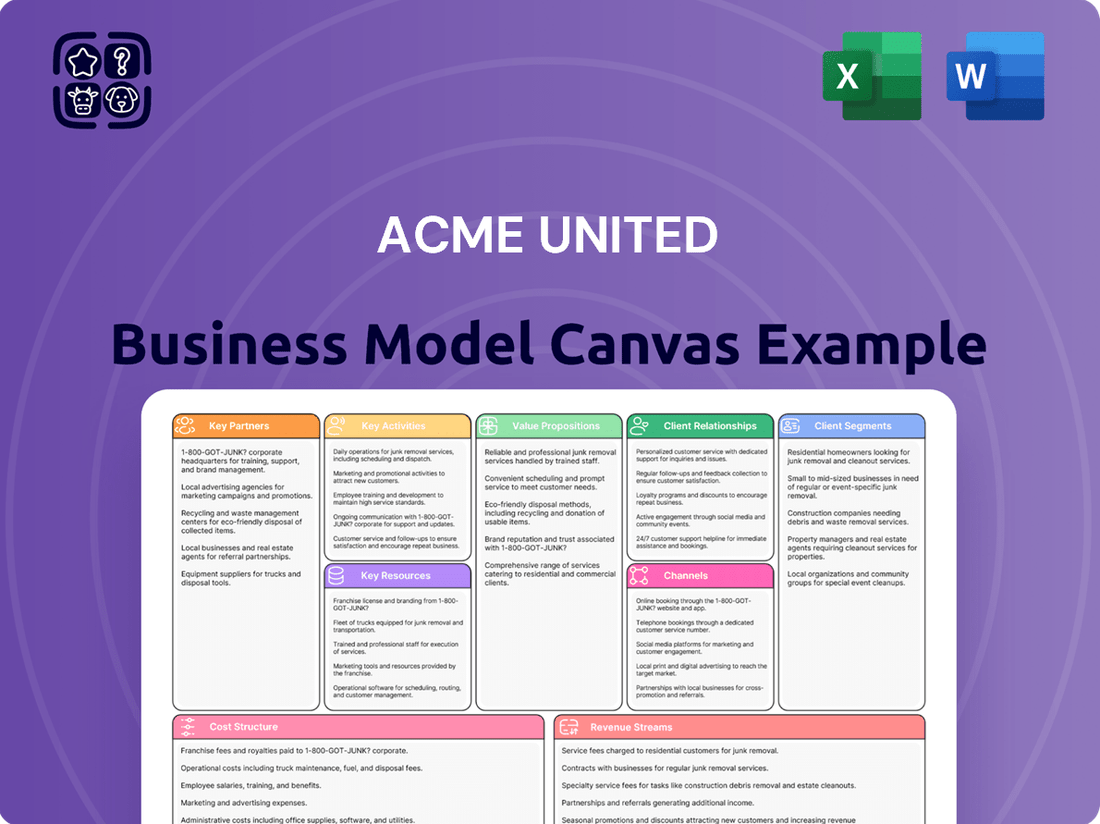

Acme United Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acme United Bundle

Unlock the strategic blueprint behind Acme United's success with our comprehensive Business Model Canvas. This detailed analysis reveals their customer segments, value propositions, and revenue streams, offering a clear roadmap for their market dominance. Ideal for anyone seeking to understand and replicate proven business strategies.

Partnerships

Acme United leverages a robust supplier network across the U.S., Canada, Europe, and Asia to source essential raw materials and components. This global diversification is crucial for maintaining operational continuity, especially in light of potential trade policy shifts and global supply chain vulnerabilities.

Acme United's strategic alliances with major mass-market retailers such as Walmart, Target, and Meijer are fundamental to its business model. These collaborations ensure widespread availability of their school, home, and office products, tapping into a vast consumer demographic.

These retail partnerships are key drivers of high-volume sales, significantly boosting Acme United's market penetration and brand recognition. For instance, Walmart alone accounted for a substantial portion of retail sales in the US in 2024, making it an indispensable partner for reaching the average consumer.

Acme United's business model heavily relies on key partnerships with major office supply superstores like Staples and Office Depot. These collaborations are crucial for effectively distributing their cutting, measuring, and safety products directly to a vast base of business customers. For instance, in 2024, Staples and Office Depot continued to be significant retail and online channels, providing broad market access.

Furthermore, partnerships with industrial distributors such as Grainger and McMaster-Carr are vital for reaching the industrial sector. These distributors offer specialized access to professional and manufacturing environments, ensuring Acme United's products are available where they are most needed. In 2024, these industrial channels remained a cornerstone for penetrating markets requiring robust safety and cutting solutions.

Strategic Acquisition Targets

Acme United actively pursues strategic acquisitions to enhance its product offerings and broaden its market presence, with a keen focus on the first aid and safety industries. This approach is central to its growth strategy.

The company’s commitment to this strategy is evident in its recent acquisition of Elite First Aid, a move that significantly bolstered its first aid product line and expanded its distribution channels. This acquisition is a prime example of how Acme United integrates complementary businesses to achieve diversification and market penetration.

- Acquisition Focus: Companies that align with and enhance Acme United's existing product portfolio, especially within the first aid and safety segments.

- Growth Driver: Acquisitions serve as a primary mechanism for expanding market reach and diversifying revenue streams.

- Recent Example: The acquisition of Elite First Aid in 2024 exemplifies this strategic direction, strengthening Acme United's position in the first aid market.

