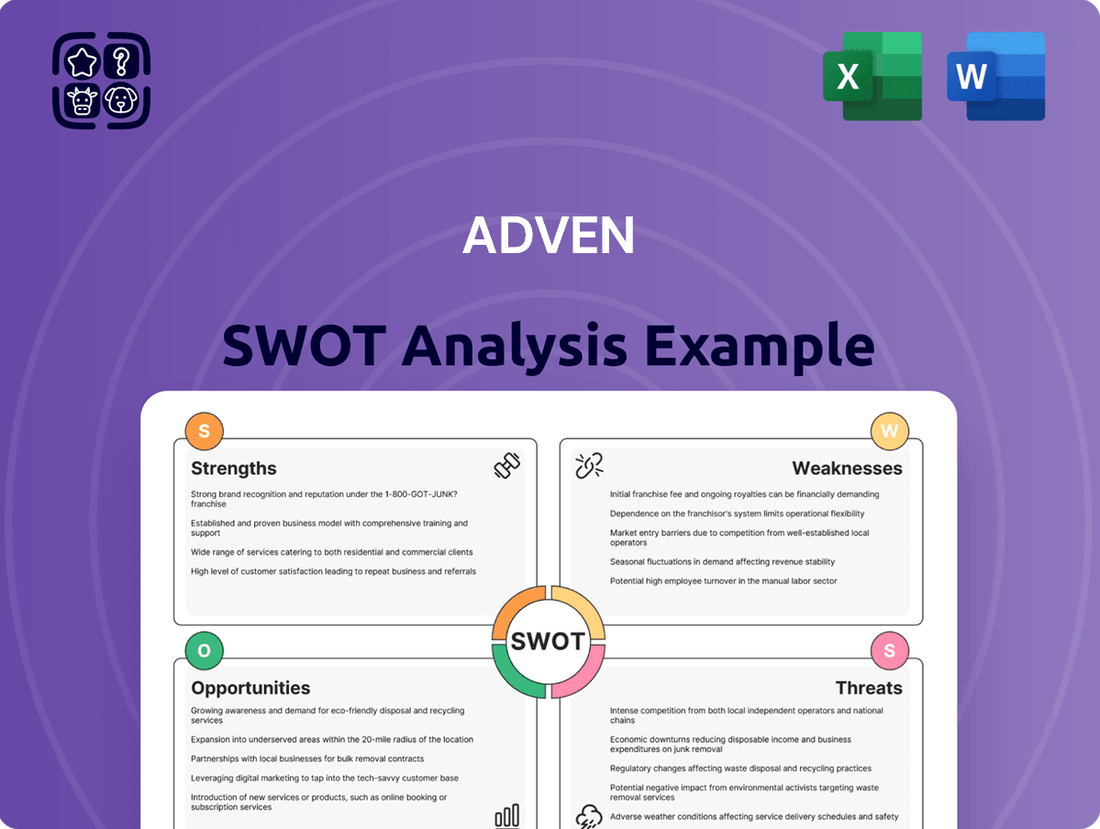

Adven SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adven Bundle

Adven's core strengths lie in its innovative technology and strong market presence, but understanding its potential weaknesses and the competitive landscape is crucial for future success. Our comprehensive SWOT analysis delves deep into these areas, providing you with the strategic clarity needed to navigate the market effectively.

Want to uncover the full picture of Adven's competitive edge, potential threats, and untapped opportunities? Purchase the complete SWOT analysis to gain access to actionable insights, detailed market context, and expert recommendations, empowering your strategic decisions.

Strengths

Adven's core 'Energy as a Service' (EaaS) model is a major strength, allowing clients to utilize advanced energy solutions without the burden of large initial capital outlays. This approach transfers the financial and operational complexities to Adven, making sophisticated energy infrastructure accessible and manageable for businesses.

This EaaS model directly addresses the growing market demand for efficient and sustainable energy solutions. By offering stability and environmental benefits, it enables clients to concentrate on their primary business operations, thereby enhancing their overall competitiveness and long-term value proposition.

