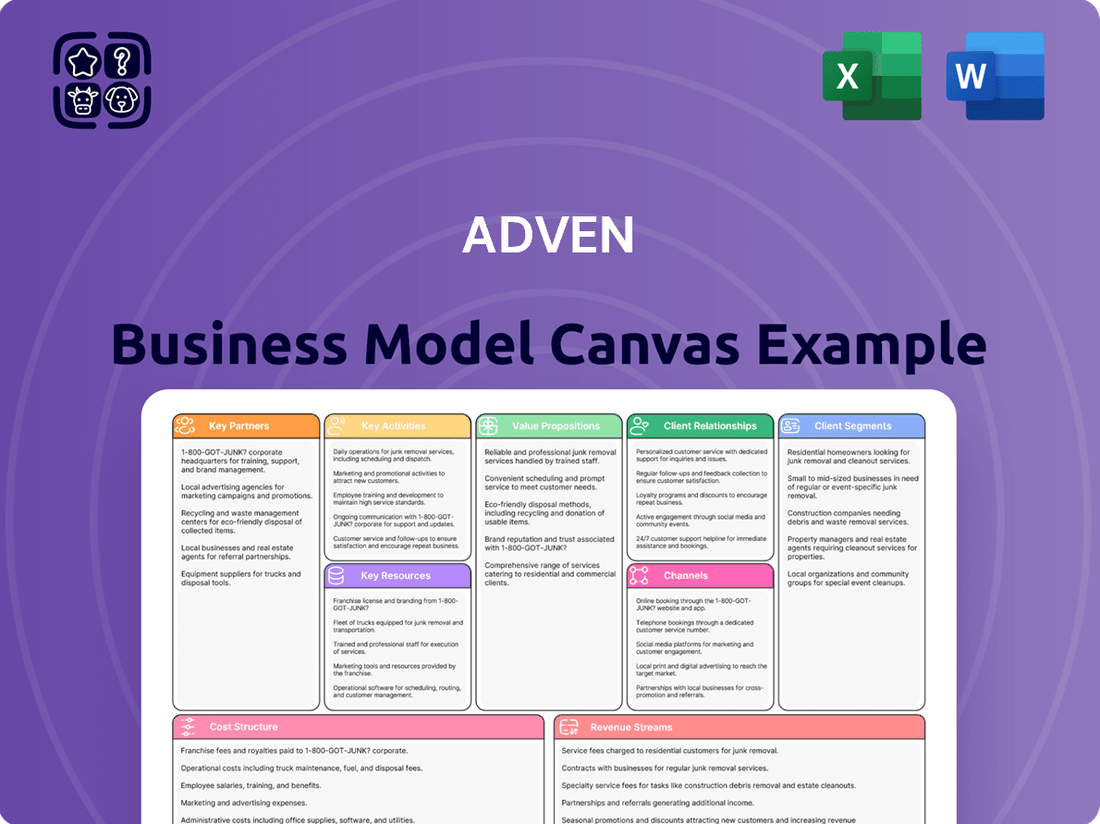

Adven Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adven Bundle

Curious about Adven's innovative approach? Our full Business Model Canvas unpacks their core strategies, from customer relationships to revenue streams, offering a clear blueprint for their success. This comprehensive tool is perfect for anyone looking to understand and replicate effective business tactics.

Partnerships

Adven actively partners with top-tier technology and equipment suppliers to integrate advanced solutions into its energy infrastructure. These collaborations provide access to innovations like high-efficiency biomass boilers and sophisticated heat pump systems, crucial for optimizing energy production. For instance, in 2023, Adven continued to expand its use of modern heat pump technology, which can achieve coefficients of performance exceeding 4, significantly reducing the primary energy needed for heating.

Strategic alliances with construction and engineering firms are fundamental for Adven's success in designing, building, and commissioning energy plants and networks. These partnerships bring specialized expertise crucial for large-scale infrastructure projects, ensuring both quality and timely delivery of new facilities or upgrades to existing ones.

For instance, in 2024, Adven secured a significant partnership with a leading European engineering firm for the development of a new offshore wind farm project, valued at an estimated €1.5 billion. This collaboration leverages the firm's proven track record in complex marine construction and offshore installation.

These collaborations are not just about execution; they are about enabling Adven to scale its operations efficiently. By integrating the capabilities of experienced construction and engineering partners, Adven can undertake and deliver more ambitious and complex projects, thereby expanding its market presence and operational capacity.

Adven's success hinges on strong partnerships with suppliers of sustainable fuels like biomass and industrial residues. These collaborations are critical for securing a reliable and cost-effective flow of raw materials, which directly supports Adven's commitment to renewable and recycled energy solutions.

By fostering these key relationships, Adven ensures it has the necessary inputs to meet its ambitious goal of operating on 95% renewable and recycled energy by 2030. For instance, in 2024, Adven continued to expand its use of bioenergy, with a significant portion of its heat production sourced from sustainable forestry by-products, demonstrating the practical impact of these supplier partnerships.

Financial Institutions and Investors

Adven's ability to fund its ambitious expansion and infrastructure projects hinges on strong alliances with financial institutions and investors. These collaborations are vital for accessing the substantial capital needed for project financing and acquiring new assets.

These partnerships allow Adven to invest in critical new energy infrastructure and broaden its innovative 'energy as a service' model. A prime example of this is Adven Group Oy's successful securing of a multi-currency infrastructure debt financing package amounting to approximately EUR 675 million in January 2025. This significant funding round was strategically used to refinance existing debt obligations and provide the necessary capital to fuel Adven's ongoing growth initiatives.

- Banks: Provide essential debt financing for infrastructure projects and working capital.

