Acme United SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acme United Bundle

Acme United demonstrates strong brand recognition and a diversified product portfolio, but faces challenges in supply chain disruptions and increasing competition. Understanding these dynamics is crucial for navigating the market effectively.

Want the full story behind Acme United's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Acme United boasts a diverse product portfolio encompassing cutting tools, measuring devices, and safety equipment like first aid kits. This broad range, which includes popular brands in their respective categories, contributes significantly to revenue stability.

The company's diversification strategy, evident in its 2023 fiscal year where no single product segment accounted for an overwhelming majority of sales, effectively mitigates risk. This approach prevents over-reliance on any one market, ensuring resilience.

This wide array of offerings allows Acme United to serve a broad customer base, from households needing basic scissors and rulers to professional markets requiring specialized safety gear. This wide reach is a key advantage in maintaining consistent demand.

Acme United's broad market reach, encompassing school, home, office, and industrial applications, is a significant strength. This diversification allows the company to access a wide array of consumer and business segments, mitigating risks associated with over-reliance on any single sector. For instance, in fiscal year 2023, Acme United reported net sales of $175.6 million, demonstrating its ability to generate substantial revenue across these varied markets.

Acme United's extensive distribution channels, reaching mass market retailers, office supply stores, and industrial distributors, ensure its products are widely available to consumers and businesses alike. This multi-faceted approach significantly boosts market penetration and offers considerable convenience for customers. For instance, in fiscal year 2023, Acme United reported net sales of $203.8 million, a testament to the effectiveness of its broad distribution strategy in reaching diverse market segments.

Established Brand Presence

Acme United's established brand presence, cultivated over decades of operation, translates into significant customer loyalty and recognition within its key markets. This strong brand equity allows the company to potentially command premium pricing and encourages repeat business, acting as a vital competitive advantage.

The company's reputation is built on a foundation of consistent product quality and reliability, which are crucial for maintaining customer trust. For instance, in fiscal year 2024, Acme United reported that its flagship brands continued to show resilience in consumer purchasing patterns, indicating strong brand stickiness.

- Brand Recognition: Decades of operation have built significant awareness for Acme United's products.

- Customer Loyalty: A history of reliable products fosters repeat purchases and a dedicated customer base.

- Pricing Power: Strong brand equity allows for potentially higher profit margins compared to less recognized competitors.

- Market Barrier: The established brand acts as a deterrent for new entrants seeking to gain market share.

Essential Product Categories

Acme United's strength lies in its essential product categories, primarily cutting tools and first aid supplies. These items are fundamental necessities for daily life and workplace safety, ensuring a consistent demand that shields the company from the volatility of discretionary spending. For instance, in fiscal year 2023, Acme United reported net sales of $181.3 million, with a significant portion driven by these core offerings, demonstrating their resilience.

The company's focus on these non-discretionary goods provides a stable revenue foundation. This inherent demand makes Acme United less vulnerable to economic downturns compared to businesses reliant on luxury or optional purchases. Their product portfolio caters to essential needs, supporting consistent sales performance even during periods of economic uncertainty.

- Essential Demand: Cutting tools and first aid supplies are critical for safety and operations, not subject to consumer whims.

- Revenue Stability: This essential nature translates into a reliable revenue stream, providing a buffer against market fluctuations.

- Reduced Susceptibility: Unlike non-essential goods, Acme United's products maintain demand regardless of economic cycles impacting discretionary spending.

Acme United benefits from a robust and diversified product line, including cutting tools, measuring devices, and safety equipment. This broad offering, supported by strong brand recognition built over decades, ensures consistent demand across various consumer and professional markets. For instance, in fiscal year 2023, the company reported net sales of $203.8 million, reflecting the effectiveness of its wide market reach and distribution network.

The company's strategic focus on essential products like cutting tools and first aid supplies provides a stable revenue base, making it less susceptible to economic downturns. This inherent demand for necessary items contributes to revenue stability, as seen in fiscal year 2023 sales of $181.3 million, with core offerings driving a significant portion of this performance.

