Accuray PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accuray Bundle

Uncover the critical political, economic, social, and technological forces shaping Accuray's trajectory. Our PESTLE analysis provides a deep dive into these external factors, offering actionable intelligence for strategic planning. Download the full version to gain a competitive edge and anticipate future market shifts.

Political factors

Government healthcare policies are a major driver for companies like Accuray. For instance, the U.S. Centers for Medicare & Medicaid Services (CMS) sets reimbursement rates for medical procedures, which directly affects how much hospitals can pay for Accuray's advanced radiotherapy systems. In 2024, CMS proposed updates to Medicare payment policies that could influence capital spending on new medical technologies.

Shifts in government healthcare spending, such as potential federal budget adjustments or changes in national health priorities, can significantly alter demand for sophisticated medical equipment. Accuray's lobbying efforts aim to ensure that policies support value-based care and improve access to critical treatments, particularly for underserved populations. Their advocacy for expanded rural healthcare access in 2024 highlights this strategic focus.

Global trade dynamics, particularly the implementation of tariffs, present a significant variable for Accuray. Changes in trade policies can directly influence the cost of components sourced internationally and the pricing of their advanced radiation therapy systems in various markets.

For example, a shift towards reshoring or increased protectionist measures in key economic blocs could necessitate higher production costs for Accuray. This could stem from tariffs on imported materials or components essential for their medical devices.

Accuray's financial outlook for fiscal year 2025 anticipates a limited effect from tariffs. However, the ongoing evolution of international trade agreements and potential new tariff impositions mean this remains a crucial factor to monitor for potential impacts on their supply chain efficiency and overall profitability.

Accuray operates within a dynamic regulatory environment for medical devices. For instance, the EU's Medical Device Regulation (MDR) continues to shape market access, requiring extensive clinical data and post-market surveillance. This evolution impacts how Accuray develops and launches its advanced radiation therapy systems.

Navigating varied international regulations is crucial. In 2024, countries like India are implementing stricter conformity assessment procedures for medical devices, while Japan's PMDA is increasingly scrutinizing software as a medical device (SaMD) components, a growing area for Accuray's AI-driven solutions.

Healthcare System Reforms and Value-Based Care

The global healthcare landscape is increasingly prioritizing value-based care, a paradigm shift away from fee-for-service models. This means providers are reimbursed based on patient outcomes and the quality of care delivered, rather than simply the volume of procedures performed. Accuray's advanced radiation oncology systems are strategically positioned to thrive in this environment by demonstrating tangible clinical and economic benefits. For instance, by enabling more precise treatments, Accuray's technology can potentially reduce side effects, shorten hospital stays, and improve patient recovery times, all key metrics in value-based reimbursement frameworks.

This trend directly impacts Accuray's market strategy, as the company emphasizes the cost-effectiveness and superior patient outcomes associated with its CyberKnife and Radixact platforms. The focus is on showcasing how these systems can lower the overall cost of cancer treatment while simultaneously enhancing patient safety and efficacy. For example, Accuray reported in its fiscal year 2024 earnings that its solutions contribute to improved operational efficiency for healthcare providers, a crucial factor when evaluating the economic value of medical technologies under new payment models.

- Value-Based Care Adoption: Many countries and payers are actively implementing value-based purchasing programs, with the US Medicare program being a prominent example of a large-scale shift.

- Accuray's Alignment: Accuray's technology is designed to support the goals of value-based care by enabling more targeted treatments, potentially leading to fewer side effects and reduced overall treatment costs.

- Demonstrating ROI: The company's efforts focus on quantifying the return on investment for healthcare systems, highlighting how its solutions can improve patient outcomes and reduce long-term healthcare expenditures.

Political Stability and Geopolitical Events

Political stability in key markets directly impacts Accuray's international operations and growth potential. For instance, the company's significant presence and expansion plans in regions like Asia Pacific are sensitive to local political climates.

Broader geopolitical events, such as trade disputes or international sanctions, can disrupt supply chains and affect market access for Accuray's advanced radiotherapy systems. This necessitates careful navigation of global political landscapes.