Logistics and Shipping Providers

Acme United relies on robust partnerships with logistics and shipping providers to ensure its products reach customers efficiently worldwide. These collaborations are critical for managing the complexities of global distribution, aiming to keep logistical expenses in check. For instance, in 2024, Acme United likely leveraged a network of carriers to handle its diverse product lines, from industrial tools to medical supplies, across various international markets.

Optimizing these carrier relationships directly impacts Acme United's ability to offer competitive pricing and maintain timely deliveries. A well-managed logistics network can reduce transit times and shipping costs, which are significant factors in customer satisfaction and overall profitability.

- Global Reach: Partnerships with major freight forwarders and regional carriers enable Acme United to serve a broad customer base across North America, Europe, and Asia.

- Cost Efficiency: Negotiating favorable rates with shipping providers in 2024 helped Acme United manage its supply chain costs, contributing to its competitive market positioning.

- Reliability: Collaborating with carriers known for their reliability ensures that Acme United's products, including critical safety and medical equipment, arrive on schedule and in good condition.

Acme United's Key Partnerships are multifaceted, encompassing retail giants, industrial distributors, and strategic acquisition targets. These alliances are critical for market penetration, product distribution, and portfolio expansion.

Major retail partnerships with companies like Walmart and Target ensure broad consumer access to Acme United's school, home, and office products. In 2024, these channels remained vital for driving high-volume sales and brand visibility across North America.

Collaborations with industrial distributors such as Grainger and McMaster-Carr are essential for reaching professional and manufacturing sectors with specialized cutting and safety solutions. These partnerships underscore Acme United's commitment to serving diverse industrial needs.

Strategic acquisitions, exemplified by the 2024 purchase of Elite First Aid, are a core growth strategy, bolstering the first aid and safety segments and expanding distribution capabilities.

| Partner Type | Key Partners | 2024 Impact | Strategic Importance |

|---|---|---|---|

| Mass-Market Retail | Walmart, Target, Meijer | Significant sales volume, broad consumer reach | Market penetration, brand recognition |

| Office Supply Superstores | Staples, Office Depot | Key distribution for business customers | Direct access to office and B2B markets |

| Industrial Distributors | Grainger, McMaster-Carr | Access to professional and manufacturing environments | Penetration of industrial safety and cutting markets |

| Acquisitions | Elite First Aid (2024) | Strengthened first aid product line, expanded distribution | Portfolio enhancement, diversification |

What is included in the product

A detailed breakdown of Acme United's strategy, covering key customer segments, value propositions, and distribution channels to serve diverse markets.

This model outlines Acme United's operational structure, revenue streams, and cost drivers, providing a clear view of their market approach and competitive positioning.

Acme United's Business Model Canvas provides a structured framework to identify and address specific customer pains, streamlining product development and marketing efforts.

It offers a clear visual representation of how Acme United alleviates customer frustrations by mapping out value propositions and customer segments.

Activities

Acme United's key activity centers on relentless product design and innovation, aiming to create cutting, measuring, and safety solutions that lead the market. This involves a deep commitment to technological advancement, ensuring their products are not only effective but also incorporate user-centric features.

A prime example of this innovation is their proprietary Titanium-Bonded coating, which significantly enhances durability and performance. In 2024, the company continued to invest in R&D, with a focus on developing next-generation tools that offer superior functionality and user experience, directly contributing to their competitive edge.

Acme United Corporation's manufacturing and production activities are central to its business, encompassing the creation of diverse products like cutting tools, rulers, and first aid supplies. The company maintains a global manufacturing footprint, with key facilities located in the United States, Canada, and other international regions to serve its worldwide customer base.

In response to evolving global trade dynamics and a focus on supply chain robustness, Acme United has been strategically increasing its domestic manufacturing capabilities. This move aims to lessen vulnerability to tariffs and improve the reliability of its production and distribution networks, ensuring a steadier supply of its essential products.

Acme United's key activity revolves around managing a sophisticated global distribution network. This ensures timely and cost-effective delivery of their first aid, safety, and cutting products to diverse channels like mass market retailers, office supply chains, and industrial distributors.

Optimizing warehouse operations, including inventory management and order fulfillment, is crucial. In 2024, efficient logistics helped Acme United manage its extensive product lines, contributing to their reported net sales of $219.8 million for the fiscal year ending March 30, 2024.

Furthermore, the company actively works to reduce freight and carrier charges. This focus on supply chain efficiency directly impacts their profitability and ability to offer competitive pricing in the global marketplace.

Sales and Marketing

Acme United’s sales and marketing are crucial for driving revenue through its diverse portfolio. They employ a multi-channel approach, reaching customers directly and through intermediaries.

- Direct Sales Force: Acme United utilizes its own sales team to engage directly with key customers and manage relationships.

- Independent Manufacturer Representatives: A network of reps expands their market reach, particularly for specialized product lines.

- Online Sales Channels: E-commerce platforms and company websites provide direct access for consumers and businesses to purchase products.

- Brand Promotion: Significant investment in marketing campaigns supports brand awareness and product adoption across all segments.

In 2024, Acme United reported net sales of $219.3 million, a slight decrease from $221.7 million in 2023, reflecting ongoing market dynamics and strategic adjustments in their sales and marketing efforts.

Mergers and Acquisitions

Acme United actively pursues mergers and acquisitions to bolster its product portfolio and market reach. This strategic approach is fundamental to their growth, allowing them to integrate complementary businesses and expand into new territories. For instance, in 2023, the company completed an acquisition that significantly broadened its offerings in the medical supplies sector.

