ACWA Power Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACWA Power Bundle

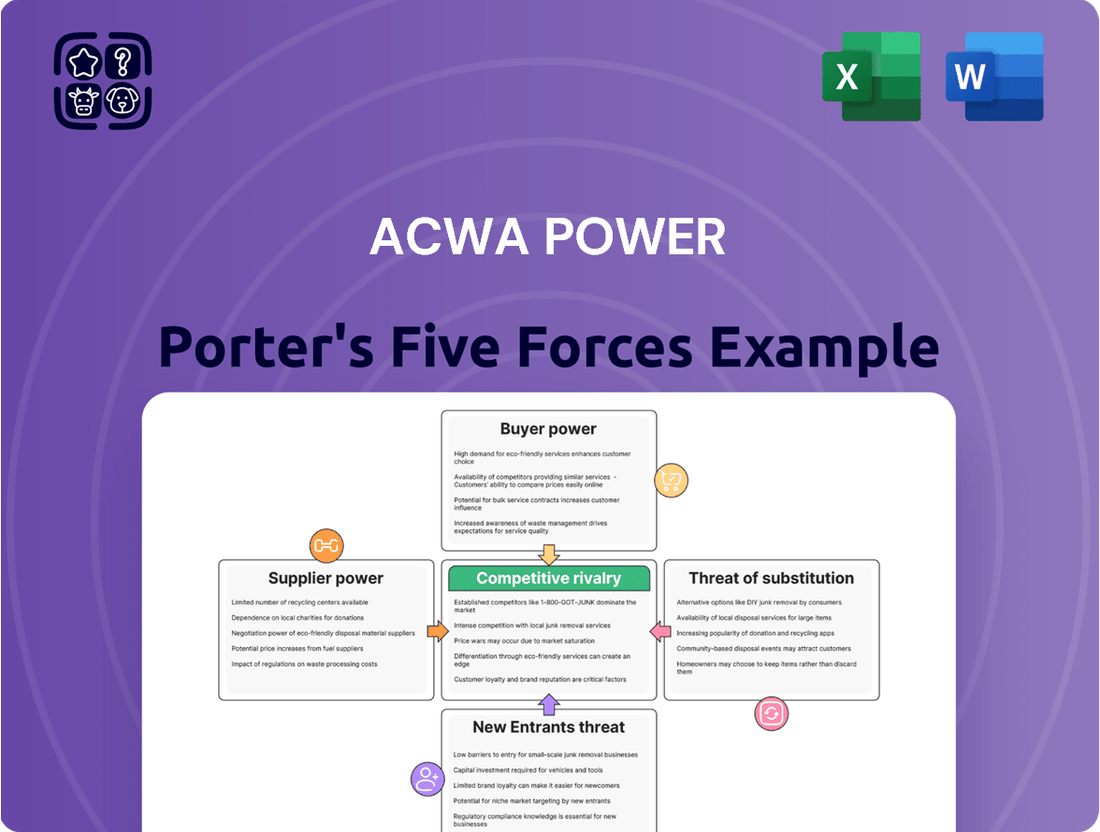

ACWA Power navigates a landscape shaped by moderate buyer power, as clients seek competitive pricing for renewable energy projects. Supplier power is also a key consideration, with specialized equipment and technology influencing project costs. The threat of new entrants is present but tempered by high capital requirements and regulatory hurdles.

The full analysis reveals the strength and intensity of each market force affecting ACWA Power, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

ACWA Power, a major player in global power and water infrastructure, frequently encounters a concentrated supplier base for its large-scale projects. This means that for crucial equipment like advanced turbines, high-efficiency solar panels, or specialized desalination membranes, there are often only a handful of manufacturers capable of meeting the technical specifications and scale required. For instance, in the renewable energy sector, the market for certain high-performance solar PV modules or wind turbine components can be dominated by a few key global players.

This limited number of specialized suppliers grants them considerable bargaining power. When ACWA Power requires these proprietary technologies or components facing high global demand, suppliers can dictate terms more effectively. This situation can directly impact ACWA Power's ability to negotiate favorable pricing and contract conditions, as finding readily available and equally capable alternatives may be challenging or impossible, potentially increasing project costs.

