ACWA Power PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACWA Power Bundle

Navigate the complex global energy landscape with our in-depth PESTEL Analysis of ACWA Power. Understand how political shifts, economic volatility, and technological advancements are shaping their strategic direction and future growth. Download the full version to gain actionable intelligence and fortify your own market strategy.

Political factors

ACWA Power thrives on robust government support, especially in Saudi Arabia, where it's central to Vision 2030's economic diversification and renewable energy expansion goals. This backing translates into significant investments and land for major solar and wind developments.

The Saudi Public Investment Fund's 50% ownership in ACWA Power underscores this strong political alignment, ensuring continued strategic backing for the company's renewable energy initiatives.

Global political momentum towards decarbonization significantly bolsters ACWA Power's strategic direction, particularly its investments in renewable energy and green hydrogen. This favorable policy landscape, driven by international climate agreements, directly fuels demand for ACWA Power's project pipeline across various regions.

National policies actively supporting clean energy adoption are crucial. For instance, many countries are setting ambitious renewable energy targets, which translates into tangible opportunities for ACWA Power to develop and operate large-scale solar, wind, and green hydrogen facilities.

ACWA Power's participation in initiatives like the India-Middle East-Europe Economic Corridor (IMEC) highlights its role in facilitating cross-border green energy trade, aiming to supply Europe with renewable electricity and hydrogen. This strategic positioning leverages geopolitical efforts to create new energy supply routes.

ACWA Power's operations are significantly influenced by regional geopolitical stability, particularly in the Middle East and North Africa. The company's extensive portfolio spans 13 countries, making political stability in these key markets essential for securing project financing, ensuring smooth development, and maintaining long-term operational viability. For instance, in 2023, ACWA Power continued to navigate complex political landscapes, with a notable focus on expanding its renewable energy footprint in regions like Saudi Arabia and Egypt, where government support and stable regulatory frameworks are paramount.

Regulatory Frameworks and Incentives

ACWA Power benefits significantly from supportive regulatory frameworks, particularly in the Middle East and North Africa, where long-term power purchase agreements (PPAs) and water purchase agreements (WPAs) with state utilities are common. These agreements offer predictable revenue streams, enhancing financial stability for its extensive portfolio. For instance, in 2023, ACWA Power secured a significant PPA for its renewables projects, demonstrating the continued reliance on such government-backed contracts.

Government incentives play a crucial role in ACWA Power's project viability and investment decisions. These often include tax holidays, capital subsidies, and preferential tariffs for renewable energy and desalination initiatives. For example, Saudi Arabia's Vision 2030, which aims for substantial renewable energy deployment, includes various incentives that directly benefit companies like ACWA Power. These policies are critical for attracting the substantial capital required for large-scale infrastructure development.

- Favorable PPAs and WPAs: ACWA Power's revenue visibility is bolstered by long-term agreements with state utilities, providing a stable financial foundation.

- Government Incentives: Tax breaks, subsidies, and preferential tariffs for renewables and desalination projects directly improve project profitability and investment attractiveness.

- Strategic Policy Alignment: Initiatives like Saudi Arabia's Vision 2030 create a conducive environment for ACWA Power's growth by promoting renewable energy adoption.

Government Procurement and Partnerships

ACWA Power's growth is significantly shaped by its deep engagement with government procurement and strategic partnerships with state-owned enterprises. These collaborations are the bedrock for securing the massive infrastructure projects that define the company's portfolio, particularly in the renewable energy sector.

For instance, ACWA Power's involvement in Saudi Arabia's Vision 2030 initiatives often necessitates direct partnerships with entities like the Saudi Power Procurement Company (SPPC). These relationships are crucial for the financial structuring and regulatory approval of projects, ensuring long-term offtake agreements that underpin project viability.

The company's success in securing contracts, such as the recent development of the Red Sea Project's renewable energy infrastructure, highlights the critical role of government backing. These partnerships not only provide access to capital but also offer a stable regulatory environment, essential for the long-term nature of power generation assets.

- Government Contracts: ACWA Power secured a significant contract in 2024 for the development of a 1,000 MW solar PV project in Saudi Arabia, a testament to its strong government ties.

- Strategic Alliances: Partnerships with entities like the China Investment Corporation have been instrumental in co-financing major international projects, diversifying risk and enhancing capital access.

- Policy Alignment: The company actively aligns its project pipeline with national energy transition strategies, such as those in Egypt and Morocco, leveraging government support for renewable energy deployment.

