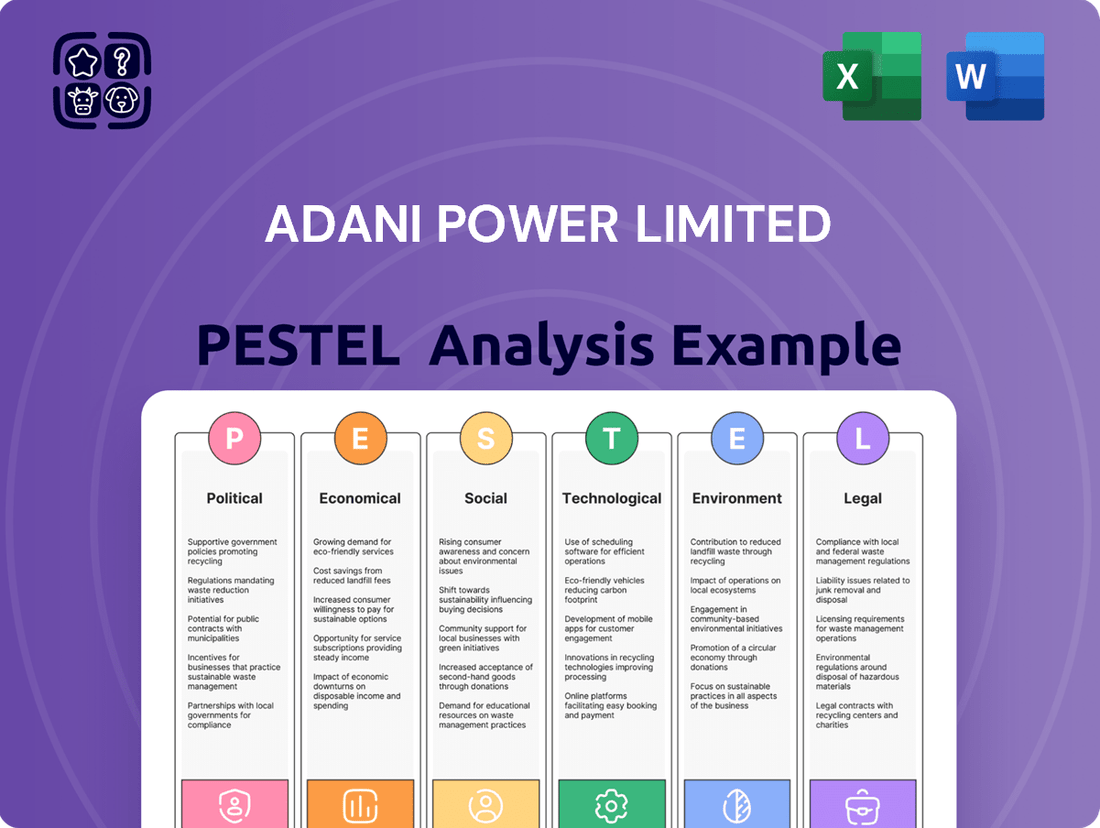

Adani Power Limited PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adani Power Limited Bundle

Adani Power Limited operates within a dynamic external environment, influenced by evolving political landscapes, fluctuating economic conditions, and rapid technological advancements in the energy sector. Understanding these forces is crucial for strategic planning and risk mitigation.

Our comprehensive PESTLE analysis dives deep into how these external factors, including social trends, environmental regulations, and legal frameworks, are shaping Adani Power Limited's present and future. Gain a competitive edge by leveraging these expert insights.

Don't get left behind in the rapidly changing energy market. Purchase the full PESTLE analysis of Adani Power Limited today to unlock actionable intelligence and make informed decisions for your business or investments.

Political factors

Government policies in India are a major influence on Adani Power, especially concerning its thermal power operations. The Indian government has outlined plans to add significant coal-fired power capacity, aiming for around 30 GW by 2032, underscoring a continued focus on coal for energy security. This commitment to thermal power provides a stable, albeit evolving, operational landscape for Adani Power.

Simultaneously, India is aggressively pursuing renewable energy targets, aiming for 500 GW of non-fossil fuel capacity by 2030. This dual policy environment, balancing thermal power needs with a rapid renewable energy transition, presents both opportunities and challenges for Adani Power as it navigates future energy strategies.

