Adani Power Limited Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adani Power Limited Bundle

Adani Power Limited's marketing mix is a powerful engine driving its success, from the diverse energy solutions it offers to its strategic pricing and expansive distribution networks. Understanding how their product portfolio, pricing models, reach, and promotional activities interlock is crucial for anyone seeking to grasp their market dominance.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Adani Power Limited. Ideal for business professionals, students, and consultants looking for strategic insights into the power sector.

Product

Adani Power Limited's core product is electricity, primarily generated through thermal power plants that predominantly use coal. This forms the backbone of their energy supply, catering to India's substantial power needs.

As of April 2025, Adani Power boasts an impressive installed capacity of 17,510 MW, solidifying its position as one of India's largest private thermal power producers. This capacity is spread across multiple states, reflecting their significant market presence.

The company actively pursues both brownfield expansions and new greenfield projects. This strategic approach is designed to continually enhance their generation capabilities and meet the escalating energy demand across India.

Long-term Power Supply Agreements (PSAs) form the bedrock of Adani Power Limited's product strategy, ensuring predictable revenue and demand. These crucial contracts, often spanning 25 years, lock in sales to state electricity boards and other major buyers, offering significant stability.

This approach provides Adani Power with a consistent offtake for its generated electricity. For example, the company has secured such long-term deals with states like Uttar Pradesh and Maharashtra, guaranteeing a steady income stream and mitigating the volatility often seen in the spot power market.

Adani Power Limited’s merchant power sales represent a dynamic segment of its product strategy, complementing its long-term power purchase agreements. This approach allows Adani Power to directly engage with the open market, selling electricity to various buyers based on prevailing demand and price signals. This flexibility is crucial for optimizing revenue streams, especially in a market characterized by price volatility.

The company's ability to participate in the merchant market provides a strategic advantage. By selling power on a short-term basis or through direct merchant sales, Adani Power can swiftly respond to immediate energy needs and capitalize on opportune market conditions. This segment of their offering is designed to enhance overall profitability by capturing higher prices when demand surges.

Data for the fiscal year 2025 indicates a substantial uptick in merchant power sales. Power sold under short-term contracts and in the merchant market saw a significant increase, demonstrating Adani Power's growing presence and success in this more agile segment of the power sector. This growth underscores the effectiveness of their strategy to diversify sales channels beyond traditional long-term commitments.

Transmission and Distribution Services

Adani Power Limited, as part of its integrated strategy, extends its reach into electricity transmission and distribution, often facilitated by sister companies like Adani Energy Solutions. This ensures a complete journey for power, from generation to the end-user. Adani Energy Solutions has been actively growing its transmission infrastructure.

Adani Energy Solutions reported a significant increase in its transmission network, with commissioned lines reaching 19,280 circuit kilometers (ckm) by the end of the fiscal year 2023-24. The company has a robust pipeline of projects, aiming to further expand its footprint in the power transmission sector.

- Transmission Network Growth: Adani Energy Solutions' commissioned transmission lines expanded to 19,280 ckm by FY24.

- Integrated Power Delivery: Ensures power reaches consumers seamlessly from generation.

- Strategic Expansion: Focus on building out a comprehensive energy infrastructure.

- Future Projects: Ongoing development to enhance network capacity and reach.

Expanding into Renewable Energy Integration

Adani Power Limited (APL) is strategically expanding its footprint into renewable energy integration, a move that aligns with the Adani Group's overarching green energy ambitions. This diversification is crucial for APL to remain competitive and contribute to India's energy transition goals. The company is actively pursuing collaborations and capacity expansions to incorporate cleaner energy sources into its existing power generation mix.

A key example of this strategy is APL's composite power allocation with Adani Green Energy Limited (AGEL) for Maharashtra. This partnership specifically includes solar power, demonstrating a tangible commitment to integrating renewable capacity. By leveraging the strengths of its group entities, APL is enhancing its portfolio beyond its traditional thermal power base.

This expansion into renewables is supported by significant investments and policy tailwinds. For instance, India's renewable energy targets, aiming for 500 GW of non-fossil fuel energy capacity by 2030, provide a strong market impetus. APL's integration efforts are therefore not just a strategic choice but a necessary adaptation to the evolving energy landscape.

- Renewable Energy Capacity Addition: APL is actively increasing its renewable energy generation capacity through strategic partnerships and direct investments.

