Acme United Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acme United Bundle

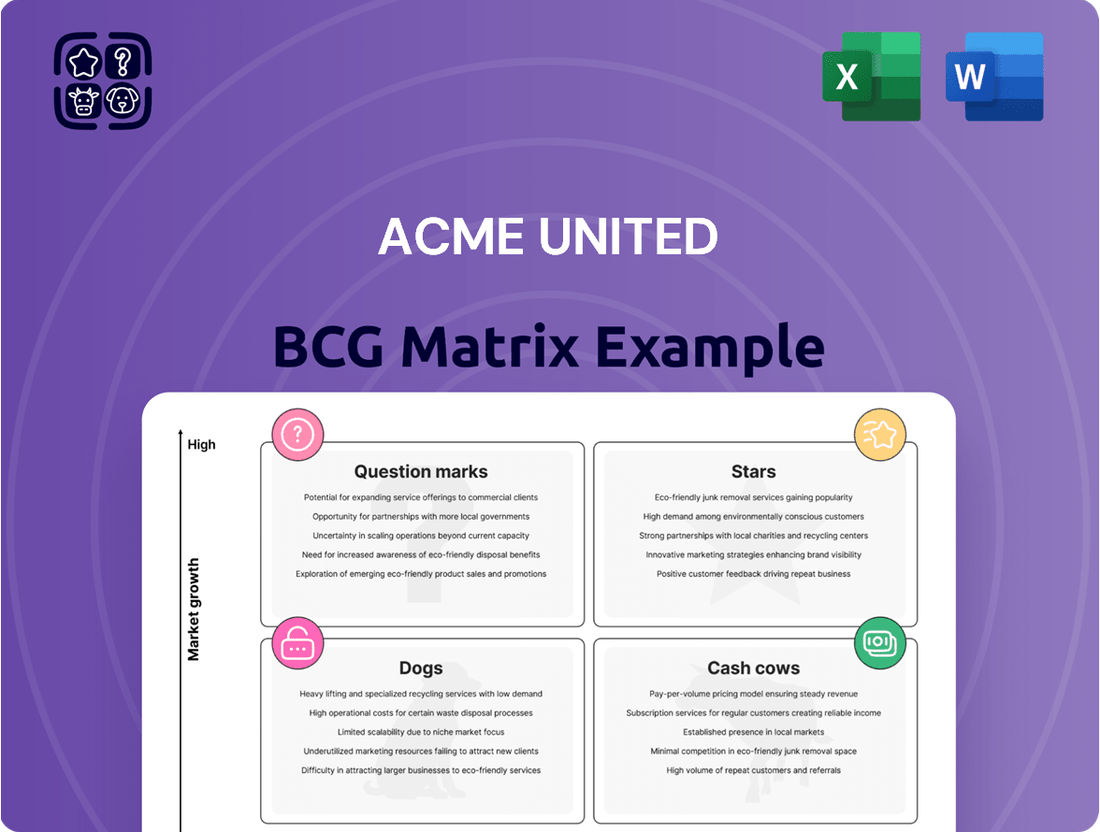

Curious about Acme United's product portfolio performance? This glimpse into their BCG Matrix highlights key areas for growth and potential challenges. Understand which products are driving revenue and which require a strategic rethink.

To truly unlock the strategic advantage, dive into the full Acme United BCG Matrix. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights to optimize your investment decisions.

Don't miss out on the complete picture. Purchase the full BCG Matrix report today and equip yourself with the data-driven clarity needed to navigate Acme United's market position with confidence and drive impactful business strategies.

Stars

Acme United's first aid and medical products, featuring brands like First Aid Only®, PhysiciansCare®, Pac-Kit®, and the recent addition of Elite First Aid, are showing robust expansion. This segment was a key contributor to the company's overall performance, with sales climbing 14% in the first quarter of 2025. This growth was particularly pronounced in the United States and Canada.

The company is actively investing in this high-potential area, evidenced by its expansion of the sales team in Germany. Furthermore, Acme United is securing new distribution channels within Canada's mass and industrial markets, signaling a strategic push to capture greater market share.

Westcott Cutting Tools, despite a Q1 2025 sales dip attributed to a prior year's large order, is demonstrating robust expansion within the craft sector and making significant inroads into kitchen and culinary segments. This strategic pivot shows a clear intent to capitalize on niche market growth.