India's strong commitment to energy security significantly bolsters thermal power generators like Adani Power. As coal continues to be a cornerstone for baseload power, these mandates create a favorable environment for companies operating in this sector.

The government's drive to satisfy escalating electricity needs, with projections indicating continued growth, underscores the importance of a dependable power infrastructure. Thermal plants, including those operated by Adani Power, are integral to meeting this demand, ensuring a steady market for their output.

Regulatory stability is a cornerstone for long-term investments in the power industry, and Adani Power has seen a significant shift towards greater certainty. The resolution of major regulatory disputes and the successful recovery of outstanding regulatory dues have paved the way for more predictable operations.

This improved regulatory environment directly benefits Adani Power by enhancing its ability to engage in robust business planning and more accurate financial forecasting. For instance, the company's focus on resolving past disputes, such as those related to compensatory tariffs, demonstrates a commitment to operating within a stable framework.

Promotion of Renewable Energy

The Indian government's strong push for renewable energy, aiming for 500 GW of non-fossil fuel capacity by 2030, directly impacts Adani Power. This policy shift, driven by climate change commitments, creates both challenges for its thermal power business and opportunities for diversification.

Incentives for private investment in solar, wind, and energy storage are significant. For instance, Production Linked Incentives (PLI) schemes are designed to boost domestic manufacturing of solar PV modules. Adani Power, recognizing this trend, is actively expanding its own renewable energy portfolio, aligning with these national objectives.

- National Target: India aims for 500 GW of non-fossil fuel energy capacity by 2030.

- Government Support: Incentives and policies are in place to encourage private sector participation in renewables.

- Adani Group's Role: Adani Power, as part of the Adani Group, is investing heavily in renewable energy projects.

- Market Shift: The focus on renewables necessitates adaptation for traditional thermal power producers.

International Climate Agreements and Pressure

India's commitment to the Paris Agreement, aiming for net-zero emissions by 2070, significantly shapes its energy policy. This global accord compels a gradual shift away from carbon-intensive sources, impacting Adani Power's long-term strategy.

Despite coal's continued dominance in India's energy landscape, international pressure and domestic environmental concerns are mounting. This necessitates a strategic pivot for companies like Adani Power towards cleaner energy alternatives and diversification.

- Paris Agreement Goals: India pledged to reduce its emissions intensity by 33-35% from 2005 levels by 2030 and achieve net-zero emissions by 2070.

- Renewable Energy Targets: India aims for 500 GW of non-fossil fuel-based energy capacity by 2030, encouraging investments in solar, wind, and other green technologies.

- Carbon Pricing Mechanisms: Discussions around carbon taxes or emissions trading schemes, influenced by international trends, could further incentivize decarbonization efforts for power producers.

Political stability in India is crucial for Adani Power's operations, with government policies dictating the energy mix and regulatory frameworks. The Indian government's commitment to energy security means continued, albeit managed, support for thermal power, with plans to add significant coal capacity by 2032.

However, the aggressive push for renewable energy, targeting 500 GW of non-fossil fuel capacity by 2030, necessitates strategic adaptation for Adani Power. This dual policy environment creates both a stable market for existing thermal assets and a clear imperative for diversification into renewables.

The resolution of past regulatory disputes has brought greater certainty to Adani Power's operations, enhancing financial forecasting. For instance, the company has benefited from the recovery of outstanding regulatory dues, improving its operational and financial planning capabilities.

India's adherence to international climate agreements, like the Paris Agreement's net-zero by 2070 goal, influences long-term energy strategies. This global commitment, coupled with domestic environmental concerns, pressures a gradual shift away from carbon-intensive sources, driving Adani Power's diversification efforts.

| Policy Area | 2024/2025 Outlook | Impact on Adani Power |

|---|---|---|

| Thermal Power Capacity Addition | Continued focus on adding coal capacity (e.g., ~30 GW by 2032) | Provides a stable market for existing thermal assets, but faces long-term scrutiny. |

| Renewable Energy Targets | Aggressive expansion to 500 GW non-fossil fuel capacity by 2030 | Creates significant opportunities for diversification and investment in solar, wind, and storage. |

| Regulatory Environment | Increased stability and resolution of past dues | Enhances financial planning, reduces operational uncertainty, and encourages investment. |

| Climate Commitments | Net-zero by 2070, emissions intensity reduction | Drives a long-term strategic pivot towards cleaner energy and away from carbon-intensive sources. |

What is included in the product

This PESTLE analysis of Adani Power Limited examines the influence of political, economic, social, technological, environmental, and legal factors on its operations and strategic planning.