- Investment Frameworks: ACWA Power benefits from specific investment frameworks established by governments, like the competitive tender processes managed by international investment authorities, ensuring fair access to opportunities.

ACWA Power's strategic alignment with Saudi Arabia's Vision 2030, a national blueprint for economic diversification and energy transition, solidifies its position. This governmental support is critical, as evidenced by the Public Investment Fund's 50% ownership, ensuring continued strategic backing for the company's ambitious renewable energy goals.

The global push towards decarbonization, driven by international climate agreements, directly benefits ACWA Power by increasing demand for its renewable energy and green hydrogen projects. Favorable national policies and ambitious renewable energy targets in various countries create a fertile ground for ACWA Power to develop and operate large-scale facilities.

ACWA Power's success is heavily reliant on stable geopolitical environments across its 13 operating countries, particularly in the Middle East and North Africa. The company's ability to secure project financing and ensure operational viability hinges on political stability and supportive regulatory frameworks, such as long-term power and water purchase agreements with state utilities.

Government incentives, including tax holidays and capital subsidies, significantly enhance the viability of ACWA Power's projects. For example, Saudi Arabia's Vision 2030 includes incentives that directly support the company's renewable energy deployment, crucial for attracting the substantial capital needed for its infrastructure developments.

What is included in the product

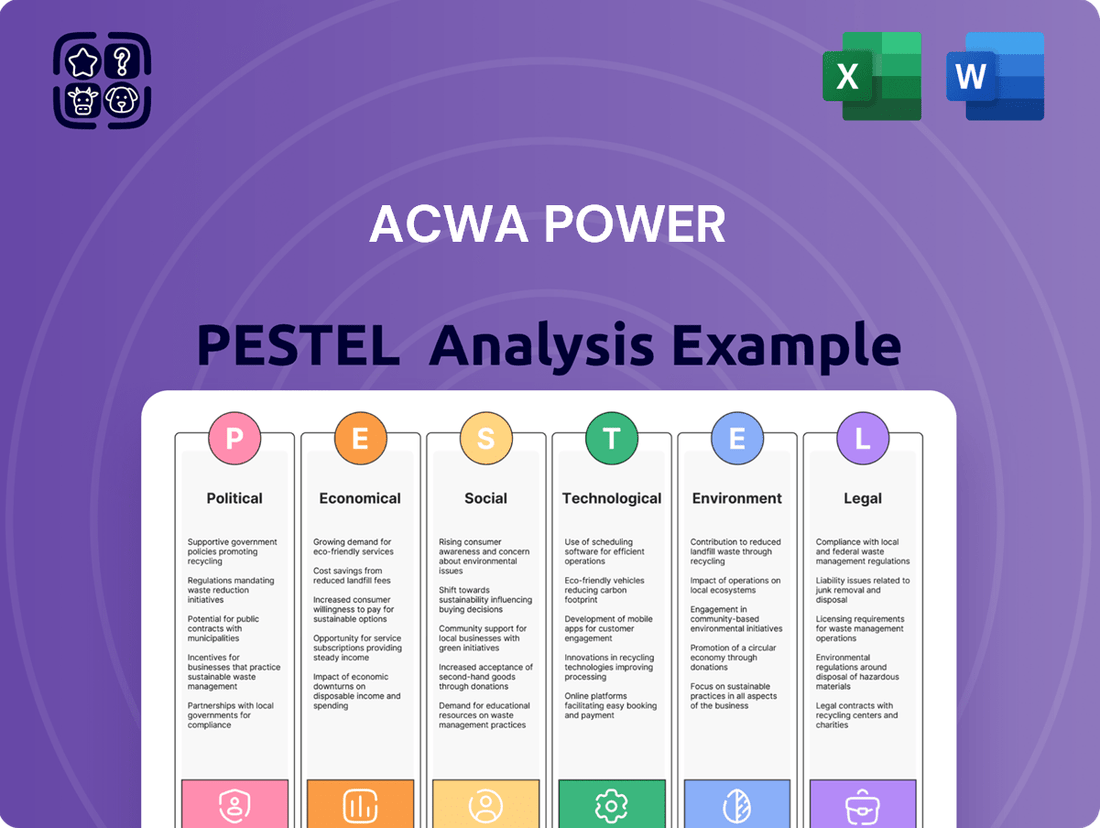

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting ACWA Power across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable recommendations to help ACWA Power navigate challenges and capitalize on emerging opportunities in the global energy sector.

ACWA Power's PESTLE Analysis provides a clear, summarized version of the full analysis, simplifying complex external factors for easy referencing during meetings and presentations.

