Adani Power Limited Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adani Power Limited Bundle

Adani Power Limited faces significant bargaining power from its key suppliers, particularly for coal, and intense rivalry from established power producers. The threat of substitutes, while currently moderate, could grow with advancements in renewable energy technologies.

The full Porter's Five Forces Analysis reveals the real forces shaping Adani Power Limited’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Adani Power Limited's significant dependence on coal, primarily sourced from domestic suppliers like Coal India Limited (CIL), grants these suppliers considerable bargaining power. CIL's decisions on production volumes and pricing directly influence Adani Power's fuel expenses and overall operational performance. In fiscal year 2023, CIL's production reached approximately 700 million tonnes, underscoring its market dominance.

The bargaining power of suppliers in logistics and infrastructure, particularly railways for coal haulage, is significant for Adani Power Limited. Railways are critical for transporting the vast quantities of coal needed for power generation. In 2023, Indian Railways saw a substantial increase in freight revenue, reflecting the demand and importance of these services. Any hikes in freight charges or disruptions in rail services directly impact Adani Power's operational costs and its ability to maintain consistent power generation, highlighting the suppliers' leverage.

Specialized equipment providers for power plants, like those manufacturing turbines and boilers, hold significant sway. Their technical expertise, coupled with the high expense and complexity of switching vendors, means Adani Power often has few alternatives. For instance, in 2023, the global market for power generation equipment saw major players like GE and Siemens Energy dominate, indicating a concentrated supplier base.

Financiers and Lenders

Financiers and lenders hold considerable sway over Adani Power Limited due to the capital-intensive nature of power generation projects. Their ability to provide or withhold essential funding for large-scale developments and ongoing operations directly impacts the company's growth trajectory and financial health. For instance, securing financing for new power plants or major upgrades requires favorable terms from banks and financial institutions.

The bargaining power of financiers is evident in their ability to dictate interest rates, loan covenants, and the very availability of project finance. These terms can significantly influence Adani Power's expansion plans and overall profitability. As of early 2024, Adani Power has been actively seeking debt financing for its ongoing projects, underscoring the critical role of lenders in its strategic execution.

- Access to Capital: Large power projects require substantial upfront investment, making financial institutions key partners.

- Influence on Terms: Lenders can set interest rates and covenants that affect Adani Power's operational flexibility and cost of capital.

- Reliance on Funding: Recent acquisitions and future growth initiatives are heavily dependent on securing robust financial backing from lenders.

Land Acquisition Challenges

Landowners and local communities can wield considerable bargaining power, acting as de facto suppliers for Adani Power Limited's projects. Their ability to influence land acquisition processes, through delays or demands for higher compensation, directly impacts project economics. For instance, in 2024, several large-scale infrastructure projects across India faced localized protests and land disputes, leading to an average project delay of 12-18 months and a 10-15% increase in associated costs.

These challenges can significantly escalate project costs and extend timelines, posing a direct threat to Adani Power's expansion plans. Successfully navigating these complexities, through effective community engagement and fair compensation, is crucial for maintaining competitive project development and ensuring timely operationalization of new power generation capacity.

- Land Acquisition Hurdles: Delays and increased compensation demands from landowners and communities can inflate project costs.

- Impact on Timelines: These challenges can lead to significant project delays, affecting Adani Power's growth strategy.

- Community Engagement: Proactive and fair engagement with local stakeholders is vital to mitigate these risks.

- Cost Escalation: In 2024, infrastructure projects experiencing land disputes saw cost overruns averaging 10-15%.

Adani Power Limited faces substantial bargaining power from its primary coal suppliers, most notably Coal India Limited (CIL). CIL's dominant market share and control over production volumes significantly influence Adani Power's fuel costs, a critical component of its operational expenses. In fiscal year 2023, CIL's production of approximately 700 million tonnes highlights its leverage.

