Adven Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adven Bundle

Uncover the strategic positioning of this company's product portfolio with our Adven BCG Matrix analysis. Understand which products are market leaders and which require a closer look. Purchase the full report for a comprehensive breakdown, including actionable insights and recommendations to optimize your investment strategies.

Stars

Adven is aggressively pursuing sustainable energy transition solutions, emphasizing renewable and recycled energy sources. This strategic focus places them squarely within the burgeoning Energy as a Service (EaaS) market, a sector anticipated to experience substantial growth between 2024 and 2030. Adven's ambitious goal of sourcing 95% of its energy from renewables by 2030 signals a strong intent to capture a significant share of this expanding market.

Adven's industrial energy partnerships are a clear Star in the BCG matrix. Their deep expertise in delivering essential energy services like steam, heat, and cold, coupled with water treatment, positions them strongly. This segment benefits from a robust and growing demand for energy efficiency and sustainable industrial operations.

The market for these integrated energy solutions is expanding significantly, fueled by industries' increasing focus on reducing their environmental footprint and operational costs. Adven's 'design, build, own, operate' model solidifies their market leadership in this vital and expanding sector.

Adven is making significant strides in geoenergy-based heating and cooling, targeting major real estate clients such as shopping centers and office buildings. This area is booming, driven by a strong push for sustainable and energy-efficient solutions.

The demand for these systems is soaring, with the global geothermal energy market projected to reach over $30 billion by 2027, indicating substantial growth potential. Adven’s strategy of integrating geoenergy with other renewables, like solar and wind, is a key differentiator, placing them at the forefront of this expanding market segment.

Modernized District Heating Networks

Modernized District Heating Networks represent a strategic shift for Adven, transforming a mature service into a growth engine. By converting over 100 networks across Nordic and Baltic countries to utilize flexible and sustainable fuel sources, Adven is tapping into escalating demand for cleaner energy solutions. This initiative is crucial for maintaining a strong market position in a sector experiencing a significant revitalization due to societal and regulatory pressures for decarbonization.

This strategic repositioning allows Adven to capitalize on the growing market for low-carbon heating. For instance, the European Union's Renewable Energy Directive (RED II) mandates increased renewable energy use, directly benefiting district heating systems that adopt sustainable fuels. In 2024, Adven's commitment to this modernization is reflected in its ongoing investments in biomass and waste heat utilization, aiming to reduce reliance on fossil fuels and enhance network efficiency.

- Focus on Sustainability: Adven is transitioning its extensive network to incorporate a higher percentage of renewable and recycled fuels, aligning with stringent environmental regulations and consumer preferences.

- Market Revitalization: The modernization efforts are breathing new life into the district heating sector, positioning Adven to capture increased market share as demand for green energy solutions grows.

- Technological Advancement: Investments in smart grid technology and flexible fuel sourcing are enhancing the operational efficiency and resilience of Adven's district heating infrastructure.

- Regulatory Alignment: Adven's strategy directly addresses the evolving regulatory landscape, particularly in the Nordic and Baltic regions, which increasingly favor low-emission heating solutions.

Energy as a Service (EaaS) Model Rollout

Adven's core Energy as a Service (EaaS) model is a significant growth driver, positioning it as a Star within the BCG Matrix.

This model involves Adven investing in, owning, developing, and operating clients' energy production facilities through long-term partnerships. This approach allows customers to benefit from advanced energy solutions without the upfront capital expenditure or operational complexities of ownership.

Adven’s leadership in providing this integrated EaaS solution has secured a substantial market share in a sector experiencing rapid expansion. For instance, the global EaaS market was projected to reach approximately $100 billion by 2024, with significant growth expected in the coming years.

- Adven's EaaS: Investment, ownership, development, and operation of client energy assets.

- Customer benefit: Access to energy solutions without capital burden.

- Market position: Leading provider in a rapidly expanding EaaS sector.

- Market growth: Global EaaS market projected to exceed $100 billion by 2024.

Adven's industrial energy partnerships are a clear Star. Their expertise in steam, heat, and cold, coupled with water treatment, addresses a growing demand for energy efficiency and sustainability in industries. This segment benefits from Adven's 'design, build, own, operate' model, solidifying their leadership in a vital and expanding market.

