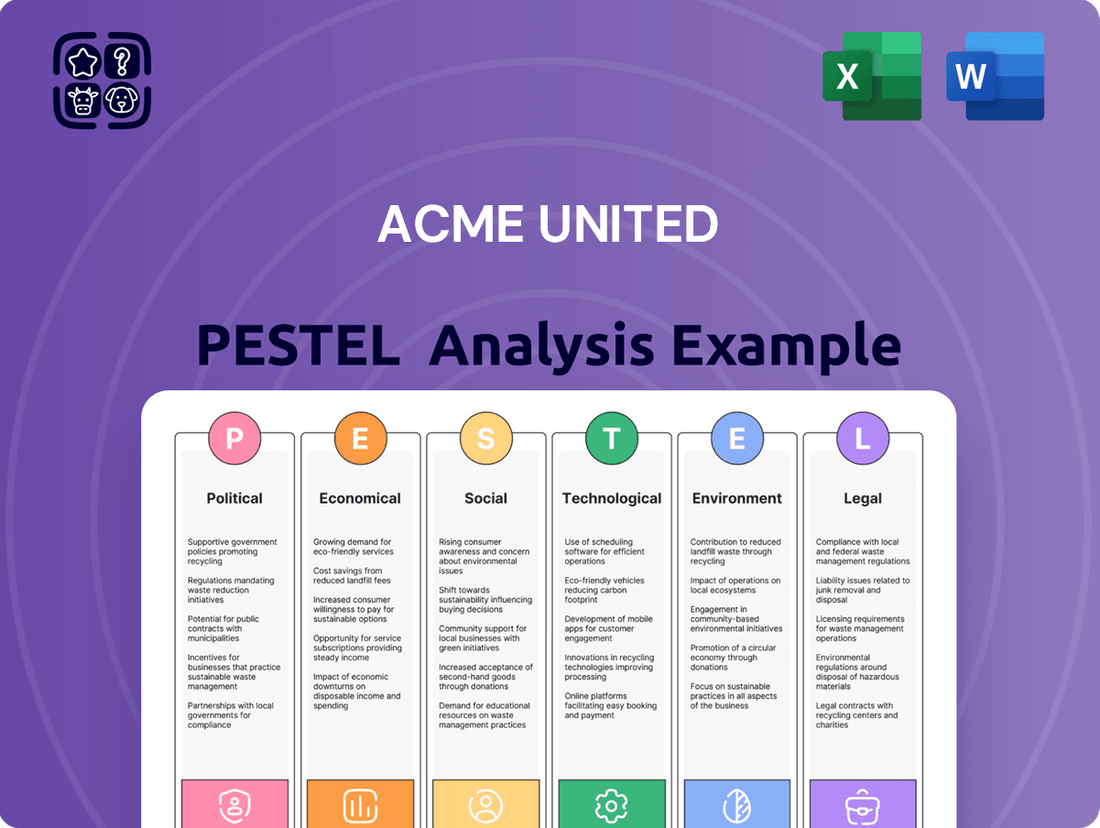

Acme United PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acme United Bundle

Uncover the critical Political, Economic, Social, Technological, Environmental, and Legal factors impacting Acme United's operations and future growth. This comprehensive PESTLE analysis provides actionable intelligence to inform your strategic decisions and competitive advantage. Download the full version now to gain a deeper understanding of the external forces shaping Acme United's landscape.

Political factors

Shifts in global trade policy, particularly around tariffs and trade agreements, directly influence Acme United's operational costs and market reach. For instance, the U.S. government's approach to trade negotiations and potential imposition of new tariffs on goods from key manufacturing regions can alter the cost of imported components for Acme United's products.

The ongoing renegotiation of trade pacts and the implementation of tariffs by various nations create a dynamic environment. In 2024, for example, the U.S. maintained tariffs on certain goods imported from China, impacting supply chains for many industries, including those that Acme United operates within. This can necessitate adjustments to sourcing strategies and potentially increase the cost of goods sold.

These policy changes can lead to increased expenses for raw materials or finished products, directly affecting Acme United's profitability and its ability to maintain competitive pricing for consumers. The company must remain agile in adapting its supply chain and pricing models to mitigate the financial impact of these evolving trade landscapes.

Government budgets for education directly influence the demand for school supplies, a key segment for Acme United. For instance, in fiscal year 2024, the U.S. Department of Education received an allocation of $80.9 billion, a figure projected to see moderate increases in subsequent years, signaling continued demand for educational materials.