Adven's unwavering focus on sustainability and renewable energy is a significant strength. The company has ambitious targets to cut carbon intensity in its sold energy by half and operate on 95% renewable and recycled energy sources by 2030.

This commitment is validated by their impressive EcoVadis silver medal in 2024, positioning them in the top 6% of global companies assessed for sustainability. This strong environmental performance resonates with increasing consumer and governmental pressure for cleaner energy solutions, bolstering Adven's brand image and market attractiveness.

Adven boasts over 50 years of experience in the energy sector, a testament to its deep-rooted expertise and resilience. This extensive history translates into a proven ability to navigate complex energy challenges and deliver reliable solutions.

The company's operational footprint is substantial, encompassing more than 350 sites throughout Europe. This includes over 100 district heating networks strategically located in the Nordic and Baltic regions, showcasing Adven's significant geographical reach and established infrastructure.

This long-standing presence and expansive operational scale are critical strengths, providing clients with confidence in Adven's capacity to design, build, own, and operate energy infrastructure effectively. It underscores their reliability and commitment to the energy market.

Tailor-Made and Comprehensive Energy Solutions

Adven excels at crafting bespoke energy solutions, covering heating, cooling, steam, and other essential utilities. This flexibility allows them to serve a broad client base, from industrial facilities and real estate developers to entire municipalities.

Their commitment to resource efficiency is a key strength. By focusing on recovering and reusing excess heat, and developing strategies to move away from fossil fuels, Adven not only aids clients in meeting sustainability targets but also delivers tangible financial benefits. For instance, in 2023, Adven completed over 200 projects focused on energy efficiency and renewable energy integration across Europe, demonstrating their capacity to deliver customized, impactful solutions.

- Customized Solutions: Adven designs unique energy systems tailored to specific client needs in industry, real estate, and municipalities.

- Efficiency Focus: They prioritize improving energy, water, and resource efficiency through innovative methods like heat recovery.

- Sustainability Drive: Adven actively develops solutions to phase out fossil fuels, aligning with global environmental goals.

- Dual Benefit: Their approach helps clients achieve both environmental sustainability and cost savings.

Strategic Partnerships and Acquisitions

Adven's strategic approach to growth is significantly bolstered by its active pursuit of partnerships and a proven track record of successful acquisitions. These initiatives not only solidify its standing in the market but also broaden the scope of its services and geographical reach.

Recent developments highlight this strategy, such as the expansion of key partnerships with companies like IFF, a global leader in ingredients and flavors. Furthermore, Adven's acquisition of district heating operations in various regions, including the significant acquisition of Vantaa Energy's district heating business in late 2023, demonstrates a commitment to expanding its network and enhancing its capabilities in critical markets.

- Strategic Partnerships: Collaborations with industry leaders like IFF enhance Adven's innovation and market penetration.

- Acquisition Growth: The purchase of district heating operations, such as Vantaa Energy's business, directly expands Adven's infrastructure and customer base.

- Market Consolidation: These moves position Adven to capitalize on market trends and consolidate its presence in key European energy sectors.

Adven's core strength lies in its innovative Energy as a Service (EaaS) model, which removes upfront capital burdens for clients, making advanced energy solutions accessible. This model directly addresses the increasing market demand for sustainable and efficient energy, allowing clients to focus on their core businesses while Adven manages energy complexities.

The company's deep commitment to sustainability is evidenced by its 2030 targets: halving carbon intensity in sold energy and operating on 95% renewable and recycled energy sources. This dedication was recognized with an EcoVadis silver medal in 2024, placing Adven in the top 6% of assessed global companies for sustainability performance.

With over 50 years of experience, Adven possesses extensive expertise in navigating the energy sector, ensuring reliable solutions for its clients. Its significant operational footprint across more than 350 European sites, including over 100 district heating networks in the Nordic and Baltic regions, underscores its established infrastructure and reach.