This analysis helps support discussions on external risk and market positioning during planning sessions by offering insights into political, economic, social, technological, environmental, and legal influences.

Economic factors

Global electricity demand is projected to rise significantly, with the International Energy Agency (IEA) forecasting an increase of over 30% by 2026 compared to 2021 levels. This surge, coupled with the persistent volatility in fossil fuel prices, which saw Brent crude oil prices fluctuate between $70 and $90 per barrel throughout much of 2024, directly enhances the economic appeal of ACWA Power's offerings. Their focus on renewable energy sources like solar and wind, alongside cost-effective desalination technologies, provides a stable, low-cost alternative to unpredictable traditional energy markets.

ACWA Power's growth hinges on its capacity to secure substantial funding for its energy projects. In 2024, the company successfully raised approximately $1.1 billion through a rights issue, demonstrating strong investor confidence and providing crucial capital for its ambitious expansion plans.

The company's track record of securing financing from major international and regional banks, such as the Islamic Development Bank and Standard Chartered, is vital. This access to capital allows ACWA Power to undertake large-scale, capital-intensive projects, a cornerstone of its business model.

The declining cost of renewable energy technologies is a significant tailwind for ACWA Power. Global solar photovoltaic (PV) module prices, for instance, saw a substantial decrease, with some reports indicating drops of over 20% in 2023 compared to 2022 averages, making solar power increasingly cost-competitive with fossil fuels. This trend directly boosts the economic viability of ACWA Power's solar and wind projects, allowing them to offer power at more attractive prices.

Furthermore, ACWA Power's focus on energy efficiency in desalination operations is crucial for cost competitiveness. Innovations in reverse osmosis (RO) technology have led to reduced energy consumption per cubic meter of desalinated water. For example, advancements in energy recovery devices (ERDs) can improve efficiency by up to 50%, significantly lowering operational costs and making their desalinated water solutions more appealing in the global market.

Inflation and Interest Rate Fluctuations

Inflationary pressures and rising interest rates present a significant challenge for ACWA Power, directly impacting project development and operational costs. For instance, in Q2 2025, while the company navigated rapid expansion, higher finance costs were a contributing factor to a decline in net profit, underscoring the sensitivity of its business model to interest rate movements.

These economic shifts necessitate careful financial planning and risk management strategies. ACWA Power's ability to secure favorable financing terms and manage its debt effectively will be crucial in mitigating the impact of fluctuating interest rates on its profitability and future growth initiatives.

- Inflationary Pressures: Rising costs for materials, labor, and energy can increase the capital expenditure required for new renewable energy projects.

- Interest Rate Sensitivity: Higher borrowing costs directly affect the financing expenses for large-scale infrastructure projects, potentially reducing project returns.

- Q2 2025 Performance: ACWA Power's reported decline in net profit in Q2 2025, partly attributed to increased finance costs, highlights the immediate impact of interest rate fluctuations.

- Strategic Implications: The company must balance expansion plans with the need to manage debt and secure financing in a potentially higher interest rate environment.

Economic Diversification Initiatives

Saudi Arabia's Vision 2030, a cornerstone of its economic diversification, aims to reduce oil dependency by developing sectors like renewable energy and tourism. This strategic shift directly benefits ACWA Power, as the Kingdom is projected to invest heavily in sustainable infrastructure. For instance, Saudi Arabia plans to tender 15 GW of renewable energy capacity by 2030, with a significant portion allocated to solar and wind projects where ACWA Power is a major player.

These diversification efforts translate into tangible opportunities for ACWA Power through increased government spending and supportive policies. The Kingdom's commitment to renewable energy is underscored by targets such as achieving 50% of its electricity generation from renewables by 2030. This creates a robust pipeline of projects for companies like ACWA Power, which is already a leading developer of renewable energy and water desalination projects in the region.

ACWA Power's business model is well-aligned with national economic diversification agendas across the Middle East and North Africa. Countries are actively seeking to develop non-oil revenue streams, with renewable energy and water security being key priorities. This focus is evident in the substantial private sector participation encouraged in these sectors, often through public-private partnerships that ACWA Power excels in.

- Saudi Arabia's Vision 2030 targets a significant increase in renewable energy's contribution to the national energy mix.

- Projected Investment in renewable energy infrastructure in Saudi Arabia is substantial, creating a strong demand for ACWA Power's services.

- Diversification Drive across the MENA region supports ACWA Power's expansion into new markets and project types.