Logistics providers, particularly the railway sector, also exert considerable bargaining power. The transportation of vast quantities of coal relies heavily on rail infrastructure, and any increases in freight charges or service disruptions directly impact Adani Power's operational costs and efficiency. Indian Railways' increased freight revenue in 2023 underscores the essential nature of these services.

| Supplier Type | Key Players | Impact on Adani Power | Supporting Data (2023/2024) |

| Coal | Coal India Limited (CIL) | Fuel cost and availability | CIL produced ~700 million tonnes (FY23) |

| Logistics | Indian Railways | Transportation costs and efficiency | Increased freight revenue (2023) |

| Equipment | GE, Siemens Energy | Capital expenditure, maintenance costs | Dominant global market share |

| Financiers | Banks, Financial Institutions | Cost of capital, project funding | Active debt seeking for projects (early 2024) |

What is included in the product

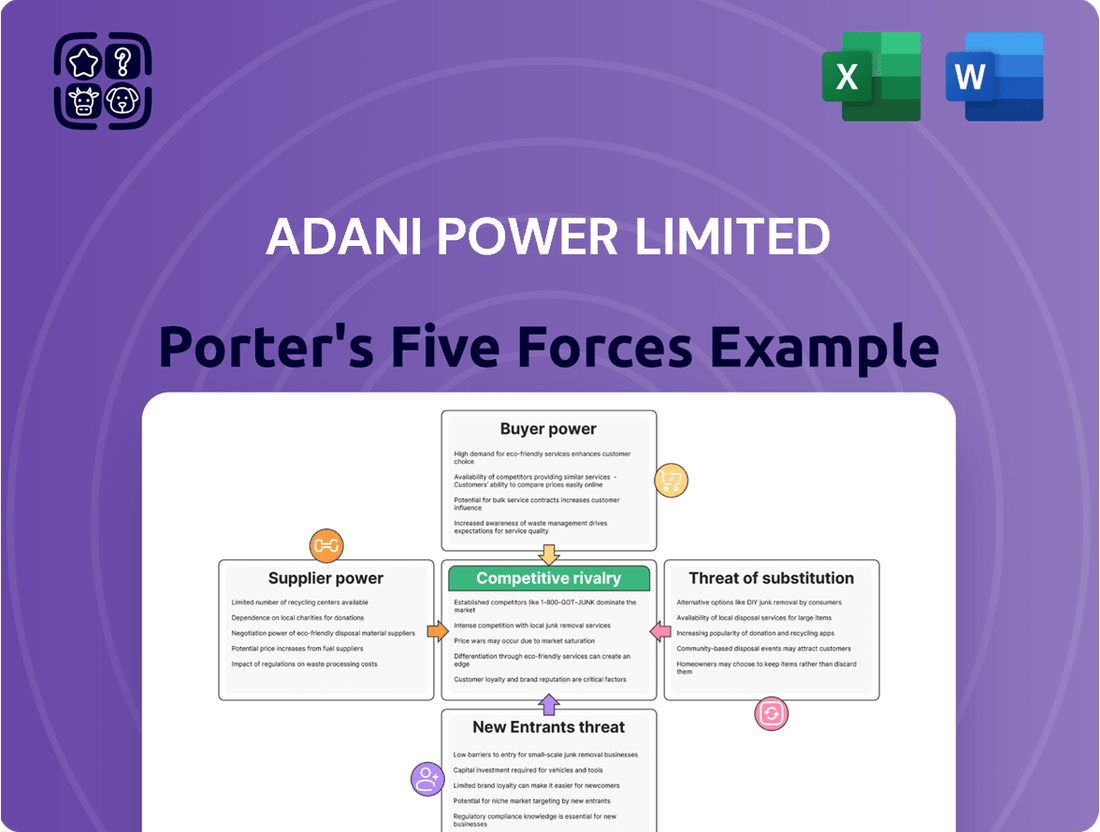

This Porter's Five Forces analysis for Adani Power Limited dissects the competitive intensity, buyer and supplier power, threat of new entrants and substitutes, and overall industry attractiveness within the Indian power sector.