Accuray's strategic joint venture in China, a crucial market, relies heavily on a stable political environment and favorable government policies for healthcare technology adoption. Similarly, efforts to increase radiotherapy access in emerging economies like India are contingent on supportive government initiatives and political stability.

- Accuray's presence in China, a key market, is influenced by the nation's political stability and regulatory environment.

- Geopolitical tensions can impact Accuray's global supply chain and market access for its medical devices.

- Expansion into emerging markets like India depends on government support and stable political conditions for healthcare infrastructure development.

Government healthcare policies significantly influence Accuray's market. For example, the U.S. Centers for Medicare & Medicaid Services (CMS) reimbursement rates for procedures directly affect hospital spending on Accuray's systems. In 2024, proposed CMS payment policy updates could impact capital investments in new medical technologies, while shifts in national health priorities or federal budgets can alter demand for advanced equipment. Accuray actively lobbies for policies that support value-based care and improved access to treatments, as seen in their 2024 advocacy for expanded rural healthcare access.

What is included in the product

Accuray's PESTLE analysis dissects the external macro-environmental landscape, examining how Political, Economic, Social, Technological, Environmental, and Legal factors present both challenges and advantages for the company.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining external factor analysis.

Economic factors

Global healthcare expenditure is a major driver for companies like Accuray. The worldwide radiotherapy market is expected to see substantial growth, fueled by increased spending on healthcare and a push for more sophisticated treatment technologies. This trend points to a positive economic outlook for Accuray.

For instance, the United States, a key market for Accuray, has seen consistent growth in national health spending. In 2023, US healthcare spending reached an estimated $4.5 trillion, representing a significant portion of the nation's GDP and highlighting a strong economic environment for medical device providers.

The escalating global incidence of cancer directly fuels the demand for radiotherapy solutions. More diagnoses, particularly for prevalent cancers like breast and prostate, translate into a larger patient pool seeking Accuray's advanced treatment options.

Globally, cancer incidence is projected to reach 28.8 million new cases annually by 2040, a significant increase from recent years, underscoring the growing need for effective cancer care technologies.

Changes in reimbursement policies, especially the move towards bundled payment models, significantly affect Accuray's financial performance by potentially consolidating payment for services and equipment. Value analysis committees are increasingly scrutinizing medical device costs, demanding clear evidence of cost-effectiveness and clinical superiority for systems like Accuray's radiation therapy platforms.

For instance, the Centers for Medicare & Medicaid Services (CMS) continually updates its payment rules, and any reduction in reimbursement rates for radiation oncology procedures or capital equipment could directly impact Accuray's sales cycles and order volumes. Demonstrating a strong return on investment and improved patient outcomes is crucial for securing favorable reimbursement in this evolving payer landscape.

Competition and Market Share

The radiotherapy market is indeed quite competitive, with Accuray being one of the significant players. However, it's not alone; other companies also vie for market share. This landscape means Accuray must constantly innovate to maintain its position.

Market share dynamics are heavily influenced by established treatment modalities. For instance, external beam radiation therapy (EBRT) continues to hold a dominant position, which can impact the adoption rates of newer technologies that Accuray might offer. Understanding these existing preferences is crucial for Accuray's strategic planning.

The availability of cutting-edge technologies within hospitals also plays a vital role. Hospitals often invest in the latest equipment, and their choices directly affect competitive dynamics. Accuray's strategic positioning is therefore tied to its ability to offer compelling technological advancements that hospitals deem essential.

Key competitive factors include:

- Market Share Dominance: Established treatment methods like EBRT continue to command a significant portion of the market, posing a challenge for newer technologies.

- Technological Advancements: The rapid evolution of radiotherapy equipment means companies like Accuray must continuously invest in R&D to stay ahead.

- Key Competitors: Major players in the radiotherapy market include Varian Medical Systems (now part of Siemens Healthineers), Elekta, and Boston Scientific, all of whom offer competing solutions.

- Hospital Adoption Rates: The willingness and ability of healthcare facilities to adopt and integrate new technologies directly impact market share and competitive positioning.

Supply Chain and Inflationary Pressures

Global economic uncertainties, particularly persistent inflationary pressures and ongoing supply chain disruptions, present significant headwinds for medical device manufacturers like Accuray. These factors directly impact operational costs and strategic planning within the MedTech sector.