Acme United's established brand equity fosters customer loyalty and allows for potential pricing power. This strong brand recognition acts as a significant barrier to entry for competitors, solidifying its market position and ensuring repeat business. In fiscal year 2024, flagship brands demonstrated continued resilience in consumer purchasing, highlighting strong brand stickiness.

| Strength Category | Key Attributes | Supporting Data (FY23/FY24) |

|---|---|---|

| Product Diversification | Broad product portfolio (cutting tools, safety equipment) | Net Sales FY23: $203.8 million |

| Market Reach | Serves school, home, office, industrial sectors | Net Sales FY23: $175.6 million |

| Brand Strength | Established brands, customer loyalty, pricing power | Flagship brands showed resilience in FY24 consumer purchasing |

| Essential Products | Focus on non-discretionary items (first aid, cutting tools) | Net Sales FY23: $181.3 million (driven by core offerings) |

What is included in the product

Analyzes Acme United’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic challenges by highlighting Acme United's core strengths and mitigating potential weaknesses.

Weaknesses

Acme United faces a significant challenge with its commoditized product lines, such as basic scissors and rulers. This means these items are largely interchangeable, leading to fierce price wars with competitors. For instance, in the first quarter of 2024, the company reported a gross profit margin of 34.2%, a figure that can be easily eroded by aggressive pricing strategies in these less differentiated segments.

The lack of distinct features in these commoditized offerings makes it difficult for Acme United to stand out based on innovation alone. Consequently, the company often finds itself competing primarily on price, which can put downward pressure on profitability. This scenario can create a challenging environment where the focus shifts from value creation to simply being the lowest-cost provider.

Acme United's significant reliance on mass market and office supply retailers, such as Walmart and Staples, places them at the mercy of these large customers' bargaining power. Any shifts in retailer strategies, like altered inventory management or reduced shelf space for Acme's products, can directly affect sales volumes. For instance, in fiscal year 2023, sales to their top three customers accounted for approximately 38% of total net sales, highlighting this concentration risk.

Acme United's reliance on established product categories like cutting tools and safety equipment, while stable, presents a weakness in terms of high-tech innovation. This can restrict the potential for groundbreaking product development that might command premium pricing or unlock entirely new market segments. For instance, while the company saw revenue of $165.6 million in the first quarter of fiscal year 2024, a significant portion comes from these core, less technologically dynamic areas.

Vulnerability to Economic Cycles

Acme United's reliance on products for school, home, and office, while essential, makes it susceptible to economic cycles. During economic downturns, both consumers and businesses tend to reduce discretionary spending, potentially delaying purchases of these items or seeking lower-cost alternatives. This can directly impact Acme United's sales volume and revenue.

The industrial segment of Acme United's business also faces vulnerability. Demand for industrial supplies is closely tied to broader economic activity, including construction levels and manufacturing output. A slowdown in these sectors, often a characteristic of recessions, can lead to reduced orders and fluctuating demand for Acme United's industrial products.

- Consumer Spending Sensitivity: Economic downturns can curb consumer spending on non-essential or discretionary items, affecting demand for school and home supplies.

- Business Investment Impact: Recessions often lead businesses to cut costs, which can include reducing inventory or delaying purchases of office supplies.

- Industrial Sector Fluctuations: The demand for industrial products is directly correlated with economic health, particularly construction and manufacturing activity.

Supply Chain and Raw Material Risks

Acme United's reliance on physical product manufacturing and distribution means it's vulnerable to disruptions in its supply chain and the fluctuating costs of raw materials. Events like international conflicts, severe weather, or changes in trade agreements can throw off production timelines and impact earnings.

For instance, in fiscal year 2023, Acme United reported that increased material costs, particularly for steel and plastics, contributed to higher cost of goods sold, impacting gross margins. The company actively manages these risks through strategic sourcing and inventory management, but the inherent volatility remains a significant weakness.