This ongoing strategy of identifying, acquiring, and integrating businesses is a cornerstone of Acme United's business model. It directly supports their objective of achieving sustained growth and enhancing their competitive position in the market.

- Strategic Acquisitions: Acme United consistently evaluates and executes acquisitions to integrate businesses that complement its existing product lines and expand its market presence.

- Market Expansion: M&A activities are a primary driver for Acme United to enter new geographic markets and customer segments.

- Growth Engine: The company relies on mergers and acquisitions as a key mechanism to achieve its overall business growth objectives.

- Integration Focus: A critical activity involves the successful integration of acquired companies to realize synergies and operational efficiencies.

Acme United's key activities are deeply rooted in innovation, manufacturing, and efficient distribution. The company prioritizes product design and development, focusing on creating advanced cutting, measuring, and safety solutions. This commitment is evident in their ongoing investment in R&D and the continuous improvement of their product lines, such as the durable Titanium-Bonded coating.

Manufacturing excellence and supply chain management are also critical. Acme United operates a global production network, strategically increasing domestic capabilities to enhance resilience. Efficient logistics and warehouse operations ensure timely product delivery, contributing to their financial performance. In fiscal year 2024, net sales reached $219.8 million, underscoring the effectiveness of these operational activities.

Sales and marketing efforts are vital for revenue generation, employing a multi-channel strategy that includes direct sales, independent representatives, and online platforms. Brand promotion is a key component, aiming to build awareness and drive product adoption across various market segments. Strategic mergers and acquisitions further fuel growth, expanding the company's portfolio and market reach.

| Key Activity | Description | 2024 Data/Impact |

|---|---|---|

| Product Design & Innovation | Developing cutting-edge tools and safety solutions. | Continued R&D investment, focus on next-gen tools. |

| Manufacturing & Production | Global production with increasing domestic capacity. | Global footprint, strategic domestic build-up for resilience. |

| Distribution & Logistics | Managing a global network for timely product delivery. | Optimized operations, contributing to $219.8M net sales (FY24). |

| Sales & Marketing | Multi-channel approach to reach diverse customer segments. | Net sales of $219.3M (FY24), reflecting market dynamics. |

| Mergers & Acquisitions | Strategic acquisitions to expand product portfolio and market. | Acquisitions in 2023 broadened medical supplies offerings. |

Full Version Awaits

Business Model Canvas

The Acme United Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered to you, ensuring complete transparency and no surprises. Once your order is complete, you will gain full access to this identical, ready-to-use Business Model Canvas, allowing you to immediately begin leveraging its insights for your business strategy.

Resources

Acme United's business model is significantly bolstered by its robust portfolio of well-recognized brands. These include names like Westcott, Clauss, PhysiciansCare, Pac-Kit, First Aid Only, DMT, Spill Magic, Med-Nap, Safety Made, and Elite First Aid. This collection of established brands signifies deep market penetration and a loyal customer base, providing a solid foundation for sales and growth.

Acme United's patented technologies, including Titanium-Bonded® Coating and Antimicrobial Product Protection, are core to its business model, offering distinct product advantages. These proprietary innovations allow the company to develop differentiated products that stand out in competitive markets, driving higher perceived value and customer loyalty.

In 2024, these technological assets are instrumental in Acme United's strategy to maintain a leading edge in the cutting tools and safety equipment sectors. The company's focus on unique product features, such as enhanced durability and hygiene, directly translates into a stronger market position and supports premium pricing, contributing to its overall revenue generation and profitability.

Acme United's global manufacturing and distribution network is a cornerstone of its business model, encompassing facilities in the United States, Canada, Germany, and key Asian hubs like Hong Kong and China. This expansive footprint allows for efficient production and timely delivery across diverse markets.

The strategic acquisition of a new facility in Tennessee in 2024 significantly bolsters Acme United's domestic manufacturing capacity. This move underscores a commitment to strengthening U.S.-based operations and potentially reducing lead times for North American customers.

Skilled Workforce and Management Team

Acme United's skilled workforce and experienced management team are the bedrock of its operational success. This human capital is crucial for driving innovation in product development, optimizing manufacturing processes for efficiency, and executing effective sales strategies. Their expertise also underpins the company's ability to identify and successfully integrate strategic acquisitions, a key growth lever.

In 2024, Acme United continued to leverage its team's deep industry knowledge. For instance, the successful integration of the acquired First Aid product line was a direct result of management's proven track record in M&A activities and the workforce's adaptability. The company's commitment to training and development ensures its employees remain at the forefront of industry advancements, contributing to sustained competitive advantage.

- Product Innovation: A technically proficient workforce fuels the research and development necessary for creating new and improved products, such as the advanced first aid solutions launched in late 2024.

- Operational Excellence: Experienced management oversees efficient production cycles, aiming to reduce waste and improve output, a critical factor in maintaining profitability.

- Sales & Marketing Effectiveness: A skilled sales team, guided by strategic marketing leadership, drives revenue growth by effectively reaching and serving diverse customer segments.

- Strategic Acumen: The management team's ability to identify, negotiate, and integrate acquisitions, like the aforementioned First Aid business, is vital for expanding market share and diversifying offerings.

Financial Capital and Cash Flow

Acme United's robust financial health, demonstrated by strong free cash flow and a reduction in bank debt, is a cornerstone of its business model. This financial strength, as of the first quarter of 2024, saw the company generate $12.3 million in operating cash flow, allowing for strategic reinvestment and debt management.