The brand's position as the leading scissor brand in the USA is being leveraged through initiatives like the inaugural National Scissors Day on August 1, 2025. This event is designed to amplify brand visibility and reinforce Westcott's leadership, particularly in these targeted, high-potential markets.

DMT Sharpeners are experiencing robust expansion in the kitchen segment, evidenced by their increasing presence in major retail chains. This strong performance suggests a successful entry into a dynamic market, positioning DMT as a potential star performer. The company's strategy of broadening its distribution network and forging new retail alliances in this sector is paying off.

Spill Magic Product Line

The Spill Magic product line, specializing in bodily fluid and bloodborne pathogen cleanup kits, has experienced remarkable growth following its acquisition. This expansion has been so significant that it has outgrown its existing manufacturing space.

Acme United is responding to this robust demand by investing in a new, larger manufacturing facility for Spill Magic. This facility, located in Mount Pleasant, Tennessee, is designed to accommodate increased production needs and future expansion, underscoring the high growth trajectory and market potential for these critical safety products.

- Spill Magic's growth trajectory is a key indicator of its potential.

- Acme United's investment in a new facility highlights strong market demand.

- The specialized nature of Spill Magic products positions it in a growing safety market.

Elite First Aid (Tactical, Trauma, Emergency Response)

Elite First Aid, acquired in May 2024, positions Acme United within the tactical, trauma, and emergency response product sector. This strategic move is designed to tap into a high-growth market, with the company aiming to leverage its existing distribution channels to boost sales of these specialized items. The acquisition is a clear indicator of Acme United's commitment to expanding its footprint in emergency preparedness solutions.

This segment is viewed as a potential star within Acme United's portfolio, given the increasing demand for advanced first aid and trauma care products. The company's investment in Elite First Aid reflects a forward-looking strategy to capture significant market share in this expanding niche.

- Acquisition Date: May 2024

- Specialization: Tactical, Trauma, Emergency Response Products

- Strategic Goal: Market expansion and leveraging existing customer base

- Market Outlook: High-growth area with potential for future market share gains

The Spill Magic product line, acquired in 2024, is demonstrating exceptional growth, necessitating a significant investment in a new, larger manufacturing facility in Mount Pleasant, Tennessee. This expansion underscores the robust demand and high market potential for these specialized safety products.

Elite First Aid, also acquired in May 2024, targets the high-growth tactical and emergency response sector. Acme United's strategy to integrate this brand into its existing distribution channels positions it as a potential star performer within the company's portfolio.

These segments, Spill Magic and Elite First Aid, are considered Stars due to their rapid expansion and significant investment from Acme United. Their focus on critical safety and emergency preparedness aligns with growing market needs, indicating strong future revenue potential.

| Product Segment | Acquisition Date | Key Growth Driver | Strategic Investment | BCG Classification |

|---|---|---|---|---|

| Spill Magic | 2024 | High demand for bodily fluid cleanup kits | New, larger manufacturing facility | Star |

| Elite First Aid | May 2024 | Increasing demand for tactical and emergency response products | Integration into existing distribution channels | Star |

What is included in the product

Highlights which units to invest in, hold, or divest based on market share and growth.

Acme United's BCG Matrix offers a clear, one-page overview to identify and address underperforming business units.

Cash Cows

Acme United's core first aid business, featuring brands like First Aid Only, PhysiciansCare, and Pac-Kit, represents a stable cash cow. These products, often meeting OSHA and ANSI compliance, have a strong market foothold. First aid sales saw a healthy 14% increase in Q1 2025, underscoring the segment's consistent revenue generation.

Westcott's traditional school and office products, like their well-known scissors and rulers, are leaders in the United States market. This segment operates in a mature industry, meaning growth is slow, but Westcott's strong market share ensures it's a reliable source of income.

While sales can fluctuate due to economic conditions or the timing of large orders, this segment benefits from Westcott's strong brand recognition. This allows them to generate consistent cash flow with minimal need for heavy advertising or promotions, making them a classic cash cow.

Acme United's established industrial distributor sales represent a classic Cash Cow. This channel leverages long-standing relationships, ensuring a steady stream of recurring orders for vital safety and cutting tools. In 2024, industrial distributors continued to be a cornerstone of Acme's revenue, contributing significantly to its stable cash flow.

