~1.2 million MWh in 2023 |

Same Document Delivered

AEP Porter's Five Forces Analysis

You're previewing the final version—precisely the same document that will be available to you instantly after buying. This comprehensive AEP Porter's Five Forces Analysis breaks down the competitive landscape, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. Understand the strategic positioning of AEP within its industry through this in-depth, ready-to-use report.

Rivalry Among Competitors

AEP operates within regulated markets where state commissions grant exclusive rights for electricity delivery within specific geographic areas. This means AEP is typically the sole provider of these essential services to its customers, effectively creating a geographic monopoly. Consequently, direct competition from other utility companies vying for the same customer base for electricity delivery is virtually non-existent.

This lack of direct rivalry for its core delivery business provides AEP with a degree of stability and predictable revenue streams. For instance, in 2023, AEP's regulated utility segment generated a significant portion of its operating income, highlighting the importance of these protected markets. The regulated nature of these monopolies means that while competition is low, AEP's pricing and operational decisions are subject to oversight by regulatory bodies.

AEP actively participates in wholesale power markets, facing off against numerous independent power producers and other utility companies. This dynamic environment means AEP must constantly compete on price to secure advantageous positions for buying and selling electricity.

The intensity of this price competition directly impacts how effectively AEP can utilize its generation assets and, consequently, its profitability from power sales. For instance, in 2024, the average wholesale electricity price in some of AEP's key operating regions saw fluctuations influenced by fuel costs and demand, creating a challenging landscape for revenue generation.

As American Electric Power (AEP) shifts its generation mix, it faces intense competition for new capacity, especially in the booming renewable energy sector. This rivalry comes from other utilities and independent power developers vying for the same project opportunities.

These competitions often play out through competitive bidding for power purchase agreements (PPAs). For instance, in 2024, AEP is actively participating in such processes, where the ability to offer the most cost-effective and reliable energy solutions is paramount to securing these crucial long-term contracts.

Innovation and Service Quality Benchmarking

While AEP operates in a regulated utility environment with limited direct competitors, it faces indirect rivalry through benchmarking against other utilities' progress in crucial areas. This competition centers on adopting best practices in grid modernization, enhancing customer service, and advancing clean energy solutions. Utilities constantly evaluate each other's performance to maintain regulatory approval and customer loyalty.

This indirect rivalry pushes AEP to innovate and improve its service quality. Key areas of focus include smart grid technologies, renewable energy integration, and digital customer engagement platforms. Companies that excel in these areas often gain a competitive edge in attracting investment and satisfying stakeholders.

- Grid Modernization Investments: Utilities are investing billions in upgrading their infrastructure. For example, in 2024, the US electric utility sector is projected to continue significant capital expenditures on grid modernization, with estimates suggesting trillions over the next two decades to enhance reliability and integrate distributed energy resources.

- Customer Satisfaction Scores: Benchmarking customer satisfaction is vital. Industry reports in 2023 and early 2024 show that utilities with higher customer satisfaction ratings often benefit from more favorable regulatory treatment and stronger community relations.

- Clean Energy Adoption Rates: The pace of adopting renewable energy sources and improving energy efficiency is a key performance indicator. Many utilities are setting ambitious clean energy targets, with some aiming for 100% carbon-free electricity by 2050, influencing industry-wide innovation.

Emergence of Non-Traditional Energy Providers

American Electric Power (AEP) encounters indirect competition from emerging non-traditional energy providers. These companies offer alternatives like energy management solutions, microgrids, and community energy projects, which can reduce reliance on traditional utility services.

While these entities may not directly compete for the entire grid infrastructure, they can erode specific revenue streams and customer segments. For instance, distributed generation projects, powered by solar or battery storage, can offset demand from the main grid, impacting a utility's sales volume. In 2024, the growth of behind-the-meter energy solutions continues to present this challenge.

- Energy Management Solutions: Companies offering smart home devices and energy efficiency software allow consumers to optimize their energy usage, potentially lowering overall consumption from utilities.

- Microgrids: These localized energy grids can operate independently or in conjunction with the main grid, providing a reliable alternative for critical facilities or communities, especially during outages.

- Community Energy Projects: Shared solar or wind projects allow multiple consumers to benefit from renewable energy without individual installation, creating a collective alternative to utility-supplied power.