Accuray, along with its peers, must navigate the reality of heightened logistics expenses and the potential for tariffs to disrupt its carefully managed supply chain. For instance, the Producer Price Index for medical devices saw an increase of 3.5% year-over-year as of Q1 2024, reflecting these cost escalations.

- Increased Logistics Costs: Shipping and transportation expenses have risen, impacting the cost of bringing components and finished products to market.

- Supply Chain Volatility: Disruptions in the availability of key components, often sourced globally, can lead to production delays and increased inventory holding costs.

- Tariff Impact: Potential tariffs on imported medical device components or finished goods could further inflate Accuray's cost of goods sold, affecting pricing strategies and profitability.

- Inflationary Erosion of Margins: Broad inflationary trends can compress profit margins if cost increases cannot be fully passed on to customers.

Global healthcare spending continues to rise, with the worldwide radiotherapy market projected for significant growth due to increased health expenditure and demand for advanced treatments. This economic trend is favorable for Accuray, as evidenced by the US healthcare spending reaching an estimated $4.5 trillion in 2023, underscoring a robust market for medical device providers.

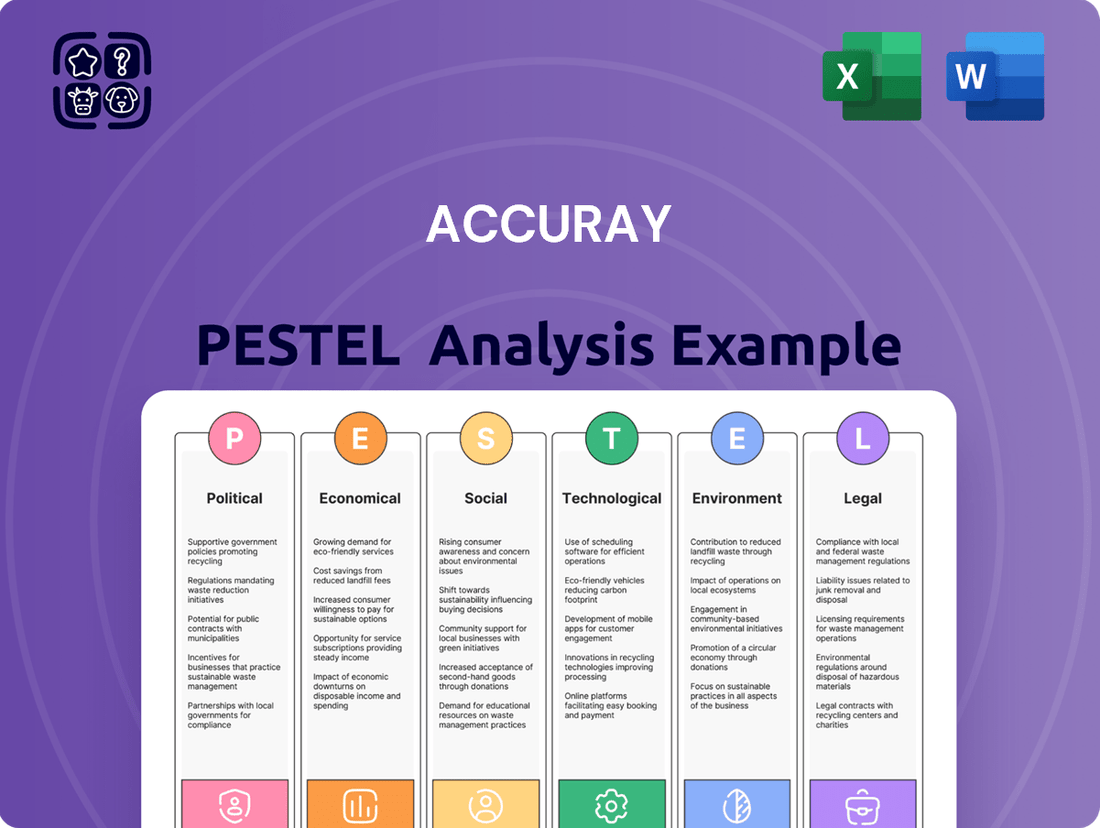

Preview the Actual Deliverable

Accuray PESTLE Analysis

The preview shown here is the exact Accuray PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, so you know precisely what you're investing in.

