ACWA Power Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACWA Power Bundle

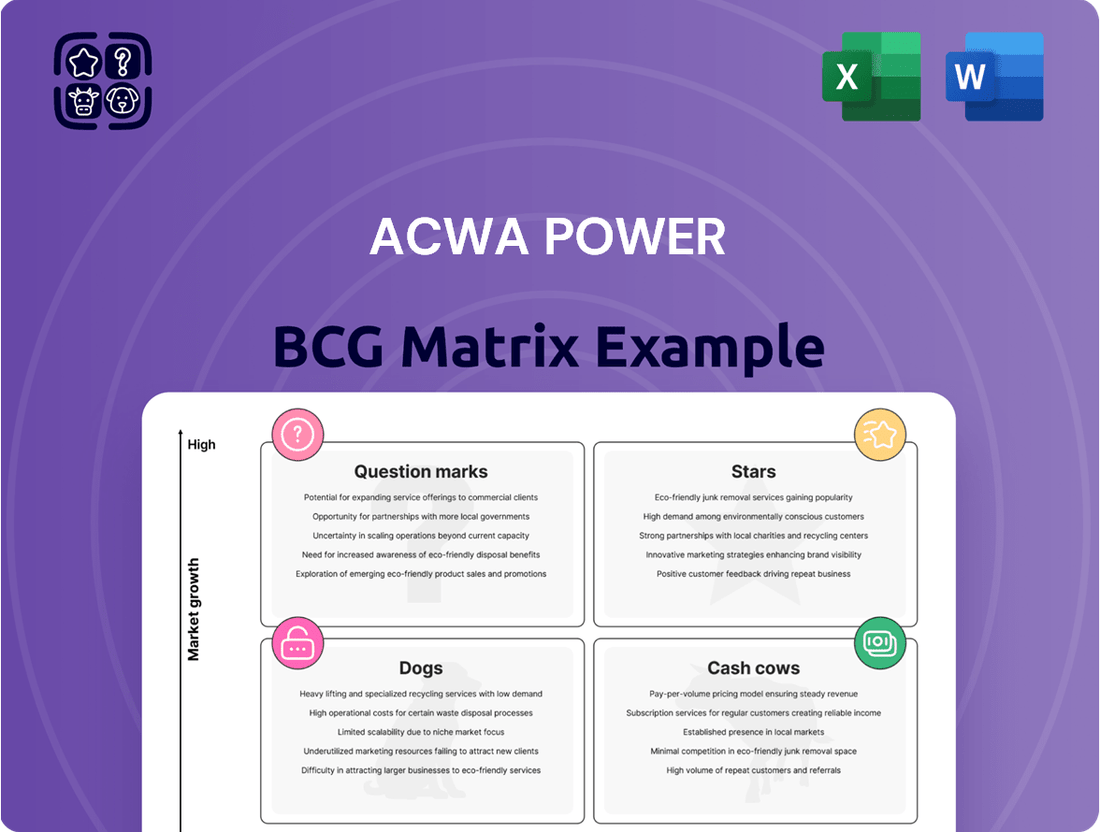

Curious about ACWA Power's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse portfolio of renewable energy projects stacks up in terms of market share and growth potential. Are their solar ventures Stars, their existing hydro assets Cash Cows, or are there emerging technologies yet to be defined as Question Marks?

Don't miss out on the full strategic picture. Purchase the complete ACWA Power BCG Matrix report to unlock detailed quadrant placements, understand the underlying data driving these classifications, and gain actionable insights to inform your investment and partnership decisions.

This isn't just a chart; it's your roadmap to navigating the dynamic renewable energy landscape with ACWA Power. Get the full report now and equip yourself with the knowledge to identify opportunities and optimize your engagement with this industry leader.

Stars

ACWA Power's green hydrogen initiatives are firmly positioned as Stars within the BCG matrix. The company is a trailblazer in large-scale green hydrogen, evident in its Neom Green Hydrogen project, slated for commissioning in Q3 2026, and the Yanbu Green Hydrogen Hub, targeting 2030 for commercial operations. These ambitious ventures represent significant upfront investment in a sector poised for substantial future growth and global decarbonization leadership.

