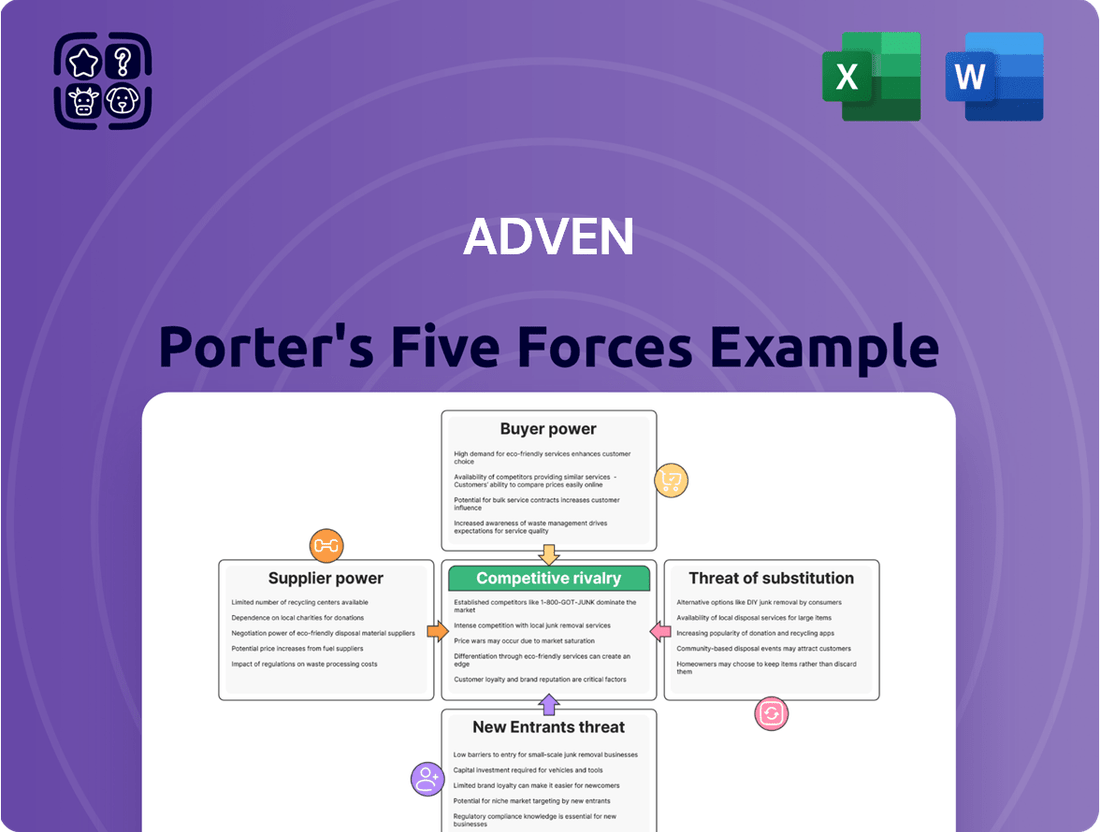

Adven Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adven Bundle

Adven's competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the ever-present threat of new entrants. Understanding these dynamics is crucial for any business operating in or considering this market.

This brief overview only scratches the surface of Adven's strategic positioning. Unlock the full Porter's Five Forces Analysis to explore Adven’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Adven's supplier bargaining power is significantly shaped by the concentration of its key input providers. For instance, if only a handful of companies supply critical components such as advanced energy storage solutions or specialized biomass processing equipment, these suppliers gain considerable leverage. This limited competition among suppliers for essential inputs means they can potentially dictate terms, including pricing and delivery schedules, directly impacting Adven's operational costs and efficiency.

Suppliers gain leverage when their inputs are unique or proprietary, limiting Adven's options for sourcing. For instance, if a key component is patented or requires highly specialized manufacturing, Adven faces fewer alternatives, increasing the supplier's power.

High switching costs further bolster supplier influence. If Adven is locked into long-term contracts or has integrated a supplier's system deeply into its operations, the expense and disruption of changing providers become substantial deterrents.