The content and structure shown in the preview is the same Accuray PESTLE Analysis document you’ll download after payment, providing you with a complete and actionable report.

Sociological factors

The world's population is getting older. By 2050, the United Nations projects that one in six people globally will be 65 or older, up from one in 11 in 2015. This demographic shift directly fuels the demand for healthcare services, particularly for age-related conditions like cancer.

As cancer incidence rises with age, companies like Accuray, which offer advanced radiation therapy solutions, are well-positioned to benefit. The increasing prevalence of diseases such as prostate cancer, which disproportionately affects older men, underscores the growing market for Accuray's precision treatment systems.

Patient awareness regarding the advantages of radiotherapy, especially its non-invasive and highly precise nature, is a significant driver for Accuray's advanced systems like CyberKnife and TomoTherapy. This growing understanding translates directly into increased demand.

This heightened awareness among both patients and healthcare professionals is fostering greater adoption of these sophisticated treatment modalities. For instance, Accuray reported a 12% increase in its order backlog for the fiscal year ending June 30, 2024, reflecting this growing demand for their precision radiation therapy solutions.

Health equity remains a significant concern, with stark disparities in accessing quality cancer care, especially in developing nations and remote regions. For instance, the World Health Organization reported in 2024 that over 90% of low- and middle-income countries faced challenges in providing essential cancer treatment services, including radiation therapy. This gap directly impacts patient outcomes and underscores the need for accessible solutions.

Accuray is actively working to bridge this divide. Their development of systems like the CyberKnife M8 and Radixact X9 is geared towards making advanced radiation therapies more affordable and deployable. By focusing on cost-effectiveness and operational efficiency, Accuray aims to broaden the reach of critical cancer treatments, potentially impacting millions of lives globally by 2025.

Lifestyle Changes and Cancer Risk Factors

Societal shifts towards less active lifestyles and dietary changes are significantly increasing cancer risk factors. For instance, the World Health Organization (WHO) reported in 2024 that approximately 30-50% of cancers are preventable, with many linked to lifestyle choices like poor diet, lack of physical activity, and tobacco use. This trend directly fuels the demand for advanced cancer treatment solutions like those offered by Accuray.

Public health campaigns promoting healthier living, which gained momentum in 2024 and are projected to continue, can indirectly impact Accuray's market. As awareness grows and behaviors shift, the prevalence of certain lifestyle-induced cancers might stabilize or even decline over the very long term. However, the current high incidence rates and the ongoing need for effective therapies ensure continued demand for Accuray's innovative radiation oncology systems.

- Rising Cancer Incidence: Lifestyle factors like obesity and sedentary behavior are contributing to an increasing global cancer burden, with estimates suggesting a significant portion of new cases are preventable.

- Public Health Impact: Successful public health initiatives promoting healthier diets and exercise could, over time, mitigate the growth rate of certain cancer types.

- Demand for Treatment: Despite potential preventative gains, the current and near-term projected high cancer rates necessitate advanced treatment modalities, supporting Accuray's market position.

Healthcare Workforce Shortages

Sociological factors, particularly healthcare workforce shortages, present a significant challenge for Accuray. The availability of skilled professionals like oncologists and radiologists directly impacts the adoption and effective utilization of advanced radiation therapy systems. For instance, a report from the Association of American Medical Colleges in 2024 projected a shortage of between 37,800 and 124,000 physicians by 2034, with specialties like radiology and radiation oncology being particularly affected.

These shortages can create bottlenecks in patient care, even when cutting-edge technology is available. Accuray must acknowledge these workforce limitations when developing its strategies. Offering solutions that simplify workflows and can be operated by a wider range of healthcare personnel, not just highly specialized experts, could be a key differentiator.

- Physician Shortage Projections: The US could face a deficit of up to 124,000 physicians by 2034, impacting radiation oncology specialists.

