AEP Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AEP Bundle

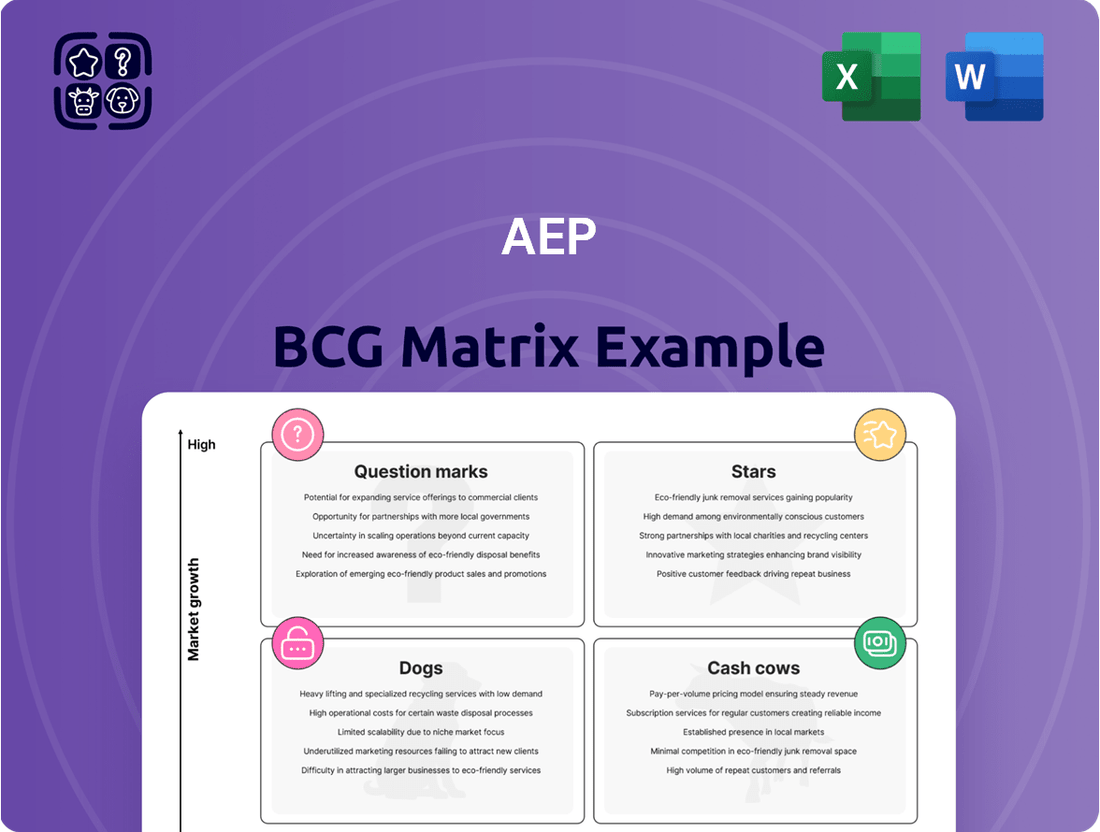

Uncover the strategic potential of this company's product portfolio with a glimpse into its BCG Matrix. See how its offerings are positioned as Stars, Cash Cows, Dogs, or Question Marks, and understand the immediate implications for market share and growth. Purchase the full BCG Matrix to unlock a comprehensive analysis, including data-driven insights and actionable strategies for optimizing your investments and product development.

Stars

AEP is channeling a significant $34 billion into modernizing its electric grid and transmission infrastructure from 2025 through 2029. These substantial investments are designed to bolster the reliability of power delivery and seamlessly incorporate a growing array of new energy generation sources.

This grid modernization is essential to meet escalating electricity demand, particularly fueled by the rapid expansion of data centers across AEP's operational areas. This high-growth segment of the market is a direct result of ongoing technological innovation and robust economic development.

AEP's aggressive expansion into renewable energy, with a planned $9.9 billion investment in regulated renewables from 2025 to 2029, firmly places this segment in the Stars category of the BCG Matrix. This substantial capital allocation signals strong growth potential and market leadership.

The company's strategic goal to achieve approximately 40% of its fuel mix from renewables by 2030 underscores a commitment to capturing a significant share of this rapidly expanding market. Federal incentives, such as those provided by the Inflation Reduction Act, further bolster the financial viability and attractiveness of these investments, ensuring AEP is well-positioned for sustained success in the clean energy sector.

AEP is experiencing substantial growth driven by the increasing demand from commercial and industrial customers, especially data centers. This trend is particularly pronounced in key states like Ohio, Indiana, and Texas.