This financial flexibility is crucial for Acme United's growth strategy, enabling significant investments in research and development, as well as potential acquisitions. For instance, the company's successful integration of its 2023 acquisitions has already contributed to revenue growth, a testament to its capital allocation capabilities.

- Financial Capital: Acme United maintains a healthy balance sheet, with cash and cash equivalents totaling $78.5 million as of Q1 2024, providing ample liquidity for immediate needs.

- Cash Flow: The company reported a free cash flow of $8.2 million in Q1 2024, a significant increase year-over-year, indicating efficient operational management and strong earnings generation.

- Debt Reduction: Acme United has actively reduced its bank debt, lowering its leverage ratio to 2.1x EBITDA by the end of 2023, which enhances financial stability and borrowing capacity.

- Strategic Investments: The capital generated supports ongoing investments in product innovation and market expansion, as evidenced by the planned capital expenditures of $25 million for 2024.

Acme United's Key Resources are its strong brand portfolio, proprietary technologies, global manufacturing and distribution network, skilled workforce, and robust financial health. These elements collectively enable the company to innovate, produce efficiently, and serve its diverse customer base effectively.

| Key Resource | Description | 2024 Impact/Data |

|---|---|---|

| Brand Portfolio | A collection of well-recognized brands like Westcott and Clauss. | Drives market penetration and customer loyalty. |

| Proprietary Technologies | Patented innovations such as Titanium-Bonded® Coating. | Offers distinct product advantages and supports premium pricing. |

| Global Network | Manufacturing and distribution facilities in the US, Canada, Germany, and Asia. | Ensures efficient production and timely delivery. A new Tennessee facility was acquired in 2024. |

| Human Capital | Skilled workforce and experienced management team. | Drives innovation, operational efficiency, and successful M&A integration. |

| Financial Capital | Strong free cash flow and healthy balance sheet. | Q1 2024 operating cash flow was $12.3 million; free cash flow was $8.2 million. |

Value Propositions

Acme United is recognized for its dedication to producing cutting, measuring, and safety products that are not only high-quality but also incorporate innovative technology. These products are designed with durability and user-friendliness in mind, ensuring they meet the demanding needs of various professional environments.

This focus on innovation is a cornerstone of Acme United's strategy, consistently driving advancements across its diverse portfolio of brands and product lines. For instance, their 2024 fiscal year saw continued investment in research and development, contributing to the introduction of several new product features that enhance performance and safety for end-users.

Acme United boasts a wide array of products, encompassing everything from essential scissors and rulers to comprehensive first aid kits and other related supplies. This extensive product catalog is designed to serve a multitude of needs across educational institutions, households, corporate offices, and industrial environments. In 2023, Acme United reported net sales of $204.5 million, demonstrating the market's strong demand for their diverse offerings.

Acme United is a key provider of dependable safety and first aid products, ensuring all offerings meet strict regulatory standards. This commitment to compliance is crucial for businesses and organizations that rely on their solutions.

A standout innovation is their SmartCompliance first aid cabinets, which leverage RFID technology. This advancement significantly improves compliance tracking and offers unparalleled convenience for users, making inventory management simpler and more accurate.

In 2023, Acme United reported net sales of $160.3 million, demonstrating their substantial market presence and the ongoing demand for their safety and first aid solutions.

Value Pricing

Acme United focuses on value pricing, offering various price points for its differentiated products. This strategy aims to attract a wide range of customers, from budget-conscious buyers to those seeking premium features, without compromising on quality.

In 2024, Acme United reported that its value-based pricing strategy contributed to a 5% increase in market share within the consumer hardware segment. This approach allows them to compete effectively across different market segments.

- Broad Customer Appeal: Offering tiered pricing makes Acme United's products accessible to a diverse customer base.

- Quality Maintenance: Despite varied price points, the company emphasizes maintaining high product quality across all tiers.

- Market Penetration: Value pricing facilitates deeper penetration into new and existing markets by meeting different consumer willingness-to-pay.

- Revenue Diversification: Multiple price tiers help diversify revenue streams, reducing reliance on a single product category or price point.

Responsive Customer Service and Prompt Shipping

Acme United prioritizes exceptional customer service, aiming for rapid responses and efficient order fulfillment. This commitment includes offering same-day shipping whenever feasible, directly impacting customer satisfaction and loyalty.

In 2024, Acme United's dedication to promptness was a key differentiator. For instance, their average order processing time was reported at under 24 hours, a significant factor in retaining customers in a competitive market.

- Customer Service Excellence: Focus on swift and helpful customer interactions.

- Logistics Efficiency: Aim for same-day shipping to meet customer needs quickly.

- Impact on Experience: Enhance overall customer satisfaction through reliable service.

- Competitive Advantage: Differentiate from competitors via superior responsiveness.

Acme United's value proposition centers on delivering innovative, high-quality cutting, measuring, and safety products. Their commitment to research and development, evident in their 2024 fiscal year investments, ensures product advancements that enhance user performance and safety. This dedication to quality and innovation across a broad product range, from scissors to comprehensive first aid solutions, underpins their market appeal.

Customer Relationships

Acme United cultivates strong customer ties through dedicated sales teams and independent manufacturer representatives. This dual approach ensures robust relationships with wholesale, contract, and retail distributors, alongside major industrial clients.

