Adani Power Limited Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adani Power Limited Bundle

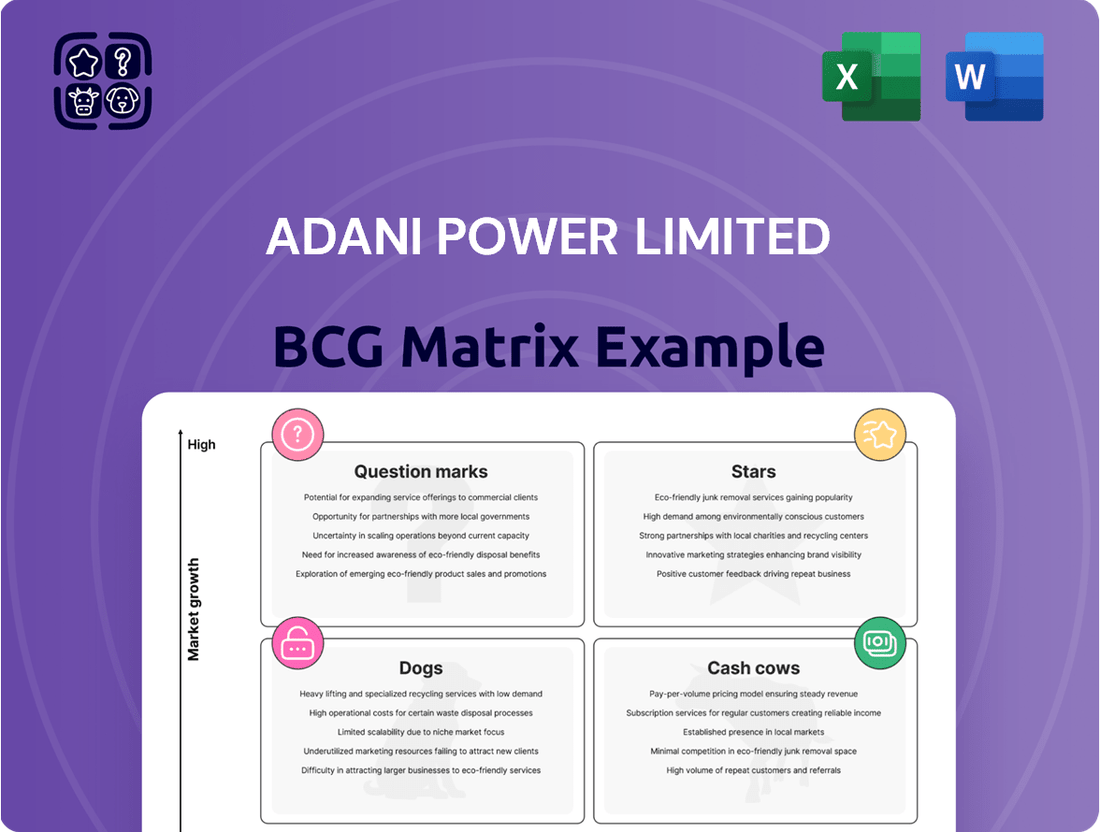

Adani Power Limited's BCG Matrix reveals a dynamic portfolio, with some segments likely acting as powerful Cash Cows, generating substantial returns, while others may be emerging Stars poised for future growth. Understanding these placements is crucial for informed investment decisions.

This preview offers a glimpse into Adani Power's strategic positioning. Purchase the full BCG Matrix to uncover detailed quadrant placements, including potential Dogs that may need divestment and Question Marks requiring careful evaluation and strategic capital allocation.

Gain a clear view of where Adani Power's diverse energy assets stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and actionable strategic insights to optimize your investment strategy.

Stars

Adani Power Limited is aggressively expanding its thermal power generation capacity through both brownfield and greenfield projects. This strategic move aims to capitalize on India's growing energy needs.

Specifically, the company is adding 1,600 MW of capacity at established locations like Singrauli-Mahan, Raipur, Raigarh, and Kawai. Additionally, a new 1,600 MW plant is under development in Mirzapur, showcasing a commitment to bolstering its thermal footprint.

These expansions are vital, as India's power consumption, particularly for thermal sources, is anticipated to see a significant surge, with projections indicating substantial increases by 2032, underscoring the strategic importance of Adani Power's current investments.