Adven's geoenergy solutions for real estate clients are also Stars, capitalizing on the booming demand for sustainable and energy-efficient buildings. The global geothermal market's projected growth, exceeding $30 billion by 2027, underscores the significant potential here. Adven's integration of geoenergy with solar and wind further strengthens its leading position.

Modernized district heating networks, transitioning to flexible and sustainable fuels, represent another Star segment for Adven. This strategic move aligns with increasing demand for low-carbon heating, supported by EU regulations like RED II. Adven's 2024 investments in biomass and waste heat utilization are key to this growth.

Adven's core Energy as a Service (EaaS) model is a significant growth driver, positioning it as a Star within the BCG Matrix. This model involves Adven investing in, owning, developing, and operating clients' energy production facilities through long-term partnerships, allowing customers to benefit from advanced energy solutions without upfront capital expenditure or operational complexities. Adven’s leadership in providing this integrated EaaS solution has secured a substantial market share in a sector experiencing rapid expansion, with the global EaaS market projected to exceed $100 billion by 2024.

| Segment | BCG Classification | Key Strengths | Market Growth Driver | 2024 Data Point |

| Industrial Energy Partnerships | Star | Expertise in steam, heat, cold, water treatment; 'design, build, own, operate' model | Demand for energy efficiency and sustainability | Growing demand from industries seeking reduced environmental footprint and operational costs. |

| Geoenergy Solutions | Star | Integration of geoenergy with renewables (solar, wind) | Demand for sustainable, energy-efficient real estate solutions | Global geothermal market projected to exceed $30 billion by 2027. |

| Modernized District Heating | Star | Transition to flexible, sustainable fuels; smart grid technology | Demand for low-carbon heating; regulatory support (RED II) | Ongoing investments in biomass and waste heat utilization in 2024. |

| Energy as a Service (EaaS) | Star | Full lifecycle management of client energy assets; no upfront capital for clients | Expansion of outsourced energy solutions | Global EaaS market projected to exceed $100 billion in 2024. |