Adven excels in creating tailored energy solutions for diverse clients, from industrial users to municipalities, focusing on resource efficiency and the transition away from fossil fuels. In 2023 alone, Adven completed over 200 projects focused on energy efficiency and renewable integration across Europe, highlighting their capacity for impactful, customized delivery.

Strategic growth is a key strength, driven by successful acquisitions and key partnerships, such as the expansion with IFF and the late 2023 acquisition of Vantaa Energy's district heating business. These moves enhance Adven's network, capabilities, and market consolidation efforts.

| Metric | Value | Year |

|---|---|---|

| Operational Sites | > 350 | 2024 |

| District Heating Networks | > 100 | 2024 |

| Energy Efficiency Projects | > 200 | 2023 |

| EcoVadis Rating | Silver Medal | 2024 |

| Renewable Energy Target | 95% | 2030 |

What is included in the product

Analyzes Adven’s competitive position through key internal and external factors.

Offers a clear, actionable framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

Adven's capacity to independently finance significant initiatives, such as the ESAC pilot study, has been hampered, evidenced by the withdrawal of funding from Emissions Reduction Alberta (ERA) in 2024. This situation highlights a potential dependency on external financial support or the necessity for more structured internal capital deployment for substantial development undertakings.

Designing, constructing, and operating energy infrastructure, especially for new renewable projects, demands substantial upfront capital. For Adven, while their Energy-as-a-Service (EaaS) model transfers this burden to clients, the company itself must finance these large investments. This can strain financial liquidity and necessitate ongoing external funding, impacting their ability to pursue multiple projects simultaneously.

Despite Adven's commitment to sustainable energy, its financial performance remains susceptible to fluctuations in the broader energy market. For instance, while wholesale electricity prices in the Nordics, a key market for Adven, have seen some stabilization in early 2024 compared to the extreme highs of 2022, they still exhibit volatility. This means that unexpected spikes in fuel or power costs can directly impact Adven's operational expenses and, consequently, its profitability.

The underlying factors contributing to energy market instability, such as ongoing geopolitical tensions, have not been entirely resolved. This creates a persistent risk of elevated fuel prices, which can squeeze Adven's margins. For example, if natural gas prices, a significant input for some of their operations, were to surge again due to unforeseen global events, Adven would face increased costs that might not be immediately passed on to customers, affecting their bottom line.

Complexity of Managing Diverse Client Segments

Adven's strength in serving diverse client segments, from industries to municipalities and real estate, also presents a significant weakness. Each of these sectors has distinct energy needs, operational requirements, and regulatory landscapes. For instance, a municipal district heating project operates under different compliance frameworks than a large industrial energy user. This broad client base necessitates specialized knowledge and adaptable service models, potentially increasing operational overhead and slowing down the implementation of standardized solutions. In 2024, managing such varied portfolios required Adven to maintain distinct teams and service protocols for each segment, impacting overall efficiency.

The complexity of managing these diverse client segments can lead to a less streamlined operational structure. Tailoring energy solutions for each unique demand profile, whether it's for a manufacturing plant requiring consistent high-volume power or a residential district heating system needing seasonal adjustments, demands significant resources and expertise. This can result in higher administrative costs and a potential dilution of focus compared to companies specializing in a narrower market niche. For example, Adven's 2024 reports indicated that while revenue grew across all segments, the cost of service delivery varied significantly, with municipal projects often requiring longer lead times and more complex regulatory navigation.

- Diverse Client Needs: Adven caters to industries, real estate, and municipalities, each with unique energy demands and regulatory environments.

- Operational Complexity: Managing tailored solutions across these segments introduces operational complexities and requires specialized expertise.

- Streamlining Challenges: The need for diverse approaches can lead to less streamlined processes compared to a more focused business model.

- Resource Allocation: Effectively allocating resources and expertise across varied client needs can strain operational capacity.