Further underscoring its Star status, ACWA Power launched a second green hydrogen project in Uzbekistan in 2024. This expansion into new markets highlights the company's aggressive pursuit of opportunities in the nascent but rapidly expanding green hydrogen sector, reinforcing its high-growth trajectory and market-leading aspirations.

ACWA Power's large-scale solar PV projects are firmly positioned as Stars in the BCG matrix, exhibiting robust market share and impressive growth. The company's significant presence in Saudi Arabia, a rapidly expanding renewable energy market, underpins this classification.

The successful full commercial operation of the 1,500MW Sudair Solar PV IPP in 2024, along with the Al Shuaiba 2 (2.1 GW) and Layla Solar PV IPP (91 MW) coming online in Q1 2025, highlights ACWA Power's execution capability and market momentum. These achievements are critical indicators of their strong performance in this segment.

Furthermore, securing 5.5 GW of solar capacity from Saudi Arabia's fourth round of PIF projects demonstrates ACWA Power's strategic foresight and continued leadership. This substantial pipeline ensures sustained growth and reinforces their Star status within the renewable energy sector.

ACWA Power's significant advancements in large-scale wind energy projects firmly place it in the Stars category of the BCG Matrix. The company's substantial investments are paying off, with projects like the 500MW Bash and Dzhankeldy wind Independent Power Producers (IPPs) in Uzbekistan becoming operational in Q1 2025. This operationalization marks a crucial milestone, demonstrating their ability to execute large-scale renewable developments.

Further solidifying its Star status, ACWA Power has secured a Power Purchase Agreement (PPA) in H1 2024 for the massive 5 GW Aral Wind project, also in Uzbekistan. This project represents a significant expansion of their wind energy capacity, indicating strong market demand and ACWA Power's strategic focus on high-growth renewable segments. These developments underscore their leadership and commitment to expanding their global renewable energy footprint.

Strategic Expansion into China's Renewable Market

ACWA Power's strategic expansion into China's renewable energy market in 2024 is a significant step, adding approximately 1.1 GW of projects to its portfolio. This move into one of the world's largest and fastest-growing renewable markets positions the company for substantial future growth.

Further bolstering its presence, ACWA Power plans to add another 700-800 MW by the end of 2025. This aggressive development strategy underscores the company's commitment to establishing a strong foothold in high-potential geographies.

- Market Penetration: ACWA Power entered China in 2024, adding 1.1 GW of renewable projects.

- Future Growth: Plans to add an additional 700-800 MW by the end of 2025.

- Innovation Hub: Established an Innovation Centre in Shanghai to support long-term growth.

Aggressive Global Renewable Energy Expansion

ACWA Power's aggressive global renewable energy expansion, particularly in high-growth regions like Indonesia and Africa, signifies a strategic move into its Stars quadrant. The company's commitment to these markets is substantial, with agreements targeting up to $10 billion in Indonesian projects spanning renewable energy, green hydrogen, and water desalination. This geographical diversification, alongside explorations into M&A in Malaysia and other Asian markets, solidifies its position as a major private investor in promising international renewable energy landscapes.

- Global Expansion: ACWA Power is actively pursuing growth beyond its established markets, targeting regions with high renewable energy potential.

- Indonesia Focus: Significant agreements in Indonesia, valued up to $10 billion, highlight a major investment commitment in renewables, green hydrogen, and water desalination.

- Strategic M&A: The company is exploring mergers and acquisitions in Malaysia and other Asian nations, indicating a proactive approach to market penetration and consolidation.

- Market Leadership: This international push positions ACWA Power as a leading private investor in diverse and rapidly expanding global renewable energy sectors.