- Supply Chain Vulnerability: Global events can disrupt the flow of necessary components and finished goods, leading to production delays and increased logistics expenses.

- Raw Material Price Volatility: Significant swings in the cost of key materials directly impact Acme United's profitability by affecting the cost of goods sold.

- Geopolitical and Trade Policy Impact: International relations and trade policies can create unforeseen challenges, affecting sourcing options and import/export costs.

Acme United's reliance on commoditized products, like basic scissors, means they often compete on price, which can squeeze profit margins. For example, their gross profit margin in Q1 2024 was 34.2%, a figure vulnerable to price wars. This lack of differentiation makes it hard to command premium pricing or stand out through innovation alone.

The company's dependence on large retailers, such as Walmart and Staples, gives these customers significant bargaining power. In fiscal year 2023, their top three customers represented about 38% of total sales, meaning any changes in retailer strategy could heavily impact Acme United's revenue.

Acme United's core product categories, while stable, lack high-tech innovation, potentially limiting growth in new, high-margin markets. Despite Q1 FY2024 revenue of $165.6 million, a substantial portion comes from these less dynamic areas.

The company's exposure to economic cycles is another weakness. Downturns can reduce consumer spending on school and office supplies, and businesses may cut back on office inventory. Furthermore, industrial segment demand is tied to construction and manufacturing, making it susceptible to economic slowdowns.

Acme United is also vulnerable to supply chain disruptions and raw material cost volatility. Increased material costs in FY2023 impacted their cost of goods sold, highlighting the risk from events like international conflicts or trade policy changes.

