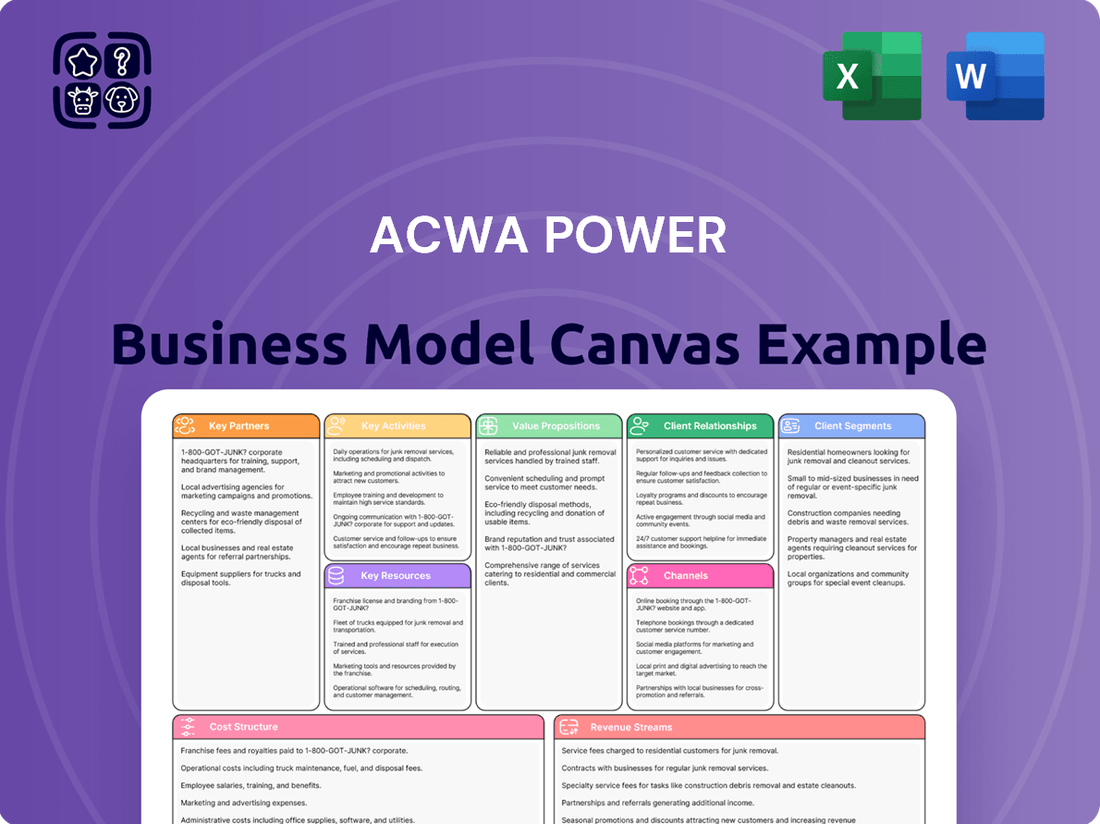

ACWA Power Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACWA Power Bundle

Unlock the strategic core of ACWA Power's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they build value through innovative energy solutions and secure key partnerships to drive growth. Discover their customer segments and revenue streams to gain actionable insights for your own ventures.

Partnerships

ACWA Power's strategic partnerships with government entities and public investment funds, notably Saudi Arabia's Public Investment Fund (PIF), are foundational to its business model. These collaborations are instrumental in securing financing and strategic alignment for massive national infrastructure projects, directly supporting ambitious national development agendas like Saudi Vision 2030.

These governmental alliances provide ACWA Power with substantial financial resources and a clear strategic roadmap, enabling the company to undertake and successfully deliver large-scale renewable energy and water desalination projects. For instance, PIF's significant investments in ACWA Power's projects underscore the mutual benefit of aligning private sector expertise with sovereign development goals.

ACWA Power's key partnerships with financial institutions and lenders are foundational to its business model. The company actively collaborates with a diverse consortium of banks, spanning local, regional, and international markets. Notable partners include the International Finance Corporation (IFC) and the National Bank of Kuwait (NBK), underscoring the global and regional reach of these relationships.

These financial alliances are critical for securing the significant project financing necessary for ACWA Power's large-scale infrastructure developments, such as power generation and water desalination plants. For instance, in 2023, ACWA Power secured over $3.2 billion in financing for its Red Sea utility assets, demonstrating the scale of these partnerships.

By engaging with these institutions, ACWA Power gains access to a broad spectrum of funding sources, which is essential for managing the capital-intensive nature of its projects. This diversified approach to financing also allows the company to effectively mitigate financial risks associated with its global operations.

ACWA Power collaborates with global technology leaders like Sungrow Renewables for solar inverters and Mingyang Smart Energy for wind turbines. These partnerships are crucial for integrating advanced, efficient technologies into their renewable energy projects, ensuring they leverage the latest innovations in solar, wind, and energy storage.

Further strengthening its technological backbone, ACWA Power partners with Gotion Power Morocco for battery storage solutions and Hysata for advanced electrolyzer technology in green hydrogen production. These collaborations are vital for operational efficiency and driving innovation in the rapidly evolving renewable energy sector, including the burgeoning green hydrogen market.

The company also works with established manufacturers such as GE Vernova, securing access to reliable and high-performance equipment for its diverse portfolio of renewable energy assets. These strategic alliances underscore ACWA Power's commitment to deploying best-in-class technology, thereby enhancing project performance and supporting its research and development efforts for sustainable energy solutions.

Joint Venture Partners and Developers

ACWA Power frequently engages in joint ventures with other developers and operators to tackle intricate, large-scale projects and to successfully penetrate new international markets. These strategic alliances are crucial for sharing the substantial risks inherent in major infrastructure development and for accessing local market knowledge and operational expertise.

Notable examples of these collaborations include significant ventures in China and Uzbekistan, demonstrating ACWA Power's commitment to global expansion through partnership. Furthermore, alliances with established entities like Engie have been instrumental in facilitating asset acquisitions, thereby broadening the company's portfolio and operational footprint.

- Strategic Alliances for Project Execution: ACWA Power forms joint ventures with other developers and operators to manage the complexities and scale of its projects.

- Market Expansion and Risk Mitigation: Partnerships enable entry into new geographical markets and distribute the financial and operational risks associated with large-scale developments.

- Leveraging Combined Expertise: Collaborations with companies like Engie for asset acquisitions allow for the pooling of technical know-how and market insights.

- Geographic Diversification: Ventures in regions such as China and Uzbekistan highlight the strategy of using partnerships to achieve broad geographic reach and growth.