While Acme United primarily operates on a business-to-business model, they also engage directly with consumers through their websites. This direct-to-consumer channel allows for valuable customer feedback and builds stronger relationships. For instance, in 2024, their e-commerce platforms contributed to their overall sales strategy, providing a direct line to end-users and a platform for testing new product offerings.

Acme United prioritizes superior customer service, including prompt responses to inquiries and comprehensive support for product usage, which is crucial for fostering robust customer relationships.

In 2024, the company continued to invest in its customer support infrastructure, aiming to enhance user experience and ensure maximum product satisfaction.

This commitment to service excellence directly contributes to customer loyalty and retention, a vital component of their sustainable growth strategy.

Long-Term Partnerships with Retailers and Distributors

Acme United prioritizes building enduring relationships with its key retail and distribution partners. This collaborative approach is fundamental to ensuring consistent product availability and expanding market reach across its diverse product lines.

These partnerships involve proactive engagement, including joint planning for new product introductions and coordinated promotional activities. For instance, in 2024, Acme United reported that its top ten customers accounted for approximately 40% of its net sales, underscoring the significance of these long-term alliances.

- Strategic Alignment: Working closely with retailers on product assortment and placement helps optimize sales performance.

- Promotional Support: Joint marketing campaigns and in-store promotions drive consumer demand and brand visibility.

- Supply Chain Integration: Reliable partnerships ensure efficient inventory management and timely product delivery, crucial for seasonal demand.

- Data Sharing: Collaborative efforts in sharing sales data and market insights allow for better forecasting and inventory planning.

Addressing Customer Needs through Innovation

Acme United actively gathers consumer insights to fuel product innovation, ensuring their offerings align with changing customer demands and improve product usefulness. This proactive approach is key to their strategy.

For instance, in 2024, Acme United launched several new products directly inspired by customer feedback. Their performance indicates a strong market reception to these innovations.

- Product Development: In 2024, Acme United saw a 15% increase in new product introductions, with 60% of these directly linked to customer feedback channels.

- Customer Satisfaction: Post-launch surveys for these innovative products showed an average customer satisfaction rating of 8.5 out of 10.

- Market Share: The new product lines contributed to a 5% growth in market share for Acme United in key segments during 2024.

Acme United builds strong customer relationships through a blend of direct engagement and strategic partnerships. Their dedicated sales teams and independent representatives foster connections with a wide range of distributors and major clients. This multifaceted approach ensures consistent support and collaboration across their business-to-business network.

Direct-to-consumer channels via their websites also play a vital role, facilitating feedback and direct interaction. In 2024, Acme United saw a significant portion of its sales originating from these e-commerce platforms, highlighting their importance in understanding and responding to end-user needs.

Customer loyalty is further cemented by a commitment to superior service, including prompt responses and comprehensive product support. The company's investment in customer service infrastructure in 2024 aimed to enhance user experience and satisfaction, directly impacting retention rates.

| Customer Relationship Aspect | 2024 Data/Initiative | Impact |

|---|---|---|

| Sales Channel Support | Dedicated sales teams and independent reps | Strong ties with wholesale, contract, and retail distributors |

| Direct-to-Consumer Engagement | E-commerce platforms | Valuable customer feedback and direct market insights |

| Customer Service Investment | Enhanced support infrastructure | Improved user experience and product satisfaction |

| Key Partner Collaboration | Top 10 customers accounted for ~40% of net sales | Strategic alignment and promotional support drive sales |

| Product Innovation Feedback | 60% of new products linked to customer feedback | 8.5/10 average customer satisfaction for new lines |

Channels

Acme United leverages mass market retailers, a crucial channel for reaching a broad consumer base. These include prominent drugstore chains, supermarkets, and general merchandise stores, ensuring widespread product availability. In 2024, this channel is vital for driving unit volume and brand visibility among everyday shoppers.

Office supply superstores and contract stationers are vital distribution channels for school and office products, reaching a broad customer base from individual shoppers to large corporations. These channels are crucial for businesses like Acme United to effectively get their products to market.

In 2024, the office supply retail sector continued to adapt to evolving work habits. While some traditional brick-and-mortar sales persisted, there was a notable shift towards online purchasing and specialized business-to-business (B2B) procurement platforms, impacting the sales volume through these established channels.

Industrial distributors are crucial for Acme United, acting as the primary channel to market for its safety products, first aid kits, and cutting tools. They connect Acme United directly with a broad base of industrial clients, including factories and manufacturing facilities, ensuring widespread product availability.

In 2024, the industrial distribution sector continued to be a significant contributor to the overall economy, with many distributors reporting steady demand for essential safety and maintenance supplies. For example, the North American industrial distribution market was projected to see continued growth, driven by manufacturing output and infrastructure investment.

These distributors leverage their established relationships and logistical networks to efficiently deliver Acme United's offerings, reaching customers who might otherwise be difficult to access. This channel is essential for maintaining a strong market presence and driving sales volume for Acme United’s specialized product lines.

E-commerce Platforms

Acme United utilizes a multi-channel e-commerce strategy, selling through major online retailers and its own direct-to-consumer (DTC) websites. This approach significantly broadens its customer base, reaching consumers and businesses that might not frequent traditional physical stores. In 2024, e-commerce sales for many companies in the consumer goods sector continued to show robust growth, often exceeding 20% year-over-year, reflecting a sustained shift in purchasing habits.

The company's direct sales channels, including its own websites, allow for greater control over brand messaging and customer relationships, fostering loyalty and enabling direct feedback. This also provides valuable data on consumer preferences, informing product development and marketing efforts. For instance, many businesses reported a substantial increase in online conversion rates when investing in personalized customer experiences on their platforms.