Adani Power's Porter's Five Forces analysis offers a clear, one-sheet summary of all five forces, perfect for quick decision-making and understanding strategic pressure.

Customers Bargaining Power

Adani Power's reliance on regulated Offtake Agreements, primarily with state electricity boards (DISCOMs), significantly shapes customer bargaining power. These long-term Power Purchase Agreements (PPAs) often feature regulated tariffs, limiting direct price negotiation once established. For instance, in fiscal year 2024, Adani Power's revenue from regulated tariffs constituted a substantial portion of its income, reflecting the prevalence of these agreements.

For residential and commercial electricity users in India, the bargaining power of customers is generally low due to limited direct alternatives for power supply. This essential service nature means consumers have few choices, especially in the short term, which strengthens Adani Power's position.

While large industrial consumers might possess some leverage to negotiate terms or consider captive power generation, this option is not universally available or cost-effective for all. India's robust economic growth, projected to continue through 2024 and beyond, fuels a consistently high demand for electricity, further diminishing the collective bargaining power of individual customers.

State governments and their associated utility companies represent Adani Power Limited's primary customer base. This concentration grants these government entities significant bargaining power due to the sheer volume of power they procure and their inherent regulatory authority over the energy sector.

Government decisions on power procurement, reforms in electricity distribution, and the timing of payments directly influence Adani Power's revenue streams and overall financial health. For instance, changes in tariff structures or delayed payments by state discoms can create cash flow challenges.

However, the government's ongoing commitment to ensuring energy security for the nation underpins a consistent demand for power generation. This strategic imperative provides a degree of stability for Adani Power, mitigating some of the risks associated with customer concentration.

High Switching Costs for Customers

For most grid-connected customers, switching power suppliers isn't a practical option. The electricity grid is highly integrated, and regulations make it difficult to change providers. This effectively locks customers into their current distribution companies, which often have power purchase agreements (PPAs) with generators like Adani Power. This situation provides Adani Power with a relatively stable demand base, though pricing is typically regulated.

The lack of easy switching options significantly reduces the bargaining power of customers. For instance, residential consumers in India, a key market for Adani Power, face limited choices for electricity providers. In 2023, the average residential electricity tariff in India was around INR 6.5 per kilowatt-hour, a figure largely determined by regulatory bodies rather than competitive market forces.

- Limited Supplier Choice: Grid infrastructure and regulatory frameworks prevent most customers from easily switching power providers.

- PPA Lock-in: Distribution companies, often tied to generators through long-term Power Purchase Agreements (PPAs), further reduce customer mobility.

- Stable Demand: This lack of switching power creates a predictable demand for Adani Power's electricity output.

- Regulated Pricing: While demand is stable, pricing is typically set by regulators, mitigating direct customer price negotiation.

Demand-Supply Dynamics

The bargaining power of customers in the power sector is significantly influenced by the interplay of demand and supply. While India's overall electricity demand is on an upward trajectory, a temporary surplus in generation capacity can empower customers. This surplus allows them to seek more favorable terms, as alternative suppliers might be readily available. For instance, if generation exceeds immediate needs, large industrial consumers might negotiate lower tariffs.

Conversely, when demand outstrips supply, the situation shifts. Periods of high demand or power deficits naturally strengthen the position of electricity generators like Adani Power Limited. During such times, customers have fewer alternatives and are more willing to accept prevailing rates to ensure a stable power supply. India's projected energy demand growth, estimated to reach approximately 3,000 billion units by 2030, generally supports the strong position of power generators.

- Rising Demand: India's electricity demand is projected to grow substantially, providing a generally favorable environment for power generators.

- Capacity Surplus Impact: A surplus in generation capacity can temporarily increase customer bargaining power, leading to potential price negotiations.

- Deficit Scenario: Power deficits strengthen generators' positions, as customers have limited alternatives and prioritize supply reliability.

