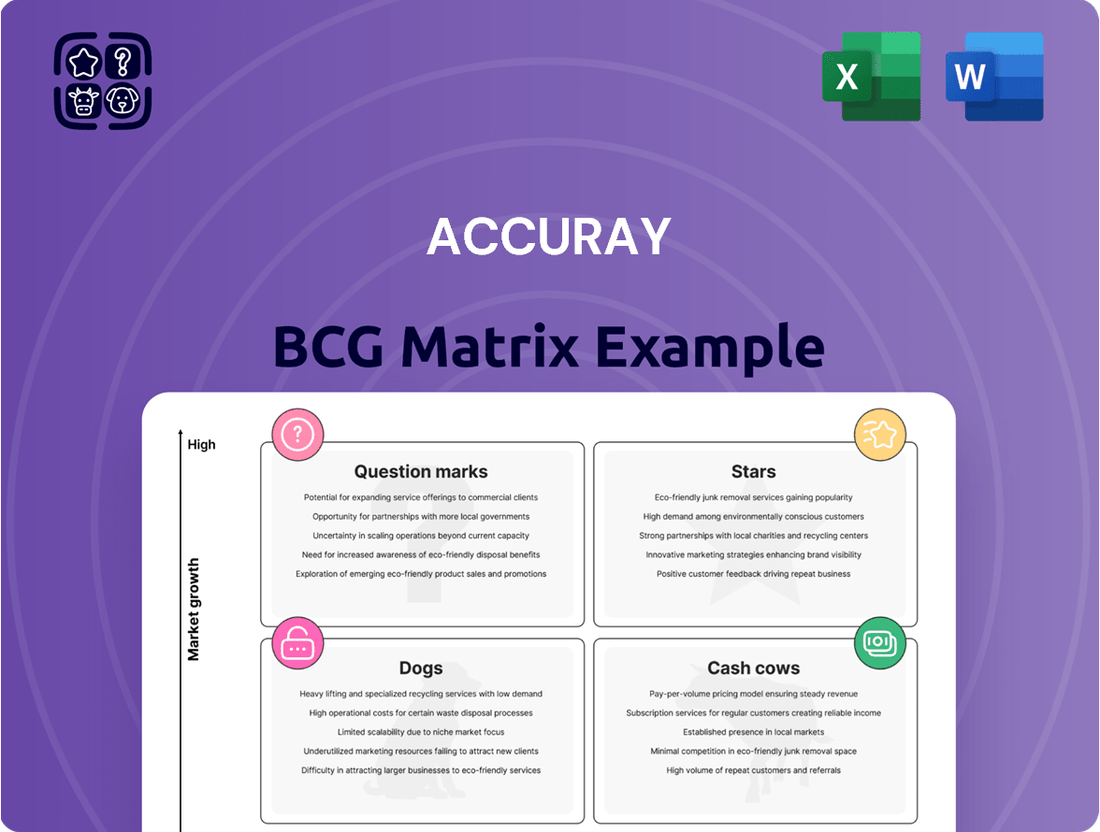

Accuray Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accuray Bundle

Uncover the strategic positioning of Accuray's product portfolio with our insightful BCG Matrix preview. See how their innovative technologies stack up as Stars, Cash Cows, Dogs, or Question Marks in the competitive healthcare landscape. Ready to transform this data into actionable growth strategies? Purchase the full BCG Matrix for a comprehensive breakdown, expert analysis, and a clear roadmap to optimize Accuray's market performance and future investments.

Stars

The CyberKnife S7 System is a standout performer for Accuray, fitting squarely into the Stars category of the BCG Matrix. Its revenue growth in fiscal Q2 2025 exceeded 50% year-over-year, a testament to its strong market penetration and demand.

This impressive growth is further supported by the broader CyberKnife market, which is projected to grow at a compound annual growth rate of 17.6% between 2025 and 2030. The S7's unique robotic radiotherapy capabilities for precise stereotactic treatments position it as a leader in a rapidly expanding segment of cancer care, justifying its Star status.