- Inter-Group Synergies: The composite power allocation with Adani Green Energy for Maharashtra highlights the effective utilization of Adani Group's internal renewable energy assets.

- Diversification of Revenue Streams: By integrating solar and potentially other renewable sources, APL aims to reduce its reliance on thermal power and create more stable, diversified revenue streams.

- Contribution to National Goals: This expansion directly supports India's ambitious renewable energy targets, positioning APL as a key player in the nation's clean energy transition.

Adani Power Limited's product is electricity, primarily generated from thermal sources, with a growing integration of renewables. Their strategy centers on long-term Power Supply Agreements (PSAs) for stability, complemented by agile merchant power sales to capture market opportunities. The company also leverages its group's transmission infrastructure to ensure end-to-end delivery.

| Product Offering | Key Features | 2024/2025 Data/Context |

|---|---|---|

| Electricity Generation (Thermal) | Core business, catering to India's demand. | Installed capacity of 17,510 MW as of April 2025. |

| Long-Term Power Supply Agreements (PSAs) | Secures predictable revenue and demand. | Contracts often span 25 years with state electricity boards. |

| Merchant Power Sales | Flexible sales in the open market. | Substantial uptick in FY25, demonstrating growth in this segment. |

| Integrated Power Delivery | Includes transmission via group companies. | Adani Energy Solutions commissioned 19,280 ckm by FY24. |

| Renewable Energy Integration | Diversification into cleaner energy sources. | Composite allocation with Adani Green Energy for solar power in Maharashtra. |

What is included in the product

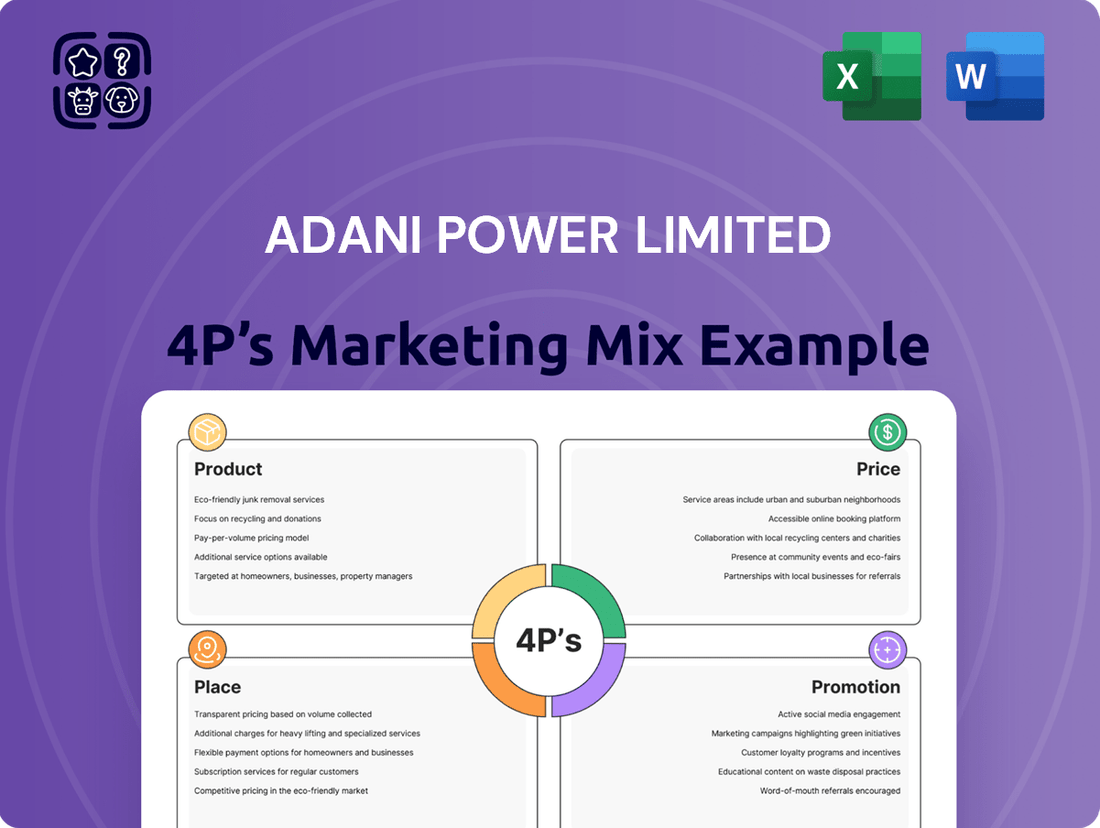

This analysis offers a comprehensive examination of Adani Power Limited's marketing strategies, dissecting its Product offerings, Pricing structures, Place (distribution) strategies, and Promotion activities to reveal its market positioning and competitive approach.