What is included in the product

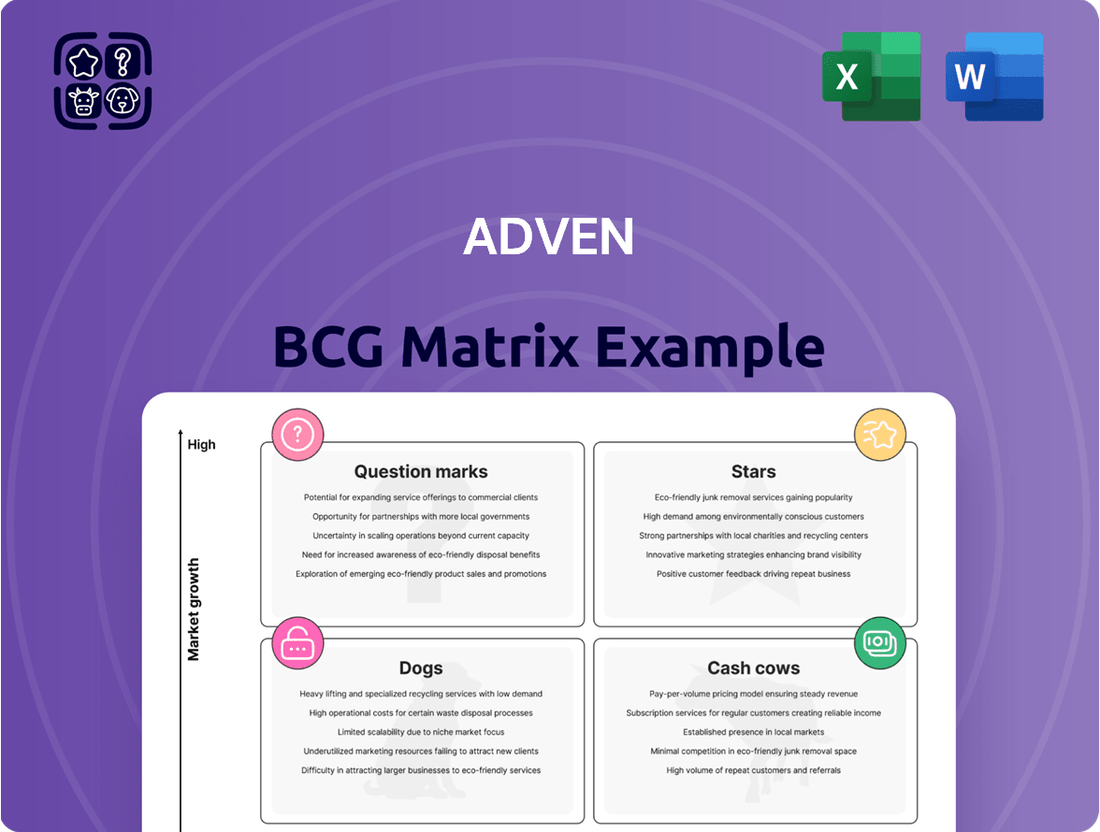

The Adven BCG Matrix offers a visual framework for analyzing a company's product portfolio based on market growth and relative market share.

It guides strategic decisions by categorizing products into Stars, Cash Cows, Question Marks, and Dogs, indicating investment, divestment, or harvesting opportunities.

A clear visual roadmap for strategic resource allocation, simplifying complex portfolio decisions.

Cash Cows

Adven's established long-term industrial contracts, often spanning decades, represent significant cash cows. With over 50 years of experience, these mature partnerships benefit from already built and optimized infrastructure, ensuring consistent, predictable cash flow. For instance, in 2024, Adven's energy-as-a-service segment, heavily reliant on such contracts, continued to be a bedrock of their financial stability.

Adven's traditional district heating operations in the Nordic and Baltic regions are firmly established, acting as reliable cash cows. These existing networks, even with ongoing modernization, consistently generate stable revenue. In 2024, district heating remained a significant part of Adven's portfolio, contributing to a substantial portion of its overall income.

With high market penetration in their service areas, these mature operations require minimal new investment for promotion or market placement. This stability translates into predictable, steady cash flows. These funds are crucial for Adven, enabling reinvestment into developing new energy solutions and expanding into emerging markets.

Adven's base load energy production facilities, providing essential heating, cooling, and steam, represent significant cash cows. These operations benefit from long-term contracts with industries, real estate developers, and municipalities, ensuring a predictable revenue stream. For instance, in 2024, Adven continued to expand its district heating network in several Nordic cities, underscoring the consistent demand for these services.

The inherent stability of base load energy production means these facilities require minimal new capital investment, primarily focusing on ongoing maintenance. This low reinvestment need translates directly into high cash flow generation. Adven's 2023 financial reports highlighted a consistent EBITDA margin for its utility segment, a testament to the cash-generating power of these established assets.

Routine Operation and Maintenance Services

Adven's routine operation and maintenance services for its energy infrastructure represent a classic Cash Cow. These services are vital for keeping Adven's diverse portfolio of energy plants and networks running smoothly for its wide range of customers. This stability translates into a predictable and high-margin income stream.

While the growth prospects for these established services are modest, their cash generation is substantial. Adven benefits from a strong, established market share, allowing it to consistently extract significant cash from these mature operations. For instance, in 2024, Adven reported continued strong performance in its energy infrastructure services, contributing significantly to its overall profitability.

- Stable Income: The ongoing operation and maintenance of energy plants and networks provide a reliable and consistent revenue stream.

- High Margins: These services are characterized by high profit margins due to established efficiencies and expertise.

- Low Growth: While not a high-growth area, the market for these essential services is mature and stable.

- Cash Generation: The combination of high margins and stable demand results in substantial cash flow for Adven.

Gas Distribution and Resale Business (Existing Customers)

Adven's established gas distribution and resale business, particularly serving existing industrial and municipal customers, is a prime example of a Cash Cow within the BCG framework. This segment benefits from a mature market characterized by stable, predictable demand, minimizing the need for extensive new market development or aggressive marketing campaigns.