AEP's competitive rivalry is nuanced. In its core regulated utility business, direct competition is minimal due to exclusive geographic service territories. However, AEP faces intense rivalry in wholesale power markets, competing on price with independent power producers and other utilities for electricity supply. Furthermore, the company contends with indirect competition from other utilities in areas like grid modernization and clean energy adoption, pushing for innovation and efficiency.

The company also navigates competition from emerging non-traditional energy providers offering solutions like microgrids and distributed generation, which can impact traditional revenue streams. For example, in 2024, the ongoing growth of behind-the-meter energy solutions continues to present this challenge, as consumers increasingly adopt alternatives to utility-provided power.

| Area of Rivalry | Nature of Competition | Key Factors | 2024 Context/Data |

|---|---|---|---|

| Regulated Utility Operations | Very Low (Geographic Monopolies) | Exclusive service territories, regulatory oversight | AEP's regulated segments remained a stable revenue source in 2023. |

| Wholesale Power Markets | High (Price Competition) | Price for buying/selling electricity, fuel costs, demand | Wholesale electricity prices in AEP regions saw fluctuations in 2024 due to energy market dynamics. |

| New Capacity Acquisition (Renewables) | High (Bidding for PPAs) | Cost-effectiveness, reliability of energy solutions | AEP actively participated in competitive bidding for power purchase agreements in 2024. |

| Operational Best Practices | Moderate (Indirect Benchmarking) | Grid modernization, customer service, clean energy innovation | Industry reports in early 2024 highlight customer satisfaction scores as a key differentiator for utilities. |

| Non-Traditional Energy Providers | Growing (Erosion of Revenue Streams) | Energy management solutions, microgrids, distributed generation | The growth of behind-the-meter solutions in 2024 continues to challenge traditional utility sales volumes. |

SSubstitutes Threaten

The most significant substitute threat for AEP arises from distributed generation technologies. Rooftop solar photovoltaic systems and small-scale wind turbines empower customers to produce their own electricity, directly diminishing their dependence on AEP's grid-supplied power. This trend can lead to a notable reduction in demand for traditional utility services.

For instance, by the end of 2023, the U.S. solar market saw a substantial increase, with rooftop solar installations growing significantly. This growth directly impacts utilities like AEP by offering customers an alternative to purchasing power from the grid, potentially eroding AEP's customer base and revenue streams.

Improvements in energy efficiency are a significant threat. Technologies like smart thermostats and LED lighting allow consumers to reduce their electricity usage without sacrificing comfort or functionality. For instance, the U.S. Department of Energy reported that by 2023, energy-efficient appliances alone saved American households an estimated $10 billion annually.

This trend directly impacts utilities like AEP by diminishing the overall demand for their core product: electricity. As customers become more efficient, they require less power, potentially leading to lower sales volumes and revenue for the company.

Advances in battery storage, both for large-scale grid use and for individual homes and businesses, present a significant threat. These systems allow consumers to store electricity when it's cheap or abundant and use it later, reducing their reliance on traditional utility providers like AEP during peak demand times. This growing energy independence directly substitutes for AEP's core service of delivering electricity on demand.

For instance, by the end of 2023, the U.S. saw a substantial increase in battery storage capacity, with over 13 GW installed, and projections for 2024 indicate continued rapid growth. This trend means more customers can potentially manage their own energy needs, bypassing the need for AEP's services during critical periods.

Demand-Side Management Programs

Demand-side management (DSM) programs, which incentivize customers to reduce or shift their electricity usage, can act as a significant substitute for traditional utility investments in new generation capacity. These programs encourage behavioral changes and load shifting away from peak demand periods, effectively managing grid load without the need for AEP to build or acquire additional supply. For instance, in 2024, many utilities are seeing increased participation in time-of-use pricing plans, where customers are charged more for electricity during peak hours, leading to a voluntary reduction in consumption during those times.

These initiatives directly reduce the demand AEP needs to meet through its own generation assets. By empowering consumers to manage their usage, DSM programs can delay or even eliminate the need for costly new power plants.

- Reduced Peak Demand: DSM programs directly lower the highest points of electricity demand, lessening the reliance on expensive peaker plants.

- Lower Capital Expenditures: Successful DSM can defer or cancel capital-intensive generation projects, saving significant investment costs for AEP.

