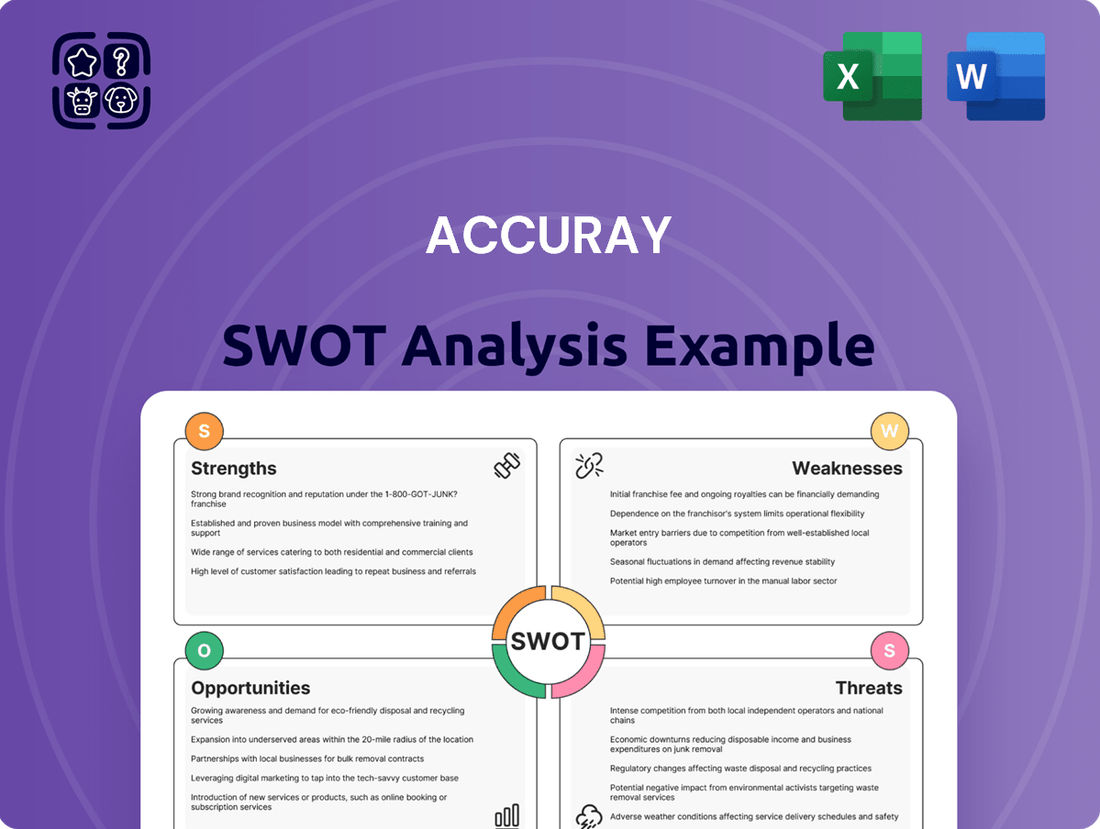

Accuray SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accuray Bundle

Accuray's strengths lie in its innovative radiation therapy systems, particularly its CyberKnife platform, which offers precise tumor targeting. However, the company faces significant competition and the high cost of its technology can be a barrier to adoption. Understanding these dynamics is crucial for any investor or strategist.

Want the full story behind Accuray's market position, its technological advantages, and the potential headwinds it faces? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Accuray's core strength lies in its proprietary advanced technology platforms, notably the CyberKnife and TomoTherapy systems. These are not just standard radiation delivery machines; they are highly precise and personalized treatment solutions designed to target tumors with exceptional accuracy, minimizing damage to surrounding healthy tissue. This technological edge is crucial in the competitive oncology market.

The distinct capabilities of CyberKnife and TomoTherapy allow Accuray to address a broad spectrum of tumors and medical conditions, establishing industry benchmarks for precision and efficacy. For instance, the CyberKnife S7 system, coupled with advanced imaging like ClearRT, represents the company's commitment to continuous innovation, aiming to directly improve patient outcomes and overall quality of life. Accuray reported revenue of $460.5 million for the fiscal year ended May 31, 2023, demonstrating market traction for its specialized technologies.

Accuray boasts a strong global commercial presence, performing well in both established and rapidly expanding emerging markets. This wide reach means their advanced radiotherapy systems are used by healthcare providers across the globe, increasing patient access to critical treatments.

Accuray's service business is a real powerhouse, making up a significant chunk of their overall revenue and, importantly, their gross margin. This means they have a steady, reliable income stream that isn't as volatile as product sales.