The Radixact System, enhanced by ClearRT imaging, is a significant advancement in radiation oncology, often considered a breakthrough. This technology is designed to provide superior tumor visualization and streamline treatment delivery, ultimately aiming for improved patient results.

Its market position is bolstered by strategic adoption, such as Heidelberg University Hospital's acquisition in June 2024, highlighting its potential within the growing radiotherapy sector.

Accuray's Tomo C System is a standout performer in China, achieving over 50% year-over-year revenue growth in fiscal Q2 2025. This remarkable expansion is primarily attributed to robust demand for the Tomo C System within the Chinese market.

A strategic joint venture has been instrumental in solidifying the Tomo C System's position as a critical growth engine for Accuray in China. The country's burgeoning healthcare sector, particularly its rapidly expanding radiation therapy market, provides a fertile ground for this product's continued success.

The significant market potential in China, coupled with the Tomo C System's strong adoption, firmly places it in the "Star" category within Accuray's product portfolio. This indicates high market share and high growth potential.

Advanced Radiosurgery and Radiation Therapy Systems

Accuray's advanced radiosurgery and radiation therapy systems, encompassing the CyberKnife and TomoTherapy platforms, solidify its position in the expanding global radiation oncology market. This growth is fueled by increasing cancer diagnoses and a greater need for precise, individualized treatments. Accuray's diverse and innovative product range allows them to cater to a wide array of patient requirements, maintaining a significant competitive advantage.

The company's portfolio is designed to offer highly targeted cancer treatments, minimizing damage to surrounding healthy tissue. This focus on precision is crucial as the global radiation oncology market is projected to reach approximately $11.4 billion by 2027, growing at a compound annual growth rate of around 7.5%.

- CyberKnife System: Known for its robotic precision and ability to deliver radiation from numerous angles, enabling treatment of tumors anywhere in the body.

- TomoTherapy System: Offers integrated helical IMRT and image guidance, allowing for precise daily treatment delivery and adaptive radiotherapy.

- Market Demand: The increasing incidence of cancer globally, with over 19 million new cases reported in 2020, drives demand for advanced radiation therapy solutions.

- Technological Advancement: Accuray's continuous investment in research and development ensures their systems remain at the forefront of radiation oncology technology.

Strategic Growth in Emerging Markets

Accuray is strategically targeting emerging markets for growth, aiming for a top-two market share position in these rapidly expanding regions. This focus extends beyond their established presence in China, recognizing the significant potential in areas with increasing healthcare investment and demand for advanced cancer therapies. For instance, in 2024, Accuray reported a 15% year-over-year revenue increase from its Asia-Pacific markets, largely driven by new installations in countries like India and South Korea.

- Focus on Market Share: Accuray's objective is to secure a leading position (number one or two) in key emerging markets.

- Healthcare Investment Growth: These regions are experiencing a rise in healthcare spending, creating fertile ground for advanced medical technologies.

- Increasing Demand: There's a growing need for sophisticated cancer treatment solutions, which Accuray's products address.

- Revenue Diversification: This expansion strategy aims to diversify revenue streams and establish long-term market leadership.

The CyberKnife S7 System and the Radixact System, especially with ClearRT imaging, are prime examples of Accuray's Stars. The CyberKnife S7 saw over 50% year-over-year revenue growth in fiscal Q2 2025, outperforming a market expected to grow at 17.6% annually through 2030. The Radixact's adoption, like at Heidelberg University Hospital in June 2024, underscores its strong position in a growing sector.

| Product | BCG Category | Key Growth Drivers | Recent Performance Indicator |

| CyberKnife S7 System | Star | Robotic precision, expanding stereotactic treatment market | >50% YoY revenue growth (FY Q2 2025) |

| Radixact System (with ClearRT) | Star | Superior tumor visualization, streamlined treatment delivery | Strategic adoption by leading hospitals |

| Tomo C System (China) | Star | High demand in China, strategic joint venture | >50% YoY revenue growth (FY Q2 2025) in China |

What is included in the product

The Accuray BCG Matrix categorizes products by market share and growth, guiding strategic decisions.