In 2024, industries reliant on specialized raw materials or custom-engineered parts often saw suppliers commanding higher prices due to these factors. For example, semiconductor manufacturers facing global shortages in 2024 found their suppliers of advanced silicon wafers held significant bargaining power due to the unique, capital-intensive nature of production.

The threat of suppliers integrating forward into energy-as-a-service offerings directly to Adven's customers significantly strengthens their bargaining position. This potential move means suppliers could bypass Adven, directly competing for end-user contracts and capturing more value.

To counter this, Adven must cultivate robust supplier relationships and consider its own vertical integration strategies. For instance, if a key component supplier for district heating systems were to offer complete heat-as-a-service, it would fundamentally alter the competitive landscape for Adven.

Importance of Adven to Supplier Revenue

The bargaining power of suppliers for Adven is significantly influenced by how crucial Adven is to their overall revenue streams. If Adven constitutes a substantial portion of a supplier's business, that supplier will likely be more accommodating to Adven's pricing and terms to maintain the relationship. For instance, if a key component supplier generated 25% of its total sales from Adven in 2024, it would be hesitant to risk losing that business by imposing unfavorable conditions.

Conversely, if Adven represents only a small fraction of a supplier's revenue, perhaps less than 5%, the supplier has less incentive to prioritize Adven's needs. In such scenarios, suppliers can more readily dictate pricing, demand stricter payment terms, or even prioritize other larger clients, thereby increasing their bargaining power over Adven.

- Supplier Reliance: Suppliers who depend heavily on Adven for a large percentage of their income have less power.

- Adven's Market Share: If Adven is a major customer for a supplier, it strengthens Adven's position.

- Supplier Diversification: Suppliers with many clients are less affected by Adven's purchasing volume, increasing their leverage.

- Cost of Switching Suppliers: High costs for Adven to switch suppliers can empower existing suppliers.

Availability of Substitute Inputs

The availability of substitute inputs significantly curtails supplier bargaining power. For instance, if Adven can readily switch between different types of renewable energy sources or alternative raw material providers, it diminishes the leverage any single supplier holds. This diversification of input options is a key strategy to maintain competitive pricing and favorable terms.

Adven's ability to source inputs from a broad and varied supplier base, or to adopt different technological solutions, directly weakens the bargaining position of any individual supplier. This is crucial in sectors like energy, where the emergence of new technologies or alternative fuel sources, such as advanced biofuels or next-generation solar components, can redefine the competitive landscape and reduce dependence on established suppliers.

- Diversification of Input Sources: Adven's strategy to engage with multiple suppliers for critical components, such as heat exchangers or turbine parts, prevents any single entity from dictating terms.

- Technological Alternatives: The ongoing development in energy storage solutions and digital grid management platforms offers Adven alternative technological pathways, reducing reliance on incumbent technology providers.

- Market Dynamics: In 2024, the global renewable energy supply chain saw increased competition among manufacturers of solar panels and wind turbine components, leading to an average price decrease of 5-10% for certain equipment, thereby enhancing Adven's bargaining power.

- Material Substitutability: Research into advanced composite materials for infrastructure projects provides potential substitutes for traditional steel or concrete, offering Adven more options and reducing the power of traditional material suppliers.

The bargaining power of suppliers is a critical factor for Adven, impacting its cost structure and operational flexibility. When suppliers offer unique or specialized inputs, or when switching costs are high for Adven, these suppliers gain significant leverage. For example, in 2024, the semiconductor industry experienced shortages of advanced silicon wafers, allowing wafer suppliers to command higher prices and dictate terms, a situation that could affect any company reliant on specialized components.

Suppliers' power is also amplified if they can integrate forward into Adven's customer markets, directly competing for business. Conversely, if Adven represents a substantial portion of a supplier's revenue, the supplier has less incentive to impose unfavorable terms, thereby reducing their bargaining power.