Research and Academic Institutions

ACWA Power actively partners with leading academic and research institutions to drive innovation. Collaborations with entities such as King Abdullah University of Science and Technology (KAUST) and various Fraunhofer Institutes are central to this strategy. These partnerships are crucial for developing cutting-edge solutions in critical areas like water desalination, renewable energy generation, and the burgeoning field of green hydrogen. This dedication to research and development, evidenced by their engagement with institutions that are global leaders in scientific advancement, ensures ACWA Power stays ahead in the competitive landscape of sustainable technologies.

The focus of these collaborations is on tangible advancements. For instance, ACWA Power's work with KAUST has explored novel membrane technologies for more efficient desalination, a vital area given global water scarcity. Similarly, partnerships with Fraunhofer Institutes aim to refine processes for green hydrogen production, a key component in decarbonizing various industries. These R&D efforts are not merely theoretical; they are designed to translate into commercially viable and impactful technologies, reinforcing ACWA Power's position as a pioneer in sustainable infrastructure.

These strategic alliances underscore ACWA Power's commitment to long-term technological leadership. By leveraging the expertise and research capabilities of top-tier academic and scientific organizations, the company can accelerate the development and deployment of next-generation energy and water solutions. This approach ensures that ACWA Power remains at the forefront of the global transition towards a more sustainable future, contributing to both environmental goals and economic growth.

ACWA Power’s key partnerships with government entities and public investment funds, like Saudi Arabia's Public Investment Fund (PIF), are crucial for securing financing and strategic direction for major national projects, aligning with initiatives such as Saudi Vision 2030. These alliances provide substantial financial backing and a clear strategic path, enabling the successful execution of large-scale renewable energy and water desalination projects.

The company also relies on strong relationships with financial institutions, including the International Finance Corporation (IFC) and the National Bank of Kuwait (NBK), to secure the significant project financing needed for its capital-intensive developments. For example, in 2023, ACWA Power secured over $3.2 billion in financing for its Red Sea utility assets, highlighting the scale of these financial collaborations.

Furthermore, ACWA Power partners with global technology leaders, such as Sungrow Renewables for solar inverters and GE Vernova for turbine equipment, to integrate advanced and efficient technologies into its projects. Collaborations with Gotion Power Morocco for battery storage and Hysata for green hydrogen electrolyzer technology are vital for operational efficiency and innovation.

Joint ventures with other developers and operators, like those in China and Uzbekistan, are essential for managing project complexities, sharing risks, and gaining local market expertise. These strategic alliances, including past collaborations with Engie for asset acquisitions, are key to ACWA Power's global expansion and portfolio growth.

| Partner Type | Key Partners | Purpose | Example Data/Impact |

|---|---|---|---|

| Government/Sovereign Funds | Public Investment Fund (PIF) | Financing, Strategic Alignment | PIF investments support national development agendas. |

| Financial Institutions | IFC, National Bank of Kuwait | Project Financing | Secured over $3.2 billion for Red Sea utility assets in 2023. |

| Technology Providers | Sungrow Renewables, GE Vernova, Gotion Power Morocco, Hysata | Technology Integration, Innovation | Leveraging advanced solar, wind, battery storage, and green hydrogen tech. |

| Joint Ventures/Operators | Engie, Local Developers | Market Entry, Risk Sharing | Facilitated expansion in China, Uzbekistan, and asset acquisitions. |

What is included in the product

This ACWA Power Business Model Canvas provides a strategic overview of their operations, detailing customer segments, value propositions, and key resources for renewable energy project development and operation.

It offers a comprehensive analysis of ACWA Power's revenue streams and cost structure, highlighting their competitive advantages in global energy markets.

ACWA Power's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their strategy, enabling rapid understanding and alignment across diverse stakeholders.

Activities

ACWA Power's primary focus is on the entire lifecycle of power and water projects, from initial concept to operational investment. This involves meticulously identifying promising opportunities, conducting thorough feasibility studies, and securing essential resources like land and permits. For instance, in 2024, the company continued to advance its significant pipeline of projects, including the development of large-scale solar and desalination facilities across the Middle East and Africa.

A crucial aspect of their key activities lies in the intricate financial structuring of these large-scale ventures. This includes attracting diverse sources of capital, negotiating with lenders and investors, and managing complex financial arrangements to ensure project viability and profitability. ACWA Power's commitment to expanding its portfolio is evident in its continuous pursuit of new projects, both in established energy markets and emerging renewable energy sectors globally.

ACWA Power's Engineering, Procurement, and Construction (EPC) Management is a core activity, encompassing the full project lifecycle. This includes meticulous design, engineering, sourcing of critical equipment, and rigorous oversight of construction phases. For instance, in 2024, the company continued to manage complex projects like the Noor Arada solar farm in Saudi Arabia, emphasizing efficient delivery.

While ACWA Power frequently partners with specialized EPC contractors, it retains robust control and supervision. This ensures adherence to strict timelines and budgetary constraints, critical for large-scale infrastructure development. Their project management expertise was evident in the successful completion of several renewable energy facilities throughout 2024, reinforcing their commitment to operational excellence.

ACWA Power's operations and maintenance (O&M) are central to its business, focusing on the long-term running of its power and water desalination facilities. This hands-on approach guarantees the consistent and efficient supply of electricity and clean water to its customers. For instance, in 2023, ACWA Power successfully maintained a high availability factor across its diverse portfolio of assets.

Key to this O&M strategy is the continuous monitoring of plant performance and proactive asset management. This meticulous attention to detail ensures that all facilities operate at peak efficiency, extending their operational life and minimizing downtime. This commitment to operational excellence is a cornerstone of ACWA Power's value proposition to its off-takers.

Securing Off-Take Agreements

Securing off-take agreements, primarily long-term Power Purchase Agreements (PPAs) and Water Purchase Agreements (WPAs), is a cornerstone activity for ACWA Power. These agreements are negotiated with sovereign entities and state-owned utilities, providing a predictable and robust revenue stream that is crucial for project financing and long-term profitability.

The company's success hinges on its capability to secure these vital contracts, which often span 20 to 30 years. For instance, in 2024, ACWA Power continued to actively pursue and sign such agreements, reinforcing its project pipeline and financial stability. These off-take agreements de-risk investments significantly, making them attractive to lenders and investors.

- Negotiation of PPAs/WPAs: ACWA Power's core activity involves detailed negotiation of terms, pricing, and duration for these long-term contracts.

- Counterparty Risk Mitigation: Agreements with government entities and state utilities are preferred for their creditworthiness, ensuring payment security.

- Revenue Stream Guarantee: These secured off-take agreements provide a predictable revenue stream, essential for project finance and investor confidence.

- Project Viability Foundation: The ability to consistently secure these off-take agreements is fundamental to the financial viability and sustainability of ACWA Power's extensive portfolio.