Similarly, investments in infrastructure and industrial development can boost the market for cutting tools and industrial safety products. The Infrastructure Investment and Jobs Act, enacted in late 2021, is set to disburse over $1 trillion through 2026, with a significant portion earmarked for transportation and public works projects, directly benefiting sectors reliant on industrial supplies.

Increased government spending in these areas translates to substantial growth opportunities for Acme United, as evidenced by the projected 5% annual growth rate in the industrial tools market through 2027, driven largely by these public investments.

Stricter workplace safety regulations globally are a significant driver for demand in industrial safety equipment and first aid supplies. For instance, in the United States, the Occupational Safety and Health Administration (OSHA) continues to enforce stringent standards, leading companies to invest more in safety gear. This trend directly benefits manufacturers like Acme United, as compliance necessitates the purchase of their products.

Governments worldwide are increasingly prioritizing worker well-being, translating into more robust safety mandates. This focus ensures a consistent and growing market for safety solutions. Regulations often require specific levels of first aid provisions and training, creating a reliable revenue stream for companies specializing in these areas, such as Acme United.

Geopolitical instability and supply chain resilience

Geopolitical instability, such as ongoing conflicts and trade disputes, presents significant risks to global supply chains. For companies like Acme United, which sources materials and manufactures products internationally, these tensions can directly affect the availability and cost of raw materials and components. For instance, disruptions in major shipping lanes, like those experienced in the Red Sea in early 2024, led to increased freight costs and extended delivery times for many industries.

Acme United's reliance on a complex, global supply network means that geopolitical events can disrupt production schedules and impact profitability. The company's diverse product portfolio, ranging from cutting tools to safety equipment, requires a steady flow of various materials. When these flows are interrupted by political instability, it can result in production delays and higher operational expenses, potentially affecting sales and earnings.

- Supply Chain Vulnerability: Geopolitical tensions can create bottlenecks, leading to shortages of critical components for Acme United's products.

- Increased Costs: Disruptions often translate to higher transportation expenses and raw material prices, squeezing profit margins.

- Strategic Imperative: Building supply chain resilience, perhaps through diversification of suppliers or regionalization of production, is crucial for Acme United to mitigate these risks.

- Market Volatility: Political uncertainty can fuel market volatility, impacting consumer and business demand for Acme United's offerings.

Local content and manufacturing incentives

Governments are increasingly implementing policies to foster local manufacturing and sourcing, a trend that directly impacts companies like Acme United. For instance, the US government's Buy American Act, updated in 2024, mandates increased domestic content percentages for federal procurements, aiming to bolster domestic supply chains. This presents Acme United with a potential opportunity to expand its U.S.-based manufacturing capabilities or forge stronger alliances with American suppliers, thereby aligning with national economic priorities.

Conversely, these initiatives can also introduce complexities. Acme United might need to re-evaluate its existing global production footprint and distribution networks to ensure compliance with evolving local content mandates in various operating regions. This could involve significant strategic adjustments, potentially increasing operational costs if global efficiencies are compromised.

- Domestic Content Mandates: Policies like the 2024 Buy American Act updates require higher percentages of U.S.-made components in federal contracts, influencing sourcing decisions.

- Incentives for Local Production: Governments may offer tax credits or subsidies for companies investing in domestic manufacturing facilities, making local expansion more attractive.

- Supply Chain Realignment: Acme United may need to shift from global sourcing to local suppliers to meet new regulatory requirements, potentially impacting cost structures.

- Partnership Opportunities: Local content rules can encourage collaborations with domestic manufacturers, fostering innovation and shared growth within national economies.

Government spending on education directly fuels demand for school supplies, a core market for Acme United. For instance, the U.S. Department of Education's budget for fiscal year 2024 was approximately $80.9 billion, with projections indicating continued investment in educational resources.

Infrastructure development, such as the U.S. Infrastructure Investment and Jobs Act, is driving demand for industrial tools and safety equipment. This act, with over $1 trillion allocated through 2026, particularly for transportation and public works, directly benefits sectors relying on these products. The industrial tools market is expected to grow at a 5% annual rate through 2027, partly due to these investments.

Stricter global workplace safety regulations, enforced by bodies like OSHA, necessitate increased investment in safety gear and first aid supplies. This trend ensures a consistent and growing market for Acme United's safety solutions, driven by a global focus on worker well-being.