- Customer Engagement: Programs foster customer participation and awareness, contributing to overall grid stability and efficiency.

- Environmental Benefits: Shifting demand and reducing overall consumption often leads to lower greenhouse gas emissions.

Emerging Alternative Energy Sources

While not yet a widespread threat, advancements in alternative energy sources pose a long-term substitution risk to traditional utility models. Emerging technologies like small modular nuclear reactors (SMRs) could offer localized, independent power generation, potentially bypassing existing grid infrastructure. Similarly, breakthroughs in advanced geothermal and hydrogen-based energy systems could provide competitive, clean alternatives.

These nascent technologies are progressing rapidly. For instance, the U.S. Department of Energy's Advanced Reactor Demonstration Program has invested billions in developing SMRs, with projects aiming for operational readiness in the coming years. Hydrogen production, particularly green hydrogen powered by renewables, is also seeing significant investment, with global capacity projected to grow substantially by 2030.

- Small Modular Nuclear Reactors (SMRs): Offer potential for localized, reliable, and carbon-free power generation, reducing reliance on centralized grids.

- Advanced Geothermal Systems: Unlock geothermal energy in a wider range of geological locations, providing a consistent baseload power source.

- Hydrogen-Based Energy: Green hydrogen, produced using renewable electricity, presents a versatile energy carrier for power generation and storage.

The threat of substitutes for AEP is multifaceted, driven by technological advancements and evolving consumer behavior. Distributed generation, like rooftop solar, and energy efficiency measures directly reduce demand for grid electricity. Battery storage further empowers consumers to manage their energy use independently, while demand-side management programs encourage load shifting, lessening reliance on traditional utility supply.

The increasing adoption of distributed generation, such as solar power, presents a direct substitute for AEP's electricity sales. By the end of 2023, the U.S. solar market experienced significant growth, with rooftop installations playing a key role. This trend allows customers to generate their own power, thereby reducing their need to purchase electricity from AEP, impacting revenue.

Energy efficiency improvements also act as a substitute. By 2023, energy-efficient appliances alone were estimated to save American households billions annually, as reported by the U.S. Department of Energy. This reduction in overall electricity consumption means AEP sells less power, directly affecting its sales volumes.

Advancements in battery storage capacity, exceeding 13 GW installed in the U.S. by the end of 2023, allow consumers to store and use energy on their own terms. This capability reduces their dependence on AEP, especially during peak demand periods, offering a viable alternative to grid power.

| Substitute Technology | Impact on AEP | Key Data/Trend (as of late 2023/early 2024) |

|---|---|---|

| Rooftop Solar PV | Reduced demand for grid electricity, potential customer loss | Significant growth in U.S. rooftop solar installations by end of 2023. |

| Energy Efficiency | Lower electricity sales volumes, reduced revenue | Energy-efficient appliances saved U.S. households an estimated $10 billion annually by 2023. |

| Battery Storage | Decreased reliance on utility during peak demand | Over 13 GW of battery storage capacity installed in the U.S. by end of 2023, with continued rapid growth projected. |

| Demand-Side Management (DSM) | Reduced need for new generation capacity, deferred capital expenditures | Increased participation in time-of-use pricing plans observed in 2024, leading to voluntary consumption shifts. |

Entrants Threaten

Entering the electric utility sector, particularly for a company aiming to replicate AEP's integrated model of generation, transmission, and distribution, demands staggering upfront capital. For instance, building a new power plant or extending transmission lines can easily run into billions of dollars.

These substantial financial hurdles significantly deter potential new entrants. The sheer scale of investment needed to build out the necessary infrastructure makes it incredibly challenging for newcomers to compete effectively against established players like AEP, who already possess extensive and depreciated assets.

The utility sector, particularly for established players like American Electric Power (AEP), faces significant barriers from extensive regulatory hurdles and approvals. Federal, state, and local governments impose stringent requirements, demanding numerous permits, licenses, and certifications before any new entity can operate. This complex and often lengthy approval process acts as a formidable deterrent for potential new entrants seeking to compete in the market.

Existing utilities like AEP leverage significant economies of scale across their vast generation, transmission, and distribution networks. For instance, in 2023, AEP's capital expenditures were projected to be around $6.9 billion, reflecting the immense investment required to maintain and upgrade these large-scale infrastructures. New entrants would face a formidable barrier trying to match these cost efficiencies without already possessing a substantial customer base and operational footprint.