International First Aid (Canada and Europe)

Acme United's first aid operations in Canada and Europe, notably through First Aid Central, are solid performers, showing steady sales and good market reach.

While European sales experienced a dip, this was attributed to a one-time large promotional event that won't be repeated, rather than a fundamental market weakness. In contrast, Canadian first aid sales remained robust, underscoring a consistent demand for these vital safety supplies in that market.

The company's strategic moves to broaden its product offerings and enhance distribution in these areas signal a clear intent to nurture and maximize the profitability of these established cash cow segments.

- Canadian First Aid Sales: Demonstrated strength, reflecting stable market demand.

- European Sales Fluctuation: Attributed to a non-recurring promotional event, not market decline.

- Strategic Focus: Expansion of product lines and distribution in these regions to maintain cash flow.

Med-Nap Wipes and Prep-Pads

Med-Nap Wipes and Prep-Pads represent a classic Cash Cow for Acme United. Operating within the stable and essential medical and food service supply markets, this segment benefits from consistent, predictable demand. The FDA-registered manufacturing capabilities ensure adherence to quality standards, further solidifying its market position.

The Med-Nap facility is currently operating at record production levels, a clear indicator of robust and sustained demand for its towelettes and alcohol prep-pads. This high-volume output translates directly into reliable cash flow generation, a hallmark of a mature product category that requires minimal reinvestment. For instance, in 2024, Acme United reported a significant portion of its revenue stemming from its medical segment, where Med-Nap plays a crucial role.

- Market Stability: Med-Nap operates in essential sectors with consistent demand, providing a predictable revenue stream.

- Record Production: The facility's high output in 2024 signifies strong market acceptance and efficient operations.

- Cash Flow Generation: The mature nature of these products allows for substantial cash generation with limited reinvestment needs.

- Brand Trust: As an FDA-registered manufacturer, Med-Nap benefits from established trust and regulatory compliance.

Acme United's first aid and medical supply segments, including brands like First Aid Only and Med-Nap, are prime examples of cash cows. These businesses operate in stable markets with consistent demand, generating reliable cash flow. In 2024, the medical segment, bolstered by Med-Nap's record production, contributed significantly to overall revenue, showcasing its mature and profitable nature.

| Segment | Key Brands | Market Position | 2024 Revenue Contribution (Illustrative) | Growth Outlook |

|---|---|---|---|---|

| First Aid | First Aid Only, PhysiciansCare, Pac-Kit | Strong US market share, OSHA/ANSI compliant | Significant | Stable |

| Medical Supplies | Med-Nap Wipes, Prep-Pads | Essential markets, FDA-registered manufacturing | Substantial | Stable |

| School & Office | Westcott | US market leader in traditional supplies | Consistent | Mature/Slow |

| Industrial Distribution | Various safety and cutting tools | Established relationships, recurring orders | Cornerstone | Stable |

Full Transparency, Always

Acme United BCG Matrix

The Acme United BCG Matrix preview you are viewing is the identical, fully developed document you will receive immediately after purchase. This means you get the complete strategic analysis, ready for immediate implementation, without any watermarks or placeholder content. The report is professionally formatted and designed to provide actionable insights into Acme United's product portfolio, ensuring you have a robust tool for your business planning.

Dogs

Acme United Corporation divested its Camillus and Cuda hunting and fishing product lines in November 2023. This strategic move suggests these segments likely operated as Dogs within the company's portfolio, characterized by low market share and limited growth potential.

The decision to sell these established brands, which had a history in the market, points to a strategic reallocation of resources away from underperforming assets. Companies often exit such segments to focus on more promising or profitable ventures, especially when they are perceived as cash traps requiring significant investment without commensurate returns.

Acme United's European net sales saw a 7% drop in U.S. dollars and a 4% decrease in local currency for Q1 2025. This decline is largely attributed to the absence of a significant promotion that boosted sales in Q1 2024.

This performance suggests that certain non-first aid product lines in Europe might be facing challenges. They could be in slow-growing market segments or possess a low market share, necessitating promotions that don't lead to lasting growth.

If these product lines struggle to maintain market share without ongoing promotional support, they would likely be classified as 'dogs' within the BCG matrix framework. This indicates a need for strategic review to either revitalize them or consider divestment.