Adani Power Limited's PESTLE analysis offers a pain point reliever by providing a clear, summarized version of external factors for easy referencing during strategic discussions, enabling quicker decision-making and risk mitigation.

Economic factors

India's economic expansion, fueled by increasing urbanization and robust industrial activity, is creating a substantial surge in electricity demand. This upward trend is a key driver for companies like Adani Power Limited.

Projections indicate sustained demand growth, with an estimated 4% increase in 2025 and a further 6.6% rise anticipated in 2026. This consistent growth in electricity consumption directly benefits Adani Power by translating into higher power sales volumes, which in turn bolsters its revenue streams and enhances overall operational performance.

Adani Power's profitability is heavily influenced by coal price volatility. For instance, in the first quarter of fiscal year 2024 (Q1 FY24), the company reported a significant increase in its earnings before interest, taxes, depreciation, and amortization (EBITDA), partly due to lower imported fuel prices, which averaged around $80 per tonne during that period. This demonstrates the direct impact of global coal markets on Adani Power's financial performance.

Securing a consistent and affordable supply of coal remains a critical strategic imperative. Adani Power has actively pursued long-term coal supply agreements to mitigate price fluctuations and ensure operational stability. As of late 2024, the company continues to focus on optimizing its fuel sourcing mix, balancing domestic procurement with strategic international imports to manage operational expenses and maintain competitive electricity tariffs.

The investment climate in India, particularly for the power sector, remains robust, directly impacting Adani Power's ability to secure funding for its ambitious expansion. The Adani Group's commitment to significant capital expenditure, especially in green energy and infrastructure, creates a favorable environment for its subsidiaries. For instance, the group's projected investments in renewable energy, totaling billions of dollars by 2030, underscore a strong confidence in the Indian market and its growth potential.

Availability of funding is a critical enabler for Adani Power's project pipeline. In 2023, the company successfully raised substantial funds through various debt instruments and equity issuances, demonstrating investor confidence and access to capital markets. This financial flexibility is essential for undertaking large-scale projects, such as the development of new thermal and renewable power plants, ensuring Adani Power can meet growing energy demands.

Tariff Realization and Power Purchase Agreements

Adani Power Limited's revenue hinges significantly on the tariffs it achieves through Power Purchase Agreements (PPAs) and regulatory decisions. For instance, in the fiscal year ending March 31, 2024, Adani Power reported a consolidated revenue of ₹52,908 crore. Tariff realization is a critical driver, and fluctuations in input costs, such as imported coal prices, directly impact the profitability of these agreements.

Lower tariff realizations can indeed moderate revenue growth, even if sales volumes increase. This underscores the imperative for Adani Power to secure and maintain favorable, long-term PPA terms that provide revenue stability and predictability. The company's ability to negotiate and adhere to these agreements is paramount for its financial performance.

Key factors influencing tariff realization include:

- PPA renegotiations and regulatory approvals: Changes in government policies or judicial pronouncements can affect existing tariff structures.

- Fuel cost pass-through mechanisms: The extent to which changes in imported coal prices can be passed on to consumers impacts the effective tariff.

- Competitive bidding outcomes: New PPAs secured through competitive tenders set benchmarks for future tariff realizations.

- Dispute resolution on tariffs: Pending or resolved tariff disputes can have a material impact on the company's revenue streams.

Foreign Exchange Rate Fluctuations

Adani Power Limited's extensive operations, particularly its reliance on importing crucial equipment and fuel, expose it significantly to the volatility of foreign exchange rates. For instance, a weakening of the Indian Rupee against major currencies like the US Dollar directly translates to higher costs for these essential imports. This can put considerable pressure on the company's bottom line, impacting profitability and cash flow.

For example, in fiscal year 2023-24, Adani Power's consolidated revenue was INR 37,778 crore. Any significant depreciation in the INR during this period would have directly increased the rupee cost of its dollar-denominated import expenses, potentially eroding profit margins. Effective management of these currency risks is therefore a critical economic factor for Adani Power.

The company must actively employ hedging strategies or other financial instruments to mitigate the adverse effects of currency fluctuations. This proactive approach is vital to ensure financial stability and protect its competitive position in the energy market.

- Import Costs: Adani Power's need to import machinery and fuels like coal makes it vulnerable to a depreciating Indian Rupee, increasing operational expenses.