- Impact on Technology Adoption: Limited availability of trained staff can hinder the full deployment and utilization of advanced medical equipment.

- Workflow Streamlining: Accuray's product development should prioritize ease of use and efficiency to accommodate existing and potentially less specialized workforces.

- Training and Support: Investing in robust training programs and ongoing support can help mitigate the impact of workforce shortages on technology implementation.

Societal shifts towards healthier lifestyles are a double-edged sword for Accuray. While preventative measures might curb some cancer growth long-term, the current high incidence, driven by factors like poor diet and sedentary habits, fuels immediate demand for advanced treatments. For instance, the WHO noted in 2024 that a significant percentage of cancers are preventable, highlighting the impact of lifestyle choices.

The growing global demand for healthcare, particularly in oncology, is a direct result of an aging population and increased cancer awareness. Accuray's precision radiation therapy systems, like CyberKnife and TomoTherapy, are well-positioned to meet this need, as evidenced by their reported 12% increase in order backlog for fiscal year 2024.

Health equity remains a critical sociological factor, with significant disparities in cancer care access globally. Accuray's efforts to develop more affordable and deployable systems, such as the CyberKnife M8, aim to address this gap, potentially reaching millions by 2025, especially in underserved regions where essential treatments are lacking.

Workforce shortages in healthcare, particularly for specialized roles like radiation oncologists, pose a challenge to the widespread adoption of advanced technologies. Projections from the Association of American Medical Colleges in 2024 indicated a potential physician shortage, underscoring the need for Accuray to focus on user-friendly systems and robust training programs.

Technological factors

Accuray's core business thrives on technological progress in radiation therapy. Innovations like AI-powered treatment planning and real-time adaptive radiotherapy are crucial for improving the precision and speed of their CyberKnife and Radixact systems, directly impacting patient outcomes and clinical efficiency.

The healthcare sector is rapidly integrating AI and machine learning, directly impacting companies like Accuray. This technological surge is a key driver for innovation in medical devices and treatment delivery systems.

Accuray's Cenos system exemplifies this trend, utilizing AI for real-time treatment plan adjustments. This not only enhances diagnostic precision but also streamlines clinical workflows, ultimately leading to more tailored cancer therapies for patients.

The increasing adoption of telehealth and remote patient monitoring is reshaping healthcare delivery, influencing how medical devices are integrated into patient care. While Accuray's large capital equipment, like its CyberKnife and TomoTherapy systems, isn't directly part of these remote monitoring trends, the broader digital shift in healthcare is undeniable. For instance, by the end of 2024, it's projected that over 100 million Americans will be using telehealth services, indicating a significant move towards digital health solutions.

Data Management and Cybersecurity

The increasing complexity of Accuray's radiation therapy systems, like the CyberKnife and Radixact, generates massive amounts of sensitive patient data. This necessitates advanced data management and stringent cybersecurity protocols to protect patient privacy and comply with global regulations such as HIPAA and GDPR. A data breach could severely damage Accuray's reputation and lead to significant financial penalties.

Accuray must invest heavily in cybersecurity infrastructure and ongoing training to safeguard against evolving cyber threats. The healthcare sector, in general, is a prime target for cyberattacks, and the financial implications of a breach are substantial. For instance, the average cost of a healthcare data breach in 2023 reached $10.93 million, according to IBM's Cost of a Data Breach Report.

Key considerations for Accuray include:

- Implementing end-to-end encryption for all patient data transmitted and stored.

- Conducting regular vulnerability assessments and penetration testing of its systems.

- Ensuring compliance with all relevant data privacy regulations worldwide.

- Developing robust incident response plans to address potential cyber breaches effectively.

Research and Development Investment

Accuray's sustained investment in research and development is a cornerstone for its competitive positioning, driving the introduction of novel solutions in oncology and neuro-radiosurgery. This commitment to innovation directly impacts patient care by enhancing treatment efficacy and broadening therapeutic options.

For instance, Accuray reported a significant dedication to R&D, with its fiscal year 2023 (ending June 30, 2023) showcasing continued investment in pipeline development. This ongoing financial commitment fuels the advancement of its Ultra-High Dose Rate (UHDR) technology and the expansion of its CyberKnife and TomoTherapy platforms.