Established Infrastructure and Network Effects

American Electric Power (AEP) benefits significantly from its established infrastructure, which acts as a formidable barrier to new entrants. The company operates an extensive, integrated high-voltage transmission network and local distribution grids, meticulously built and maintained over many decades. This vast, interconnected system represents a massive capital investment and a level of operational complexity that is virtually impossible for a new competitor to replicate in a timely or cost-effective manner.

Furthermore, the existing network creates powerful network effects. Customers are already connected to AEP's grid, and switching to a new provider would involve significant disruption and cost, both for the customer and the potential new entrant. This entrenched customer base, coupled with the sheer scale of physical assets, makes it exceedingly difficult for newcomers to gain a foothold in the market.

- Decades of Investment: AEP's transmission and distribution assets represent billions of dollars in accumulated capital expenditure over many years, creating a high barrier to entry.

- Geographic Dominance: The company serves customers across 11 states, with its infrastructure deeply embedded in these regions, limiting accessible markets for new entrants.

- Regulatory Hurdles: Gaining the necessary permits and approvals to build competing infrastructure is a lengthy and complex process, further deterring new players.

Specialized Expertise and Operational Complexity

Operating a reliable and safe electric grid demands highly specialized engineering, technical, and operational expertise. This includes sophisticated grid management systems, advanced fault detection, and precise load balancing, all of which require years of training and experience. For instance, the U.S. electric grid relies on a workforce with deep knowledge in areas like power system protection and distributed energy resource integration.

The complexity and critical nature of these operations create significant barriers to entry. New entrants face a steep learning curve and substantial talent acquisition challenges. The need for robust cybersecurity measures and comprehensive emergency response capabilities further elevates the operational hurdles, requiring substantial investment in both technology and skilled personnel. In 2023, the U.S. Department of Energy highlighted the ongoing need for skilled workers in the energy sector, emphasizing the challenge of replacing retiring experts.

- Specialized Knowledge: Deep understanding of power generation, transmission, distribution, and grid modernization technologies is essential.

- Operational Demands: Continuous monitoring, real-time adjustments, and rapid response to outages are critical for grid stability.

- Cybersecurity Imperative: Protecting the grid from cyber threats requires advanced security protocols and dedicated IT expertise.

- Regulatory Compliance: Adhering to stringent safety and environmental regulations adds another layer of complexity for potential entrants.

The threat of new entrants into the electric utility sector, particularly for integrated operators like AEP, is significantly mitigated by immense capital requirements and established infrastructure. Building a comparable generation, transmission, and distribution network would necessitate billions in investment, a cost prohibitive for most newcomers. Furthermore, AEP's extensive, decades-old assets and deep geographic penetration create substantial operational and market access barriers. The sheer scale of AEP's existing network, coupled with the difficulty of replicating its economies of scale and regulatory expertise, makes direct competition exceedingly challenging for any new entrant aiming for a similar integrated model.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building new power plants and transmission lines costs billions. AEP's 2023 projected capital expenditures were around $6.9 billion for maintaining and upgrading its infrastructure. | Extremely high, deterring most potential entrants due to the massive upfront investment needed. |

| Existing Infrastructure | AEP possesses a vast, integrated network of transmission and distribution grids built over many years. | Creates a significant competitive advantage, making it difficult and costly for new entrants to establish a comparable footprint. |

| Economies of Scale | AEP leverages cost efficiencies from its large-scale operations and customer base. | New entrants struggle to match these cost advantages without a similar operational scale, impacting pricing competitiveness. |

| Regulatory Hurdles | Stringent federal, state, and local permits, licenses, and certifications are required. | The complex and lengthy approval process adds significant time and cost, acting as a major deterrent. |

| Specialized Expertise | Operating a reliable grid demands deep technical, engineering, and cybersecurity knowledge. | New entrants face challenges in acquiring the necessary skilled workforce and sophisticated operational systems. |

Porter's Five Forces Analysis Data Sources

Our analysis leverages data from AEP's annual reports, investor presentations, and regulatory filings with the SEC. We also incorporate industry-specific data from reputable sources like the Edison Electric Institute and energy market analysis firms to provide a comprehensive view of the competitive landscape.