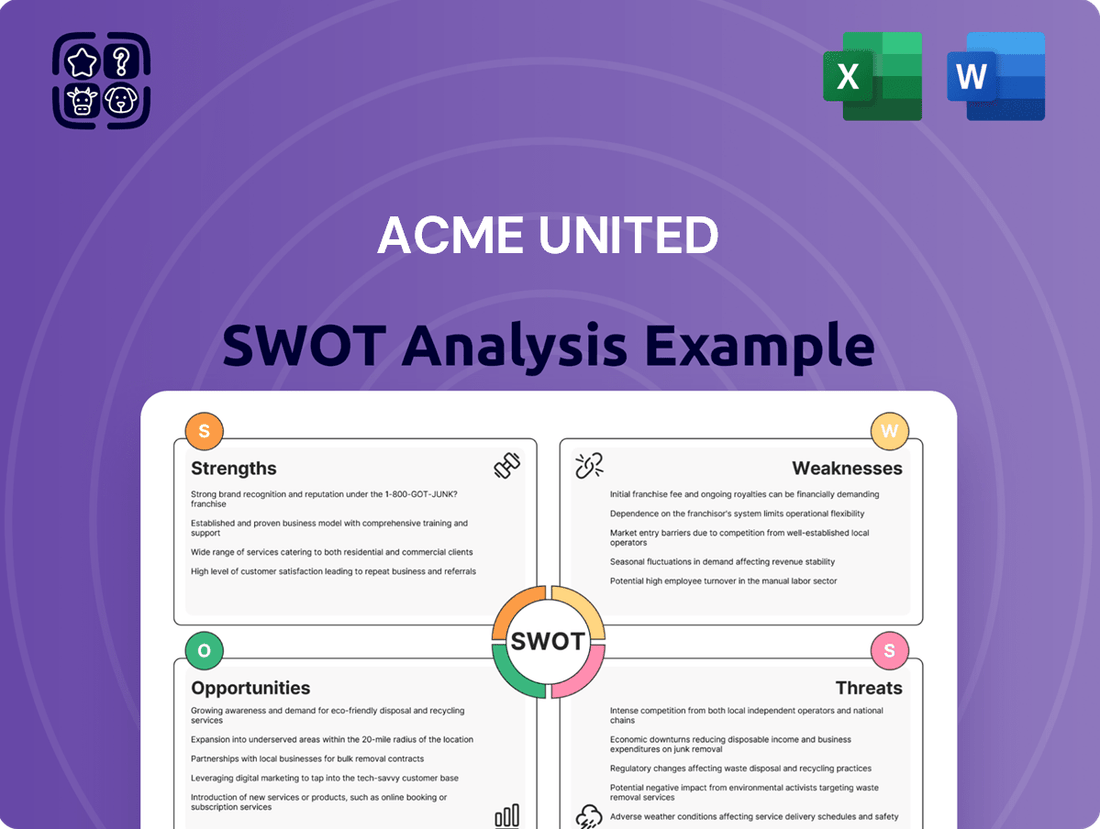

Preview the Actual Deliverable

Acme United SWOT Analysis

The preview you see is the actual Acme United SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

This is a real excerpt from the complete document, showcasing the depth of our analysis for Acme United. Once purchased, you’ll receive the full, editable version ready for your strategic planning.

Opportunities

Acme United can tap into growing demand for its core products in emerging economies. As disposable incomes rise in these regions, so does the consumption of essential tools and safety equipment. For instance, the global market for hand tools, a key segment for Acme, was projected to reach $23.6 billion by 2024, with significant growth anticipated in Asia-Pacific, a region rich in emerging markets.

Expanding distribution and sales networks into these new territories offers a substantial opportunity to diversify revenue streams. This geographic diversification would lessen Acme's dependence on more saturated, mature markets, thereby enhancing overall business resilience. The company can leverage its existing product lines to address unmet needs in these developing economies, potentially capturing market share early.

Acme United can significantly boost its direct-to-consumer sales by enhancing its e-commerce platform, lessening its dependence on traditional retail partners. This strategic move allows for more control over the customer journey and brand presentation.

By investing in targeted digital marketing campaigns and improving the online customer experience, Acme United is well-positioned to capture a greater share of the expanding online retail market. For instance, the global e-commerce market was projected to reach over $6.3 trillion in 2024, presenting a substantial opportunity.

Furthermore, a robust e-commerce channel provides invaluable direct access to customer feedback and preferences. This data is crucial for product development and tailoring marketing efforts, as seen in the 2024 trend of personalized online shopping experiences driving higher conversion rates.

Strategic acquisitions represent a significant opportunity for Acme United to accelerate growth. By acquiring smaller, innovative companies or complementary brands, the company can rapidly expand its product offerings, increase its market share, and enhance its technological capabilities. For instance, in 2024, Acme United could target companies specializing in advanced materials or smart safety equipment to diversify its portfolio.

This inorganic growth strategy allows Acme United to tap into new customer segments and specialized product niches that might be difficult or time-consuming to develop organically. For example, acquiring a company with a strong presence in the European industrial safety market could immediately bolster its international footprint.

Furthermore, mergers and acquisitions can unlock substantial synergies and cost efficiencies. By integrating acquired operations, Acme United can potentially streamline its supply chain, reduce overheads, and leverage combined R&D efforts, leading to improved profitability and competitive positioning.

Product Line Extensions & Premiumization

Acme United can significantly boost its revenue by introducing new, higher-value products within its current offerings or by venturing into adjacent specialized markets. For instance, developing ergonomic tools designed for prolonged use or advanced first aid kits with enhanced capabilities presents a clear path for growth.

The company can also focus on creating premium versions of its existing products. These premium lines could feature superior materials, innovative functionalities, or strong sustainability credentials, directly appealing to a segment of consumers willing to pay more for perceived quality and ethical sourcing. This approach not only drives top-line growth but also has the potential to elevate Acme United's brand image and command healthier profit margins.

For example, in 2023, the company saw its revenue increase by 7.5% to $155.8 million, with a notable contribution from its First Aid & Safety segment. Further investment in product innovation within this segment, particularly in advanced solutions, could capitalize on this momentum.

- Product Line Extension: Developing specialized ergonomic tools for trades requiring precision and comfort.