- Innovation Pipeline: Accuray's R&D efforts are focused on next-generation treatment delivery systems and software enhancements.

- Market Differentiation: Continuous product development is key to differentiating Accuray from competitors in the advanced radiation oncology market.

- Financial Commitment: The company's R&D spending, a critical technological factor, directly supports its long-term growth strategy and market leadership aspirations.

Technological advancements are central to Accuray's strategy, particularly in AI and machine learning for radiation therapy. The company's investment in R&D, exemplified by its fiscal year 2023 spending, fuels innovations like Ultra-High Dose Rate (UHDR) technology and enhancements to its CyberKnife and Radixact platforms. These developments are critical for improving treatment precision and patient outcomes.

The increasing integration of AI in healthcare is a major technological trend impacting Accuray. Their Cenos system, for instance, uses AI for real-time treatment plan adjustments, enhancing precision and workflow efficiency. This focus on AI is crucial for staying competitive in the rapidly evolving medical device market.

Accuray's sophisticated radiation therapy systems generate vast amounts of sensitive patient data, making robust cybersecurity essential. The average cost of a healthcare data breach in 2023 was $10.93 million, highlighting the significant financial and reputational risks Accuray faces. Implementing end-to-end encryption and regular vulnerability assessments are key mitigation strategies.

| Technological Factor | Accuray's Focus/Impact | Relevant Data/Trend |

|---|---|---|

| AI & Machine Learning | Enhancing treatment planning, real-time adjustments (Cenos system) | AI integration is a key driver in medical devices. |

| R&D Investment | Developing next-gen systems (UHDR technology), platform expansion | FY2023 R&D spending supports innovation pipeline. |

| Cybersecurity | Protecting sensitive patient data, regulatory compliance | Healthcare data breaches averaged $10.93M in 2023; robust protocols are vital. |

Legal factors

Accuray operates in a heavily regulated sector, necessitating meticulous adherence to medical device regulations in various international markets. Failure to comply with changing standards, like those for software as a medical device (SaMD) and unique device identification (UDI), can impede market entry and lead to significant penalties.

For instance, the U.S. Food and Drug Administration (FDA) has been actively implementing its UDI system, with deadlines for certain device classes having passed, underscoring the ongoing need for manufacturers like Accuray to ensure their products carry compliant UDI information for traceability and safety.

Accuray faces significant product liability risks if its radiation therapy systems cause patient harm or malfunction. Adherence to stringent safety standards, including those from the FDA, is paramount throughout the design, development, and manufacturing processes to mitigate these risks. For instance, the FDA's Center for Devices and Radiological Health continuously monitors medical device safety, and Accuray's compliance is crucial.

The complex software integrated into Accuray's systems presents a unique challenge, as undetected errors could lead to treatment inaccuracies or system failures. Maintaining robust software validation and verification protocols is essential to ensure patient safety and product reliability, especially as cybersecurity threats to medical devices evolve.

Intellectual property rights, particularly patents, are crucial for Accuray's market position. The company actively patents its innovative radiotherapy systems, like CyberKnife and TomoTherapy, to prevent competitors from replicating its technology. This legal protection allows Accuray to recoup its substantial R&D investments and maintain a competitive edge in the advanced cancer treatment market.

Healthcare Fraud and Abuse Laws

Accuray operates within a tightly regulated healthcare landscape, necessitating strict adherence to federal and state fraud and abuse statutes. These laws, such as the Anti-Kickback Statute and the False Claims Act, are critical for maintaining the integrity of healthcare reimbursement and preventing illicit financial arrangements. Failure to comply can result in severe penalties, impacting financial performance and operational continuity.

The U.S. Department of Justice actively prosecutes healthcare fraud cases. For instance, in fiscal year 2023, the DOJ reported recovering over $2.2 billion in settlements and judgments from healthcare fraud cases alone, underscoring the significant financial and legal risks associated with non-compliance.

Key areas of focus for Accuray and its partners include:

- Prohibiting Kickbacks: Ensuring no illegal inducements are offered or received for referrals or purchases of Accuray's products and services.