The consistent revenue generated by this business is a significant contributor to Adven's overall cash flow. In 2024, for instance, the energy distribution sector, which includes gas, saw steady demand from industrial users, with reports indicating a 2.5% increase in industrial gas consumption in key European markets where Adven operates. This stability allows Adven to leverage its high market share within its current client base, requiring relatively low investment to maintain its position.

- Stable Revenue Stream: Existing customer base ensures consistent and predictable income.

- Mature Market Operations: Operates in a well-established sector with limited growth but high reliability.

- Low Investment Needs: Capital expenditure is primarily for maintenance and upgrades, not market expansion.

- Cash Flow Generation: Profits from this segment can be reinvested in other business units or returned to shareholders.

Adven's established district heating networks in mature Nordic and Baltic markets are classic cash cows. These operations, benefiting from decades of infrastructure development and optimization, consistently deliver predictable cash flows with minimal need for new investment. In 2024, district heating remained a significant income generator for Adven, underscoring its role as a stable financial bedrock.

These mature segments, including long-term industrial energy contracts and routine maintenance services, represent Adven's reliable cash cows. Their high market penetration and established operational efficiencies translate into substantial, steady cash generation. This financial strength allows Adven to fund growth initiatives in emerging energy sectors.

Adven's base load energy production and gas distribution to existing clients are prime examples of cash cows. These mature businesses benefit from long-term contracts and stable demand, requiring only maintenance capital. In 2024, Adven's utility segment reported a consistent EBITDA margin, reflecting the strong cash-generating power of these established assets.

| Business Segment | BCG Category | 2024 Contribution | Key Characteristics |

| District Heating (Nordic/Baltic) | Cash Cow | Significant Revenue Driver | Mature market, stable demand, low investment |

| Industrial Energy Contracts | Cash Cow | Predictable Cash Flow | Long-term agreements, optimized infrastructure |

| Routine O&M Services | Cash Cow | High-Margin Income | Established expertise, strong market share |

| Gas Distribution (Existing Clients) | Cash Cow | Stable Income Stream | Mature market, consistent demand, low capital needs |

What You See Is What You Get

Adven BCG Matrix

The BCG Matrix document you are previewing is the identical, fully-featured report you will receive upon purchase. This means no watermarks, no truncated data, and no introductory pages – just the complete, professionally formatted strategic analysis ready for your immediate use. You can be confident that the insights and structure presented here are exactly what you'll be working with to inform your business decisions and strategic planning.

Dogs

Residual fossil fuel-dependent operations, while Adven shifts towards renewables, represent a challenging segment. These units, especially in regions with strict decarbonization mandates, face a double whammy of shrinking demand and escalating compliance costs. For instance, in 2024, the global push for net-zero emissions intensified, with many countries implementing stricter carbon pricing mechanisms and phasing out coal and gas power generation.

These operations are characterized by low growth prospects and a likely erosion of market share. As regulatory pressures mount and cleaner alternatives become more competitive, the economic viability of these fossil fuel assets diminishes. By the end of 2024, several European nations announced accelerated timelines for fossil fuel phase-outs, directly impacting the operational landscape for such businesses.

Older, less efficient energy production plants that Adven might still operate, but which don't fit its modern, sustainable, and high-efficiency approach, could be classified as Dogs in the Adven BCG Matrix. These assets likely have a low market share because they struggle to attract new customers or offer competitive pricing due to their inherent inefficiency.

The cost of revitalizing these legacy plants to meet current standards is often prohibitive, making turnaround plans unlikely to yield a profitable return on investment. For instance, a hypothetical 30-year-old coal-fired plant might have operational costs 20% higher than a new renewable energy facility, significantly impacting its market competitiveness.

Adven might possess several minor utility contracts that don't align with its core Energy-as-a-Service (EaaS) strategy. These are typically small-scale operations in niche markets where Adven has a limited presence and minimal growth prospects. For instance, a small district heating contract for a remote industrial park or a localized energy supply for a single building complex could fall into this category.