- 2024 Context: While specific surplus/deficit figures fluctuate, the long-term demand growth trend underpins generator stability in 2024.

Adani Power's primary customers are state-owned distribution companies (DISCOMs), which are often government entities. This concentration means these large buyers hold significant sway, especially given their regulatory authority and the sheer volume of power they purchase. For instance, Adani Power's reliance on regulated tariffs, as seen in its 2024 financial reporting, highlights how these long-term agreements limit direct price negotiation by individual end-consumers.

While individual residential and commercial customers have very little bargaining power due to the lack of alternative suppliers and the essential nature of electricity, the DISCOMs themselves are the key negotiating parties. These entities, by virtue of their scale and regulatory oversight, can influence terms, though the regulated nature of tariffs often dictates pricing rather than direct negotiation.

The bargaining power of these large customers is also influenced by the overall supply-demand balance in India. In 2024, while demand is robust, any temporary surplus in generation capacity can empower DISCOMs to seek more favorable terms, as seen in market fluctuations. However, India's projected energy demand growth to 2030 generally supports generators' positions.

| Customer Type | Bargaining Power | Key Factors |

| State DISCOMs | Moderate to High | Volume of purchase, regulatory authority, PPA terms |

| Large Industrial Consumers | Low to Moderate | Potential for captive generation, energy efficiency initiatives |

| Residential/Commercial Consumers | Very Low | Lack of alternatives, essential service nature, regulated tariffs |

Full Version Awaits

Adani Power Limited Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Adani Power Limited, detailing the competitive landscape including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing actionable insights into Adani Power's strategic positioning and market dynamics.

Rivalry Among Competitors

The Indian power sector is a battleground with formidable public sector undertakings (PSUs) like NTPC and numerous significant private companies vying for dominance. Adani Power actively engages in competition with these entities for crucial new project opportunities, essential fuel supply agreements, and a larger slice of the market, which naturally drives down tariffs due to competitive bidding processes.

This intense rivalry is further amplified by the fragmented landscape of the private sector, where many players contribute to the overall competitive pressure. For instance, in 2023, India's total installed power capacity reached approximately 427 GW, with both public and private entities contributing substantially, highlighting the scale of competition Adani Power navigates.

Adani Power Limited faces heightened competitive rivalry due to significant capacity additions across India's power sector. The nation's total installed power capacity reached 476 GW by June 2025, with numerous players aggressively expanding in both thermal and renewable energy sources.

This rapid expansion can create periods of oversupply, particularly in the merchant power market, leading to intense competition and downward pressure on electricity tariffs. Such an environment can erode profitability margins for all existing players, including Adani Power, as they vie for market share amidst abundant supply.

Electricity is largely a homogeneous product, meaning consumers, whether industrial or residential, primarily focus on reliability and cost. This lack of differentiation means Adani Power, like its competitors, struggles to charge premium prices based on brand appeal or unique product features. The competition therefore centers on operational excellence and securing cost-effective fuel supplies.

Given this homogeneous market, Adani Power's strategy must heavily lean towards cost leadership. In 2023, the company reported a consolidated revenue of ₹27,533 crore, highlighting the scale of its operations where even minor cost efficiencies can significantly impact profitability. Maintaining competitive tariffs is crucial for market share in such an environment.

Regulatory Environment

The regulatory environment significantly influences competitive rivalry in the power sector. Adani Power Limited operates within a framework that dictates tariff setting, power market operations, and fuel sourcing. For instance, the Central Electricity Regulatory Commission (CERC) and state electricity regulatory commissions play a crucial role in approving tariffs, which directly impacts profitability and competitive positioning. The draft Power Market (First Amendment) Regulations, 2025, are intended to boost market liquidity and introduce new trading mechanisms, potentially altering how companies compete for power sales.