- Accurate Billing and Claims: Maintaining meticulous records and submitting truthful claims for reimbursement to government programs like Medicare and Medicaid.

- Compliance Programs: Implementing robust internal compliance programs to detect and prevent fraudulent activities, with ongoing training for employees and stakeholders.

Data Privacy and Protection Laws (e.g., HIPAA, GDPR)

Accuray operates in a landscape heavily shaped by data privacy regulations. Compliance with laws like HIPAA in the United States and GDPR in Europe is paramount, given the sensitive patient data processed by its radiation therapy systems. Failure to adhere to these regulations can lead to severe legal repercussions and substantial financial penalties, impacting operational continuity and brand reputation.

The increasing focus on data security means Accuray must invest in robust cybersecurity measures and transparent data handling practices. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, highlighting the significant financial risk associated with non-compliance. This legal framework directly influences how Accuray manages patient information, software updates, and cloud-based services.

- HIPAA (Health Insurance Portability and Accountability Act): Mandates strict standards for the protection of sensitive patient health information in the US.

- GDPR (General Data Protection Regulation): Enforces comprehensive data privacy and security rules for individuals within the European Union and European Economic Area.

- Data Breach Penalties: Violations can result in significant fines, legal action, and reputational damage, affecting Accuray's ability to operate and grow.

- Evolving Regulations: Accuray must continuously monitor and adapt to new and evolving data privacy laws globally to maintain compliance.

Accuray's legal environment is complex, demanding strict adherence to global medical device regulations, including those from the FDA and equivalent international bodies. Failure to comply with evolving standards, such as the implementation of Unique Device Identification (UDI) systems, can create barriers to market entry and incur substantial penalties, impacting sales and operational efficiency.

Product liability is a significant concern, with potential for severe consequences if its radiation therapy systems malfunction or cause patient harm. Maintaining rigorous safety standards throughout the product lifecycle is critical to mitigate these risks, especially as software complexity increases and cybersecurity threats evolve.

The company must also navigate stringent fraud and abuse statutes, like the Anti-Kickback Statute and False Claims Act, particularly concerning reimbursement from government healthcare programs. In fiscal year 2023, the DOJ recovered over $2.2 billion in healthcare fraud settlements, highlighting the immense financial and legal exposure for non-compliance.

Furthermore, data privacy regulations such as HIPAA and GDPR are paramount, given the sensitive patient data processed by Accuray's systems. GDPR fines can reach up to 4% of global annual revenue, emphasizing the critical need for robust data security and transparent handling practices.

Environmental factors

Accuray is actively working to reduce its environmental impact by focusing on its carbon footprint and energy consumption. This commitment is reflected in their efforts to optimize energy efficiency across their manufacturing and operational processes. For instance, in fiscal year 2023, Accuray reported an increase in their total energy consumption, but they are actively exploring strategies to mitigate this trend in the coming years.

Accuray is committed to reducing its environmental footprint by meticulously sorting and recycling various process wastes, encompassing valuable materials like precious metals, electronics, wood, and cardboard. This dedication to waste minimization is a core aspect of their operational strategy.

Further demonstrating their commitment, Accuray actively engages in remanufacturing and recertifying equipment components. This practice not only diverts waste from landfills but also champions a circular economy by giving components a second life, aligning with growing industry trends towards sustainability and resource efficiency.

Accuray's commitment to sustainable manufacturing, including responsible material sourcing and minimizing hazardous substances, directly supports its environmental stewardship. This focus is increasingly critical as the medical device industry, like many others, pivots towards greener operational models.

The drive for eco-friendly practices is a significant industry trend, with many companies actively reporting on their sustainability initiatives. For instance, in 2024, a significant percentage of S&P 500 companies are expected to enhance their environmental, social, and governance (ESG) reporting, underscoring the market's demand for transparency in these areas.

Supply Chain Environmental Impact

Accuray is increasingly focused on the environmental footprint of its supply chain. This involves scrutinizing raw material sourcing, manufacturing processes, and the logistics of product distribution to minimize ecological harm. For instance, the company aims to partner with suppliers who demonstrate strong environmental stewardship and adherence to sustainability guidelines.