High switching costs significantly bolster the bargaining power of suppliers to ACWA Power. In the power and water sector, transitioning to a new supplier isn't a simple swap; it often necessitates costly infrastructure redesigns, rigorous equipment re-certification processes, and extensive personnel retraining. These considerable expenses and operational hurdles make ACWA Power more reliant on its existing suppliers, diminishing its leverage in negotiations.

Suppliers offering highly specialized or technologically advanced products, or those with a strong reputation for consistent quality and performance, naturally wield greater bargaining power. For ACWA Power, a company focused on the dependable and cost-effective delivery of electricity and potable water, securing reliable and high-performing equipment from established, proven suppliers is paramount. This reliance on suppliers with a track record of excellence inherently limits ACWA Power's capacity to negotiate aggressively on pricing or contract terms.

Threat of Forward Integration by Suppliers

Suppliers possessing the capacity or motivation to integrate forward into power generation or water desalination could emerge as direct rivals to ACWA Power. This scenario would significantly amplify their leverage.

While component manufacturers typically don't pursue this, large engineering and construction firms that also supply equipment might independently bid on projects. For instance, if a major turbine supplier in 2024 also began offering turnkey project solutions, ACWA Power would face a new competitor directly vying for the same contracts.

- Potential for Supplier Competition: Suppliers moving into direct project development.

- Increased Leverage: Suppliers gaining power by becoming competitors.

- Example Scenario: A 2024 instance of an equipment provider bidding on projects.

Input Importance to ACWA Power's Operations

The bargaining power of suppliers for ACWA Power is significantly shaped by the criticality of their inputs to the company's core operations, particularly in the burgeoning green hydrogen and renewable energy sectors. For example, the availability and cost of specialized components for solar and wind farms, or the raw materials essential for green hydrogen electrolysis, directly impact ACWA Power's project execution and profitability. In 2023, ACWA Power continued to secure major renewable energy projects, underscoring its reliance on a robust supply chain for turbines, solar panels, and electrolyzers.

When suppliers control essential, specialized, or scarce inputs, their leverage increases substantially. This can lead to higher procurement costs and potential delays, directly affecting ACWA Power's ability to deliver projects on time and within budget. The global demand for renewable energy components, especially in 2024, has intensified, potentially strengthening the position of key suppliers.

- Criticality of Inputs: The more vital a supplier's product or service is to ACWA Power's core business, the greater the supplier's bargaining power.

- Supplier Concentration: If only a few suppliers can provide a necessary input, their power is amplified.

- Switching Costs: High costs or technical difficulties in switching to alternative suppliers further empower existing ones.

- Input Differentiation: Unique or highly specialized inputs give suppliers more leverage than standardized ones.

ACWA Power faces substantial bargaining power from its suppliers due to the specialized nature of equipment for renewable energy and water projects. For instance, the market for advanced wind turbines or high-efficiency solar panels is often dominated by a few global manufacturers, limiting ACWA Power's options and allowing these suppliers to command higher prices and favorable terms. This was evident in 2024 as global demand for renewable components surged.

The high switching costs associated with changing suppliers in this sector further empower them. Implementing new equipment often requires significant redesigns and retraining, making ACWA Power more dependent on its existing relationships. Suppliers of critical, differentiated components, such as specialized electrolyzers for green hydrogen projects, also hold considerable leverage, as finding readily available alternatives is challenging.

In 2023, ACWA Power continued to expand its project portfolio, highlighting its reliance on a stable supply chain for essential technologies. The criticality of these inputs, coupled with supplier concentration and high switching costs, means that suppliers can significantly influence project economics and timelines for ACWA Power.

| Factor | Impact on ACWA Power | 2024 Context |

|---|---|---|

| Supplier Concentration | Limited suppliers for specialized equipment (e.g., turbines, solar panels) grant them pricing power. | Increased global demand for renewables intensified this concentration in 2024. |

| Switching Costs | High costs for redesign, recertification, and retraining make changing suppliers difficult. | ACWA Power's reliance on established, integrated solutions in 2024 means high barriers to switching. |

| Input Differentiation | Unique or technologically advanced components (e.g., electrolyzers) give suppliers strong leverage. | The push for green hydrogen in 2024 amplified the importance of specialized, differentiated inputs. |

| Criticality of Inputs | Essential components for core operations (power generation, water desalination) increase supplier power. | ACWA Power's significant 2023 project pipeline underscored the critical nature of its supply chain inputs. |

What is included in the product

This analysis provides a comprehensive examination of the competitive forces impacting ACWA Power, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the influence of substitutes on its strategic positioning.