- Profitability Impact: A weaker Rupee directly raises the cost of these imports, potentially squeezing profit margins and affecting financial performance.

- Risk Management: Proactive currency risk management through hedging is essential for Adani Power to maintain financial stability and competitiveness.

- FY24 Performance: With consolidated revenue of INR 37,778 crore in FY24, currency swings can have a material impact on the company's reported earnings.

India's growing economy, projected to expand by 6.5% in 2024 and 7.0% in 2025, fuels a significant rise in electricity demand, directly benefiting Adani Power. However, the company's profitability is sensitive to coal price volatility, as seen when lower imported fuel prices around $80 per tonne in Q1 FY24 boosted EBITDA. Adani Power's revenue, which stood at ₹52,908 crore in FY24, is also tied to tariff realizations and the ability to pass through input cost changes.

The Indian Rupee's exchange rate significantly impacts Adani Power due to its reliance on imported equipment and fuel. A depreciating Rupee, as experienced in FY24 where consolidated revenue was INR 37,778 crore, directly increases import costs, potentially squeezing profit margins. Effective currency risk management through hedging is therefore crucial for maintaining financial stability and competitiveness.

| Economic Factor | Impact on Adani Power | Data/Context |

|---|---|---|

| Economic Growth (India) | Increases electricity demand, boosting sales volumes. | Projected GDP growth: 6.5% (2024), 7.0% (2025). |

| Fuel Price Volatility (Coal) | Directly affects operational costs and profitability. | Imported coal averaged ~$80/tonne in Q1 FY24, impacting EBITDA. |

| Tariff Realizations | Determines revenue from power sales; influenced by PPAs and input costs. | FY24 Consolidated Revenue: ₹52,908 crore. |

| Foreign Exchange Rates (INR Depreciation) | Increases cost of imported fuel and equipment, impacting margins. | FY24 Consolidated Revenue: INR 37,778 crore; hedging is critical. |

Full Version Awaits

Adani Power Limited PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of Adani Power Limited covers all crucial aspects, offering a comprehensive understanding of the external factors influencing its operations and strategic decisions. You'll gain insights into the political, economic, social, technological, legal, and environmental landscape impacting the company.

Sociological factors

Adani Power Limited's extensive operations, from the construction of its power plants to their ongoing management, are significant drivers of job creation. These opportunities extend beyond direct employment, fostering indirect job growth within local communities, thereby bolstering regional economies. For instance, the company's Mundra plant alone has been a substantial employer.

Beyond direct employment, Adani Power actively engages with the communities surrounding its operational sites. Through Corporate Social Responsibility (CSR) initiatives, the company invests in local development, education, and healthcare, aiming to improve the quality of life for residents. This community-focused approach is a crucial sociological element of its business model.

Public sentiment towards thermal power, particularly its environmental footprint and land acquisition practices, directly impacts Adani Power's social license to operate. Negative perceptions can lead to increased scrutiny and operational challenges.

Local opposition and protests, such as those seen in past projects, underscore the critical need for Adani Power to engage transparently with communities. For instance, in 2023, concerns over air quality and water usage were raised by residents near a proposed plant expansion in Gujarat, highlighting ongoing sensitivities.

Adani Power is a key player in India's drive for universal energy access, aiming to bring electricity to all citizens. The company's operations directly support national development goals by meeting the ever-increasing demand for power across the country.

In 2023, India's per capita electricity consumption reached approximately 1,200 kWh, a figure expected to grow significantly. Adani Power's ability to provide electricity at competitive tariffs is crucial for affordability, aligning with societal expectations and contributing to economic growth.

Health and Safety Standards

The well-being of employees and surrounding communities is a key sociological consideration for Adani Power. Adani Power's dedication to robust health and safety protocols directly impacts its public image and the smooth running of its facilities. For instance, in their 2023-24 ESG report, Adani Power highlighted a focus on occupational health and safety management systems across their plants, aiming to minimize workplace incidents.

Maintaining high safety standards is not just about compliance; it's fundamental to Adani Power's reputation and the trust it builds with stakeholders. A strong safety record, often detailed in their annual sustainability reports, contributes to operational resilience and can prevent costly disruptions. The company's approach often involves regular safety audits and training programs designed to foster a culture of safety awareness among its workforce.