This deep dive is designed for professionals seeking to understand Adani Power Limited's marketing blueprint, providing actionable insights into its operational strategies and market impact.

Adani Power's 4Ps marketing mix analysis acts as a pain point reliever by clearly defining its competitive pricing (Price) and accessible distribution (Place) strategies, addressing customer concerns about affordability and availability of power.

This analysis simplifies complex market challenges by highlighting Adani Power's customer-centric product offerings (Product) and targeted promotional efforts (Promotion), easing the burden of understanding their market position.

Place

Adani Power Limited boasts a significant nationwide power plant network, with operational facilities strategically located across eight key Indian states. This extensive presence, spanning Gujarat, Maharashtra, Karnataka, Rajasthan, Chhattisgarh, Madhya Pradesh, Jharkhand, and Tamil Nadu, underscores its commitment to a diversified supply base. As of March 31, 2024, Adani Power's total installed capacity reached 15,250 MW, with its thermal power portfolio forming the backbone of this extensive network, contributing significantly to meeting India's growing energy demands.

Adani Power Limited’s primary distribution strategy focuses on direct supply to state electricity boards and significant industrial clients. This approach leverages long-term Power Purchase Agreements (PPAs), ensuring a stable revenue stream and predictable demand for its generated electricity.

This direct sales model is crucial for Adani Power, as it bypasses the complexities of retail distribution. For instance, as of the fiscal year 2023, Adani Power's consolidated revenue was INR 14,775 crore, with a substantial portion derived from these bulk supply contracts, highlighting the effectiveness of this channel.

Adani Power Limited's integrated transmission and distribution infrastructure, particularly through its synergy with Adani Energy Solutions, is a significant competitive advantage. This vast network, spanning thousands of kilometers, ensures power reaches diverse consumers efficiently. For instance, Adani Energy Solutions manages a significant portion of India's power transmission network, enabling Adani Power to deliver electricity reliably across extensive geographical areas.

Strategic Greenfield and Brownfield Project Locations

Adani Power prioritizes strategic site selection for both new greenfield developments and expansions of existing brownfield facilities. This approach focuses on optimizing fuel logistics, reducing electricity transmission costs, and serving areas with significant and increasing power needs.

Recent developments underscore this strategy. For instance, Adani Power secured a significant 1,600 MW coal-based thermal power project in Uttar Pradesh, a state experiencing robust demand growth. Concurrently, the company continues to expand its operations in Chhattisgarh, a region with established coal reserves and a strong industrial base.

- Uttar Pradesh Project: Adani Power won a 1,600 MW project in Uttar Pradesh, expected to commence operations by 2029, addressing the state's growing energy deficit.

- Chhattisgarh Expansion: Ongoing expansions in Chhattisgarh are leveraging existing infrastructure and proximity to coal mines, enhancing operational efficiency.

- Transmission Efficiency: Site selection aims to minimize the distance to key demand centers, reducing transmission losses which can typically range from 5-10% in India's power grid.

- Fuel Sourcing Advantage: Locations are chosen to ensure reliable and cost-effective access to fuel, whether it be domestic coal, imported coal, or other energy sources.

Cross-Border Power Supply

Adani Power Limited's reach extends beyond India's borders through its strategic cross-border power supply initiatives. A prime example is the Godda Ultra-supercritical Thermal Power Plant located in Jharkhand. This facility plays a crucial role in supplying electricity to the Bangladesh Power Development Board, effectively broadening Adani Power's 'place' in the international market.

This cross-border operation highlights Adani Power's commitment to regional energy security and its capability to manage complex international power transmission agreements. The Godda plant's capacity and its role in powering a neighboring nation underscore its significance in Adani Power's overall market presence and strategic growth.

- Godda Plant Capacity: The Godda plant boasts a capacity of 1,496 MW (2 x 748 MW units).

- Bangladesh Agreement: It supplies power under a long-term agreement with Bangladesh.