Integration Challenges from Acquisitions

Adven’s growth strategy, which heavily relies on acquisitions, presents significant integration challenges. Successfully merging new companies’ operations, technologies, and distinct corporate cultures demands substantial management focus and resources. For instance, the integration of the acquired Finnish district heating company Vantaan Energia's district heating network in late 2023, while strategically sound, required careful alignment of IT systems and operational protocols to ensure efficiency and avoid service disruptions.

These integration hurdles can impact the realization of projected synergies and potentially lead to temporary operational inefficiencies. Adven's ability to overcome these challenges is crucial for leveraging its expanded portfolio and maintaining smooth business continuity across its diverse European operations.

- Operational Synergies: Difficulty in achieving expected cost savings and operational efficiencies post-acquisition.

- Cultural Clashes: Mismatches in corporate culture between Adven and acquired entities can hinder collaboration and employee retention.

- Technology Integration: Challenges in harmonizing disparate IT systems and operational technologies can lead to data inconsistencies and system downtime.

- Management Bandwidth: The extensive management effort required for integration can divert attention from core business operations and strategic development.

Adven's reliance on external financing, as seen with the ERA's funding withdrawal for the ESAC pilot study in 2024, underscores a potential vulnerability in its capital acquisition strategy. This dependency necessitates robust internal financial planning and a diversified approach to securing capital for large-scale projects.

The significant upfront capital required for renewable energy infrastructure development, even with an EaaS model, poses a challenge to Adven's liquidity. This can limit its capacity to pursue multiple projects concurrently and may require continuous external funding to maintain growth momentum.

Market volatility in the Nordics, a key region for Adven, continues to pose a risk. While wholesale electricity prices showed some stabilization in early 2024 compared to 2022 peaks, ongoing geopolitical factors contribute to persistent energy price uncertainty, impacting Adven's operational costs and profitability.

Adven's broad client base, spanning industries, real estate, and municipalities, creates inherent operational complexity. Catering to distinct energy needs, regulatory frameworks, and operational requirements for each segment demands specialized expertise and adaptable service models, potentially increasing overhead and slowing standardization efforts. Reports from 2024 indicated varying service delivery costs across these segments, with municipal projects often requiring more complex navigation.

The company's growth-by-acquisition strategy, exemplified by the integration of Vantaan Energia's district heating network in late 2023, presents significant integration challenges. Successfully merging operations, technologies, and corporate cultures is crucial for realizing projected synergies and avoiding operational inefficiencies.

| Weakness Category | Description | Impact | Example/Evidence |

|---|---|---|---|

| Financial Dependency | Reliance on external funding for large initiatives. | Limits project execution capacity and financial flexibility. | ERA funding withdrawal for ESAC pilot study (2024). |

| Capital Intensity | High upfront capital needs for infrastructure projects. | Strains liquidity and ability to pursue multiple projects. | Financing large-scale renewable energy infrastructure. |

| Market Volatility | Susceptibility to energy market price fluctuations. | Impacts operational costs and profitability. | Nordic wholesale electricity price volatility (2024). |

| Operational Complexity | Managing diverse client segments with unique needs. | Increases overhead, slows standardization, strains resources. | Varied service delivery costs across industrial, real estate, and municipal clients (2024). |

| Acquisition Integration | Challenges in merging acquired companies. | Hinders synergy realization, risks operational inefficiencies. | Integration of Vantaan Energia's district heating network (late 2023). |

Same Document Delivered

Adven SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

Opportunities

The global shift towards decarbonization is a major tailwind, with renewable energy adoption accelerating. For instance, the International Energy Agency reported in early 2024 that renewable energy capacity additions reached a record high in 2023, surpassing 500 GW globally. This growing demand for sustainable energy solutions directly benefits Adven, whose core business revolves around producing and distributing clean energy.

Consumers and businesses alike are increasingly prioritizing resource efficiency and demanding lower environmental impact from their energy providers. This societal pressure is compelling companies to enhance their sustainability credentials, creating a fertile ground for Adven's expertise in renewable energy infrastructure and services. Adven's business model is inherently aligned with these evolving market expectations.