Geopolitical instability, including trade disputes and conflicts, poses risks to global supply chains, impacting raw material costs and availability for companies like Acme United. Disruptions in shipping lanes, such as those in the Red Sea in early 2024, led to increased freight costs and delivery delays.

| Factor | Impact on Acme United | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Government Education Spending | Drives demand for school supplies. | U.S. Dept. of Education FY24 budget: ~$80.9 billion. |

| Infrastructure Investment | Boosts demand for industrial tools and safety equipment. | Infrastructure Investment and Jobs Act disbursing over $1 trillion through 2026. |

| Workplace Safety Regulations | Increases demand for safety and first aid products. | Continued enforcement by OSHA globally. |

| Geopolitical Instability | Disrupts supply chains, increases costs. | Red Sea shipping disruptions (early 2024) increased freight costs. |

What is included in the product

This PESTLE analysis of Acme United provides a comprehensive examination of how political, economic, social, technological, environmental, and legal factors influence the company's operations and strategic direction.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, helping Acme United to quickly address external threats and opportunities.

Economic factors

Ongoing inflation and the unpredictable swings in raw material costs, particularly for metals and plastics vital to Acme United's cutting and measuring tools, directly impact production expenses and profitability. While 2024 saw some easing of these price pressures, they remain notably higher than pre-pandemic figures, with modest increases expected into 2025.

Effectively navigating these cost challenges through smart sourcing strategies and strategic pricing adjustments will be key for Acme United to safeguard its profit margins in the coming year.

Consumer spending is a critical driver for Acme United, directly influencing demand for its school, home, and office products. In late 2024 and into 2025, analysts project continued resilience in consumer spending, though inflation and interest rate impacts might moderate growth compared to prior years. For instance, the U.S. Personal Consumption Expenditures (PCE) price index saw a moderate increase in early 2024, suggesting consumers are still spending, but perhaps more cautiously.

Disposable income trends are equally important. As of the latest available data from the Bureau of Economic Analysis (BEA) in mid-2024, disposable personal income has shown a steady upward trend, which generally supports spending. However, any significant shifts in employment or wage growth could alter this trajectory, directly impacting Acme United's sales, especially in its mass market and office supply segments that cater to a broader consumer base.

Acme United operates across diverse segments, each with its own growth trajectory. The cutting tools market, a key area for Acme United, is poised for significant expansion, projected to reach USD 16.4 billion by 2034, with an anticipated compound annual growth rate (CAGR) of 6.1% starting in 2025. This growth is fueled by advancements in manufacturing and the increasing adoption of automation.

The first aid kit market also presents a positive outlook, expected to grow at a CAGR of 4.15% between 2025 and 2033. Concurrently, the office and school supplies sector continues to demonstrate steady growth, providing a stable revenue stream for Acme United.

Interest rates and access to capital

Interest rate fluctuations directly impact Acme United's borrowing costs for everything from daily operations to major investments and acquisitions. For instance, if the Federal Reserve maintains its benchmark interest rate in the 5.25%-5.50% range through 2025, as many analysts project, Acme United's financing expenses will remain elevated compared to periods of lower rates.

Higher interest rates can also curb the capital expenditure plans of Acme United's industrial and business clients. This slowdown in customer expansion could translate to reduced demand for the company's industrial products. Projections suggest that by 2025, borrowing costs will likely present a more significant hurdle for businesses than the cost of raw materials.

- Interest Rate Environment: The Federal Reserve's Federal Funds Rate target range is anticipated to remain a key factor influencing borrowing costs throughout 2025.

- Impact on Capital Expenditure: Elevated borrowing costs can stifle investment and expansion by Acme United's customer base, potentially dampening demand for its products.

- Cost Comparison: In 2025, the expense associated with borrowing capital is expected to be a more substantial constraint for businesses than the price of materials.

E-commerce penetration and distribution channel shifts

The ongoing surge in e-commerce continues to reshape the retail landscape, offering substantial growth avenues. Global online consumer goods revenues are projected to reach approximately $6.3 trillion in 2024, underscoring the channel's increasing dominance. This trend necessitates that Acme United strategically enhances its digital presence and direct-to-consumer capabilities to capitalize on this expanding market.

Simultaneously, Acme United must navigate the evolving dynamics of its traditional distribution channels. Maintaining strong partnerships with mass market retailers and office supply stores remains crucial, even as consumer purchasing habits shift online. The company's ability to balance these channel strategies will be key to sustained market share and revenue generation in the coming years.

Key considerations for Acme United include:

- E-commerce Growth: Leveraging the projected 8.5% year-over-year growth in global e-commerce sales for 2024.

- Channel Integration: Developing a cohesive strategy that integrates online sales with existing brick-and-mortar retail relationships.

- Digital Investment: Allocating resources to improve website functionality, online marketing, and fulfillment for e-commerce operations.