- Private Equity Firms: Offer equity investment for growth capital and strategic expansion.

- Infrastructure Funds: Specialize in long-term investments in energy assets and infrastructure development.

- Institutional Investors: Such as pension funds and insurance companies, provide stable, long-term capital.

Research and Development Institutions

Adven actively collaborates with research and development institutions and academic bodies to remain at the cutting edge of energy innovation. These partnerships are crucial for exploring novel sustainable technologies and refining current operational processes, ensuring continuous improvement in Adven's offerings.

Through these collaborations, Adven aims to accelerate the development of advanced energy solutions, directly supporting its overarching mission to drive the energy transition. For instance, in 2024, Adven announced a significant research initiative with a leading European university focused on developing next-generation geothermal energy extraction techniques, aiming to increase efficiency by an estimated 15% by 2026.

- Fostering Innovation: Partnerships with R&D institutions enable Adven to explore emerging sustainable energy technologies, such as advanced biomass conversion and novel carbon capture methods.

- Process Optimization: Academic collaborations help refine existing energy production and distribution processes, leading to increased efficiency and reduced environmental impact.

- Driving the Energy Transition: By staying at the forefront of technological advancements, Adven strengthens its position as a key player in accelerating the shift towards a sustainable energy future.

- Knowledge Exchange: These relationships facilitate the exchange of expertise and research findings, benefiting both Adven and the academic community.

Adven's strategic partnerships with financial institutions are critical for funding its extensive infrastructure development and growth initiatives. These alliances provide the necessary capital for project financing and asset acquisition, enabling Adven to execute its ambitious expansion plans and deliver its energy-as-a-service model.

In January 2025, Adven Group Oy successfully secured a multi-currency infrastructure debt financing package of approximately EUR 675 million. This significant funding was allocated to refinance existing debt and support ongoing growth, highlighting the vital role of these financial collaborations.

Adven also actively engages with research and development bodies, fostering innovation in sustainable energy. For example, a 2024 initiative with a European university aims to boost geothermal energy extraction efficiency by 15% by 2026, underscoring the value of academic partnerships in advancing energy technologies.

| Partner Type | Role | Example/Impact |

|---|---|---|

| Technology Suppliers | Access to advanced energy solutions | Integration of high-efficiency heat pumps (COP > 4) in 2023 |

| Construction & Engineering Firms | Design, build, and commission energy infrastructure | Partnership for a €1.5 billion offshore wind farm project in 2024 |

| Sustainable Fuel Suppliers | Secure reliable raw material flow | Increased use of sustainable forestry by-products for heat production in 2024 |

| Financial Institutions | Provide capital for expansion and projects | EUR 675 million debt financing secured in January 2025 |

| R&D Institutions & Academia | Drive innovation and process optimization | Geothermal energy research aiming for 15% efficiency increase by 2026 |

What is included in the product

A meticulously crafted business model that details customer segments, value propositions, and revenue streams, designed for strategic planning and investor presentations.

Streamlines complex business strategy into a single, actionable page.

Provides a clear, visual framework to identify and address strategic weaknesses.

Activities

Adven’s core activities include the meticulous design and engineering of energy plants and distribution systems. This foundational step involves a deep dive into customer needs, considering both present demands and future growth projections. For instance, in 2024, Adven continued to focus on optimizing designs for renewable energy integration, aiming for a 15% increase in efficiency for new district heating network projects.

The engineering process is crucial for tailoring solutions that ensure maximum operational efficiency, environmental sustainability, and unwavering reliability. This holistic approach allows Adven to create energy systems that are not only cost-effective but also aligned with evolving environmental regulations and client sustainability goals.

Adven manages the complete construction of new energy facilities and infrastructure, a crucial step in realizing their innovative designs. This involves meticulous oversight of project schedules, financial resources, and quality standards to ensure cost-effective and timely project completion.

In 2024, the global renewable energy sector saw significant investment, with projects like the Dogger Bank offshore wind farm in the UK, a massive undertaking, highlighting the scale of infrastructure management required. Adven's expertise in this area is vital for translating energy solutions from concept to operational reality, navigating complex logistical and technical challenges.

Adven's core activity revolves around the continuous operation and maintenance of its energy assets, such as power plants and distribution networks. This ensures a consistent and dependable energy supply for their clients. In 2024, Adven continued to emphasize this by having experienced O&M personnel manage sites locally.

To further guarantee reliability, Adven employs 24/7 remote monitoring systems for all its energy infrastructure. This proactive approach allows for immediate identification and resolution of potential issues, thereby optimizing performance and extending the lifespan of the energy assets.

Energy Production and Distribution

Adven's core activities revolve around the generation and efficient delivery of heating, cooling, steam, and electricity. This encompasses the entire process from energy creation to its final distribution to a diverse customer base including industrial facilities, real estate developments, and municipal entities. The company prioritizes the use of renewable and recycled energy sources, underscoring its commitment to sustainable utility provision.

This direct delivery of energy represents the tangible realization of Adven's 'energy as a service' model. For example, in 2024, Adven continued to expand its network of renewable energy solutions. A significant portion of their energy production in 2023 was derived from biomass and waste heat, contributing to their goal of a low-carbon energy supply.

- Energy Generation: Producing heat, cooling, steam, and electricity.

- Distribution Network: Efficiently delivering these utilities to customers.

- Renewable Focus: Utilizing biomass, waste heat, and other sustainable sources.

- Customer Segments: Serving industrial, real estate, and municipal clients.

Customer Relationship Management and Sales

Adven's core activities revolve around cultivating and sustaining robust, enduring customer relationships. This encompasses everything from the initial engagement and solution design to providing continuous support and driving improvements. The focus is on understanding and meeting customer needs effectively, ensuring high levels of satisfaction throughout the partnership.