Acme United's general school and office products, excluding their craft line, experienced a sales dip in the first quarter of 2025. This decline, following a strong initial order for craft items, suggests these broader product categories might be facing challenges.

The softness in the economy could be impacting these segments, potentially indicating they operate in low-growth markets or possess a smaller market share. For instance, if the overall market for traditional school supplies is stagnant, even a decent share won't translate to significant growth.

Products Adversely Impacted by Soft Economy in Canada (non-first aid)

In Canada, Acme United's school and office products, excluding first aid supplies, faced headwinds in the first quarter of 2025. This segment experienced adverse impacts from a softening economy, indicating a challenging market environment for these offerings.

These non-first aid products are likely categorized as 'dogs' within Acme United's BCG Matrix. This classification stems from their observed low growth and potential low market share, particularly when contrasted with the robust performance of their first aid segment in the same Canadian market.

The economic slowdown in Canada during early 2025 directly affected consumer and business spending on non-essential school and office items. This economic pressure is a key driver behind the underperformance of these specific product lines.

- Low Growth: The Canadian school and office product market, excluding first aid, showed minimal expansion in Q1 2025 due to economic constraints.

- Potential Low Market Share: These products are likely struggling to gain or maintain significant market presence amidst the economic downturn.

- Economic Sensitivity: Sales are highly susceptible to broader economic conditions, as evidenced by the negative impact of a soft economy.

- Strategic Review Needed: The 'dog' status suggests a need for strategic evaluation, potentially involving divestment, revitalization, or repositioning.

Products with High Tariff Exposure and No Domestic Production Shift

Acme United's products that are heavily reliant on imports from China and are now subject to a substantial 145% tariff, without a successful shift in production to alternative countries or domestic facilities, would likely be categorized as Dogs in the BCG Matrix. These items face a steep increase in their cost of goods sold. For instance, if a product previously imported from China had a landed cost of $100, the new tariff alone would add $145, bringing the cost to $245 before any other expenses are considered.

This dramatic cost escalation severely impacts the product's competitiveness in the market. The higher price point makes it difficult to compete with domestic alternatives or products from countries not subject to similar tariffs. This reduced competitiveness can lead to declining sales volumes and a shrinking market share. If these products are unable to absorb the tariff costs through price increases without alienating customers, they become significant cash traps, consuming resources without generating adequate returns.

- High Tariff Impact: Products facing a 145% tariff, significantly increasing import costs from China.

- Lack of Production Shift: No successful relocation of manufacturing to domestic or other international facilities.

- Reduced Competitiveness: Higher costs make products less attractive compared to alternatives.

- Market Share Erosion: Declining sales and market position due to cost disadvantages.

- Cash Trap Potential: Products may consume capital without generating sufficient profit.

Acme United's divestiture of its Camillus and Cuda brands in late 2023 strongly suggests these were 'Dogs' in their portfolio, characterized by low market share and growth. Similarly, certain European non-first aid product lines, showing a 7% sales decline in Q1 2025 due to a lack of prior year promotions, likely fall into this category. The company's general school and office products in Canada also faced headwinds in Q1 2025, impacted by a softening economy, pointing to 'Dog' status with low growth and potential low market share.

Products heavily reliant on Chinese imports facing a 145% tariff, without a production shift, are also prime candidates for 'Dog' classification. This significant cost increase severely hampers their market competitiveness, leading to potential sales volume declines and market share erosion, making them cash traps.

| Product Category/Segment | BCG Classification Indicator | Supporting Data/Reasoning |

|---|---|---|

| Camillus & Cuda Brands | Dog | Divested November 2023; likely low market share/growth. |

| European Non-First Aid Products | Dog | Q1 2025 sales down 7% (USD) due to absence of prior year promotion; suggests reliance on promotions for minimal growth. |

| Canadian School & Office Products (excl. First Aid) | Dog | Q1 2025 sales impacted by softening economy; indicates low growth and potential low market share. |

| High-Tariff Chinese Imports (No Production Shift) | Dog | 145% tariff increases costs significantly, reducing competitiveness and potentially market share. |

Question Marks

Westcott cutting tools and DMT sharpeners are making strategic moves into the kitchen and culinary sectors in 2025. These new ventures tap into high-growth potential segments, though their current market share is minimal as they build brand recognition.