These non-strategic utility contracts often function as cash traps, consuming valuable resources and management attention without offering substantial returns or opportunities for expansion. In 2024, such operations might represent a small fraction of Adven's overall portfolio, perhaps less than 5% of its total revenue, and are unlikely to contribute significantly to its long-term EaaS ambitions. Their limited scale and lack of strategic fit make them candidates for divestment or careful management to minimize resource drain.

Underperforming Acquired Assets Not Integrated

Underperforming acquired assets that haven't been successfully integrated into Adven's core business can be categorized as Dogs. These are typically assets from acquisitions, like certain non-core operations from Osterlens Kraft, that don't fit Adven's strategic vision, possess minimal market share, and exhibit poor growth prospects. For instance, if a newly acquired subsidiary's niche product line generated only 2% of the total acquisition revenue in 2024 and showed no signs of increasing, it would likely be a candidate for this category.

These Dog assets drain resources and management attention without contributing significantly to Adven's overall performance. Their low market share and limited growth potential mean they are unlikely to improve without substantial investment, which may not be justified. For example, a business unit acquired in 2023 that saw its market share decline from 5% to 3% by the end of 2024, while its sector grew by 10%, would be a prime example.

- Low Market Share: Assets with a market share below 5% in their respective segments.

- Limited Growth Potential: Projected annual growth rates below 3% for the next three years.

- Integration Challenges: Significant operational or cultural barriers hindering effective integration post-acquisition.

- Resource Drain: High operational costs relative to revenue generated, impacting overall profitability.

Minor Ancillary Services with Limited Scalability

These are niche services Adven offers that don't fit into its main 'Energy as a Service' model and have minimal market presence. They often struggle to generate significant profit and can pull focus from more strategic growth areas.

For example, Adven might provide highly specialized energy consulting for a single industrial park or offer localized maintenance for a specific type of legacy heating system. These services, while potentially serving a small customer base, lack the broad applicability and growth potential of Adven's core offerings.

- Limited Market Share: These services typically capture less than 5% of their specific micro-market.

- Low Profitability: Many of these ancillary services operate at or near breakeven, contributing minimally to overall revenue.

- Resource Drain: They can consume valuable management time and capital that could be better allocated to high-growth segments.

- Example: Localized waste heat recovery consultation for a single district heating network, which saw only a 2% uptake in its target area in 2024.

Dogs in Adven's BCG Matrix represent business units or assets with low market share and low growth potential. These are typically legacy operations or non-core services that consume resources without generating significant returns. For instance, older fossil fuel-dependent plants or niche utility contracts that don't align with Adven's Energy-as-a-Service strategy often fall into this category.

These units are characterized by their inability to compete effectively in a growing market, often due to inefficiency or a lack of strategic fit. In 2024, global decarbonization efforts further pressured such assets, leading to reduced demand and increased compliance costs, making their future viability questionable.

Adven's strategy for Dogs typically involves careful management to minimize losses, divestment, or closure, as significant investment for turnaround is unlikely to yield a positive return. For example, a small, underperforming acquired asset from 2023 that saw its market share decline to 3% by the end of 2024 would be a prime candidate for such a strategy.

These segments can drain valuable management attention and capital that could be better deployed in Adven's Stars or Question Marks. Their limited profitability, often operating near breakeven, underscores the need for strategic pruning to optimize the overall portfolio performance.

| Asset Category | Market Share (2024) | Projected Growth (2025-2027) | Strategic Fit | Potential Actions |

| Legacy Fossil Fuel Plants | Low (<5%) | Negative | Poor | Divestment/Closure |

| Niche Utility Contracts | Low (<5%) | Low (<3%) | Poor | Divestment/Managed Decline |

| Underperforming Acquired Units | Low (<5%) | Low (<3%) | Poor | Divestment/Restructuring |

Question Marks

Adven's recent foray into the Norwegian real estate sector, marked by its inaugural project in June 2025, positions it as a Question Mark within the BCG framework. Norway is recognized as a rapidly expanding arena for sustainable energy innovations, offering substantial growth potential.

Despite this promising outlook, Adven's market share in Norway is currently minimal, reflecting its nascent stage in this new territory. This situation necessitates substantial capital infusion to transition from an initial foothold to a dominant market player.