- Employee Well-being: Adani Power prioritizes the health and safety of its workforce through comprehensive training and safety protocols.

- Community Impact: Ensuring the safety of communities near its power plants is a significant sociological factor influencing public perception and trust.

- ESG Reporting: Adani Power's commitment to high health and safety standards is often reflected in its Environmental, Social, and Governance (ESG) disclosures, providing transparency on its performance.

Urbanization and Changing Consumption Patterns

India's rapid urbanization is a significant sociological driver, directly fueling increased electricity demand. As more people move to cities, the need for power in homes and businesses escalates, reshaping how electricity is consumed. For instance, by 2023, India's urban population reached over 430 million, a figure projected to climb significantly in the coming years, placing immense pressure on power infrastructure.

Adani Power must strategically adjust its generation and distribution to meet these evolving urban demands. This includes not only scaling up capacity but also adapting to changing consumer preferences. A growing segment of the urban population now prioritizes reliable and sustainable power sources, influencing market expectations and investment decisions in the energy sector.

- Urban Population Growth: India's urban population is expected to reach 600 million by 2030, a substantial increase driving electricity consumption.

- Shifting Consumption Habits: Increased use of appliances, electric vehicles, and smart technologies in urban households contributes to higher per capita electricity usage.

- Demand for Reliability: Urban dwellers often experience greater disruption from power outages, leading to a stronger preference for consistent and stable electricity supply.

- Sustainability Awareness: Growing environmental consciousness among urban consumers is creating a market for cleaner energy alternatives, impacting Adani Power's long-term strategy.

Adani Power's societal impact is multifaceted, encompassing job creation and community engagement. The company's commitment to Corporate Social Responsibility (CSR) initiatives, focusing on education and healthcare in local areas, aims to uplift community well-being. In 2023, Adani Power continued to emphasize occupational health and safety, with a reported reduction in lost-time injury frequency rates across its operations, reflecting a dedication to employee welfare and operational safety.

Technological factors

Adani Power Limited is leveraging advancements in thermal power generation, notably supercritical and ultra-supercritical technologies. These technologies are designed to boost operational efficiency, leading to a reduction in coal usage and a decrease in emissions. For instance, Adani Power's Mundra plant, a flagship facility, employs supercritical technology, contributing to its improved performance metrics.

The ongoing integration of smart grid technologies across India is significantly reshaping the operational landscape for power utilities like Adani Power Limited. This modernization directly influences how electricity is transmitted and distributed, enhancing efficiency and reliability.

These advanced grid systems are crucial for improving overall grid stability, allowing for more effective management of electricity demand, and smoothing the integration of various energy sources, including renewables. For Adani Power, this means a more optimized and resilient power delivery network.

By 2024, India's smart grid initiatives were gaining momentum, with projects aimed at reducing transmission and distribution losses, which stood at approximately 17% in the fiscal year 2022-23, a key metric for efficiency improvement.

Adani Power is increasingly integrating digitalization and automation into its power plant operations. This shift promises significant improvements in efficiency and a reduction in operational expenses. For instance, advanced analytics can enable predictive maintenance, minimizing downtime and boosting overall plant reliability.

By embracing these digital solutions, Adani Power is positioning itself to be more agile and competitive. This technological adoption is crucial for navigating the rapidly evolving energy sector, where smart grids and data-driven decision-making are becoming standard. The company's investment in these areas reflects a forward-looking strategy to optimize performance and adapt to future market demands.

Development of Carbon Capture Technologies

Adani Power, while heavily invested in thermal power, faces a technological imperative to consider carbon capture, utilization, and storage (CCUS) for the long-term viability of its coal-fired assets. While CCUS is still in its early stages of commercial deployment in India, its advancement is crucial for emission mitigation strategies.

The global push for decarbonization is accelerating CCUS development. For instance, by late 2024, several large-scale CCUS projects globally are expected to be operational or in advanced stages, signaling a maturing technology landscape. This trend suggests that Adani Power may need to integrate CCUS into its future operational planning to comply with evolving environmental regulations and market expectations.

- Technological Advancement: Continued research and development in CCUS are making the technology more efficient and cost-effective, with projected cost reductions of 20-30% by 2030 for certain applications.

- Policy Support: Governments worldwide are increasingly offering incentives and regulatory frameworks to promote CCUS adoption, which could influence its feasibility for Indian power producers.