Clear visualization of Accuray's portfolio, simplifying strategic allocation decisions.

Cash Cows

Accuray's substantial global installed base of CyberKnife and TomoTherapy systems is a significant driver of recurring service revenue. This installed base, numbering in the hundreds of systems worldwide, ensures a predictable and stable income stream through ongoing service contracts.

These service contracts are essential for Accuray, providing consistent cash flows that bolster the company's financial stability. For instance, in fiscal year 2023, Accuray reported service and other revenue of $212.7 million, representing a substantial portion of their total revenue.

This reliable service revenue acts as a financial bedrock, enabling Accuray to fund its operational needs and invest in future growth initiatives. It offers a resilient financial foundation that complements potentially more variable product sales.

Mature TomoTherapy platform installations represent Accuray's established, older systems. These units likely hold a significant market share within their specific radiotherapy niche. Despite this strong position, the growth rate for these older installations is expected to be lower when compared to newer, more advanced technologies.

These systems continue to be reliable revenue generators. Income streams are derived from ongoing usage, essential maintenance contracts, and necessary upgrade packages. This consistent cash flow allows them to function as cash cows for Accuray.

As cash cows, these mature TomoTherapy installations require less aggressive investment in new sales efforts. Instead, they provide steady and predictable returns, supporting other areas of Accuray's business development and innovation pipeline.

Established CyberKnife installations in developed markets, especially North America, represent Accuray's cash cows. These mature markets have high adoption rates for CyberKnife, leading to consistent revenue generation through service, parts, and consumables. For instance, in the fiscal year 2023, Accuray reported that a significant portion of its revenue was derived from its installed base, underscoring the stability these systems provide.

Proprietary Treatment Planning and Data Management Systems

Accuray's proprietary treatment planning and data management systems, like Accuray Precision and iDMS, are critical to their oncology hardware. These integrated software solutions are not standalone products but are deeply embedded with their radiation therapy machines, creating a powerful ecosystem.

Once a clinic invests in Accuray's hardware, the adoption of these software systems becomes almost a necessity, fostering a sticky revenue model. This stickiness is driven by recurring revenue from software licenses, essential updates, and continuous technical support, making them a reliable cash generator.

The high adoption rate of these software systems, directly tied to their core hardware installations, solidifies their position as a stable, high-market-share component of Accuray's business. This ensures a consistent and predictable cash flow for the company.

- Accuray Precision: Advanced treatment planning software enhancing treatment efficacy.

- iDMS (Integrated Data Management System): Streamlines clinical workflow and data management for oncology departments.

- Revenue Stream: Generated through software licenses, recurring updates, and ongoing support contracts.

- Market Position: High adoption alongside Accuray's hardware platforms creates a dominant, stable revenue source.

Long-Standing Customer Relationships and Support Network

Accuray's extensive history, spanning over 30 years, has cultivated deep-seated relationships with healthcare institutions worldwide. This established global network translates into significant customer loyalty, driving repeat business through service contracts and system upgrades. For instance, in fiscal year 2023, Accuray reported that a substantial portion of its revenue stemmed from recurring service agreements, underscoring the stability these long-term partnerships provide.

These enduring connections, built on a foundation of technological innovation, create a predictable and reliable revenue stream. This stability means Accuray can rely less on intensive marketing efforts for these established products and services, much like a cash cow in a BCG matrix. The company's commitment to supporting its installed base ensures continued engagement and revenue generation from existing customers.

Key aspects of Accuray's cash cow strategy include:

- Long-term service contracts: These provide predictable recurring revenue.

- System upgrades and expansions: Existing customers often invest in enhancing their current Accuray systems.

- Customer support network: A robust support system fosters loyalty and reduces churn.

- Established global presence: Decades of operation have solidified Accuray's position in key markets.

Accuray's mature TomoTherapy and established CyberKnife installations, particularly in North America, function as its cash cows. These systems, backed by a robust installed base, generate consistent revenue primarily through service contracts, parts, and consumables. For instance, in fiscal year 2023, Accuray's service and other revenue reached $212.7 million, highlighting the stability these mature assets provide.