Innovation and Technology Advancement

ACWA Power is deeply committed to innovation, pouring significant resources into research and development. This focus is particularly strong in areas like renewable energy, green hydrogen production, and cutting-edge desalination techniques. For instance, in 2024, the company continued to explore novel energy storage solutions, aiming to enhance grid stability and the reliability of renewable sources.

The company’s drive for technological advancement is crucial for staying ahead in a rapidly evolving energy landscape. By improving the efficiency of existing processes and developing new technologies, ACWA Power aims to reduce costs and environmental impact. This strategic emphasis ensures they remain competitive and actively contribute to achieving global energy transition targets.

- R&D Investment: ACWA Power consistently allocates capital to R&D, focusing on next-generation renewable energy, green hydrogen, and advanced water treatment.

- Efficiency Gains: Efforts are concentrated on improving the operational efficiency of solar, wind, and desalination plants, leading to better resource utilization.

- Energy Storage: Exploration of advanced battery technologies and other storage mechanisms is a key activity to ensure consistent power supply from intermittent renewables.

- Competitive Edge: Continuous innovation allows ACWA Power to offer more cost-effective and sustainable energy solutions, solidifying its market position.

ACWA Power's core activities revolve around developing, constructing, and operating power and water desalination projects. This includes securing long-term off-take agreements, primarily Power Purchase Agreements (PPAs) and Water Purchase Agreements (WPAs), with creditworthy entities, often government-backed. The company also actively manages the financial structuring, engineering, procurement, and construction (EPC) phases, and ensures the ongoing operations and maintenance (O&M) of its diverse asset portfolio.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Project Development & Securing Off-take Agreements | Identifying opportunities, feasibility studies, and negotiating long-term PPAs/WPAs. | Continued to advance a significant pipeline of projects, signing new agreements for renewable energy and water infrastructure. |

| Financial Structuring & Fundraising | Attracting capital, negotiating with lenders, and managing complex financial arrangements. | Successfully closed financing for several large-scale projects, leveraging diverse debt and equity sources. |

| EPC Management | Overseeing design, engineering, procurement, and construction phases. | Managed complex construction schedules for major solar and wind farms, emphasizing timely delivery and cost control. |

| Operations & Maintenance (O&M) | Ensuring efficient and reliable operation of power and water facilities. | Maintained high availability factors across its operational assets, demonstrating operational excellence. |

| Innovation & R&D | Investing in new technologies for renewable energy and water solutions. | Explored advancements in energy storage and green hydrogen production to enhance sustainability and efficiency. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you are seeing the complete, unedited version of ACWA Power's strategic framework, ready for your immediate use. No mockups or samples, just the authentic business model in its entirety.

Resources

ACWA Power's extensive portfolio of assets is its bedrock, encompassing a wide array of power generation and water desalination facilities strategically located across numerous countries. This physical infrastructure is the engine driving its revenue streams and market presence.

As of the first quarter of 2025, ACWA Power's impressive asset base comprised 101 operational plants. The sheer scale of this portfolio is underscored by a total investment cost of USD 107 billion, reflecting significant capital deployment and commitment to developing critical infrastructure.

The company's gross capacity is substantial, reaching 78.9 GW for power generation and an impressive 9.5 million cubic meters per day for desalinated water. These operational assets are the direct generators of income, forming the core of ACWA Power's business model and its ability to deliver essential services.

ACWA Power's financial capital is a cornerstone of its business model, enabling it to pursue ambitious global projects. This includes substantial equity investments and a robust debt financing structure, drawing from both international and local banking institutions. The company has a proven track record of successful capital raises, demonstrating strong investor confidence.

Securing multi-billion dollar financing is paramount to ACWA Power's continued growth and expansion strategy. For instance, in 2023, the company secured significant funding for various renewable energy projects, underscoring its capacity to manage and execute large-scale, capital-intensive ventures in the energy sector.

ACWA Power's strength lies in its over 4,000-strong workforce, a critical asset for its complex energy and water projects. This team possesses deep expertise across engineering, project management, finance, and operations, enabling the company to deliver on ambitious undertakings.

The company's commitment to people development and talent retention ensures a continuous pipeline of skilled professionals. This focus on human capital is fundamental to ACWA Power's ability to successfully develop, execute, and operate large-scale infrastructure projects globally.

Advanced Technology and Innovation Capabilities

ACWA Power’s advanced technology and innovation capabilities are central to its business model, focusing on access to and development of cutting-edge solutions across renewable energy and water. This includes significant investment in solar, wind, green hydrogen, battery energy storage, and desalination technologies. The company’s commitment to R&D and strategic partnerships with global technology leaders ensures it remains at the forefront of the industry.

These capabilities are not just about acquiring technology; they involve cultivating proprietary knowledge and establishing dedicated R&D centers. For example, ACWA Power’s involvement in projects like the Noor Ouarzazate Solar Power Station in Morocco, one of the world’s largest concentrated solar power plants, showcases its ability to deploy and manage advanced solar technologies. Their strategic focus on green hydrogen, a key area for decarbonization, further highlights their forward-thinking approach to innovation.

ACWA Power’s technological prowess directly translates into delivering efficient, reliable, and sustainable solutions for its clients and partners. This commitment to innovation is a key differentiator, enabling the company to secure and execute large-scale projects globally. By integrating advanced technologies, ACWA Power aims to drive down costs and improve the performance of renewable energy and water solutions, contributing to a sustainable future.

Key technological strengths include:

- Proprietary knowledge and R&D centers: Investing in internal expertise and research facilities to drive innovation.

- Strategic partnerships: Collaborating with leading technology providers and research institutions worldwide.

- Expertise in diverse renewable technologies: Deep capabilities in solar (PV and CSP), wind, and emerging areas like green hydrogen and battery storage.

- Advanced desalination capabilities: Leading the development and deployment of efficient and sustainable water treatment technologies.

Long-Term Off-Take Contracts and Government Relationships

ACWA Power's long-term Power Purchase Agreements (PPAs) and Water Purchase Agreements (WPAs) are foundational assets, offering substantial revenue stability and predictability for decades. These agreements, primarily with government entities and state utilities, act as a bedrock for financial planning and investment. For instance, ACWA Power has secured numerous such agreements globally, underpinning its project financing and operational continuity.

These long-term contracts, often spanning 20 to 25 years, are critical for securing project financing and de-risking investments. They provide a guaranteed revenue stream, making projects attractive to lenders and investors. In 2024, ACWA Power continued to expand its portfolio with new agreements, reinforcing its commitment to stable, long-term revenue generation. The company's success in securing these contracts highlights its strong market position and operational capabilities.