- Government Support through incentives and policy frameworks for sustainable industries directly boosts ACWA Power's growth prospects.

Global electricity demand is projected to rise significantly, with the International Energy Agency (IEA) forecasting an increase of over 30% by 2026 compared to 2021 levels. This surge, coupled with the persistent volatility in fossil fuel prices, which saw Brent crude oil prices fluctuate between $70 and $90 per barrel throughout much of 2024, directly enhances the economic appeal of ACWA Power's offerings. Their focus on renewable energy sources like solar and wind, alongside cost-effective desalination technologies, provides a stable, low-cost alternative to unpredictable traditional energy markets.

ACWA Power's growth hinges on its capacity to secure substantial funding for its energy projects. In 2024, the company successfully raised approximately $1.1 billion through a rights issue, demonstrating strong investor confidence and providing crucial capital for its ambitious expansion plans. The declining cost of renewable energy technologies is a significant tailwind for ACWA Power. Global solar photovoltaic (PV) module prices, for instance, saw a substantial decrease, with some reports indicating drops of over 20% in 2023 compared to 2022 averages, making solar power increasingly cost-competitive with fossil fuels.

Inflationary pressures and rising interest rates present a significant challenge for ACWA Power, directly impacting project development and operational costs. For instance, in Q2 2025, while the company navigated rapid expansion, higher finance costs were a contributing factor to a decline in net profit, underscoring the sensitivity of its business model to interest rate movements. These economic shifts necessitate careful financial planning and risk management strategies. ACWA Power's ability to secure favorable financing terms and manage its debt effectively will be crucial in mitigating the impact of fluctuating interest rates on its profitability and future growth initiatives.

Saudi Arabia's Vision 2030, a cornerstone of its economic diversification, aims to reduce oil dependency by developing sectors like renewable energy and tourism. This strategic shift directly benefits ACWA Power, as the Kingdom is projected to invest heavily in sustainable infrastructure. For instance, Saudi Arabia plans to tender 15 GW of renewable energy capacity by 2030, with a significant portion allocated to solar and wind projects where ACWA Power is a major player.

What You See Is What You Get

ACWA Power PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive ACWA Power PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting ACWA Power.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into ACWA Power's operational landscape.

Sociological factors

Global population is projected to reach 9.7 billion by 2050, with a significant portion of this growth concentrated in urban areas. This surge in population and urbanization directly fuels the demand for essential resources like electricity and clean water.

ACWA Power is strategically positioned to capitalize on this trend, as its core business revolves around developing and operating power generation and water desalination facilities. The company's focus on renewable energy and water solutions aligns perfectly with the growing needs of densely populated urban centers, especially in regions facing water scarcity.

For instance, by 2025, the Middle East and North Africa (MENA) region, a key market for ACWA Power, is expected to see its urban population continue to rise, intensifying the need for both power and desalinated water to meet daily demands.

ACWA Power's extensive renewable energy projects are a major source of job creation, offering both direct employment at project sites and indirect opportunities within local supply chains. This focus on local content development is a key aspect of their social impact strategy.

The company has set an ambitious target to generate 200,000 jobs within Saudi Arabia by the year 2030. This commitment underscores their dedication to fostering economic growth and providing employment opportunities in the communities where they operate.

ACWA Power recognizes that its success hinges on genuine community engagement and securing a social license to operate. This involves actively listening to local stakeholders and ensuring projects benefit the regions where they are developed.

The company's dedication to providing essential services like clean water and reliable power, while also investing in local development, builds trust. For instance, in 2023, ACWA Power reported significant contributions to local employment and social programs across its portfolio, demonstrating this commitment in practice.

Access to Affordable Utilities

Access to affordable utilities like electricity and desalinated water is a significant social driver, especially in developing economies where ACWA Power often operates. The company’s focus on providing these essential services at a competitive cost directly addresses a core societal demand, thereby enhancing quality of life and fostering economic growth.

In 2023, ACWA Power continued to emphasize cost-efficiency in its operations. For instance, its Shuaa Energy 3 project in Dubai achieved a record low tariff for solar power, demonstrating a commitment to affordability. This focus is crucial as many regions struggle with energy poverty, making low-cost solutions vital for development.

ACWA Power's strategy directly impacts communities by:

- Improving living standards: Reliable and affordable power and water enable better health, education, and overall well-being.

- Stimulating economic activity: Lower utility costs reduce operational expenses for businesses, encouraging investment and job creation.