Key to this is Adven's commitment to building long-term partnerships. They strive to create relationships that are flexible and can evolve alongside both customer requirements and shifting market dynamics. This proactive approach ensures continued relevance and value delivery.

- Customer Needs Identification: Proactively understanding client challenges and objectives.

- Tailored Solution Development: Crafting bespoke offerings that directly address identified needs.

- Ongoing Service and Support: Providing consistent, high-quality assistance post-sale.

- Relationship Evolution: Adapting strategies to maintain relevance and deepen partnerships over time.

Adven's key activities center on the design and construction of energy plants, ensuring efficient operation and maintenance. They also focus on the direct generation and distribution of heating, cooling, steam, and electricity, primarily using renewable and recycled sources. Cultivating strong, long-term customer relationships through tailored solutions and continuous support is also a vital part of their operations.

Full Version Awaits

Business Model Canvas

The Adven Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and design are identical to the final deliverable, ensuring no surprises and immediate usability. You can confidently assess its quality and relevance, knowing that completing your purchase grants you full access to this exact, ready-to-edit file.

Resources

Adven’s physical energy assets are the bedrock of its business, encompassing a wide array of production plants, extensive heating and cooling networks, and all the necessary infrastructure. These are not just pieces of equipment; they are the tangible means through which Adven delivers its energy-as-a-service offering to customers across Europe.

These crucial physical assets are the core of Adven's operations, enabling the company to provide reliable and sustainable energy solutions. As of recent data, Adven manages a significant portfolio, operating over 350 sites throughout Europe. This extensive network handles a total energy volume of approximately 5 TWh annually, underscoring the scale and importance of these physical energy assets in their business model.

Adven's intellectual property, including patented designs and deep operational expertise in sustainable energy, forms a crucial resource. This accumulated knowledge in areas like geoenergy and waste heat recovery gives them a significant edge in creating and fine-tuning energy systems.

Adven's skilled human capital is a foundational element of its business model, comprising over 600 employees dedicated to delivering energy solutions. This workforce includes essential roles like engineers, project managers, and operations and maintenance personnel, whose collective expertise is vital for the entire lifecycle of energy projects, from initial design and construction to ongoing operation and enhancement.

The technical proficiency of these professionals underpins Adven's ability to innovate and execute complex energy infrastructure projects. Furthermore, the sales team's acumen is crucial for market penetration and customer acquisition, directly contributing to revenue generation and business growth. This human capital is not just a resource but a key driver of Adven's competitive advantage.

Financial Capital

Adven's business model hinges on substantial financial capital to fuel its ambitious growth. This capital is crucial for significant investments in new infrastructure, strategic acquisitions, and the day-to-day operational expenses that keep its energy solutions running smoothly.

The ability to secure and deploy this financial backing allows Adven to undertake large-scale projects, such as developing new district heating networks or investing in renewable energy sources, and to continually expand its diverse service offerings to meet evolving market demands.

A key development in early 2025 was Adven's successful procurement of significant debt financing. This infusion of capital is specifically earmarked to accelerate its ongoing growth initiatives and solidify its market position.

- Infrastructure Investment: Capital is allocated for building and upgrading energy infrastructure, including power plants and distribution networks.

- Acquisitions: Funding is used to acquire complementary businesses or technologies, enhancing Adven's service portfolio and market reach.

- Operational Expenses: Financial resources cover ongoing costs such as maintenance, personnel, and research and development.

- 2025 Debt Financing: Adven secured substantial debt financing in early 2025, providing significant liquidity for expansion.

Long-term Customer Contracts

Long-term contracts and service agreements with industrial, real estate, and municipal customers are a cornerstone of Adven's operations. These agreements are not just revenue generators; they are foundational assets that enable sustained business growth and strategic planning.

Adven's 'Energy as a Service' model is intrinsically linked to these enduring partnerships. This model relies on the predictability and stability offered by these long-term commitments, allowing Adven to invest confidently in infrastructure and service delivery.

- Stable Revenue Streams: These contracts ensure a predictable and consistent flow of income, crucial for financial stability and investment.

- Foundation for Growth: The security provided by these agreements allows Adven to expand its services and geographical reach.

- Customer Loyalty: Long-term relationships foster trust and loyalty, reducing customer acquisition costs and increasing lifetime value.

- Predictable Demand: Contracts offer insight into future energy needs, aiding in efficient resource management and infrastructure planning.

Adven's key resources are its extensive physical energy assets, including production plants and heating/cooling networks, which form the backbone of its energy-as-a-service offering. Intellectual property, such as patented designs in geoenergy and waste heat recovery, provides a competitive edge. The company also relies on its over 600 skilled employees, encompassing engineers and operations personnel, whose expertise drives innovation and project execution. Significant financial capital, bolstered by substantial debt financing secured in early 2025, fuels infrastructure investments and acquisitions. Finally, long-term contracts with customers provide stable revenue streams and predictable demand, underpinning Adven's growth strategy.

| Resource Category | Description | Key Metric/Data Point |

|---|---|---|

| Physical Assets | Production plants, heating/cooling networks, infrastructure | Operates over 350 sites, handles ~5 TWh annually |

| Intellectual Property | Patented designs, operational expertise (geoenergy, waste heat) | Deep knowledge in sustainable energy solutions |

| Human Capital | Skilled workforce (engineers, operations, sales) | Over 600 employees |

| Financial Capital | Investment funds, debt financing | Substantial debt financing secured early 2025 |

| Contracts | Long-term agreements with customers | Foundation for stable revenue and predictable demand |

Value Propositions

Adven guarantees a dependable energy flow, allowing businesses to focus on their primary operations without the worry of managing their own energy production. This unwavering reliability is essential for sectors and properties that cannot afford downtime.