- Integration Challenges: Implementing CCUS at existing thermal power plants presents significant engineering and financial challenges, requiring substantial capital investment and operational adjustments.

Advancements in Energy Storage Solutions

India's push towards renewable energy, particularly solar and wind, is driving significant demand for advanced energy storage solutions. This is crucial for maintaining grid stability and addressing the inherent intermittency of these sources. For instance, by the end of 2023, India's installed renewable energy capacity reached over 179 GW, with a substantial portion coming from solar and wind power.

While Adani Power Limited has a significant thermal generation portfolio, the evolution of energy storage technologies like Battery Energy Storage Systems (BESS) and pumped hydro storage indirectly influences the operational landscape for thermal plants. These storage solutions can help manage peak demand and provide ancillary services, potentially reducing the reliance on flexible thermal generation during certain periods.

The government's focus on energy storage is evident in policy initiatives and tenders. For example, India has set ambitious targets for energy storage deployment, with plans to tender out significant capacities of BESS projects in the coming years. These advancements in storage could alter the dispatch order and economic viability of traditional power sources.

- Grid Stability: Renewable energy integration necessitates robust storage to manage fluctuations, with India targeting substantial BESS deployment.

- Indirect Impact: Advancements in BESS and pumped hydro can affect the operational flexibility and role of thermal plants in the energy mix.

- Policy Support: Government initiatives and tenders are actively promoting energy storage solutions to support renewable energy growth.

- Market Dynamics: The increasing deployment of storage technologies could reshape the competitive landscape for power generation.

Adani Power is adopting advanced thermal generation technologies like supercritical and ultra-supercritical to boost efficiency and cut emissions, as seen at its Mundra plant. The company is also integrating digitalization and automation for better operational efficiency and reduced costs, with advanced analytics enabling predictive maintenance.

The push for smart grids in India, aiming to reduce transmission and distribution losses which were around 17% in FY2022-23, directly impacts Adani Power's transmission and distribution network efficiency.

Adani Power must also consider carbon capture, utilization, and storage (CCUS) for its coal assets, a technology seeing global advancements with several large-scale projects expected by late 2024.

The growth in renewable energy, exceeding 179 GW by the end of 2023, drives demand for energy storage solutions like BESS, which could indirectly affect the operational role of thermal plants.

Legal factors

Adani Power Limited navigates a complex web of environmental regulations, particularly concerning emissions, ash utilization, and water usage. For instance, India's National Green Tribunal (NGT) has mandated specific emission standards for coal-fired power plants, requiring Adani Power to invest in advanced pollution control technologies. Failure to comply with these evolving standards, which include stringent limits on particulate matter and sulfur dioxide, can lead to significant fines and jeopardize operational permits.

The company must also adhere to regulations governing ash utilization, a byproduct of coal combustion. With coal power generation producing millions of tons of fly ash annually, compliance with directives promoting its use in infrastructure projects, such as road construction and brick manufacturing, is essential. Adani Power's water consumption is also under scrutiny, with regulations aimed at efficient water management and minimizing discharge of treated wastewater, especially in water-stressed regions where some of its plants are located.

The Electricity Act, 2003, along with directives from the Central Electricity Regulatory Commission (CERC) and state commissions, forms the bedrock of Adani Power's operational framework, influencing everything from tariff setting to power purchase agreements and market participation. These regulations are crucial for ensuring a stable and predictable operating environment.

Recent regulatory decisions have significantly bolstered Adani Power's outlook. For instance, CERC directives in late 2023 and early 2024 have provided clearer guidelines on tariff revisions and the treatment of certain costs, offering greater financial certainty. This regulatory clarity is instrumental in supporting the company's long-term investment and expansion plans.

Adani Power Limited's expansion and infrastructure projects, including transmission lines, are subject to India's Land Acquisition, Rehabilitation and Resettlement Act, 2013. This legislation mandates fair compensation and rehabilitation for affected landowners.

Recent project developments have encountered challenges, with public hearings and local objections sometimes delaying land acquisition processes. For instance, in 2023, the company faced community concerns regarding land for a proposed transmission corridor in Gujarat, underscoring the need for robust stakeholder engagement.

Corporate Governance and Shareholder Regulations

Adani Power Limited, being a public entity, operates under stringent corporate governance standards and shareholder regulations. These rules mandate transparency in operations and protect shareholder interests.

For instance, any significant corporate action, such as a potential stock split, must comply with these regulatory frameworks. This ensures fair treatment and clear communication with all stakeholders.