- Contractual Revenue Stability: Long-term PPAs and WPAs with government entities provide predictable, multi-decade revenue streams, crucial for financial forecasting and investor confidence.

- Project Financing Enablement: These agreements are essential for securing debt financing and attracting equity investment for large-scale infrastructure projects.

- Government and Regulatory Relationships: Strong ties with governments and regulatory bodies are vital for securing new project approvals, navigating permits, and ensuring smooth operations.

- Market Access and Risk Mitigation: These relationships grant ACWA Power access to key markets and mitigate regulatory and political risks associated with energy and water infrastructure development.

ACWA Power's key resources are a blend of tangible assets, financial strength, human expertise, technological innovation, and crucial long-term contracts. The company's vast portfolio of 101 operational power and water facilities, with a total investment of USD 107 billion as of Q1 2025, forms its physical bedrock. This is complemented by a robust financial capital structure, enabling the pursuit of massive global projects, and a dedicated workforce of over 4,000 professionals possessing specialized skills.

The company's commitment to advanced technology and R&D, particularly in renewables and green hydrogen, ensures it remains competitive and sustainable. Furthermore, its extensive network of long-term Power Purchase Agreements (PPAs) and Water Purchase Agreements (WPAs) provides a stable and predictable revenue stream, underpinning its financial stability and growth strategy.

| Resource Category | Key Components | Significance |

|---|---|---|

| Physical Assets | 101 operational power & water facilities (as of Q1 2025) | Revenue generation, market presence, operational capacity (78.9 GW power, 9.5M m³/day water) |

| Financial Capital | Equity investments, debt financing (local & international banks) | Enables ambitious project development, capital raises, project financing |

| Human Capital | Over 4,000 skilled employees | Expertise in engineering, project management, finance, operations; talent development |

| Technology & Innovation | Renewable energy (solar, wind), green hydrogen, battery storage, desalination expertise | Drives efficiency, cost reduction, competitive advantage, sustainable solutions |

| Contracts & Relationships | Long-term PPAs/WPAs (20-25 years), government/utility relationships | Revenue stability, project financing security, market access, risk mitigation |

Value Propositions

ACWA Power's primary value is providing dependable electricity and desalinated water at affordable prices. This directly tackles the fundamental need for these vital resources in many countries, fostering economic growth and improving living standards.

The company achieves this competitive pricing through highly efficient operations and smart financial strategies. For instance, in 2024, ACWA Power continued to secure long-term power purchase agreements that lock in favorable rates for consumers, such as their recent projects in the Middle East where electricity costs are among the lowest globally.

ACWA Power is actively shaping the global energy transition by championing renewable sources like solar, wind, and the burgeoning field of green hydrogen. This strategic focus directly supports worldwide decarbonization efforts and aligns with national sustainability blueprints, such as Saudi Vision 2030, which aims for significant renewable energy integration.

The company's core offering revolves around providing tangible solutions that demonstrably lower carbon emissions and foster the development of more sustainable energy infrastructures. For instance, ACWA Power's commitment is evident in projects like the Noor Ouarzazate Solar Power Station in Morocco, one of the world's largest concentrated solar power plants, which significantly reduces reliance on fossil fuels.

ACWA Power's commitment extends beyond energy generation to securing vital water resources, positioning it as the world's largest private desalination company. This focus is crucial for arid regions, where reliable access to potable water is a significant challenge.

The company's desalination projects directly address a fundamental human need, ensuring sustainable community development by providing a consistent supply of clean water. This capability is a key differentiator in its business model.

In 2023, ACWA Power's water segment contributed significantly to its overall operations, with a substantial portion of its portfolio dedicated to desalination, underscoring its critical role in water security initiatives globally.

Large-Scale Project Execution and Delivery

ACWA Power excels at bringing large-scale power and water projects to life, demonstrating a robust history of successful development, financing, and operational launch. This expertise is crucial for clients needing reliable, high-capacity infrastructure.

The company's capacity to manage complex, multi-billion dollar investments and rapidly deploy gigawatts of power generation is a key differentiator. For instance, in 2024, ACWA Power continued to advance its substantial pipeline, including major projects like the Red Sea Project's desalination capacity, underscoring its delivery prowess.

- Proven Track Record: Consistently delivers complex, multi-billion dollar infrastructure projects on time and within budget.

- Gigawatt Scale Delivery: Proven ability to commission massive power generation capacity, meeting critical energy demands.

- Client Assurance: Guarantees successful project implementation and timely, reliable supply of power and water.

Commitment to Sustainability and ESG

ACWA Power deeply embeds environmental, social, and governance (ESG) principles across its business. This dedication fosters stakeholder trust and appeals to investors focused on sustainability. For example, in 2023, ACWA Power reported a significant reduction in its carbon intensity, aiming for further decreases by 2030.

The company's commitment is evident in tangible initiatives that go beyond standard reporting. These actions reinforce its reputation as a responsible corporate citizen.

- Environmental Stewardship: ACWA Power actively engages in projects like coral reef restoration, contributing to marine biodiversity.

- Social Impact: The company prioritizes providing essential services, such as clean water access, to communities that need it most.

- Governance Excellence: Robust governance frameworks ensure transparency and ethical conduct in all operations, a key factor for attracting ESG-focused capital.

- Sustainable Financing: In 2024, ACWA Power successfully issued green bonds, underscoring its ability to attract capital aligned with its sustainability goals.

ACWA Power provides essential electricity and desalinated water at competitive prices, directly addressing fundamental needs and supporting economic development. Their efficiency and strategic financial planning, including securing long-term power purchase agreements in 2024, ensure affordability for consumers globally.

The company is a leader in the energy transition, championing renewables like solar and wind, and investing in green hydrogen. This focus aligns with global decarbonization goals and national sustainability agendas, such as Saudi Vision 2030, which aims for substantial renewable energy integration.

ACWA Power's value proposition includes tangible solutions for reducing carbon emissions and building sustainable energy infrastructure, exemplified by projects like the Noor Ouarzazate Solar Power Station in Morocco. They are also the world's largest private desalination company, crucial for water security in arid regions.

ACWA Power demonstrates a strong ability to execute large-scale projects, from development to financing and operation, with a proven track record in delivering complex, multi-billion dollar investments. In 2024, they continued to advance significant projects, including the Red Sea Project's desalination capacity, highlighting their delivery capabilities.