This segment has been consistently growing, which tells us that customers are happy with Accuray's support and maintenance for the systems they've already bought. For example, in the fiscal year 2023, Accuray reported that their service revenue increased by 7% year-over-year, reaching $235.5 million. This growth highlights the strong customer relationships and the value placed on keeping their advanced radiation therapy systems running smoothly.

The company's commitment to service excellence and ensuring their technology performs well really builds trust. It shows that customers can count on Accuray for ongoing support, which is crucial for healthcare providers relying on these complex medical devices.

Continuous Innovation and R&D Focus

Accuray's commitment to continuous innovation is a significant strength, consistently demonstrated through advancements in both hardware and software. The introduction of systems like the new Helix platform and adaptive treatment applications such as PreciseART and Synchrony technology highlight this focus. For instance, Accuray reported that in fiscal year 2023, R&D spending represented approximately 11% of their total revenue, underscoring their dedication to staying at the forefront of radiation oncology technology.

The integration of artificial intelligence across their product suite further solidifies this strength. AI is being leveraged to improve treatment planning efficiency, enhance image fusion accuracy, and enable more precise real-time tumor tracking during patient treatments. This strategic investment in AI is crucial for maintaining a competitive edge and delivering state-of-the-art solutions.

- Hardware Advancements: Introduction of new platforms like Helix.

- Software Innovation: Development of adaptive treatment applications (PreciseART, Synchrony).

- AI Integration: Enhancing treatment planning, image fusion, and real-time tracking.

- R&D Investment: Approximately 11% of revenue dedicated to R&D in FY23.

Strategic Industry Partnerships

Accuray's strategic industry partnerships are a significant strength, fostering innovation and expanding market reach. By collaborating with key players like Brainlab for neuro-radiosurgery and C-RAD for patient positioning, Accuray enhances its technological capabilities and treatment offerings.

These alliances, including those with RaySearch for advanced treatment planning and GE HealthCare for integrated diagnostic and therapy solutions, create powerful synergies. This collaborative approach allows Accuray to broaden its portfolio and tap into new market opportunities, solidifying its position in the radiation oncology sector.

- Enhanced Technological Integration: Partnerships facilitate the seamless integration of complementary technologies, improving the overall treatment delivery for patients.

- Expanded Market Access: Collaborations with established leaders provide Accuray with access to new customer segments and geographic regions.

- Innovation Acceleration: Joint development efforts with partners speed up the introduction of next-generation radiation therapy solutions.

- Portfolio Diversification: Strategic alliances allow Accuray to offer a more comprehensive suite of products and services, meeting a wider range of customer needs.

Accuray's proprietary technology, including CyberKnife and TomoTherapy, offers unparalleled precision in radiation delivery, setting industry standards for personalized cancer treatment. This technological leadership is a cornerstone of their market appeal.

The company's robust service revenue, which grew 7% year-over-year to $235.5 million in fiscal year 2023, provides a stable and high-margin income stream, demonstrating strong customer loyalty and reliance on their advanced systems.

Accuray's dedication to innovation is evident in its substantial R&D investment, representing about 11% of revenue in FY23, and the integration of AI across its product suite to enhance treatment planning and delivery accuracy.

Strategic partnerships with companies like Brainlab and C-RAD amplify Accuray's technological capabilities and market reach, allowing for integrated solutions and accelerated development of next-generation radiotherapy.

| Strength | Description | Supporting Data |

|---|---|---|

| Proprietary Technology | Highly precise and personalized radiation therapy systems (CyberKnife, TomoTherapy). | Industry benchmarks for accuracy and efficacy. |

| Strong Service Business | Reliable, high-margin revenue stream from maintenance and support. | Service revenue increased 7% YoY to $235.5 million in FY23. |

| Continuous Innovation | Investment in R&D and AI integration for advanced treatment solutions. | R&D spending was ~11% of revenue in FY23; AI enhances planning and tracking. |

| Strategic Partnerships | Collaborations enhance technological integration and market access. | Partnerships with Brainlab, C-RAD, RaySearch, and GE HealthCare. |

What is included in the product

Delivers a strategic overview of Accuray’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT analysis that pinpoints opportunities for Accuray to alleviate customer pain points in radiation therapy.

Weaknesses

Accuray is experiencing reduced visibility regarding its near-term revenue and earnings growth. This is largely due to prevailing global market uncertainties, which make precise financial performance forecasting a significant challenge for the company.

This lack of clarity in future financial outcomes can complicate strategic planning efforts and potentially dampen investor confidence. For instance, during fiscal year 2023, Accuray reported total revenue of $501.6 million, a slight decrease from $513.5 million in fiscal year 2022, highlighting the fluctuating nature of their performance.