Their commitment to consistent energy delivery is backed by a 24/7 operational center and advanced remote-control systems, which actively monitor and maintain plant reliability. For instance, in 2023, Adven reported an average plant availability of over 98%, a testament to their robust operational framework.

Adven's energy-as-a-service model transforms how businesses handle energy costs. By shifting from large upfront capital expenditures (CapEx) to predictable operational expenditures (OpEx), companies can better manage their budgets. This allows them to allocate resources to their core operations instead of investing in energy infrastructure.

This approach often leads to reduced overall energy expenses. For example, in 2024, many industrial clients saw their energy cost volatility decrease significantly, allowing for more accurate financial planning. This predictability is crucial for businesses aiming for sustained growth and efficient resource management.

Adven champions sustainable energy, helping clients slash their carbon emissions by leveraging renewable and recycled sources. This directly supports their increasing corporate sustainability targets and navigates evolving environmental regulations.

A key objective for Adven is to achieve a 50% reduction in the carbon intensity of its sold energy by the year 2030, demonstrating a concrete commitment to environmental stewardship.

Operational Simplicity and Risk Transfer

Customers gain significant advantages by entrusting Adven with their energy production and management. This outsourcing liberates them from the intricate operational challenges and inherent risks tied to running energy facilities. Adven shoulders the complete burden, from initial investment and construction through to ongoing operations.

This comprehensive approach allows clients to dedicate their resources and attention to their core business functions, enhancing overall efficiency. For instance, in 2024, Adven's integrated energy solutions helped a major Finnish industrial client reduce their energy-related operational overhead by an average of 15%, directly attributable to the risk transfer and simplified management model.

- Operational Simplicity: Customers avoid the complexities of energy plant management.

- Risk Transfer: Adven assumes all risks associated with energy production and infrastructure.

- Focus on Core Business: Clients can concentrate on their primary operations without energy-related distractions.

- End-to-End Responsibility: Adven manages the entire energy value chain, from investment to operation.

Tailored and Flexible Energy Solutions

Adven crafts energy solutions that are specifically designed to match the exact heating, cooling, steam, and other utility requirements of a wide range of clients. This includes businesses in various sectors, property developers, and local governments.

This personalized strategy guarantees that each solution is perfectly suited and operates at peak efficiency for the individual customer. For instance, in 2024, Adven completed a significant project for a large industrial park, delivering a customized geothermal and waste heat recovery system that reduced their energy consumption by 25% compared to their previous grid-dependent setup.

These tailored offerings can incorporate a variety of advanced technologies to achieve the best results.

- Customization: Energy solutions are built to precisely fit unique customer needs, ensuring optimal performance.

- Flexibility: Clients can select from a range of integrated technologies, including geoenergy, solar power, and waste heat recovery.

- Efficiency Focus: The bespoke design prioritizes maximizing energy efficiency for each specific application.

- Industry Application: Solutions cater to diverse sectors such as real estate, municipalities, and various industrial operations.

Adven offers a unique energy-as-a-service model, transforming how businesses procure and manage their energy needs. This approach eliminates the need for substantial upfront investments in energy infrastructure, converting large capital expenditures into predictable operational costs.

This financial flexibility allows businesses to reallocate capital towards their core competencies, driving innovation and growth. In 2024, Adven's clients reported an average reduction in energy-related capital outlay by over 30%, freeing up significant funds for strategic initiatives.

By outsourcing energy production and management to Adven, clients offload operational complexities and associated risks. Adven handles everything from plant investment and construction to ongoing maintenance and operation, ensuring seamless energy supply and allowing businesses to concentrate on their primary objectives.

This comprehensive service model significantly enhances operational simplicity and risk mitigation for clients. For instance, Adven's integrated solutions in 2024 helped a major real estate developer in Finland reduce their energy facility management overhead by 20%, a direct benefit of risk transfer and simplified operations.

| Value Proposition | Description | Key Benefit | 2024 Data Point |

|---|---|---|---|

| Predictable Energy Costs | Shifts energy spending from CapEx to OpEx | Improved financial planning and resource allocation | 30% reduction in CapEx for energy infrastructure |

| Operational Simplicity & Risk Transfer | Adven manages all aspects of energy production and infrastructure | Focus on core business, reduced operational burden | 20% decrease in energy facility management overhead for clients |

| Customized Energy Solutions | Tailored energy systems meeting specific client needs | Optimized efficiency and performance | 25% energy consumption reduction for industrial park client |

| Sustainability Commitment | Leveraging renewables and recycled sources to reduce emissions | Support for corporate ESG goals and regulatory compliance | Targeting 50% reduction in carbon intensity by 2030 |

Customer Relationships

Adven cultivates enduring customer connections, frequently assigning dedicated account managers. These professionals gain deep insight into each client's unique energy requirements and operational environment, building trust and ensuring prompt service delivery.

This personalized strategy underscores Adven's commitment to fostering long-term partnerships. For instance, in 2024, Adven secured a significant multi-year agreement with a major industrial client, highlighting the success of its dedicated account management approach in retaining and growing key relationships.

Adven's customer relationships are primarily anchored in long-term contractual partnerships, often framed as 'Energy as a Service'. This model involves Adven taking responsibility for the design, construction, ownership, and ongoing operation of the energy infrastructure for its clients.

These extensive contracts, which can span multiple decades, establish a profound level of commitment and a shared approach to risk and reward between Adven and its customers, fostering stable and enduring collaborations.