- Export Revenue: This cross-border supply contributes to Adani Power's diversified revenue streams.

- Regional Impact: The project supports energy needs in the South Asian region.

Adani Power's strategic placement is defined by its extensive network of operational power plants across eight Indian states, totaling 15,250 MW of installed capacity as of March 31, 2024. This nationwide footprint is complemented by its cross-border supply to Bangladesh via the Godda plant, demonstrating a broad market reach.

The company's distribution strategy emphasizes direct supply to state electricity boards and industrial clients through long-term Power Purchase Agreements (PPAs), ensuring stable revenue. This focus on bulk supply, which contributed significantly to its INR 14,775 crore consolidated revenue in FY23, bypasses retail complexities.

Adani Power also leverages integrated transmission infrastructure, notably through Adani Energy Solutions, to ensure efficient and reliable power delivery across vast geographical areas. Strategic site selection for new projects and expansions prioritizes fuel logistics, reduced transmission costs, and proximity to high-demand centers.

| Location Focus | Installed Capacity (MW) | Key Markets Served | Strategic Advantage |

|---|---|---|---|

| Nationwide Network (8 States) | 15,250 (as of Mar 31, 2024) | State Electricity Boards, Industrial Clients | Diversified supply, stable PPAs |

| Godda, Jharkhand | 1,496 | Bangladesh Power Development Board | Cross-border supply, regional energy security |

| Uttar Pradesh (New Project) | 1,600 (expected by 2029) | Growing energy deficit state | Addressing demand growth |

| Chhattisgarh (Expansion) | Ongoing | Industrial base, proximity to coal | Operational efficiency, fuel access |

Full Version Awaits

Adani Power Limited 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Adani Power Limited 4P's Marketing Mix Analysis is fully complete and ready for your immediate use, covering Product, Price, Place, and Promotion strategies.

Promotion

Adani Power Limited prioritizes transparent financial reporting and strong investor relations to effectively communicate its performance, strategic growth initiatives, and future prospects to a discerning financial audience. Recent financial disclosures, such as the Q4 FY24 results showing a significant year-on-year profit increase to ₹2,797 crore, underscore this commitment.

The company leverages its recent quarterly and annual results, alongside announcements of capacity expansions like the 1,600 MW Godda Ultra Mega Power Project, and strategic acquisitions as crucial promotional tools to attract and retain investor confidence and capital.

Adani Power Limited strategically leverages media releases and project announcements to communicate its growth narrative. For instance, the company frequently highlights new power plant commissioning and significant capacity additions, such as the recent expansion of its Godda plant in Jharkhand, which aims to bolster power supply to Bangladesh. These announcements underscore Adani Power's role in addressing India's burgeoning energy demands and showcase its expanding operational footprint.

Adani Power Limited's promotional efforts highlight their commitment to operational excellence. They frequently showcase high plant load factors, a key indicator of efficient energy generation, and their adoption of cutting-edge technology such as ultra-supercritical thermal power plants. This focus on advanced infrastructure and optimized performance positions Adani Power as a dependable and forward-thinking energy provider.

Sustainability and ESG Reporting

Adani Power Limited actively communicates its dedication to sustainability and Environmental, Social, and Governance (ESG) principles. This commitment is showcased through comprehensive integrated annual reports and dedicated Business Responsibility Sustainability Reports, providing stakeholders with transparent insights into the company's operational ethos.

The company's proactive approach to ESG is further validated by its performance in assessments conducted by reputable organizations. For instance, Adani Power has consistently achieved strong scores from S&P Global and CDP (formerly the Carbon Disclosure Project), underscoring its responsible operational practices and commitment to environmental stewardship.

- ESG Reporting: Adani Power publishes integrated annual reports and Business Responsibility Sustainability Reports to detail its ESG performance.

- Third-Party Validation: The company aims for high scores in assessments by S&P Global and CDP to demonstrate its commitment to responsible operations.

- Focus on Sustainability: These reports highlight efforts in environmental protection, social responsibility, and corporate governance.

Corporate Branding and Group Synergy

Adani Power Limited leverages the robust corporate branding of the Adani Group, a conglomerate renowned for its extensive infrastructure development. This association with a major player in sectors like ports, logistics, and energy transmission significantly bolsters Adani Power's image, projecting an aura of stability and large-scale operational capability. The group's established reputation for executing ambitious projects implicitly enhances Adani Power's credibility in the power generation sector.