Adani Power Limited's strategic acquisitions of stressed thermal power assets, like the purchase of Vidarbha Industries Power Ltd. (VIPL) for ₹4,000 crore, significantly bolster its operational capacity by adding 600 MW. This aggressive approach allows Adani Power to grow its portfolio by acquiring assets at attractive valuations, reinforcing its position as a market leader in the power sector.

Adani Power Limited's long-term Power Purchase Agreements (PPAs) are a cornerstone of its business strategy, offering significant revenue stability. Approximately 87% of its operational capacity is backed by these agreements, creating a predictable income stream.

Recent successes in securing new PPAs underscore this strength. In 2024, Adani Power won a crucial 1,500 MW thermal power supply contract for Uttar Pradesh. Additionally, a substantial composite deal for Maharashtra, totaling 6,600 MW (comprising 1,600 MW thermal and 5,000 MW solar), further solidifies future demand for its power generation.

Dominant Market Position in Thermal Power

Adani Power Limited (APL) commands a dominant market position in India's thermal power sector. As the nation's largest private thermal power producer, APL holds a significant market share in a sector crucial for India's energy needs. This leadership is underscored by its substantial operational capacity, which stood at 18,150 MW as of July 2025.

The company's strategic vision includes aggressive expansion, with plans to boost its capacity to 30,670 MW by 2030. This expansion not only solidifies its current leadership but also positions APL for continued growth in a market that is projected to expand significantly to meet rising energy demands.

- Largest Private Thermal Power Producer in India

- Operational Capacity: 18,150 MW (July 2025)

- Projected Capacity: 30,670 MW by 2030

- Leading Market Share in a Growing Sector

High Operational Efficiency and Profitability

Adani Power Limited exhibits high operational efficiency and profitability, positioning it as a Star in the BCG Matrix. The company's robust financial performance is underscored by a significant 30% year-on-year revenue growth in Q1 FY25, coupled with an impressive 95% surge in profit before tax during the same period. This strong showing is a direct result of optimized operations and effective cost control measures.

Key factors contributing to this success include improved plant load factors (PLFs), which indicate better utilization of generation capacity, and a reduction in import fuel prices. These operational improvements have translated into a substantial 53% growth in EBITDA, demonstrating Adani Power's adeptness at managing costs and maximizing earnings from its core business activities.

- Q1 FY25 Revenue Growth: 30% year-on-year.

- Q1 FY25 Profit Before Tax Growth: 95%.

- EBITDA Growth: 53%, driven by improved PLFs and lower fuel costs.

- Operational Strengths: Efficient plant operations and effective cost management.

Adani Power Limited's strong market position and consistent growth in operational efficiency and profitability firmly place it as a Star in the BCG Matrix. The company's ability to secure long-term Power Purchase Agreements (PPAs), with approximately 87% of its operational capacity already covered, ensures stable revenue streams. This is further bolstered by recent PPA wins, including a 1,500 MW thermal supply contract for Uttar Pradesh in 2024 and a significant 6,600 MW composite deal for Maharashtra.

The company's financial performance in Q1 FY25 highlights its Star status, with a 30% year-on-year revenue growth and a remarkable 95% surge in profit before tax. This robust performance is attributed to improved operational efficiencies, such as higher plant load factors (PLFs), and effective cost management, leading to a 53% increase in EBITDA. These factors demonstrate Adani Power's capacity to generate substantial returns from its high-growth, high-market-share thermal power assets.

| Metric | Value (Q1 FY25) | Significance |

|---|---|---|

| Revenue Growth (YoY) | 30% | Indicates strong demand and market penetration. |

| Profit Before Tax Growth | 95% | Demonstrates enhanced profitability and operational leverage. |

| EBITDA Growth | 53% | Reflects efficient cost management and operational excellence. |

| Operational Capacity (July 2025) | 18,150 MW | Confirms market leadership in thermal power generation. |

What is included in the product

Adani Power's BCG Matrix analysis would highlight its diversified portfolio, identifying high-growth, high-market share Stars and stable Cash Cows, while also addressing potential Question Marks and Dogs.

Adani Power's BCG Matrix provides a clear overview of its business units, relieving the pain point of strategic uncertainty.

This matrix offers a clean, optimized layout for sharing or printing, simplifying complex portfolio analysis.