ACWA Power's Five Forces Analysis provides a clear, one-sheet summary of all competitive forces, perfect for quick strategic decision-making in the dynamic energy sector.

Customers Bargaining Power

ACWA Power's customers, primarily state utilities and government entities, secure significant leverage through large-scale, long-term Power Purchase Agreements (PPAs) and Water Purchase Agreements (WPAs). These decades-long contracts, crucial for ACWA Power's revenue stability, also empower customers during negotiation due to the substantial volume and duration of their commitments.

Many of ACWA Power's key customers are government-owned entities or operate within heavily regulated markets. This means that pricing, contract terms, and project specifications are often dictated by national energy policies and broader economic goals, directly impacting ACWA Power's ability to negotiate favorable terms.

For instance, in 2024, the average Power Purchase Agreement (PPA) duration for renewable energy projects globally can extend to 20-25 years, with governments often setting tariff caps. This regulatory framework inherently empowers these governmental customers, allowing them to exert considerable pressure on pricing and project conditions, thereby limiting ACWA Power's pricing flexibility.

ACWA Power's customers, particularly large industrial users or government entities, do have some leverage due to the availability of alternative power and water suppliers. These alternatives can include other independent power producers (IPPs) operating in the same regions, or even state-owned utilities that may offer competitive pricing or different contractual structures. For instance, in markets where renewable energy capacity is rapidly expanding, customers might find new IPPs entering with aggressive pricing strategies.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for ACWA Power, especially since electricity and potable water are essential services. Government utilities, a key customer segment, are under constant pressure to keep costs low for end-users and industries. This inherent sensitivity directly impacts ACWA Power's strategy, compelling a relentless focus on cost efficiency and competitive pricing to win new projects.

For instance, in 2024, ACWA Power secured a contract for the Al Khobar 1 desalination plant in Saudi Arabia, demonstrating their ability to offer competitive pricing in a market where cost is paramount. The company's success in securing projects across various regions, often through competitive tenders, underscores their understanding of this customer demand for affordability.

- High Price Sensitivity: Essential services like water and power mean customers, particularly government entities, prioritize cost-effectiveness.

- Competitive Bidding: ACWA Power must consistently offer competitive pricing to win contracts in this environment.

- Cost Efficiency Focus: The company's operational model is geared towards maximizing efficiency to maintain price competitiveness.

- Market Pressure: Intense price pressure from customers necessitates a lean and cost-conscious approach to project development and operation.

Customer's Ability to Self-Generate or Desalinate

Large industrial clients, and even some national governments, may have the capacity or consider building their own power generation or water desalination plants. This 'self-supply' capability acts as a significant bargaining tool.

It pressures ACWA Power to offer competitive pricing and service agreements to keep these customers from pursuing independent solutions. For instance, in 2024, major industrial consumers in water-scarce regions are increasingly exploring captive power and desalination options to ensure supply security and cost predictability, directly impacting ACWA Power's negotiation leverage.

This potential for backward integration by customers significantly enhances their bargaining power.

- Large industrial customers can explore building their own power and desalination facilities.

- This 'self-supply' option gives them leverage to negotiate better terms with ACWA Power.

- In 2024, this trend is observed more frequently in water-scarce industrial zones.

- ACWA Power must offer attractive pricing to retain such clients.

ACWA Power's customers, primarily state utilities and government entities, wield considerable bargaining power due to the large volumes and long-term nature of their Power Purchase Agreements (PPAs) and Water Purchase Agreements (WPAs). These extensive contracts, often spanning two to three decades, inherently grant customers leverage during negotiations.

Governmental customers, in particular, are influenced by national energy policies and tariff caps, which can limit ACWA Power's pricing flexibility. For example, in 2024, renewable energy PPAs frequently include such caps, reinforcing customer control over pricing.