- Retailer Partnerships: Adapting offerings and support for traditional retailers to remain competitive in an omnichannel environment.

Inflationary pressures continue to impact Acme United, with raw material costs, especially for metals and plastics, remaining elevated in 2024 and projected to see modest increases into 2025. Consumer spending, while resilient, may be tempered by these economic conditions. Interest rates are expected to remain a more significant constraint on business investment in 2025 than material costs.

Full Version Awaits

Acme United PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Acme United provides actionable insights into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a deep understanding of the external forces shaping Acme United's strategic landscape.

Sociological factors

Societal awareness regarding safety has significantly intensified, directly boosting demand for products like first aid kits and industrial safety gear. This heightened consciousness stems from robust public health initiatives, extensive media reporting on unfortunate incidents, and a widespread move towards proactive safety protocols across all environments.

For instance, in 2024, consumer spending on home safety equipment saw a notable uptick, with reports indicating a 7% year-over-year increase in purchases of emergency preparedness supplies. This trend underscores a growing consumer preference for preventative measures, directly benefiting companies like Acme United that offer comprehensive safety solutions.

Consumer demand for sustainable and eco-friendly products is a significant sociological factor impacting businesses like Acme United. Globally, there's a clear trend towards prioritizing items that are responsibly sourced, manufactured with minimal environmental impact, and packaged using sustainable materials. This heightened environmental awareness directly influences purchasing decisions, pushing companies to innovate and offer greener alternatives.

Acme United, like many manufacturers, is feeling this pressure to adapt. For instance, a 2024 report indicated that over 60% of consumers are willing to pay more for sustainable products. This societal shift necessitates integrating sustainability into core business practices, from product design to supply chain management, to meet evolving consumer expectations and maintain market relevance.

The widespread adoption of remote and hybrid work models, accelerated by events in recent years, significantly alters the landscape for office supplies. For instance, a 2024 survey indicated that over 60% of American workers were in some form of hybrid or fully remote arrangement, directly impacting the volume of traditional office supplies purchased for corporate environments. This shift necessitates Acme United's adaptation by focusing on products suitable for home offices and flexible workspaces, potentially seeing growth in categories like ergonomic accessories and home-based organizational tools.

DIY and home improvement trends

The surge in do-it-yourself (DIY) and home improvement projects is a significant sociological driver impacting tool manufacturers. This trend, amplified by economic considerations and a desire for personalized living spaces, directly translates into increased demand for cutting and measuring tools suitable for household applications. For instance, the U.S. home improvement market was valued at approximately $450 billion in 2023, with a notable portion attributed to DIY expenditures.

Acme United can strategically position itself to capture this growing consumer segment. By tailoring marketing efforts to homeowners and hobbyists, and ensuring product availability through accessible retail channels, the company can effectively tap into this market. This approach aligns with consumer behavior observed in 2024, where online DIY tutorials and social media platforms are increasingly influencing purchasing decisions for home improvement supplies.

Key aspects of this trend include:

- Increased consumer engagement: Homeowners are actively seeking to personalize and maintain their properties, driving demand for tools.

- Economic influence: Cost-saving motivations often lead consumers to undertake projects themselves rather than hiring professionals.

- Lifestyle shifts: A growing emphasis on home-based activities and hobbies further fuels interest in DIY projects.

- Digital marketing opportunities: Platforms like YouTube and Pinterest are crucial for reaching and educating DIY enthusiasts.

Demographic shifts and population changes

Demographic shifts significantly impact Acme United's product demand. A growing student population, for instance, directly fuels the need for school and art supplies. In 2024, the U.S. K-12 student enrollment was projected to be around 50.4 million, indicating a robust market for educational products.

Conversely, an aging demographic presents different opportunities. As the population ages, there's an increased demand for home safety products and tools that cater to the needs of seniors. In 2023, individuals aged 65 and over represented approximately 17.3% of the U.S. population, a figure expected to grow, creating a sustained market for these specialized items.

- Student Population Growth: U.S. K-12 enrollment in 2024 estimated at 50.4 million.

- Aging Demographics: U.S. population aged 65+ was about 17.3% in 2023, with continued growth.

- Market Tailoring: Acme United can align product development with these demographic trends to capture specific market segments.

Societal awareness regarding safety has significantly intensified, directly boosting demand for products like first aid kits and industrial safety gear. This heightened consciousness stems from robust public health initiatives and extensive media reporting on unfortunate incidents, as seen in a 2024 consumer spending increase of 7% on home safety equipment. Acme United benefits from this trend as consumers increasingly prefer preventative measures and comprehensive safety solutions.