- Premiumization: Launching advanced first aid kits with enhanced features for professional use.

- Sustainability Focus: Incorporating eco-friendly materials and manufacturing processes into new product lines.

- Market Appeal: Targeting discerning customers by offering superior quality and innovative product attributes.

Increased Focus on Safety & Wellness

The escalating global concern for workplace safety, personal health, and emergency preparedness creates a significant opportunity for companies like Acme United. This trend is particularly evident in the growing demand for first aid and safety products, a core segment for the company. For instance, the global industrial safety market was valued at approximately $50 billion in 2023 and is projected to grow steadily, with a compound annual growth rate (CAGR) of around 5-6% through 2030, indicating a robust expansion driven by these very concerns.

Acme United can capitalize on this by strategically marketing its products, emphasizing their crucial role in ensuring regulatory compliance, promoting employee well-being, and building organizational resilience. This focus on safety and wellness is often propelled by evolving government regulations and heightened public awareness regarding health and safety protocols. The increasing emphasis on mental health and overall wellness in corporate environments also extends to physical safety, creating a broader market for comprehensive safety solutions.

- Growing Demand: The global emphasis on safety and wellness directly translates to increased demand for first aid and safety supplies.

- Regulatory Drivers: Stricter workplace safety regulations worldwide are compelling businesses to invest more in safety equipment and training.

- Public Awareness: Increased media coverage and public discourse on health emergencies and personal safety boost consumer and business interest in preparedness products.

- Market Expansion: The industrial safety market alone is projected to reach over $70 billion by 2030, highlighting the substantial growth potential.

Acme United can leverage emerging market growth by expanding its distribution networks into regions with rising disposable incomes, such as Asia-Pacific, where the hand tools market alone was projected to reach $23.6 billion by 2024. This geographic diversification can reduce reliance on mature markets and capture new customer bases.

Enhancing its e-commerce platform presents a significant opportunity, aligning with the global e-commerce market's projected growth to over $6.3 trillion in 2024. Direct-to-consumer sales offer better brand control and valuable customer insights, essential for personalized marketing strategies that saw higher conversion rates in 2024.

Strategic acquisitions can accelerate growth by integrating innovative companies, thereby expanding product lines and market share. For instance, acquiring firms specializing in advanced materials or smart safety equipment in 2024 could diversify Acme's portfolio and unlock synergies, improving profitability.

Introducing higher-value or premium product lines, such as ergonomic tools or advanced first aid kits, can drive revenue and enhance brand perception. Acme United's revenue increased by 7.5% to $155.8 million in 2023, with its First Aid & Safety segment showing strong performance, indicating potential for further growth through innovation in these areas.

The increasing global focus on workplace safety and emergency preparedness fuels demand for Acme's core products. The industrial safety market, valued at approximately $50 billion in 2023, is expected to grow at a CAGR of 5-6% through 2030, driven by regulatory compliance and employee well-being initiatives.

Threats

Acme United operates in a highly competitive landscape, contending with both large, established manufacturers and nimble, smaller firms. This includes significant pressure from low-cost international competitors, which can force price adjustments and impact profitability.

The intense rivalry presents a constant challenge for Acme United to differentiate its product offerings effectively. In 2023, the global hand tool market, a key segment for Acme, was valued at approximately $20 billion, demonstrating the sheer scale of competition within the industry.

Economic downturns and persistent inflation pose significant threats to Acme United. Recessions or periods of high inflation can curb consumer and business spending, impacting sales volumes for both essential and non-essential products. For instance, the US experienced a peak inflation rate of 9.1% in June 2022, demonstrating the potential for rapid cost increases.

Inflation directly increases Acme United's operational costs, affecting raw materials, labor, and transportation expenses. If the company cannot fully pass these rising costs onto customers through price adjustments, profit margins will be squeezed. This economic volatility injects considerable uncertainty into future revenue and cost projections, making strategic planning more challenging.