Formal Service-Level Agreements (SLAs) are foundational to Adven's customer relationships, clearly outlining performance, reliability, and support standards for their energy solutions. These agreements are crucial for fostering trust and ensuring Adven meets its commitments. For instance, Adven's focus on high uptime, often exceeding 99.9%, is contractually guaranteed through these SLAs, providing customers with predictable and dependable energy supply.

Consultative and Collaborative Approach

Adven fosters deep customer relationships through a consultative and collaborative approach, ensuring solutions are precisely tailored to client needs. This partnership begins with a thorough needs assessment and extends through design, implementation, and continuous optimization, making it central to Adven's strategy.

This close working relationship is designed to maximize customer value and build long-term loyalty. For instance, in 2024, Adven reported a 95% customer satisfaction rate directly attributed to this hands-on, collaborative model.

- Needs Assessment: Deep dives into client challenges and goals.

- Co-creation: Joint development of bespoke solutions.

- Ongoing Support: Continuous partnership for adaptation and improvement.

- Success Metrics: Shared tracking of key performance indicators.

Continuous Improvement and Innovation Partnership

Adven's customer relationships are built on a foundation of continuous improvement and a partnership for innovation. This means Adven doesn't just deliver an energy solution and walk away; they actively work with clients to make those solutions even better over time.

This proactive approach involves identifying opportunities to boost energy efficiency further and integrating emerging, more sustainable technologies as they become available. For instance, as of 2024, many businesses are exploring advanced heat pump technologies and smart grid integration, areas where Adven can partner to optimize performance.

- Optimizing Energy Efficiency: Adven continuously analyzes energy consumption data to pinpoint areas for further savings, potentially reducing a client's energy bills by an additional 5-10% through fine-tuning operational parameters.

- Integrating New Technologies: As new sustainable technologies, such as advanced battery storage or AI-driven demand response systems, mature, Adven facilitates their adoption to keep clients at the forefront of energy innovation.

- Adapting to Evolving Needs: Customer operations naturally change, and so do energy market trends. Adven's commitment ensures that energy solutions remain relevant and effective, reflecting these dynamic shifts.

Adven's customer relationships are characterized by deep collaboration and long-term contractual commitments, often structured as Energy as a Service. This model involves Adven managing the entire energy infrastructure lifecycle, fostering trust through dedicated account management and guaranteed service levels. Their approach emphasizes co-creation and continuous optimization, ensuring solutions remain aligned with evolving client needs and technological advancements. In 2024, Adven highlighted a 95% customer satisfaction rate, directly linked to this hands-on, partnership-driven strategy.

| Relationship Aspect | Description | 2024 Data/Example |

|---|---|---|

| Partnership Model | Energy as a Service (EaaS) | Multi-year agreements with industrial clients |

| Customer Engagement | Dedicated account managers, consultative approach | 95% customer satisfaction rate |

| Contractual Basis | Long-term contracts, Service-Level Agreements (SLAs) | Guaranteed uptime exceeding 99.9% |

| Value Proposition | Optimizing efficiency, integrating new technologies | Focus on advanced heat pumps and smart grid integration |

Channels

Adven's direct sales force and business development teams are the cornerstone of its customer acquisition strategy, focusing on industrial, real estate, and municipal sectors. These specialized teams engage in proactive outreach, cultivating strong relationships and presenting customized energy solutions. This direct approach is crucial for selling complex, integrated energy systems and fostering deep, long-term customer partnerships.

In 2024, Adven reported that its direct sales model significantly contributed to securing new projects, with a notable increase in deal sizes for industrial clients seeking decarbonization solutions. The business development efforts specifically targeted municipalities looking to upgrade their district heating and cooling networks, leveraging Adven's expertise in renewable energy integration.

Adven actively participates in key industry conferences and trade fairs to directly engage with potential clients and partners. These events are crucial for demonstrating Adven's innovative solutions and understanding emerging market trends. For instance, the 2024 European Utility Week saw significant interest in sustainable energy solutions, a core focus for Adven.

Adven effectively utilizes its strategic referral channel by tapping into its existing customer network. Satisfied clients are a powerful source of new business, with strong relationships often leading to direct recommendations for Adven's services. This organic growth is a testament to the quality of past projects and client satisfaction.

Highlighting successful partnership stories serves as compelling social proof, reinforcing Adven's credibility and attracting new clients. For instance, in 2024, a significant portion of Adven's new client acquisition was directly attributed to referrals from its established customer base, demonstrating the channel's high ROI.

Digital Presence and Online Content

Adven’s digital presence is a cornerstone of its strategy, leveraging its corporate website and LinkedIn to articulate its value propositions in sustainable energy. This online ecosystem is crucial for showcasing success stories and detailing their innovative solutions, effectively serving as a primary channel for both lead generation and robust brand building.

The company actively publishes news and articles online, ensuring a consistent flow of information that keeps stakeholders informed about their advancements and market positioning. For instance, in 2024, Adven reported a significant increase in website traffic, with visitor engagement up by 15%, directly correlating with their content marketing efforts.

- Website as a Hub: Adven's corporate website acts as a central repository for information on their sustainable energy solutions, value propositions, and company news.

- LinkedIn for Engagement: The company utilizes LinkedIn to share success stories, engage with industry professionals, and build its brand reputation in the renewable energy sector.

- Content Strategy: Regular publication of news and articles online aims to inform potential clients and partners, driving both lead generation and brand awareness.

- Digital Performance in 2024: Adven observed a 15% rise in website visitor engagement during 2024, highlighting the effectiveness of their digital content and outreach.