Technological factors

The cutting tools market is rapidly advancing with a strong push towards automation and digital manufacturing, embodying Industry 4.0 principles. This evolution necessitates tools offering extreme accuracy and efficiency, a trend that saw the global cutting tools market reach an estimated USD 21.5 billion in 2023, with projections suggesting growth to USD 29.1 billion by 2030.

Acme United, a key player in cutting technology, must prioritize research and development to create cutting-edge materials, coatings, and designs. This investment is crucial to meet the escalating demand for high-precision tools, particularly from sectors like automotive and aerospace, which are increasingly relying on advanced manufacturing techniques.

The integration of smart features, including the Internet of Things (IoT) and Artificial Intelligence (AI), is significantly enhancing tool performance and contributing to reduced operational downtime. For instance, smart tooling can provide real-time data on wear and performance, allowing for predictive maintenance and optimizing production cycles.

Technological advancements are rapidly reshaping the landscape of first aid and safety products. Innovations like smart bandages that monitor wound healing, highly specialized kits tailored for specific sports or environments, and cutting-edge wound care technologies are becoming more prevalent.

Acme United is well-positioned to capitalize on these trends by integrating these innovations into its established brands, such as First Aid Only® and PhysiciansCare®. This strategic integration can lead to the development of more effective, user-friendly, and specialized safety solutions that meet evolving consumer needs.

The market is also witnessing a significant surge in demand for portable and niche first aid kits, reflecting a growing emphasis on preparedness for diverse situations. For instance, the global market for medical devices, which includes many safety and first aid components, was projected to reach over $600 billion in 2024, indicating substantial growth potential for innovative product offerings.

The surge in e-commerce platforms demands that Acme United refine its online sales approach, ensuring user-friendly websites and impactful digital marketing. Mobile commerce is particularly vital, expected to capture 57% of all e-commerce sales in 2024, highlighting the need for Acme United to optimize its mobile presence and potentially integrate advanced features like product visualization to better connect with online consumers.

Automation and AI in manufacturing and operations

Acme United's manufacturing operations stand to gain significantly from increased automation and AI adoption. These technologies promise to boost efficiency, trim operational expenses, and elevate product quality. For instance, by 2024, the manufacturing sector globally saw automation investments surge, with companies reporting an average 15% increase in productivity due to robotic process automation.

Beyond the factory floor, AI offers powerful tools to refine the customer experience. Personalized product suggestions and predictive analytics can anticipate customer desires, thereby enhancing satisfaction. In 2025, early adopters of AI in customer relationship management are projected to see a 20% uplift in customer retention rates.

The integration of these advanced technologies provides Acme United with a substantial competitive advantage. Companies leveraging AI in their supply chain management, for example, have reported a 10% reduction in lead times and a 5% decrease in inventory holding costs.

- Enhanced Efficiency: Automation and AI can streamline production lines, leading to faster output and reduced waste.

- Cost Reduction: Automating repetitive tasks lowers labor costs and minimizes errors, directly impacting the bottom line.

- Improved Product Quality: AI-powered quality control systems can detect defects with greater accuracy than manual inspection.

- Personalized Customer Experiences: AI enables tailored recommendations and proactive customer service, boosting engagement and loyalty.

Data analytics for product development and market insights

The growing power of data analytics is a significant technological factor for Acme United. These tools provide unprecedented insights into what customers want, emerging market trends, and how to run operations more smoothly. For instance, by examining sales figures and customer comments, Acme United can make smarter choices about new products and how to reach specific customer groups.

Acme United's ability to leverage data analytics is crucial for staying competitive. Analyzing vast datasets allows for more informed decisions in areas like product innovation and inventory control. This data-driven approach helps the company adapt quickly to shifts in consumer behavior and market dynamics, ensuring it remains responsive and relevant.

- Enhanced Product Development: Data analytics helps identify unmet customer needs, guiding the creation of products that resonate with the market. For example, analyzing purchase patterns in 2024 could reveal a growing demand for eco-friendly tool options within Acme's portfolio.

- Improved Market Insights: By processing market research and competitor data, Acme United can pinpoint emerging trends and opportunities, such as the increasing adoption of smart home technology influencing tool usage.

- Optimized Operations: Analyzing operational data can lead to greater efficiency in areas like supply chain management and manufacturing processes, potentially reducing costs and lead times.

- Targeted Marketing: Understanding customer segmentation through data allows for more effective and personalized marketing campaigns, increasing engagement and conversion rates.