The company integrates Environmental, Social, and Governance (ESG) principles, fostering trust and attracting sustainable investment. In 2023, ACWA Power reported a notable reduction in carbon intensity and aims for further improvements, reinforced by initiatives like issuing green bonds in 2024.

| Value Proposition | Description | Key Differentiator | Example/Fact |

| Affordable & Reliable Energy/Water | Providing essential services at competitive prices. | Operational efficiency and smart financial strategies. | Secured favorable rates via long-term PPAs in 2024; lowest global electricity costs in Middle East projects. |

| Energy Transition Leadership | Championing renewable energy and green hydrogen. | Strategic focus on decarbonization and sustainability. | Noor Ouarzazate Solar Power Station (Morocco); aligns with Saudi Vision 2030. |

| Large-Scale Project Execution | Developing, financing, and operating complex infrastructure. | Proven ability to manage multi-billion dollar investments and gigawatt-scale delivery. | Advancing Red Sea Project desalination capacity in 2024; commissioned significant power generation capacity. |

| ESG Integration | Embedding environmental, social, and governance principles. | Building stakeholder trust and attracting ESG-focused capital. | Reduced carbon intensity in 2023; issued green bonds in 2024. |

Customer Relationships

ACWA Power's customer relationships are predominantly built on the foundation of long-term contractual agreements, primarily Power Purchase Agreements (PPAs) and Water Purchase Agreements (WPAs). These agreements are the bedrock of their business model, ensuring stability and predictability.

These contracts typically have durations of 20 to 25 years. For instance, in 2023, ACWA Power continued to secure and operate projects under such long-term agreements, underscoring their commitment to this strategy. This extended commitment provides ACWA Power with a reliable revenue stream and guarantees a consistent supply of power and water for its customers.

The longevity of these PPAs and WPAs fosters deep trust and a strong sense of commitment between ACWA Power and its clients, often government entities or large industrial consumers. This enduring partnership is crucial for the significant capital investments required in the energy and water sectors.

ACWA Power cultivates direct relationships with crucial stakeholders, including government bodies, national utilities, and major industrial clients. This direct interaction is key to grasping their specific requirements and crafting bespoke energy and water solutions.

For instance, in 2023, ACWA Power secured a significant contract to develop a 200 MW solar photovoltaic project in Kazakhstan, directly engaging with the Ministry of Energy. This tailored approach facilitates the management of complex, large-scale projects, underscoring the importance of these direct connections.

ACWA Power actively cultivates robust strategic partnerships with national governments across its operational regions. These alliances are fundamental to successfully navigating complex regulatory landscapes, obtaining crucial project approvals, and ensuring alignment with each nation's overarching development objectives. For instance, in 2024, ACWA Power continued its significant engagement with governments in the Middle East and Africa, securing key agreements that underpin its renewable energy expansion plans.

Investor Confidence and Transparency

ACWA Power prioritizes building investor confidence through unwavering transparency. This is crucial for securing the capital needed for its ambitious global expansion plans.

The company actively engages with financial stakeholders via regular investor calls and comprehensive reports. These communications detail ACWA Power's progress, financial health, and strategic outlook, reinforcing trust.

- Transparent Financial Reporting: ACWA Power consistently provides detailed financial statements and performance updates, ensuring investors have a clear view of the company's operations and profitability. For instance, in their 2023 annual report, they highlighted a significant increase in revenue, demonstrating their growth trajectory.

- Consistent Communication Channels: The company maintains open lines of communication through quarterly earnings calls, investor presentations, and dedicated investor relations teams. This proactive approach addresses investor queries promptly and keeps them informed about market developments and strategic initiatives.

- Demonstrating Growth Trajectory: By showcasing a strong pipeline of projects and successful project completions, ACWA Power builds confidence in its future earnings potential. Their commitment to renewable energy, a sector projected for substantial growth through 2030, further bolsters investor sentiment.

- Attracting and Retaining Capital: This focus on transparency and consistent communication is directly linked to ACWA Power's ability to attract new investment and retain existing capital. It signals a stable and reliable investment opportunity, essential for funding large-scale renewable energy projects.

Commitment to Local Impact and Community Development

ACWA Power prioritizes local impact and community development, embedding these principles into its operational strategy. This commitment translates into tangible benefits for the regions where it operates, fostering strong relationships and contributing to sustainable growth.

The company actively pursues initiatives aimed at maximizing local content and creating employment opportunities. For instance, in 2024, ACWA Power's projects in Saudi Arabia were reported to have a significant local content target, with a substantial portion of procurement and labor sourced domestically. This focus not only supports the local economy but also builds capacity within the community.

Furthermore, ACWA Power engages in social development projects that address critical community needs. A prime example is their work in water-scarce regions, where providing access to clean water for households directly improves quality of life and demonstrates a deep understanding of local challenges. These efforts build considerable goodwill and solidify the company's position as a responsible corporate citizen.

- Local Content Maximization: ACWA Power aims to maximize the use of local goods and services in its projects, contributing to economic diversification and job creation.

- Job Creation: The company prioritizes hiring and training local talent, creating sustainable employment pathways for community members.

- Social Development Initiatives: ACWA Power invests in projects that address essential community needs, such as improving access to clean water and supporting education.

- Community Engagement: Through these actions, ACWA Power builds trust and strengthens its social license to operate, fostering long-term partnerships with local stakeholders.

ACWA Power's customer relationships are primarily managed through direct engagement with government entities and large industrial clients, fostering long-term partnerships built on trust and tailored solutions. These relationships are solidified through extensive Power Purchase Agreements (PPAs) and Water Purchase Agreements (WPAs), often spanning two decades or more, ensuring revenue stability and predictable demand.

The company's approach emphasizes transparency and consistent communication with investors, detailing progress and financial health through regular calls and reports. This focus on demonstrating a strong growth trajectory, exemplified by its pipeline of renewable energy projects, is crucial for attracting and retaining the significant capital required for its global operations. For example, in 2023, ACWA Power reported substantial revenue growth, reinforcing investor confidence.

Furthermore, ACWA Power actively cultivates strong relationships with local communities by prioritizing local content, job creation, and social development initiatives. This commitment, evident in projects across Saudi Arabia in 2024 that focused on domestic procurement and employment, builds goodwill and secures its social license to operate.

Channels

ACWA Power primarily engages governments and large industrial clients through a direct sales approach. This involves actively participating in competitive bidding for Independent Power Producer (IPP) and Independent Water Producer (IWP) projects. For instance, in 2023, ACWA Power secured a significant contract for the 1,100 MW Sudair Solar PV IPP project in Saudi Arabia, showcasing their success in these direct bidding channels.

Strategic partnerships and joint ventures are key channels for ACWA Power to enter new markets and execute complex projects, especially in unfamiliar territories or for novel technologies. These collaborations allow the company to tap into local knowledge, share technical expertise, and collectively manage the inherent risks of large-scale developments.