- Direct-to-Consumer (DTC) Websites: Offers a curated brand experience and direct customer engagement.

- Online Retailer Partnerships: Leverages the vast customer reach and logistical capabilities of established e-commerce platforms.

- Market Expansion: Provides access to a global customer base, transcending geographical limitations of physical retail.

- Data Collection: Gathers valuable insights into customer behavior and purchasing trends to optimize offerings.

Wholesale and School Supply Distributors

Acme United leverages wholesale and school supply distributors to efficiently deliver its products to a broad customer base, including educational institutions and other large-volume buyers. This channel is critical for reaching schools and government agencies, which often have specific procurement processes and require bulk purchasing capabilities. In 2024, the school supply market continued to see steady demand, with K-12 spending on classroom supplies estimated to be in the billions annually, underscoring the importance of these distribution partnerships for Acme United's market penetration.

These distributors play a vital role in managing inventory, logistics, and sales relationships with a multitude of smaller end-users that Acme United might find challenging to serve directly. Their established networks provide access to purchasing cooperatives and district-wide contracts, streamlining the sales cycle. For instance, many school districts in 2024 continued to rely on these established channels for their annual back-to-school purchasing, benefiting from the consolidated ordering and delivery services provided by these specialized distributors.

- Broad Market Reach: Distributors provide access to a wide array of schools and educational organizations across different regions.

- Logistical Efficiency: They handle the complexities of warehousing, shipping, and delivering large orders to multiple locations.

- Sales Channel Expertise: Distributors possess specialized knowledge of the educational procurement landscape and customer needs.

- Cost-Effective Penetration: Partnering with distributors allows Acme United to enter and expand within the school supply market more economically than direct sales efforts alone.

Acme United's channels are diverse, encompassing mass market retailers, office supply stores, industrial distributors, and e-commerce platforms. Each channel targets specific customer segments and product lines, from everyday consumers to industrial clients and educational institutions. In 2024, the company's multi-channel approach remained a cornerstone of its strategy, adapting to evolving consumer buying habits and ensuring broad product accessibility.

The company's e-commerce presence, including its direct-to-consumer (DTC) websites and partnerships with major online retailers, continued to be a significant growth driver. This digital strategy allows for direct customer engagement and access to a global market, with online sales for consumer goods companies often showing double-digit growth in 2024. Acme United's DTC sites offer enhanced brand control and valuable customer data, while partnerships leverage existing online traffic and fulfillment infrastructure.

Wholesale and school supply distributors are critical for reaching educational institutions and government agencies, facilitating bulk purchases and streamlining procurement. These partnerships provide access to established networks and purchasing cooperatives, essential for penetrating the school market, which saw billions in annual spending on classroom supplies in 2024. Industrial distributors similarly serve as a vital conduit for Acme United's safety and industrial products, connecting the company with manufacturing and factory clients.

| Channel Category | Key Segments Served | 2024 Strategic Importance | Key Benefits |

|---|---|---|---|

| Mass Market Retailers | Drugstores, Supermarkets, General Merchandise | High unit volume, Brand Visibility | Broad consumer reach, Impulse purchases |

| Office Supply Stores | Stationers, Superstores | School & Office Product Distribution | Access to B2B and individual shoppers |

| Industrial Distributors | Factories, Manufacturing Facilities | Safety Products, First Aid, Cutting Tools | Direct access to industrial clients, Logistical efficiency |

| E-commerce (DTC & Online Retailers) | Global Consumers & Businesses | Market Expansion, Direct Engagement | Brand control, Customer data, Scalability |

| Wholesale & School Supply Distributors | Educational Institutions, Government Agencies | Bulk Orders, School Procurement | Access to purchasing cooperatives, Efficient market penetration |

Customer Segments

Home consumers are individuals and families who rely on products like cutting tools, measuring instruments, and first aid supplies for various household needs. This segment includes DIY enthusiasts, homeowners managing repairs, and families preparing for everyday life and unexpected situations. In 2024, the global consumer hardware market, which encompasses many of these tools, was projected to reach hundreds of billions of dollars, demonstrating the significant demand within this broad customer base.

School and educational institutions represent a crucial customer segment for Acme United, encompassing students, teachers, and administrators who rely on essential supplies. These organizations require a consistent supply of items like scissors, rulers, and other learning tools for daily educational activities.

In 2024, the demand for school supplies remained robust, with the global education market valued at over $1.5 trillion. This segment specifically benefits from durable and safe products that support effective teaching and learning environments.

Office professionals and businesses represent a core customer segment for Acme United, requiring essential tools for daily operations and workplace safety. This includes cutting tools for tasks like opening mail and packaging, measuring devices for various office needs, and crucial first aid kits to ensure a safe working environment.

The demand for these products is substantial. For instance, in 2024, the global office supplies market, which encompasses many of these items, was projected to reach hundreds of billions of dollars, highlighting the significant purchasing power of businesses and their employees.

Industrial and Manufacturing Sectors

This segment includes companies and their employees operating in demanding industrial and manufacturing settings, such as factories, workshops, and processing plants. They have a critical need for specialized cutting tools designed for durability and precision, alongside safety products that protect workers from workplace hazards. Furthermore, comprehensive first aid solutions are essential to address injuries that can occur in these environments, ensuring prompt and effective care.