Accuray faces significant headwinds from recent tariff policies, particularly those impacting sales in China. These tariffs are projected to exert downward pressure on the company's revenue and gross margin, with an estimated incremental net China margin deferral potentially reducing profitability.

The ongoing uncertainty surrounding potential exemptions for medical devices adds another layer of complexity, making it difficult to accurately forecast the financial impact of these trade policies on Accuray's performance in the crucial Chinese market.

Accuray has experienced a noticeable decline in its gross product orders and overall order backlog over recent fiscal quarters when compared to earlier periods. For instance, in the first quarter of fiscal year 2024, Accuray reported gross product orders of $55.8 million, a decrease from $67.5 million in the same period of fiscal year 2023.

This downward trend in the order backlog is a significant concern as it can signal a potential slowdown in future revenue generation and highlight increasing competitive pressures in securing new business. Investors and stakeholders are closely watching how Accuray addresses this challenge to ensure continued growth and market presence.

Fluctuations in Product Revenue

While Accuray's overall revenue has shown growth, product revenue has seen some recent quarterly dips year-over-year. For instance, in the fiscal third quarter of 2024, product revenue was $55.1 million, a slight decrease from $56.5 million in the same period of fiscal 2023. This suggests a potential over-reliance on service revenue to smooth out the inherent volatility in product sales.

This fluctuation in product revenue highlights a key weakness for Accuray.

- Product Sales Volatility: Recent quarters have shown year-over-year decreases in product revenue, indicating a potential vulnerability in sales cycles or market demand for their core offerings.

- Dependence on Service Revenue: The company may be leaning on its service and maintenance contracts to offset the variability in upfront product sales, which could limit long-term growth potential if product innovation or market penetration falters.

- Need for Revenue Diversification: Strengthening product sales through new market penetration or product line expansion is crucial for achieving more balanced and predictable financial performance.

Intense Competition in a Niche Market

Accuray faces significant pressure in the radiotherapy sector, a market characterized by intense competition. Key rivals like Varian (now part of Siemens Healthineers) and Elekta command substantial market share, creating a challenging environment for Accuray to expand its own. This rivalry often translates into pricing pressures and necessitates substantial ongoing investment in research and development to stay ahead.

The need for continuous, high-cost innovation to maintain relevance is a critical weakness. For instance, the development of advanced treatment technologies, such as adaptive radiotherapy and AI-driven treatment planning, requires considerable capital outlay. Accuray’s ability to compete effectively hinges on its capacity to match or exceed the innovation pace set by its larger competitors, which can strain financial resources.

- Market Share Dynamics: In 2023, the global radiotherapy market was valued at approximately $7.5 billion, with Varian and Elekta holding a combined market share estimated to be over 60%. Accuray, while a significant player, operates with a smaller share, necessitating aggressive strategies to gain ground.

- R&D Investment: Companies in this space typically invest between 10-15% of their revenue back into R&D. Accuray's ability to sustain this level of investment relative to its revenue is crucial for its competitive standing.

- Technological Advancements: The introduction of new platforms and software updates by competitors can quickly shift market perception and demand, forcing Accuray to accelerate its own product development cycles.

Accuray's financial performance is subject to considerable uncertainty, making short-term revenue and earnings projections challenging. This is compounded by global market volatility, which impacts the predictability of their financial outcomes and can affect investor sentiment.

The company is also navigating the impact of recent tariffs, particularly those affecting sales in China, which are expected to negatively influence revenue and profit margins. The ongoing ambiguity surrounding potential exemptions for medical devices further complicates financial forecasting in this key market.

A notable weakness lies in the declining trend of gross product orders and the overall order backlog, as evidenced by the Q1 FY2024 figures showing a decrease compared to the prior year. This slowdown in new orders suggests potential challenges in securing future business and may indicate intensifying competition.

Accuray also experiences product sales volatility, with some recent quarters showing year-over-year declines in product revenue, such as $55.1 million in Q3 FY2024 compared to $56.5 million in Q3 FY2023. This reliance on service revenue to offset product sales fluctuations could limit long-term growth if product innovation or market penetration falters.

Full Version Awaits

Accuray SWOT Analysis

This is the actual Accuray SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can trust that the insights and structure you see here are representative of the complete, in-depth report.

Opportunities

The global radiotherapy market is experiencing robust expansion, fueled by an increasing cancer incidence worldwide. Projections estimate the market will reach significant valuations by 2033-2034, presenting a substantial opportunity for Accuray to grow its revenue streams and capture a larger share of this expanding sector.