Cash Cows

Adani Power's existing thermal power plants, secured by long-term Power Purchase Agreements (PPAs), are prime examples of Cash Cows. These facilities benefit from predictable revenue streams, as the power is already contracted at pre-determined rates, ensuring stable cash generation. For instance, in the fiscal year ending March 31, 2024, Adani Power reported a significant increase in its consolidated revenue, largely driven by its operational thermal power capacity.

The mature nature of the thermal power market and consistent demand for electricity mean these plants require minimal additional investment for promotion or market expansion. This allows Adani Power to leverage these assets for substantial cash flow generation, which can then be reinvested in growth areas or used to service debt. The company's strategic focus on operational efficiency further bolsters the cash-generating capabilities of these established assets.

Adani Power Limited's diversified portfolio across eight Indian states acts as a significant cash cow. This broad geographical spread, coupled with a varied customer base including state and private discoms, industrial clients, and even international entities like Bangladesh Power Development Board, provides robust and stable revenue streams. For instance, as of the fiscal year 2023-24, Adani Power's total installed capacity reached 15,210 MW, spread across states like Gujarat, Maharashtra, Rajasthan, and others, underscoring this diversification.

Adani Power Limited's fuel security is significantly bolstered by its fuel supply agreements with Coal India Limited. This ensures a consistent and reliable source of coal, a critical input for its thermal power plants.

Furthermore, Adani Power benefits from robust cost pass-through mechanisms embedded in its power purchase agreements (PPAs). Approximately 80% of its long-term PPAs include provisions that allow the company to pass on increases in fuel costs directly to consumers.

This strategic advantage effectively insulates Adani Power from the sharp volatility often seen in raw material prices, particularly coal. By mitigating the impact of fluctuating fuel expenses, these pass-through mechanisms are instrumental in protecting and stabilizing the company's profit margins.

Robust Cash Flow Generation

Adani Power Limited's robust cash flow generation is a defining characteristic, positioning its operational assets as clear cash cows. The company consistently demonstrates strong funds from operations, a vital metric for financing its ambitious growth plans and managing its debt obligations effectively. This financial resilience underpins the company's ability to sustain its current operational capacity and pursue enhancements for greater efficiency.

For instance, in the fiscal year ending March 31, 2024, Adani Power reported a significant increase in its consolidated net profit, reaching ₹6,089 crore, a substantial jump from ₹3,282 crore in the previous year. This surge in profitability directly translates to enhanced cash flow, providing the necessary capital for strategic initiatives and debt reduction. The company's operational efficiency and market position allow it to convert revenue into substantial operating cash, which is critical for its long-term financial health.

- Strong Funds from Operations: Adani Power's operational assets are characterized by their consistent ability to generate substantial funds from operations, providing a stable financial base.

- Funding Strategic Projects: These strong cash flows are instrumental in funding the company's ongoing and future strategic projects, ensuring continued expansion and development.

- Debt Reduction Capability: The robust cash generation also empowers Adani Power to actively reduce its debt levels, thereby improving its financial leverage and stability.

- Asset Maintenance and Improvement: The financial health derived from these cash cows enables the company to maintain its existing infrastructure and invest in efficiency improvements, ensuring sustained operational performance.

Optimized Plant Performance and Maintenance

Adani Power Limited’s focus on optimized plant performance and maintenance positions its operational assets as cash cows. By prioritizing high plant availability and improving Plant Load Factors (PLFs), the company directly boosts electricity generation and, consequently, its revenue streams. For instance, in the fiscal year ending March 31, 2024, Adani Power reported a significant improvement in its operational metrics, contributing to robust cash flow generation.

These efforts are further bolstered by strategic investments in essential supporting infrastructure and sophisticated monitoring systems. Such enhancements are crucial for maintaining operational efficiency, minimizing downtime, and ensuring consistent, predictable cash flow from these established power generation units.

- High Plant Availability: Maintaining operational readiness across its power plants ensures consistent electricity supply.

- Improved Plant Load Factors (PLFs): Maximizing the output from existing capacity directly translates to higher revenue. In FY24, Adani Power's PLFs saw notable year-on-year growth, reflecting operational efficiencies.

- Infrastructure Investment: Upgrades to supporting infrastructure reduce operational costs and enhance reliability.