By 2030, AEP has already secured agreements for 24 gigawatts of new customer load. Notably, a significant 75% of this projected increase is attributed to the burgeoning needs of data centers.

This rapid escalation in demand presents AEP with considerable capital investment opportunities. The company will need to invest heavily in building out the necessary grid infrastructure to support this new load.

Strategic Capital Investment Plan (New $70 Billion Plan)

AEP's newly announced five-year capital investment plan totals approximately $70 billion. This represents a significant escalation from their prior $54 billion plan, signaling an aggressive approach to future growth and infrastructure enhancement.

This substantial capital allocation is strategically aimed at accommodating anticipated load increases and bolstering AEP's transmission and distribution networks. It underscores a firm dedication to securing a leading market position and expanding its operational footprint.

The sheer scale of this investment suggests robust growth potential across AEP's diverse business segments.

- Capital Plan Increase: AEP's new five-year plan is $70 billion, up from $54 billion.

- Strategic Focus: Investments target projected load growth and infrastructure strengthening.

- Market Ambition: The plan demonstrates a commitment to future market leadership and expansion.

- Growth Indicator: The significant capital allocation points to high growth prospects.

Advanced Grid Technologies and AI Integration

AEP is aggressively investing in advanced grid technologies, including smart grids and artificial intelligence (AI). These upgrades are crucial for improving energy distribution efficiency and ensuring grid reliability. For instance, AI-powered predictive maintenance can significantly reduce downtime. In 2024, AEP's capital expenditures for grid modernization were substantial, reflecting a commitment to this area.

The integration of distribution automation circuit reconfiguration (DACR) allows AEP to dynamically manage its network, rerouting power to minimize disruptions during outages. This proactive approach enhances customer service and operational resilience. AEP's strategic focus on these technologies positions them to capture a larger share of the evolving energy market.

- Smart Grid Investment: AEP's 2024 capital plan included significant allocations towards smart grid infrastructure, aiming to enhance real-time monitoring capabilities.

- AI for Efficiency: The company is leveraging AI for predictive analytics to anticipate and prevent equipment failures, improving overall grid performance.

- Distribution Automation: DACR implementation is a key component of AEP's strategy to rapidly restore power and optimize energy flow.

- Market Position: These technological advancements are designed to solidify AEP's leadership in the growing smart energy management sector.

Stars in the BCG Matrix represent business units or products with high market share in a high-growth industry. AEP's investments in regulated renewables and its ability to secure significant new customer load, particularly from data centers, firmly place these segments as Stars.

The company's substantial capital allocation towards renewable energy projects and grid modernization to support increased demand highlights its strategic focus on these high-growth areas. This positions AEP to capitalize on the expanding clean energy market and the burgeoning needs of energy-intensive industries.

What is included in the product

The AEP BCG Matrix evaluates business units based on market share and growth, guiding investment decisions.

Visualize your portfolio's health and strategic focus in one clear view.

Quickly identify high-potential areas and divest from underperformers.

Cash Cows

AEP's regulated transmission and distribution operations are its bedrock, acting as reliable cash cows. These segments boast high market share within their 11-state service territories, ensuring a stable and predictable revenue flow. The essential nature of electricity delivery means demand remains consistent, generating strong cash flow.

These operations benefit from cost recovery mechanisms, allowing AEP to recoup investments and earn a regulated rate of return. With a large, established customer base, the need for extensive promotional spending is minimal, further solidifying their cash-generating power. For instance, in 2024, AEP's regulated businesses continued to be the primary driver of earnings.

AEP's existing customer base, spanning across 11 states and serving millions, represents a significant cash cow. This extensive reach translates into a stable and predictable revenue stream, a hallmark of mature businesses within the BCG matrix.

In 2023, AEP reported serving approximately 5.7 million customers, highlighting the sheer scale of its established market presence. The company's commitment to providing reliable and affordable energy in these territories ensures sustained demand, which is crucial for generating consistent cash flow.

This mature market environment, characterized by lower growth prospects, allows AEP to leverage its high market share for strong profitability. The focus here is on efficient operations and maximizing returns from a well-entrenched customer base.

American Electric Power (AEP) demonstrates robust financial stability, consistently generating strong earnings and maintaining a reliable history of quarterly cash dividends. This financial resilience means AEP produces more cash than it needs for operations, allowing for strategic reinvestment and shareholder returns. For instance, in 2023, AEP maintained its dividend payout, a testament to its mature and consistently cash-generating business model.