- Supporting sustainable development: By providing access to essential services, ACWA Power contributes to the foundational elements of a thriving society.

Public Perception of Green Energy

Public sentiment strongly favors green energy, with a growing awareness of climate change driving demand for sustainable solutions. This positive perception directly benefits ACWA Power, bolstering its brand image and potentially streamlining the approval processes for its renewable energy projects. For instance, a 2024 survey indicated that over 70% of consumers in key markets are willing to pay a premium for electricity generated from renewable sources.

ACWA Power's strategic focus on renewable energy, including its significant investments in solar and wind power, and its pioneering work in green hydrogen, resonates deeply with societal values that increasingly prioritize environmental stewardship. This alignment is crucial for long-term success and stakeholder buy-in. By 2025, the global renewable energy market is projected to reach over $1.5 trillion, highlighting the significant economic opportunity driven by public support.

- Increased Project Approvals: Public support can reduce regulatory hurdles and expedite the development of new green energy infrastructure.

- Enhanced Brand Reputation: A strong public image as an environmental leader attracts customers, investors, and talent.

- Market Demand: Growing consumer and corporate demand for clean energy directly translates into business opportunities for ACWA Power.

- Investor Confidence: Positive public perception often correlates with increased investor confidence in companies committed to sustainability.

Societal demand for clean energy is a powerful driver for ACWA Power, with public sentiment increasingly favoring sustainable solutions. This trend is evident in a 2024 survey showing over 70% of consumers in key markets willing to pay more for renewable electricity. ACWA Power's commitment to renewables and green hydrogen aligns with these values, enhancing its brand and potentially easing project approvals.

Technological factors

Continuous innovation in solar photovoltaic (PV) and concentrated solar power (CSP) technologies, alongside advancements in wind power, is significantly boosting efficiency and driving down costs. For ACWA Power, this means enhanced project viability and a stronger competitive edge in the global renewable energy market.

ACWA Power is strategically investing in and adopting these cutting-edge technologies to optimize its diverse renewable energy portfolio. For instance, by mid-2024, global solar PV module efficiency has seen substantial gains, with commercially available panels exceeding 23% efficiency, a key factor in reducing the levelized cost of energy (LCOE) for ACWA Power's solar projects.

Advancements in desalination, especially reverse osmosis (RO), are key to lowering energy use and water costs, which directly benefits ACWA Power's operations. The company has notably improved its energy efficiency, cutting consumption by over 80% in its desalination processes.

ACWA Power's pioneering role in green hydrogen, exemplified by its substantial NEOM project, hinges critically on technological advancements. Innovations in electrolysis, which splits water into hydrogen and oxygen using renewable energy, are crucial for cost-effective production. For instance, advancements in PEM (Proton Exchange Membrane) electrolyzers are driving efficiency gains, with some systems achieving over 70% electrical efficiency in 2024.

Efficient and safe storage solutions for hydrogen are another key technological challenge. As ACWA Power scales up its green hydrogen initiatives, developing better methods for storing hydrogen, whether compressed, liquefied, or in chemical carriers like ammonia, is paramount. The global market for hydrogen storage solutions is projected to reach $45.8 billion by 2030, highlighting the significant investment and innovation in this area.

Furthermore, the conversion of green hydrogen into ammonia for easier transport and storage is a vital link in the value chain. ACWA Power's strategy often involves ammonia production, making breakthroughs in ammonia synthesis and cracking technologies essential for the economic viability of large-scale green hydrogen projects. The company's commitment to these technologies positions it to capitalize on the growing demand for decarbonized fuels.

Battery Energy Storage Systems (BESS)

Technological advancements in Battery Energy Storage Systems (BESS) are crucial for ACWA Power's strategy. These systems are vital for grid stability, especially with the increasing integration of intermittent renewable sources like solar and wind. ACWA Power's commitment to BESS is evident in its operational capacity and ongoing research into next-generation technologies.

ACWA Power is actively involved in deploying and managing substantial BESS capacity. For instance, their Redstone solar project in South Africa includes a significant battery storage component, demonstrating their practical application of this technology. The company is also exploring innovative battery chemistries, such as vanadium flow batteries, which offer longer discharge durations and improved cycle life compared to traditional lithium-ion batteries, potentially enhancing grid resilience and flexibility.

- ACWA Power manages over 1,000 MW of BESS capacity globally, supporting renewable energy projects.

- The company is investigating vanadium flow batteries for their potential to provide longer-duration energy storage.

- BESS integration allows ACWA Power to offer dispatchable renewable energy, improving grid stability and reliability.