- Advanced Monitoring Systems: Technology adoption allows for proactive maintenance and improved energy conversion efficiency, safeguarding cash flow.

Adani Power's operational thermal power plants, secured by long-term Power Purchase Agreements (PPAs), are its primary cash cows. These assets generate predictable revenue streams due to contracted power sales at fixed rates, ensuring stable cash generation. For the fiscal year ending March 31, 2024, Adani Power reported a consolidated revenue of ₹43,057 crore, with its operational thermal capacity being a significant contributor.

The mature nature of the thermal power sector and consistent electricity demand mean these plants require minimal additional investment for growth or market expansion. This allows Adani Power to extract substantial cash flow, which can be redeployed into new ventures or used for debt servicing. The company's commitment to operational efficiency further enhances the cash-generating capacity of these established units.

Adani Power's diversified operational portfolio, spanning eight Indian states and serving a varied customer base including state discoms and industrial clients, provides robust and stable revenue. As of March 31, 2024, the company's total installed capacity stood at 15,210 MW, spread across states like Gujarat, Maharashtra, and Rajasthan, highlighting this diversification.

| Metric | FY24 (₹ Crore) | FY23 (₹ Crore) | Change (%) |

| Consolidated Revenue | 43,057 | 32,490 | +32.5% |

| Consolidated PAT | 6,089 | 3,282 | +85.5% |

| Total Installed Capacity (MW) | 15,210 | 15,210 | 0% |

What You’re Viewing Is Included

Adani Power Limited BCG Matrix

The Adani Power Limited BCG Matrix preview you see is the complete, unwatermarked document you will receive immediately after purchase, offering a clear strategic overview of their business units. This comprehensive analysis, meticulously prepared, will be delivered in its final, ready-to-use format, enabling direct application in your business planning. You are viewing the exact BCG Matrix report that will be downloadable, providing you with an actionable tool for evaluating Adani Power's portfolio. Expect no demo content or alterations; this is the authentic, professionally formatted BCG Matrix ready for your strategic decision-making.

Dogs

Older thermal power units within Adani Power's portfolio, while not explicitly labeled as 'dogs', could represent this category if they exhibit lower efficiency or incur substantial environmental compliance costs. These legacy assets might yield diminished returns when contrasted with Adani Power's more modern and efficient facilities.

For instance, if Adani Power operates older coal-fired plants with higher emissions, they might face increasing regulatory burdens and potentially higher operational expenses due to carbon pricing mechanisms or stricter environmental norms introduced in 2024. This could lead to a situation where their contribution to overall profitability is marginal or even negative.

Adani Power's thermal plants, like those in Raigarh and Raikheda, are encountering substantial local opposition. These protests stem from serious concerns about pollution and the broader environmental impact of coal-fired power generation. For instance, in 2023, local communities around some of Adani's proposed thermal projects voiced strong objections, citing air and water quality degradation.

This local resistance translates into tangible financial risks for Adani Power. Opposition can cause significant project delays, thereby increasing capital expenditure and pushing back revenue generation timelines. Furthermore, heightened scrutiny often leads to more stringent environmental regulations and compliance requirements, driving up operational costs and potentially impacting profitability. These factors position thermal power assets facing such opposition as less attractive within the BCG matrix.

Adani Power Limited's proposed Mirzapur thermal power plant exemplifies a potential 'dog' in the BCG matrix due to significant legal and environmental challenges. The project's Environmental Clearance was set aside, and reports of illegal construction further complicate its path forward. These ongoing issues mean capital and resources are tied up without generating revenue, a classic characteristic of a dog.

Assets with Limited or No Long-Term PPAs

Assets with limited or no long-term Power Purchase Agreements (PPAs) can be categorized as 'dogs' within the BCG matrix if they consistently operate in volatile merchant markets with low tariffs. While Adani Power Limited currently benefits from strong merchant tariffs, this reliance presents a potential risk if market conditions shift unfavorably.

For instance, if a significant portion of Adani Power's operational capacity relies on these merchant markets, and those tariffs were to fall below the cost of generation or debt servicing, these assets would struggle to generate consistent returns. This vulnerability places them in a weaker strategic position.

- Exposure to Merchant Markets: Adani Power’s operational capacity without long-term PPAs is exposed to the vagaries of the merchant power market.