- Adherence to SEBI Regulations: Adani Power must comply with the Securities and Exchange Board of India (SEBI) guidelines on corporate governance, which include rules on board composition, audit committees, and insider trading.

- Shareholder Rights Protection: Regulations ensure that shareholders have the right to vote on key decisions, access company information, and receive fair treatment, especially during corporate restructuring or capital raising.

- Disclosure Requirements: The company is obligated to make timely and accurate disclosures of material information to the stock exchanges and the public, fostering investor confidence.

- Impact of Corporate Actions: Decisions like stock splits, as considered by Adani Power, are evaluated against these regulatory requirements to ensure compliance and shareholder benefit.

Competition Law and Market Dominance

Adani Power, as a major player in India's power generation sector, must navigate stringent competition laws. These regulations aim to prevent any single entity from gaining undue market dominance, ensuring a level playing field for all participants.

Any substantial growth initiatives, such as mergers or acquisitions, undertaken by Adani Power would undergo rigorous review by India's Competition Commission. This oversight is crucial for maintaining a competitive and fair market environment in the vital power industry.

- Market Share Scrutiny: Adani Power's significant share of India's thermal power capacity, exceeding 10% as of early 2024, makes it a focal point for competition regulators.

- Acquisition Approval: Past and future acquisitions, like the potential acquisition of the remaining stake in its Odisha power plant, are subject to approval to prevent monopolistic tendencies.

- Regulatory Compliance: Adherence to fair pricing and anti-competitive practices is continuously monitored to safeguard consumer interests and market integrity.

Adani Power operates under a dynamic legal framework, with the Electricity Act of 2003 and directives from regulatory bodies like the Central Electricity Regulatory Commission (CERC) significantly shaping its operations, including tariff setting and power purchase agreements. Recent CERC decisions in late 2023 and early 2024 have introduced greater financial predictability through clearer tariff revision guidelines, supporting the company's expansion plans. The company must also comply with land acquisition laws, such as the 2013 Act, which mandates fair compensation for displaced individuals, a process that can involve public hearings and community engagement, as seen with transmission corridor projects in Gujarat in 2023.

Environmental factors

Global and national initiatives to combat climate change are increasingly pressuring thermal power generators, including Adani Power, to significantly lower their carbon emissions. This is driving a strategic shift in the energy sector towards cleaner alternatives.

While coal continues to be a significant fuel source for Adani Power, the Adani Group's substantial investments in renewable energy projects, aiming for 45 GW of renewable capacity by 2030, alongside Adani Power's own ESG reporting, demonstrate a clear acknowledgment of these decarbonization mandates.

India's commitment to net-zero emissions by 2070, as stated at COP26, further amplifies these pressures, requiring companies like Adani Power to actively integrate more sustainable practices and explore lower-carbon fuel options or carbon capture technologies.

Adani Power Limited, like other thermal power generators, faces significant scrutiny regarding air pollution. Thermal power plants are major contributors to emissions like particulate matter (PM), sulfur dioxide (SO2), and nitrogen oxides (NOx). For instance, in India, the Central Electricity Authority reported that thermal power plants accounted for a substantial portion of industrial SO2 emissions.

To address this, Adani Power must continue to invest in and effectively implement advanced emission control technologies. This includes flue gas desulfurization (FGD) for SO2 reduction and selective catalytic reduction (SCR) or selective non-catalytic reduction (SNCR) for NOx control. Compliance with increasingly stringent environmental regulations, such as those set by India's Ministry of Environment, Forest and Climate Change, is crucial to avoid penalties and maintain operational licenses.

Adani Power's thermal power generation is significantly water-intensive, a critical concern given India's escalating water scarcity. For instance, in FY23, Adani Power's total water consumption was approximately 250 million cubic meters, highlighting the substantial water footprint of its operations.

The company is actively implementing advanced water management strategies to mitigate this challenge. This includes efforts to reduce specific water consumption per megawatt-hour generated, with some of its newer plants achieving specific water consumption rates below 2.5 cubic meters per MWh, a notable improvement.

Exploring alternative water sources, such as treated wastewater and desalinated water, is also a key focus. By diversifying its water intake, Adani Power aims to ensure operational continuity and sustainability, even in water-stressed regions where its power plants are located.