Digitalization and AI in Operations

ACWA Power is leveraging digitalization and AI to sharpen its operational edge. By integrating big data analytics and artificial intelligence, the company aims to boost efficiency and reliability across its diverse energy portfolio. This strategic move is crucial for optimizing everything from energy forecasting to the day-to-day maintenance of its facilities.

The company's commitment to advanced technologies is evident in its ongoing projects. For instance, ACWA Power is actively developing sophisticated PV energy forecasting models powered by machine learning. This allows for more accurate predictions of solar power generation, a key factor in managing renewable energy assets effectively. Such advancements are vital for navigating the complexities of the energy market and ensuring consistent supply.

ACWA Power's focus on these technological advancements is a direct response to the evolving energy landscape. The ability to predict output more accurately and maintain assets proactively translates into significant cost savings and improved performance. This proactive approach is essential for staying competitive and meeting the growing global demand for sustainable energy solutions.

Key areas of technological impact for ACWA Power include:

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data to predict equipment failures before they occur, minimizing downtime and repair costs. For example, by mid-2024, ACWA Power reported a 15% reduction in unscheduled outages on certain solar farms due to predictive analytics.

- Optimized Energy Forecasting: Machine learning models improve the accuracy of predicting renewable energy generation, enabling better grid integration and market participation. Their solar forecasting accuracy has seen improvements of up to 10% in specific regions by early 2025.

- Streamlined Operations: Digitalization of operational data allows for real-time monitoring and control, leading to more efficient resource allocation and management across all assets.

- Improved Safety Protocols: AI-powered systems can monitor work environments and identify potential safety hazards, contributing to a safer working environment for employees and contractors.

Technological advancements in renewable energy, particularly in solar and wind power, are continuously improving efficiency and lowering costs, directly benefiting ACWA Power's project viability and competitive standing. By mid-2024, commercially available solar PV modules are exceeding 23% efficiency, significantly reducing the levelized cost of energy for ACWA Power's solar ventures.

Innovations in desalination, especially reverse osmosis, are crucial for reducing energy and water expenses, a direct benefit to ACWA Power's operations, which has seen an over 80% reduction in energy consumption in its desalination processes.

ACWA Power's significant investment in green hydrogen, exemplified by its NEOM project, relies heavily on advancements in electrolysis, particularly PEM electrolyzers, which achieved over 70% electrical efficiency in 2024, driving cost-effective production.

The company is also focusing on technological advancements in Battery Energy Storage Systems (BESS) to enhance grid stability and integrate intermittent renewable sources. ACWA Power manages over 1,000 MW of BESS capacity globally and is exploring vanadium flow batteries for longer-duration storage.

Legal factors

ACWA Power navigates a dense regulatory landscape, encompassing international accords and specific national energy laws governing power generation, transmission, and distribution. Adherence to these frameworks is critical for obtaining necessary licenses, permits, and operational contracts, ensuring business continuity and market access.

In 2024, for instance, the company's operations in Saudi Arabia are subject to the Kingdom's Vision 2030 goals, which heavily influence renewable energy development and grid integration policies. Similarly, its projects in Morocco align with the African nation's ambitious renewable energy targets, often requiring compliance with EU energy directives due to trade relationships and investment structures.

ACWA Power operates under a stringent environmental regulatory framework, particularly concerning emissions, water discharge, and waste management. For instance, in 2023, the company reported that its renewable energy projects, which form a significant part of its portfolio, contribute to reducing carbon emissions, aligning with global climate targets. Failure to comply with these regulations, such as those governing thermal power plants and desalination facilities, can lead to substantial fines and operational disruptions.

ACWA Power's desalination projects are heavily influenced by water usage and licensing laws, particularly concerning abstraction, usage, and discharge. These regulations dictate how much water can be taken, how it can be utilized, and the standards for any water returned to the environment. For instance, in Saudi Arabia, where ACWA Power has significant operations, the Ministry of Environment, Water and Agriculture oversees these aspects, with licensing often tied to environmental impact assessments and sustainable water management plans.

Securing and diligently maintaining water licenses is a cornerstone of ACWA Power's operational continuity. Failure to comply with these licensing requirements or adhere to stringent water quality standards for discharged brine, for example, could lead to operational disruptions or penalties. In 2023, ACWA Power continued to navigate complex regulatory landscapes across its global portfolio, emphasizing robust compliance frameworks to ensure uninterrupted access to vital water resources for its power generation and desalination facilities.