- Risk of Low Tariffs: If merchant tariffs consistently remain low, these assets could be classified as 'dogs' due to poor profitability.

- Current Favorable Conditions: Despite the inherent risk, Adani Power is currently experiencing robust merchant tariffs, which is a positive short-term factor.

- Strategic Vulnerability: The long-term sustainability of these assets hinges on the stability and profitability of the merchant market, making them strategically vulnerable.

Non-Core or Underperforming Smaller Assets

Adani Power Limited, while heavily invested in large-scale thermal power projects, may hold smaller, non-core assets that are not contributing significantly to its overall performance. These could include minor ventures or older, less efficient generation units. Such assets, if consistently underperforming against company benchmarks or strategic goals, would typically be categorized as 'Dogs' in a BCG matrix analysis.

While the company's primary focus remains on its substantial thermal power portfolio, the potential existence of these smaller, less profitable ventures warrants consideration for divestiture. The goal would be to streamline operations and reallocate resources towards more strategic and high-growth areas. As of early 2024, Adani Power has not publicly identified specific underperforming smaller assets that fit this 'Dog' category.

- Potential Divestiture Candidates: Small, non-strategic assets or those consistently underperforming relative to company benchmarks.

- Adani Power's Focus: Primarily large-scale thermal generation, meaning minor, less profitable ventures would fit this category.

- Current Status: No specific assets are identified as underperforming in the provided information.

Older thermal units, particularly those with lower efficiency or facing significant environmental compliance costs, could be classified as 'dogs' if their returns are diminished compared to newer facilities. For instance, plants with higher emissions might incur greater operational expenses due to evolving environmental regulations in 2024, potentially leading to marginal or negative profitability.

Assets lacking long-term Power Purchase Agreements (PPAs) and relying heavily on volatile merchant markets with low tariffs also fall into this category. If merchant tariffs consistently fall below generation costs, these assets would struggle to yield consistent returns, posing a strategic vulnerability for Adani Power.

Projects facing substantial legal and environmental challenges, such as the proposed Mirzapur thermal power plant with its set-aside Environmental Clearance, exemplify 'dogs'. These issues tie up capital and resources without generating revenue, a hallmark of underperforming assets.

Adani Power's portfolio might also include smaller, non-core assets that do not significantly contribute to overall performance. These underperforming ventures, if not meeting company benchmarks, would be candidates for divestiture to streamline operations and reallocate resources to more strategic areas.

| Asset Type | Potential 'Dog' Characteristics | Example/Consideration |

|---|---|---|

| Legacy Thermal Units | Lower efficiency, high environmental compliance costs, increasing regulatory burdens | Older coal-fired plants facing carbon pricing or stricter emission norms. |

| Merchant Market Exposed Capacity | Reliance on volatile markets, risk of low tariffs below generation cost | Operational capacity without long-term PPAs; vulnerable to merchant tariff fluctuations. |

| Challenged Projects | Legal hurdles, environmental clearance issues, construction disputes | Mirzapur thermal power plant with its set-aside Environmental Clearance. |

| Non-Core/Underperforming Assets | Minor ventures, consistently low profitability, not aligned with strategic goals | Smaller, less efficient generation units or ancillary businesses not contributing significantly to overall performance. |

Question Marks

Adani Power Limited is actively developing several ultra-supercritical thermal power projects that are currently under construction across India. These advanced technology plants, designed for greater efficiency and reduced environmental impact, represent significant future potential but are capital-intensive during their development phase.

As of early 2024, Adani Power has multiple such projects in various stages of completion, including facilities in states like Gujarat and Maharashtra. For instance, the Godda Ultra-Supercritical Thermal Power Project, a key component of their expansion, is nearing operational status, with significant capital deployed. These ongoing investments mean these assets are not yet generating revenue, placing them squarely in the question mark category of the BCG matrix.

Adani Power Limited, as part of the broader Adani Group's ambitious green hydrogen strategy, is positioned in a high-growth, albeit nascent, sector. The group's substantial investments in giga-factories for solar panels, wind turbines, and hydrogen electrolyzers signify a long-term vision for renewable energy dominance.