Traditional Power Generation Portfolio (Natural Gas and Nuclear)

Even as AEP navigates the energy transition, its traditional power generation assets, specifically natural gas and nuclear plants, remain vital cash cows. These facilities are the backbone of its current operations, providing essential baseload power that customers rely on daily. In 2024, these plants continued to demonstrate high operational efficiency, contributing significantly to AEP's overall revenue stream.

- Reliable Baseload Power: Natural gas and nuclear plants offer consistent energy output, crucial for grid stability.

- Mature Market Contribution: These assets operate in established markets, generating predictable cash flows.

- Revenue Stability: Despite the shift to renewables, these traditional sources ensure consistent revenue generation for AEP.

- High Utilization Rates: In 2024, these plants maintained high utilization, maximizing their cash-generating potential.

Long-Term Customer Agreements and Load Stability

AEP's long-term customer agreements, especially with major industrial clients and burgeoning data centers, create a predictable revenue stream. These commitments, often spanning multiple years, offer significant load stability, a crucial factor for utilities. For instance, AEP has secured agreements for substantial new customer load, bolstering its cash cow status in a mature utility sector.

- Secured Long-Term Load: AEP has locked in significant new customer demand, ensuring consistent revenue.

- Data Center Growth: Agreements with data centers contribute to predictable, high-volume energy consumption.

- Revenue Stability: These customer commitments provide a solid foundation for ongoing cash generation.

- Mature Market Strength: In a largely developed utility market, these agreements solidify AEP's position and cash flow.

AEP's regulated transmission and distribution operations are its core cash cows, benefiting from high market share and essential service demand across its 11-state territory. These segments provide stable, predictable revenue streams due to cost recovery mechanisms and minimal promotional spending needs.

The company's extensive customer base, serving millions, underpins its cash cow status by ensuring consistent demand and revenue generation in mature markets. In 2023, AEP served approximately 5.7 million customers, highlighting this significant market presence.

Traditional power generation assets, including natural gas and nuclear plants, also function as cash cows for AEP, supplying essential baseload power. These facilities maintained high operational efficiency in 2024, contributing substantially to the company's revenue.

Long-term customer agreements, particularly with industrial clients and data centers, further solidify AEP's cash cow position by providing predictable, high-volume energy consumption and load stability.

| Segment | Market Share | Cash Flow Driver | Key Metric (2023/2024) |

| Regulated Transmission & Distribution | High (within 11-state territory) | Essential Service, Cost Recovery | Stable Earnings |

| Traditional Power Generation (Gas/Nuclear) | Established Markets | Baseload Power, High Utilization | High Operational Efficiency |

| Long-Term Customer Agreements | Growing Demand (e.g., Data Centers) | Load Stability, Predictable Revenue | Secured New Customer Load |

Full Transparency, Always

AEP BCG Matrix

The BCG Matrix document you are currently previewing is precisely the same comprehensive file you will receive immediately after completing your purchase. This means you'll get the fully formatted, data-rich analysis without any alterations or watermarks, ready for your strategic planning needs. The preview accurately represents the professional-grade report you'll download, ensuring transparency and immediate usability for your business decisions.

Dogs

AEP's aging coal-fired power plants, representing roughly 42% of its capacity in September 2024, are increasingly challenged by a shifting regulatory landscape and diminishing economic appeal. These assets are categorized as potential 'dogs' within the BCG matrix, demanding substantial investment for environmental compliance or facing premature retirement.

The implementation of stricter environmental rules, like the EPA's 111(d) regulation, is a key driver for this classification. Compliance requires significant capital outlay, which may not be justifiable given the declining market share of coal in the broader energy sector and the high operational expenses associated with these older facilities.

AEP's extensive infrastructure includes legacy components situated in areas with sluggish population and economic expansion. These assets, often referred to as 'dogs' in the BCG matrix, may demand consistent upkeep and capital without generating commensurate returns or expanding market presence.

For instance, in 2024, AEP's capital expenditure plans often prioritize grid modernization and upgrades in their higher-growth service territories. This strategic allocation implies that investments in older, less dynamic infrastructure within low-growth regions might be deliberately scaled back.

The challenge with these legacy assets lies in their potential to become a drain on resources. While they continue to provide essential service, their limited growth prospects mean they are unlikely to contribute significantly to AEP's overall market share or revenue expansion.

AEP has strategically divested non-core operations, including its commercial renewable energy portfolio and retail and distributed resources business. These moves are indicative of a deliberate shift to concentrate on core, high-growth areas. For instance, in 2023, AEP completed the sale of its distributed resources business, a move that generated approximately $2.2 billion.

These divested segments, while possessing inherent value, were identified as areas where AEP sought to reduce its market presence and reallocate resources. This strategic pruning suggests these particular operations were not aligning with AEP's future growth objectives or delivering the most robust returns compared to other business units.