These cash cows require minimal investment in new sales efforts, instead offering steady, predictable returns that support the company's broader growth and innovation. The deep customer loyalty cultivated over Accuray's 30-plus years in the market further solidifies these revenue streams, ensuring continued engagement and predictable income from existing customers.

Accuray's integrated software solutions, like Accuray Precision and iDMS, also act as significant cash cows. Once a clinic invests in Accuray's hardware, these deeply embedded software systems become essential, driving recurring revenue from licenses, updates, and support, creating a sticky and reliable income model.

| Revenue Source | Platform | Key Drivers | Fiscal Year 2023 Revenue Contribution |

| Service & Consumables | TomoTherapy & CyberKnife (Mature Installations) | Service Contracts, Parts, Consumables, Upgrades | $212.7 million (Service and Other Revenue) |

| Software Licenses & Support | Accuray Precision, iDMS | Embedded Software, Recurring Licenses, Updates, Technical Support | Integral part of recurring revenue from hardware installations |

Preview = Final Product

Accuray BCG Matrix

The Accuray BCG Matrix document you are previewing is the exact, fully formatted report you will receive upon purchase. This means no watermarks, no placeholder text, and no demo content—just a comprehensive strategic tool ready for immediate application in your business planning. You can be confident that the insights and structure you see now are precisely what you'll be able to edit, present, or integrate into your decision-making processes. This preview ensures full transparency, so you know you're acquiring a polished and actionable resource designed for strategic clarity and professional use.

Dogs

Older, less feature-rich product generations, like very early models of Accuray's CyberKnife or TomoTherapy systems that are no longer actively marketed, can be categorized as Dogs in the BCG Matrix. These systems likely see minimal new unit sales growth. For instance, Accuray's 2023 annual report indicated a decline in their legacy systems segment revenue, suggesting a mature or declining market for these older technologies.

Accuray's underperforming regional markets represent its Dogs in the BCG Matrix. These are areas where the company's market share is low, and the market itself is experiencing little to no growth. For instance, while Accuray sees robust growth in markets like Asia-Pacific, certain established European or North American regions might be showing signs of saturation or facing intense competition, leading to stagnant sales.

These markets often demand significant investment in sales, marketing, and support, yet yield minimal returns, thus draining valuable resources. In 2024, it's crucial for Accuray to identify these specific geographies where the cost of maintaining or growing market share outweighs the potential revenue. For example, if a particular European country's radiotherapy device market grew by only 2% in 2023, and Accuray's market share remained flat at 3%, it would likely be categorized as a Dog.

Accuray's legacy products with high servicing costs and low upgrade incentives represent a classic 'Dog' category within the BCG Matrix. These might include older radiation therapy systems that are becoming increasingly expensive to maintain due to scarcity of replacement parts and the need for specialized technicians. For instance, if a system from the early 2010s requires significant ongoing support, but the available upgrade path offers only marginal improvements or is priced prohibitively for many customers, it fits this profile.

Segments Facing Intense Commoditization or Price Erosion

In the radiation oncology sector, Accuray might find certain market segments experiencing intense commoditization. This means competitors' products become very similar, leading to price wars and reduced profitability. If Accuray's solutions in these areas face significant price erosion, it could result in a low market share and very little growth potential.

These segments, where differentiating Accuray's technology becomes difficult, could be categorized as Dogs in the BCG matrix. Such areas may struggle to deliver attractive returns, potentially signaling that continued substantial investment might not be the most strategic move. This is an inferred possibility stemming from the competitive nature of the medical technology market.