ACWA Power's green hydrogen projects are classified as Stars due to their high market share and rapid growth potential. The Neom Green Hydrogen project, set for commissioning in Q3 2026, and the Yanbu Green Hydrogen Hub, targeting 2030, represent significant investments in a sector vital for global decarbonization. The company's expansion into Uzbekistan with a second green hydrogen project in 2024 further solidifies its leading position in this burgeoning market.

| Project Area | Status/Timeline | Key Developments |

|---|---|---|

| Green Hydrogen | Neom: Q3 2026 commissioning; Yanbu: 2030 commercial ops | Large-scale initiatives, global decarbonization focus |

| Solar PV | Sudair: 1,500MW operational (2024); Al Shuaiba 2 (2.1 GW) & Layla (91 MW): Q1 2025 | Strong growth in Saudi Arabia, secured 5.5 GW from PIF projects |

| Wind Energy | Bash & Dzhankeldy (Uzbekistan): 500MW IPPs operational Q1 2025 | Secured 5 GW Aral Wind PPA (H1 2024) |

| China Market Entry | 1.1 GW added in 2024; 700-800 MW planned by end-2025 | Established Innovation Centre in Shanghai |

| Global Expansion | Indonesia: Up to $10 billion in projects; M&A exploration in Malaysia | Targeting high-growth regions in Asia and Africa |

What is included in the product

Highlights which ACWA Power units to invest in, hold, or divest based on market share and growth.

Provides a clear, visual representation of ACWA Power's portfolio, easing strategic decision-making.

Cash Cows

ACWA Power's established large-scale desalination plants are firmly in the Cash Cows quadrant of the BCG Matrix. These facilities, including the Jubail 3A IWP (operational since 2023) and significant UAE projects like Taweelah and UAQ, dominate a mature market segment where ACWA Power holds a substantial market share.

These plants generate consistent and significant cash flows, underpinned by their essential function of providing potable water and secured by long-term off-take agreements. Their operational efficiency and market leadership translate into robust profitability, requiring minimal new investment for continued success.

ACWA Power's operational conventional power assets, primarily thermal plants, serve as reliable cash cows, generating consistent and predictable revenue. These established facilities are crucial for funding the company's expansion into newer, high-growth areas.

The company's strategic acquisition of Engie's operational gas power and water desalination assets, slated for completion in 2025, will significantly bolster this segment. This deal adds 4.6 GW of power generation capacity, enhancing the stability and cash-generating potential of the conventional portfolio.

These conventional assets typically operate under long-term agreements, ensuring a steady and dependable inflow of cash. This financial bedrock is essential for ACWA Power to invest in and develop its more capital-intensive renewable energy projects.

ACWA Power's long-term off-take agreements are the bedrock of its cash cow strategy. These contracts, often spanning 20-30 years, guarantee revenue from projects like the Sudair Solar PV IPP in Saudi Arabia, which commenced operations in 2022. This secured demand from state utilities provides a stable, predictable income stream, freeing up capital for growth in other areas.

These agreements are crucial because they insulate ACWA Power from the volatility of energy markets. For instance, the company's portfolio includes numerous renewable energy projects in the Middle East and North Africa, regions where off-take agreements with national power companies are standard. This stability is a hallmark of cash cows, generating consistent profits with limited need for further investment or marketing push.

Operation & Maintenance Services

ACWA Power's Operation and Maintenance (O&M) services are a cornerstone of its integrated business model, acting as a significant cash cow. This segment consistently generates revenue by managing a large portfolio of power and water assets, contributing reliably to the company's profitability. By leveraging its existing infrastructure and deep expertise, ACWA Power offers a steady, high-margin service that demands less capital investment for growth compared to developing new projects.

The O&M segment benefits from the company's extensive operational footprint. For instance, as of the first half of 2024, ACWA Power managed a gross diversified portfolio of 70.2 GW, with O&M services supporting a substantial portion of this capacity. This provides a stable revenue stream, underpinning the company's financial resilience.

- Consistent Revenue Generation: O&M services provide predictable income streams from existing assets.

- High Profitability: This segment typically offers higher margins due to leveraging established infrastructure and expertise.

- Lower Growth Investment: Compared to new project development, O&M requires less capital for expansion, enhancing cash flow.

- Strategic Importance: O&M is crucial for maintaining asset performance and ensuring long-term value, supporting ACWA Power's overall strategy.

Successful Capital Recycling Strategy

ACWA Power's capital recycling strategy effectively leverages its mature assets as cash cows. By divesting stakes in operational projects that provide stable returns, the company unlocks capital for future growth initiatives.

In 2024, ACWA Power successfully divested interests in three operational projects located in Uzbekistan and Saudi Arabia, generating SAR 400 million. These mature assets, having completed their primary growth phase, now serve as reliable sources of cash flow.