Technological advancements are significantly impacting Acme United's core markets. The cutting tools sector is embracing Industry 4.0, demanding greater accuracy and efficiency, with the global market valued at approximately USD 21.5 billion in 2023 and projected to reach USD 29.1 billion by 2030.

Innovations in first aid and safety are also prominent, with smart bandages and specialized kits gaining traction. The broader medical device market, encompassing safety components, was projected to exceed $600 billion in 2024, showcasing substantial growth potential for new product integration.

Acme United can leverage automation and AI in manufacturing to boost efficiency and reduce costs, with global manufacturing automation investments showing a 15% productivity increase by 2024. Furthermore, AI in customer relationship management is expected to improve customer retention by 20% in 2025.

Data analytics offers critical insights for product development, market understanding, and operational optimization. For instance, analyzing purchase patterns in 2024 could highlight a growing demand for eco-friendly tool options, while AI-driven supply chain management can reduce lead times by 10%.

Legal factors

Acme United's product portfolio, particularly its first aid kits and industrial safety equipment, operates under a strict framework of product safety and quality regulations. Compliance with standards set by bodies such as the Occupational Safety and Health Administration (OSHA), the International Electrotechnical Commission (IEC), the International Organization for Standardization (ISO), and the American National Standards Institute (ANSI) is not merely a recommendation but a prerequisite for market entry and maintaining consumer confidence.

For instance, in 2024, the global market for medical devices, which includes many of Acme's first aid components, was valued at over $500 billion, highlighting the critical importance of meeting rigorous safety benchmarks. Failure to adhere to these evolving regulations, which often involve periodic re-audits and updates to quality management systems, can lead to significant financial penalties, product recalls, and severe damage to Acme United's established brand reputation.

Environmental compliance and sustainability reporting are increasingly stringent. Regulations like the EU's Ecodesign for Sustainable Products Regulation (ESPR) and the Corporate Sustainability Reporting Directive (CSRD) mandate detailed disclosures on environmental impact and product sustainability. Acme United needs to ensure its products align with ecodesign principles, focusing on durability, repairability, and recyclability, while also bolstering its ESG reporting transparency.

Acme United, as an employer and a provider of industrial safety gear, must navigate a complex web of labor laws and workplace safety standards across its operating regions. These regulations, covering everything from minimum wage and working hours to hazard prevention and personal protective equipment (PPE) requirements, directly impact operational expenses and employee management. For instance, in the United States, the Occupational Safety and Health Administration (OSHA) sets stringent standards, with penalties for non-compliance that can reach hundreds of thousands of dollars for willful violations.

These legal frameworks not only shape Acme United's internal operations but also serve as a significant market driver for its core business. As companies strive to meet or exceed mandated safety levels, the demand for high-quality safety products, such as those manufactured by Acme United, naturally increases. In 2024, the global industrial safety market was valued at approximately $50 billion, with projections indicating continued growth driven by evolving regulatory landscapes and a heightened focus on worker well-being.

Import/export laws and trade compliance

Acme United's global operations mean it must closely follow import and export laws, customs rules, and trade compliance. Shifts in tariffs, trade pacts, and how customs works can affect how much it costs and how smoothly goods move across borders. For instance, the U.S. trade policy, including the possibility of retaliatory tariffs, requires careful tracking and strategic changes to maintain competitive pricing and efficient supply chains.

Key considerations for Acme United include:

- Tariff Rates: Fluctuations in import duties on raw materials and finished goods directly impact cost of goods sold. For example, a 10% tariff on steel imports could significantly increase manufacturing expenses.

- Trade Agreements: Participation in or exclusion from trade agreements like USMCA (United States-Mexico-Canada Agreement) affects market access and sourcing options.

- Customs Procedures: Changes in documentation requirements or inspection protocols can cause delays and add administrative burdens to international shipments.

- Export Controls: Adherence to regulations governing the export of certain technologies or sensitive products is critical to avoid penalties.

Consumer protection and labeling laws

Consumer protection and labeling laws are critical for Acme United's market presence. Regulations, such as the Federal Trade Commission's (FTC) guidelines on advertising and the Consumer Product Safety Commission's (CPSC) standards, mandate truthful product claims and safety information. For instance, in 2024, the FTC continued its focus on deceptive environmental marketing claims, a key area for companies emphasizing sustainability. Acme United must ensure its product labeling, particularly for items like cutting tools and first-aid supplies, accurately reflects durability and repairability to avoid penalties and maintain brand integrity.