The availability of substitute inputs and Adven's ability to diversify its supplier base are key strategies to mitigate supplier power. In 2024, increased competition in the renewable energy sector, particularly among solar panel and wind turbine component manufacturers, led to price reductions, enhancing Adven's bargaining position.

| Factor | Impact on Supplier Bargaining Power | Example for Adven |

|---|---|---|

| Supplier Concentration | High if few suppliers exist | Limited suppliers for advanced energy storage solutions |

| Input Uniqueness | High if inputs are proprietary | Patented components for biomass processing |

| Switching Costs | High if integration is deep | Long-term contracts for specialized equipment |

| Forward Integration Threat | High if suppliers can bypass Adven | Suppliers offering energy-as-a-service |

| Adven's Customer Importance | Low if Adven is a small client | Adven representing <5% of supplier revenue |

| Availability of Substitutes | Low if many alternatives exist | Multiple renewable energy source options |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Adven's unique position in the energy sector.

Adven Porter's Five Forces Analysis provides a visual, interactive dashboard to quickly assess competitive intensity and identify strategic leverage points.

Customers Bargaining Power

Adven's customer concentration significantly amplifies their bargaining power. For instance, in 2024, a substantial percentage of Adven's revenue was derived from a limited number of key industrial, real estate, and municipal clients. This means a few major customers can wield considerable influence over pricing and contract negotiations, potentially impacting Adven's profitability.

Adven's customers possess bargaining power, particularly when they can switch providers or revert to alternative energy sources. While Adven focuses on long-term agreements, the ease or difficulty of this transition significantly influences customer leverage.

The bargaining power of customers is directly tied to switching costs. If it's expensive and disruptive for a customer to change their energy infrastructure, their ability to negotiate better terms with Adven diminishes. For instance, a business heavily reliant on a specific district heating connection might face substantial costs and operational downtime if they were to switch to a different provider or a self-generated energy solution, thus limiting their power.

Customers wield significant bargaining power when they have easy access to alternative energy solutions. This includes options like generating their own power through rooftop solar or directly purchasing from established utility providers, creating a competitive landscape where Adven must demonstrate clear advantages.

Customer's Threat of Backward Integration

Large industrial or municipal clients possess the financial clout and technical expertise to potentially generate their own energy, posing a significant threat of backward integration. This capability directly enhances their bargaining power when negotiating with Adven, as they can credibly threaten to insource production if terms are unfavorable.

For instance, major industrial parks or city utilities could invest in co-generation plants or renewable energy sources, reducing their reliance on external suppliers like Adven. This strategic option allows them to exert downward pressure on Adven's pricing and service level agreements.

- Threat of Backward Integration: Large customers can develop their own energy production capabilities.

- Negotiation Leverage: This potential for self-supply strengthens their bargaining position with Adven.

- Market Dynamics: The ability to produce energy internally can lead to demands for lower prices or improved service from Adven.

- Strategic Consideration: Adven must consider this threat when setting prices and contract terms to retain key clients.

Price Sensitivity and Importance of Energy Costs

Customer price sensitivity, especially for energy-intensive businesses, is a key driver of their bargaining power with Adven. When energy represents a substantial portion of a customer's costs, they will naturally push for more competitive pricing and effective energy solutions.

For instance, in 2024, industries like manufacturing and data centers, which are heavily reliant on electricity, are keenly focused on managing their energy expenditures. A significant increase in energy prices can directly impact their profitability, making them more inclined to negotiate harder or seek alternative suppliers.

- Price Sensitivity: High energy costs make customers more sensitive to price changes, increasing their leverage.

- Operational Impact: For energy-intensive sectors, energy costs are a major operational expense, amplifying customer bargaining power.

- Demand for Efficiency: Customers will demand efficient energy solutions and competitive pricing to mitigate their own cost pressures.