- Capital Recycling: ACWA Power actively recycles capital by selling mature, operational assets.

- 2024 Divestments: SAR 400 million was generated in 2024 from three divestment deals in Uzbekistan and Saudi Arabia.

- Cash Cow Functionality: These divested assets, having achieved stable returns, act as cash cows, providing consistent income.

- Reinvestment Strategy: The capital freed up is strategically reinvested into higher-potential 'Stars' and 'Question Marks' within ACWA Power's portfolio.

ACWA Power's established large-scale desalination plants and conventional power assets are prime examples of its cash cows. These mature operations, supported by long-term off-take agreements, generate consistent and significant cash flows with minimal need for further investment, providing a stable financial foundation.

The company's Operation and Maintenance (O&M) services also function as cash cows, leveraging its extensive operational footprint and expertise to deliver high-margin, predictable revenue streams. This segment is crucial for maintaining asset performance and supporting ACWA Power's strategic growth initiatives.

ACWA Power's capital recycling strategy further solidifies its cash cow segment. By divesting stakes in operational projects, such as the SAR 400 million generated in 2024 from three deals, the company unlocks capital for reinvestment into higher-growth areas.

| Asset Type | BCG Quadrant | Key Characteristics | 2024 Financial Insight |

|---|---|---|---|

| Desalination Plants | Cash Cow | Mature market, high market share, long-term agreements, stable cash flow | Jubail 3A IWP operational since 2023 |

| Conventional Power Assets | Cash Cow | Established thermal plants, predictable revenue, long-term agreements | Acquisition of Engie assets (4.6 GW) to bolster portfolio |

| Operation & Maintenance (O&M) | Cash Cow | Leverages existing infrastructure, high margins, consistent revenue | Managed 70.2 GW gross portfolio (H1 2024) |

| Capital Recycling | Cash Cow Functionality | Divestment of mature assets, unlocks capital | SAR 400 million generated from 3 divestments in 2024 |

Full Transparency, Always

ACWA Power BCG Matrix

The ACWA Power BCG Matrix preview you're examining is precisely the comprehensive document you will receive upon purchase, offering a complete, unwatermarked analysis ready for immediate strategic application.

What you see is the definitive ACWA Power BCG Matrix report, meticulously prepared and delivered instantly after your purchase, ensuring you gain access to the full, professionally formatted strategic tool without any alterations.

This preview showcases the exact ACWA Power BCG Matrix document that will be yours after a successful transaction, providing an analysis-ready, fully editable file for your business planning and competitive insights.

Dogs

The Noor 3 CSP plant in Morocco faced a challenging 2024, marked by a significant leakage and an extended outage. This operational disruption meant the plant had a severely reduced capacity, effectively giving it a low market share and generating minimal, if any, positive cash flow during this period.

The plant's performance in 2024 clearly positioned it as a 'Dog' within ACWA Power's portfolio. Despite its potential, its inability to operate reliably and contribute meaningfully to the company's overall output during this critical year highlights its 'Dog' status.

Although Noor 3 resumed stable generation in April 2025, its 2024 performance, characterized by substantial operational issues and financial underperformance, solidified its classification as a 'Dog' for that year.

Older, less strategic thermal power assets within ACWA Power's portfolio, especially those with lower efficiency or facing declining market demand for conventional energy, could be categorized as Dogs. These assets may present limited growth prospects and might not fit with the company's focus on renewable energy. For instance, if an older coal plant experiences rising maintenance costs and faces stricter emissions regulations, its future viability becomes questionable.

Within ACWA Power's extensive portfolio, certain niche projects or minority stakes might exhibit limited growth prospects. These ventures, while operational, may not align with the company's core expansion strategies or possess significant potential for scaling. For instance, a small renewable energy project in a region with regulatory hurdles or low demand might fall into this category.

Such projects, if they lack a clear path to substantial revenue generation or market share increase, could be considered "Dogs" in the BCG matrix framework. They might tie up management attention and capital without delivering commensurate returns, potentially hindering the focus on more promising growth areas. In 2024, ACWA Power's strategic focus remains on large-scale renewable projects, making smaller, less scalable assets a candidate for re-evaluation.