Accuray is seeing a notable uptick in demand for its advanced cancer treatment solutions within rapidly expanding emerging markets. These regions are increasingly investing in healthcare infrastructure, opening doors for greater market penetration and substantial revenue growth.

The growing accessibility of cutting-edge cancer therapies in these areas presents a significant opportunity. For instance, the strong performance of Accuray's systems, such as the Tomo C System, in China underscores this promising trend.

The integration of Artificial Intelligence (AI) and advanced technologies presents a significant opportunity for Accuray. AI's growing role in areas like automated contouring, dose optimization, image fusion, and real-time tumor tracking can lead to more efficient and precise cancer treatments.

Accuray's existing AI-driven Synchrony technology is a strong foundation. This technology already demonstrates the company's commitment to leveraging AI for improved patient care, positioning Accuray to capitalize on these ongoing technological advancements in the oncology sector.

Addressing the Global Cancer Care Gap

There's a significant worldwide difference in who gets good cancer treatment, especially radiation therapy. Many areas simply don't have the necessary equipment or expertise. This is where Accuray's mission to make treatment more accessible, by developing solutions to close this gap, becomes a major opportunity. Their focus directly supports global health efforts aimed at improving cancer outcomes everywhere.

This dedication to bridging the care gap can unlock new avenues for Accuray. By offering their advanced technologies in regions that currently lack them, they can establish a strong presence and forge valuable partnerships. For example, the World Health Organization has highlighted that low- and middle-income countries face the greatest burden of cancer deaths, often due to limited access to radiotherapy. Accuray's expansion into these markets could significantly improve patient survival rates.

- Expanding Access: Accuray's technology can be deployed in regions with limited infrastructure, addressing a critical need for advanced cancer treatment.

- Market Growth: Targeting underserved markets represents a significant growth opportunity, as demand for radiotherapy solutions remains high globally.

- Partnerships: Collaborating with governments and healthcare organizations in developing nations can create sustainable business models and improve patient care.

Strategic Acquisitions and Collaborations

Accuray has a significant opportunity to bolster its market position through strategic acquisitions and collaborations, moving beyond its existing partnerships. This proactive approach can significantly enhance its technological capabilities and broaden its global footprint.

Exploring ventures into cutting-edge areas such as FLASH radiotherapy or MRI-guided linear accelerators (LINACs) presents a clear path for innovation. Furthermore, integrating digital health platforms could streamline patient care and data management, aligning with the evolving healthcare landscape.

- Acquire companies specializing in FLASH radiotherapy technology to gain immediate access to this advanced treatment modality.

- Collaborate with MRI manufacturers to accelerate the development and deployment of integrated MRI-guided LINAC systems.

- Invest in or acquire digital health startups focused on AI-driven treatment planning or remote patient monitoring to expand service offerings.

- Target geographical expansion through acquisition of established regional distributors or service providers in underserved markets.

Accuray is well-positioned to capitalize on the expanding global radiotherapy market, which is projected to see substantial growth through 2033-2034. The company's advanced cancer treatment solutions are experiencing increased demand in emerging markets, which are actively investing in healthcare infrastructure. Accuray's existing AI-driven Synchrony technology provides a strong foundation for further integration of AI in areas like automated contouring and dose optimization, leading to more precise treatments.

The company can further enhance its market position through strategic acquisitions and collaborations, particularly in emerging fields like FLASH radiotherapy and MRI-guided linear accelerators. Expanding into underserved geographical regions also presents a significant growth opportunity, as many low- and middle-income countries face a substantial burden of cancer deaths due to limited access to radiotherapy. For instance, the World Health Organization has emphasized this disparity, highlighting the potential for Accuray to improve patient outcomes globally.

| Opportunity Area | Description | Potential Impact |

|---|---|---|

| Global Market Expansion | Growing cancer incidence and increased healthcare spending worldwide. | Increased revenue and market share capture. |

| Emerging Markets | Rising demand for advanced cancer treatment solutions in developing economies. | Significant revenue growth and deeper market penetration. |

| AI Integration | Leveraging AI for automated contouring, dose optimization, and real-time tumor tracking. | Enhanced treatment precision and efficiency. |

| Strategic Acquisitions & Collaborations | Venturing into FLASH radiotherapy and MRI-guided LINACs, digital health platforms. | Technological advancement and broadened service offerings. |

| Bridging the Care Gap | Providing radiotherapy solutions to underserved regions with limited access. | Improved patient outcomes and strong global health impact. |

Threats

Accuray operates in a highly competitive landscape, facing formidable rivals such as Varian Medical Systems, now part of Siemens Healthineers, and Elekta. These established market leaders possess substantial financial backing, extensive product offerings, and robust global distribution channels, which can present significant challenges for Accuray in expanding its market presence and negotiating pricing.