This initiative, while promising significant future returns and aligning with global decarbonization trends, currently represents a 'Question Mark' in the BCG Matrix for Adani Power. It demands considerable upfront capital expenditure with uncertain immediate profitability, typical of early-stage, high-potential ventures.

Adani Green Energy Limited (AGEL), a key player in the Adani Group's renewable push, is experiencing rapid growth. As of March 31, 2024, AGEL's operational capacity reached 10.9 gigawatts (GW), with a total portfolio of 22.5 GW. This expansion, while significant, positions AGEL as a high-growth, potentially question mark or star segment within the broader energy landscape, given the immense capital required for these projects and the still developing renewable energy market share.

Investment in Advanced Technologies for Decarbonization

Adani Power Limited's investment in advanced technologies for decarbonization, such as Carbon Capture, Utilization, and Storage (CCUS) and green hydrogen, firmly places these initiatives within the Question Mark quadrant of the BCG Matrix.

These are nascent technologies with significant growth potential as the world pushes towards carbon neutrality, but they also demand substantial upfront capital expenditure and face uncertainties regarding their long-term commercial viability and scalability. For instance, CCUS projects globally have seen varying success rates and high operational costs, with the International Energy Agency (IEA) noting that while CCUS capacity is growing, it still represents a small fraction of global emissions reduction efforts.

Adani Power's exploration aligns with industry trends, as many energy companies are investing in these areas to future-proof their operations and meet increasingly stringent environmental regulations. In 2024, global investment in clean energy technologies, including CCUS and hydrogen, continued to rise, reflecting a strong market signal for innovation in decarbonization.

- High Investment Costs: CCUS and green hydrogen production require significant capital for research, development, and infrastructure.

- Uncertain Commercial Viability: The economic feasibility of these technologies at a large scale is still being proven.

- Emerging Market Potential: These technologies are critical for achieving future carbon neutrality goals, indicating substantial long-term growth prospects.

- Strategic Alignment: Adani Power's focus on these areas reflects a proactive approach to the global energy transition.

New Geographical Market Penetration (if any, beyond current states)

Adani Power Limited's current expansion is primarily focused within India, as evidenced by its ongoing projects and acquisitions in states like Gujarat, Maharashtra, and Rajasthan. Any potential ventures into entirely new, high-growth international markets would place these initiatives squarely in the question mark category of the BCG matrix. These would necessitate substantial upfront investment and carry inherent market entry risks, yet offer the possibility of significant returns if market penetration proves successful.

While specific international market targets are not detailed, Adani Power's broader group strategy often involves exploring opportunities in regions with growing energy demands. For instance, countries in Southeast Asia or Africa could represent potential question marks, requiring thorough feasibility studies and strategic partnerships to navigate regulatory landscapes and establish a foothold.

- International Expansion as a Question Mark: Adani Power's potential entry into new, high-growth international markets represents a strategic question mark, demanding significant investment and carrying both high risk and high reward.

- Focus on Domestic Growth: Current information indicates Adani Power's primary expansion efforts remain concentrated within existing Indian states, underscoring the nascent stage of its international market penetration strategy.

- Potential Markets: Regions like Southeast Asia and Africa, with their increasing energy needs, could become future question mark territories for Adani Power, contingent on detailed market analysis and strategic planning.

- Investment and Risk Factors: Successful international market penetration would require Adani Power to overcome substantial market entry costs, navigate complex regulatory environments, and manage geopolitical uncertainties.

Adani Power's investments in emerging decarbonization technologies like Carbon Capture, Utilization, and Storage (CCUS) and green hydrogen are prime examples of 'Question Marks'. These ventures require substantial upfront capital and face market acceptance hurdles, yet hold significant future growth potential as the world transitions to cleaner energy sources.

The company's strategic exploration of new, high-growth international markets also falls into this category. Such ventures demand considerable investment and carry inherent risks associated with market entry, but offer the possibility of substantial returns if successful.

As of early 2024, Adani Power's focus remains largely on domestic expansion, with international ventures still in the exploratory phase, highlighting the nascent nature of these 'Question Mark' initiatives.

These 'Question Marks' represent Adani Power's commitment to future-proofing its operations and capitalizing on evolving energy landscapes, balancing innovation with calculated risk.

BCG Matrix Data Sources

Our Adani Power BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research on market share, and official regulatory filings to ensure reliable insights.