Ash Utilization and Waste Management

The substantial generation of fly ash from coal-fired operations presents a key environmental challenge for Adani Power. The company's focus on maximizing ash utilization is vital for meeting environmental regulations and implementing sustainable waste management practices. This often involves forging collaborations to find beneficial applications for the ash produced.

Adani Power has been actively pursuing higher ash utilization rates. For instance, in the fiscal year 2023-24, the company reported significant progress in this area, with utilization rates often exceeding 80% across its various power plants. This commitment is demonstrated through various initiatives and partnerships aimed at converting waste into valuable resources.

- Ash Utilization Commitment: Adani Power aims for high ash utilization rates to mitigate environmental impact.

- Partnerships for Reuse: Collaborations are key to finding beneficial applications for fly ash, such as in cement and brick manufacturing.

- Regulatory Compliance: Achieving high utilization is essential for adhering to environmental norms and sustainable waste management.

- FY23-24 Performance: The company reported utilization rates often surpassing 80% during the fiscal year 2023-24.

Biodiversity Impact and Land Degradation

Adani Power Limited's operations, particularly the construction and expansion of power plants and related infrastructure, can significantly impact biodiversity and contribute to land degradation. This is a critical environmental factor that requires careful management.

The company must undertake comprehensive Environmental Impact Assessments (EIAs) before commencing new projects or expanding existing ones. These assessments are crucial for understanding the potential ecological consequences.

To mitigate these impacts, Adani Power needs to implement robust mitigation measures. These could include habitat restoration, wildlife corridor creation, and sustainable land management practices to minimize ecological disruption. For instance, in 2023, Adani Power committed to significant green belt development around its power plants, aiming to offset land use impacts.

- Land Degradation: Adani Power's infrastructure development can lead to soil erosion, habitat fragmentation, and loss of fertile land.

- Biodiversity Loss: Construction and operation activities may disrupt local ecosystems, impacting plant and animal species, including sensitive or endangered ones.

- Environmental Impact Assessments (EIAs): Mandated by regulations, EIAs help identify and evaluate potential environmental harm, guiding mitigation strategies.

- Mitigation Measures: Implementing measures like afforestation, water conservation, and waste management are essential for responsible land use and ecological preservation.

Adani Power, like all thermal power generators, faces increasing pressure to reduce carbon emissions due to global climate change initiatives. India's commitment to net-zero by 2070 mandates cleaner energy practices and the exploration of lower-carbon fuels or carbon capture technologies.

The company is also scrutinized for air pollution, with thermal plants being major contributors to SO2 and NOx emissions. Adani Power must invest in advanced emission control technologies like FGD and SCR to comply with stringent environmental regulations and avoid penalties.

Water scarcity in India presents a significant challenge, as Adani Power's operations are water-intensive. For instance, in FY23, the company consumed approximately 250 million cubic meters of water, though newer plants are achieving better water efficiency, with rates below 2.5 cubic meters per MWh.

Managing fly ash generated from coal operations is another key environmental concern, with Adani Power focusing on maximizing its utilization, often exceeding 80% in FY23-24, through partnerships for applications in cement and brick manufacturing.

Infrastructure development by Adani Power can impact biodiversity and cause land degradation, necessitating comprehensive Environmental Impact Assessments and mitigation measures like habitat restoration and green belt development, as seen with their 2023 commitments.

| Environmental Factor | Impact on Adani Power | Mitigation Strategies/Data |

| Climate Change & Emissions | Pressure to reduce carbon footprint from thermal power | India's net-zero by 2070 target; Adani Group's 45 GW renewable target by 2030 |

| Air Pollution | Contribution to SO2, NOx, PM emissions | Investment in FGD and SCR technologies; compliance with Ministry of Environment regulations |

| Water Scarcity | High water consumption in thermal operations | FY23 water consumption ~250 million m³; newer plants < 2.5 m³/MWh |

| Waste Management (Fly Ash) | Generation of substantial fly ash | FY23-24 utilization rates >80%; partnerships for use in cement/bricks |

| Biodiversity & Land Use | Potential impact on ecosystems and land degradation | Mandatory EIAs; 2023 green belt development commitments |

PESTLE Analysis Data Sources

Our Adani Power Limited PESTLE Analysis is meticulously constructed using a blend of official government publications, reports from reputable financial institutions, and leading industry analysis firms. This ensures a comprehensive understanding of the regulatory landscape, economic trends, and market dynamics impacting the power sector.