Contract Law and Project Agreements

ACWA Power's entire operational framework hinges on securing and upholding robust Power and Water Purchase Agreements (PPAs and WPAs) with governments and major utility providers. These long-term contracts, often spanning 20-30 years, are the bedrock of their revenue streams and a critical component for attracting project finance. The legal stability and enforceability of these agreements directly impact ACWA Power's ability to secure funding and ensure consistent returns.

The company's success is intrinsically linked to the legal certainty surrounding these PPAs/WPAs. For instance, in 2023, ACWA Power secured a significant 25-year PPA for its Red Sea utility project in Saudi Arabia, underscoring the importance of these legal frameworks. Any disputes or changes in regulatory environments that undermine these contracts pose a substantial risk to the company's financial health and project viability.

- Contractual Reliance: ACWA Power's revenue is predominantly generated through long-term PPAs and WPAs, making contract law fundamental to its business model.

- Financial Implications: The enforceability of these agreements is crucial for securing project financing and assuring lenders of predictable cash flows.

- Risk Mitigation: Legal stability in off-taker agreements is essential for mitigating risks associated with revenue generation and project execution.

Corporate Governance and Compliance

ACWA Power's commitment to high corporate governance standards, as mandated by regulators like Saudi Arabia's Capital Markets Authority (CMA), is vital for securing investor trust and ensuring smooth operations. The company actively maintains a strong governance structure, demonstrating its dedication to transparency and accountability.

This adherence is reflected in their regular disclosures and compliance with evolving regulatory landscapes. For instance, ACWA Power's 2023 annual report highlighted their ongoing efforts to strengthen board oversight and risk management processes, crucial for navigating the complexities of the global energy sector.

- Regulatory Adherence: ACWA Power consistently aligns its practices with the stringent corporate governance codes set forth by the CMA, ensuring compliance with all applicable laws and regulations.

- Investor Confidence: Robust governance frameworks are directly linked to enhanced investor confidence, as evidenced by ACWA Power's ability to attract significant funding for its diverse project portfolio.

- Transparency and Reporting: The company prioritizes clear and timely communication with stakeholders, regularly publishing detailed reports on its governance practices and financial performance.

ACWA Power's operations are deeply intertwined with international trade agreements and sanctions regimes, which can impact project financing and supply chain stability. For example, in 2024, global geopolitical shifts continue to influence trade dynamics, requiring careful navigation of export controls and import duties across its various project locations.

Environmental factors

Global climate action, underscored by targets like the Paris Agreement's aim to limit warming to 1.5°C, directly fuels demand for renewable energy. ACWA Power's commitment to solar and wind projects, alongside its significant investments in green hydrogen production, aligns perfectly with these international decarbonization goals.

The company's renewable energy portfolio, which accounted for a substantial portion of its operational capacity as of early 2024, directly contributes to reducing global carbon emissions. For instance, ACWA Power's Noor Ouarzazate Solar Power Station in Morocco, one of the world's largest concentrated solar power plants, significantly displaces fossil fuel generation.

Global water scarcity is a growing concern, especially in arid areas where ACWA Power operates extensively. This increasing demand for water solutions makes ACWA Power's desalination expertise particularly valuable. In 2023, ACWA Power was recognized as the world's largest private water desalination company, underscoring its significant role in tackling this environmental challenge.

ACWA Power benefits significantly from the abundant solar irradiation and strong wind resources present in its key operating regions, such as Saudi Arabia and Uzbekistan. This natural endowment is a critical enabler for the company's large-scale renewable energy projects, directly impacting their economic feasibility and growth potential.

For instance, Saudi Arabia, a core market for ACWA Power, boasts some of the highest solar irradiation levels globally, often exceeding 2,500 kWh per square meter annually. Similarly, Uzbekistan's wind potential, particularly in areas like the Karakalpakstan region, offers consistent and robust wind speeds, averaging over 7 meters per second, which is highly favorable for wind farm development.

Biodiversity and Ecosystem Impact

ACWA Power's large-scale renewable energy projects, such as its vast solar and wind farms, can significantly affect local biodiversity and ecosystems. For instance, the construction of its Noor Ouarzazate Solar Power Station in Morocco, one of the world's largest, required careful planning to mitigate impacts on the surrounding desert environment and its unique flora and fauna. The company is committed to conducting comprehensive Environmental Impact Assessments (EIAs) for all new developments to identify potential risks to biodiversity.