This group synergy translates into tangible benefits, fostering trust among stakeholders and facilitating access to capital for expansion. For instance, the Adani Group's overall market capitalization, which stood at approximately INR 3.5 trillion as of early 2024, underscores the financial strength that Adani Power can draw upon. This collective strength allows Adani Power to undertake and successfully deliver on massive power generation projects, reinforcing its position as a reliable energy provider.

- Brand Association: Adani Power benefits from the Adani Group's strong brand recognition in infrastructure.

- Reputational Synergy: The group's track record in large-scale development enhances Adani Power's perceived reliability.

- Financial Backing: Access to the Adani Group's substantial financial resources supports ambitious project execution.

- Market Confidence: The group's overall market presence instills confidence in Adani Power's capacity and future prospects.

Adani Power Limited actively promotes its growth and operational efficiency through consistent communication of key performance indicators and strategic developments. The company highlights its expanding generation capacity, with a total installed capacity of 15,200 MW as of March 2024, showcasing its contribution to meeting India's energy demands.

The company leverages positive financial results, such as the reported EBITDA of ₹12,962 crore for FY24, to reinforce investor confidence and attract capital for further expansion. Announcements regarding new project commissioning and capacity additions, like the recently commissioned 660 MW unit at Raipur, are central to its promotional narrative.

Adani Power emphasizes its commitment to sustainability and ESG principles, supported by strong third-party validations from S&P Global and CDP, demonstrating responsible operational practices. This focus on environmental stewardship and corporate governance is a key element in building a positive brand image and attracting socially conscious investors.

The company benefits significantly from the Adani Group's established brand reputation in infrastructure, which lends credibility and financial strength to Adani Power's operations and expansion plans. This synergy allows Adani Power to project an image of stability and large-scale capability, fostering trust among stakeholders and facilitating access to capital.

| Metric | Value (as of March 2024) | Significance |

|---|---|---|

| Total Installed Capacity | 15,200 MW | Demonstrates significant contribution to national energy supply |

| EBITDA (FY24) | ₹12,962 crore | Indicates strong operational profitability and financial health |

| New Unit Commissioned | 660 MW (Raipur) | Highlights ongoing expansion and growth initiatives |

Price

Adani Power Limited actively engages in competitive bidding to secure long-term Power Purchase Agreements (PPAs) with various state utilities. This strategy is fundamental to its business model, ensuring stable revenue streams and operational predictability.

The success in these bidding rounds hinges on offering competitive tariffs. For instance, in a significant development in Uttar Pradesh, Adani Power secured a contract by presenting the lowest discovered tariff, demonstrating its cost-efficiency and market competitiveness. This approach is vital for winning and retaining lucrative, long-duration contracts.

Adani Power Limited's Power Purchase Agreements (PPAs) often feature a blended tariff structure. This typically includes a fixed charge component, ensuring revenue stability for the company, and a variable component linked to fuel costs. This dual approach helps manage operational expenses while accommodating the volatility of fuel prices.

For instance, the Uttar Pradesh PPA demonstrates this model, with quoted tariffs reflecting both fixed energy charges and fuel cost adjustments. This pricing mechanism allows Adani Power to cover its capital expenditure and operational costs while passing through the fluctuating costs of fuel to the off-takers, ensuring a degree of financial predictability.

Adani Power Limited's merchant market pricing for electricity is directly tied to the ebb and flow of supply and demand, as well as the clearing prices established on power exchanges. This dynamic means that when demand is high and supply is constrained, prices can climb, offering potential for higher revenue per unit. For instance, during periods of peak electricity consumption in 2024, merchant tariffs saw significant upward movement on Indian power exchanges.

While achieving higher volumes in the merchant market can compensate for lower tariff realizations, the inherent volatility remains a key factor influencing profitability. Adani Power's financial reports for the fiscal year ending March 31, 2024, indicated that a portion of their revenue was derived from these merchant sales, with performance fluctuating based on these market conditions. The company's strategy often involves balancing these merchant sales with long-term power purchase agreements to mitigate risk.