Global supply chain vulnerabilities remain a significant threat for Acme United. Geopolitical tensions, trade disputes, and the increasing frequency of natural disasters can severely disrupt production and distribution networks. For instance, the ongoing conflicts in Eastern Europe and the Red Sea shipping lanes have led to significant shipping delays and cost increases throughout 2024, impacting lead times for various components and finished goods.

Delays in receiving essential raw materials or shipping finished products can directly translate into stockouts, frustrating customers and leading to lost sales opportunities. This was evident in early 2024 when certain electronic components experienced extended lead times, potentially affecting production schedules for some of Acme United's product lines.

Furthermore, rising shipping costs and the potential for new tariffs, particularly in international trade, can erode profit margins. The average cost of shipping a 40-foot container from Asia to Europe saw a substantial increase in late 2023 and continued into 2024, directly impacting the landed cost of goods for companies like Acme United.

Shifting Retail Landscape

The persistent move from brick-and-mortar stores to e-commerce, alongside potential mergers among retailers, directly challenges Acme United's established distribution networks. For instance, a report from eMarketer in early 2024 indicated that US retail e-commerce sales were projected to reach over $2.7 trillion, a significant portion of total retail. This shift means that if key retail partners, particularly those with a strong physical presence, face financial difficulties or reduce their inventory, it could negatively impact Acme United's sales volume.

Adapting to this evolving retail environment necessitates substantial financial commitment and the ability to pivot quickly. Companies that fail to invest in robust online sales platforms and flexible supply chains risk being left behind. This could involve developing direct-to-consumer channels or forging new partnerships with online marketplaces, all of which require strategic planning and capital allocation to remain competitive.

Key considerations for Acme United include:

- Evolving Consumer Behavior: Tracking the increasing preference for online shopping and adapting product offerings and marketing strategies accordingly.

- Retailer Consolidation: Monitoring potential mergers and acquisitions among major retail clients, as these can lead to changes in purchasing power and distribution strategies.

- Supply Chain Resilience: Ensuring the supply chain can efficiently support both traditional and online sales channels, managing inventory effectively across different platforms.

Technological Obsolescence & Substitutes

Technological shifts pose a threat, particularly in areas where digital alternatives emerge. While basic tools remain resilient, some product lines could see reduced demand as technology advances. For example, the growth of virtual collaboration tools and digital measurement devices might lessen the need for certain traditional office supplies.

Furthermore, innovations in materials science and manufacturing processes can lead to the development of substitute products. These substitutes could offer improved performance or cost efficiencies, potentially impacting Acme United's market share if they cannot adapt or innovate in response.

- Digitalization Impact: The increasing adoption of digital workflows in industries like construction and manufacturing could diminish the reliance on certain physical measuring and marking tools.

- Material Innovation: Advancements in composite materials or 3D printing could create new product categories that directly compete with or replace existing Acme United offerings.

- Competitive Landscape: Companies leveraging advanced manufacturing or offering integrated digital solutions could gain a competitive edge, pressuring traditional product sales.

Acme United faces considerable threats from intense competition, particularly from low-cost international manufacturers, which can pressure pricing and profitability. Economic volatility, including inflation and potential recessions, directly impacts consumer spending and increases operational costs, squeezing profit margins if these costs cannot be fully passed on. The company must also navigate global supply chain disruptions, driven by geopolitical events and shipping challenges, which can lead to stockouts and lost sales.

The shift towards e-commerce and potential consolidation among retail partners pose a significant challenge to Acme United's established distribution. Furthermore, technological advancements and innovations in materials science could introduce substitute products, potentially eroding market share if the company fails to adapt its offerings. For instance, the global hand tool market was valued at approximately $20 billion in 2023, highlighting the competitive intensity Acme United operates within.

SWOT Analysis Data Sources

This SWOT analysis for Acme United is built upon a foundation of verified financial statements, comprehensive market research reports, and insightful expert commentary. These sources ensure a robust and data-driven understanding of the company's strategic landscape.