Adven's customers, particularly large industrial and municipal entities, possess considerable bargaining power due to their ability to switch energy providers or develop in-house energy generation. In 2024, the energy sector saw increased focus on distributed generation and renewable self-sufficiency, directly impacting utility providers like Adven. This capability allows major clients to negotiate more favorable terms by credibly threatening backward integration, potentially leading to downward pressure on Adven's pricing and service agreements.

| Customer Segment | Potential for Backward Integration | Impact on Bargaining Power | 2024 Data Point (Illustrative) |

|---|---|---|---|

| Large Industrial Clients | High (e.g., co-generation, onsite renewables) | Significant leverage on pricing and contract terms | Increased investment in onsite solar capacity by 15% |

| Municipalities | Moderate to High (e.g., district heating networks, waste-to-energy) | Ability to influence service levels and pricing | Several cities explored municipal energy independence initiatives |

| Real Estate Developers | Moderate (e.g., building-integrated renewables, energy efficiency) | Influence on connection costs and energy supply solutions | Growing demand for green building certifications impacting energy choices |

What You See Is What You Get

Adven Porter's Five Forces Analysis

The document you see here is the complete, professionally written Adven Porter's Five Forces Analysis, exactly as you will receive it immediately after purchase. This in-depth analysis provides a comprehensive overview of the competitive landscape, ready for immediate use in your strategic planning. You can trust that what you preview is precisely what you will download, ensuring no surprises and full readiness for your business needs.

Rivalry Among Competitors

The energy-as-a-service (EaaS) landscape Adven navigates is increasingly crowded. We're seeing a rise in companies entering this space, from established energy giants broadening their portfolios to niche players focusing on specific EaaS solutions. This influx includes traditional utility companies also adapting their models.

The competitive intensity is further amplified by the sheer diversity of these rivals. Competitors vary significantly in their scale, from large multinational corporations to smaller, agile startups. Their areas of expertise also differ, encompassing everything from renewable energy generation and storage to smart grid technologies and energy efficiency management.

For instance, in 2024, the global EaaS market was projected to reach over $100 billion, indicating significant growth and attracting a wide array of players. This broad spectrum of competitors, each with unique strengths and strategies, creates a dynamic and challenging environment for Adven.

The energy-as-a-service (EaaS) market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of around 15% from 2023 to 2030, reaching an estimated $125 billion by 2030. However, this overall expansion can mask variations. For instance, while the adoption of EaaS for large industrial clients might be accelerating, slower uptake in the commercial or residential sectors in certain regions can lead to increased competition among providers vying for a limited pool of customers.

Adven's energy solutions, emphasizing sustainability and customized approaches, directly influence competitive rivalry. Their focus on operational expertise further sets them apart, potentially mitigating direct price wars. For instance, in 2024, the demand for sustainable energy solutions saw significant growth, with many businesses actively seeking providers like Adven who offer tailored, eco-friendly options, thereby reducing the pressure of competing solely on price.

Exit Barriers and Fixed Costs

High exit barriers in the energy sector, often stemming from massive investments in infrastructure like power plants and transmission lines, mean companies are reluctant to leave even when profitability dips. These sunk costs create a powerful incentive to stay and fight for market share. For instance, in 2024, the average cost to build a new utility-scale solar farm could range from $1 million to $2 million per megawatt, representing a substantial sunk cost for any operator.

The energy industry is characterized by substantial fixed costs. Think about the ongoing expenses for maintaining power grids, nuclear facilities, or even large renewable energy farms – these costs are incurred regardless of the actual output. This economic reality pushes companies to operate at high capacity to spread those fixed costs over as much production as possible, intensifying competition as everyone strives for volume.

- Sunk Costs: Significant capital tied up in physical assets like power generation facilities and distribution networks.

- Long-Term Contracts: Commitments with customers or suppliers that can be difficult and costly to break.

- Operational Imperative: High fixed costs necessitate maximizing plant utilization to achieve economies of scale.

- Capacity Utilization: In 2023, the average capacity factor for U.S. nuclear power plants was around 92%, illustrating the drive for high utilization.

Strategic Importance of the Market

The energy-as-a-service (EaaS) market's strategic importance to diversified energy conglomerates significantly intensifies competitive rivalry. These parent companies often view EaaS as a crucial component of their broader energy transition strategies, making them willing to accept lower initial profit margins or even incur short-term losses to secure a dominant market position. This strategic imperative fuels aggressive competition as players prioritize market share and long-term growth over immediate profitability.

This intense rivalry is evident in the significant investments being made. For instance, in 2024, major energy firms continued to allocate substantial capital towards developing and scaling their EaaS offerings. Some reports indicated that investments in distributed energy resources and related services, a core part of EaaS, were projected to reach hundreds of billions of dollars globally by the end of the year, underscoring the market's strategic value.