Impact of Fuel Costs on Pricing

Adani Power's pricing strategy is significantly influenced by fuel costs, particularly coal, which is a primary input for its thermal power plants. Fluctuations in global coal prices directly affect the company's cost of electricity generation, impacting its competitiveness in offering tariffs to consumers. For instance, in the fiscal year 2023-24, Adani Power's consolidated EBITDA saw a positive impact from lower imported fuel prices, demonstrating the direct correlation between fuel expense management and profitability.

The company's ability to maintain competitive pricing hinges on its success in managing these volatile fuel expenses. Recent performance indicators highlight this sensitivity:

- Lower Import Fuel Prices: Adani Power reported improved EBITDA in recent quarters, partly attributable to a decrease in the cost of imported coal.

- Cost of Production: As a significant portion of its generation capacity relies on thermal power, the price of coal is a direct determinant of Adani Power's operational costs.

- Tariff Competitiveness: The company's capacity to offer attractive tariffs to discoms and industrial consumers is directly linked to its ability to control and mitigate fuel price volatility.

Strategic Acquisitions and Debt Management

Adani Power Limited's pricing strategy is intrinsically linked to its robust debt management and strategic financial maneuvers. The company has actively pursued acquisitions of distressed power assets, securing them at favorable valuations. This approach not only expands operational capacity but also bolsters financial resilience, enabling more competitive pricing in the long run.

The company's commitment to deleveraging is a key component of its financial strategy, directly impacting its ability to offer competitive tariffs. By actively working to reduce its debt burden, Adani Power enhances its financial flexibility and operational efficiency. This focus on financial health underpins its capacity for sustained profitability and market competitiveness.

- Debt Reduction Efforts: Adani Power has been focused on reducing its consolidated debt. For instance, as of March 31, 2024, the company's consolidated debt stood at approximately INR 49,000 crore, with ongoing initiatives to further optimize this figure.

- Strategic Acquisitions: The acquisition of DB Power Limited for INR 7,017 crore in August 2023 exemplifies Adani Power's strategy of acquiring operational assets at attractive valuations, thereby enhancing its market position and operational scale.

- Financial Leverage: By managing its leverage effectively through debt reduction and efficient operations, Adani Power aims to maintain a strong credit profile, which translates into lower borrowing costs and improved pricing power.

Adani Power's pricing strategy centers on securing long-term Power Purchase Agreements (PPAs) through competitive bidding, often winning contracts by offering the lowest discovered tariffs, as seen in Uttar Pradesh. This involves a blended tariff structure, combining fixed charges for revenue stability with variable components tied to fuel costs, like coal, to manage price volatility. For instance, the company's fiscal year 2023-24 performance benefited from lower imported fuel prices, directly impacting its cost of production and tariff competitiveness.

Merchant market pricing for Adani Power is dictated by real-time supply and demand dynamics on power exchanges, with tariffs seeing upward trends during peak consumption periods in 2024. While this offers potential for higher revenue, it also introduces inherent volatility, as evidenced by fluctuating merchant sales contributing to overall financial performance in FY24. The company aims to balance this with the stability of PPAs to mitigate risk.

Financial health significantly influences Adani Power's pricing. By actively reducing its consolidated debt, which stood around INR 49,000 crore as of March 31, 2024, and acquiring assets like DB Power for INR 7,017 crore in August 2023, the company enhances its financial flexibility and operational scale. This deleveraging strategy supports lower borrowing costs and improved pricing power.

| Pricing Aspect | Mechanism/Strategy | Impact/Example |

|---|---|---|

| PPA Tariffs | Competitive Bidding, Lowest Discovered Tariff | Secured Uttar Pradesh contract by offering the lowest tariff. |

| Tariff Structure | Blended: Fixed Charges + Variable Fuel Cost Pass-through | Manages revenue stability and fuel price volatility. |

| Merchant Market | Supply & Demand, Exchange Clearing Prices | Tariffs rose during peak demand in 2024; FY24 merchant sales performance varied. |

| Fuel Cost Influence | Directly impacts Cost of Production (Coal) | Lower imported fuel prices positively impacted EBITDA in FY23-24. |

| Financial Leverage | Debt Reduction, Strategic Acquisitions | Debt ~INR 49,000 cr (Mar 2024); DB Power acquisition (Aug 2023) enhances scale. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Adani Power Limited is built upon a foundation of verified public disclosures, including annual reports, investor presentations, and official company press releases. We also incorporate insights from reputable industry analyses and market research reports to capture their strategic positioning and operational activities.