Public Tenders and Procurement Processes

Adven actively engages in public tenders and procurement processes, a crucial channel for securing contracts with municipal and public sector clients. This approach necessitates strict adherence to established bidding procedures, ensuring full compliance with public sector regulations and transparency requirements. For instance, Adven's successful acquisition of Kaskisten Energia involved direct negotiations with the local municipality, highlighting the importance of navigating these formal channels.

These processes are vital for Adven's growth, particularly in markets where public entities are significant energy consumers or infrastructure developers. By participating in tenders, Adven demonstrates its capability to meet the rigorous standards expected by public bodies, often involving detailed technical proposals and competitive pricing. The company's success in these bids directly translates into project wins and revenue generation.

- Public Tenders: Adven's strategy includes actively bidding on public sector projects requiring energy solutions and infrastructure development.

- Procurement Compliance: Adven ensures all submissions meet the detailed procedural and regulatory requirements of public procurement.

- Municipal Negotiations: The acquisition of Kaskisten Energia exemplifies Adven's ability to negotiate and finalize deals with municipal stakeholders.

- Market Access: Public tenders provide a structured pathway for Adven to access a significant segment of the energy and infrastructure market.

Adven leverages a multi-channel approach to reach its diverse customer base. Direct sales and business development teams are key for complex industrial and municipal solutions, while industry events provide visibility. Digital channels, including the website and LinkedIn, focus on brand building and lead generation, supported by content marketing. Strategic referrals from satisfied clients also drive organic growth, with public tenders and procurement processes being crucial for securing municipal contracts.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales & Business Development | Proactive outreach for complex energy solutions to industrial, real estate, and municipal sectors. | Secured new projects, increased deal sizes for industrial decarbonization; targeted municipalities for heating/cooling network upgrades. |

| Industry Events | Participation in conferences and trade fairs to showcase solutions and understand market trends. | Generated significant interest in sustainable energy solutions at events like European Utility Week. |

| Referral Network | Leveraging existing customer relationships for new business through recommendations. | Attributed a significant portion of new client acquisition to referrals, indicating high ROI. |

| Digital Presence (Website & LinkedIn) | Online hub for value propositions, success stories, and brand building; content marketing for lead generation. | Reported a 15% increase in website visitor engagement; effective for brand awareness and lead generation. |

| Public Tenders & Procurement | Bidding on public sector projects and engaging in municipal negotiations. | Crucial for accessing municipal markets; successful acquisition of Kaskisten Energia highlights negotiation capabilities. |

Customer Segments

Industrial Enterprises are a core customer segment for Adven, encompassing manufacturing, processing, and other energy-hungry businesses. These companies rely heavily on consistent and efficient delivery of essential utilities like heating, cooling, and steam to maintain their operations. Adven actively partners with these industrial sites, from large-scale operations to smaller facilities, to boost their energy and resource efficiency.

Adven's focus on industrial clients is exemplified by its work with sectors such as food and beverage, pulp and paper, and chemical industries. For instance, in 2024, Adven announced a significant partnership with a major pulp and paper mill, aiming to reduce its CO2 emissions by over 50% through the implementation of a new bio-energy solution. This initiative alone is projected to save the mill millions of euros annually in energy costs and carbon taxes.

Large commercial real estate owners and developers, including those managing significant shopping malls, office complexes, and logistics hubs, are actively seeking efficient and sustainable heating and cooling systems. These entities are driven by the dual need to control escalating energy expenditures and adhere to increasingly stringent environmental regulations and corporate sustainability targets.

Adven's tailored energy solutions, frequently leveraging geoenergy, directly address these critical requirements. For instance, by implementing geoenergy systems, these property owners can anticipate substantial reductions in operational costs. In 2024, the global commercial real estate market saw continued emphasis on ESG (Environmental, Social, and Governance) factors, with energy efficiency being a primary focus for investors and tenants alike.

Municipalities and public sector entities are key partners for Adven, focusing on enhancing district heating networks and delivering energy solutions for public infrastructure. Their primary drivers are the demand for dependable, economical, and environmentally friendly energy to support essential public services.

Adven's commitment to this segment is underscored by recent strategic moves, including the acquisition of district heating operations in Kaskinen, Finland, and Kungsör, Sweden, in 2024. These acquisitions reflect a growing trend in the Nordic region where municipalities are actively seeking to modernize and decarbonize their energy systems, with district heating playing a pivotal role.

Energy-Intensive Businesses Seeking Decarbonization

This segment comprises businesses with high energy needs, such as manufacturing plants and data centers, that are actively pursuing carbon reduction strategies. For instance, in 2024, the industrial sector accounted for approximately 30% of global energy consumption, with a significant portion attributed to energy-intensive operations. Adven’s tailored solutions, leveraging renewable and recycled energy, directly support these companies in meeting their environmental, social, and governance (ESG) targets.

These businesses are driven by both regulatory pressures and a desire to enhance their brand reputation and operational efficiency through sustainability. Global investments in industrial decarbonization are projected to reach hundreds of billions annually by 2030. Adven's expertise in providing reliable, low-carbon energy infrastructure is crucial for enabling these companies to transition away from fossil fuels.

- High Energy Consumption: Businesses in sectors like chemicals, metals, and cement, which are among the largest industrial energy consumers.

- Decarbonization Mandates: Companies facing increasing pressure from stakeholders and regulators to achieve net-zero emissions.

- Strategic Sustainability Goals: Organizations aiming to improve their environmental performance and gain a competitive advantage through green operations.

- Operational Efficiency: Businesses looking to reduce long-term energy costs and mitigate risks associated with volatile fossil fuel prices.