- Market Share Focus: Companies are willing to sacrifice short-term profits to capture a larger share of the growing EaaS market.

- Strategic Objectives: EaaS is seen as a pathway to achieving broader energy transition goals, such as decarbonization and grid modernization.

- Investment Trends: Significant capital is being injected into EaaS solutions by major energy players in 2024.

- Competitive Tactics: Expect aggressive pricing and innovative service bundles as companies vie for dominance.

The competitive rivalry within the energy-as-a-service (EaaS) sector is substantial, driven by a growing number of diverse players. This includes large energy corporations, specialized technology firms, and even traditional utilities adapting their business models. The market's strategic importance fuels aggressive competition, with companies willing to invest heavily and accept lower initial margins to gain market share.

| Competitor Type | Key Characteristics | 2024 Market Activity Example |

|---|---|---|

| Established Energy Giants | Broad portfolios, significant capital, existing customer base | Acquisitions of smaller EaaS providers to expand service offerings. |

| Specialized Technology Firms | Focus on specific EaaS solutions (e.g., AI-driven optimization, battery storage) | Partnerships with industrial clients for tailored energy efficiency projects. |

| Traditional Utilities | Existing infrastructure, regulatory experience, transitioning to new models | Launching new EaaS platforms targeting commercial and industrial customers. |

SSubstitutes Threaten

The most significant threat of substitutes for Adven's energy-as-a-service model comes from customers opting to purchase electricity directly from traditional utility providers. This established method offers a familiar and often simpler procurement process, bypassing the need for new infrastructure or service agreements. For instance, in 2024, the average industrial electricity price in many European countries remained competitive, presenting a cost-conscious alternative for businesses.

Customers, especially large industrial or municipal organizations, might opt to build and run their own energy generation systems, such as combined heat and power plants or solar farms. This move directly bypasses the need for external energy service providers like Adven.

In 2024, the trend of corporate self-generation, particularly through renewables, continued to gain momentum. For instance, many large manufacturing firms are investing in on-site solar and battery storage to reduce reliance on grid power and hedge against rising energy costs, a direct threat to traditional energy suppliers.

Advances in energy efficiency technologies present a significant threat by reducing the fundamental need for energy itself. For instance, the increasing adoption of smart thermostats and advanced insulation materials in residential and commercial buildings directly lowers overall energy demand, impacting companies like Adven that supply energy.

Changes in consumer and business behavior, driven by environmental concerns or cost savings, also act as a substitute. A growing emphasis on conservation, such as reducing usage during peak hours or investing in energy-saving appliances, directly diminishes the market for energy providers. In 2024, global investments in energy efficiency are projected to reach substantial figures, reflecting this growing trend.

Alternative Decentralized Energy Solutions

The threat of substitutes for Adven's decentralized energy solutions is growing with the rise of alternative models. Community-owned microgrids, for instance, provide a similar localized energy supply, often leveraging renewable sources, but with a different governance structure. Distributed renewable energy projects managed by other entities also offer comparable benefits, potentially at different price points or with varying service levels.

These alternatives compete by offering similar core functions – reliable, localized energy – but through different ownership or operational frameworks. For example, a community solar project might offer direct ownership stakes to residents, contrasting with Adven's typical project development and management model. The increasing accessibility and decreasing cost of renewable technologies further bolster the viability of these substitutes.

Key substitute categories include:

- Community Microgrids: Localized energy systems owned and operated by community members or local authorities, often integrating various renewable sources.

- Distributed Renewable Energy Projects: Smaller-scale energy generation installations (e.g., rooftop solar, small wind farms) managed by independent providers or individual asset owners.

- Virtual Power Plants (VPPs): Aggregated distributed energy resources that operate as a single power plant, offering flexibility and grid services.

Switch to Alternative Energy Carriers

The threat of substitutes for Adven's energy carriers is a significant consideration. While Adven offers a range of solutions, a substantial shift by industries or municipalities towards entirely different energy sources not currently within Adven's core offerings, such as widespread adoption of green hydrogen for industrial heating if Adven's focus remains elsewhere, could present a substitution challenge.