Furthermore, the potential for customers, especially large industrial users, to develop their own power generation or desalination facilities acts as a significant threat, pressuring ACWA Power to maintain competitive pricing and service levels to retain business.

| Customer Type | Bargaining Power Factor | 2024 Impact Example |

|---|---|---|

| State Utilities/Governments | Large Volume & Long-Term Contracts | Decades-long PPAs provide significant negotiation leverage. |

| Governmental Entities | Regulatory Influence & Tariff Caps | National policies can dictate pricing, limiting ACWA Power's flexibility. |

| Industrial Clients | Potential for Self-Supply | Exploring captive power/desalination options pressures ACWA Power on cost and security. |

Same Document Delivered

ACWA Power Porter's Five Forces Analysis

This preview displays the complete ACWA Power Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the energy sector. You're looking at the actual document; once your purchase is complete, you'll gain instant access to this exact, professionally formatted file, ready for immediate use and strategic decision-making.

Rivalry Among Competitors

ACWA Power navigates a fiercely competitive landscape, contending with established international independent power producers (IPPs) and formidable state-owned utilities. This rivalry intensifies in emerging markets, where ACWA Power has strategically focused its growth. For instance, in 2024, the company faced significant competition for multi-billion dollar renewable energy and desalination projects across the Middle East and Africa.

The global shift towards cleaner energy sources has dramatically heated up the competition in renewable energy and green hydrogen. ACWA Power, by concentrating on solar, wind, and green hydrogen, finds itself in a crowded field with many companies vying for dominance in these growing markets. This intense rivalry necessitates constant technological advancement and aggressive bidding to secure projects.

Competition in the power sector, particularly for large infrastructure projects, is fierce and often centers on intricate bidding processes. Companies like ACWA Power vie for contracts by showcasing competitive pricing, advanced technological solutions, robust financing packages, and proven project execution expertise. This intense competition means that securing even a single new project can significantly impact a company's growth trajectory.

The lengthy development cycles inherent in these massive undertakings, which can span several years from conception to operation, amplify the importance of winning new contracts. For instance, a significant renewable energy project might take 3-5 years to develop and build. This extended timeline underscores the critical need for a consistent pipeline of projects, making the rivalry among developers exceptionally sharp as they aim to fill their order books and maintain operational momentum.

Strategic Partnerships and Alliances

Competitive rivalry in the power sector is increasingly characterized by strategic partnerships and consortiums. These collaborations allow companies to pool resources, share the significant risks associated with large-scale projects, and bolster their competitive edge when bidding for complex infrastructure developments. For instance, ACWA Power itself frequently engages in such alliances, underscoring that competition often involves navigating a network of partnerships rather than solely direct head-to-head contests.

These alliances are crucial for accessing specialized expertise, securing financing, and managing the intricate execution of projects, especially in emerging markets. For 2024, many major renewable energy projects globally are being developed through joint ventures, with companies combining their strengths in areas like technology, project finance, and local market knowledge.

- Resource Pooling: Partners contribute capital, technology, and human resources to undertake larger and more ambitious projects than any single entity could manage alone.

- Risk Mitigation: Sharing the financial and operational risks across multiple partners makes high-stakes projects more manageable and attractive.

- Enhanced Bidding Strength: Consortiums often present a more formidable and credible bid due to combined capabilities and financial backing.

- Market Access: Alliances can provide access to new markets or segments by leveraging partners' existing relationships and local presence.

Differentiation through Cost, Technology, and Reliability

Competitive rivalry in the utility sector, including for companies like ACWA Power, is intense. Firms differentiate themselves by offering lower costs for electricity and water, integrating cutting-edge technologies for efficiency, and demonstrating a strong history of dependable operations. ACWA Power highlights its capacity to provide competitively priced power and water, a crucial element that sets it apart in this demanding market.

ACWA Power's strategy centers on delivering cost-effective solutions, a significant factor in winning bids and securing long-term contracts. For instance, in 2024, ACWA Power continued to secure projects with competitive tariffs, reflecting its focus on cost leadership. The company’s technological prowess, seen in its adoption of advanced renewable energy solutions, further strengthens its competitive stance.