Divested Assets with Low Future Growth for ACWA Power

Divesting assets with low future growth is a strategic move for ACWA Power, allowing them to reallocate capital towards more promising ventures. This approach aligns with their capital recycling strategy, which focuses on monetizing value from existing projects to fund new developments. For instance, if ACWA Power sold a solar farm in a region with saturated market demand and limited expansion potential, this asset could be classified as a 'Dog'.

- Focus on Higher Growth: By divesting low-growth assets, ACWA Power can concentrate its resources on projects with greater expansion and profitability potential.

- Capital Reallocation: This strategy frees up capital that would otherwise be tied to underperforming or stagnant assets, enabling investment in new, high-return opportunities.

- Portfolio Optimization: Regularly reviewing and divesting 'Dogs' helps maintain a dynamic and growth-oriented portfolio, crucial in the rapidly evolving renewable energy sector.

Unsuccessful or Shelved Development Opportunities

Resources invested in development opportunities that ultimately do not materialize into successful projects, or bids that are lost in highly competitive or low-growth markets, can be considered dogs in terms of resource allocation. These represent sunk costs in ventures that failed to capture market share or generate returns, consuming capital without delivering on growth prospects. For instance, ACWA Power’s pursuit of certain renewable energy projects in mature markets, where competition drove down margins significantly, could have resulted in such investments.

- Sunk Costs in Unsuccessful Bids: Investments made in preparing bids for projects that were ultimately unsuccessful, particularly in markets with limited growth potential or intense competition, represent capital that did not yield returns.

- R&D for Uncommercialized Technologies: Funds allocated to research and development for technologies or project types that did not achieve commercial viability or market acceptance.

- Market Entry Failures: Resources spent on attempting to enter new geographic markets or sectors where the company was unable to gain traction or achieve profitability.

In ACWA Power's 2024 operational review, the Noor 3 CSP plant exemplifies a 'Dog' asset due to significant operational issues, including a major leakage and extended outage, leading to minimal contribution and low market share. While the plant resumed stable generation in April 2025, its 2024 performance firmly placed it in the 'Dog' category, highlighting its inability to generate positive cash flow during that period.

Older, less efficient thermal assets or niche renewable projects with limited growth prospects and regulatory hurdles also fit the 'Dog' profile for ACWA Power. These assets may consume resources without aligning with the company's strategic focus on large-scale renewables, potentially hindering investment in more promising areas.

Divesting such 'Dogs' is a strategic imperative for ACWA Power, enabling capital reallocation towards higher-growth opportunities and portfolio optimization. This aligns with their capital recycling strategy, ensuring resources are focused on ventures with greater expansion and profitability potential.

Unsuccessful bids and R&D for uncommercialized technologies also represent 'Dogs' in terms of resource allocation, signifying sunk costs in ventures that failed to capture market share or deliver returns. For instance, investments in projects with significantly reduced margins due to intense competition in mature markets would fall into this category.

Question Marks

The Yanbu Green Hydrogen Hub, a flagship early-stage green hydrogen project for ACWA Power, is categorized as a Question Mark within the BCG matrix. While the broader green hydrogen market is a Star, this specific venture, currently in the Front-End Engineering Design (FEED) phase with commercial operations anticipated around 2030, faces considerable uncertainty.

The project demands substantial initial capital outlay and complex technological integration, typical of Question Marks. Its future market share and profitability remain unproven in the developing global green hydrogen landscape, despite its high growth potential.

With an estimated investment of $5 billion, the Yanbu project aims to produce 650,000 tons of green ammonia annually by 2030, a testament to its ambitious scale but also its inherent risks and unproven market penetration.

ACWA Power's strategic push into China, Indonesia, and numerous African nations places it in nascent markets ripe for renewable energy and water infrastructure development. These regions represent significant growth opportunities, though ACWA Power's footprint is still establishing itself, requiring substantial investment to build market share.

In 2024, ACWA Power secured a significant contract for a 1.2 GW solar PV project in China, signaling a strong commitment to this high-potential market. Similarly, its ongoing expansion in Indonesia, including a recent partnership for a 200 MW wind farm, highlights its intent to capture a larger share of the archipelago's burgeoning renewable energy sector.