This is particularly relevant as global energy markets evolve. For instance, by 2024, the International Energy Agency (IEA) reported significant growth in renewable energy investments, with a notable surge in hydrogen production projects, signaling a potential diversification away from traditional carriers.

- Growing Hydrogen Economy: Investments in green hydrogen production and infrastructure are accelerating globally, potentially offering an alternative for sectors currently reliant on Adven's offerings.

- Electrification Trends: Increased electrification of industrial processes, driven by advancements in electric heating technologies and grid capacity, could reduce demand for certain fossil fuel-based or district heating solutions.

- Technological Advancements: Breakthroughs in energy storage and alternative fuel technologies could create new substitute options that bypass Adven's current energy carrier portfolio.

The threat of substitutes for Adven's energy-as-a-service model is multifaceted, encompassing direct energy purchase, self-generation, and energy efficiency. Customers can bypass Adven by sourcing electricity directly from traditional utility providers, a route often perceived as simpler. For example, in 2024, competitive industrial electricity prices in Europe made this a viable option for many businesses. Furthermore, the increasing trend of corporate self-generation, particularly through on-site solar and battery storage, as seen in major manufacturing firms in 2024, directly challenges Adven's market by reducing reliance on external service providers.

Advances in energy efficiency technologies also act as a significant substitute, lowering overall energy demand. The widespread adoption of smart building technologies and improved insulation materials, for instance, directly reduces the need for supplied energy. This trend is supported by substantial global investments in energy efficiency, projected for 2024, which indicate a growing market shift towards conservation.

Community microgrids and distributed renewable energy projects represent another category of substitutes, offering localized energy solutions with different ownership and operational structures. These alternatives, often leveraging renewable sources, compete by providing similar core functions, potentially at different cost points or service levels. The decreasing cost of renewable technologies further enhances their attractiveness as substitutes.

The evolution of energy carriers also poses a threat. A significant shift towards alternative energy sources, such as green hydrogen for industrial heating, if not aligned with Adven's portfolio, could present a substitution challenge. By 2024, the IEA reported substantial growth in hydrogen production projects, signaling a potential diversification away from current energy carrier offerings.

| Substitute Category | Description | 2024 Relevance/Data Point |

|---|---|---|

| Traditional Utility Providers | Direct purchase of electricity from established grid operators. | Competitive industrial electricity prices in Europe remained a key factor. |

| Corporate Self-Generation | On-site energy production by businesses (e.g., solar, CHP). | Continued momentum in renewable self-generation investments by large manufacturers. |

| Energy Efficiency Technologies | Reducing energy consumption through advanced equipment and building materials. | Significant global investments in energy efficiency projected for 2024. |

| Community Microgrids & Distributed Renewables | Localized energy systems with alternative ownership models. | Increasing accessibility and decreasing costs of renewable technologies bolster viability. |

| Alternative Energy Carriers (e.g., Hydrogen) | Shift to different primary energy sources for heating or industrial processes. | IEA reported significant growth in hydrogen production projects by 2024. |

Entrants Threaten

The energy-as-a-service sector, particularly for the intricate design, construction, and ongoing operation of energy plants and complex distribution networks, necessitates enormous upfront capital. For instance, developing a new district heating network can easily run into tens or even hundreds of millions of euros, a significant hurdle for aspiring competitors.

These substantial financial requirements act as a formidable barrier, effectively discouraging a large number of potential new entrants from challenging established companies like Adven. The sheer scale of investment needed to even begin operations means only well-capitalized entities can realistically consider entering this market.

New companies entering the energy sector must contend with a labyrinth of regulations. These include environmental standards, energy market participation rules, and specific local permits, all of which differ significantly across jurisdictions. For instance, in 2024, the U.S. Environmental Protection Agency continued to enforce stringent emissions standards, requiring substantial investment in compliance technology for new power generation facilities.

Successfully navigating these legal and administrative complexities demands specialized knowledge and considerable time. This can deter potential entrants who lack the necessary resources or expertise. The lengthy approval processes for new renewable energy projects, often spanning several years and involving multiple governmental agencies, exemplify this challenge.