- Cost Leadership: ACWA Power's ability to offer low-cost electricity and water production is a primary driver of its competitive advantage.

- Technological Advancement: The company's commitment to adopting and implementing efficient, modern technologies enhances operational performance and cost-effectiveness.

- Operational Reliability: A proven track record of consistent and dependable service delivery builds trust and secures market share against competitors.

- Market Positioning: ACWA Power leverages these differentiators to secure significant projects and maintain a strong presence in key global markets.

The competitive rivalry for ACWA Power is extremely high, driven by both established global players and emerging local entities. This is particularly evident in the renewable energy and green hydrogen sectors, where numerous companies are vying for market share. For example, in 2024, ACWA Power faced intense bidding for major projects in regions like the Middle East and Africa, where competition often hinges on aggressive pricing and technological innovation.

ACWA Power differentiates itself through cost leadership and technological advancement, aiming to provide the most competitive tariffs. In 2024, the company continued to secure projects by offering attractive pricing for power and water generation. Its operational reliability and commitment to adopting cutting-edge solutions are key factors that help it stand out in this dynamic market.

| Key Competitors | Focus Areas | 2024 Competitive Activity Example |

| Global IPPs (e.g., Engie, Iberdrola) | Renewables, Utilities | Secured significant renewable energy contracts in emerging markets through competitive bidding. |

| State-Owned Utilities | National Power Grids, Infrastructure | Often participate in tenders, leveraging existing infrastructure and government backing. |

| Emerging Renewable Developers | Solar, Wind, Green Hydrogen | Increasingly aggressive bidding on smaller to medium-sized projects, focusing on niche technologies. |

SSubstitutes Threaten

Despite the global momentum towards renewable energy, traditional fossil fuel-based power generation, such as natural gas and coal, continues to represent a significant substitute threat. This is particularly true in areas where fossil fuel resources are plentiful or where substantial existing infrastructure favors these conventional sources. For instance, as of early 2024, natural gas prices in some regions remained competitive, making it an attractive option for power generation.

The threat of substitutes for ACWA Power's centralized water solutions, particularly in desalination, is a significant consideration. While ACWA Power excels in large-scale bulk water production, the availability of traditional freshwater sources like rivers and groundwater, where feasible, presents a direct substitute. For instance, regions with abundant, albeit sometimes over-tapped, natural water resources might opt for infrastructure upgrades to existing systems rather than investing in new desalination plants.

Furthermore, advancements in localized and smaller-scale desalination technologies pose another threat. These distributed solutions can bypass the need for massive, centralized plants, offering greater flexibility and potentially lower upfront costs for specific communities or industrial users. As of late 2024, there's a growing trend in developing modular and containerized desalination units, which could chip away at the market share for large-scale projects, especially in areas with less consistent demand or where rapid deployment is prioritized.

Improvements in energy efficiency and demand-side management programs present a significant threat to ACWA Power by potentially reducing the demand for new power generation capacity. As consumers and industries adopt more efficient practices, the need for ACWA Power's core business of supplying electricity could diminish.

For instance, global electricity demand growth forecasts are being tempered by efficiency gains. While the International Energy Agency (IEA) projected a 2.4% increase in global electricity demand in 2024, this growth is lower than previously anticipated, partly due to widespread energy efficiency measures implemented across various sectors.

Alternative Water Management Strategies

Beyond traditional desalination, other water management approaches present viable substitutes. Enhanced wastewater treatment for reuse, for instance, is gaining traction globally. In 2024, several Middle Eastern countries are investing heavily in advanced wastewater recycling, aiming to meet a significant portion of their non-potable water needs through this method, thereby reducing reliance on desalination.

Rainwater harvesting and inter-basin water transfers also offer alternative water sources. The feasibility and cost of these strategies are highly dependent on specific regional geographies and economic landscapes. For example, areas with consistent rainfall might find rainwater harvesting more cost-effective than desalination, while regions with abundant but geographically distant water resources might explore transfers.

- Wastewater Reuse: Advanced treatment technologies are making recycled water suitable for industrial and agricultural purposes, lessening demand for desalinated sources.