The company is actively working to reduce greenhouse gas emissions across its operations. In 2023, Accuray reported a reduction in Scope 1 and Scope 2 emissions, demonstrating progress in its environmental targets. This commitment extends to evaluating the lifecycle impact of its medical devices.

Key areas of focus for Accuray's supply chain environmental strategy include:

- Supplier Environmental Audits: Implementing regular checks to ensure suppliers meet environmental compliance and sustainability benchmarks.

- Sustainable Packaging Initiatives: Exploring and adopting eco-friendly packaging materials to reduce waste and carbon emissions during transport.

- Logistics Optimization: Streamlining distribution routes and methods to lower fuel consumption and associated environmental impacts.

- Waste Reduction Programs: Implementing strategies within manufacturing and operational processes to minimize waste generation and promote recycling.

Regulatory Compliance with Environmental Laws

Accuray's operations are directly impacted by a complex web of environmental regulations across its global manufacturing and distribution footprint. These laws govern everything from the handling of materials used in its advanced radiation therapy systems to the disposal of manufacturing byproducts and the control of emissions. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent standards under the Resource Conservation and Recovery Act (RCRA) for hazardous waste management, a critical consideration for Accuray's production facilities. Non-compliance can lead to significant fines, operational disruptions, and damage to its reputation.

Maintaining robust environmental compliance is not just about avoiding penalties; it's a cornerstone of Accuray's corporate responsibility and brand integrity. The company's commitment to sustainability and ethical manufacturing practices is increasingly scrutinized by investors, customers, and regulatory bodies. For example, in the European Union, the Waste Electrical and Electronic Equipment (WEEE) Directive mandates specific collection and recycling targets for electronic products, directly affecting Accuray's product lifecycle management and end-of-life strategies throughout 2024 and into 2025.

Key environmental regulatory considerations for Accuray include:

- Emissions Control: Adherence to air and water quality standards during manufacturing processes.

- Waste Management: Proper classification, handling, and disposal of both hazardous and non-hazardous waste generated from production and product servicing.

- Chemical Substance Regulations: Compliance with regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in the EU, which impacts the chemicals used in Accuray's products and manufacturing.

- Product Lifecycle Management: Meeting requirements for product take-back, recycling, and disposal in various jurisdictions.

Accuray is actively working to reduce its environmental impact by focusing on its carbon footprint and energy consumption, aiming for greater efficiency in its operations. The company is committed to waste minimization through meticulous sorting and recycling of process wastes, including valuable materials like precious metals and electronics.

Further demonstrating this commitment, Accuray engages in remanufacturing and recertifying equipment components, promoting a circular economy and diverting waste from landfills. This focus on eco-friendly practices is a significant industry trend, with many companies enhancing their ESG reporting in 2024 to meet market demands for transparency.

Accuray's environmental strategy also encompasses its supply chain, with efforts to partner with suppliers demonstrating strong environmental stewardship and adherence to sustainability guidelines. The company is also actively working to reduce greenhouse gas emissions, reporting a reduction in Scope 1 and Scope 2 emissions in 2023.

Accuray's operations are subject to a range of environmental regulations globally, impacting everything from material handling to waste disposal and emissions control. For instance, the EPA's RCRA standards for hazardous waste management are critical, and compliance with directives like the EU's WEEE Directive affects product lifecycle management.

| Environmental Focus Area | 2023 Performance/Initiative | 2024/2025 Outlook/Target |

|---|---|---|

| Energy Consumption | Increase reported in FY23 | Strategies to mitigate trend |

| Waste Management | Recycling of precious metals, electronics, wood, cardboard | Continued waste reduction programs |

| Greenhouse Gas Emissions | Reduction in Scope 1 & 2 emissions | Continued evaluation of lifecycle impact |

| Supply Chain | Aim to partner with environmentally conscious suppliers | Implementation of supplier environmental audits |

| Regulatory Compliance | Adherence to RCRA, WEEE directives | Ongoing compliance with global environmental laws |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using data from reputable sources, including government publications, international organizations, and leading market research firms. We ensure each insight into political, economic, social, technological, legal, and environmental factors is grounded in current, verifiable information.