In 2024, ACWA Power continued to leverage these alliances. For instance, its joint venture with PIF and NEOM for the development of the green hydrogen project in Saudi Arabia exemplifies this strategy, aiming to position the Kingdom as a leader in sustainable energy. Such ventures are vital for navigating regulatory landscapes and accessing diverse skill sets, underpinning ACWA Power's aggressive global growth trajectory.

The Investor Relations team at ACWA Power is crucial for connecting with investors and financial analysts, ensuring the company can secure funding. In 2024, ACWA Power continued to leverage these relationships to support its extensive project pipeline.

Through detailed financial reports, engaging investor presentations, and active participation in roadshows, ACWA Power effectively communicates its strategy and performance. This proactive engagement is vital for attracting the capital needed to fuel its significant growth ambitions.

ACWA Power’s commitment to transparent communication via its investor relations channels ensures continuous access to funding, a necessity for developing new renewable energy projects globally. This access directly supports their mission to deliver clean energy solutions.

Industry Forums and Conferences

ACWA Power leverages industry forums and conferences as crucial channels to showcase its expertise and connect with the global energy sector. Participation in events like the Future Investment Initiative (FII) allows the company to highlight its project pipeline and technological advancements. In 2024, ACWA Power continued its active presence at key global energy summits, fostering dialogue and securing strategic alliances.

These high-profile events serve as platforms for ACWA Power to announce significant milestones, such as new project awards or innovative partnership agreements, directly engaging with investors, policymakers, and potential clients. For instance, ACWA Power's engagement at the 2024 World Future Energy Summit provided opportunities to discuss its role in accelerating the energy transition.

The company's own Innovation Days also fall under this channel, creating focused environments for deep dives into emerging technologies and collaborative problem-solving with industry peers. These events are instrumental in positioning ACWA Power as a thought leader and driving business development.

- Showcasing Capabilities: ACWA Power utilizes industry forums to present its portfolio of renewable energy projects and technological innovations.

- Stakeholder Engagement: Events like FII facilitate direct interaction with investors, government officials, and strategic partners.

- Business Development: Networking at conferences provides opportunities to identify new markets and secure project financing.

- Thought Leadership: ACWA Power's participation in panel discussions and presentations establishes its expertise in the renewable energy sector.

Digital Presence and Corporate Communications

ACWA Power actively cultivates its digital presence through its corporate website, serving as a primary hub for project updates, financial disclosures, and sustainability efforts. This strategic online communication aims to keep stakeholders informed, bolster brand image, and attract investment and talent.

The company's digital strategy heavily emphasizes content marketing, particularly focusing on Environmental, Social, and Governance (ESG) themes. This approach is crucial for demonstrating commitment to sustainable development and appealing to investors prioritizing ESG factors.

In 2024, ACWA Power continued to highlight its renewable energy projects, such as the Noor Argan solar complex in Morocco and the Red Sea Project's renewable energy infrastructure in Saudi Arabia. These projects underscore the company's dedication to clean energy transitions.

- Digital Information Dissemination: ACWA Power's corporate website is the central platform for sharing detailed information on its global project portfolio, financial results, and sustainability performance.

- Stakeholder Engagement and Brand Building: The digital channels are vital for fostering transparency with investors, partners, and the public, thereby enhancing brand reputation and trust.

- Talent Acquisition and Partnership Attraction: A strong digital presence helps attract skilled professionals and potential business partners by showcasing the company's vision and achievements in the renewable energy sector.

- ESG Content Leadership: ACWA Power utilizes content marketing, especially concerning ESG initiatives, to position itself as a leader in sustainable energy solutions and attract environmentally conscious investors.

ACWA Power utilizes direct sales through competitive bidding for IPP and IWP projects, securing significant contracts like the 1,100 MW Sudair Solar PV IPP in 2023. Strategic partnerships and joint ventures are crucial for market entry and risk management, exemplified by the 2024 green hydrogen project with PIF and NEOM. Investor relations and digital channels, including their website, are vital for securing funding and communicating ESG commitments, supporting their global growth.

Customer Segments

Government entities and ministries are ACWA Power's foundational customer segment, particularly those overseeing energy, water, and national development. These partnerships are crucial as ACWA Power's project development directly supports national strategic visions, such as Saudi Vision 2030, by delivering vital infrastructure for economic expansion and public services.

ACWA Power's engagement with governments is characterized by long-term, strategic relationships. For instance, in 2023, the company secured significant project awards, including the development of a 2,400 MW clean energy project in Saudi Arabia, directly aligning with the Kingdom's ambitious renewable energy targets and underscoring the deep governmental reliance on such partnerships for national progress.

State-owned utilities and off-takers represent a core customer segment for ACWA Power, acting as the primary purchasers of electricity and desalinated water. These entities, often national power companies or water procurement authorities, enter into long-term agreements to secure reliable bulk supply, ensuring national energy and water security.

ACWA Power directly addresses the substantial demand from these public bodies, supplying the essential resources needed to power national grids and sustain public water systems. In 2023, ACWA Power's portfolio included significant capacity serving such off-takers, contributing to the reliable delivery of power and water across various regions.

Large industrial consumers, such as petrochemical plants or mining operations, often have critical needs for a consistent and high-volume supply of power, steam, or desalinated water. These are not just utility needs; they are fundamental to the continuity and profitability of their core businesses.

ACWA Power addresses these specialized demands by offering to develop and operate captive power and water facilities tailored precisely to the unique operational requirements of these industrial clients. This approach ensures a secure and reliable resource flow, directly supporting the client's production cycles.

These relationships are typically characterized by long-term, direct contractual agreements, often referred to as Power Purchase Agreements (PPAs) or Water Purchase Agreements (WPAs). For instance, ACWA Power's involvement in projects like the Shuaa Energy 2 solar PV plant in Dubai, supplying power to the Dubai Electricity and Water Authority (DEWA), demonstrates its capability in large-scale, dedicated supply contracts, which can be adapted for industrial clients.

International Markets and Developing Nations

ACWA Power's international strategy centers on markets with significant energy and water needs, especially in the Middle East, Africa, Central Asia, and Southeast Asia. These regions are actively pursuing energy transition and infrastructure development, creating substantial demand for ACWA Power's expertise. For instance, in 2024, ACWA Power continued to advance projects in Saudi Arabia, Egypt, and Uzbekistan, underscoring its commitment to these growth regions.

This geographic diversification is crucial for broadening ACWA Power's customer base and mitigating risks associated with reliance on a single market. The company's focus on developing nations often involves partnerships with governments and local entities, aligning with national development agendas. In 2023, ACWA Power reported a substantial portion of its project pipeline was located in these emerging economies, highlighting their strategic importance.

- Middle East & North Africa: Continued focus on renewable energy projects, particularly solar and wind, in countries like Saudi Arabia and Egypt.