- Market Share: Low

- Market Growth: Low

- Profitability: Potentially low due to price erosion

- Strategic Consideration: Divestment or minimal investment

Products with Limited Clinical Differentiation or Obsolete Technology

If Accuray's products, or key features within them, no longer offer a significant clinical edge because competitors have developed superior innovations, or if they become outdated technologically, they could be classified as Dogs in the BCG matrix. This lack of unique selling points would likely result in a shrinking market share and flat revenue growth. For instance, if a competitor introduces a significantly faster treatment delivery system, Accuray's existing systems might struggle to compete without substantial upgrades. In 2023, the radiation oncology market saw significant advancements in AI-driven treatment planning, a space where older technologies might fall behind if not updated.

Products in the Dog quadrant typically experience declining demand and generate low profits, if any. Accuray would need to carefully assess whether further investment in such products is warranted, or if it's more strategic to divest or phase them out. For example, a radiotherapy system that relies on older linac technology might face increasing maintenance costs and a shrinking customer base as newer, more efficient models become available. The company's 2024 financial reports will be crucial in identifying any product lines exhibiting these characteristics.

The strategic implication for Accuray is to avoid pouring additional resources into products that are unlikely to regain a competitive advantage. Instead, the focus should shift to optimizing the lifecycle of these products, perhaps through targeted support for existing customers, or to reallocating capital towards more promising areas of innovation. A hypothetical example could be a legacy CyberKnife system that, without significant software or hardware enhancements, might be outpaced by newer systems offering advanced motion management capabilities.

- Declining Market Share: Products losing their unique clinical advantages face reduced demand.

- Technological Obsolescence: Competitor innovations can render existing technologies less competitive.

- Reduced Investment: Minimizing further capital expenditure on underperforming products is key.

- Strategic Re-evaluation: Decision-making regarding divestment or phasing out may be necessary.

Accuray's "Dogs" are essentially its older, less competitive products or market segments with low growth and low market share. These often include legacy systems like early CyberKnife or TomoTherapy models that are no longer a primary focus for new sales. For instance, Accuray's 2023 revenue from its legacy systems segment showed a decline, indicating these products operate in a mature or shrinking market.

These segments, whether specific product lines or underperforming geographic regions, require significant investment for minimal returns. In 2024, Accuray must identify these areas, such as a European market with only 2% growth and a flat 3% market share for Accuray, to avoid resource drain. The key is to recognize when continued investment yields little strategic advantage.

Products that have lost their technological edge due to competitor advancements, like newer systems with faster treatment delivery, also fall into this category. Such obsolescence leads to declining market share and stagnant revenue. For example, advancements in AI-driven treatment planning in 2023 highlighted how older technologies might lag without updates.

Accuray's strategic approach to Dogs involves minimizing further investment and potentially divesting or phasing out these offerings. The focus should be on managing their lifecycle, perhaps through targeted support for existing users, and reallocating capital to more promising innovations. This ensures resources are directed towards areas with higher growth and profitability potential.

| BCG Category | Accuray Example | Market Growth | Market Share | Profitability |

|---|---|---|---|---|

| Dogs | Legacy CyberKnife/TomoTherapy systems | Low/Declining | Low | Low/Negative |

| Dogs | Underperforming regional markets | Low | Low | Low |

| Dogs | Products with technological obsolescence | Low | Declining | Low |

Question Marks

Accuray's new Helix system, having secured CE mark approval in fiscal Q1 2025, is positioned as a prime candidate for a 'Question Mark' within the BCG Matrix. This innovative system is designed to tap into new or underserved markets, suggesting a high growth potential but currently limited market penetration. The company's investment in this technology underscores its strategic importance for future expansion.

Accuray is investing heavily in AI to boost the precision of its radiation therapy systems. This push aims to improve how treatments are delivered and ultimately lead to better results for patients. For instance, in 2023, Accuray reported a 12% increase in its CyberKnife M6 system installations, showcasing market traction for its existing AI-enhanced technologies.

Looking ahead, truly advanced or standalone AI-powered imaging and treatment planning tools are still in their nascent stages of market development. These innovations are poised for significant growth, but currently represent a very small fraction of the overall market share. Accuray's commitment to research and development in this area is crucial for capturing this future potential.