Underperforming Regulatory Jurisdictions

AEP has encountered difficulties in certain regulatory environments, impacting its ability to achieve authorized returns. For instance, in 2023, AEP's reported return on equity (ROE) for its regulated utilities was 9.2%, below its allowed ROE in several jurisdictions. This underperformance can be attributed to unfavorable regulatory decisions or protracted rate case proceedings.

These regulatory headwinds directly affect revenue generation and profitability, effectively classifying these segments as 'dogs' within the AEP portfolio. Such situations can lead to capital being invested without yielding the anticipated financial results, hindering overall portfolio growth.

- Regulatory Challenges: AEP's regulated segments have faced hurdles in earning their allowed returns, with a reported ROE of 9.2% for regulated utilities in 2023.

- Impact on Profitability: Unfavorable regulatory outcomes and delayed rate case approvals limit revenue growth and profitability.

- Capital Inefficiency: These underperforming jurisdictions tie up capital without generating expected returns, acting as 'dogs' in the AEP BCG Matrix.

Outdated or Inefficient Technologies

Within AEP's operational technology, systems that haven't been modernized and are proving inefficient can be categorized as 'dogs' in the BCG matrix. These are the older technologies that are costly to maintain but don't offer significant benefits in terms of efficiency or customer experience.

While AEP is making substantial investments in areas like smart grid technology and artificial intelligence, the lingering presence of outdated systems presents a challenge. For instance, legacy IT infrastructure that requires frequent patching and manual intervention, rather than automated processes, would fit this 'dog' classification. These technologies may consume resources without contributing to a competitive edge or improved service delivery.

Consider the ongoing costs associated with maintaining older power distribution management systems. If these systems lack the advanced analytics capabilities of newer platforms and require more manual oversight, they could be prime examples of 'dogs.' In 2024, utilities are increasingly pressured to reduce operational expenditures, making the identification and divestment or modernization of such inefficient technologies a strategic imperative.

- Legacy SCADA Systems: Older Supervisory Control and Data Acquisition systems that are difficult to integrate with modern analytics platforms and require specialized, often expensive, maintenance.

- Outdated Meter Reading Infrastructure: Manual or semi-automated meter reading processes that are slower and more prone to error compared to advanced smart metering solutions.

- Aging Communication Networks: Communication infrastructure that lacks the bandwidth or security features necessary for real-time data transmission required by smart grid applications.

- Legacy Billing and Customer Service Platforms: Systems that are not integrated with digital customer engagement tools, leading to higher customer service costs and lower satisfaction.

Dogs in AEP's portfolio represent assets or business units with low market share and low growth potential, requiring careful management to avoid becoming a drain on resources. AEP's older coal-fired power plants, facing regulatory pressures and declining market relevance, exemplify these 'dogs.' Similarly, outdated IT systems and underperforming regulated segments that struggle to achieve allowed returns also fit this classification.

These 'dogs' demand ongoing investment for maintenance or compliance but offer little prospect for significant revenue growth or market expansion. AEP's strategic decisions, like divesting non-core assets and prioritizing investments in grid modernization, indicate a focus on shedding or minimizing exposure to these low-return areas. The challenge lies in managing their decline or finding cost-effective ways to maintain essential services without hindering overall portfolio performance.

| BCG Category | AEP Example | Market Share | Market Growth | Strategic Consideration |

|---|---|---|---|---|

| Dogs | Aging Coal Plants (e.g., Muskingum River) | Low (declining coal usage) | Low (stagnant or declining demand for coal power) | Divest, retire, or invest only for essential compliance. |

| Dogs | Legacy IT Systems (e.g., outdated billing platforms) | Low (internal focus, not market-facing) | Low (obsolete technology) | Modernize or replace to improve efficiency and reduce costs. |

| Dogs | Underperforming Regulated Jurisdictions | Low (limited ability to gain market share due to regulation) | Low (constrained by regulatory approvals and economic conditions) | Focus on regulatory advocacy, cost control, or potential divestment if returns remain persistently low. |

Question Marks

New energy storage solutions represent a significant growth opportunity for AEP, fitting squarely into the 'Question Marks' category of the BCG matrix. AEP is projected to pour substantial capital into these technologies, anticipating 2025 as a pivotal year for their market penetration.

While vital for stabilizing grids with intermittent renewables like solar and wind, the large-scale energy storage market is still in its nascent stages. Profitability and broad adoption remain uncertain, demanding AEP's strategic investment to build a strong market position.