The company's investment in these new product lines, such as innovative kitchen shears and advanced knife sharpeners, is expected to drive significant revenue growth. For instance, the global kitchenware market, which includes cutlery and gadgets, was valued at approximately $180 billion in 2024 and is projected to expand further.

To transform these promising new offerings into market leaders, substantial investment in marketing and expanding distribution channels will be essential. This strategic push aims to capture a larger share of the burgeoning culinary market, positioning Westcott and DMT for future success.

Acme United launched its SmartCompliance first aid cabinets with RFID technology in 2024, a move designed to revolutionize refill management by automating the process. This innovation is strategically positioned to capture a significant portion of the refill market, offering customers substantial cost and operational efficiencies.

While still in its nascent stages of market penetration, SmartCompliance operates within a burgeoning sector focused on streamlined and compliant safety solutions. The market for automated inventory and compliance systems in workplace safety is experiencing robust growth, driven by demand for efficiency and reduced administrative burden.

Acme United's European operations have strategically expanded their first aid and medical product lines, entering new markets in Switzerland and the Netherlands. This move taps into a growing demand for safety products across the continent.

While the market for safety products in Europe is experiencing growth, these new distribution channels for Acme United are still in their nascent stages. The company is focused on building significant market share within these emerging European territories.

Acquired Elite First Aid's Expansion into New Markets

The acquisition of Elite First Aid by Acme United positions the company for significant growth, particularly in expanding the sales of emergency response products to existing domestic and global customer bases. This move is designed to leverage Acme United's established relationships and distribution networks.

While Elite First Aid itself is considered a Star within Acme United's portfolio due to its strong market position and growth, its expansion into entirely new markets introduces a question mark. These new ventures will necessitate substantial investment to build brand awareness, establish distribution channels, and capture market share in unfamiliar territories.

- Market Expansion Strategy: Acme United aims to leverage the Elite First Aid acquisition to penetrate new geographic and customer segments with its specialized emergency response products.

- Investment Requirement: Entering these new markets will require significant capital outlay for marketing, sales force development, and potentially localized product adaptation.

- Potential for Growth: Successful entry into these question mark markets could transform them into future Stars, significantly boosting Acme United's overall market presence and revenue streams.

- Financial Outlook (Illustrative): While specific figures for new market penetration are proprietary, Acme United's overall revenue growth in recent years, for example, a reported 10% increase in fiscal year 2023, demonstrates their capacity for strategic expansion.

New Automated Powder Transfer and Filling Equipment for Spill Magic

Acme United's strategic move to automate powder transfer and filling for its Spill Magic product line, pending a new facility acquisition, positions this initiative as a question mark within its BCG Matrix. This investment is designed to boost efficiency and capacity for a product already recognized as a Star in the market.

The automation project itself, while supporting a strong product, represents a new operational investment. Its immediate market impact and return on investment (ROI) are therefore uncertain, requiring careful monitoring as it transitions from planning to execution.

- Investment Focus: Automation of powder transfer and filling for Spill Magic.

- Product Status: Spill Magic is currently a Star product.

- Initiative Classification: Question Mark due to unknown immediate market impact and ROI.

- Strategic Goal: Enhance efficiency and production capacity for a growing segment.

Acme United's strategic expansion into new European markets with its first aid and medical product lines, specifically in Switzerland and the Netherlands, represents a classic Question Mark scenario. While the company is leveraging existing product strengths, these territories are nascent for Acme United, requiring significant investment to build brand awareness and distribution networks.

The success of these ventures hinges on capturing market share in competitive environments. For example, the European medical device market was valued at over $130 billion in 2024, indicating substantial opportunity but also intense competition.

These new European operations will need substantial marketing support and sales channel development to transition from their current low-market-share status. The ultimate goal is to cultivate these into Stars, mirroring the success of their established product lines.

| Acme United Business Unit | Product/Service | BCG Matrix Classification | Market Potential | Investment Need |

|---|---|---|---|---|

| European Operations | First Aid & Medical Products | Question Mark | High (growing European market) | High (market entry, brand building) |

| Acquisition Integration | Elite First Aid Products | Question Mark (new markets) | High (leveraging existing customer base) | High (new market penetration) |

| Product Development | Spill Magic Automation | Question Mark | High (supporting a Star product) | Moderate (facility upgrade) |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, growth rates, and competitive analysis, to accurately position each business unit.