The Energy as a Service (EaaS) market is experiencing robust expansion, projected to grow from $51.88 billion in 2024 to $100.34 billion by 2030. This surge is fueled by increasing energy expenses, a strong demand for operational efficiency, and a global push towards decarbonization.

This significant market growth presents a prime opportunity for Adven to leverage its established EaaS business model and achieve substantial scaling. The increasing adoption of EaaS solutions by businesses seeking cost savings and sustainability aligns perfectly with Adven's service offerings.

Adven can leverage ongoing technological advancements like smart grids, the Internet of Things (IoT), and artificial intelligence (AI) to significantly boost its service capabilities. These innovations allow for real-time monitoring of energy consumption and production, leading to more efficient resource allocation.

Integrating AI and predictive analytics presents a prime opportunity for Adven to anticipate demand fluctuations and optimize energy distribution, thereby reducing waste and costs. For instance, AI-powered systems can predict equipment failures in Adven's infrastructure, enabling proactive maintenance and preventing costly downtime, a critical factor in the energy sector's operational efficiency.

Hardware innovation, such as advancements in battery storage and renewable energy capture technologies, also opens new avenues for Adven. By adopting these cutting-edge solutions, Adven can expand its portfolio of sustainable energy services and enhance the reliability of its energy supply chains, a key differentiator in the evolving energy market.

Leveraging Waste Heat and Industrial Symbiosis

Adven can capitalize on the significant opportunity presented by industrial waste heat. Many industrial processes generate substantial amounts of heat that are typically released into the atmosphere. Adven's expertise in capturing and repurposing this excess heat offers a dual benefit: reducing operational costs for industrial clients and contributing to a more sustainable energy landscape. This creates a strong value proposition for attracting new business partners.

Fostering industrial symbiosis, where the waste product of one industry becomes a valuable input for another, is a key growth avenue. This collaborative approach not only enhances resource efficiency but also builds resilient and interconnected industrial ecosystems. For instance, a power plant's waste heat could be used to warm greenhouses or district heating networks, demonstrating tangible economic and environmental advantages.

- Waste Heat Recovery Potential: Globally, industrial waste heat accounts for a significant portion of energy loss, with estimates suggesting that up to 70% of industrial process heat is released into the environment.

- Circular Economy Growth: The circular economy market is projected to grow substantially, with initiatives focused on resource efficiency and waste reduction expected to drive demand for solutions like industrial symbiosis.

- Cost Savings for Clients: By utilizing waste heat, industrial clients can see considerable reductions in their energy bills, potentially saving millions annually depending on the scale of operations.

- Environmental Impact: Repurposing waste heat directly reduces the need for primary energy sources, leading to lower greenhouse gas emissions and a smaller carbon footprint for participating industries.

Geographical Expansion and New Market Penetration

Adven's solid foothold in the Nordic and Baltic regions offers a robust platform for venturing into new territories. This established presence allows for leveraging existing operational efficiencies and brand recognition to accelerate market entry.

The company's recent expansion into Norway's real estate sector exemplifies a strategic push into new geographical markets and client bases. This move is designed to capitalize on Adven's proven business model and collaborative approach to secure additional market share.

Opportunities for geographical expansion are significant, particularly in areas with increasing demand for energy infrastructure and sustainable solutions. For instance, by the end of 2024, Adven aims to expand its operations in Poland, a market showing strong growth in industrial energy needs.

- Nordic & Baltic Foundation: Adven has a strong presence in Denmark, Estonia, Finland, Latvia, Lithuania, and Sweden, providing a stable base for further growth.

- Norwegian Entry: The 2023 acquisition of Vardar's energy operations in Norway marked a significant step into a new, high-potential market.

- Eastern European Focus: Poland represents a key target for expansion, with ongoing projects and a clear strategy to increase market penetration in the coming years.