Compliance with increasingly strict environmental regulations, particularly for existing power plants, is a significant driver pushing utilities like AEP to consider investments in carbon capture and storage (CCS) technologies. This is a critical area for decarbonization efforts.

CCS represents a high-cost, emerging technology with considerable uncertainty surrounding its commercial viability and the stability of regulatory frameworks. These factors position it as a 'question mark' within the AEP BCG Matrix, indicating potential but also significant risk.

While essential for long-term decarbonization goals, the market penetration and the return on investment for CCS are still largely unproven. For instance, the U.S. Department of Energy's Carbon Capture program has seen significant investment, with projects aiming for cost reductions, but widespread commercial deployment at scale remains a future prospect.

American Electric Power (AEP) is experiencing a surge in demand, with over 190 gigawatts of new load requests currently in development, far exceeding their existing commitments. This presents a classic question mark scenario in the BCG matrix, as these potential growth areas require significant investment and face considerable uncertainty.

The challenge lies in converting these numerous requests into firm contracts and then constructing the necessary infrastructure to serve these emerging, high-growth markets. Success hinges on navigating complex regulatory approvals, securing adequate financing, and effectively competing with other energy providers.

However, if AEP can successfully capture market share in these new load areas, the potential upside is substantial, offering significant opportunities for future revenue and expansion.

Pilot Programs for Decentralized Energy Resources

AEP's involvement in pilot programs for decentralized energy resources (DERs) positions them within a rapidly expanding market. These initiatives, such as microgrids or advanced solar installations, represent a significant growth opportunity, though AEP's current market share in this nascent sector is likely minimal.

The inherent uncertainty surrounding the long-term success and scalability of these pilot programs necessitates considerable upfront investment. Strategic marketing efforts will be crucial to drive customer adoption and demonstrate the value proposition of these distributed generation solutions.

- Market Growth: The global distributed generation market was valued at approximately $250 billion in 2023 and is projected to grow at a CAGR of over 8% through 2030, indicating a strong growth trajectory.

- Investment Needs: Pilot programs often require substantial capital for technology development, infrastructure integration, and regulatory compliance, potentially running into tens or hundreds of millions of dollars for comprehensive testing.

- Adoption Challenges: Educating consumers and businesses about the benefits of DERs and overcoming existing grid infrastructure limitations are key challenges that require targeted marketing and policy support.

- Strategic Importance: Successfully scaling these pilots could significantly enhance AEP's competitive position in the evolving energy landscape, offering new revenue streams and improved grid resilience.

Strategic Partnerships for Emerging Technologies

American Electric Power (AEP) is actively exploring strategic partnerships within emerging technology sectors, exemplified by its agreement with Bloom Energy. This collaboration aims to acquire up to 1 gigawatt of fuel cells specifically for data center applications, a segment experiencing significant growth.

This move positions AEP to capitalize on the escalating demand for reliable and potentially cleaner energy solutions in the data center industry. While the immediate impact on AEP's established business is still unfolding, these ventures into nascent technologies represent a calculated approach to future market expansion.

The Bloom Energy partnership, for instance, highlights AEP's strategy of engaging with high-growth potential areas. Although AEP's direct market share in the fuel cell sector is currently minimal, these collaborations are designed to foster innovation and establish a foothold in what is anticipated to be a substantial future market.

- Partnership Focus: AEP's agreement with Bloom Energy for 1 GW of fuel cells for data centers.

- Growth Opportunity: Addresses high-growth demand in the data center energy sector.

- Market Share: Represents high-growth potential with currently low direct market share for AEP in this specific technology.

- Strategic Intent: Positions AEP to develop its role in emerging energy solutions for critical infrastructure.

AEP's exploration into new energy storage solutions, carbon capture technologies, and pilot programs for decentralized energy resources (DERs) all fit the 'Question Marks' category of the BCG matrix. These areas offer significant future growth potential but also carry substantial investment risk and market uncertainty.

The company's strategic partnerships, like the one with Bloom Energy for fuel cells in data centers, also represent 'Question Marks'. These ventures are designed to tap into high-growth sectors where AEP currently has a minimal market share, requiring considerable investment to establish a strong position.

AEP's substantial influx of new load requests, exceeding 190 GW, further exemplifies a 'Question Mark' scenario. Successfully converting these opportunities into revenue streams hinges on navigating regulatory hurdles and infrastructure development, presenting both high reward and significant risk.

These 'Question Marks' demand careful strategic allocation of capital, as success could lead to substantial future market leadership, while failure could result in significant financial losses.

BCG Matrix Data Sources

Our BCG Matrix leverages proprietary market data, including sales figures, customer acquisition costs, and competitive landscape analysis, to provide a comprehensive view of product performance.