These legal frameworks extend to clear communication regarding product origin, materials, and performance. The increasing consumer demand for transparency means that misleading advertising, or 'greenwashing,' can lead to significant reputational damage and fines. For example, the EU's proposed Ecodesign for Sustainable Products Regulation (ESPR) aims to enhance product durability and repairability information for a wider range of goods, impacting how companies like Acme United present their product lifecycles. Compliance with these evolving directives is essential for building consumer trust and fostering long-term loyalty.

- FTC Enforcement: The FTC actively pursued cases against companies making unsubstantiated environmental claims in 2024, highlighting the risk of 'greenwashing'.

- Product Durability Standards: Emerging regulations, like the EU's ESPR, will increasingly require detailed information on product lifespans and repair options.

- Consumer Trust: Accurate and transparent labeling directly correlates with consumer confidence, impacting purchasing decisions for products like Acme's safety equipment.

Acme United must navigate a complex landscape of international trade laws, including tariffs, customs regulations, and trade agreements, which directly influence its global supply chain and pricing strategies. For example, changes in import duties on raw materials in 2024 could significantly impact its cost of goods sold, while adherence to export controls is crucial to avoid penalties.

The company is also subject to stringent consumer protection and labeling laws, such as those enforced by the FTC and CPSC, requiring accurate product claims and safety information. With the FTC's continued focus on deceptive environmental marketing in 2024, Acme United must ensure its sustainability messaging is transparent to maintain brand integrity and avoid fines.

Furthermore, evolving environmental regulations, like the EU's Ecodesign for Sustainable Products Regulation, will increasingly demand detailed information on product durability and repairability. This necessitates a proactive approach to product lifecycle management and transparent reporting to meet both legal requirements and growing consumer expectations for sustainability.

| Legal Factor | Impact on Acme United | 2024/2025 Data/Trend |

|---|---|---|

| Trade Compliance | Affects supply chain costs and market access. | Potential for increased tariffs on key materials. |

| Consumer Protection | Requires accurate product claims and safety information. | Heightened FTC scrutiny on environmental marketing. |

| Environmental Regulations | Mandates product durability and repairability disclosures. | EU's ESPR to drive demand for sustainable product information. |

Environmental factors

Consumers and businesses are increasingly prioritizing environmentally friendly products, driving demand for items made from recycled, recyclable, or biodegradable materials. For instance, a 2024 Nielsen report indicated that 73% of global consumers would change their consumption habits to reduce their environmental impact.

Acme United has a significant opportunity to innovate its product lines, such as stationery and packaging, to meet this growing preference. This trend also aligns with global sustainability goals and increasing regulatory pressures, which could lead to competitive advantages for companies proactively adopting greener practices.

Global waste management and recycling regulations are tightening, impacting product design and lifecycle. Acme United must assess the recyclability of its products and packaging, potentially engaging in circular economy strategies. For instance, the EU's Ecodesign for Sustainable Products Regulation (ESPR), fully in effect from July 2024, mandates improved durability, reparability, and recyclability for many product categories.

Growing pressure to curb carbon emissions and energy use is a significant environmental factor for manufacturers like Acme United. Companies are increasingly expected to adopt greener production methods. For instance, in 2023, the European Union's Corporate Sustainability Reporting Directive (CSRD) began requiring more detailed environmental disclosures, impacting companies operating within or selling to the EU.

Acme United could face demands to lower its carbon footprint and improve energy efficiency across its operations. This might involve investments in renewable energy sources or upgrades to machinery to reduce consumption. Reporting on Scope 1 (direct emissions), Scope 2 (indirect emissions from purchased energy), and Scope 3 (all other indirect emissions) is becoming standard practice, with new Australian accounting standards also emphasizing these disclosures starting from 2024.

Supply chain environmental impact

The environmental footprint of Acme United's entire supply chain, from sourcing raw materials to delivering finished goods, is under increasing scrutiny. This extends beyond direct operations to the impacts of suppliers and logistics partners. For instance, the transportation sector alone accounted for approximately 24% of global direct CO2 emissions from fuel combustion in 2022, a figure that directly affects companies like Acme United.

Regulatory bodies and investors are now demanding greater transparency and accountability regarding these value chain impacts. Companies are increasingly required to analyze and report on environmental metrics across their entire operations. By 2024, many jurisdictions are implementing stricter due diligence laws, pushing businesses to actively manage environmental risks within their supply networks.

Acme United must therefore conduct a thorough assessment of its sourcing and logistics practices. This proactive approach is essential to minimize its environmental footprint and ensure compliance with evolving due diligence directives. For example, a shift towards more fuel-efficient transportation methods or sourcing materials from suppliers with strong environmental certifications can significantly reduce overall impact.