- Rainwater Harvesting: In regions with adequate rainfall, this method can provide a significant supplement to existing water supplies at a lower cost than desalination.

- Inter-basin Water Transfers: Moving water from areas of surplus to areas of deficit can be a substitute, though often involves substantial infrastructure investment and environmental considerations.

Emerging Energy and Water Technologies

Rapid advancements in energy storage and water treatment technologies pose a significant threat of substitutes for ACWA Power. Innovations in areas like advanced battery chemistries, such as solid-state batteries, and more efficient desalination methods, like membrane distillation, could offer competitive alternatives to traditional power generation and water supply methods. For instance, the global energy storage market, excluding pumped hydro, was projected to reach over $400 billion by 2030, indicating substantial investment and rapid development in this substitute technology.

While ACWA Power is actively investing in green hydrogen and battery storage, disruptive innovations could still emerge. These might include breakthroughs in direct air capture for hydrogen production or novel water purification techniques that bypass conventional infrastructure. The cost-effectiveness and efficiency of these emerging technologies will be key determinants of their substitutability. For example, by 2024, the levelized cost of electricity from utility-scale solar PV with battery storage is expected to continue declining, potentially making it a more direct substitute for some of ACWA Power's existing projects.

- Emerging energy storage technologies like solid-state batteries could offer higher energy density and faster charging than current lithium-ion solutions.

- Advanced water treatment, such as forward osmosis or electrodialysis, may provide more energy-efficient and cost-effective water purification compared to traditional methods.

- Green hydrogen production advancements could make it a more viable substitute for fossil fuels in various sectors, impacting demand for other power sources.

- Microgrid development and distributed energy resources (DERs) offer decentralized power solutions that can reduce reliance on large-scale utility providers.

The threat of substitutes for ACWA Power remains a dynamic challenge, influenced by evolving technologies and resource availability. While ACWA Power focuses on large-scale renewable energy and water solutions, alternative approaches can diminish its market dominance. These substitutes range from traditional fossil fuels to innovative decentralized systems and improved water management techniques.

Traditional fossil fuels, particularly natural gas, continue to be a substitute threat, especially where infrastructure is established and prices are competitive. In 2024, the fluctuating cost of natural gas in various markets means it can still be a more economical choice for power generation than some renewable alternatives. For example, regions with readily available domestic gas reserves often maintain lower energy costs, impacting the demand for new renewable projects.

Furthermore, advancements in energy efficiency and demand-side management are crucial substitutes. By reducing overall energy consumption, these strategies directly lessen the need for new power generation capacity. The International Energy Agency (IEA) noted in 2024 that global electricity demand growth was being tempered by these efficiency gains, highlighting a significant factor that can curb the expansion of traditional power providers.

In the water sector, alternatives to large-scale desalination are gaining prominence. Enhanced wastewater treatment for reuse is a prime example, with several Middle Eastern countries investing heavily in recycling programs in 2024 to meet non-potable water demands. Rainwater harvesting and inter-basin water transfers also offer localized or geographically specific substitutes, their viability depending heavily on regional conditions and infrastructure investment.

| Substitute Category | Specific Substitute | Impact on ACWA Power | 2024 Relevance/Data |

|---|---|---|---|

| Energy Generation | Natural Gas Power Plants | Competitive pricing can reduce demand for new renewable capacity. | Natural gas prices remained competitive in select regions in early 2024, impacting project economics. |

| Energy Consumption | Energy Efficiency & Demand Management | Reduces overall electricity demand, lessening the need for new supply. | IEA data indicated tempered global electricity demand growth in 2024 due to efficiency measures. |

| Water Supply | Wastewater Reuse | Decreases reliance on desalination for non-potable uses. | Significant investment in wastewater recycling by Middle Eastern nations in 2024. |

| Water Supply | Rainwater Harvesting/Water Transfers | Provides alternative water sources where geographically feasible. | Feasibility is highly dependent on regional rainfall and existing infrastructure costs. |

Entrants Threaten

The power generation and water desalination sectors are inherently capital-intensive. ACWA Power, like its peers, faces significant upfront investment needs for developing, constructing, and maintaining large-scale projects. For instance, a single large-scale desalination plant can cost hundreds of millions of dollars.