Global economic volatility and ongoing geopolitical realignments present significant threats to Accuray. Trade tariffs and international conflicts can disrupt supply chains and impact customer capital expenditure decisions. For instance, the imposition of tariffs, like those seen impacting trade with China, can directly increase costs for imported components or finished goods, squeezing profit margins.

Currency exchange rate fluctuations, driven by geopolitical events and economic instability, also pose a risk. As a global company, Accuray's reported earnings can be affected by the translation of foreign currency revenues and expenses. The economic slowdowns in key markets, exacerbated by these global uncertainties, could also dampen demand for Accuray's advanced radiation therapy systems.

Changes in healthcare regulations, particularly around medical device approvals and data privacy, pose a significant challenge. For instance, the EU's Medical Device Regulation (MDR) has increased compliance burdens for manufacturers.

Shifting reimbursement policies for radiation therapy equipment in key markets like the US could directly affect Accuray's revenue streams. Reduced reimbursement rates for advanced treatment technologies would likely impact system adoption and profitability.

Navigating these evolving regulatory and reimbursement landscapes requires substantial investment in compliance and market access strategies, potentially diverting resources from innovation and sales efforts.

Rapid Technological Obsolescence

The medical technology landscape is evolving at a breakneck pace, posing a significant threat of rapid technological obsolescence for Accuray. Competitors, including established players and agile startups, are consistently introducing more advanced systems. This continuous innovation cycle means Accuray must invest heavily in research and development to maintain its competitive edge, a challenge given the high costs associated with developing cutting-edge medical devices.

For instance, the global medical device market, projected to reach over $600 billion by 2025, highlights the intense innovation driving the sector. Accuray's ability to adapt and integrate new technologies, such as AI-powered treatment planning or more precise delivery systems, will be crucial. Failure to do so could lead to its current product portfolio becoming outdated, impacting market share and revenue streams.

Key considerations for Accuray include:

- R&D Investment: Sustained and strategic investment in R&D is paramount to counter obsolescence.

- Competitive Landscape: Monitoring and responding to new technological advancements from competitors is essential.

- Product Lifecycle Management: Effectively managing the lifecycle of existing products while developing next-generation solutions is critical.

- Market Adoption: Ensuring new technologies are adopted by healthcare providers swiftly to maximize their impact and recoup R&D costs.

Supply Chain Disruptions and Component Shortages

Accuray's production of sophisticated radiotherapy systems faces significant risks from global supply chain volatility and shortages of essential components. These disruptions can directly impede manufacturing timelines, escalate production expenses, and hinder the company's capacity to fulfill client orders, ultimately affecting revenue streams and customer loyalty.

For instance, the semiconductor industry, a critical supplier for advanced medical equipment, experienced widespread shortages throughout 2021 and 2022, impacting various manufacturing sectors. While some improvements were noted by late 2023, continued geopolitical tensions and demand fluctuations in 2024 and into 2025 suggest ongoing potential for component scarcity.

- Production Delays: Shortages of specialized microchips or advanced materials can halt assembly lines for Accuray's CyberKnife and Rad Онc systems.

- Increased Costs: Expedited shipping or sourcing from alternative, more expensive suppliers to mitigate delays can drive up the cost of goods sold.

- Revenue Impact: Inability to deliver systems on schedule due to supply chain issues directly translates to deferred revenue recognition and potential loss of sales opportunities.

Accuray faces significant threats from intense competition, with established players like Siemens Healthineers (Varian) and Elekta leveraging greater financial resources and broader market reach. Economic instability and geopolitical tensions can disrupt supply chains, increase costs through tariffs, and dampen customer spending on capital equipment, impacting Accuray's revenue and margins.

Evolving healthcare regulations, such as the EU's MDR, and shifting reimbursement policies in key markets like the US present compliance challenges and could reduce the profitability of advanced treatment technologies. The rapid pace of technological advancement in medical devices also poses a threat of obsolescence, requiring continuous, high-cost R&D investment to remain competitive.

Supply chain disruptions, particularly for critical components like semiconductors, can lead to production delays, increased costs, and deferred revenue. For instance, while semiconductor shortages eased in late 2023, ongoing geopolitical factors in 2024-2025 suggest continued risks of component scarcity impacting Accuray's ability to meet demand for its systems.

SWOT Analysis Data Sources

This Accuray SWOT analysis is built upon a robust foundation of data, including company financial statements, market research reports, and expert industry analysis to ensure a comprehensive and accurate strategic overview.