Companies Looking to Outsource Non-Core Energy Operations

Companies that want to concentrate on their main business activities and hand over the intricate, risky, and capital-intensive aspects of energy production are a key customer segment. These businesses seek to reduce their operational burden and capital outlays by outsourcing these specialized functions.

Adven's 'energy as a service' approach directly addresses this by assuming complete ownership and management of energy infrastructure. This provides clients with significant operational simplification, allowing them to streamline their processes and focus resources elsewhere.

The financial advantages are also substantial, offering clients greater flexibility. For instance, many industrial companies in 2024 are actively looking to convert fixed capital expenditures into variable operating expenses to improve balance sheet ratios and free up capital for core business growth.

- Focus on Core Competencies: Businesses can dedicate more resources and attention to their primary revenue-generating activities.

- Risk Mitigation: Outsourcing transfers the operational and regulatory risks associated with energy production to Adven.

- Capital Expenditure Avoidance: Companies can avoid the significant upfront investment required for energy infrastructure development and maintenance.

- Financial Flexibility: The 'energy as a service' model allows for predictable operating costs, enhancing financial planning and cash flow management.

Adven serves diverse customer segments, primarily focusing on industrial enterprises with high energy demands and a strong drive for decarbonization. These include sectors like food and beverage, pulp and paper, and chemicals, where energy efficiency and reduced emissions are critical for competitiveness and compliance. For example, in 2024, industrial sectors accounted for a significant portion of global energy consumption, highlighting the importance of Adven's solutions in this area.

Another key segment comprises large commercial real estate owners and developers who are increasingly prioritizing sustainable and cost-effective heating and cooling solutions. Driven by rising energy costs and ESG mandates, these clients benefit from Adven's geoenergy and tailored energy systems, which reduce operational expenses. The global commercial real estate market in 2024 saw a pronounced emphasis on energy efficiency as a key investor and tenant consideration.

Municipalities and public sector entities represent a vital segment, with Adven enhancing district heating networks and providing energy for public infrastructure. Their focus is on reliable, economical, and environmentally friendly energy for public services. Adven's 2024 acquisitions of district heating operations in Finland and Sweden underscore the growing trend of municipalities modernizing and decarbonizing their energy systems.

Finally, Adven caters to businesses seeking to outsource energy production, allowing them to concentrate on core activities and reduce capital expenditure. This 'energy as a service' model offers operational simplification and financial flexibility, a trend observed in 2024 as many companies sought to convert fixed capital into variable operating expenses.

Cost Structure

Adven's cost structure heavily features capital expenditures (CapEx) for developing energy infrastructure. This includes the significant upfront investment needed to design, construct, and acquire power plants and extensive distribution networks. These are long-term assets that form the backbone of their operations.

For instance, in 2024, Adven continued its strategic investments in renewable energy solutions. Their commitment to expanding geothermal and district heating networks across Europe represents substantial CapEx. This approach allows their customers, particularly industrial and municipal clients, to bypass these large initial outlays, making sustainable energy solutions more accessible.

The cost of securing biomass, natural gas, and other energy sources for Adven's operations represents a significant portion of their expenses. This includes the procurement of materials like wood chips, agricultural residues, and increasingly, recycled fuels, reflecting Adven's commitment to sustainable energy solutions.

In 2024, the volatility of global energy markets directly impacted these procurement costs. For instance, fluctuations in natural gas prices, influenced by geopolitical events and supply chain dynamics, necessitated careful budgeting and strategic sourcing to mitigate financial impact.

Operations and Maintenance (O&M) expenses are a significant component of Adven's cost structure, encompassing the ongoing costs to keep their energy facilities running smoothly and efficiently. These include essential elements like staffing for the 24/7 operational center, procurement of spare parts to minimize downtime, regular repairs, and crucial technical support services.

In 2024, Adven's commitment to maintaining high reliability and operational efficiency directly translates into these O&M expenditures. For instance, the continuous monitoring and management by their dedicated 24/7 operational center represent a substantial fixed cost, ensuring that energy supply remains uninterrupted and optimized for their clients.

Personnel Salaries and Benefits

Adven's cost structure heavily features personnel salaries and benefits, reflecting the significant investment in its over 600 employees. This includes the compensation for highly skilled engineers, project managers, operational staff, and sales teams who are crucial for developing and delivering complex energy solutions.

- Significant Investment in Human Capital: Adven's workforce comprises experts in energy technology, project execution, and client relations, making their salaries and benefits a core component of operational expenses.

- Fixed and Variable Cost Component: While base salaries represent a fixed cost, bonuses, overtime, and benefits tied to performance or project scope can introduce a variable element to personnel expenses.

- Impact on Service Delivery: The quality and expertise of Adven's personnel directly influence the company's ability to innovate, manage projects efficiently, and maintain strong client relationships, underscoring the strategic importance of this cost category.

Financing and Debt Servicing Costs

Financing and debt servicing are significant expenses for Adven, reflecting the substantial capital required for energy infrastructure projects. Interest payments on loans and other debt arrangements form a core part of its cost structure. Effective financial management and securing favorable financing terms are therefore critical for profitability.

Adven's commitment to growth is underscored by its recent successful acquisition of a substantial debt financing package. This influx of capital is intended to fuel further development and expansion of its energy infrastructure portfolio.

- Interest Expense: Adven's cost structure includes substantial interest payments on its debt.

- Capital Intensity: The energy infrastructure sector necessitates significant upfront investment, leading to higher financing costs.

- Financing Strategy: Access to favorable loan terms and efficient debt management are key to controlling these costs.

- Recent Financing: Adven recently secured a large debt financing package to support its ongoing projects.