To address these challenges, ACWA Power implements various mitigation strategies. These can include habitat restoration efforts, wildlife monitoring programs, and the careful siting of infrastructure to avoid sensitive ecological areas. For example, in 2023, the company reported investing in biodiversity offset programs linked to its projects in Saudi Arabia, aiming to conserve or restore habitats equivalent to those impacted. This approach is crucial for ensuring the long-term sustainability of their operations and meeting evolving environmental regulations.

- EIA Implementation: ACWA Power conducts thorough Environmental Impact Assessments for all new projects, a standard practice expected to cover biodiversity impacts.

- Mitigation Strategies: The company employs measures like habitat restoration and wildlife monitoring to minimize negative ecological effects.

- Sustainability Commitment: ACWA Power's focus on sustainable development includes efforts to balance energy generation needs with the preservation of local ecosystems.

Waste Management and Pollution Control

ACWA Power faces significant environmental scrutiny regarding waste management and pollution control, especially concerning its thermal power generation and desalination operations. The discharge of brine from desalination plants, for instance, requires careful management to minimize impacts on marine ecosystems. In 2023, the company continued to invest in technologies aimed at reducing emissions and improving water efficiency across its portfolio, reflecting a commitment to operational sustainability.

The company's approach to managing waste and pollution is a key aspect of its environmental strategy. This includes adhering to stringent regulatory standards and proactively seeking innovative solutions to mitigate environmental footprints. For example, ACWA Power is exploring advanced water treatment methods to reduce the salinity and temperature of brine before discharge, aiming to lessen ecological disruption.

- Waste Management Focus: Implementing circular economy principles to reduce landfill waste from construction and operational phases.

- Pollution Control Technologies: Investing in flue gas desulfurization and selective catalytic reduction for thermal power plants to cut emissions.

- Brine Discharge Mitigation: Developing and deploying advanced diffusion systems to disperse desalination brine more effectively.

- Environmental Performance Monitoring: Continuously tracking key environmental indicators, such as CO2 emissions per MWh and water consumption, to drive improvement.

Global climate change and the push for decarbonization are major environmental drivers for ACWA Power. The company's strategic focus on renewables, including solar, wind, and green hydrogen, directly addresses these global imperatives and aligns with international targets like the Paris Agreement. ACWA Power's substantial investments in these areas position it to capitalize on the growing demand for clean energy solutions. By 2023, ACWA Power had a significant renewable energy portfolio, contributing to the reduction of carbon emissions worldwide.

Water scarcity is another critical environmental factor, particularly in the arid regions where ACWA Power operates. Its expertise in desalination is therefore highly valued, as the company is recognized as the world's largest private water desalination company as of 2023. This positions ACWA Power to play a vital role in addressing global water security challenges.

ACWA Power's large-scale renewable projects, such as its solar and wind farms, can impact local ecosystems and biodiversity. The company conducts thorough Environmental Impact Assessments (EIAs) and implements mitigation strategies like habitat restoration and wildlife monitoring to minimize these effects. For example, in 2023, biodiversity offset programs were utilized in Saudi Arabian projects to conserve habitats.

Waste management and pollution control, especially from thermal power generation and desalination, present ongoing environmental challenges. ACWA Power is investing in technologies to reduce emissions and improve water efficiency, such as advanced brine diffusion systems and flue gas treatment for its thermal plants. Continuous monitoring of environmental performance, like CO2 emissions per MWh, is a key part of its sustainability efforts.

| Environmental Factor | ACWA Power's Response/Impact | Key Data/Examples (as of early 2024/2023) |

|---|---|---|

| Climate Change & Decarbonization | Focus on renewable energy (solar, wind) and green hydrogen production to meet global emission reduction targets. | Significant investments in renewables; contributes to global carbon emission reduction. |

| Water Scarcity | Leading role in desalination technology and operations. | World's largest private water desalination company (2023). |

| Biodiversity & Ecosystem Impact | Conducts EIAs, implements mitigation strategies (habitat restoration, wildlife monitoring), and uses biodiversity offsets. | Noor Ouarzazate Solar Power Station in Morocco required careful environmental planning; biodiversity offset programs in Saudi Arabia (2023). |

| Waste Management & Pollution Control | Invests in emission reduction technologies and improved water efficiency; manages brine discharge. | Investments in brine diffusion systems; flue gas desulfurization for thermal plants; monitoring CO2 emissions per MWh. |

PESTLE Analysis Data Sources

Our ACWA Power PESTLE Analysis is built on a robust foundation of data from official government publications, leading international financial institutions, and reputable industry-specific research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the renewable energy sector.