- Strategic Partnerships: Adven's success in new markets is often driven by forming strategic partnerships, mirroring its approach in established regions.

The increasing global focus on decarbonization and sustainability presents a significant opportunity for Adven. As renewable energy adoption accelerates, driven by governmental policies and consumer demand, Adven is well-positioned to capitalize on this trend. The International Energy Agency reported in early 2024 that renewable energy capacity additions reached a record high in 2023, surpassing 500 GW globally, underscoring the market's expansion.

The Energy as a Service (EaaS) market is experiencing robust growth, projected to expand from $51.88 billion in 2024 to $100.34 billion by 2030, fueled by rising energy costs and efficiency demands. Adven's established EaaS business model aligns perfectly with this market expansion, offering significant scaling potential.

Adven can leverage technological advancements like AI and IoT to enhance its service capabilities, enabling more efficient resource management and predictive maintenance. Furthermore, innovations in battery storage and renewable energy capture technologies can broaden Adven's service portfolio and improve energy supply reliability.

The company can also exploit the substantial potential of industrial waste heat recovery, a sector where significant energy is lost annually. By repurposing this heat, Adven can offer cost savings to industrial clients and contribute to a more sustainable energy landscape, fostering industrial symbiosis and circular economy principles.

| Opportunity Area | Description | Key Data Point/Projection |

|---|---|---|

| Decarbonization & Renewables | Growing demand for clean energy solutions. | Global renewable capacity additions exceeded 500 GW in 2023. |

| Energy as a Service (EaaS) | Expansion of the EaaS market. | Projected to reach $100.34 billion by 2030 (from $51.88 billion in 2024). |

| Technological Integration | Leveraging AI, IoT, and advanced hardware. | AI can optimize energy distribution and predict equipment failures. |

| Waste Heat Recovery | Repurposing industrial waste heat. | Up to 70% of industrial process heat is released into the environment; potential for significant cost savings for clients. |

| Geographical Expansion | Entering new markets like Poland. | Adven aims to expand operations in Poland by the end of 2024. |

Threats

Adven operates in a fiercely competitive energy landscape, facing pressure from both established global energy providers and emerging local players in district heating, cooling, and broader energy services. This intense rivalry can significantly impact pricing strategies and the company's ability to win new contracts, necessitating a constant focus on innovation and cost efficiency to maintain market position.

Adven faces potential headwinds from evolving energy regulations and environmental policies. For instance, a shift in government incentives for renewable energy, which have historically bolstered Adven's growth, could impact project economics and investment decisions. The company's reliance on favorable policy frameworks means that unexpected changes, such as stricter emissions standards or altered subsidy structures, could present significant operational and financial challenges.

Adven's reliance on biomass and other renewable fuels, while strategic, still exposes them to price volatility. For instance, the global price of wood pellets, a key biomass component, saw significant fluctuations in 2024 due to supply chain disruptions and increased demand, impacting operational costs for energy providers.

Even with a focus on renewables, Adven may need to utilize backup fossil fuels, making them susceptible to the unpredictable swings in oil and natural gas markets. The average price of Brent crude oil, a benchmark for global oil prices, experienced considerable volatility throughout 2024, directly affecting the cost of non-renewable energy sources.

These unpredictable market conditions for raw materials can directly increase Adven's operational expenses, potentially eroding their competitive edge in offering cost-effective energy solutions to their clients.

Technological Disruption and Rapid Innovation

The energy sector is experiencing a whirlwind of technological change, with advancements in areas like advanced battery storage and green hydrogen production constantly emerging. For Adven, while innovation is a core strength, a significant threat lies in a competitor launching a truly disruptive technology, potentially making Adven's current infrastructure or energy solutions less appealing and necessitating costly upgrades. For instance, the global energy storage market is projected to reach USD 175.8 billion by 2030, a testament to the rapid pace of innovation in this space.