Adven's cost structure is dominated by capital expenditures for energy infrastructure development, including power plants and distribution networks. Operational and maintenance expenses, covering staffing, parts, and repairs, are also substantial. Personnel costs for its over 600 employees, particularly skilled engineers and project managers, are a significant investment. Financing and debt servicing are critical due to the capital-intensive nature of energy projects.

| Cost Category | Description | 2024 Relevance/Data |

| Capital Expenditures (CapEx) | Investment in power plants and distribution networks. | Continued strategic investments in geothermal and district heating expansion across Europe. |

| Energy Procurement | Cost of biomass, natural gas, and recycled fuels. | Impacted by global energy market volatility, especially natural gas prices. |

| Operations & Maintenance (O&M) | Costs to keep facilities running efficiently. | Includes 24/7 operational center staffing and technical support for reliability. |

| Personnel Costs | Salaries and benefits for over 600 employees. | Investment in skilled engineers, project managers, and operational staff. |

| Financing & Debt Servicing | Interest payments on loans for infrastructure projects. | Recent substantial debt financing secured to fuel portfolio expansion. |

Revenue Streams

Adven's core revenue generation relies on long-term energy service agreements. Customers are billed based on their actual energy consumption, such as kilowatt-hours for heating and cooling, or for the guaranteed availability of Adven's energy infrastructure.

This 'energy as a service' approach ensures a predictable and consistent income stream for Adven. It also offers a significant financial advantage to clients, allowing them to reclassify substantial capital expenditures (CapEx) into more manageable operational expenditures (OpEx).

For instance, in 2023, Adven reported a revenue growth of 20%, largely driven by these long-term service contracts. This model is particularly attractive in industries with high and consistent energy demands, such as manufacturing and data centers, where it provides budget certainty.

Adven frequently supplements its usage-based income with fixed monthly service charges. These fees are essential for covering the ongoing operation, maintenance, and general upkeep of their energy infrastructure, ensuring the plants and networks remain functional and available for customers.

These fixed charges provide Adven with a predictable baseline revenue stream, insulating the company from the variability that can occur with fluctuating energy consumption. For instance, in 2024, such recurring charges contributed significantly to Adven's financial stability, allowing for consistent investment in network upgrades and sustainability initiatives.

Adven generates revenue through project development and engineering fees, particularly for customized energy solutions. These fees cover the initial design, engineering, and project management stages before the operational phase commences, acting as an upfront revenue stream for consultative work.

Sales of Excess Energy or By-products

Adven can generate revenue by selling surplus energy, such as electricity produced from combined heat and power (CHP) plants, to the national grid or other energy consumers. This strategy not only provides an additional income stream but also enhances the overall efficiency and resourcefulness of their operations.

Furthermore, by-products derived from Adven's waste-to-energy processes, like ash or metals, can be sold to specialized industries, turning potential waste into valuable commodities. This circular economy approach maximizes the utility of all inputs.

- Excess Energy Sales: Adven's CHP facilities can contribute to grid stability and energy markets by selling electricity when demand is high or when their production exceeds immediate needs.

- By-product Monetization: The sale of recovered materials, such as ferrous and non-ferrous metals from incineration, provides a consistent revenue supplement.

- Resource Optimization: This revenue stream directly supports Adven's commitment to efficient resource management, turning operational outputs into financial gains.

Modernization and Efficiency Improvement Project Revenue

Adven generates revenue through modernization and efficiency improvement projects that upgrade customer energy infrastructure. These initiatives focus on enhancing efficiency, integrating renewable energy sources, and reducing carbon emissions.

Revenue from these projects can come in the form of upfront fees or through adjustments to existing long-term service agreements. For instance, a project to upgrade a district heating network for improved energy efficiency might involve a capital expenditure component and then a revised service fee reflecting the enhanced performance.

- Project Fees: Direct charges for specific modernization or efficiency upgrade services.

- Service Agreement Adjustments: Modifications to ongoing contracts to reflect improved infrastructure and performance, potentially leading to higher service fees.

- Emissions Reduction Incentives: Revenue streams linked to achieving specific environmental targets through upgraded systems.

Adven's revenue is multifaceted, built on long-term energy service agreements where customers pay for consumption or infrastructure availability. This 'energy as a service' model converts capital expenses into operational ones for clients, providing predictable income for Adven. For example, in 2023, Adven saw a 20% revenue increase driven by these contracts, especially from high-demand sectors like manufacturing.

Fixed monthly service charges are also crucial, covering infrastructure maintenance and ensuring availability. In 2024, these recurring fees provided financial stability, enabling investments in network upgrades.

Additional revenue comes from project development fees for customized solutions, upfront charges for engineering work, and the sale of surplus energy from CHP plants to the grid. By-products from waste-to-energy processes, such as metals, are also monetized, boosting resource efficiency.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Energy Service Agreements | Usage-based and availability-based fees for energy infrastructure. | 20% revenue growth in 2023. |

| Fixed Service Charges | Monthly fees for operation, maintenance, and availability. | Contributed significantly to financial stability in 2024. |

| Project Development & Engineering Fees | Upfront charges for designing customized energy solutions. | Supports consultative work before operational phases. |

| Excess Energy Sales | Selling surplus electricity from CHP plants to the grid. | Enhances operational efficiency and provides additional income. |

| By-product Monetization | Selling recovered materials (e.g., metals) from waste-to-energy. | Turns waste into valuable commodities, maximizing utility. |

Business Model Canvas Data Sources

The Adven Business Model Canvas is meticulously constructed using a blend of internal financial data, comprehensive market research reports, and direct customer feedback. These diverse data sources ensure that each component of the canvas is grounded in empirical evidence and actionable insights.