Changes in regulatory policies can create both opportunities and challenges. Regulations promoting open access, for example, allow consumers to choose their power supplier, intensifying competition among generation companies. Conversely, government policies aimed at ensuring energy security or promoting renewable energy can shift the competitive focus. In 2024, the Indian power sector continued to navigate evolving regulations, with a focus on grid stability and the integration of renewable energy sources, impacting the operational strategies of all players, including Adani Power.

- Tariff Setting: Regulated tariffs, approved by commissions like CERC, directly impact revenue streams and competitive pricing strategies.

- Market Regulations: Rules governing power trading, including spot markets and long-term contracts, define competitive dynamics and market access.

- Policy Shifts: Government initiatives, such as those promoting renewable energy or energy efficiency, can reshape the competitive landscape by favoring certain technologies or business models.

- Open Access: Policies allowing open access to transmission infrastructure can increase competition by enabling more players to sell power directly to consumers.

Backward and Forward Integration

Competitive rivalry in the power sector is intensified by backward and forward integration. Some competitors possess integrated operations, spanning from fuel sourcing, such as captive coal mines, to power distribution. This integration can translate into significant cost advantages and enhanced control over the entire value chain.

Adani Power Limited benefits from its position within the larger Adani Group, which has substantial interests in coal mining and logistics. This group synergy offers certain integrated advantages, allowing for more streamlined operations and potentially lower input costs. For instance, Adani Enterprises, another Adani Group entity, operates coal mines, supplying fuel to Adani Power's thermal power plants.

However, other major players in the Indian power market also actively pursue similar integration strategies. This creates a dynamic competitive landscape where companies leverage their control over different stages of the energy production and delivery process to gain an edge. The pursuit of integration means that rivalry is not just about generation capacity but also about securing fuel supply and managing distribution networks effectively.

- Integrated Operations: Competitors may control fuel sources (e.g., coal mines) and distribution networks, offering cost and supply chain advantages.

- Adani Group Synergy: Adani Power leverages the Adani Group's presence in coal mining and logistics, providing partial integration benefits.

- Industry Trend: Integration is a common strategy among major power producers, intensifying competition across the value chain.

- Market Dynamics: Companies compete on generation efficiency, fuel security, and distribution reach, driven by integrated business models.

Adani Power faces intense competition from both public sector undertakings and a fragmented private sector in India's rapidly expanding power market. This rivalry drives down tariffs, particularly in the merchant power segment, as companies like Adani Power compete for market share amidst increasing generation capacity. The homogeneous nature of electricity means competition hinges on operational efficiency and cost control, with Adani Power's 2023 revenue of ₹27,533 crore underscoring the scale where cost advantages are critical.

The competitive landscape is further shaped by regulatory frameworks and the trend towards backward and forward integration. Policies on tariff setting and market operations directly influence how companies compete, while integrated players, including those within the Adani Group's coal mining and logistics operations, gain cost advantages. As of June 2025, India's installed power capacity reached 476 GW, a testament to the dynamic and competitive environment Adani Power navigates.

| Competitor Type | Key Competitors | Competitive Pressure Driver | Example Impact |

|---|---|---|---|

| Public Sector Undertakings (PSUs) | NTPC | Scale, Government backing | Price competition in bidding |

| Private Sector | Tata Power, JSW Energy, Reliance Power | Capacity expansion, Efficiency | Tariff pressure in merchant market |

| Integrated Players | Companies with captive mines, distribution | Cost advantage, Supply chain control | Lower input costs, Market access |

SSubstitutes Threaten

The most significant threat of substitutes for Adani Power Limited stems from the rapid expansion of renewable energy sources, particularly solar and wind power. These alternatives are becoming increasingly cost-competitive, driven by technological advancements and supportive government policies. India's commitment to clean energy is substantial, with installed renewable energy capacity reaching 220.10 GW by March 2025, a figure projected to grow to 500 GW by 2030. This growth directly challenges the dominance of traditional thermal power generation, Adani Power's core business.