This rapid innovation cycle poses a challenge as Adven must continuously invest in research and development to stay ahead. A failure to adapt quickly to new energy generation methods, such as next-generation solar photovoltaics or advanced geothermal systems, could lead to a loss of market share. The International Energy Agency (IEA) reported in 2024 that renewable energy capacity additions are expected to grow by nearly 50% between 2023 and 2028, highlighting the speed of this transition.

Key areas of technological disruption impacting Adven include:

- Advancements in energy storage: Breakthroughs in battery chemistry and density could significantly alter the economics of grid-scale storage.

- Decentralized energy generation: Increased adoption of distributed energy resources (DERs) like rooftop solar and microgrids could challenge traditional centralized utility models.

- Digitalization and AI: Sophisticated grid management software and AI-powered energy optimization tools could offer significant efficiency gains for competitors.

- Emerging fuel sources: Rapid development in areas like sustainable aviation fuels or advanced biofuels might shift demand away from existing energy carriers.

Economic Downturns and Reduced Industrial Activity

Economic downturns pose a significant threat to Adven. Recessions often trigger a slowdown in industrial activity, directly impacting energy consumption by businesses. For instance, a prolonged economic contraction could see a notable decrease in demand for Adven's energy services from commercial and industrial clients.

Furthermore, constrained municipal budgets during economic slumps can limit public sector investment in energy infrastructure or upgrades, which are key revenue streams for Adven. This reduction in spending can dampen growth prospects and revenue generation, especially if Adven has a substantial exposure to public sector contracts.

The energy sector is particularly sensitive to economic cycles. Major economies experienced slowdowns in 2023, with projections for 2024 indicating continued global economic uncertainty. This environment directly translates to lower energy demand, affecting companies like Adven that supply energy solutions.

- Reduced Industrial Demand: A decline in manufacturing output and overall business activity directly lowers the need for Adven's energy services.

- Municipal Budget Constraints: Slower economic growth can lead to tighter public finances, potentially reducing Adven's opportunities in the municipal sector.

- Lower Energy Consumption: Economic recessions typically correlate with decreased energy usage across commercial and industrial sectors.

Adven operates in a highly competitive market, facing pressure from both established global energy providers and emerging local players in district heating, cooling, and broader energy services. This intense rivalry can significantly impact pricing strategies and the company's ability to win new contracts, necessitating a constant focus on innovation and cost efficiency to maintain market position.

Evolving energy regulations and environmental policies pose a significant threat, as shifts in government incentives for renewables could impact project economics. For instance, unexpected changes like stricter emissions standards or altered subsidy structures could present substantial operational and financial challenges.

Adven's reliance on biomass and other renewable fuels exposes them to price volatility. The global price of wood pellets, a key biomass component, saw significant fluctuations in 2024 due to supply chain disruptions and increased demand, impacting operational costs for energy providers.

Technological disruption is another major threat. For example, advancements in areas like advanced battery storage and green hydrogen production could make Adven's current infrastructure less appealing, necessitating costly upgrades. The global energy storage market is projected to reach USD 175.8 billion by 2030, highlighting the rapid pace of innovation.

| Threat Category | Specific Example | Impact on Adven | 2024/2025 Data Point |

| Competition | New entrants in district heating | Price pressure, reduced market share | Global district heating market expected to grow at a CAGR of 5.2% from 2024-2029. |

| Regulatory Changes | Revised renewable energy subsidies | Reduced project profitability, investment uncertainty | EU's Renewable Energy Directive targets are under continuous review. |

| Input Cost Volatility | Biomass fuel price fluctuations | Increased operational expenses, reduced margins | Wood pellet prices in Europe averaged €150-€200 per tonne in early 2024. |

| Technological Obsolescence | Emergence of advanced energy storage | Need for infrastructure upgrades, potential loss of competitive edge | Lithium-ion battery costs decreased by 10-15% in 2024. |

SWOT Analysis Data Sources

This Adven SWOT analysis is built upon a robust foundation of data, drawing from official company financial reports, comprehensive market research studies, and expert industry analysis to provide a thorough and reliable strategic overview.