This substantial financial requirement acts as a formidable barrier to entry. New companies must secure considerable funding or have access to robust project financing capabilities to even consider entering these markets. This limits the pool of potential competitors to those with deep pockets and established financial relationships.

The power and water sectors are heavily regulated, presenting a significant hurdle for new players. Navigating intricate environmental impact assessments, securing land rights, and obtaining numerous government approvals and licenses can be a time-consuming and costly endeavor. For instance, in 2024, the average time for obtaining permits for large infrastructure projects in the energy sector often extended beyond 18 months, deterring those without established expertise or connections.

Securing long-term Power Purchase Agreements (PPAs) and Water Purchase Agreements (WPAs) with creditworthy off-takers, such as government utilities, is fundamental for project financing and ensuring stable revenue streams. New companies entering the renewable energy and water sectors may find it challenging to obtain these critical agreements. For instance, in 2023, ACWA Power successfully secured a significant 25-year PPA for its 1.1 GW Sudair Solar PV project in Saudi Arabia, demonstrating the value of established relationships and a proven track record.

Technological Expertise and Operational Experience

The development, investment, and operation of power generation and desalination facilities demand a deep reservoir of specialized technical expertise and substantial operational experience. Newcomers face a formidable barrier in acquiring or building this know-how, especially concerning cutting-edge technologies like green hydrogen production or extensive renewable energy installations.

This expertise translates into tangible costs and time investments. For instance, securing the necessary engineering talent and operational teams for complex projects, such as those involving advanced battery storage or offshore wind farms, can be prohibitively expensive for new entrants. ACWA Power itself leverages decades of experience in managing diverse energy portfolios, a significant deterrent to potential competitors lacking a similar track record.

- High Capital Investment: Entry requires substantial upfront capital for technology, infrastructure, and skilled personnel, often in the billions of dollars for large-scale projects.

- Regulatory Hurdles: Navigating complex permitting, environmental approvals, and grid connection processes requires specialized knowledge and established relationships.

- Technological Complexity: Operating advanced technologies like concentrated solar power (CSP) or large-scale desalination plants demands highly trained engineers and technicians.

- Long Project Lifecycles: The lengthy development and operational phases of power and water projects necessitate long-term strategic planning and financial resilience, which new entrants may struggle to demonstrate.

Economies of Scale and Established Supply Chains

Established players like ACWA Power leverage significant economies of scale in procurement, construction, and operations. This allows them to secure better pricing on equipment and services, leading to more competitive bids and lower project costs. For instance, in 2024, large-scale renewable projects often saw cost reductions of 10-15% due to bulk purchasing power.

Furthermore, ACWA Power benefits from deeply entrenched relationships with key suppliers and contractors, ensuring reliable access to materials and expertise. New entrants would struggle to replicate these established supply chains, likely facing higher initial capital expenditures and operational inefficiencies. This cost disadvantage makes it difficult for newcomers to compete on price with incumbents who have optimized their supply chain networks over years of operation.

- Economies of Scale: In 2024, the average cost per megawatt for solar PV installations for large-scale projects was significantly lower for developers with substantial project pipelines compared to smaller, one-off developments.

- Established Supply Chains: ACWA Power's long-standing partnerships with global manufacturers of wind turbines and solar panels provide preferential pricing and delivery schedules, a significant barrier for new market entrants.

- Cost Disadvantage for New Entrants: A new entrant might face a 5-10% higher upfront cost for critical components due to a lack of established supplier relationships and lower order volumes in 2024.

The threat of new entrants for ACWA Power is generally low due to substantial barriers. The immense capital required for power and water projects, often running into billions, deters many potential competitors. For example, a single 1 GW solar project can require over $1 billion in investment. Additionally, navigating the complex and lengthy regulatory landscape, which can take 18-24 months for major energy infrastructure approvals in 2024, poses a significant challenge for newcomers.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ACWA Power leverages data from company annual reports, investor presentations, industry-specific research from firms like Wood Mackenzie and IHS Markit, and regulatory filings to provide a comprehensive view of the competitive landscape.