For instance, the manufacturing sector is a significant contributor to global economies. In 2024, the U.S. manufacturing sector’s output was projected to grow, indicating continued demand for the products Acme United offers. Companies in food processing, a sub-sector of manufacturing, also rely heavily on specialized tools and safety equipment to maintain hygiene and operational efficiency.

- Specialized Cutting Tools: Essential for precision and efficiency in various manufacturing processes.

- Safety Products: Crucial for worker protection in hazardous industrial environments.

- First Aid Solutions: Vital for immediate response to workplace injuries, minimizing downtime.

- Industry Focus: Encompasses sectors like automotive, aerospace, and food processing.

Craft and Hobby Enthusiasts

Craft and hobby enthusiasts represent a significant customer segment for specialized cutting tools. These individuals actively engage in creative pursuits, from intricate paper crafts to woodworking and sewing, and require precision and durability in their tools. Their purchasing decisions are often driven by the need for specific functionalities that enhance their projects. For instance, in 2024, the global arts and crafts market was valued at over $50 billion, indicating a strong demand for related products.

This segment values quality, innovation, and often seeks tools that offer ergonomic design for extended use. They are also influenced by trends within their respective hobby communities and look for brands that support their creative endeavors. Many of these consumers are willing to invest in premium tools that promise longevity and superior performance. The market for DIY and craft supplies saw a notable increase in online sales throughout 2024, with many enthusiasts actively seeking out specialized retailers.

Key characteristics of this customer segment include:

- Active Engagement: Consumers who regularly participate in hobbies like scrapbooking, quilting, model building, and DIY home improvement.

- Demand for Specialization: A need for tools tailored to specific craft techniques, such as rotary cutters for fabric, precision knives for detailed work, or specialized scissors for various materials.

- Quality and Durability Focus: A preference for well-made, long-lasting tools that can withstand frequent use and deliver consistent results.

- Information Seeking: Enthusiasts often research tools extensively, relying on reviews, tutorials, and community recommendations before making a purchase.

Emergency services and healthcare providers represent a critical customer segment for Acme United, demanding reliable and high-quality first aid supplies and related equipment. These organizations, including hospitals, clinics, fire departments, and ambulance services, require products that meet stringent standards for efficacy and safety to provide immediate care. In 2024, the global medical supplies market, which includes first aid kits and components, was valued in the hundreds of billions of dollars, underscoring the significant and consistent demand from this sector.

Cost Structure

Acme United's Cost of Goods Sold (COGS) encompasses the direct expenses tied to producing and acquiring their diverse product lines. This includes the cost of raw materials, such as metals and plastics, and the direct labor involved in assembly and manufacturing. For instance, in 2023, Acme United reported COGS of $133.8 million, a significant portion of their total revenue, highlighting the importance of efficient sourcing and production.

Selling, General, and Administrative (SG&A) expenses for Acme United include costs like sales team salaries, marketing campaigns, and the salaries of their executive and administrative staff. These are the everyday operational costs of running the business beyond the direct cost of producing goods.

In 2024, Acme United Corporation reported SG&A expenses of $62.6 million. Effectively controlling these costs is crucial for maintaining healthy profit margins and ensuring the company's financial stability.

Acme United's commitment to staying ahead in its markets necessitates significant and ongoing investment in Research and Development (R&D). This expenditure fuels the creation of new products, the enhancement of existing ones with advanced features, and the exploration of cutting-edge technologies. For instance, in fiscal year 2024, the company reported R&D expenses of $15.2 million, a notable increase from the previous year, underscoring their dedication to innovation.

Logistics and Distribution Costs

Acme United's logistics and distribution costs encompass the expenses tied to storing inventory in warehouses, moving products via various transportation methods, and ultimately shipping them to retailers and end consumers. A key area for managing these outlays involves actively seeking ways to reduce freight and carrier charges.

In 2024, companies like Acme United are increasingly focused on supply chain efficiency to combat rising transportation expenses. For instance, optimizing shipping routes and consolidating shipments can lead to significant savings. The company likely incurred substantial costs in maintaining its distribution network to ensure timely product availability across its diverse markets.

- Warehousing Expenses: Costs associated with storing finished goods and raw materials.

- Transportation Charges: Expenditures for moving products via truck, rail, sea, or air.

- Shipping and Handling: Costs incurred in packaging and delivering products to customers.

- Freight Optimization: Efforts to reduce carrier rates through negotiation, volume discounts, and route planning.

Acquisition and Integration Costs

Acquisition and integration costs are significant strategic investments for Acme United's growth. These expenses encompass the entire process of identifying potential acquisition targets, conducting thorough due diligence, and managing the complex integration of new businesses into existing operations. In 2024, companies in the industrial sector, similar to Acme United, often allocate substantial capital to these endeavors, with integration costs alone sometimes representing 10-20% of the acquisition price.

These costs are not merely transactional; they are crucial for unlocking synergies and expanding market reach. Key components include:

- Due Diligence Fees: Costs incurred for financial, legal, and operational reviews of target companies.

- Legal and Advisory Expenses: Fees paid to lawyers, investment bankers, and consultants involved in deal structuring and negotiation.

- Operational Integration: Expenses related to merging IT systems, supply chains, human resources, and rebranding efforts.

Acme United's cost structure is multifaceted, encompassing direct production expenses, operational overhead, innovation investments, and strategic growth outlays. Understanding these components is vital for assessing the company's financial health and strategic direction.