- Growing pressure for supply chain transparency: Stakeholders expect detailed reporting on environmental impacts from raw material extraction to end-of-life.

- Regulatory compliance: New due diligence directives mandate companies to identify and mitigate environmental risks throughout their value chains.

- Strategic adjustments needed: Acme United should evaluate and potentially modify sourcing strategies and logistics to reduce its environmental footprint.

- Industry benchmarks: Companies in the industrial sector are increasingly setting science-based targets for emissions reduction, aiming for significant cuts by 2030.

Climate change and resource scarcity

Climate change presents significant operational challenges for Acme United, potentially impacting the availability and cost of raw materials vital for its product lines. Extreme weather events, a growing consequence of a warming planet, can disrupt supply chains, leading to delays and increased logistical expenses. For instance, the UN's Intergovernmental Panel on Climate Change (IPCC) Sixth Assessment Report (2021-2022) highlighted an increased frequency and intensity of such events globally.

Businesses are increasingly mandated to incorporate climate-related financial risks into their strategic planning and public disclosures. This regulatory push, exemplified by evolving SEC climate disclosure rules and similar initiatives in other regions, requires companies like Acme United to conduct thorough climate risk assessments. Such assessments are crucial for understanding potential vulnerabilities and developing adaptation strategies.

A proactive approach to resource management and climate risk assessment is therefore essential for Acme United's long-term resilience and profitability. This includes identifying alternative sourcing options for key materials and investing in supply chain diversification to mitigate the impact of climate-induced disruptions. For example, companies in manufacturing sectors are increasingly exploring recycled materials and sustainable sourcing certifications to build more robust supply chains.

Key considerations for Acme United include:

- Supply Chain Vulnerability: Assessing the reliance on raw materials susceptible to climate impacts, such as those affected by drought or extreme weather.

- Regulatory Compliance: Staying ahead of evolving climate disclosure requirements and integrating them into corporate reporting.

- Resource Management: Developing strategies for more efficient resource utilization and exploring the use of recycled or renewable materials.

- Climate Risk Assessment: Quantifying the financial implications of climate-related physical and transition risks on operations and market demand.

Consumer and business demand for sustainable products is surging, with 73% of global consumers in 2024 indicating a willingness to alter consumption habits for environmental benefit. Acme United can capitalize on this by innovating product lines, like stationery, with recycled or biodegradable materials, aligning with global sustainability goals and potentially gaining a competitive edge through greener practices.

Tightening global regulations on waste management and recycling, such as the EU's Ecodesign for Sustainable Products Regulation (ESPR) from July 2024, necessitate a review of product and packaging recyclability. Acme United should explore circular economy strategies and ensure compliance with mandates for improved product durability, reparability, and recyclability.

The increasing focus on curbing carbon emissions and energy use is pushing manufacturers towards greener production methods. The EU's Corporate Sustainability Reporting Directive (CSRD), effective since 2023, requires detailed environmental disclosures, impacting companies like Acme United. Similarly, Australian accounting standards from 2024 emphasize Scope 1, 2, and 3 emissions reporting.

Acme United faces growing scrutiny over its entire supply chain's environmental footprint, from raw material sourcing to delivery. The transportation sector's 24% share of global direct CO2 emissions in 2022 highlights the impact of logistics. By 2024, stricter due diligence laws in many regions require businesses to actively manage environmental risks within their supply networks, urging Acme United to assess and potentially modify its sourcing and logistics.

| Environmental Factor | Impact on Acme United | Actionable Insight | Relevant Data/Regulation |

| Consumer Demand for Sustainability | Increased demand for eco-friendly products. | Innovate product lines with recycled/biodegradable materials. | 73% of global consumers (2024 Nielsen) would change habits to reduce environmental impact. |

| Waste Management & Recycling Regulations | Need to ensure product and packaging recyclability. | Adopt circular economy strategies; assess material lifecycle. | EU Ecodesign for Sustainable Products Regulation (ESPR) fully effective July 2024. |

| Carbon Emissions & Energy Use | Pressure to adopt greener production methods. | Invest in renewable energy; upgrade machinery for efficiency. | EU CSRD (2023) requires detailed environmental disclosures; Australian standards (2024) emphasize emissions reporting. |

| Supply Chain Environmental Footprint | Scrutiny on all value chain impacts. | Evaluate sourcing and logistics for environmental risk reduction. | Transportation sector accounted for 24% of global direct CO2 emissions (2022); stricter due diligence laws by 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Acme United is built on a robust foundation of data from official government publications, leading economic indicators, and reputable industry analysis firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.