Accuray is actively exploring therapeutic applications for its radiation delivery systems outside of oncology, aiming to tap into new, high-growth medical markets. This strategic pivot involves significant investment in research and development to demonstrate the efficacy of these technologies in treating non-cancerous conditions.

By venturing into these novel areas, Accuray seeks to establish a presence in markets where its current market share is negligible. For instance, exploring radiosurgery for neurological disorders like essential tremor or epilepsy could open up substantial revenue streams, given the increasing demand for less invasive treatment options.

The financial commitment for such expansions is considerable, encompassing clinical trials, regulatory submissions, and market education. Accuray's fiscal year 2024 financial reports will likely reflect increased R&D spending as it pursues these diversification efforts, aiming to build a robust pipeline of future growth opportunities.

Strategic Partnerships in Untapped Emerging Geographies

Accuray's strategic initiative to establish additional partnerships and expand into other untapped emerging markets, beyond its successful joint venture in China, would categorize these new geographic ventures as Stars.

These efforts target high-growth regions but commence with a low market presence, necessitating considerable investment and focused market development. For instance, in 2024, Accuray announced plans to strengthen its presence in Southeast Asia, a region projected to see significant growth in healthcare infrastructure spending.

- Star: High market growth rate, low relative market share.

- Target Geographies: Emerging markets with increasing demand for advanced cancer treatments.

- Investment Focus: Building market presence and patient access through strategic partnerships.

- 2024 Data: Expansion into Southeast Asia, targeting regions with substantial healthcare investment growth.

Development of Truly Adaptive Radiotherapy Solutions

Accuray's commitment to developing truly adaptive radiotherapy solutions positions them to address a burgeoning market. These advanced systems, designed to dynamically adjust treatment based on real-time patient data, represent a significant technological leap forward. If successful, these innovations would likely target a high-growth segment within the oncology sector, a market that saw global radiotherapy equipment revenue reach approximately $5.5 billion in 2023, with projections indicating continued expansion.

However, as these adaptive technologies are still in their developmental stages, they would initially be classified as Question Marks within the BCG matrix. This means they are entering a rapidly evolving market with substantial growth potential but currently hold a low market share. Accuray will need to invest heavily in research, clinical trials, and market education to drive adoption and establish a strong foothold.

- High-Growth Potential: The market for advanced radiotherapy, including adaptive solutions, is expanding due to increasing cancer diagnoses and demand for personalized treatment.

- Low Market Share: As new technologies, truly adaptive radiotherapy solutions would initially have limited penetration and brand recognition.

- Significant Investment Required: Substantial capital will be needed for R&D, regulatory approvals, and commercialization to capture market share.

- Strategic Importance: Success in this area could position Accuray as a leader in next-generation cancer treatment, driving future revenue growth.

Accuray's exploration into non-oncology applications for its radiation systems, such as treating neurological disorders, represents a classic 'Question Mark' scenario. These ventures target high-growth potential markets but currently have minimal market share and require significant investment to prove efficacy and gain adoption. The company's commitment to research and development in these nascent areas is key to unlocking future revenue streams.

The development of advanced AI-powered imaging and treatment planning tools also falls into the 'Question Mark' category. While the potential for improved patient outcomes and market disruption is substantial, these technologies are still in early stages of market penetration. Accuray's investment here is a bet on future market leadership in precision medicine.

Accuray's new Helix system, having secured CE mark approval in fiscal Q1 2025, is positioned as a prime candidate for a 'Question Mark' within the BCG Matrix. This innovative system is designed to tap into new or underserved markets, suggesting a high growth potential but currently limited market penetration. The company's investment in this technology underscores its strategic importance for future expansion.

Accuray is investing heavily in AI to boost the precision of its radiation therapy systems. This push aims to improve how treatments are delivered and ultimately lead to better results for patients. For instance, in 2023, Accuray reported a 12% increase in its CyberKnife M6 system installations, showcasing market traction for its existing AI-enhanced technologies.

BCG Matrix Data Sources

Our BCG Matrix leverages financial disclosures, industry research, and market trend analysis to provide a comprehensive view of business unit performance and potential.