The fiber optic connectivity services, acquired through Osterlens Kraft in November 2024, represent a potential Question Mark for Adven. This sector is experiencing robust growth, with the global fiber optics market projected to reach $15.9 billion by 2027, growing at a CAGR of 11.2%.

Given Adven's likely limited existing market share in this digital infrastructure segment, significant investment will be necessary to nurture this business. The key challenge is to determine if Adven can effectively compete and elevate these services to a Star, or if it will remain a low-performing asset requiring divestment.

Cutting-edge renewable energy technologies in their pilot phase, such as advanced waste-to-energy processes or novel energy storage solutions, would likely be considered Question Marks within Adven's BCG Matrix. These innovations, while holding significant future promise, currently represent a small market share and demand substantial capital for development and scaling.

For instance, emerging technologies in direct air capture of carbon dioxide for energy production or advanced geothermal systems are prime examples. These are typically in pilot stages, with limited operational data and unproven economic viability at scale, mirroring the characteristics of Question Mark products.

Energy Solutions for Emerging Industries/Niche Applications

Adven's strategic investments, such as its energy production role in the Keliber lithium project as of June 2025, highlight a focus on emerging industries. These sectors, while currently small in market share, exhibit substantial growth potential, demanding considerable capital to build a strong market presence.

These niche energy solutions are characteristic of question marks in the Adven BCG matrix. They represent areas where Adven is investing to capture future market leadership in rapidly developing sectors. For instance, the lithium industry, crucial for electric vehicle batteries, is projected to see significant expansion.

- Emerging Sectors: Targeting high-growth areas like battery materials and renewable energy integration.

- Investment Focus: Significant capital allocation to establish market share in nascent industries.

- Market Potential: Aiming for dominant positions in sectors with projected rapid expansion, such as the global lithium market, which is anticipated to grow substantially in the coming years.

- Strategic Positioning: Developing specialized energy solutions tailored to the unique demands of these niche applications.

Development of Enhanced Digital Energy Management Platforms

Adven's development of enhanced digital energy management platforms, particularly those leveraging AI for optimization, positions them within a high-growth segment of the smart grid and IoT-enabled energy market. These platforms are designed to facilitate data-driven decision-making for customers, offering advanced analytics and predictive capabilities. For instance, by 2024, the global smart grid market was projected to reach over $100 billion, with software and analytics forming a significant portion of this growth.

While the potential is substantial, Adven's market share in these specific software and platform offerings is likely in its early stages. This suggests these initiatives would be categorized as question marks in the BCG matrix, requiring significant investment to capture market share in a rapidly expanding but competitive landscape. The focus is on building capabilities and gaining traction.

- High Growth Potential: The demand for sophisticated energy management software is escalating, driven by the need for efficiency and sustainability.

- Nascent Market Share: Adven's presence in this specific software segment is likely new, indicating an opportunity for significant expansion.

- Investment Requirement: Developing and marketing these advanced platforms necessitates substantial capital to compete effectively and build market penetration.

- Strategic Focus: The goal is to establish a strong foothold, leveraging AI and IoT to differentiate offerings and capture future market share.

Question Marks represent Adven's ventures into markets with high growth potential but currently low market share. These are strategic bets requiring significant investment to develop into market leaders. The key is to identify which of these will successfully transition to Stars.

Adven's investments in emerging technologies, such as advanced battery materials and niche renewable energy solutions, fit this category. These areas, while promising, demand substantial capital to scale and compete effectively.

The company's focus on acquiring and developing new digital infrastructure, like fiber optic networks, also falls under Question Marks. These require substantial resources to build out and gain market traction.

Ultimately, Adven must carefully manage these Question Marks, channeling resources to those with the highest probability of success, while potentially divesting from those that fail to gain momentum.

| Business Unit | Market Growth | Market Share | Investment Need | Potential Outcome |

| Norwegian Real Estate | High | Low | High | Star or Dog |

| Fiber Optic Connectivity | High | Low | High | Star or Dog |

| Pilot Renewable Tech | High | Very Low | Very High | Star or Dog |

| Lithium Project Energy Role | High | Low | High | Star or Dog |

| AI Energy Management Platforms | High | Low | High | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.