- Sub-Saharan Africa: Expanding presence with a focus on essential water and power infrastructure to address growing demand and energy access gaps.

- Central Asia: Developing large-scale renewable projects, such as the 1.1 GW Syr Darya CCGT plant in Uzbekistan, to meet increasing energy needs.

- Southeast Asia: Exploring opportunities in markets like Vietnam and Indonesia for sustainable energy solutions and water treatment facilities.

Financial Investors and Shareholders

Financial investors and shareholders are a vital customer segment for ACWA Power, providing the essential capital that fuels project development and operational expansion. While they don't directly consume the power or water produced, their trust and investment are paramount to the company's ability to secure funding for its ambitious projects. ACWA Power's strategic focus on financial performance and sustainable growth is specifically designed to attract and retain these key stakeholders.

ACWA Power's commitment to delivering strong returns and managing its portfolio effectively is crucial for maintaining investor confidence. For instance, the company's robust project pipeline, which includes significant renewable energy developments, is a key draw for investors seeking exposure to the growing clean energy sector. The company's financial health is a direct reflection of its ability to meet the expectations of this segment.

- Capital Provision: Investors and shareholders inject the necessary equity and debt financing for ACWA Power's large-scale infrastructure projects.

- Financial Performance Focus: The company prioritizes profitability, cash flow generation, and dividend policies to satisfy shareholder expectations.

- Growth Strategy Alignment: ACWA Power's expansion plans in renewable energy and water desalination are designed to offer attractive long-term investment opportunities.

- Risk Management: Effective management of project risks and operational efficiencies are communicated to investors to assure the stability of their investments.

ACWA Power's customer segments are diverse, ranging from government entities and state-owned utilities that purchase bulk power and water, to large industrial consumers requiring tailored solutions. The company also relies on financial investors and shareholders for capital, aligning its growth strategies with their return expectations.

In 2023, ACWA Power's project portfolio underscored its commitment to serving these varied needs, with a significant focus on renewable energy developments that align with national energy transition goals. The company's international presence, particularly in the Middle East, Africa, and Central Asia, highlights its strategy to tap into markets with substantial infrastructure demands.

| Customer Segment | Key Needs | ACWA Power's Offering | Example Engagement (2023/2024 Focus) |

|---|---|---|---|

| Government Entities & Ministries | National energy security, economic development, public services | Developing and operating large-scale power and water infrastructure | Secured 2,400 MW clean energy project in Saudi Arabia (2023) |

| State-Owned Utilities & Off-takers | Reliable bulk supply of electricity and desalinated water | Long-term Power and Water Purchase Agreements (PPAs/WPAs) | Supplying power to DEWA via Shuaa Energy 2 (ongoing) |

| Large Industrial Consumers | Consistent, high-volume power, steam, or water | Tailored captive facilities and dedicated supply solutions | Developing projects for industrial zones in target regions |

| Financial Investors & Shareholders | Strong financial returns, sustainable growth, risk management | Attractive investment opportunities in clean energy and water | Continued expansion of project pipeline in growth markets |

Cost Structure

ACWA Power's cost structure is heavily influenced by the substantial capital expenditure required for developing and constructing its large-scale power and water desalination facilities. These upfront investments encompass engineering design, the procurement of specialized equipment, extensive civil works, and the final commissioning of plants.

For instance, the company's Shuaa Energy 2 project in Dubai, a significant solar power initiative, involved considerable upfront capital. While specific figures are project-dependent, such large-scale developments often represent billions of dollars in initial investment, underscoring ACWA Power's asset-heavy operational model.

Operational and Maintenance (O&M) expenses are a significant part of ACWA Power's cost structure once its plants are up and running. These costs include essential inputs like fuel for thermal power stations, chemicals vital for water treatment processes, and the procurement of spare parts to keep everything functioning smoothly. Routine maintenance is also a continuous expenditure to ensure optimal plant performance and longevity.

Beyond physical components, O&M also covers the human element: salaries for the skilled staff who operate and manage the plants, as well as broader administrative overhead. In 2024, for instance, efficient O&M practices are paramount for ACWA Power, directly impacting plant availability, which is crucial for revenue generation, and for effectively controlling these recurring operational costs.

ACWA Power's business model is heavily influenced by significant financing and debt servicing costs due to the capital-intensive nature of its renewable energy projects. These costs primarily include interest payments on the substantial debt the company utilizes to fund its developments.

For instance, in 2023, ACWA Power reported financing costs of SAR 2.07 billion, a notable increase from SAR 1.76 billion in 2022, underscoring the direct impact of debt levels and interest rate environments on its profitability.

Effective debt management and favorable interest rates are therefore critical levers for ACWA Power to control its overall cost structure and maintain healthy financial performance.

Research and Development (R&D) Investment

ACWA Power strategically invests in Research and Development (R&D) across several key areas. These include exploring new technologies in renewable energy generation, advancing the production and application of green hydrogen, and refining desalination processes. These investments are crucial for staying ahead in a competitive market.

The primary goal of these R&D expenditures is to enhance the efficiency of existing technologies, drive down operational costs, and foster the development of novel solutions tailored for upcoming projects. For instance, in 2023, ACWA Power continued its focus on optimizing solar photovoltaic (PV) and concentrated solar power (CSP) technologies, alongside advancements in battery storage integration, aiming for greater grid stability and cost-effectiveness. The company's commitment to innovation is reflected in its ongoing pilot projects and collaborations with technology providers.

- Focus on Green Hydrogen: ACWA Power is actively researching and developing cost-effective methods for green hydrogen production, including electrolysis technologies and integration with renewable energy sources.

- Desalination Technology Advancement: Significant resources are directed towards improving the energy efficiency and reducing the environmental impact of desalination plants, a critical area for water-scarce regions.

- Renewable Energy Efficiency Gains: Continuous R&D efforts are made to boost the performance and reliability of solar (PV and CSP) and wind power assets.

- Strategic Cost for Competitiveness: R&D is viewed as a vital long-term investment, underpinning ACWA Power's ability to offer competitive energy solutions and secure future projects.

Corporate and Administrative Overheads

Corporate and administrative overheads form a crucial part of ACWA Power's cost structure, encompassing essential functions like general management, legal services, human resources, and marketing. These costs, while not directly linked to specific project execution, are vital for maintaining the company's global operations and driving its strategic vision forward.

These overarching expenses are fundamental to supporting a multinational enterprise like ACWA Power. They ensure the company can effectively manage its diverse portfolio, navigate complex regulatory environments, attract and retain talent, and build its brand presence across various markets.

- General Management: Costs associated with executive leadership and overall organizational planning.

- Legal & Compliance: Expenses related to legal counsel, contract management, and regulatory adherence.