ACWA Power's involvement in Battery Energy Storage Systems (BESS), with 5.3 GWh capacity, often complements their renewable energy projects. However, the market's rapid expansion and the potential for BESS to function as a standalone service position it as a 'Question Mark' within the BCG matrix for ACWA Power.

This segment is experiencing substantial growth, driven by the critical need for grid stability and the integration of intermittent renewable sources. ACWA Power's strategic focus and market share in standalone BESS solutions are likely still in development, necessitating ongoing investment and aggressive market penetration strategies to solidify its competitive standing in this evolving domain.

Projects in Active Bidding or Early Development Stages

ACWA Power is actively pursuing new opportunities, indicated by its participation in bids for projects like the Al-Zour North Independent Water and Power Project (IWPP) in Kuwait. This aligns with the company's strategy to expand its footprint in critical infrastructure sectors.

These early-stage projects, such as the significant desalination plant development in Azerbaijan, are situated in markets demonstrating robust growth potential for power and water solutions. However, ACWA Power's market share in these specific future ventures is nascent, pending successful bid acquisitions and project progression.

These ventures represent substantial future upside, yet they also carry inherent risks and require significant upfront capital investment before any returns are realized.

- Al-Zour North IWPP, Kuwait: Represents a key bid in a high-demand market.

- Azerbaijan Desalination Plant: Highlights expansion into emerging water infrastructure markets.

- Market Share Uncertainty: Current share in these specific future projects is low until bids are won.

- High Potential, High Risk: Significant capital commitment and uncertainty precede potential returns.

Advanced Technology Integration and R&D Initiatives

ACWA Power's commitment to advanced technology is evident in its deployment of sophisticated tracker systems for solar photovoltaic projects. These technologies are designed to optimize energy generation by following the sun's path throughout the day, significantly boosting efficiency compared to fixed-tilt installations.

The establishment of an R&D center in Shanghai underscores ACWA Power's forward-looking strategy. This hub focuses on critical future technologies including solar, wind, green hydrogen, energy storage, and desalination. For instance, in 2023, ACWA Power announced progress on several green hydrogen projects, aiming to be a key player in this emerging sector.

- Solar PV Tracker Deployment: ACWA Power is actively integrating advanced tracker technologies across its solar farms to maximize energy yield.

- Shanghai R&D Center: This facility is a strategic investment in innovation across solar, wind, green hydrogen, energy storage, and desalination.

- Green Hydrogen Focus: The company is making substantial investments in green hydrogen, with several projects in development, positioning itself for future market leadership.

- Emerging Technology Investments: These R&D initiatives represent significant capital allocation towards technologies with high growth potential, aiming to secure long-term competitive advantages.

Question Marks in ACWA Power's portfolio represent ventures with high growth potential but uncertain market share. These are typically new technologies or projects in developing markets where ACWA Power is still establishing its presence.

Significant investment is required for these ventures, and their future success hinges on market adoption and competitive positioning. The company is actively pursuing these opportunities to diversify its offerings and tap into future growth areas.

ACWA Power's strategic investments in areas like Battery Energy Storage Systems (BESS) and early-stage green hydrogen projects exemplify these Question Marks, demanding careful management and market development.

These initiatives, while carrying higher risk, are crucial for ACWA Power's long-term growth strategy, aiming to build leadership in emerging energy sectors.

| Project/Area | Potential | Current Status | Investment (Est.) | Market Share |

|---|---|---|---|---|

| Yanbu Green Hydrogen Hub | High (Green Hydrogen) | FEED Phase, Ops ~2030 | $5 Billion | Nascent |

| Standalone BESS | High (Grid Stability) | Developing Market Share | Significant | Developing |

| China Solar PV | High (Renewable Growth) | Secured 1.2 GW Contract (2024) | Undisclosed | Growing |

| Indonesia Wind Farm | High (Renewable Growth) | Partnership for 200 MW | Undisclosed | Growing |

BCG Matrix Data Sources

Our ACWA Power BCG Matrix leverages a robust data foundation, integrating company financial reports, global energy market analysis, and project-specific performance metrics to inform strategic positioning.