Large hydro and pumped storage projects are a significant substitute for thermal power, offering clean and dispatchable energy. India possesses substantial untapped hydropower potential, with ongoing and planned projects aimed at reducing reliance on thermal baseload power. For instance, two pumped storage projects (PSPs) totaling 3 GW are anticipated to be operational by 2025, directly impacting the demand for Adani Power's thermal generation.

The threat of substitutes for Adani Power Limited is intensifying as nuclear power gains traction. While still a nascent segment, nuclear energy offers a low-carbon baseload power source, with new reactors coming online and ambitious expansion plans. For instance, Unit 7 of the Rajasthan Atomic Power Project was connected to the northern grid in June 2025, signaling this growing capacity.

Governments globally, including India, are increasingly prioritizing nuclear energy, with a particular focus on developing small modular reactors (SMRs). This strategic push indicates a long-term commitment to diversifying the energy mix and reducing reliance on fossil fuels, thereby presenting a credible alternative to conventional power generation methods that Adani Power currently utilizes.

Energy Storage Solutions

Advancements in battery energy storage systems (BESS) increasingly pose a threat to traditional thermal power generation by Adani Power Limited. These systems, like lithium-ion batteries, are becoming more efficient and cost-effective, directly competing with the baseload power provided by thermal plants. For instance, by the end of 2023, global BESS installations reached over 140 GW, a significant jump from previous years, highlighting their growing capacity to complement intermittent renewables and reduce reliance on thermal power for grid stability.

The expanding Over-the-Counter (OTC) market for BESS contracts further solidifies their position as viable substitutes. This market growth indicates increased investor confidence and the commoditization of energy storage, making it easier for utilities and grid operators to procure and integrate these solutions. As BESS capabilities improve, they can increasingly provide ancillary services traditionally offered by thermal plants, such as frequency regulation, thereby diminishing the unique value proposition of thermal power.

- Growing BESS Capacity: Global BESS installations surpassed 140 GW by the end of 2023, demonstrating a substantial increase in their ability to substitute thermal power.

- Cost Reductions: The levelized cost of storage for utility-scale batteries has seen a significant decline, making them more economically competitive with thermal generation.

- Ancillary Service Provision: BESS are increasingly capable of providing grid stability services, directly challenging the role of thermal power plants in maintaining grid reliability.

Decentralized and Captive Generation

Industrial and commercial customers are increasingly installing their own power generation systems, such as rooftop solar or waste-to-energy plants. This shift aims to reduce reliance on traditional grid power and control energy expenses. For instance, in 2023, India saw significant growth in distributed solar capacity, with commercial and industrial segments being major contributors.

These captive generation solutions, often encouraged by government policies, directly challenge the market share of large thermal power providers like Adani Power. By generating their own electricity, these consumers reduce their need to purchase power from external sources, thereby potentially shrinking the overall demand for Adani Power's output.

- Captive Power Growth: The trend of businesses investing in captive power generation is a significant threat.

- Cost Mitigation: Consumers seek to reduce operational costs by controlling their energy supply.

- Policy Support: Favorable government policies often incentivize the adoption of decentralized energy solutions.

- Demand Erosion: This directly impacts the customer base and revenue streams of traditional power producers.

The increasing adoption of distributed generation, like rooftop solar by commercial and industrial entities, directly erodes Adani Power's customer base. By 2023, India's distributed solar capacity saw substantial growth, with businesses actively reducing their reliance on grid power. This trend, often supported by favorable policies, directly impacts Adani Power's market share and revenue potential.

Entrants Threaten

The sheer cost of building and operating power plants, particularly thermal ones, presents a formidable barrier to entry. Adani Power's substantial investments in its existing fleet, which includes significant capital expenditure for plant construction and fuel supply chains, underscore this high capital intensity. This financial hurdle naturally limits the pool of potential new competitors.