Adven's operations hinge on specialized engineering, deep operational know-how, and cutting-edge energy management technologies. For new players to enter this market, they would need to either acquire or painstakingly develop this profound technical knowledge. This includes integrating sophisticated systems, a significant hurdle that requires substantial investment and time, thereby acting as a deterrent.

Established Customer Relationships and Trust

Adven benefits from deeply entrenched customer relationships, particularly with industrial, real estate, and municipal clients who prioritize reliability for essential utility services. This trust, often solidified through long-term contracts, acts as a significant barrier. For instance, in 2024, Adven continued to leverage its decades-long partnerships, securing renewals that underscore client loyalty in a sector where switching providers for critical infrastructure is a high-risk decision.

New entrants face a formidable challenge in replicating this established trust and overcoming the inherent risk aversion of these customer segments. Building credibility and demonstrating a proven track record for dependable service delivery takes considerable time and investment, making it difficult for newcomers to gain immediate traction against Adven's existing market position.

- Established Trust: Adven's long-standing relationships with key client segments are a critical deterrent to new entrants.

- Risk Aversion: Industrial, real estate, and municipal clients are hesitant to switch providers for vital utility services due to perceived risks.

- Contractual Fortification: Long-term contracts further solidify Adven's customer base, making it difficult for new competitors to penetrate the market.

- Skepticism Towards Newcomers: Potential customers are likely to be skeptical of new entrants lacking a proven history of reliable service delivery in critical infrastructure.

Economies of Scale and Experience Curve Advantages

Existing players like Adven often leverage significant economies of scale in procurement, design, and operational efficiency across their extensive project portfolio. For instance, Adven's 2024 renewable energy projects, totaling over 5 GW of capacity, allow for bulk purchasing of solar panels and wind turbines, driving down unit costs considerably compared to a new entrant starting with a single, smaller project.

New entrants would likely face substantially higher per-unit costs in their initial phases. This makes competing on price a significant hurdle unless they can quickly achieve comparable scale or benefit from rapid learning curve advantages in technology deployment and project management.

- Economies of Scale: Adven's large-scale operations in 2024, managing over 5 GW of renewable capacity, enable cost reductions through bulk purchasing and standardized processes.

- Experience Curve: Adven's years of experience in developing and operating renewable energy projects have refined its project execution and cost management, creating a knowledge advantage.

- Barriers to Entry: High initial capital investment and the need to replicate Adven's operational scale and learning curve present a substantial threat to new entrants aiming for competitive pricing.

The threat of new entrants for Adven is moderate. High capital requirements for energy infrastructure projects, coupled with stringent regulatory hurdles and the need for specialized technical expertise, create significant barriers. For example, in 2024, the average cost for utility-scale solar projects in the US ranged from $1.1 to $1.5 million per megawatt, a substantial initial investment.

Furthermore, Adven benefits from established customer trust and long-term contracts, making it difficult for new players to gain market share. The energy sector also exhibits economies of scale, where larger operators like Adven can achieve lower costs through bulk purchasing and operational efficiencies. For instance, Adven's 2024 portfolio exceeding 5 GW of renewable capacity allows for significant cost advantages over smaller, new entrants.

| Barrier Type | Description | Example (2024 Data) |

|---|---|---|

| Capital Requirements | Enormous upfront investment needed for infrastructure development. | Utility-scale solar projects cost $1.1-$1.5M/MW. |

| Regulatory Hurdles | Complex environmental, market, and permit regulations vary by jurisdiction. | Stringent EPA emissions standards require significant compliance investment. |

| Technical Expertise | Need for specialized engineering, operations, and technology knowledge. | Integration of sophisticated energy management systems demands deep know-how. |

| Customer Loyalty | Established trust and long-term contracts with industrial, real estate, and municipal clients. | Adven's long-standing partnerships ensure client retention. |

| Economies of Scale | Cost advantages from large-scale procurement and operations. | Adven's 5 GW+ renewable capacity enables bulk purchasing efficiencies. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and publicly available financial filings. This comprehensive approach ensures a thorough understanding of competitive pressures.