- Human Resources: Investment in employee recruitment, training, compensation, and benefits.

- Marketing & Communications: Outlays for brand promotion, public relations, and stakeholder engagement.

For instance, in 2023, ACWA Power reported consolidated administrative expenses of SAR 540 million, underscoring the significant investment required to manage its extensive global operations and development pipeline.

ACWA Power's cost structure is fundamentally shaped by its capital-intensive projects, operational expenses, financing costs, and investments in innovation.

The significant upfront investment in constructing power and water facilities, coupled with ongoing operational and maintenance needs, forms the bedrock of its expenditures. Financing costs, particularly interest on debt, also play a substantial role, as seen in the SAR 2.07 billion financing costs reported in 2023.

Furthermore, strategic R&D for technological advancement and corporate administrative overheads are crucial components. In 2023, administrative expenses alone reached SAR 540 million, illustrating the investment in managing its global operations.

| Cost Category | Key Components | 2023 Impact (SAR) |

| Capital Expenditure | Project Development & Construction | Billions (Project Specific) |

| Operational & Maintenance (O&M) | Fuel, Chemicals, Spare Parts, Staffing | Ongoing, Directly impacts profitability |

| Financing Costs | Interest on Debt | 2.07 Billion (2023) |

| Research & Development (R&D) | New Technologies, Green Hydrogen, Desalination | Ongoing investment for efficiency & innovation |

| Corporate & Administrative | Management, Legal, HR, Marketing | 540 Million (2023) |

Revenue Streams

ACWA Power's core revenue generation hinges on long-term Power Purchase Agreements (PPAs) signed with government utilities and other major electricity buyers. These agreements are the bedrock of their financial model, ensuring consistent income by selling electricity at pre-determined, often indexed, prices for extended periods, typically 20-25 years.

For instance, ACWA Power's significant presence in Saudi Arabia, a key market, is largely driven by these PPAs. In 2024, the company continued to secure and operate under such contracts, which provide the predictable cash flows essential for financing its large-scale renewable energy projects.

Water Purchase Agreements (WPAs) are a primary revenue driver for ACWA Power's water segment, mirroring the structure of Power Purchase Agreements (PPAs) in their energy business. These agreements involve selling desalinated water to government utilities or large industrial customers.

These long-term contracts, often spanning 20-30 years, provide ACWA Power with predictable revenue streams by guaranteeing a buyer for the water produced. For instance, ACWA Power's Shuqaiq 3 Desalination Plant in Saudi Arabia, with a capacity of 450,000 cubic meters per day, operates under a WPA with the Saline Water Conversion Corporation (SWCC).

ACWA Power generates revenue by leveraging its extensive experience in developing and managing the construction of new energy projects. These fees are earned during the crucial early stages of a project, even before it starts producing power and generating operational revenue.

For instance, in 2023, ACWA Power's development and construction management activities contributed to its overall financial performance, underscoring the importance of this revenue stream. This expertise allows them to secure and execute complex projects, thereby diversifying their income beyond just power generation.

Capital Recycling and Divestments

ACWA Power actively optimizes its financial structure by divesting equity stakes in completed and operational projects. This allows the company to free up capital, which is then strategically redeployed into new development ventures and growth initiatives. For instance, in 2023, ACWA Power continued its focus on capital recycling, a key component of its financial strategy to fuel further expansion.

The company's approach involves not only selling down ownership in existing assets but also refinancing project debt. These financial maneuvers enhance overall returns on investment and provide the necessary liquidity to pursue a robust pipeline of new projects. This continuous cycle of reinvestment is fundamental to ACWA Power's business model, ensuring sustained portfolio growth and market leadership.

- Capital Recycling: ACWA Power's strategy involves selling stakes in mature projects to generate cash.

- Reinvestment: This recycled capital is then used to fund new, high-growth development opportunities.

- Financial Optimization: Project refinancing also plays a role in improving financial efficiency and returns.

- Portfolio Expansion: This approach supports the continuous growth and diversification of ACWA Power's asset base.

Green Hydrogen Sales

ACWA Power is positioning itself as a pioneer in the burgeoning green hydrogen market, anticipating substantial future revenue from its production and sale. This strategic move aligns with the global push for decarbonization, tapping into a significant long-term growth avenue.

While the green hydrogen segment is still in its nascent stages for ACWA Power, it represents a critical component of their future business model. The company's early investments and project development in this area are designed to capture a leading market position as demand for clean energy solutions escalates.

- First Mover Advantage: ACWA Power aims to leverage its early entry into green hydrogen production to establish market leadership and secure long-term offtake agreements.

- Decarbonization Alignment: Revenue from green hydrogen sales directly supports global efforts to reduce carbon emissions, creating a socially responsible and commercially viable income stream.

- Projected Growth: The International Energy Agency (IEA) projects significant growth in the hydrogen economy, with green hydrogen expected to play a crucial role in sectors like industry and transportation, indicating a strong future market for ACWA Power's output.

ACWA Power's revenue streams are diversified, primarily driven by long-term Power Purchase Agreements (PPAs) and Water Purchase Agreements (WPAs) for its energy and water projects, respectively. These contracts provide stable, predictable income. The company also earns fees from developing and managing project construction and benefits from capital recycling through the sale of stakes in operational assets, which fuels further investment. Emerging revenue from green hydrogen production is a key future growth area.

| Revenue Stream | Description | Key Characteristics | 2024 Relevance |

|---|---|---|---|

| Power Purchase Agreements (PPAs) | Selling electricity generated from renewable and thermal power plants. | Long-term contracts (20-25 years), fixed or indexed prices, government off-takers. | Core revenue driver for operational assets like the Mohammed bin Rashid Al Maktoum Solar Park. |

| Water Purchase Agreements (WPAs) | Selling desalinated water to utilities and industrial clients. | Long-term contracts (20-30 years), guaranteed off-take, stable revenue. | Significant for desalination plants such as the one in Shuaibah, Saudi Arabia. |

| Development & Construction Management Fees | Earning fees for expertise in project development and construction. | Pre-operational revenue, leverages technical and project management capabilities. | Contributes to financial performance during project execution phases. |

| Capital Recycling | Divesting equity stakes in operational projects. | Frees up capital for new investments, enhances returns on equity. | Ongoing strategy to fund new developments and maintain financial flexibility. |

| Green Hydrogen Sales | Producing and selling green hydrogen. | Nascent but high-growth potential, aligns with decarbonization trends. | Future revenue stream from projects like the NEOM green hydrogen facility. |

Business Model Canvas Data Sources

The ACWA Power Business Model Canvas is built using a blend of financial reports, market intelligence on renewable energy trends, and internal strategic planning documents. These sources provide a comprehensive view of the company's operations and market positioning.