The Indian power sector is characterized by significant regulatory complexity, demanding extensive licenses, clearances, and environmental approvals. This intricate process is a substantial barrier for potential new entrants, effectively limiting participation to entities with substantial resources and proven expertise in navigating such requirements.

For instance, obtaining a Generation License in India involves multiple stages and clearances from various government bodies, a process that can extend over several years. While recent reforms in 2023-2024 have aimed at streamlining some of these procedures, the inherent complexity still acts as a strong deterrent, protecting established players like Adani Power Limited.

Newcomers face significant hurdles in securing reliable and affordable fuel, especially coal, and gaining access to the national transmission grid. These are essential for power generation and distribution. Established entities like Adani Power benefit from existing long-term fuel contracts and developed infrastructure, creating a barrier for emerging competitors.

The dominant position of Coal India Limited, a primary supplier of coal, further consolidates this advantage for existing players. In 2023-24, Coal India Limited produced over 773 million tonnes of coal, highlighting its critical role in the fuel supply chain and the challenge for new entrants to secure comparable linkages.

Economies of Scale and Experience

New entrants face a significant hurdle due to the substantial economies of scale enjoyed by established players like Adani Power. These existing giants benefit from lower per-unit costs in generation, fuel procurement, and overall operations, making it difficult for newcomers to compete on price without massive upfront investment and years of operational experience.

Adani Power's expanding operational capacity, reaching over 15,000 MW by early 2024, further solidifies its cost advantage. This scale allows for more efficient resource utilization and bargaining power with suppliers, creating a barrier that new, smaller operations would find challenging to overcome.

- Economies of Scale: Existing large players achieve lower per-unit costs in generation, procurement, and operations.

- Experience Curve: New entrants need significant investment and operational experience to match efficiencies.

- Adani Power's Capacity: Adani Power's growing capacity, exceeding 15,000 MW by early 2024, enhances its cost leadership.

Government Support for Incumbents

While the Indian government is actively promoting renewable energy, it also continues to support thermal power to meet the nation's escalating energy demand and ensure energy security. This dual approach can create a challenging environment for new entrants, as government policies or tenders may sometimes favor established players or large-scale projects. For instance, the government aims to add an additional 80 GW of coal-based capacity by 2031-32, a significant undertaking that often benefits existing, well-capitalized companies. This continued backing of thermal power, even as renewables grow, can act as a barrier to smaller, newer companies trying to enter the market.

The threat of new entrants for Adani Power Limited is significantly mitigated by the immense capital requirements for establishing power generation facilities, coupled with stringent regulatory hurdles. Navigating India's complex licensing and approval processes demands substantial resources and expertise, acting as a strong deterrent for potential new players. Furthermore, securing essential fuel supplies and grid access presents considerable challenges for newcomers, as established companies like Adani Power benefit from existing infrastructure and long-term contracts.

Economies of scale achieved by Adani Power, with its capacity exceeding 15,000 MW by early 2024, allow for lower per-unit costs, making it difficult for smaller entrants to compete on price. The government's continued support for thermal power, alongside renewable energy growth, can also favor established, well-capitalized entities in securing large-scale projects and government tenders.

| Barrier | Description | Impact on New Entrants |

| Capital Intensity | High costs for plant construction and fuel infrastructure. | Limits the number of potential competitors. |

| Regulatory Complexity | Extensive licenses, clearances, and environmental approvals. | Deters entities without significant resources and expertise. |

| Fuel and Grid Access | Securing reliable and affordable fuel (e.g., coal) and transmission access. | Established players have existing contracts and infrastructure advantages. |

| Economies of Scale | Lower per-unit costs for large-scale operations. | New entrants struggle to match cost efficiencies without massive investment. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Adani Power Limited is built upon a foundation of robust data, including their annual reports, regulatory filings with the Ministry of Corporate Affairs, and industry-specific reports from organizations like CRISIL and ICRA. We also incorporate data from financial news outlets and energy sector publications to capture current market dynamics and competitive pressures.