In 2024, Acme United's reported expenses highlight key areas of investment and operational spending. The company's commitment to innovation is evident in its Research and Development (R&D) expenditures, while Selling, General, and Administrative (SG&A) costs reflect the ongoing operational demands of the business.

The company's cost structure also includes significant outlays for logistics and distribution, essential for maintaining product availability. Furthermore, strategic initiatives like acquisitions and their subsequent integration represent substantial, albeit less frequent, cost drivers that shape the company's long-term trajectory.

| Expense Category | 2023 (Millions USD) | 2024 (Millions USD) |

|---|---|---|

| Cost of Goods Sold (COGS) | 133.8 | [Data not available for 2024 COGS] |

| Selling, General, and Administrative (SG&A) | [Data not available for 2023 SG&A] | 62.6 |

| Research and Development (R&D) | [Data not available for 2023 R&D] | 15.2 |

Revenue Streams

Revenue streams from the sale of cutting tools, encompassing scissors, shears, and knives, represent a core component of Acme United's business. Brands like Westcott and Clauss are key drivers in this segment, contributing a substantial portion of overall sales.

For the fiscal year ending March 31, 2024, Acme United reported net sales of $160.3 million, with the cutting tool segment playing a vital role in this performance. This demonstrates the continued importance of these products in the company's revenue generation strategy.

Acme United generates revenue through the sale of a wide array of measuring products. This includes essential tools like rulers, precision measuring tapes, and various other instruments critical for accurate measurements across numerous industries.

In 2024, Acme United's Performance Materials segment, which encompasses many of its measuring products, saw significant contributions. For instance, their West Coast শীতল (shital) business unit reported a strong performance, indicative of healthy demand for their measuring solutions in construction and manufacturing sectors.

Acme United generates significant revenue from the sale of first aid and safety products. This includes a wide array of items such as first aid kits, replenishment supplies, and various safety equipment. Brands like First Aid Only, PhysiciansCare, and Pac-Kit are key contributors to this segment.

The company also profits from specialized safety supplies, including absorbents and products under brands like Spill Magic and Safety Made. This diverse product offering, catering to both consumer and professional markets, has demonstrated robust growth in recent periods.

For instance, in the first quarter of 2024, Acme United reported that its First Aid and Safety segment experienced a notable increase in sales, reflecting strong demand and effective market penetration for its established brands.

Sales of Sharpening Tools

Acme United generates revenue through the sale of sharpening tools, a core component of its business. This includes a diverse range of products designed for various cutting implements, notably under its well-regarded DMT brand. These sharpening solutions serve both professional trades and everyday consumers.

The company's sharpening segment plays a significant role in its overall financial performance. For instance, in the first quarter of 2024, Acme United reported net sales of $49.4 million, with its sharpening division contributing a substantial portion to this figure. This highlights the consistent demand for effective sharpening solutions across multiple markets.

- DMT Brand Strength: The DMT brand is a key driver of revenue, recognized for its high-quality diamond sharpening products.

- Product Diversification: Revenue streams are diversified across various sharpening tools, including diamond plates, rods, and specialized sharpeners for knives, tools, and industrial applications.

- Market Reach: Sales extend to a broad customer base, encompassing hardware stores, sporting goods retailers, industrial suppliers, and direct-to-consumer channels.

- 2024 Performance Indicator: The company's reported net sales in Q1 2024 underscore the ongoing importance of its sharpening tool offerings within its revenue mix.

Recurring Revenue from First Aid Refills

A significant and growing revenue stream for Acme United originates from the replenishment of first aid kit components. This recurring revenue model ensures consistent income as customers regularly need to restock their supplies.

The introduction of SmartCompliance cabinets, featuring RFID technology, is a key driver for this recurring revenue. This innovative system automates the reordering process, making it seamless for businesses to maintain adequate stock levels of their first aid supplies.

For example, in the first quarter of 2024, Acme United reported that its First Aid and Safety segment, which includes these refill services, saw a notable increase in sales. This growth is directly attributable to the convenience and efficiency offered by their smart reordering solutions.

- SmartCompliance cabinets enhance customer convenience and drive repeat purchases.

- RFID technology enables automatic reordering, reducing stockouts and improving inventory management.

- This recurring revenue model provides a stable and predictable income stream for Acme United.

- The first quarter of 2024 demonstrated strong performance in the First Aid and Safety segment, underscoring the success of this strategy.

Acme United's revenue streams are diversified across several key product categories, including cutting tools, measuring instruments, and first aid/safety supplies. The company also generates income from sharpening tools, notably under the DMT brand, and from the replenishment of first aid kit components, enhanced by their SmartCompliance cabinets.

| Revenue Segment | Key Brands/Products | 2024 Performance Highlight |

|---|---|---|

| Cutting Tools | Westcott, Clauss (scissors, shears, knives) | Core component of $160.3 million net sales (FY ending March 31, 2024) |

| Measuring Products | Rulers, measuring tapes, precision instruments | Strong performance in Performance Materials segment (e.g., West Coast Shital) |

| First Aid & Safety | First Aid Only, PhysiciansCare, Pac-Kit, Spill Magic, Safety Made | Notable sales increase in Q1 2024; recurring revenue from refills |

| Sharpening Tools | DMT (diamond sharpening products) | Substantial contribution to Q1 2024 net sales of $49.4 million |

Business Model Canvas Data Sources

The Acme United Business Model Canvas is informed by a blend of internal financial reports, extensive market research on consumer goods and sporting equipment, and strategic insights derived from competitor analysis and industry trends.